当前位置:网站首页>Q2 encryption market investment and financing report in 2022: gamefi becomes an investment keyword

Q2 encryption market investment and financing report in 2022: gamefi becomes an investment keyword

2022-07-05 17:10:00 【Why do migrant workers bother migrant workers】

Affected by the secondary market ,5、6 Monthly financing activity decreased sharply .

The cryptocurrency market fluctuated greatly in the second quarter .

Macro level , The Federal Reserve has decided to raise interest rates 75 BPS to 1.75% , The range of single interest rate hike reached 1994 It has reached a new high in recent 30 years since . Under the background of interest rate hike , Investors' trading sentiment was frustrated , It is likely to sell risky assets before the economy slows , This also brings bearish sentiment to the encryption market .

From the encryption market itself ,5 month Luna crash 、UST Undocking not only brings the narrative of algorithmic stability currency into a dead end , It also brought a series of chain reactions . When the price of the currency fell sharply , A large number of mortgage assets of institutions are facing liquidation , The size of the lending market has shrunk sharply , Three arrows 、Celsius、Jump、Hashed 、Delphi And other institutions suffered heavy losses , some CeFi The platform is also facing the pressure of user redemption .

In terms of numbers , Whole DeFi TVL from 2400 More than 100 million dollars have fallen sharply to the current 720 Billion dollars , It's broken 70%.NFT The performance of the market is also unsatisfactory , The market value started at the beginning of the year 350 US $billion to 223 Billion dollars , Declined 36 %.GameFi aspect , Once the P2E King of chain Tour Axie Infinity, Its game token AXS It fell from the highest point 92%.

so to speak ,2022 Second quarter , The encryption market is in chaos .

But although the secondary market has repeatedly hit new lows , The investment trend and theme of the primary market are taking shape , Established institutions and new investors quickly enter , Look for the best investment opportunities in various vertical fields . The primary market often ambushes into hot areas before the secondary market , It also indicates a period “ time difference ” The investment direction of the secondary market . Therefore, grasp the investment and financing situation of the primary market , It is equivalent to laying out in advance for future secondary market investment .

Look back Q2 Primary market investment and financing activities ,Odaily The daily planet found :

Q2 The amount of financing is 511 pen , exceed 1 The number of transactions with more than $100 million reached 28 pen ;

Crypto financial service providers are closely connected with the traditional financial industry , And in custody 、 Settlement 、 Continuous innovation in payment and other fields , Therefore, it has received more attention from capital ;

In terms of financing quantity and amount ,GameFi It is the preferred theme for the layout of major investment institutions ;

Q2 There are 11 Institutions participated 10 More than times of investment ;

Animoca Brands Participate in investment 41 pen , It is an institution with the most investment projects ;

Traditional organization and enterprise layout Web3 Prefer transaction payment 、 Yuan universe and DAO.

notes :Odaily According to the business type of each project 、 service object 、 Dimensions such as business model will Q2 Disclosure of financing ( actual close The time is often earlier than the announcement ) All items of are transferred into 5 Competition Road : infrastructure 、 application 、 Technical service provider 、 Financial service providers and other service providers . Each track is divided into different sub blocks, including GameFi、DeFi、NFT、 payment 、 wallet 、DAO、Layer1、 Cross chain and others .

Q2 The amount of financing is 511 pen , The total amount disclosed is 127.13 Billion dollars

According to the Odaily Planet daily does not make complete statistics ,2022 year 4 Month to 6 In June, the global encryption market occurred 511 Investment and financing events ( Excluding fund raising and mergers and acquisitions ), The total amount disclosed is 127.1 Billion dollars , Focus on infrastructure 、 Technical service provider 、 Financial service provider 、 Apps and other service providers racetrack , Among them, the financing amount obtained by the technical service provider is the largest , by 35.83 Billion dollars .

In all financing events , The scale of financing exceeds 1 The number of transactions with more than $100 million reached 28 pen . Among them, the infrastructure track 3 pen , Technical service provider racetrack 5 pen , Financial service provider racetrack 12 pen , Other service providers racetrack 3 pen , Apply the track 5 pen .

According to the CB Insights released 2022 The blockchain report in the first quarter of 2013 shows that , In the first quarter of this year, the financing scale of the blockchain industry reached 92 Billion dollars , The number of blockchain investment and financing transactions is 461 pen , The financing scale exceeds 1 The total number of transactions above US $100 million 28 pen .

by comparison ,Q2 The investment activity of the primary market has increased to a certain extent . The financial service track is closely linked with the traditional financial industry , And be able to host 、 Settlement 、 Continuous innovation in payment and other fields , Support the growth of the financial industry , So it gets more attention .

Affected by the secondary market ,5、6 Monthly financing activity decreased sharply

5、6 The encryption market was affected by Luna The news of the crash and the insolvency of major institutions has a great impact , Market sentiment continues to be depressed , There is a serious loss of funds in the market . It can be seen from the investment and financing Q2 The number and amount of financing showed a trend of accelerating decline , Low financing activity .4 The moon has 184 Financing , The amount of financing is about 70.5 Billion dollars ,5 The moon has 165 Financing , The amount of financing is about 35.4 Billion dollars ,6 The moon has 162 Financing , The amount of financing is about 21.2 Billion dollars .

GameFi and NFT More favored by capital

From the distribution of sub track financing quantity ,GameFi The relevant application scenarios, infrastructure and technical solutions of have won the attention and layout of many large institutions , It is also the most favored track by the capital side , We have gained 82 Financing , In total, it accounts for... Of the total financing 16%, Number one . Among them the GameFi The investment in technical services is shared 9 pen .

Even though GameFi After a short period of prosperity, there were a large number of capital projects , Give a person “ A flash in the pan ” Illusion , But from the financing situation , Yes GameFi Focus on investment in applications and infrastructure , It also indicates that capital is right GameFi Still have high expectations .

Also favored by capital NFT Track , Get... Together 67 Financing , second . With NFT The continuous expansion of the market , Its ecosystem is also constantly improving . Especially when NFT And IP After the combination of incubation and copyright commercialization ,NFT It has also become an important means of institutional brand marketing and external publicity . And since the outbreak of digital collections , Consumers' acceptance of digital collections, a new way of collection, is also getting higher and higher , NFT Is also ushering in a period of accelerated development .

Besides , The financing news of other sub tracks is also very active , share 60 pen , Rank third . Incubation is included in this category 、 consulting 、 marketing 、 Technology development platform 、 On chain monitoring 、 Carbon credit 、 Points reward and other fields . We can also see a positive 、 Obvious features : Investment institutions are actively expanding new directions , growing Web3 Use scenarios and dialogue opportunities with end users .

Judging from the financing amount of the sub track ,GameFi The financing amount is far ahead , the height is 29.96 Billion dollars , Accounting for... Of the total financing of the whole industry 23.5%. Trading and payment also have good performance , Respectively by 16 $and 13.53 Billion dollars ranked third and fourth , And chain storage 、 The attention of technical services such as data and chain reform is low .

in addition , Before Ethereum upgrade ,Layer 2 It is considered to be without sacrificing decentralization and security , The main way to achieve faster transaction speed and greater transaction throughput . therefore Layer 2 The field has also been highly expected . But according to the data ,Layer 2 The financing performance in this quarter is not ideal , have only 5 Projects were invested , The amount invested is 1.9 Billion dollars .

Last year, various institutions launched special funds , investment 、 incubation DeFi Project comparison , After experiencing security vulnerabilities 、 Token supply mechanism and liquidation in the declining market , The investment organization is right DeFi Our investment is also more cautious and rational .

边栏推荐

- CMake教程Step2(添加库)

- 微信公众号网页授权登录实现起来如此简单

- CMake教程Step5(添加系统自检)

- stirring! 2022 open atom global open source summit registration is hot!

- 外盘期货平台如何辨别正规安全?

- Iphone14 with pill screen may trigger a rush for Chinese consumers

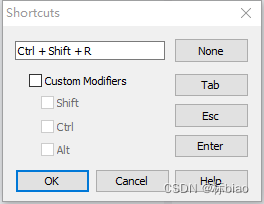

- winedt常用快捷键 修改快捷键latex编译按钮

- Deep learning plus

- npm安装

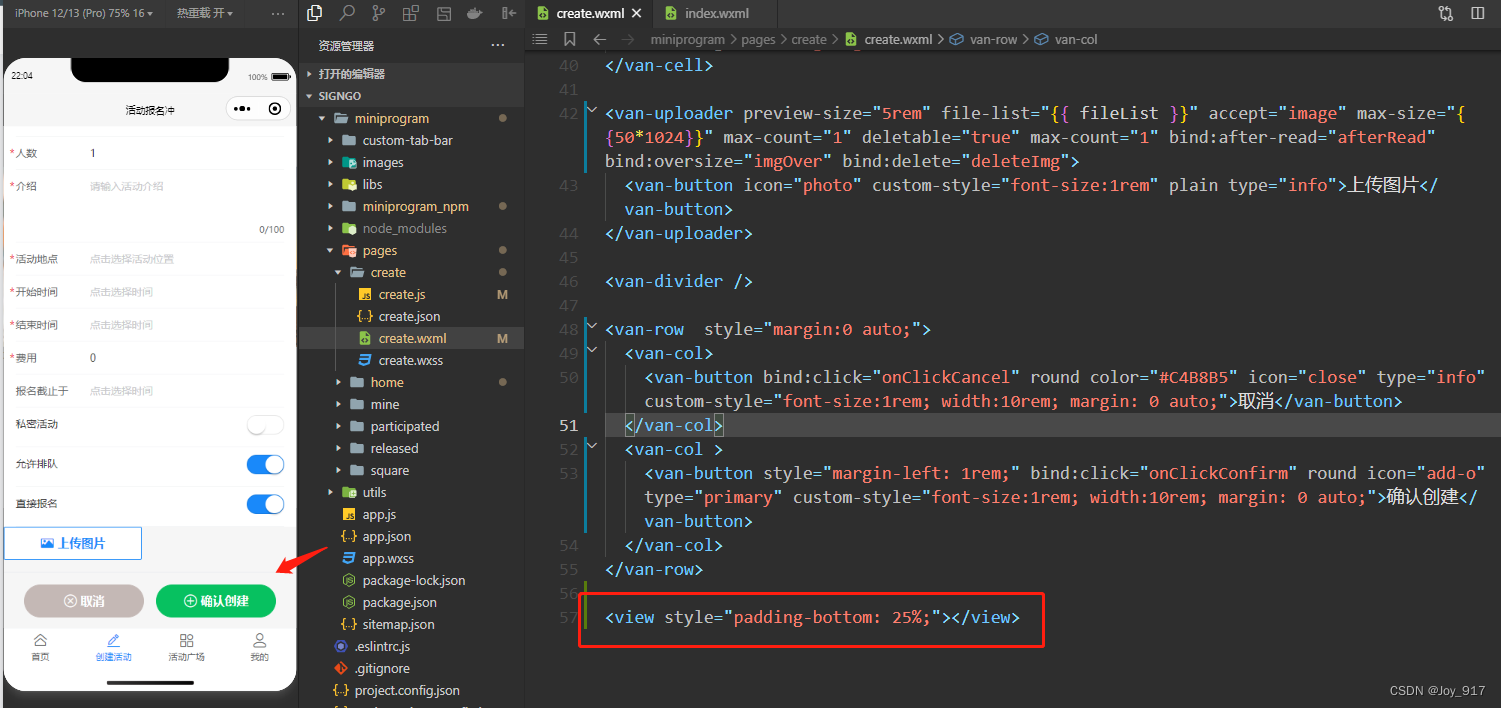

- Combined use of vant popup+ other components and pit avoidance Guide

猜你喜欢

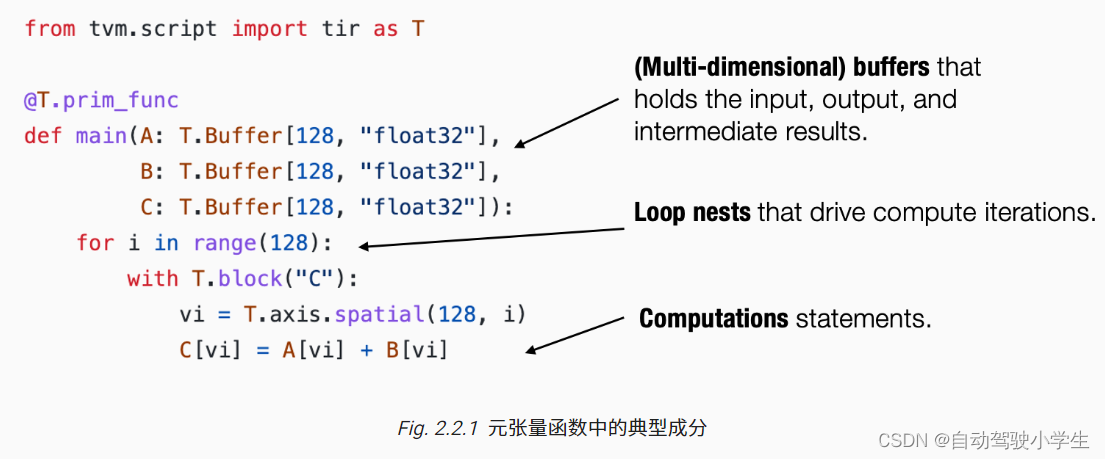

Machine learning compilation lesson 2: tensor program abstraction

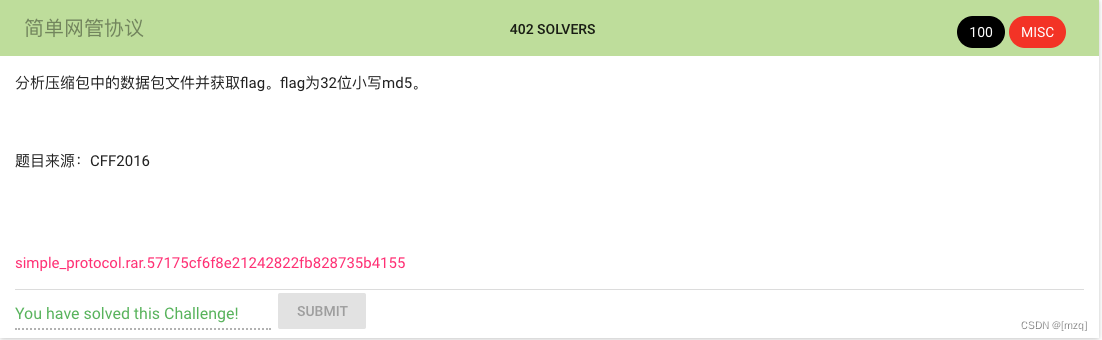

Jarvis OJ 简单网管协议

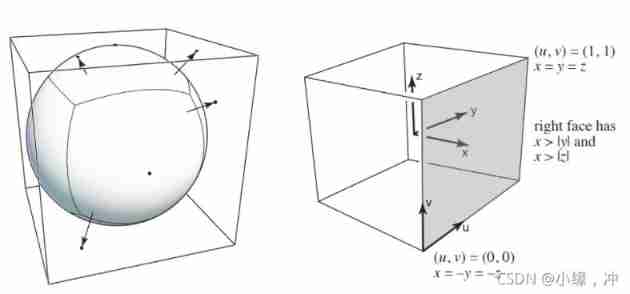

Games101 notes (II)

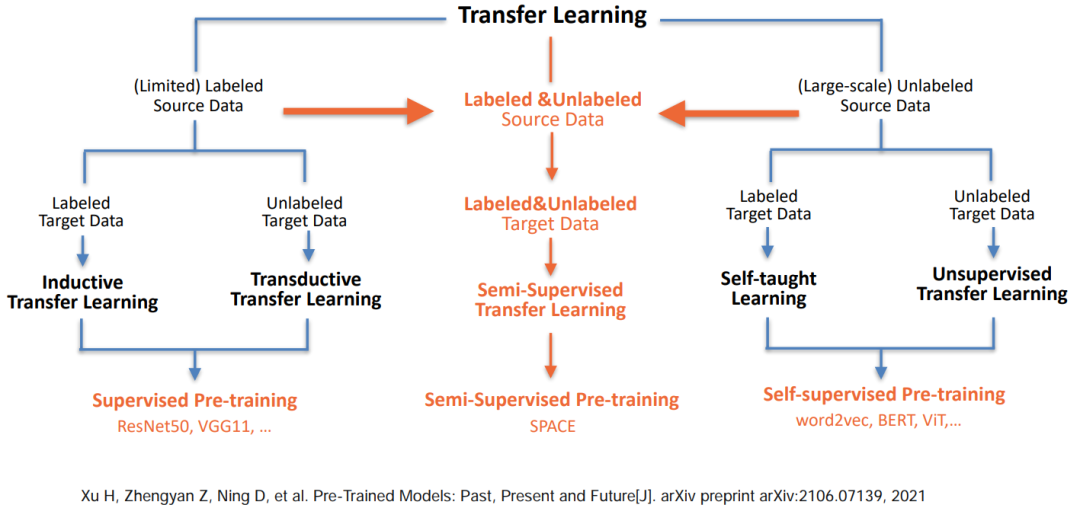

dried food! Semi supervised pre training dialogue model space

国产芯片产业链两条路齐头并进,ASML真慌了而大举加大合作力度

Solution of vant tabbar blocking content

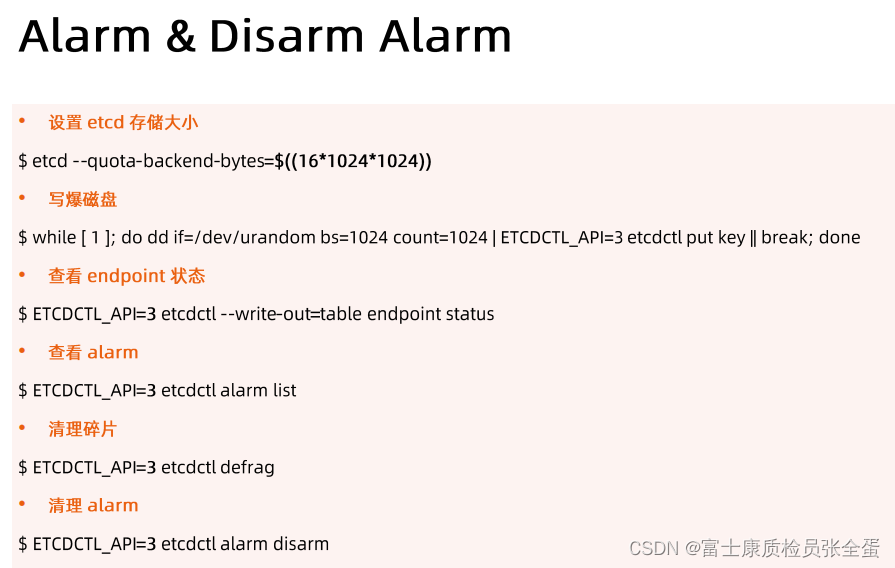

Etcd 构建高可用Etcd集群

Embedded-c Language-1

winedt常用快捷键 修改快捷键latex编译按钮

![[Web attack and Defense] WAF detection technology map](/img/7c/60a25764950668ae454b2bc08fe57e.png)

[Web attack and Defense] WAF detection technology map

随机推荐

C# TCP如何限制单个客户端的访问流量

C language to get program running time

stirring! 2022 open atom global open source summit registration is hot!

【剑指 Offer】66. 构建乘积数组

[first lecture on robot coordinate system]

Zhang Ping'an: accélérer l'innovation numérique dans le cloud et construire conjointement un écosystème industriel intelligent

PHP人才招聘系统开发 源代码 招聘网站源码二次开发

The third lesson of EasyX learning

[Jianzhi offer] 66 Build product array

Combined use of vant popup+ other components and pit avoidance Guide

How can C TCP set heartbeat packets to be elegant?

The second day of learning C language for Asian people

项目引入jar从私服Nexus 拉去遇到的一个问题

IDC报告:腾讯云数据库稳居关系型数据库市场TOP 2!

Thoughtworks 全球CTO:按需求构建架构,过度工程只会“劳民伤财”

Etcd build a highly available etcd cluster

WR | 西湖大学鞠峰组揭示微塑料污染对人工湿地菌群与脱氮功能的影响

Solution of vant tabbar blocking content

手机开证券账户安全吗?怎么买股票详细步骤

Embedded-c Language-3