当前位置:网站首页>[Chongqing Guangdong education] National Open University spring 2019 2727 tax basis reference questions

[Chongqing Guangdong education] National Open University spring 2019 2727 tax basis reference questions

2022-07-04 11:32:00 【yuyueshool】

Test paper code :2727

Tax base test questions ( Open book )

2019 year 7 month

One 、 Multiple choice questions ( Put the letter sequence number of the only correct answer in the four options of each question in parentheses . Every little question 3 branch , common 15 branch )

1. From the perspective of formal characteristics , Taxation is mandatory 、 gratuitousness 、 The characteristic of fixity , among ,( ) Is its basic guarantee .

A. mandatory B. Fixity

C. gratuitousness D. Normative

2. Of the following taxes , The tax object is consistent with the tax basis ( ).

A. Tonnage tax B. Vehicle and vessel use tax

C. The consumption tax D. corporate income tax

3. In the following options , The correct statement about the registration management of general VAT taxpayers is ( ).

A. Individual industrial and commercial households shall not apply for general taxpayer qualification registration

B. The period of tax counseling period management for small commercial wholesale enterprises newly registered as general taxpayers is 6 Months

C. The business period of a registered general taxpayer refers to the continuous operation period within the taxpayer's duration , It does not include uncollected sales

Sales revenue month

D. Unless otherwise specified , Once the taxpayer is recognized as an ordinary taxpayer , No conversion to small-scale taxpayers

4. Among the following items, the output tax that should be calculated for the deemed sales behavior is ( ).

A. Use self-produced goods for non taxable items B. Use the purchased goods for construction in progress

C. Use self-produced goods in exchange for means of production D. Reward the purchased goods to internal employees

5. In the following behaviors , Those who pay both value-added tax and consumption tax are ( ).

A. The distillery presents its own Baijiu to the cooperative units

B. Cigarette factories transfer their own cut tobacco to produce cigarettes

C. Sell the taxable consumer goods recovered from the entrusted processing directly

D. Grain Baijiu sold in department stores

Two 、 Multiple choice questions ( Put the letter numbers of at least two correct answers in the four options of each question in parentheses , No score will be given for multiple or missing selections . Every little question 5 branch , common 20 branch )

6. Restrain residents ( citizens ) In the international practice of jurisdiction , Special criteria for determining the resident status of natural persons include ( ).

A. Take personal subjective will as the judgment standard

B. Take permanent residence as the judgment standard

C. Judging by nationality

D. Capital control standards

7. About tax jurisdiction , The following statements are correct ( ).

A. Tax jurisdiction emerged after the formation of international tax

B. Tax jurisdiction is independent and exclusive

C The determination of dual resident status of legal persons can often only be resolved through negotiation between the countries concerned

D. International recognition of the source of transnational business income , Generally, the standard of place of business activities is adopted

8. According to the relevant provisions of consumption tax , Among the following consumer goods, those belonging to the cosmetics tax category are ( ).

A. Perfume 、 Essence

B. High grade skin care cosmetics

C Nail Polish 、 Blue eye oil

D. Makeup oil for actors 、 Cleansing Oil

9. In the following options , Input tax cannot be deducted ( ).

A. Input tax of duty-free goods

B. Input tax on goods with normal losses

C Input tax on fixed assets purchased for production

D. Input tax of goods consumed by non taxable items

3、 ... and 、 Judgment questions ( Judge whether the following statements are correct , Correctly mark in brackets after the question “√”, Wrongly mark in brackets after the question “×”. Every little question 5 branch , common 15 branch )

10. General VAT taxpayers purchase goods for external donations , Obtain the legal tax deduction certificate , VAT input tax can be deducted .( )

11. The real estate tax exempt unit provides its real estate to others for free , There is still no need to pay property tax .( )

12. County residents exchange their own residential houses , Land value-added tax should be calculated and paid .( )

Four 、 Short answer ( Each question 15 branch , common 30 branch )

13. Briefly describe the difference between the threshold and the amount of exemption .

14. What are the characteristics of VAT ?

5、 ... and 、 Calculation questions ( common 20 branch )

15. A communication equipment factory is a general VAT taxpayer ,2018 year 2 The following purchase and sales business occurred in the month :

(1) Purchase a batch of raw materials , Accepted and warehoused , The tax indicated on the special VAT invoice obtained is 29. 825 Ten thousand yuan ;

(2) Pay freight to the transportation company 2.5 Ten thousand yuan , And obtain the special VAT invoice issued by the transportation company ;

(3) The sales income excluding tax obtained from selling products this month 270 Ten thousand yuan ; take 100 Advanced employees of the enterprise will be rewarded with self-produced mobile phones , The ex factory price of similar products is each 1200 element .

Calculate the enterprise 2 Value added tax payable in the month .( The VAT rate in this question is based on 2018 year 5 month 1 The current tax rate is calculated .)

边栏推荐

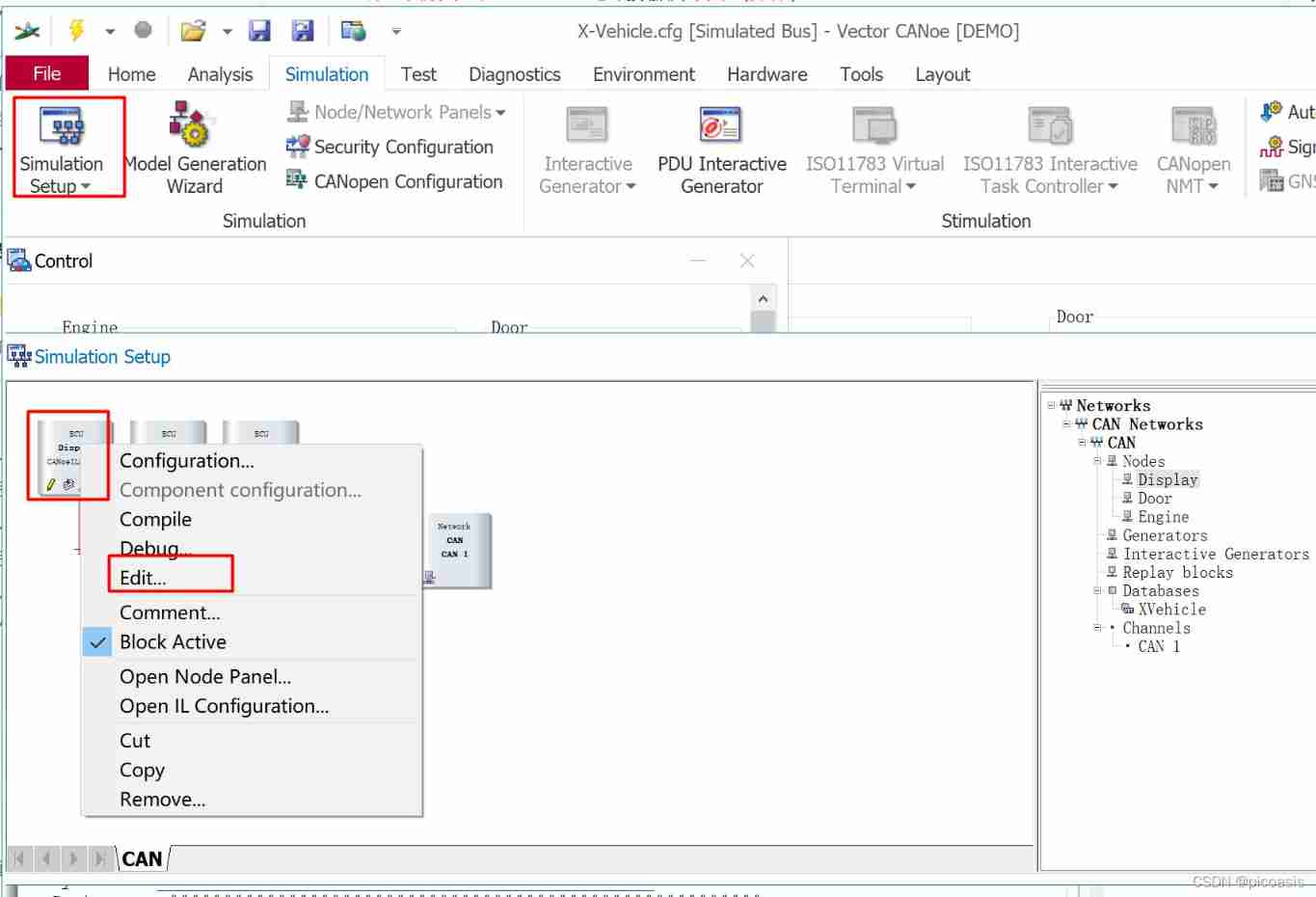

- Canoe: distinguish VT, VN and vteststudio from their development history

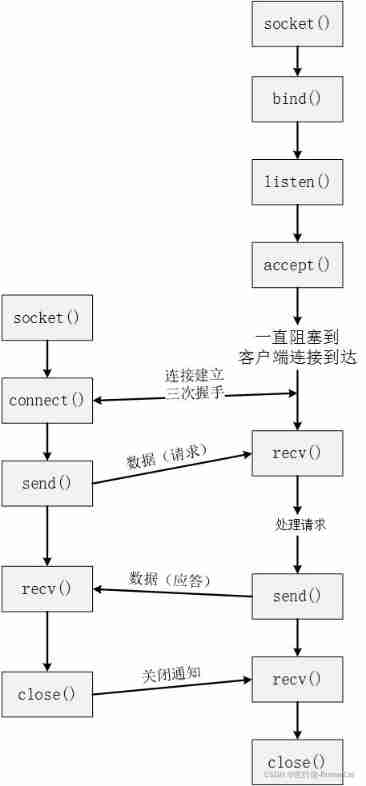

- TCP slicing and PSH understanding

- No response after heartbeat startup

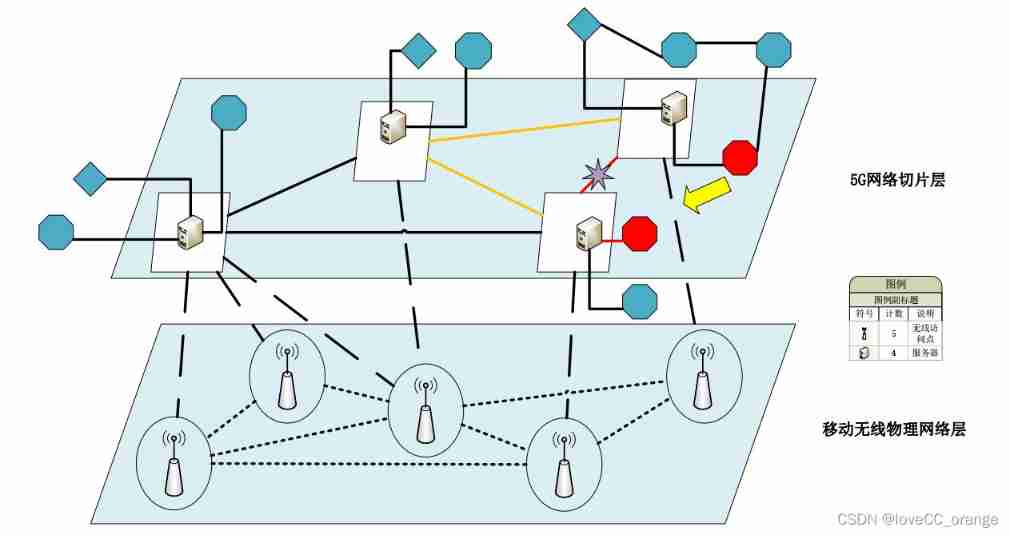

- Lvs+kept realizes four layers of load and high availability

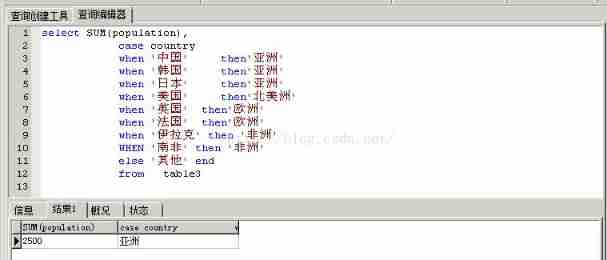

- If function in SQL

- SSH原理和公钥认证

- LxC shared directory addition and deletion

- Attributes and methods in math library

- Digital simulation beauty match preparation -matlab basic operation No. 6

- LVS+Keepalived实现四层负载及高可用

猜你喜欢

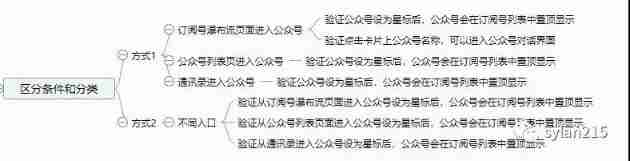

Notes on writing test points in mind mapping

Canoe the second simulation engineering xvehicle 3 CAPL programming (operation)

Usage of case when then else end statement

![[Yunju entrepreneurial foundation notes] Chapter II entrepreneur test 15](/img/72/0fe9cb032339d5f1ccf6f6c24edc57.jpg)

[Yunju entrepreneurial foundation notes] Chapter II entrepreneur test 15

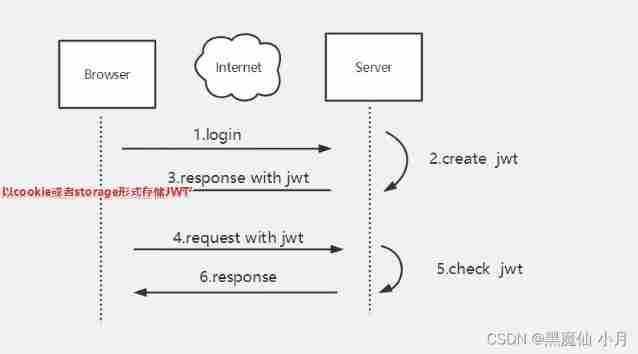

Simple understanding of seesion, cookies, tokens

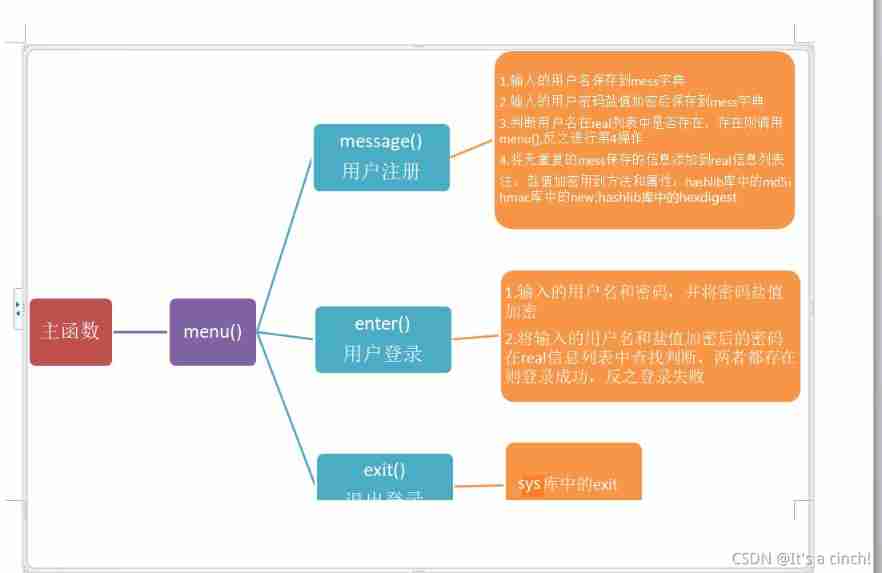

Login operation (for user name and password)

2021-08-09

TCP slicing and PSH understanding

![[Yunju entrepreneurial foundation notes] Chapter II entrepreneur test 6](/img/38/51797fcdb57159b48d0e0a72eeb580.jpg)

[Yunju entrepreneurial foundation notes] Chapter II entrepreneur test 6

2021 annual summary - it seems that I have done everything except studying hard

随机推荐

Oracle11g | getting started with database. It's enough to read this 10000 word analysis

Canoe: what is vtsystem

Customized version of cacti host template

QQ one click cookie acquisition

QQ get group settings

20 kinds of hardware engineers must be aware of basic components | the latest update to 8.13

Introduction to Lichuang EDA

Simple understanding of seesion, cookies, tokens

[Yunju entrepreneurial foundation notes] Chapter II entrepreneur test 10

QQ get group link, QR code

Heartbeat报错 attempted replay attack

守护进程Xinted和日志记录Syslogd

re. Sub() usage

[Yunju entrepreneurial foundation notes] Chapter II entrepreneur test 16

Number and math classes

Understanding of object

[Yunju entrepreneurial foundation notes] Chapter II entrepreneur test 18

Automatic translation between Chinese and English

2021-08-09

Some tips on learning database