当前位置:网站首页>The bad policy has no long-term impact on the market, and the bull market will continue 2021-05-19

The bad policy has no long-term impact on the market, and the bull market will continue 2021-05-19

2022-08-02 14:01:00 【Make friends with time BTC】

Late yesterday, the regulator issued another announcement requiring financial payment institutions not to carry out business related to virtual currency, and the "The Shanghai Securities News issued an article proposing that if virtual currencies are to be completely blocked, the relevant departments need to upgrade the technology at a deeper level.

Many investors regard this news as a big negative for the market, but I think that in the short term, these news may indeed affect some investors, butJudging from the overall market situation, it does not play much role, and it can even be said that we don't need to care too much.

So far, in this bull market, all the bad news we have seen from domestic regulators is compared with the 2017 94 policyIt's all trivial.When the policy was introduced that year, it was a drain on domestic digital currency transactions, which almost shattered the confidence of most investors. Only a small number of investors persevered and enjoyed the crazier wave of gains that followed.

Why?I think an important reason is that in addition to domestic digital currency transactions, overseas markets are also booming, so after the domestic capital entry was cut off, overseas transactions were quickly filled up, so overall, even if it was such a big "bad""It doesn't have much impact on the follow-up market.

After 1994, the overseas market has become the mainstream, and the domestic share is almost negligible relative to the overseas market. Therefore, the introduction of this regulatory policy is very important.The impact of the overall transaction is even smaller.

Furthermore, the two core driving forces of this round of bull market are the over-issuing of the US dollar and the large-scale currency release, and the other is the large-scale progress of overseas institutions.In the market, neither of these two factors is related to domestic investors and domestic transactions.

And among these two core driving forces, the most fundamental is the over-issue of the dollar.If there is no over-issuance of the US dollar, I estimate that the time for overseas institutions to enter the market in a big way may not be so early.

So we have to keep an eye on the dollar overhang.

If there is any policy that can completely reverse the trend of this bull market, then I think it must be a policy related to reversing the over-issue of the US dollar.Any policy that can reverse the over-issue of the US dollar (such as the Fed's balance sheet reduction, interest rate hikes, etc.) will be the policy to change the direction of the bull market, and policies that have little to do with this will at most only affect market sentiment in the short term.Will not change the trend direction in the long run.

So that's why, on the policy side, my focus is on the policies of the US government, especially the Fed and the US Treasury.

Although the introduction of this regulatory policy has no fundamental impact on the big market, I estimate that it will have a greater impact on our retail investors, and may deposit and withdraw funds.will be more difficult.

In fact, when we take the first step into this field, we should have this mental preparation in our mind: what we enter is aNo man's land is from an old world into a new world, and the new world and the old world are two completely different ecologies.Adventure in the new world, we will reap unexpected gains, but also experience hardships that are unimaginable to ordinary people.For the vast majority of people, it must be the first to go through many hardships, and finally to achieve a positive result.

The incomprehension of others, the strange vision of people outside the circle, and various disadvantages from the policy side are all tests and challenges for us.If you want to be successful in this field, you must be mentally prepared for all such challenges.Without such mental preparation, we will not be able to reach the other side of victory, let alone see a bright future.

边栏推荐

- tinymce-plugins

- Supervision strikes again, what about the market outlook?2021-05-22

- Data Organization---Chapter 6 Diagram---Graph Traversal---Multiple Choice Questions

- FFmpeg 的AVCodecContext结构体详解

- Fabric.js 动态设置字号大小

- Gstreamer Plugin注册流程详解

- 文件加密软件有哪些?保障你的文件安全

- 多个驻外使领馆发提醒 事关赴华出行、人身财产安全

- CSDN(成长一夏竞赛)- 最大数

- About the development forecast of the market outlook?2021-05-23

猜你喜欢

方舟生存进化淘宝面板服务器是怎么一回事?

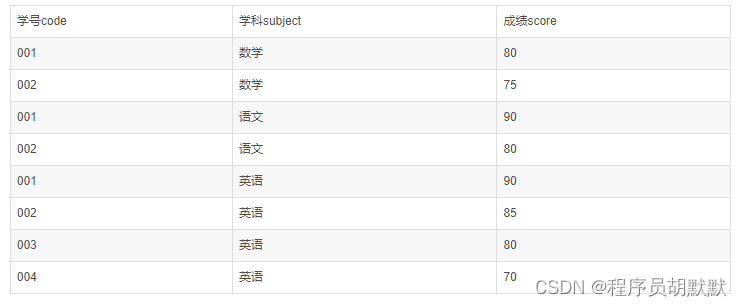

面试SQL语句,学会这些就够了!!!

供应磷脂-聚乙二醇-羧基,DSPE-PEG-COOH,DSPE-PEG-Acid,MW:5000

How to do short video food from the media?5 steps to teach you to get started quickly

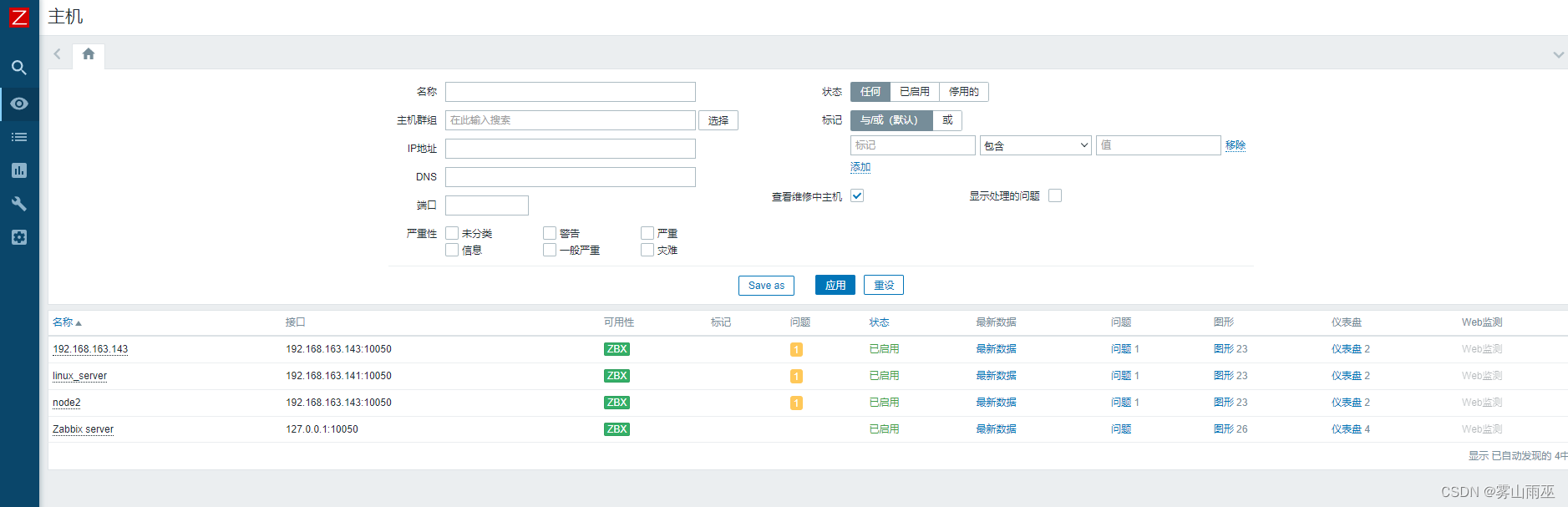

配置zabbix自动发现和自动注册。

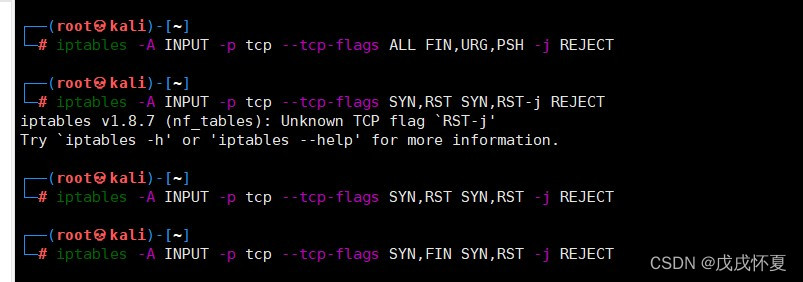

网络安全第三次作业

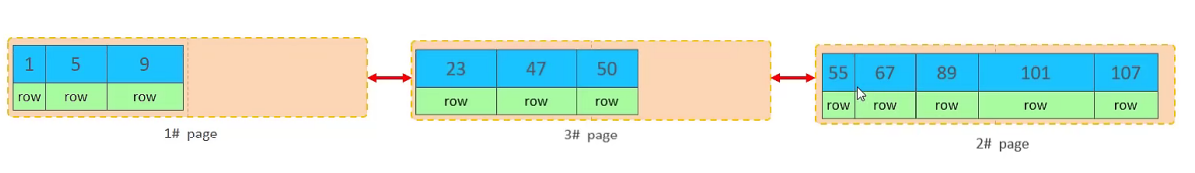

乐心湖‘s Blog——MySQL入门到精通 —— 囊括 MySQL 入门 以及 SQL 语句优化 —— 索引原理 —— 性能分析 —— 存储引擎特点以及选择 —— 面试题

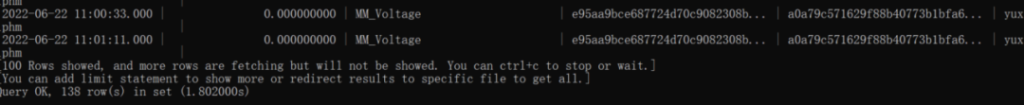

玉溪卷烟厂通过正确选择时序数据库 轻松应对超万亿行数据

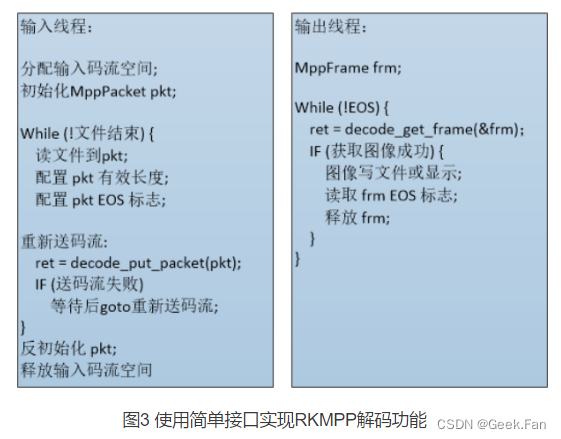

RKMPP库快速上手--(一)RKMPP功能及使用详解

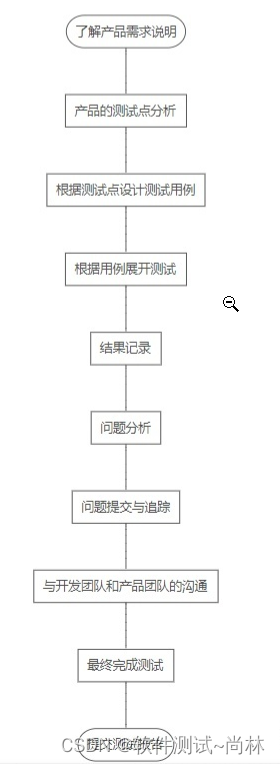

Differences and concepts between software testing and hardware testing

随机推荐

政策利空对行情没有长期影响,牛市仍将继续 2021-05-19

【学习笔记】数位dp

鲲鹏devkit & boostkit

static修饰的函数有什么特点(static可以修饰所有的变量吗)

Awesome!Alibaba interview reference guide (Songshan version) open source sharing, programmer interview must brush

基于深度学习的图像检索方法!

FreeBSD bnxt以太网驱动源码阅读记录三:

如何解决mysql服务无法启动1069

rust使用mysql插入数据

CVE-2020-27986 (Sonarqube sensitive information leak) vulnerability fix

What is the difference between web testing and app testing?

社区收藏缓存设计重构实战

Interview | with questions to learn, Apache DolphinScheduler Wang Fuzheng

GTK:Gdk-CRITICAL **: IA__gdk_draw_pixbuf: assertion ‘GDK_IS_DRAWABLE (drawable)‘ failed

大而全的pom文件示例

k8s之KubeSphere部署有状态数据库中间件服务 mysql、redis、mongo

不精确微分/不完全微分(Inexact differential/Imperfect differential)

二叉树的类型、构建、遍历、操作

stack && queue

智能指针-使用、避坑和实现