当前位置:网站首页>Accounting regulations and professional ethics [11]

Accounting regulations and professional ethics [11]

2022-07-04 16:28:00 【Star drawing question bank】

1. The parties involved in government procurement only include purchasers and suppliers .()(1 branch )

2. As one of the parties to government procurement , Before participating in government procurement activities () Inside , There is no major illegal record in business activities .(2 branch )

A. Half a year

B. A year

C. Two years

D. Three years 3. The following ( ) The budget management functions and powers of the Standing Committee of the National People's Congress .(3 branch )

A. Supervise the implementation of the central and local budgets

B. Examine and approve the adjustment plan of the central budget

C. Repeal the same constitution formulated by the State Council 、 Laws that conflict with the budget 、 The administrative law on final accounts stipulates 、 Decisions and orders

D. Cancel Province 、 Autonomous region 、 The same as the constitution formulated by the people's Congress of the municipality directly under the central government and its Standing Committee 、 Laws and administrative regulations conflict with the budget 、 Local regulations and resolutions on final accounts 4. Of the following , Accounting administrative regulations are ( ).(2 branch )

A.《 accounting law 》

B.《 Regulations on financial and accounting reports of enterprises 》

C.《 The basic work of accounting is standardized 》

D.《 Enterprise accounting system 》5. The taxpayer will give the purchased goods to others for free , Because the value-added tax has been paid when the goods are purchased , therefore , When giving gifts to others, they can no longer be included in sales tax .(1 branch )

6. In addition to national laws 、 Except as otherwise provided in administrative regulations , The bank shall not be any unit or individual ().(3 branch )

A. Query account status

B. Frozen funds

C. Deduction

D. Open an account 7. When the tax authorities have disputes over tax payment , You can apply for administrative reconsideration first , Then pay taxes and late fees according to the tax decisions of the tax authorities .(1 branch )

8. The following statement about the establishment of tax registration , The right ones ().(3 branch )

A. Engage in production 、 The business taxpayer has not applied for the industrial and commercial business license but has been established with the approval of the relevant departments , It shall be established from the date of approval by the relevant departments 30 Apply for tax registration within days , Tax authority issues tax registration certificate and duplicate

B. Engage in production 、 The business taxpayer has not applied for the industrial and commercial business license and has not been established with the approval of the relevant departments , It should start from the date of tax liability 30 Apply for tax registration within days , The tax authority issues a temporary tax registration certificate and a copy

C. Overseas enterprises contract construction in China 、 install 、 assembly 、 Exploration engineering and provision of labor , It shall be from the date of signing the project contract or agreement 30 Intraday , Apply to the local tax authority where the project is located for tax registration , The tax authority issues a temporary tax registration certificate and a copy

D. A withholding agent that has gone through tax registration shall, from the date of the occurrence of the withholding obligation 30 Intraday , Apply to the tax authority at the place of tax registration for tax withholding registration , Tax authorities issue tax withholding registration certificates 9. So-called (), It refers to the act of unauthorized people pretending to sign in the name of others or fictitious people .(2 branch )

A. forge

B. To alter

C. imitation

D. change 10. Understand professional ethics 、 emotional 、 Faith turns into (), Is the fundamental purpose of professional ethics training .(2 branch )

A. Economic performance

B. Benefits

C. action

D. habit 11. Selling goods or taxable services , Its tax liability occurs on the day when the sales payment is received or the voucher for claiming the sales payment is obtained , If the invoice is issued first, it is the day of issuing the invoice .(1 branch )

12. If an accountant violates professional ethics seriously, his accounting qualification certificate shall be revoked , The following are not legal cases ().(2 branch )

A. Private accounting books

B. Often late 、 Leave early , Work not seriously

C. Changing the accounting treatment method at will

D. Failing to keep accounting data as required , Causing damage to accounting data 、 Lost 13. Local accounting regulations refer to provincial 、 Autonomous region 、 The people's Congress and its Standing Committee of municipalities directly under the central government are dealing with Accounting Law 、 Local accounting regulations formulated on the premise that accounting administrative regulations do not conflict .( )(1 branch )

14. According to need , The whole process of monetary capital business of the unit should be handled by one person .( )(1 branch )

15. In the following procurement activities , apply 《 Government procurement law 》 The adjustment is ( ).(2 branch )

A. A public institution uses financial funds to purchase office supplies

B. A state-owned enterprise purchases raw materials

C. A wholly state-owned company purchases office supplies

D. A partnership purchases office supplies 16. The following is about the advantages of decentralized procurement , What's right ( ).(3 branch )

A. flexibility

B. Reduce the cost of purchasing

C. Achieve economies of scale

D. Meet the timeliness of procurement 17. The income from the sale of goods does not belong to the production and operation income of the enterprise , Therefore, it is not the tax object of enterprise income tax .(1 branch )

18. The following statements about the destruction of accounting archives , The right ones ().(3 branch )

A. The practice of destroying accounting archives by the Archives Department of the company does not comply with the regulations

B. The accounting archives need to be destroyed at the expiration of the storage period , The Archives Department of the unit shall put forward opinions

C. A list of destruction of accounting archives should be prepared , And the person in charge of the unit shall sign on the list of destruction of accounting archives

D. When destroying, the archives department and accounting department of the unit shall jointly send personnel to supervise the destruction 19. The following principles that should not be adhered to in payment and settlement are ().(2 branch )

A. Keep your word . Performance payment

B. Whose money goes into whose account . Who controls

C. The bank advances moderately

D. Banks do not advance money 20. Accounting professional ethics " Be honest ” In the basic requirements of , The requirements for certified public accountants are ().(2 branch )

A. keep a secret , Not tempted by interests

B. Distinguish between public and private , No greed, no occupation

C. Be honest , tell the truth , Do the honest thing

D. Prudent practice , Credibility comes first 21. China's accounting legal system consists of Accounting Law 、 Accounting department regulations and accounting normative documents are composed of three levels .( )(1 branch )

22. Of the following , What belongs to the regulations of the accounting department is ( ).(2 branch )

A.《 Regulations on financial and accounting reports of enterprises 》

B.《 Accounting file management method 》

C.《 Measures for the administration of accounting professional qualifications 》

D.《 The basic work of accounting is standardized 》23. The characteristics of accounting professional ethics are mainly reflected in ().(3 branch )

A. The combination of consciousness and compulsion

B. Accounting activities are closely related to the public interest

C. The combination of timeliness and procedure

D. Combination of impartiality and independence 24. The following statements about the collection method of fiscal revenue in China are incorrect ().(2 branch )

A. Directly pay into the single account of the State Treasury

B. Directly pay into the financial account of extra budgetary funds

C. Summarized and paid to the single account of the state treasury

D. Summarize and pay to the zero balance account of the financial department and budget unit 25. The responsibilities of the person in charge of the unit include ( ).(3 branch )

A. The authenticity of the accounting work and accounting materials of the unit 、 Integrity is responsible for

B. The authenticity of financial and accounting reports should be guaranteed 、 complete

C. We should ensure that accounting institutions and accountants perform their duties according to law

D. Don't encourage 、 To direct 、 Force accounting institutions and accountants to deal with accounting matters in violation of the law 26. When collecting value-added tax, it is allowed to deduct all the taxes paid on the purchased fixed assets at one time , This practice belongs to ().(2 branch )

A. Productive value-added tax

B. Income type VAT

C. Consumption value-added tax

D. Distributive VAT 27. The state is to realize its functions , By virtue of political power , According to the standards stipulated by law , A specific distribution method of paid fiscal revenue .(1 branch )

28. The characteristics of Taxation do not include ().(2 branch )

A. Fixity

B. economy

C. mandatory

D. gratuitousness 29. Taxable consumer goods subject to compound tax rates include Baijiu and cigarettes , The proportional tax rate is applicable to all other taxable consumer goods .(1 branch )

30. Acceptance Bank of bank acceptance bill , The drawer shall be charged according to the face value () The handling charge .(2 branch )

A. One thousandth

B. Five thousandths

C. One in ten thousand

D. Five out of ten thousand 31. according to 《 Enterprise income tax law 》 Regulations , Enterprises are divided into resident enterprises and non resident enterprises .(1 branch )

32. The person in charge of the unit refers to the legal representative of the unit .()(1 branch )

33. According to the provisions of China's financial legal system , Of the following , It can be used to handle the depositor's loan redeposit 、 The funds for loan repayment and other settlement are ().(2 branch )

A. Personal savings account

B. General deposit account

C. Temporary deposit accounts

D. Special deposit account 34. The methods of accounting professional ethics evaluation mainly pass () To carry out .(3 branch )

A. Public opinion

B. traditional custom

C. Inner faith

D. Assessment and comparison 35. Of the following , Account opening units can use cash, including ().(3 branch )

A. The wages of employees

B. Bonuses paid to individuals

C. The price of purchasing agricultural and sideline products from individuals

D. Travel expenses that must be carried by business travelers 36. Self education in the form of accounting professional ethics education is for accountants () Behavior activities .(3 branch )

A. Self learning

B. Own moral cultivation

C. self-improvement

D. Self development 37. Value added tax payers according to their business scale , It is divided into ().(3 branch )

A. General taxpayers

B. Ordinary taxpayers

C. Special taxpayers

D. Small scale taxpayers 38. The bank settlement account is changed , After the bank receives the change notice from the depositor , Change procedures shall be handled in time , And in () Report to the people's Bank of China within working days .(2 branch )

A.2

B.3

C.5

D.439. The tax authorities may take tax preservation measures or compulsory enforcement measures in accordance with the approved Authority , The approval authority here refers to the tax bureau above the municipal level ( branch office ) The director approved .(1 branch )

40. Accounting institutions 、 Accountants should supervise the financial revenue and expenditure , In the following statements , The right is ( ).(3 branch )

A. For financial revenues and expenditures with incomplete approval procedures , It should be stopped and corrected

B. Financial revenues and expenditures that are not included in the unified accounting of the unit in violation of the provisions , Should be returned , Request supplement 、 correct

C. For violations of national unity _ My finance 、 financial 、 Financial revenue and expenditure stipulated by the accounting system , Do not handle

D. For financial revenues and expenditures that seriously violate the interests of the state and the public , It should be reported to the competent unit or the finance 、 Audit 、 Tax authority report 41.《 accounting law 》 Regulations , Bookkeepers and economic business matters ( ) The duties and authorities of should be separated from each other 、 Mutual restriction .( The difficulty coefficient : difficult )(3 branch )

A. Handling personnel

B. Auditors

C. Property keeper

D. Vetting staff 42. The over rate progressive tax rate refers to the division of several levels based on the relative rate of the amount of tax objects , Stipulate the corresponding differential tax rates . China's land value-added tax adopts this tax rate .(1 branch )

43. According to the provisions of consumption tax , Taxpayers selling taxable consumer goods by installment collection , The occurrence time of its tax obligation is ().(2 branch )

A. The date of receipt agreed in the written contract

B. The day of receiving the first sales payment

C. The day on which the taxable consumer goods are delivered

D. The day on which the voucher for the sales payment is obtained 44." Taxpayers approved by the tax authorities shall use the unified special envelope for express delivery of tax declaration , Handle the delivery formalities through the postal department , And ask the postal department for a receipt as a way to declare evidence ” go by the name of ().(2 branch )

A. Self declaration

B. Mail declaration

C. Data message declaration

D. Simple declaration 45.《 Basic norms of enterprise internal control 》 By ( ) according to 《 Company law of the people's Republic of China 》、《 Securities Law of the people's Republic of China 》《 Accounting Law of the people's Republic of China 》 And other relevant laws and regulations .(2 branch )

A. The Ministry of Finance

B. The Ministry of Finance and the National Audit Office

C. The Ministry of Finance and the National Audit Office 、 The securities and futures commission 、 CBRC 、 Circ

D. The Ministry of Finance and the tax bureau 、 auditing department 、 The securities and futures commission 、 CBRC 、 Circ 46. Treasury single account refers to ().(2 branch )

A. The financial department opens a single treasury account at the central bank

B. An account opened by the financial department at the agency bank for the budget unit , Used for financial authorization payment

C. It needs to be approved by the superior government or the Ministry of finance 、 Special special accounts that can only be opened with the approval of the government at the same level or authorized by the financial department

D. The extra budgetary fund income account opened by the financial department in the commercial bank 47. The VAT 、 Consumption tax can transfer all or part of the tax burden to others , It is an indirect tax .(1 branch )

48. Accounting handover list , Generally, it should be filled in ().(2 branch )

A. One copy

B. In duplicate

C. triplicate

D. In quadruplicate 49. Accountants should study and practice hard , Keep forging ahead , This is the accounting professional ethics () Basic requirements .(2 branch )

A. Objective justice

B. Improve your skills

C. Be honest and self disciplined

D. I love my job 50. Taxpayers are subject to tax cuts 、 Tax exempt treatment , In tax cuts 、 Tax declaration may not be handled during the tax exemption period .(1 branch )

51. National unified accounting system , The main contents include ( ).(3 branch )

A. Accounting system

B. Accounting supervision system

C. Accounting organization management system

D. Accounting work management system 52. Mr. Pan Xulun, the father of modern accounting in China, advocated :" With faith and determination , Keep your faith , Believe in doing things , Treat others with faith , Never forget ' Lixin ', When there is success .” The content of accounting professional ethics embodied in this sentence is ().(2 branch )

A. Participate in management

B. Be honest

C. Be honest and self disciplined

D. Objective justice 53. Government procurement by invitation to bid , The bidder shall, five working days before the end of the prequalification announcement period , Submit qualification certificates as required by the announcement .()(1 branch )

54. The retention period of accounting archives can be divided into two categories: permanent and fixed . The following accounting files that are permanently kept by the enterprise are ().(2 branch )

A. Original certificate

B. Annual accounting report

C. General ledger

D. Accounting handover list 55. Cultivate the professional ethics of accountants , We should know from accounting ethics 、 sentiment 、 will 、 Beliefs and habits , This determines the significance of accounting professional ethics education ().(2 branch )

A. Sequence

B. Contemporaneity

C. Omnidirectional

D. Subjectivity 56. Of the following , Allow taxpayers to calculate VAT , The type of VAT deducted from the depreciation of purchased fixed assets is ().(2 branch )

A. Consumption value-added tax

B. Income type VAT

C. Productive value-added tax

D.D、 Value added tax of actual consumption 57. According to the provisions of the legal system of enterprise income tax , Of the following , Tax exempt income is ().(3 branch )

A. Interest income from national debt

B. Financial appropriation

C. Dividends between resident enterprises that meet the specified conditions 、 Dividends and other equity investment income

D. Income from donations 58. Of the following , The contents of accounting supervision and inspection implemented by the financial department are ( )(3 branch )

A. Whether the personnel engaged in accounting work have accounting qualification certificates

B. Accounting voucher 、 Accounting books 、 Whether the financial and accounting reports and other accounting materials are true 、 complete

C. Whether the accounting conforms to the provisions of the accounting law and the national unified accounting system

D. Whether to pay taxes in full and on time in accordance with the provisions of the tax law 59. The drawer issued a dishonoured cheque , The bearer has the right to claim compensation from the drawer for the amount of the cheque () Compensation for .(2 branch )

A.5%

B.2%

C.10%

D.3%60. The general principle of China's accounting work management system is ( ).(2 branch )

A. Unified leadership

B. Unified leadership , Hierarchical management

C. Hierarchical management

D. Unified leadership , centralized management 61. The professional ethics punishment implemented by accounting professional organizations , The procedure can be divided into () Wait for different stages .(3 branch )

A. survey 、 Analyze and confirm the facts

B. Determine the terms of the rules of use

C. Make a decision

D. Implement the decision 62. If there is no record on the bank draft () And so on , The draft is invalid .(3 branch )

A. indicate " Bank draft ” The words...

B. A promise of unconditional payment

C. Determined amount

D. Name of payer 63. The following statement , The right ones ( ).(3 branch )

A. Accounting qualification certificate , It is a legal certificate to prove that accountants can engage in accounting work

B. Once the accounting qualification certificate is obtained , Effective in the province

C. Management of accounting qualification , Implement the principle of territoriality

D. Acquisition of accounting qualification , Implement the examination system 64.《 accounting law 》 Regulations , The person in charge of the unit is responsible for the accounting work and accounting materials of the unit ( ) be responsible for .(3 branch )

A. Authenticity

B. Relevance

C. accuracy

D. integrity 65. Because taxes are fixed , So once the tax is determined , There will be no change .(1 branch )

66. Of the following , It is impossible to become the subject of the crime of retaliating against accountants ( ).(2 branch )

A. Person in charge of accounting institutions of state-owned enterprises

B. The person in charge of a company

C. The head of the academic community

D. Person in charge of public institution 67. For units whose business income and expenditure are mainly in currencies other than RMB, one of the foreign currencies can be selected as the bookkeeping base currency , And prepare the financial accounting report of the unit in the selected foreign currency .( )(1 branch )

68. Of the following , Taxable sales that should be included in value-added tax include ().(3 branch )

A. The packaging deposit charged to the buyer

B. Output tax charged to buyers

C. The handling charge charged to the buyer for the sale of goods

D. The freight charged to the buyer for the sale of goods 69. When the cashier of an enterprise reviews an invoice for purchasing materials by a purchaser , It is found that the unit price and amount figures on the invoice have been altered , The unit price of materials is also higher than the market price 1 times . This invoice should belong to ( ).(2 branch )

A. Untrue original documents

B. Illegal original documents

C. Inaccurate original documents

D. Incomplete original documents 70. According to the provisions of the payment and settlement method , Of the following , Those who meet the basic requirements of payment and settlement are ().(3 branch )

A. Company 、 Individuals and banks handle payment and settlement , Bills and settlement vouchers printed in accordance with the unified regulations of the people's Bank of China must be used

B. Company 、 Individuals and banks should follow 《 Measures for the administration of RMB bank settlement accounts 》 Issued in accordance with the provisions of 、 Use account

C. The signatures and other records on bills and settlement vouchers should be true , Do not forge 、 To alter

D. Filling in bills and settlement vouchers should be standardized , Complete the elements , The number is correct , The handwriting is clear , Not bad, not missing , No scribble , Prevent erasure 71. The following statement about the cancellation of tax registration is correct ().(3 branch )

A. After the cancellation of tax registration , The party concerned will no longer accept the management of the original tax authority

B. The taxpayer terminates the tax obligation according to law , It should go through the cancellation of registration with the administrative department for Industry and commerce or other authorities , Hold relevant certificates to apply to the original tax registration authority for cancellation of tax registration

C. Taxpayers terminate their tax obligations according to law , According to the regulations, it is not necessary to cancel the registration in the administrative department for Industry and commerce or other organs , It shall start from the date of approval or termination by the relevant authority 15 Intraday , Hold relevant certificates to apply to the original tax registration authority for cancellation of tax registration

D. A taxpayer whose business license is revoked by the administrative department for Industry and commerce or whose registration is revoked by other authorities , It shall start from the date when the business license is revoked or the registration is revoked 15 Intraday , Apply to the original tax authority for cancellation of tax registration 72. Among the following taxes in force in China , The central and local shared taxes are ().(3 branch )

A. The VAT

B. Deed tax

C. Sales Tax

D. corporate income tax 73. When filling in the bill issue date in Chinese capital, it should be preceded by " zero "” Month of ().(3 branch )

A. January

B. February

C. March

D. Ten months 74. China's budget legal system consists of 《 Budget law 》 and 《 Regulations on the implementation of the budget law 》 constitute .()(1 branch )

75. according to 《 Provisional Regulations on value added tax 》 The provisions of the , VAT general taxpayers are engaged in goods with different VAT rates , Sales of goods with different tax rates are not accounted for separately , The method to determine the applicable VAT rate is ().(2 branch )

A. apply 3% Collection rate

B. Applicable from low tax rate

C. The average tax rate is applicable

D. Applicable from high tax rate 76. The superior government can use the funds budgeted by the lower government beyond the budget , Governments at lower levels shall not misappropriate or intercept funds belonging to the budgets of governments at higher levels .()(1 branch )

77. The following statements about the scope of use of special deposit accounts , The right ones ().(3 branch )

A. Extra budgetary funds . Securities trading settlement funds . Special deposit account for futures trading margin and trust fund , Cash can be withdrawn

B. The funds in the company's bank card account must be transferred and deposited by its basic deposit account

C. Capital construction funds . Renovation funds . Policy oriented real estate development funds . Where a financial institution needs to withdraw cash from its interbank capital account , The account opening shall be reported to the local branch of the people's Bank of China for approval

D. In addition to transferring payment items to its basic deposit account or special financial deposit account for extrabudgetary funds, the income remittance account , Only charge but not pay , No cash withdrawal 78. The checks that can be used for transfer are ().(3 branch )

A. cash cheque

B. transfer cheque

C. Ordinary checks

D. Cross a check 79. Payment and settlement must be through () Approved financial institutions .(2 branch )

A. People's Bank of China

B. CBRC

C. The securities and futures commission

D. The State Council 80. The government procurement conducted by the purchaser with loans from international organizations and foreign governments must apply 《 Government procurement law 》.()(1 branch )

81. Treasury centralized collection and payment system refers to the treasury single account system set up by the financial department on behalf of the state , All operating funds are collected into the treasury single account system 、 Payment and management system .()(1 branch )

82. The purchaser of government procurement refers to those who conduct government procurement according to law ( ).(3 branch )

A. State organs

B. Business unit

C. Group organizations

D. Enterprises 83. A production and operation enterprise in Shanghai has opened a non independent accounting office in Beijing , The Shanghai tax authority shall issue ().(2 branch )

A. Tax registration certificate

B. Temporary tax registration certificate

C. Registration tax registration certificate

D. Foreign related tax registration certificate 84. In our country 《 Budget law 》 The prescribed forms of budgetary expenditure include ( ).(3 branch )

A. Economic construction expenditure

B. education 、 science 、 Culture 、 health 、 Expenditure for the development of sports and other undertakings

C. State administrative expenses

D. Defense spending 85. From the perspective of belonging , Budget revenue can be divided into ().(3 branch )

A. Revenue from the central budget

B. Local budget revenue

C. Income from state-owned assets

D. The central and local budgets share revenue 86.《 Enterprise income tax law 》 The provisions of the , The enterprise income tax is levied on a quarterly basis , Monthly prepayment .(1 branch )

87. The tax period of consumption tax is 1 Japan 、3 Japan 、5 Japan 、10 Japan 、15 Japan 、 A month or 1 Quarterly .(1 branch )

88. In order to expand sales , It is proposed to pay 5 Ten thousand yuan rebate , The salesperson takes the instructions of the general manager of the company to the finance department to request to withdraw the money . Liu, the manager of the finance department, believes that the expenditure does not comply with the relevant regulations , But considering the approval of the general manager of the company , And the payment amount is within its approved limit , The payment was made . Liu's above behavior violates () Accounting professional ethics requirements .(2 branch )

A. Be honest

B. Stick to the rules

C. Participate in management

D. Strengthen service 89. The basic elements that constitute the professional ethics of accountants refer to ().(3 branch )

A. Understanding of accounting ethics

B. Accounting moral belief

C. Accounting moral will

D. Accounting ethics 90. The correct statement about the personal income tax rate is ().(3 branch )

A. Wages 、 Salary income , apply 5% to 45% The excess progressive tax rate

B. Individual businesses 、 Income from production and operation of sole proprietorship enterprises and partnerships , And the contracted management of enterprises and institutions 、 Income from lease operation , apply 5% to 35% The excess progressive tax rate

C. Income from remuneration , Applicable proportional tax rate , The tax rate shall be 20%, And reduce the amount of tax payable 30%, Its effective tax rate is 14%

D. Income from royalties , dividend 、 Dividend income , Income from lease of property , Income from transfer of property , Accidental income and other income , Applicable proportional tax rate , Its tax rate is generally 20%91.《 Government procurement law 》 The specified cases where single source procurement can be adopted are ().(3 branch )

A. Only from a single supplier

B. In case of unforeseen emergency, it is impossible to purchase from other suppliers

C. It is necessary to ensure the consistency of the original procurement projects or the requirements of supporting services , We need to continue to purchase from the original supplier , And the total amount of additional purchase funds does not exceed the purchase amount of the original contract 10% Of

D. Buyers are used to using certain products 92. Fixity only includes continuity in time , It does not include the fixity of the collection proportion .(1 branch )

93. Establishing and improving the internal supervision and management system of centralized procurement includes many aspects , The core problem is to form a restraint mechanism of mutual checks and balances within the centralized procurement organization .()(1 branch )

94. The following are not taxpayers of consumption tax ().(2 branch )

A. Cigarette factories that produce and sell cigarettes

B. Enterprises importing cosmetics

C. Individual industrial and commercial households entrusted with the processing of wooden disposable chopsticks

D. A unit that produces and sells televisions 95. according to 《 Government procurement law 》 Relevant provisions of , Complex in technology or special in nature , Goods or services for which detailed specifications or specific requirements cannot be determined , The applicable government procurement method is invitation to bid .( )(1 branch )

96. The following statement about the basic principles that should be observed in the management of bank settlement accounts , The wrong is ().(2 branch )

A. Depositors of personal bank settlement accounts can only open a basic deposit account in the bank

B. Depositors can choose their own bank to open a bank settlement account

C. The opening and use of bank settlement accounts must comply with the law

D. The bank must keep the information of the depositor's Bank Settlement Account confidential according to law 97. according to 《 Payment and settlement method 》 The provisions of the :"() Handling payment and settlement must comply with the laws of the state 、 Administrative regulations and the provisions of these measures , Do not harm the public interest .”(3 branch )

A. City credit cooperatives

B. Rural credit cooperatives

C. Company

D. Individual businesses 98. The handover personnel cannot handle the handover procedures in person due to illness or other special reasons , Approved by the person in charge of the unit , May by () Agent handover .(2 branch )

A. The transferor entrusts others

B. The transferor authorizes others

C. Head of accounting organization

D. Relatives of the transferor 99.( ) It refers to the legal norms regulating various accounting relationships in economic relations .(2 branch )

A. accounting law

B. Accounting administrative regulations

C. The accounting system

D. Accounting regulations 100. According to the provisions of the legal system of individual income tax , Taxpayers of individual income tax can be divided into resident taxpayers and non resident taxpayers , The criteria are ().(3 branch )

A. Whether there is a residence in the territory

B. Domestic working hours

C. Income earning workplace

D. Domestic residence time

边栏推荐

- Recommend 10 excellent mongodb GUI tools

- Unity脚本API—Component组件

- TypeError: list indices must be integers or slices, not str

- Neuf tendances et priorités du DPI en 2022

- Qt---error: ‘QObject‘ is an ambiguous base of ‘MyView‘

- What should ABAP do when it calls a third-party API and encounters garbled code?

- Unity脚本API—Transform 变换

- What does IOT engineering learn and work for?

- Proxifier global agent software, which provides cross platform port forwarding and agent functions

- Intranet penetrating FRP: hidden communication tunnel technology

猜你喜欢

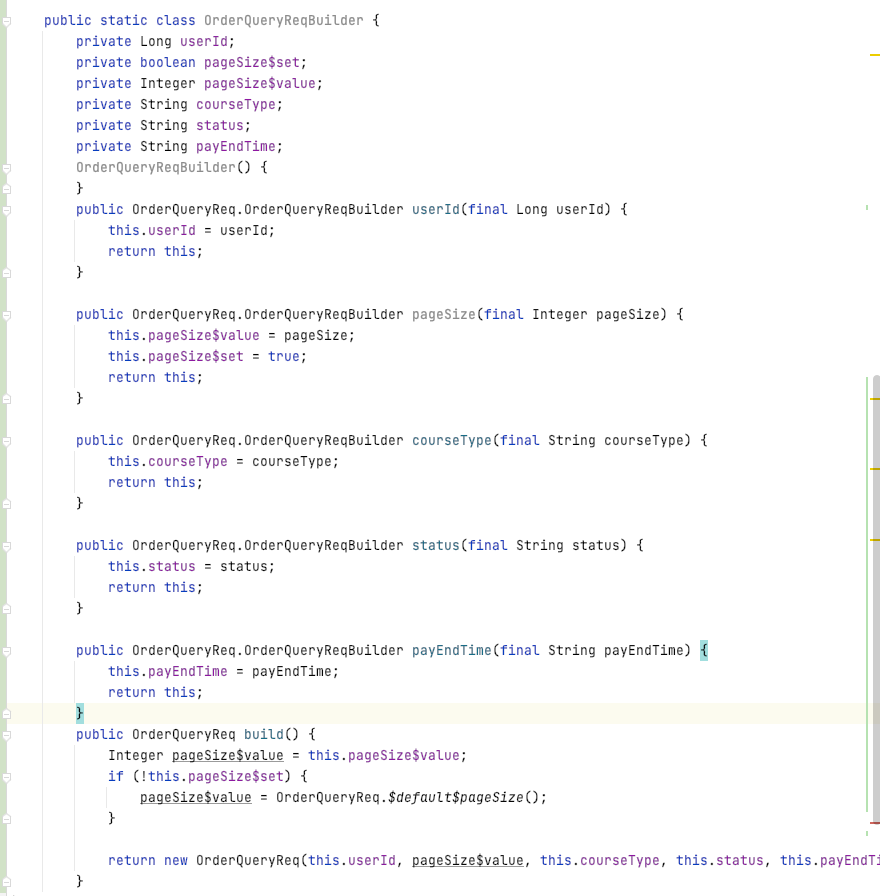

Lombok使用引发的血案

Detailed explanation of MySQL composite index (multi column index) use and optimization cases

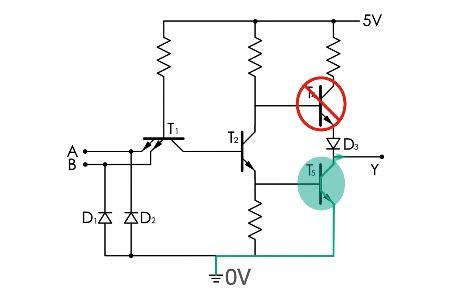

In today's highly integrated chips, most of them are CMOS devices

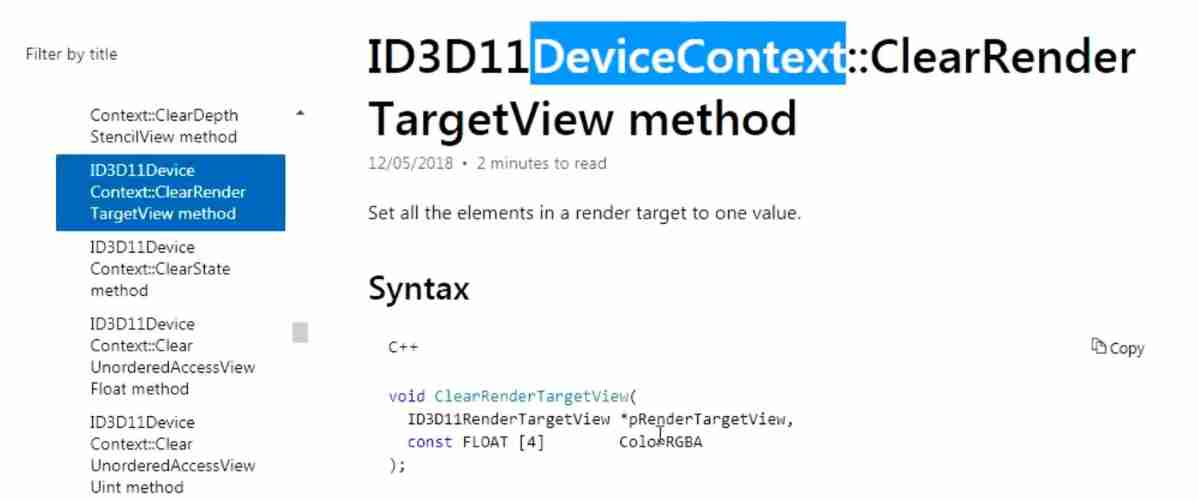

D3D11_ Chili_ Tutorial (2): draw a triangle

Penetration test --- database security: detailed explanation of SQL injection into database principle

Principle and general steps of SQL injection

函數式接口,方法引用,Lambda實現的List集合排序小工具

Anta is actually a technology company? These operations fool netizens

![[North Asia data recovery] a database data recovery case where the disk on which the database is located is unrecognized due to the RAID disk failure of HP DL380 server](/img/79/3fab19045e1ab2f5163033afaa4309.jpg)

[North Asia data recovery] a database data recovery case where the disk on which the database is located is unrecognized due to the RAID disk failure of HP DL380 server

Working group and domain analysis of Intranet

随机推荐

Qt---error: ‘QObject‘ is an ambiguous base of ‘MyView‘

Redis shares four cache modes

Essential basic knowledge of digital image processing

JS tile data lookup leaf node

Understand the rate control mode rate control mode CBR, VBR, CRF (x264, x265, VPX)

Understand the context in go language in an article

MySQL - MySQL adds self incrementing IDs to existing data tables

An article learns variables in go language

Go deep into the details of deconstruction and assignment of several data types in JS

What should ABAP do when it calls a third-party API and encounters garbled code?

Logstash ~ detailed explanation of logstash configuration (logstash.yml)

The new generation of domestic ORM framework sagacity sqltoy-5.1.25 release

Game theory

Statistical learning: logistic regression and cross entropy loss (pytoch Implementation)

MySQL~MySQL给已有的数据表添加自增ID

What is the catalog of SAP commerce cloud

深入JS中几种数据类型的解构赋值细节

[book club issue 13] ffmpeg common methods for viewing media information and processing audio and video files

[tutorial] yolov5_ DeepSort_ The whole process of pytoch target tracking and detection

Unity脚本API—Time类