当前位置:网站首页>Summary: in October, more investment management strategies have come to the new overseas defi project!

Summary: in October, more investment management strategies have come to the new overseas defi project!

2020-11-08 16:17:00 【Gavin talking about defi】

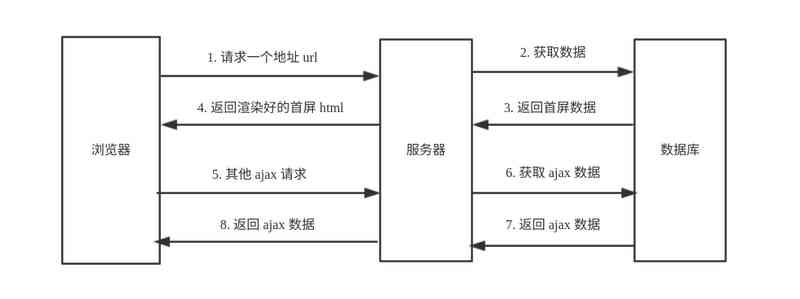

Recently, I communicate with some friends who are more serious about projects , I found that everyone lacks a sense of direction , In fact, in addition to liquidity mining , There have been some new ones in the last month 、 It's been applied DeFi Direction . Just like in the process of traditional finance maturing , The proportion of institutional operation is getting higher and higher , except YFI,DeFi There have also been a variety of asset management solutions based on decentralized contracting .

So what are the opportunities and recent new projects ? This short article just makes a more comprehensive summary :

- ETF Index :10 month Set Protocol The team released DeFi Pulse Index & Set Worthy of attention , adopt Index investment DeFi We already have 1450 Ten thousand dollars , Although it also received DeFi The impact of currency price fluctuations , But it has been shown that ETF It's a real demand scenario .

- Revenue aggregator optimization :Rari and APY.finance Yes YFI It's been iterated , Added risk rating score mechanism ,APY.Finance Last month I raised 360 Thousands of dollars .

- Liquidation solutions :DeFi-Saver Provide a mechanism for mortgagors to avoid liquidation ,KeeperDAO It contains 5 Asset management strategy ,B.Protocol Recently, it has gained more attention abroad .

among Index、B.Protocol Me and Gavin I'm also keeping an eye on , About 10 New opportunities for the month , We think UBI It's also a great decentralization program ,UBI It has excellent performance in acquiring new users , and DeFi Capital injection can be realized more efficiently , The convergence of the two may produce a synergistic acceleration effect . And in the DeFi in ,ETF It is also a friendly asset management tool for new coin holders ,UBI+ETF May be able to be UBI+DeFi The possibility of starting point , So we're looking at priorities Will decentralize ETF Mechanism access UBI.city, Hopefully it will bring interesting chemical reactions .

DeFi For the most part , The problem of trading and borrowing has been solved .

Even to improve the capital efficiency of decentralized exchanges and loan agreements , There are countless design improvements still being proposed , But one thing is for sure , It's no longer “ Proof of concept ” The stage of .

Trading and lending are the cornerstones of the financial system , But in traditional finance , Only a small part of it is driven by individual investors . contrary , Investors are through mutual funds 、 The involvement of intermediaries such as hedge funds or other asset management companies . Due to investors' demand for yield optimization and capital efficiency ,DeFi Now there has been a form of fund managers on the chain .

The starting point

Once the token can be traded on the chain , Funds will emerge to manage assets , But the vast majority of crypto fund management is off the chain .

Melon and Set Protocol It's the first batch of DeFi Asset management products .Melon from Mona El Isa found , It's designed for professional fund managers , But it's not on the market yet .

Set Protocol Is early DeFi An integral part of sport .“Set” It's a basket of assets , They are automatically rebalanced to predefined thresholds . Even if the price changes ,BTCETH50 set Still hold BTC and ETH Of 50/50 ratio .

Set At first it got a certain amount of attention , But the real breakthrough is 9 Month launch DeFi Pulse Index Set. Its market value is 1450 Thousands of dollars ; With DeFi The collapse of tokens , Its performance has been trapped . For all that , It can still be said that investors are widely exposed to DeFi The best place —FTX DeFi Perp Yes 200 Thousands of dollars in Hold positions .

Revenue optimizer

Such as Staked Of RAY and Yearn.Finance Several yield optimizers such as 2020 At the beginning of the year , Take advantage of DeFi Interest rate differences between loan agreements . They have had some success , But until COMP And after the outbreak of liquidity mining ,Yearn To break through the encirclement .

then ,Yearn Launched the vault , In which investors can deposit assets in an automated investment strategy . It is associated with Set The original design is similar to , But the strategy is more complex and asset specific . It's a real innovation , And it's very similar to a professional financial manager , It's just that it's transparent and on the chain .

Yearn yes DeFi The prototype of the asset manager , Several other projects are already offering services similar to asset management .

Harvest、Rari Capital and APY.Finance Both have similar asset aggregation and revenue optimization strategies . Harvest has some other assets and Strategies , But with Yearn There's no big difference . It has 3.5 Billion dollars in savings , however Last month, Suffered attack .

Rari and APY.finance It's the next evolution of the revenue optimizer , It simplifies the choice of strategy , And the risk scoring mechanism is introduced , So it gives investors more information .Rari There are three pool options : One is with Yearn It's like a vault ETH pool , One is low risk “ Stabilization pool ” And one that is considered high risk “ Revenue pools ”. In three pools of funds , with 5900 Million dollars in assets .

APY.Finance Last month I raised 360 Thousands of dollars , and On Thursday adopt Balancer LBP It's a token , It assigns a score to each strategy , And use that score to provide a risk adjusted , The set of revenue optimization .

Community liquidators

without doubt ,DeFi Supported by the margin position clearing robot .DeFi Saver It's one in Maker、Compound and Aave Products built on , By automatically selling some of the collateral and repaying the loan to raise the mortgage rate, users are protected from liquidation .

The cost of liquidation is high , A transaction fee is 8-13%. Of course , It's hard to know when liquidation will take place . Two projects recently launched are trying to bring liquidation related opportunities to ordinary investors .

KeeperDAO from Polychain and Three Arrows raised Seven figure funding , And appoint ren CEO(Taiyang Zhang) and Amber Group Of Tiantian Kullander As a team member . It brings together five assets , be used for “ Liquidation Compound or dYdX Position in 、 To take over Maker CDP、 To readjust SET Basket , Or in Kyber and Uniswap Arbitrage between ”.

B.Protocol It's the latest entrant , Released last week . It also has a liquidity pool , It's possible to liquidate an unencumbered position , But its real enemy is MEV( The value of mining by miners ). Increasingly, liquidation becomes gas The war .B. Protocol image DeFi-Saver The same is based on Maker above , however B.Protocol There was no mortgage program , It is “ In return for priority in liquidation , Share revenue with platform users “.

B.Protocol In the last week An agreement in Executed a flash loan , So that it can be accessed directly Maker Of oracle, This caused some sensationalism .

About

ChinaDeFi - ChinaDeFi.com It's a research driven DeFi Innovation organizations , From all over the world every day <span style='color:#BB8719'>500 A good source of information </span> Close to <span style='color:#BB8719'>900 Content </span> in , seek <span style='color:#BB8719'> Think more deeply 、 It's more systematic </span> The content of , Provide decision-making assistant materials to the Chinese market at the fastest speed

版权声明

本文为[Gavin talking about defi]所创,转载请带上原文链接,感谢

边栏推荐

- Do these mistakes in your resume affect your annual salary of one million?

- How to solve the conflict when JD landed on Devops platform?

- Elasticsearch 学习一(基础入门).

- Builder pattern

- Hello world of rabbitmq

- 契约式设计(Dbc)以及其在C语言中的应用

- Summary of rendering of water wave and caustics (etching) in webgl

- 浅谈,盘点历史上有哪些著名的电脑病毒,80%的人都不知道!

- markdown使用

- 框架-SPI四种模式+通用设备驱动实现-源码

猜你喜欢

我们做了一个医疗版MNIST数据集,发现常见AutoML算法没那么好用

模板引擎的整理归纳

C + + things: from rice cookers to rockets, C + + is everywhere

软件开发中如何与人协作? | 每日趣闻

Flink's sink: a preliminary study

我用 Python 找出了删除我微信的所有人并将他们自动化删除了

大龄程序员没有出路吗?

Tips and skills of CSP examination

I used Python to find out all the people who deleted my wechat and deleted them automatically

PHP生成唯一字符串

随机推荐

Huawei has an absolute advantage in the 5g mobile phone market, and the market share of Xiaomi is divided by the market survey organization

write文件一个字节后何时发起写磁盘IO

浅谈OpenGL之DSA

One minute comprehensive understanding of forsage smart contract global shared Ethereum matrix plan

2035我们将建成这样的国家

On the concurrency of update operation

Elasticsearch learning one (basic introduction)

Solution to the problem of offline connection between ADB and mobile phone

小青台正式踏上不归路的第3天

LeanCloud 十月变化

Google's AI model, which can translate 101 languages, is only one more than Facebook

laravel8更新之维护模式改进

python开发qt程序读取图片的简单流程

laravel8更新之速率限制改进

这几个C++的坑,一旦踩中了,加班是肯定避免不了了!

别再在finally里面释放资源了,解锁个新姿势!

Improvement of maintenance mode of laravel8 update

刚刚好,才是最理想的状态

构建者模式(Builder pattern)

10 common software architecture patterns