当前位置:网站首页>Asset security issues or constraints on the development of the encryption industry, risk control + compliance has become the key to breaking the platform

Asset security issues or constraints on the development of the encryption industry, risk control + compliance has become the key to breaking the platform

2022-07-07 01:10:00 【Sina Finance blockchain】

Blockchain funds face security risks from multiple perspectives . A small negligence in any link will lead to heavy losses . The industry is mixed , The problem of trust cost has not changed greatly due to blockchain Technology , Especially when large amounts of money are involved , For example, the exchange 、 The running behavior of wallet ;DeFi Technical loopholes in platforms or exchanges ; Or the fund tray , These exist to threaten the security of users' funds .

But in the current situation , Many users think , It is safer to deposit funds in the exchange , But I don't know “ Tall trees catch much wind ”, Because of its huge size , It has also become a pastry in the eyes of hackers : according to an uncompleted statistic , So far, the exchange has happened 28 Bitcoin theft incidents , Loss as high as 120 Ten thousand bitcoins , According to bitcoin 44300 Dollar settlement , The stolen amount reached 530 Over US $100 million .

indeed , Large exchanges may compensate users for asset losses , But the idea that the exchange will definitely compensate for its losses is not reliable , Some exchanges were stolen , Some platforms ( For example, Duane ) Will take out special funds to compensate users , Some platforms ( for example Mt.Gox) Forced to go through the bankruptcy process , Some platforms ( for example Bitfinex) Then share the loss to all users of the platform .

Encryption market as “ Extrajudicial ” The land , There are many hidden dangers in itself , Plus cryptocurrency as a new product , In technology 、 There are many gaps in cognition , therefore , Scams around cryptocurrency abound .

The growing scale of digital assets is also gradually facing the corresponding security storage 、 Safe circulation and other issues . According to company safety statistics , By the end of 2021 end of the year , Digital assets have been stolen for 25 Over $100 million , As happened before Crypto.com A small number of users on the have extracted cryptocurrencies in their accounts without authorization and stolen 4,836.26ETH and 443.93 BTC; Bitcoin and ERC-20 Such as token large withdrawal stolen valuation 1.5 Billion dollars .

Various potential safety hazards caused by users' lack of safety awareness and standardized operation have been emerging in endlessly , Phishing attack 、 Fraud and other events are typical . Users should carefully keep all kinds of private information , Any minor negligence may cause irreparable losses . These asset theft events are fed back to the platform , The platform needs to improve its security awareness : Traditional safety protection facilities cannot completely solve the risk of money theft , For example, sign more 、 Hot and cold wallet separation 、 Construction of risk control system . Common theft risks focus on hot and cold wallet theft 、 System FLAW 、 Phishing attack 、 Transaction data tampering attacks . To solve these problems, we need to start from secure storage 、 The security circulation and algorithm levels form a set of security schemes .

Current situation of encryption industry

2022 year 1 month 1 Japan , According to the Finbold A report released showed ,2021 year 1 month 1 Japan , The number of cryptocurrencies in the world is 8153 individual , By 2021 year 12 month 31 Japan , The number of 16223 individual , comparison 1 The monthly increase is about 98.98%.Finbold data display ,2021 In, the encryption industry created 8070 New species Token, On average, there are about 21 A new cryptocurrency is launched on the market .

According to relevant data , By 2021 year 6 month , The number of cryptocurrency users worldwide has reached 2.21 Billion , From which 1 Million users increased to 2 Million users took only four months .2021 year 1 The month and 2 The increase in the number of users since September is more driven by bitcoin , but 5 Since September, it has benefited from the adoption of Shanzhai coins , The number of users ranges from 4 Month end 1.43 Billion increase to 6 Of the month 2.21 Billion , It's almost 8000 Wanxin users , Most of the new users are right ShibaToken(SHIB) and Dogecoin(DOGE) And other tokens . Get into 2021 In the second half of the year , The growth rate of user scale has slowed down , By 2021 year 12 month 29 Japan , Globally, 2.95 100 million cryptocurrency users , comparison 2021 At the beginning of the year 178.30%.

Cryptocurrency has increasingly become an important component of the assets of mainstream investment institutions , According to global asset management company Natixis Investment Managers Survey , Of all the institutions surveyed ,28% Our institutions are currently investing in cryptocurrencies , Nearly a third of them said , They plan to increase the configuration of cryptocurrency .

Besides , Ernst & young, an accounting firm, released a new study saying , Traditional alternative investors are slowly becoming interested in cryptocurrencies .31% Hedge fund managers 、24% Alternative investors and 13% The private equity fund manager said , They plan to include cryptocurrency in their portfolio in the next one to two years .

According to the 《 Collins Dictionary 》, Metauniverse refers to a persistent online virtual world , Known as the “ The dream future of the Internet world ”. at present , All walks of life are chasing the meta universe track , among , Mainstream technology companies take VR、AR And other simulation technology as a breakthrough “ Quanzhou Internet ”,2021 year 10 month 28 Japan , Facebook Announce that the company name will be changed to “Meta”, Express the company's determination to focus on turning to the emerging computing platform based on virtual reality . tencent 、 Technology giants such as NVIDIA are also involved in the track .

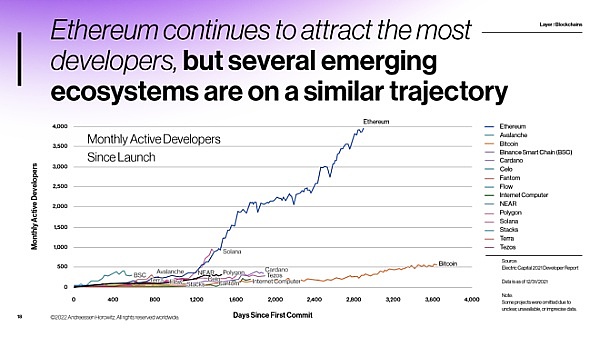

At present , Ethereum dominates Web3 The right to speak , But now there are many other blockchains .Solana、Polygon、BNB Chain、Avalanche and Fantom And other blockchain developers are striving for similar success .

Ethereum's leadership has a lot to do with its early start , And its community is also very healthy . In terms of developer interests , Ethereum has the most builders , Nearly every month 4000 An active Developer . Next to that is Solana( There are almost 1000 people ) and Bitcoin( about 500 people ). Ethereum's overwhelming development team helps explain why its users are willing to pay more than... On average every day 1500 Thousands of dollars in gas Cost to use it .

We see the industry narrative from DeFi To NFT、DAO、L2、Play-to-Earn、Metaverse、Web3, Then back NFT,L1 The war of crossed 5 Stages . The encryption industry is demonstrating the rationality of its capital allocation by grasping new narrative themes , To satisfy investors' appetite for huge profits .

at present , The market value of mainstream tokens in the market seems to tend to be reasonable , However, the market value of other Shanzhai coins is still accompanied by a foam . The Fed's interest rate hike was initially ignored , Think it is not completely believable , But now most people believe it and reflect it in the price . The new development of further hawkish sentiment in the Federal Reserve led to a slight decline , But it soon received support . It seems that interest rates will be raised this year 4 To 5 Time , No more, no more , At least in the current expectation . Speculative assets like BTC and ETH And other major currencies , But there is no 2018 The year is serious . Most of the third or fourth huge amount of money raised by cryptocurrency venture capital companies may flow to where they have been : New projects rather than old projects . If the macro situation improves , These capital may still get ten times or a hundred times the income from the new project , But it is difficult for old projects to achieve the same growth rate .

Continue to pursue safe boundaries HyperPay Do not change the original intention of safety

Different security solutions usually correspond to different private key storage methods , Usually include HSM( Secure with dedicated physical hardware keys )、MPC Multiparty Computing ( Similar to private key sharding )、 Multiple signatures, etc , For exchange or hedge fund clients who need to perform a large number of withdrawals every day , They may prefer to store keys online with low latency MPC Solution , Instead of a multi signature solution that stores keys offline , The latter will extend the time required for the exchange to withdraw .

However, for institutional customers with stronger security needs , Many hosting providers are also making a fuss about where private keys are stored . for example Coinbase Custody as well as Xapo Have set up vaults in the United States or many places around the world to store the private keys of users' assets , among Xapo Even a vault has been built in Switzerland to renovate abandoned military bunkers , Only creatures have been collected in advance DNA Information personnel can enter .

HyperPay Escrow wallets are managed by HyperBC Fund custody , And regularly through slow fog technology 、 Know Chuangyu 、CERTIK And other well-known security companies .HyperPay The wallet was founded on 2017 year , It's a collection trust management wallet 、 Decentralized self-management wallet 、HyperMate Hardware wallet 、 A multi ecological digital asset wallet that manages wallets in one , Provide users with asset custody 、 Value added in financial management 、 Consumer payment and other one-stop services . So far, ,HyperPay More than one million wallet users , The scale of asset management exceeds 10 Billion dollars , Transfer excess 3.1 100 million times , Hosted wallet public chain support 53+, Self managed wallet public chain support 33+,HyperMate The hardware wallet supports the public chain 17+.

HyperPay Self managed wallet is one of the wallets that support the most public chain currencies on the market , Currently supported 50 Multiple common chains , And support ETH、TRON、EOS、BSC、HECO、OEC、HSC、Polygon、AVAX、Fantom、Sol、Optimism、Arbitrum Wait for the public chain DApp application , Users can easily manage assets on different chains by creating one identity , The user's private key is stored locally in the user's device , Ensure the security of users' private keys and assets by physically isolating important data .

HyperPay Through multi-party secure computing MPC、 Trusted execution environment TEE、 cloudy TEE Security architecture and other security measures ensure the security of users' assets . And deployed a cutting-edge security and risk control center , Invest resources and constantly iterate Technology , To monitor the overall system operation 、 Account security and software operation , At the same time, big data is used to analyze users' transactions 、 Capital volume and trading behavior , And multiple verification systems on the chain to mark suspicious situations . Once there is any suspicious situation , The user's account will be blocked until authorized by the user , So as to achieve in a dangerous environment , Minimize risk .

And in terms of financial security , recently ,HyperBC Lithuania encryption asset custody license has been obtained ,HyperBC its HyperPay Wallet became the first digital currency wallet with compliance custody license , Provide compliance custody services for digital assets of global users , Secure digital assets .

Conclusion

The theft of the giant whale will not stop , Hackers' attacks will become more and more rampant , The future will pose more severe challenges to the security of encrypted assets . The encryption industry platform can not only protect user assets at the level of providing technology , More and more platforms refine and summarize the core advantages , Guide industry norms , Based on user thinking , Provide users with high-quality asset security mechanism , Enhance user trust . As encrypted assets gradually get widespread attention , To prevent the loss of encrypted assets 、 Security issues such as theft , And multi-party trust , Technology accumulation of the platform itself , Determines the height of the platform in the encryption industry .

At a time when compliance has become the main theme of the encryption market ,HyperPay Wallet will continue to carry out encrypted Asset Services under the compliance framework , Constantly explore safe boundaries , Provide users with more assured products , Connect the real and virtual worlds through the digital economy , Grow with users , Achieve win-win results .( Golden Finance )

editor : Zhang Jingdi

边栏推荐

- mongodb客户端操作(MongoRepository)

- [batch dos-cmd command - summary and summary] - string search, search, and filter commands (find, findstr), and the difference and discrimination between find and findstr

- [force buckle]41 Missing first positive number

- 【js】获取当前时间的前后n天或前后n个月(时分秒年月日都可)

- 资产安全问题或制约加密行业发展 风控+合规成为平台破局关键

- Dell笔记本周期性闪屏故障

- Address information parsing in one line of code

- Activereportsjs 3.1 Chinese version | | | activereportsjs 3.1 English version

- 随时随地查看远程试验数据与记录——IPEhub2与IPEmotion APP

- Informatics Orsay Ibn YBT 1172: find the factorial of n within 10000 | 1.6 14: find the factorial of n within 10000

猜你喜欢

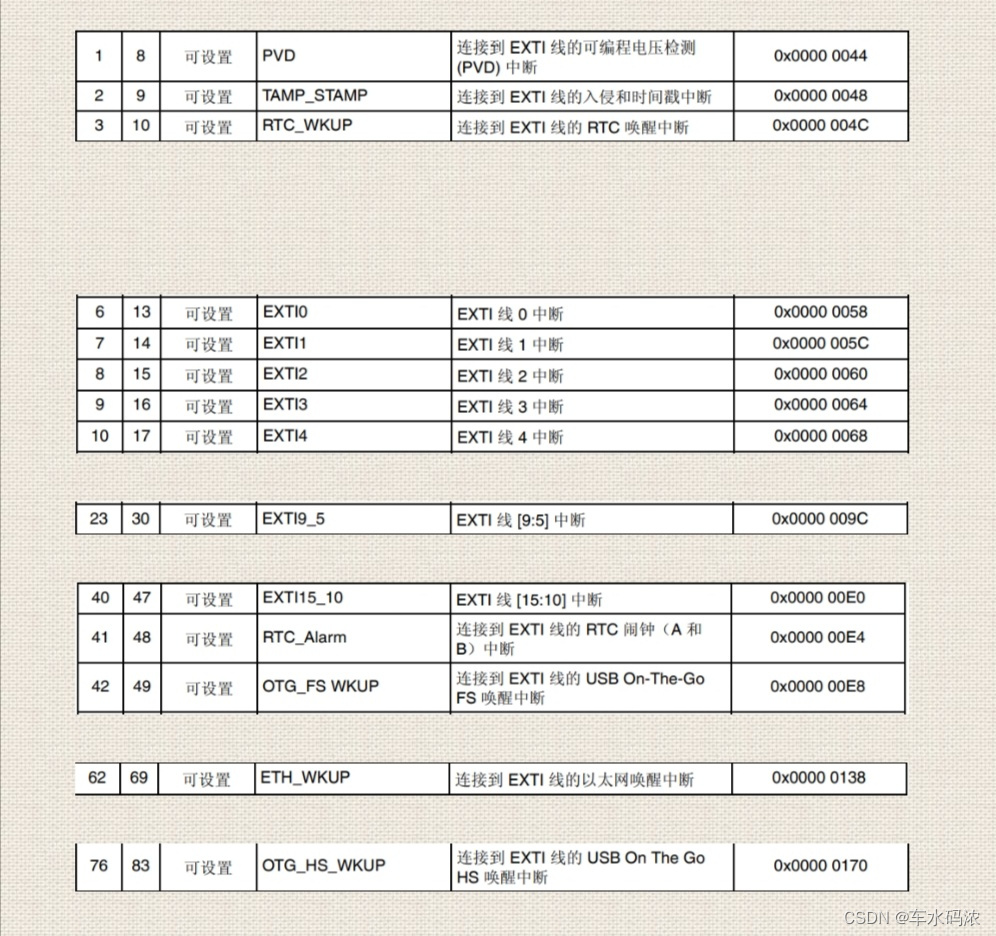

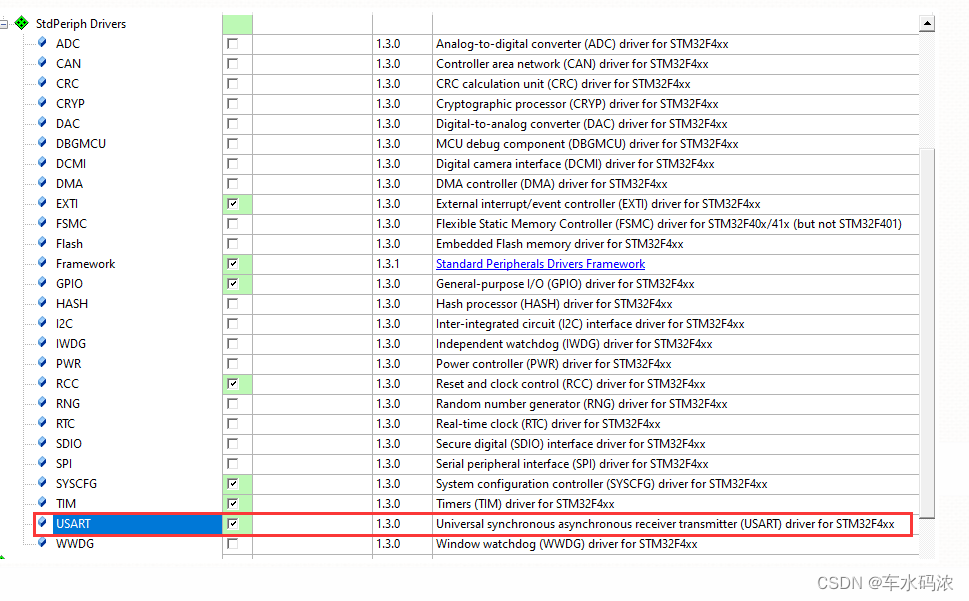

Part IV: STM32 interrupt control programming

Lldp compatible CDP function configuration

Niuke cold training camp 6B (Freund has no green name level)

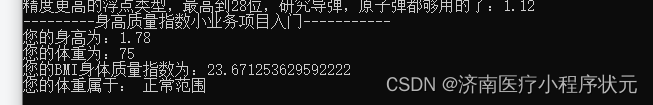

身体质量指数程序,入门写死的小程序项目

迈动互联中标北京人寿保险,助推客户提升品牌价值

第七篇,STM32串口通信编程

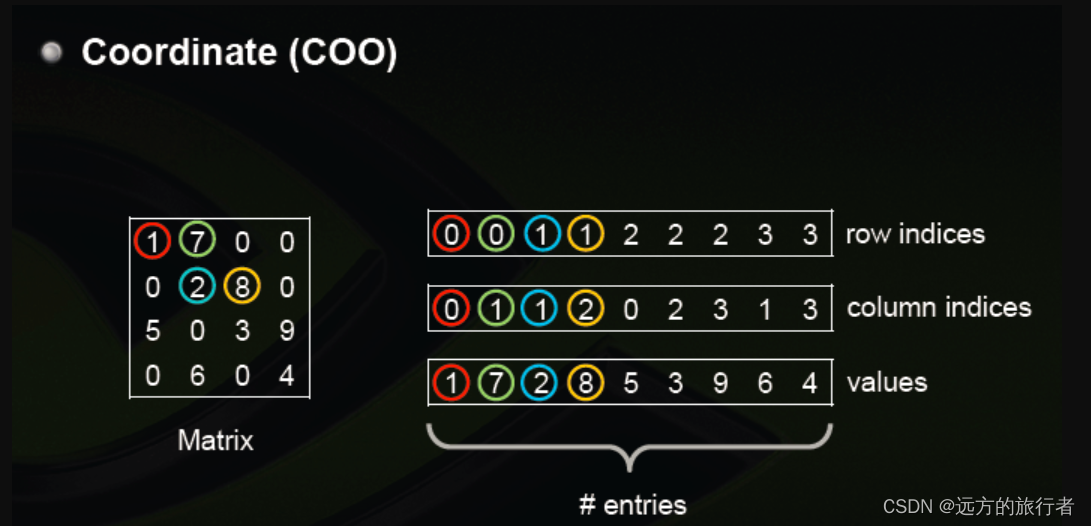

Data type of pytorch tensor

![[hfctf2020]babyupload session parsing engine](/img/db/6003129bc16f943ad9868561a2d5dc.png)

[hfctf2020]babyupload session parsing engine

![[batch dos-cmd command - summary and summary] - string search, search, and filter commands (find, findstr), and the difference and discrimination between find and findstr](/img/4a/0dcc28f76ce99982f930c21d0d76c3.png)

[batch dos-cmd command - summary and summary] - string search, search, and filter commands (find, findstr), and the difference and discrimination between find and findstr

UI control telerik UI for WinForms new theme - vs2022 heuristic theme

随机推荐

[batch dos-cmd command - summary and summary] - view or modify file attributes (attrib), view and modify file association types (Assoc, ftype)

Dr selection of OSPF configuration for Huawei devices

The cost of returning tables in MySQL

Address information parsing in one line of code

Return to blowing marshland -- travel notes of zhailidong, founder of duanzhitang

Informatics Orsay Ibn YBT 1172: find the factorial of n within 10000 | 1.6 14: find the factorial of n within 10000

深度学习简史(一)

Part IV: STM32 interrupt control programming

Learning notes 5: ram and ROM

深度学习框架TF安装

界面控件DevExpress WinForms皮肤编辑器的这个补丁,你了解了吗?

golang中的WaitGroup实现原理

C9 colleges and universities, doctoral students make a statement of nature!

There is an error in the paddehub application

Dell笔记本周期性闪屏故障

Batch obtain the latitude coordinates of all administrative regions in China (to the county level)

[100 cases of JVM tuning practice] 04 - Method area tuning practice (Part 1)

【案例分享】网络环路检测基本功能配置

Boot - Prometheus push gateway use

自旋与sleep的区别