当前位置:网站首页>Folding and sinking sand -- weekly record of ETF

Folding and sinking sand -- weekly record of ETF

2022-07-06 00:24:00 【Anchor data】

Title Map : self-control

Market Overview

2022 After the Spring Festival in the year of the tiger A Stocks ushered in the first trading week , Under the influence of the sharp rise in the peripheral market ,A There is no doubt that stocks will open higher . It is also jokingly called by shareholders “ Chinese diving champion ” Of A stocks , In this week, he has shown us the trend of high opening and low going for many times . But fortunately, the final closing was a good start in the first week . Similarly, this week has fully and extremely interpreted the structural differentiation market . Under the influence of the sharp decline of mobile phones in Ningde era , The growth enterprise market simply turns the momentum of the past into counseling, and it is pressed on the ground and cannot be rubbed up , New energy sources , The power equipment sector also fell endlessly , And in commodities , The real estate , Driven by infrastructure , The performance of Shanghai stock index is very strong .

We know the market performance in the past period , The overall performance of the market includes 、 Hot market segments , Style wait review Our investment strategy , Grasp the market trend to a certain extent , Auxiliary investment .

The performance of key market indexes

From the following key indexes of the market, we can get an overview of the overall performance of the market : The best performance in the past week is the Shanghai Composite Index , The worst is gem .

| Name of the securities | Stock code | 2022-02-07 to 13( This week, ) | near 10 God | near 30 God | near 60 God | 2022 Since the year |

|---|---|---|---|---|---|---|

| The Shanghai composite index | 000001 | 3.02% | 2.71% | -3.55% | -6.0% | -4.86% |

| personal witness 500 | 000905 | 2.5% | 2.46% | -6.04% | -7.9% | -8.35% |

| Total syndrome | 000985 | 1.21% | 1.56% | -5.53% | -8.72% | -8.35% |

| personal witness 1000 | 000852 | 0.87% | 1.54% | -7.84% | -10.73% | -12.19% |

| Shanghai and Shenzhen 300 | 000300 | 0.82% | 0.99% | -4.43% | -9.25% | -6.86% |

| Shenzhen Stock Index | 399001 | -0.78% | -0.02% | -7.1% | -12.03% | -10.99% |

| kechuang 50 | 000688 | -4.85% | -2.05% | -7.77% | -16.07% | -16.35% |

| Gem index | 399006 | -5.59% | -2.15% | -8.09% | -17.72% | -17.34% |

2022-02-07 One 2022-02-13( This week, ) In the field ETF Up and down charts

The top ten with the largest increase ETF As shown below :

The best ones are coal ETF They are basically commodity sectors , The rest is education , Building materials, etc .

| Name of the securities | Stock code | 2022-02-07 to 13( This week, ) | near 10 God | near 30 God | near 60 God | 2022 Since the year |

|---|---|---|---|---|---|---|

| coal ETF | 515220 | 13.83% | 10.27% | 4.58% | 3.82% | 8.18% |

| energy ETF | 159930 | 13.07% | 9.4% | 3.7% | 4.95% | 8.95% |

| energy ETF fund | 159945 | 12.26% | 9.23% | 2.98% | 4.1% | 7.51% |

| Soybean meal ETF | 159985 | 11.13% | 9.58% | 14.91% | 19.56% | 17.77% |

| resources ETF | 510410 | 9.77% | 7.32% | 0.57% | -4.7% | 0.84% |

| education ETF | 513360 | 9.24% | 5.98% | -12.56% | -21.37% | -12.04% |

| tourism ETF | 562510 | 9.09% | 3.54% | 5.46% | 8.09% | 12.65% |

| goods ETF | 510170 | 8.91% | 6.01% | -0.64% | -5.23% | 0.37% |

| win-win ETF | 517090 | 8.67% | 6.18% | 3.9% | 6.39% | 10.1% |

| Building material ETF | 516750 | 8.59% | 6.33% | -3.43% | 3.59% | 1.77% |

The top ten with the biggest decline ETF As shown below :

The worst is Private enterprises take the lead 100ETF, Almost all of them are new energy , Power equipment and other sectors .

| Name of the securities | Stock code | 2022-02-07 to 13( This week, ) | near 10 God | near 30 God | near 60 God | 2022 Since the year |

|---|---|---|---|---|---|---|

| Private enterprises take the lead 100ETF | 159973 | -12.99% | -4.42% | 0.72% | -6.77% | -12.39% |

| New energy leader ETF | 159752 | -9.2% | -4.25% | -4.54% | -16.05% | -17.61% |

| Battery fund | 562880 | -9.12% | -4.4% | -6.17% | -20.49% | -18.13% |

| New energy 50 | 516270 | -9.07% | -4.23% | -4.72% | -16.16% | -17.03% |

| New energy 80 | 516850 | -8.44% | -3.81% | -5.63% | -17.99% | -18.08% |

| The battery ETF | 561910 | -8.41% | -3.92% | -6.03% | -20.28% | -18.22% |

| Photovoltaic fund | 516290 | -8.21% | -2.77% | -7.01% | -17.67% | -20.71% |

| New energy BS | 516580 | -7.83% | -3.17% | -5.28% | -17.72% | -17.36% |

| Low carbon ETF | 562300 | -7.3% | -2.58% | -3.71% | -8.56% | -12.99% |

| Smart tram | 560000 | -7.19% | -3.85% | -6.69% | -18.75% | -16.04% |

Source of the article : official account -- Anchor investment notes (ID: anchor_data)

边栏推荐

- Pointer pointer array, array pointer

- Spark AQE

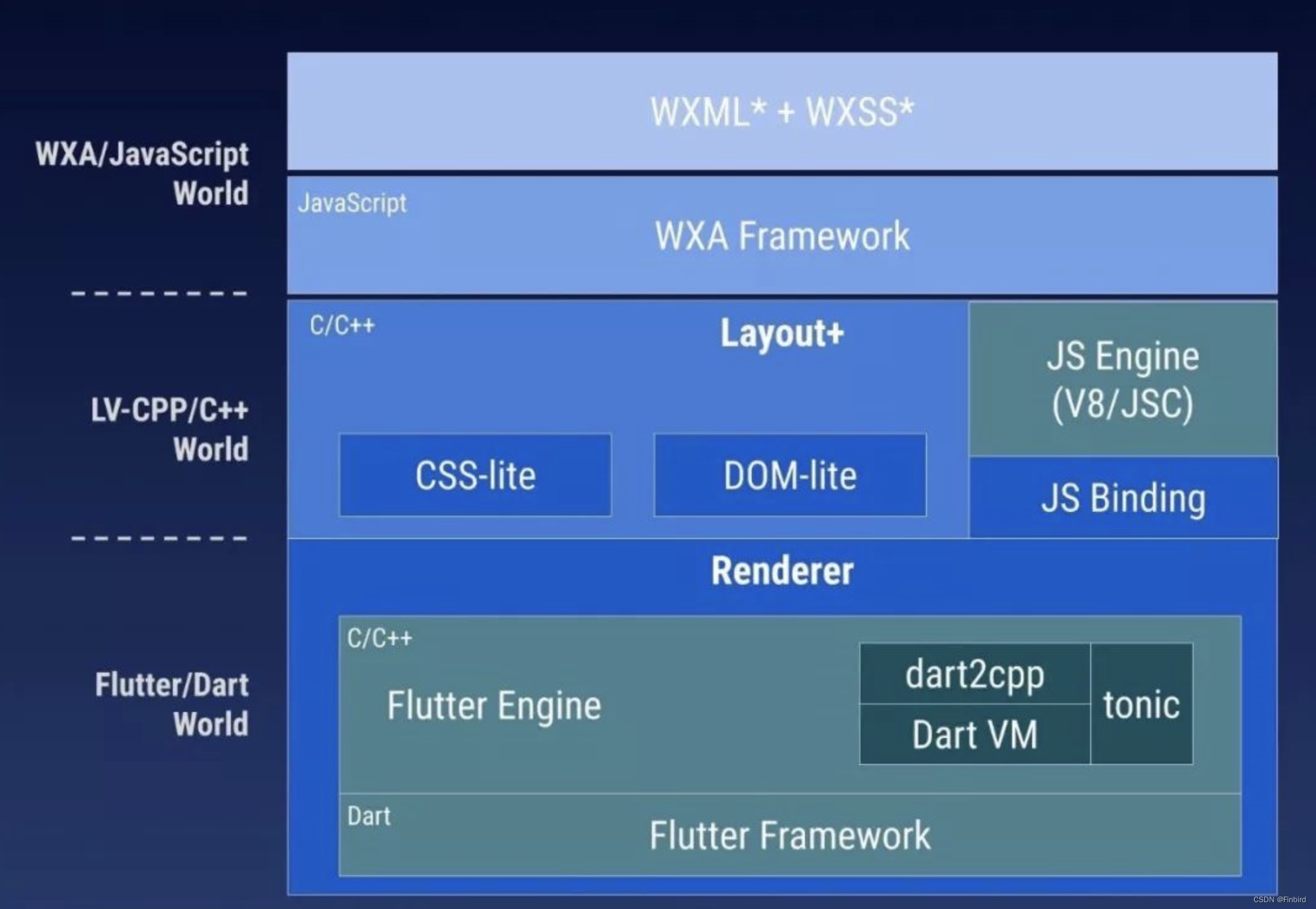

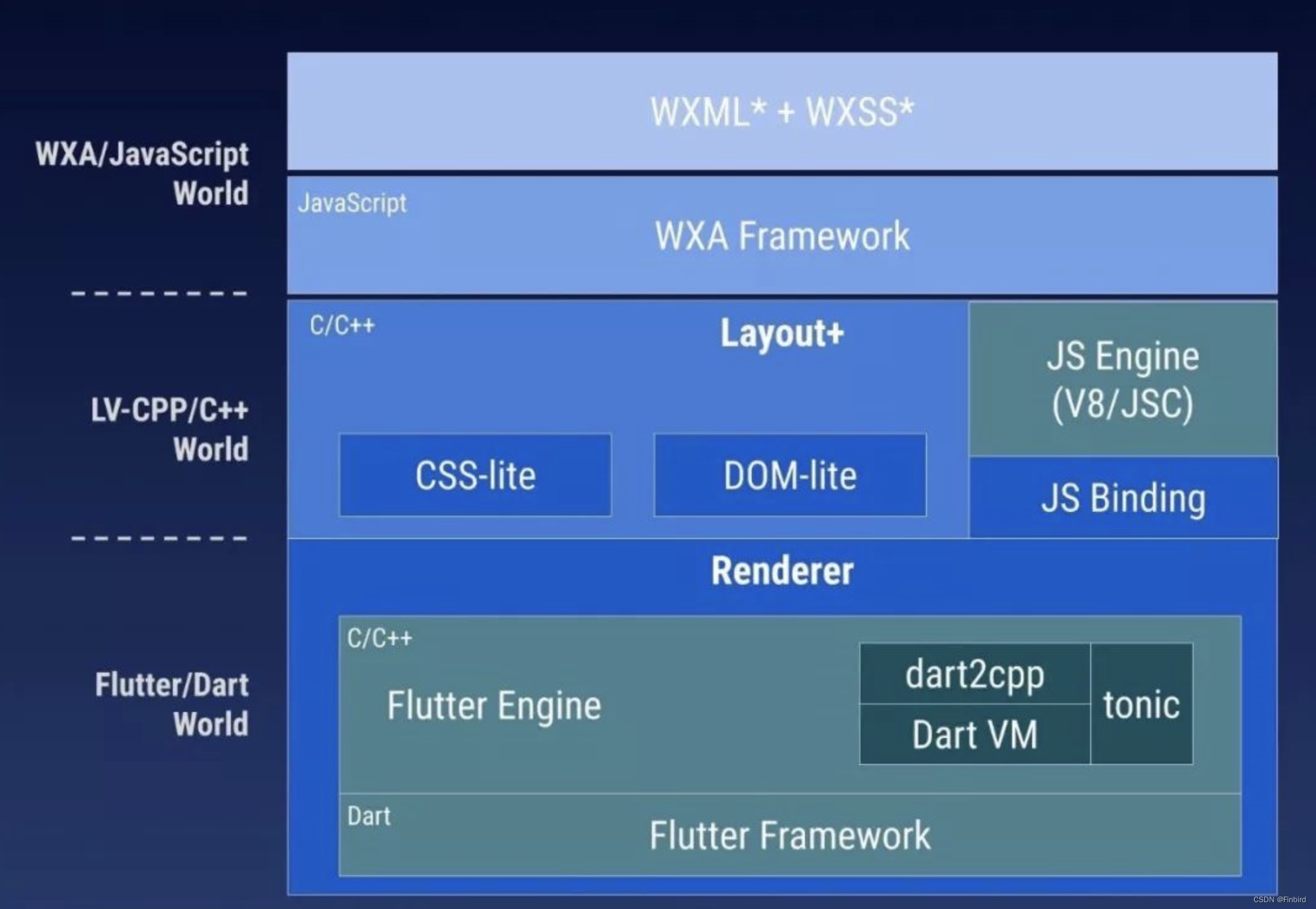

- How to use the flutter framework to develop and run small programs

- OS i/o devices and device controllers

- PHP determines whether an array contains the value of another array

- Basic introduction and source code analysis of webrtc threads

- Global and Chinese markets of universal milling machines 2022-2028: Research Report on technology, participants, trends, market size and share

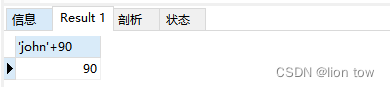

- MySQL之函数

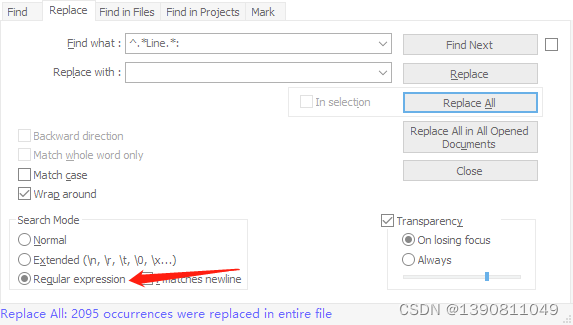

- notepad++正则表达式替换字符串

- Classic CTF topic about FTP protocol

猜你喜欢

How to use the flutter framework to develop and run small programs

MySQL之函数

如何利用Flutter框架开发运行小程序

Notepad++ regular expression replacement string

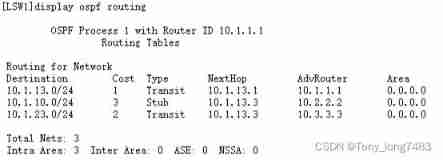

Huawei equipment is configured with OSPF and BFD linkage

MySql——CRUD

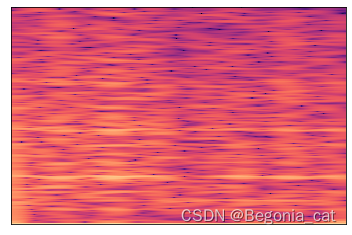

Recognize the small experiment of extracting and displaying Mel spectrum (observe the difference between different y_axis and x_axis)

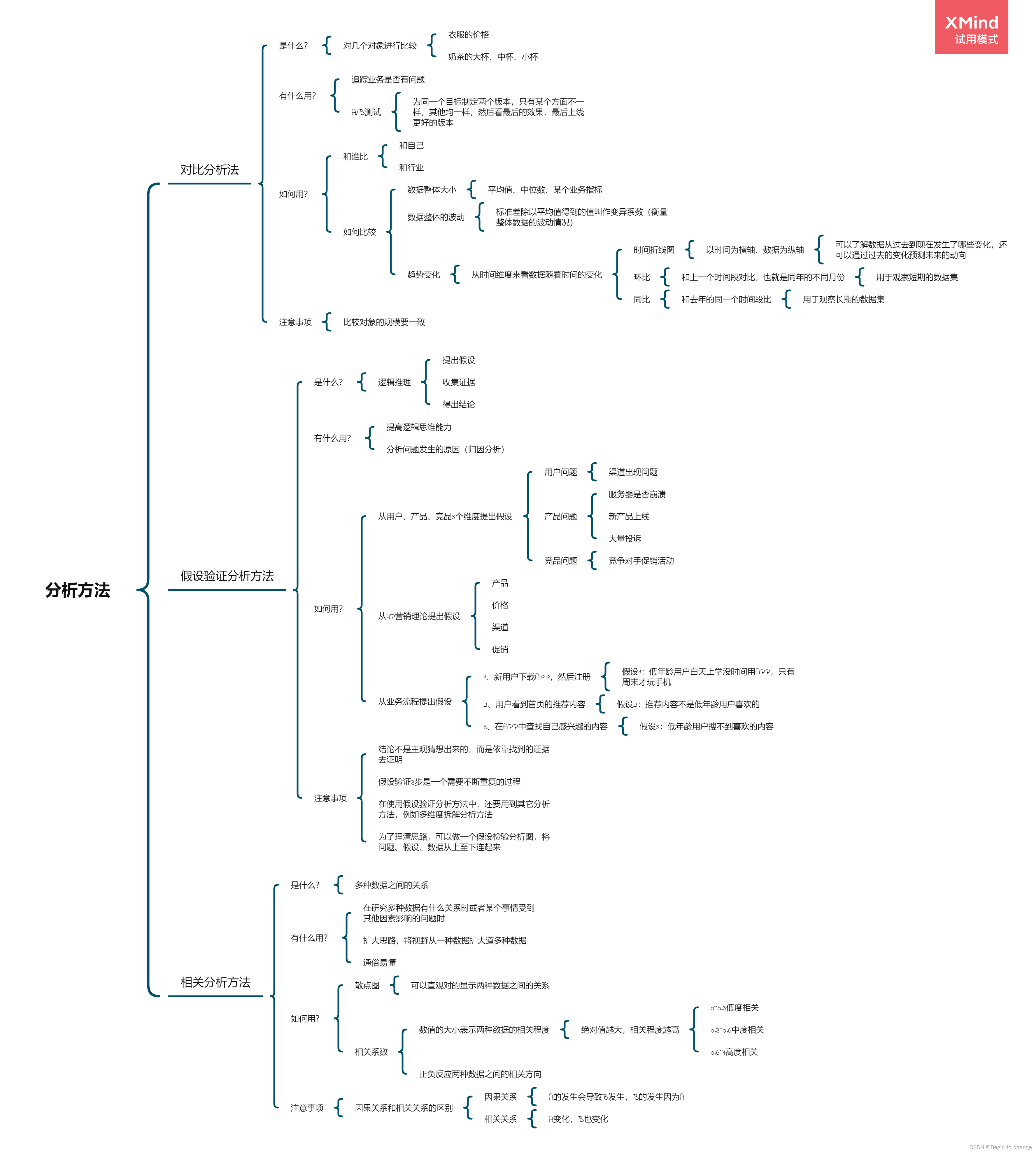

Data analysis thinking analysis methods and business knowledge -- analysis methods (II)

提升工作效率工具:SQL批量生成工具思想

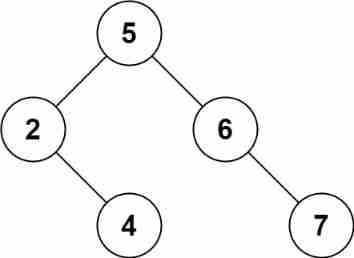

Leetcode 450 deleting nodes in a binary search tree

随机推荐

Spark-SQL UDF函数

[binary search tree] add, delete, modify and query function code implementation

Gd32f4xx UIP protocol stack migration record

MySQL之函数

Codeforces round 804 (Div. 2) [competition record]

Priority queue (heap)

Spark SQL空值Null,NaN判断和处理

【NOI模拟赛】Anaid 的树(莫比乌斯反演,指数型生成函数,埃氏筛,虚树)

Extracting profile data from profile measurement

Notepad++ regular expression replacement string

LeetCode 6004. Get operands of 0

LeetCode 1189. Maximum number of "balloons"

What are Yunna's fixed asset management systems?

[EI conference sharing] the Third International Conference on intelligent manufacturing and automation frontier in 2022 (cfima 2022)

Notepad + + regular expression replace String

Power query data format conversion, Split Merge extraction, delete duplicates, delete errors, transpose and reverse, perspective and reverse perspective

Spark AQE

Pointer - character pointer

Search (DFS and BFS)

DEJA_VU3D - Cesium功能集 之 055-国内外各厂商地图服务地址汇总说明