当前位置:网站首页>Read Elephant Swap in one article, why does it bring such a high premium to ePLATO?

Read Elephant Swap in one article, why does it bring such a high premium to ePLATO?

2022-07-31 07:59:00 【Grapefruit Finance】

Since April this year, after experiencing the de-anchoring of UST and the successive "bankruptcies" of leading investment institutions and unicorn CeFi platforms, the crypto industry has ushered in an unprecedented development crisis. On the one hand, market confidenceInsufficient or even panic, which led to the accelerated flight of funds, on the other hand, the slow growth of the overall market led to weak returns in various sectors, making it difficult for investors to obtain considerable returns, and the market further fell into a new round of vicious circles.

Of course, even if the overall market is in a downward cycle, there are still many profit opportunities in the crypto market. The new LaaS protocol Elephant Swap is using its unique LaaS solution to inject confidence into the recovery of liquidity in the DeFi market, and at the same time for investmentIt brings a very considerable arbitrage space.At present, Plato Farm is the first project to use the Elephant Swap liquidity service. Investors can pledge their PLATO assets to Elephant Swap to obtain ePLATO at 1:1 and obtain potential premium income.According to the latest price, the current price of PLATO is 0.00287USDT, while the premium of ePLATO has reached 0.052USDT, so every arbitrageur can get a lot of arbitrage space from it.

Elephant Swap is so sacred, why can it magnify the value of PLATO so much?

Attracting other investors through considerable incentives, injecting funds into the fund pool to provide liquidity is the main idea. For example, if I hold 3 Ethereum and a large amount of USDT in my hand, I can put these funds into theSome capital pools to get incentives to improve capital utilization.Therefore, how to provide incentives and mobilize the enthusiasm of these fund holders to provide liquidity is always a problem that we need to think about.

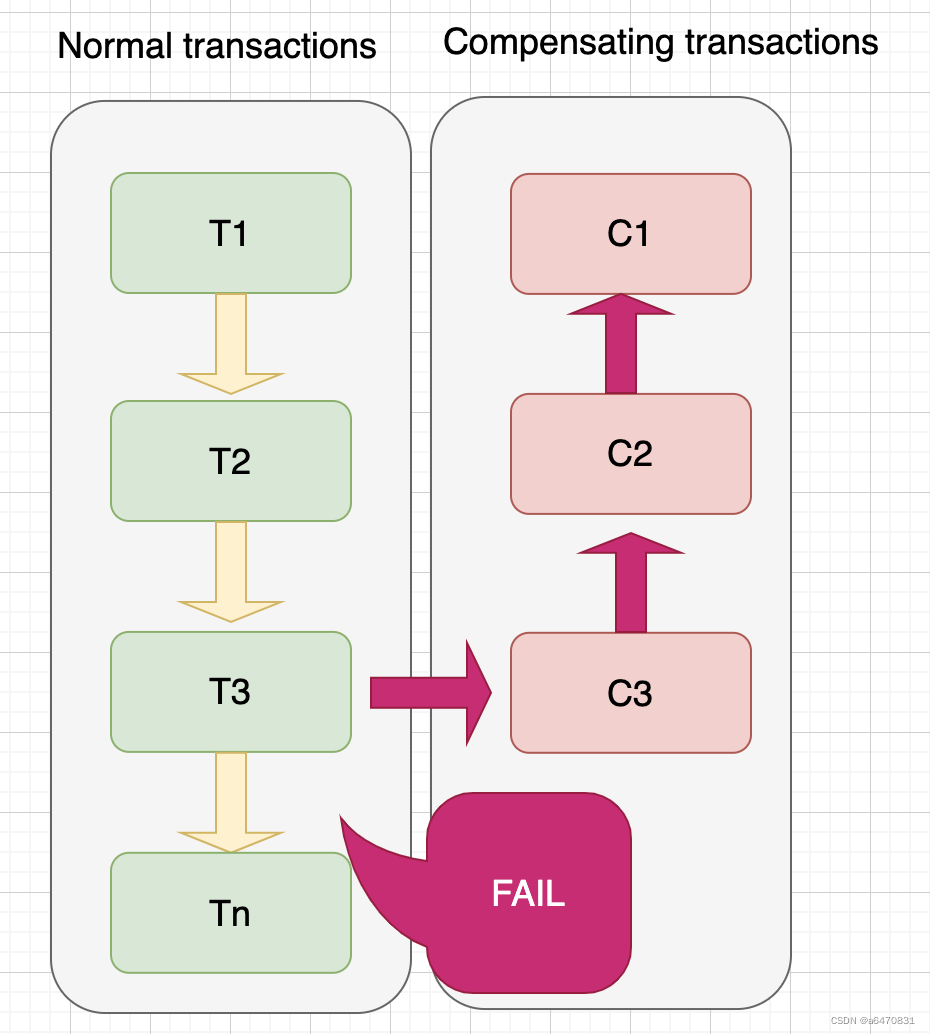

Although the LaaS (liquidity as a service) track has developed to a certain height at the end of last year, whether it is the "mercenary" form of liquidity mining, or the existing LaaS agreement is still a single generationCoins are used as incentives, and these LaaS protocols no longer work when the market faces a downturn.Elephant Swap is an emerging protocol written on the LaaS track. It has built a new incentive method that does not depend on a single token. The liquidity effect will not be affected by the external market. At the same time, any liquidity needs such as DeFi projects and encrypted assets can be used in Elephant.Get liquidity services in Swap.

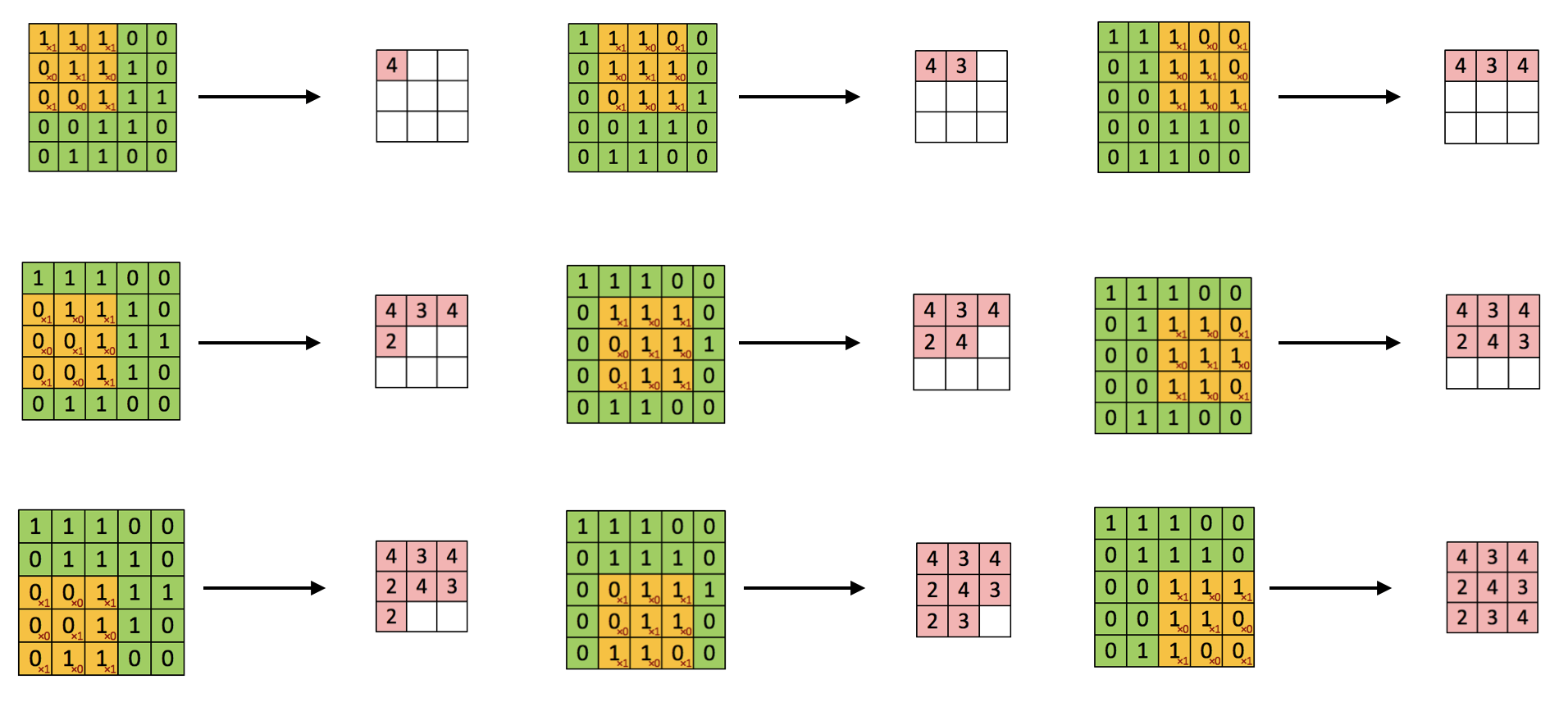

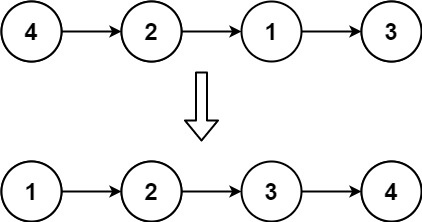

The mechanism of Elephant Swap is well understood. If a crypto asset wants to obtain liquidity, it needs to go online on Elephant Swap and build a pool of the TOKEN, and whenever the TOKEN is pledged in the pool, the contract of Elephant Swap willThe locked eTOKEN will be minted 1:1 (the initial anchor is 3 times the original TOKEN price), and the holders of the locked eTOKEN need to conduct transactions in Elephant Swap, such as liquidity mining, pledge, DEX trading, etc.In order to obtain the speed of unlocking eTOKEN, the higher the transaction frequency and the larger the transaction volume, especially the more eTOKEN unlocked in the transaction, the higher the unlocking speed obtained. After the eTOKEN is unlocked, you can trade and make profits.

For example, the current farm metaverse project Plato Farm has logged into Elephant Swap. If you are a PLATO holder, when we want to carry out arbitrage, you first need to pledge PLATO to Elephant Swap and obtain the locked ePLATO.After locking ePLATO, we need to continuously trade in Elephant Swap to obtain the unlocking speed, such as providing liquidity (especially using unlocked ePLATO for higher gains), Swap transactions, etc. to obtain the speed of unlocking ePLATO.

When we unlock each ePLATO, at the current price of 0.052, we will be able to make a profit of 0.049USDT. If we pledge PLATO (348432 pieces) equivalent to 1000USDT into Elephant Swap, we are expected to unlock allWhen ePLATO, the arbitrage income of 16073USDT was obtained.

Of course, most investors prefer to continue to use the unlocked ePLATO for liquidity in order to obtain a higher unlocking speed, so ePLATO will have a higher purchase demand in Swap due to its rigid demand, so weIt can be seen that since the launch of Elephant Swap on PLATO for a few days, it has maintained an upward trend.On the one hand, the premium generated can be seen as the recognition of the Elephant Swap mechanism by investors and the market, and it is also an early verification of the feasibility of the Elephant Swap model.

From another point of view, based on this arbitrage opportunity, more and more people will hold PLATO and participate in it, which means that it is beneficial to the price growth of the secondary market for PLATO, and it also means thatWith a large amount of PLATO in a locked state, the circulation plate of PLATO is lowered.At the same time, a large number of transactions in Elephant Swap will also bring continuous liquidity and market confidence to PLATO, which will also greatly promote the ecological development of Plato Farm.At present, PLATO's launch of Elephant Swap has also started a trading competition, and arbitrageurs are expected to obtain additional rewards from it.

At the same time, Elephant Swap will also launch a joint airdrop activity with Safepal, and participating users are expected to receive ePLATO airdrops.

边栏推荐

- Calculation example of matlab program iEEE9 node system for power flow calculation of AC-DC hybrid system based on alternate iteration method

- 2704:寻找平面上的极大点

- 2022.07.13 _ a day

- linux redis6.2.6配置文件

- 正则表达式绕过

- Spark 在 Yarn 上运行 Spark 应用程序

- Leetcode952. Calculate maximum component size by common factor

- 电压源的电路分析知识分享

- Vscode: Project-tree plugin

- 页面懒加载

猜你喜欢

随机推荐

把 VS Code 当游戏机

How to set the computer password?How to add "safety lock" to your computer

解决安装 Bun 之后出现 zsh compinit: insecure directories, run compaudit for list. Ignore insecure directorie

mysql insert new field method

CNN--各层的介绍

一文读懂Elephant Swap,为何为ePLATO带来如此高的溢价?

[PSQL] SQL Basic Course Reading Notes (Chapter1-4)

波士顿房价数据集 Boston house prices dataset

【面试:并发篇38:多线程:线程池】ThreadPoolExecutor类的基本概念

链表实现及任务调度

Vscode:Project-tree插件

The Perfect Guide|How to use ODBC for Agentless Oracle Database Monitoring?

【科普向】5G核心网架构和关键技术

【愚公系列】2022年07月 Go教学课程 022-Go容器之字典

个人报错问题 持续总结

The Spark run on Yarn Spark application

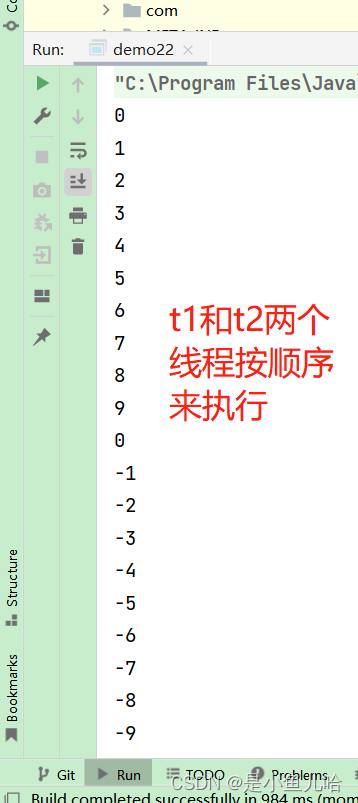

进程和线程的区别&&run和start区别与联系

安装部署KubeSphere管理kubernetes

2022.07.12_Daily Question

DAY18: Xss Range Clearance Manual