当前位置:网站首页>3. Type of fund

3. Type of fund

2022-07-07 05:02:00 【raindayinrain】

1. Classification Overview

1.1. significance

Make correct investment comparison and selection for investors .

For fund management companies , Fund performance comparison should be conducted in the same category ; Research and evaluation institutions of the fund , Classification is the basis of rating ;

For regulators , Supervision of different fund categories .

1.2. Classification standard and introduction

1.2.1. According to the classification of investment objects

Stock fund , Fund assets 80% The above investment in stocks .

Bond funds , Fund assets 80% The above is invested in bonds .

Money market funds , Invest only in money market instruments .

Hybrid funds , Invest in stocks , bond , Money market instruments . Not a stock fund , Not a bond fund .

Fund in Fund ,80% The above fund assets are invested in other fund units .

Trading open-end securities investment fund, Feeder Fund , It refers to investing the vast majority of fund assets in tracking the same underlying index ETF, Closely track the performance of the target index , Funds operating in an open mode .

Alternative investment funds , In stock , bond , Assets other than traditional assets such as currency are investment target funds . Hassan's public offering alternative funds in China's market include the following types :

1. Commodity funds

In cash , Futures contracts are the object of investment , gold ETF, Commodity Futures ETF.

2. Unlisted equity funds

3. Real estate funds

1.2.2. Classified according to investment objectives

Growth , Take the pursuit of capital appreciation as the basic goal .

Income type , Pursue stable recurring income .

Balanced type , Balance growth , income .

1.2.3. Classified according to investment philosophy

Active ,

Passive 【 Index 】. Passive attempts to replicate the performance of the index . Generally, a specific index is selected as the tracking object . Also known as index fund .

Index funds , It is a fund that purchases all or part of the securities in the securities market included in the index according to the standard of a certain index , The aim is to achieve the same level of return as the index . In index funds , Listed and traded open-end index funds are also known as exchange traded funds 【ETF】, Develop rapidly .

1.2.4. According to the source and purpose of the Fund

Onshore funds , Offshore funds , International Fund .

Onshore funds , Raise funds at home , Invest in the domestic securities market .

Offshore funds , A country 【 region 】 Securities investment funds in other countries 【 region 】 Sale of securities investment fund shares , And invest the raised funds in their own countries 【 region 】 Or a third country 【 region 】 Securities investment funds in the securities market . Such as the mainland and Hong Kong mutual recognition Fund .

International Fund , Capital comes from domestic , Invest in foreign markets . Such as QDII fund .【 Qualified domestic investors 】

1.2.5. Special types of funds

1. Hedge Strategy Fund

Originally known as Principal Guaranteed Fund , It refers to the operation through a certain capital guaranteed investment strategy , Introduce breakeven guarantee mechanism , When the principal guarantee period of the guarantee fund unitholders expires , Investment principal guarantee available .

2. Listed Open-end funds

It can purchase fund units in the OTC market , redeem , It can also trade fund units in the exchange , Subscription of fund units , Redeemed open-end funds . It is a local innovation in China .

3. Graded funds

Divide the basic share into sub shares with different expected risk returns , Which can be listed and traded in part or in whole .

# 2. Stock fund

## 2.1. The role of stock fund in investment portfolio

More suitable for long-term investment

## 2.2. The difference between stock fund and stock

1. The stock price is always changing every trading day ; The net value of stock fund units is calculated only once a day . There is only one price per day .

2. The stock price is due to the number of shares bought and sold by investors , The strength of multi air force varies with the contrast of strength . The net value of stock fund units is not subject to subscription , Redemption affects .

3. The net value of fund units is compounded by the prices of securities held .

4. Stock funds diversify .

## 2.3. Types of equity funds

### 2.3.1. Classified by investment market

Domestic equity funds , Foreign equity funds , Global Equity Fund .

Domestic equity funds , Take the domestic stock market as the investment place .

Foreign equity funds , Take the non domestic stock market as the investment place .

Global Equity Fund , Invest in the global stock market .

Foreign stock funds can be further divided into single country funds , Regional , The global .

### 2.3.2. By stock size

Small ticket stock , Mid cap stocks , Large cap stocks .

One is based on market value ,<5 Billion ,>20 Billion .

One is all listed companies according to the market , By rank .

### 2.3.3. Classified by stock nature

Value type , Growth type .

Value type , P / E ratio , Low price to book ratio . Suitable for long-term .

Growth type , P / E ratio , High price to book ratio . Suitable for short term .

Value type , Growth type , Balanced type .

### 2.3.4. Classified by fund investment style

The broader market 、 Midrange , Small cap mixed growth , Balance , value

### 2.3.5. By industry

# 3. Bond funds

## 3.1. The role of bond funds in portfolios

## 3.2. The difference between bond funds and bonds

1. The yield of bond funds is not as fixed as the interest of bonds

2. Bond funds have no fixed maturity date

3. The yield of bond funds is more difficult to predict than the yield of a single bond bought and held to maturity

4. Different investment risks

## 3.3. Types of bond funds

government bonds , Corporate bonds , Financial bonds, etc .

short-term bond , Long term bonds, etc .

Low-grade bonds , High registration bonds, etc .

There are also the following types :

1. Standard bond funds , Invest in fixed income financial instruments . Do not invest in the stock market .

2. General bond funds , Main investment bonds , Investable stock .

3. Other strategic , Such as convertible bond fund, etc .

# 4. Money market funds

## 4.1. The role of money market funds in portfolios

Low risk , Good liquidity .

## 4.2. The investment objects of money market funds and money market instruments

The investment object is money market instruments , It often refers to short-term financial instruments with a maturity of less than one year , Also known as cash investment vehicles . Money market funds should invest in the following financial instruments :

1. cash

2. The deadline is 1 Within years 【 contain 】 Of bank deposits , Bond repo , Central bank bills , Inter bank deposit receipt .

3. The remaining period is 397 God 【 contain 】 Bonds within , Non financial corporate debt financing instruments , Asset Backed Securities .

4. The securities and futures commission , Other money market instruments with good liquidity recognized by the bank .

Do not invest in the following financial instruments :

1. Stocks

2. Convertible bonds , Exchangeable bonds

3. Floating rate bonds with time deposit interest rate as the benchmark interest rate , Except for those who have entered the last interest rate adjustment period

4. Credit rating in AA+ The following bonds and non-financial corporate debt financing instruments

5. The securities and futures commission , Banks prohibit investment .

## 4.3. The payment function of money market funds

1. Apply for fund units every trading day , redeem

2. In the fund contract, the way of income distribution is agreed as dividend reinvestment , Daily income distribution .

3. Quote daily at face value .

## 4.4. The emergence and development of American money market funds

## 4.5. The development of money market funds in China

Yu'e Bao launched by Tianhong fund and Alipay , Yu'e Bao automatically purchases Tianhong Monetary Fund .

Floor money market fund is a mechanism that uses the balance of stock account to buy Monetary Fund ,T+0 transaction . It is divided into redemption application type , Transactional , Trading and redemption . Redemption type -519 start , You can apply for , redeem , Non Tradable .T Daily subscription , Enjoy the benefits of the day l;T Day redemption , Don't enjoy the day's income .T Daily subscription share ,T+1 redeemable ;T Daily redemption funds ,T Daily availability ,T+1 Take . Transactional ,511 start , On site subscription is available , redeem , transaction .T Buy... Daily , Enjoy the benefits of the day ;T Sell on , Don't enjoy the benefits .T Daily subscription ,T+1 Enjoy the benefits ;T Day redemption ,T Enjoy daily benefits .T Buy... Daily ,T Day redeemable , Can sell .T Sell on ,T Daily availability ,T+1 Take .T Daily subscription ,T Day can be redeemed and sold ;T Day redemption ,T Daily availability ,T+1 Take . Trading and redemption ,159 start .

# 5. Hybrid funds

## 5.1. The role of hybrid funds in portfolios

## 5.2. Types of hybrid funds

Partial strand type , Partial debt type , Equity debt balance , Flexible configuration, etc . According to the latest classification , Mixed funds are divided into partial stock types , Partial debt type , Flexible configuration , Principal-guaranteed , Hedging strategy , Absolute return target , other .

1. Partial strand type , stock investment >=60%, Or performance benchmarks , Share ratio >=60%

2. Flexible configuration . Flexible configuration .

3. Partial debt type , Bond investment >=60% Or performance benchmarks , Bond ratio >=70%

4. Principal-guaranteed ,

5. Hedging strategy

6. Absolute return target , The performance benchmark is the income from bank time deposits or a certain value . According to the investment strategy , Flexible strategy , Hedging strategies .

7. other

# 6. Hedge Strategy Fund

## 6.1. The predecessor of Hedge Strategy Fund

Capital Guarantee Fund .

1. The manager shall bear the principal guaranteed repayment obligation for the investment principal of the share holder . guarantee , The manager shall be jointly and severally liable to the investor .2. Administrator and principal guaranteed obligor , The administrator pays the principal guarantor , The principal guarantor is under the loss due , Pay the loss .3. Other mechanisms .

Capital Guarantee Fund , In case of loss , Now managers often pay . There is a risk of insolvency .

Hedge funds often invest most of their money in bonds with the same maturity , The rest is invested in stocks , Derivatives, etc . The goal is to lock in risks and strive for higher returns .

## 6.2. The investment strategy of the hedge fund

Hedge Insurance Strategy , Fixed proportion portfolio insurance strategy .CPPI By comparing the current net worth of the portfolio with the bottom line of the portfolio value , Dynamically adjust the risk assets in the portfolio , Proportion of Principal Guaranteed assets , Take into account breakeven , value-added . Investment steps :

1. According to the minimum target value of the portfolio at the end of the period and the reasonable discount rate , Set the value of Principal Guaranteed assets to be held .

2. Calculate the amount by which the current net worth of the portfolio exceeds the bottom line of value .

3. Determine the investment proportion of risk assets according to a certain multiple of safety cushion .

Amount of venture capital investment = Magnification *( Current net worth - Value bottom line )

Venture capital ratio = Amount of venture capital / The net value of the Fund * 100%

## 6.3. Types of hedge funds

Principal guarantee , Income guarantee , Bonus guarantee . The general principal guarantee ratio is 100%.

## 6.4. Analysis of Hedge Fund

Closed cycle , Long closing period , It is more likely to obtain better income , But the opportunity cost borne by investors is also higher .

Break even ratio ,

Safety mat , The maximum allowable loss limit of venture capital investment

# 7. Trading open index funds 【ETF】

## 7.1.ETF Characteristics

### 7.1.1. Passively operate index funds

ETF The constituent securities contained in a selected index 【 Stocks , Bonds, etc 】 Or commodities as investment objects , According to the type and proportion of securities or commodities constituting the index , Take complete replication or sampling replication , Index funds that invest passively .

### 7.1.2. Unique physical subscription , Redemption mechanism

Investors apply to fund management companies for ETF, You need to take this one ETF A designated basket of securities or commodities in exchange for ; Redemption is not cash , But a corresponding basket of securities or commodities ; If you want to realize , These securities or commodities need to be sold again . send ETF There is no need to buy securities or commodities with cash and sell securities or commodities with redemption .ETF There is a minimum subscription , Redemption share , Only investors of a certain scale can participate ETF Physical subscription in the primary market , redeem .

China currently has only cross time zones ETF, Cannot buy cross time zone market securities , Therefore, the full cash replacement mode is used for subscription , redeem . Some commodities and bonds ETF Purchase in kind , redeem , All cash substitution in parallel . Stocks ETF Usually purchase in kind , redeem .

### 7.1.3. Implement a trading system in which the primary market and the secondary market coexist

Primary market , Investors with a certain scale of funds can exchange shares for shares at any time during trading hours 【 apply for the purchase 】, Exchange shares for shares 【 redeem 】 Transactions . The secondary market ,ETF Listed on the market like common stocks 【ETF There is no stamp duty on share transactions 】, According to the market price ETF Share trading 【1 hand 100 From 】. The trading price in the secondary market cannot deviate a lot from the net value of fund shares , Otherwise, arbitrage transactions will be triggered , Restore the secondary market price to near the net value of fund units .

## 7.2.ETF Arbitrage transactions

When the price of the same commodity is inconsistent in different markets , There will be arbitrage transactions . Traditionally , A fixed number of securities under the relationship between supply and demand , Form a secondary market price independent of its own net worth . Variable quantity securities , Such as open-end funds , Only net worth . Yes ETF, Investors can buy at ETF Carry out arbitrage transactions when there is a price difference between the trading price of the secondary market and the net value of fund units .

The secondary market ETF The trading price is lower than the net value of the share , Discount transaction , Buy in the secondary market , Primary market redemption . Then sell the redeemed shares in the secondary market to realize arbitrage 【 Buy at a low price , Sell at a high price 】; The trading price in the secondary market is higher than the net share , Premium trading , Large investors buy a basket of stocks in the secondary market , In the primary market, it is converted into ETF share , Sell again in the secondary market ETF, Realize arbitrage transaction .【 Buy at a low price , Sell at a high price 】. Arbitrage makes the secondary market not deviate a lot from the share net value .

## 7.3.ETF And LOF difference

All have open-end funds that can be subscribed , redeem , Characteristics of floor trading .

1. apply for the purchase , The subject matter of redemption is different .ETF The exchange is fund shares , A basket of securities or commodities ;LOF apply for the purchase , Redeemed fund shares , cash .

2. apply for the purchase , The place of redemption is different .ETF apply for the purchase , Redemption through the exchange ;LOF apply for the purchase , Redemption can be made at the consignment outlet , Or on the exchange .

3. apply for the purchase , Redemption restrictions . Investors of a certain scale can participate ETF Subscription in the primary market , redeem ;LOF apply for the purchase , There is no requirement for redemption .

4. Investment strategy .ETF It usually adopts completely passive management , Aim to fit an index ;LOF It is ordinary open-end funds that increase the way of exchange trading , It can be an index fund , It can also be an actively managed fund .

5. Quotation frequency of net worth . Secondary market net worth quotation ,ETF Every time 15 second ;LOF Usually 1 One or more times a day .

## 7.4.ETF The type of

Stock type , Bond type , Commodity type, etc .

Stock type can be further divided into global indexes , composite index , Industry index , Style index , Strategy index, etc .

According to the copy method , It is divided into complete replication , Sample replication .

## 7.5.ETF Feeder Fund

ETF A feeder fund invests most of the fund's assets in a ETF【 The goal is ETF】, Closely track the performance of the underlying index , Funds that can be redeemed over the counter .ETF Feeder funds invest in targets ETF The assets shall not be less than 90%, The rest should be invested in the underlying index component stocks , Alternative constituent stocks, etc .ETF The feeder fund manager shall not be responsible for ETF In the property of the Feeder Fund ETF Part of the accrued management fee .

ETF The main features of feeder funds are :

1. The feeder fund is attached to the main fund . Feeder funds and ETF Are different parts of the same legal entity , The feeder fund is in a subordinate position .

2. Feeder funds provide banks , Securities company OTC , Internet company platforms, etc ETF channel . Most of the ETF Floor trading 【 Need to open a stock account 】, After the establishment and opening of the feeder fund for redemption , Investors can purchase feeder funds , Participate in ETF investment . The feeder fund is mainly for small and medium-sized investors on the platforms of banks and Internet companies ETF Opened the channel .

3. Feeder funds can provide regular fixed investment intervention ETF

4. Feeder funds do not participate ETF Arbitrage in China

5. Feeder funds are special funds 【FOF】, The feeder fund holds targets ETF The market value shall not be less than 90%.

# 8.QDII fund

## 8.1.QDII Fund overview

Trial Measures for the administration of overseas securities investment by qualified domestic institutional investors . Institutions that can raise funds in China for overseas securities investment with the approval of the CSRC are called qualified domestic institutional investors 【QDII】. Here, we mainly discuss the QDII product , You can use RMB , dollar , Or other foreign exchange currencies are raised as valuation currencies .

## 8.2.QDII The role of funds in portfolios

QDII The fund can invest in the international market

## 8.3.QDII The investment object of the Fund

### 8.3.1.QDII Financial products or instruments that the fund can invest in

1. Bank deposits , Negotiable certificate of deposit , Bank acceptance bill , bank money , Commercial paper , Repurchase agreements , Money market instruments such as short-term government bonds

2. government bonds , Corporate bonds , Convertible bonds , Mortgage backed securities , Asset backed securities, etc , Other securities recognized

3. Common shares listed and traded in the securities markets of countries or regions that have signed a memorandum of understanding on bilateral regulatory cooperation with the CSRC , Preferred stock , Global depositary receipts and American Depositary Receipts , Real estate trust certificate .

4. And fixed income , equity , credit , Commodity Index , Funds and other structured investment products linked to the subject matter

5. Forward contract , swap , Warrants listed and traded on overseas exchanges recognized by the Securities Commission , option , Futures and other financial derivatives

### 8.3.2.QDII The fund prohibits investment

1. Buy real estate

2. Purchase real estate mortgage

3. Proof of purchase or representation of precious metals

4. Buy physical goods

5. Except for redemption payable , Except for temporary purposes such as transaction liquidation , Borrow cash . Borrowing for temporary purposes shall not exceed the total amount 10%

6. Buy securities . Financial derivatives are excluded

7. Participate in short selling transactions without holding underlying assets

8. Securities underwriting

9. Other prohibited behaviors

# 9. Graded funds

## 9.1. Basic concept of graded Fund

According to the risk income distribution of the Fund agreed in advance , Divide the master fund shares into sub shares with different expected risk returns , A structured securities investment fund that can list some or all of its shares . The fund units are the master fund units , The sub share with lower expected risk return is A Class share , The sub share with higher expected risk return is B Class share .

## 9.2. Characteristics of graded funds

### 9.2.1. A fund , Multi class share , Various investment instruments

It can simultaneously meet the needs of investors with different risk and return preferences . Master fund shares , For common stock index fund shares , Higher risk , Higher returns .A Similar fixed income products , Low risk , The income is relatively stable .B Class share acquisition deducted A All gains or losses of the master fund other than the agreed gains of class shares . High risk , High expected returns .

A class , Suitable for conservative , Investors who prefer fixed income varieties

B class , It is suitable for radical investors who prefer leveraged investment

The master Fund , Suitable for configuration investors with high risk tolerance

### 9.2.2.A class ,B Class share rating , Asset consolidation operation

Fund shares are divided into sub shares with different risk return characteristics , The fund assets are still operated as a whole . Different categories share stubbornness , On the one hand, income distribution depends on the agreed income distribution conditions , On the one hand, it is affected by the overall investment performance .

### 9.2.3. Fund shares can be listed and traded on the exchange

The master fund can pass the OTC , There are two ways to raise , Outside , The fund units obtained on the floor are registered in the OTC system , On site system . Fund shares can be transferred to the OTC market through cross system custody , Conversion of floor market .

There are three types of shares in the market , Master fund shares ,A Class share ,B Class share .

The shenzhen stock exchange , The master fund can subscribe , redeem

Shanghai , The master fund can subscribe , redeem , transaction

A class ,B Class tradable

Certain sub shares can be purchased separately from the secondary market , Combine multiple sub shares into parent shares .

subscription 、 apply for the purchase , Optional separation , Spin off .

### 9.2.4. Including derivatives and leverage characteristics

### 9.2.5. Multiple ways to realize income , Rich investment strategies

Interest arbitrage , Multiple investment strategies , Diversified income realization methods

## 9.3. Classification of graded funds

### 9.3.1. By way of operation

closed , open

closed , Master fund units can only be purchased at the time of issuance , thereafter , No subscription , Redemption of master fund shares . Trading shares in the secondary market . open , Daily subscription , Redemption of master fund shares , Pairing conversion realizes the master Fund , Classification conversion .

### 9.3.2. Classified by investment object

Stock type , Bond type ,QDII etc.

### 9.3.3. Classified by investment style

Active investment , Passive investment

### 9.3.4. Classified according to the way of raising

Merger and raising , Raise separately . Merger and raising , Raise with the master Fund . Raise separately , Raise by classification , Re merger .

### 9.3.5. Classified according to the income distribution rules between sub shares

Simple financing , Complex

Simple financing is equivalent to B The level share will be transferred to... At a certain agreed cost A Level share financing to obtain leverage ; Multiple options are often implied in sub shares with complex levels , The valuation , Pricing is more complicated .

### 9.3.6. Classified by whether there are master fund shares

There are shares of the master Fund , There is no master fund share

Most bond structured funds , There is no master fund share .

### 9.3.7. Classified by whether there are conversion terms

There are conversion terms , There is no conversion clause

Term conversion clause , take A The agreed income of class shares is converted to A Class share holders . Irregular conversion , When the threshold value is reached, it is converted downward or upward .

## 9.4. Specification of graded funds

Guidelines for the management of graded fund business

# 10. Fund in Fund

## 10.1. The concept and characteristics of funds

FOF, Refers to funds that invest in other securities investment funds .

## 10.2. The operation norms of funds in funds

in the light of FOF The definition of , Diversify investment , Fund expenses , General meeting of fund unitholders , Information disclosure, etc

### 10.2.1. Clarify the definition of fund in the Fund

80% The above fund assets are invested in public fund units approved or registered by the CSRC

### 10.2.2. Strengthen decentralized investment , Prevent centralized holding risks

The market value of a single Fund , Not higher than FOF Net worth 20%, No other FOF. except ETF Outside the Feeder Fund , All managed by the same manager FOF Hold a single Fund , No more than 20%

### 10.2.3.FOF Do not hold derivatives products such as graded funds

### 10.2.4. Prevent benefit transmission

except ETF Outside the Feeder Fund ,FOF When investing in other funds , The term of the invested fund >=1 year , Net worth >=1 Billion

### 10.2.5. Reduce double charges

Managers should not be right FOF Charge for self-management in . The custodian is similar .

### 10.2.6. The principle of participating in the general meeting of holders of funds

representative FOF Share holders perform their obligations

### 10.2.7. strengthening FOF information disclosure

### 10.2.8. Ensure the fairness of the valuation

FOF A fair valuation method should be used , In time , Accurately reflect the value changes of fund assets .

### 10.2.9. Clarify the fund company to carry out FOF The organizational structure of the business

Set up an independent department , Provide specialized personnel , Make business rules , Relevant arrangements . except ETF Outside the Feeder Fund ,FOF The fund manager shall not concurrently serve as the fund manager of other funds .

### 10.2.10. Strengthen the responsibilities of relevant subjects

## 10.3. Types of funds in the Fund

In terms of operation mode ,FOF Products can be summarized as active management and active , Active management passive , Passive management, active , Passive management passive .

### 10.3.1. Active management active

Fund managers actively judge the future performance of different assets and choose the time , Invest the target in each actively managed fund based on the allocation conclusion .

### 10.3.2. Active management passive

Fund managers invest in passive fund products through active management .

### 10.3.3. Passive management, active

FOF Invest in the sub fund in the way of index compilation or specific investment proportion , The sub fund is actively managed

### 10.3.4. Passive management passive

FOF Invest in the sub fund in the way of index compilation or specific investment proportion , The sub fund is passively managed

According to the investment target , Investment direction , Subdivided into : Stock type , Bond type , Currency type , mixed type , other .

## 10.4. The origin and development status of funds overseas

边栏推荐

- Programmers go to work fishing, so play high-end!

- 【數模】Matlab allcycles()函數的源代碼(2021a之前版本沒有)

- R language principal component PCA, factor analysis, clustering analysis of regional economy analysis of Chongqing Economic Indicators

- C语言中函数指针与指针函数

- sublime使用技巧

- Ansible中的inventory主機清單(預祝你我有數不盡的鮮花和浪漫)

- A simple and beautiful regression table is produced in one line of code~

- Tree map: tree view - draw covid-19 array diagram

- sscanf,sscanf_ S and its related usage "suggested collection"

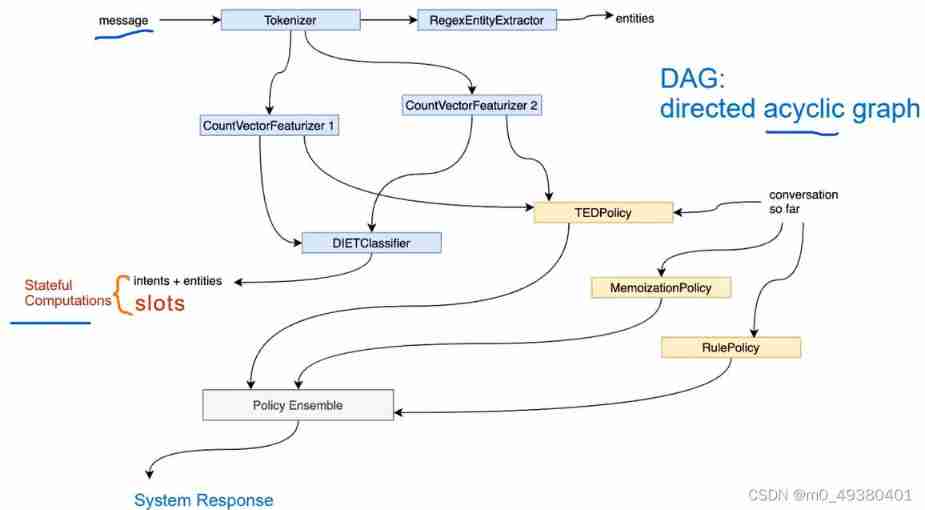

- Gavin teacher's perception of transformer live class - rasa project actual combat e-commerce retail customer service intelligent business dialogue robot microservice code analysis and dialogue experim

猜你喜欢

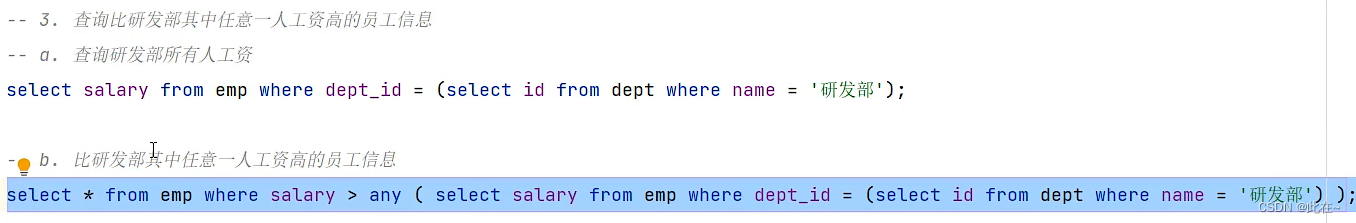

Mysql database (basic)

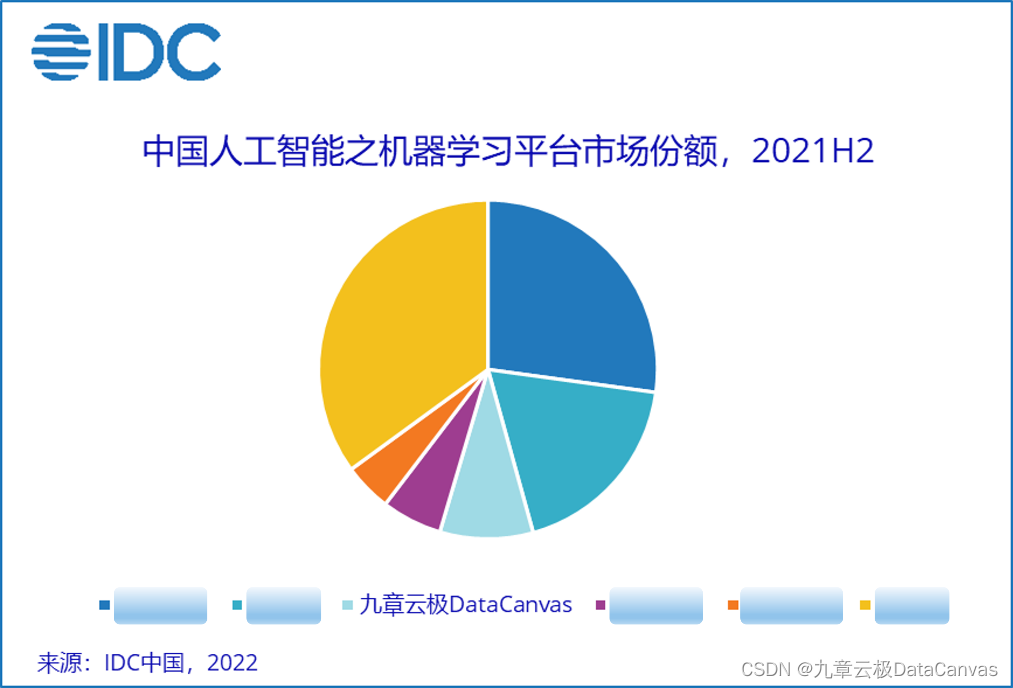

Chapter 9 Yunji datacanvas company has been ranked top 3 in China's machine learning platform market

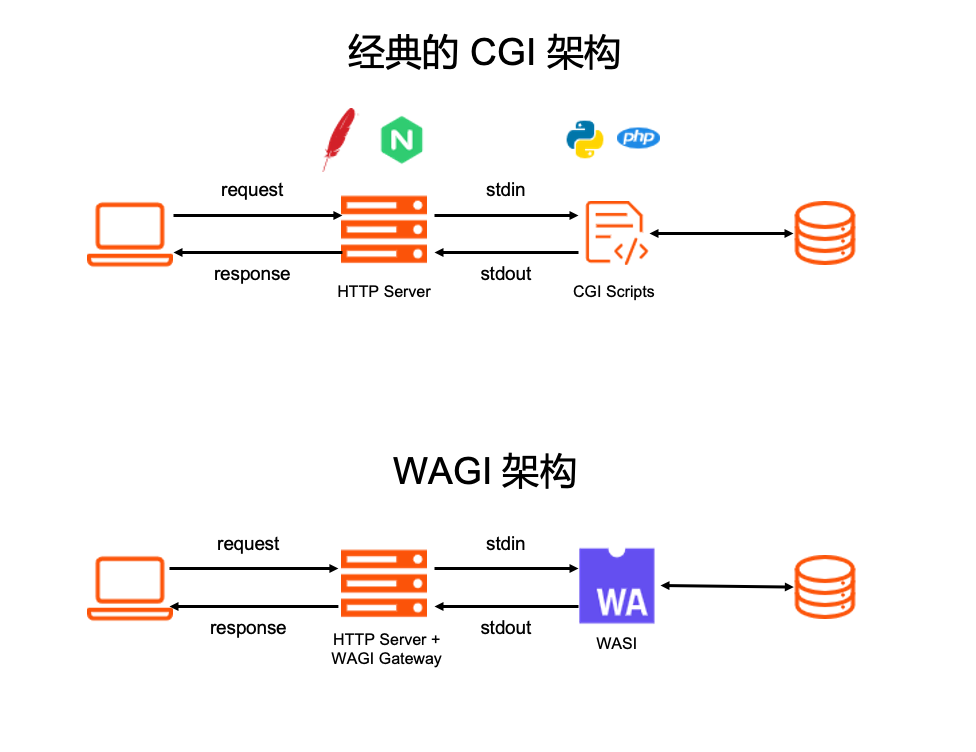

When knative meets webassembly

Gavin teacher's perception of transformer live class - rasa project actual combat e-commerce retail customer service intelligent business dialogue robot microservice code analysis and dialogue experim

![Local tool [Navicat] connects to remote [MySQL] operation](/img/e8/a7533bac4a70ab5aa3fe15f9b0fcb0.jpg)

Local tool [Navicat] connects to remote [MySQL] operation

【愚公系列】2022年7月 Go教学课程 005-变量

高手勿进!写给初中级程序员以及还在大学修炼的“准程序员”的成长秘籍

mpf2_ Linear programming_ CAPM_ sharpe_ Arbitrage Pricin_ Inversion Gauss Jordan_ Statsmodel_ Pulp_ pLU_ Cholesky_ QR_ Jacobi

MySQL数据库(基础篇)

九章云极DataCanvas公司获评36氪「最受投资人关注的硬核科技企业」

随机推荐

01机器学习相关规定

Jetson nano配置pytorch深度学习环境//待完善

PLC模拟量输出 模拟量输出FB analog2NDA(三菱FX3U)

STM32封装ESP8266一键配置函数:实现实现AP模式和STA模式切换、服务器与客户端创建

How does vscade use the built-in browser?

Thesis landing strategy | how to get started quickly in academic thesis writing

ServiceMesh主要解决的三大痛点

offer如何选择该考虑哪些因素

Camera calibration (I): robot hand eye calibration

Decorator basic learning 02

U++4 接口 学习笔记

【Android Kotlin协程】利用CoroutineContext实现网络请求失败后重试逻辑

树与图的深度优先遍历模版原理

A detailed explanation of head pose estimation [collect good articles]

Using thread class and runnable interface to realize the difference between multithreading

Vscode automatically adds a semicolon and jumps to the next line

ClickHouse(03)ClickHouse怎么安装和部署

Structure actual training camp | after class homework | module 6

Function pointer and pointer function in C language

Inventory host list in ansible (I wish you countless flowers and romance)