当前位置:网站首页>Financial markets, asset management and investment funds

Financial markets, asset management and investment funds

2022-07-04 23:19:00 【raindayinrain】

1. Financial markets

Classification by period : short-term , long-term

Classify according to the subject matter : Notes , negotiable securities , Derivatives , foreign exchange , Gold, etc

Classified by delivery period : Spot market ; The futures market

Classified by transaction nature : The distribution market ; Circulation market

Classification by geographical scope : At home , It is also divided into national , Regionally , Local financial markets ; The international .

2. Constituent elements

1. Market participants

Mainly including the government , The central bank , Financial institutions , Individuals and business residents .

2. financial instruments

A legal certificate proving the relationship between bonds and debts and based on which monetary capital transactions are carried out , It's a legal contract , Rights and of both parties to the transaction

Obligations are protected by law .

3. The organization of financial transactions

3.1. Floor trading .

The establishment and dissolution of the stock exchange , To be decided by the State Council .

Shanghai stock exchange , Shenzhen Stock Exchange ;

China Financial Futures Exchange , Shanghai Futures Exchange ;

Zhengzhou Commodity Exchange , Dalian Commodity Exchange ;

National small and medium-sized enterprise share transfer system ;

Shanghai Gold Exchange .

3.2. OTC trading

The buyer and the seller have a face-to-face discussion on the counter , Decentralized trading . Such as over-the-counter trading .

A typical OTC market is the interbank bond market , Agency Share Transfer System , Over the counter bond market, etc .

3.3. Telecommunication network transaction mode

Mainly through electronic communication or Internet technology to complete the transaction .

3. regulatory

3.1. reason

1. Externality issues

Financial institutions based on their own interests , Sometimes you don't think about the big picture .

Financial products room , Between financial institutions , The correlation between financial institutions and other market entities , Risk is easily transmitted .

2. Vulnerability issues

Financial institutions operate in high debt , Under the collapse of market information , Financial institutions are fragile .

3. Imperfect competition

Large financial institutions have a certain degree of monopoly ,

It has certain influence and even control over the price of the financial market , It is difficult to compete completely freely .

4. Information asymmetry

The majority of small and medium-sized investors are vulnerable to unfair treatment , Even fraud .

3.2. Regulatory body

China's financial supervision adopts banking , securities business , Separate supervision mode of insurance industry .

Under the leadership of the State Council , The people's Bank of China as the central bank , Undertake the formulation and implementation of monetary policy , Prevent and defuse financial risks , Macro regulatory responsibilities for maintaining financial stability .

China Banking Regulatory Commission , The China Securities Regulatory Commission and the China Insurance Regulatory Commission have conducted separate inspections of banking financial institutions , Securities financial institutions , Insurance financial institutions and the business activities of these institutions shall be subject to supervision and administration .

There are also exchanges in the financial market , Industry associations and other self-discipline institutions shall implement self-discipline management within their respective scope .

4. Asset management

4.1. The essence

. Risk and benefit match

savings , Depositors and banks are creditors and debtors , The bank needs to repay the principal when due , Pay interest .

Asset management , The investor and the manager are the relationship between the principal and the trustee , At the investor's own risk , Self owned income , The manager charges a certain proportion of the management fee . The fundamental utility value of asset managers lies in the collection of assets , Portfolio investment , To manage risk , Get a more reasonable risk return .

2. Managers need to insist on " The seller is responsible for "

Do not harm the interests of investors ; Truth is the truth , Perform risk notification , Information disclosure .

3. Investors need to " The buyer is conceited "

At your own risk , Self owned income

Significance of asset management :

1. Effectively allocate resources for the market economic system

2. Make investment and financing easier

3. Connect investors , Demand side

4. It is conducive to the reasonable pricing of financial assets , Strengthen the liquidity of financial markets

# 3. China's asset management industry

## 3.1. Fund management company and its subsidiaries

Securities investment fund management company , Matched by China Securities Regulatory Commission , Set up in China ,

Engaged in securities investment fund management business , And other permitted businesses .

1. Publicly raised funds :

No specific object raising , The accumulated funds raised from specific objects exceed 200 people , And other circumstances specified .

Publicly raised funds , It shall be registered with the securities regulatory authority under the State Council .

2. Specific customer asset management business ,

Raise funds from specific customers or accept the entrustment of specific customers' property to act as asset manager ,

The custodian institution acts as the asset custodian , For the benefit of the asset client , Use entrusted property for investment .

Engage in specific asset management business through the establishment of asset management plan ,

You can handle specific asset management business for a single customer ,

And handle specific asset management business for specific multiple customers .

Single customer ,

Initial assets entrusted by the client >=3000W, Unless otherwise specified .

Multiple customers ,

The initial amount of a single asset management plan for entrusted investment shall not be less than 100W,

And can identify , Judge , The natural person who bears the investment risk , legal person , A legally established organization ,

Or approved specific customers .

The number of clients of a single asset management plan shall not exceed 200 people ;

The total initial assets entrusted by the client shall not be less than 3000w, No more than 50 Billion ,

Unless otherwise specified .

3. Special asset management plan

Set up special subsidiaries ,

Invest in equity not transferred through the stock exchange , bond , Other property rights ,

And specific asset management plans for other assets recognized .

4. Private equity fund management business

Set up special subsidiaries ,

Through the establishment of special purpose institutions or private equity investment funds in the form of partnerships or companies

To engage in private equity investment fund management business .

## 3.2. Private institutions

Private equity funds do not have administrative approval for the establishment of private equity fund management institutions and the issuance of private equity funds ,

All kinds of issuers are allowed to issue on the basis of law and compliance ,

Issue private equity funds to investors whose cumulative amount does not exceed the specified amount .

Non public funds shall be raised from qualified investors , The cumulative number of investors shall not exceed 200 people .

Qualified investors are :

Have the ability to identify and bear risks ,

The amount invested in a single private equity fund shall not be less than 100w

Units and individuals that meet the following standards :

1. Net worth is not less than 1000w For the unit

2. Financial assets shall not be less than 300w Or near 3 Average annual income >=50w personal .

The following investors are qualified investors :

1. Social security fund , Pension funds such as enterprise annuity , Charitable funds and other social welfare funds .

2, An investment plan established according to law and filed with the fund industry association

3. Private equity fund managers and practitioners who invest in the private equity funds they manage

4, Other investors as required .

With a partnership , Contract and other unincorporated forms ,

Pooling funds to invest directly or indirectly in private equity funds ,

It is necessary to check whether the final investor is a qualified investor and count the number .1,2,4 No penetration verification .

Private fund management institutions can engage in

Private equity investment fund ,

Private equity funds ,

Venture capital fund and other raising and management businesses .

The private equity fund manager shall be in accordance with the provisions of the fund industry association , Apply to the Fund Industry Association for registration . Go through the fund filing procedures .

### 3.3. securities company

Securities companies may engage in the following customer asset management businesses according to law :

1. Handle directional asset management business for a single customer ;

2. Handle collective asset management business for multiple customers ;

3. Handle special asset management business for customers for specific purposes ;

Qualified investors :

Have corresponding risk identification ability , Ability to bear risks

Units and individuals that meet the following conditions :

1. The total financial assets of individuals or families shall not be less than 100w RMB ;

2. company , The net assets of enterprises and other institutions shall not be less than 1000w RMB .

All kinds of collective investment products established and regulated according to law are regarded as a single qualified investor .

Securities companies can set up private investment fund subsidiaries , be engaged in

Private investment fund business .

Alternative subsidiaries of securities companies can also be established ,

be engaged in < List of securities self operated investment varieties of securities companies > Financial products outside , Equity, etc .

Securities companies established in China , Insurance asset management company , An asset management institution engaged in the management of non-public offering securities investment funds , eligible , May apply for public fund management business .

## 3.4. Futures companies

A single customer handles asset management business ,

Specific multiple clients handle asset management business .

## 3.5. Trust company

Trust companies can establish and manage single fund trust plans and collective fund trust plans in China .

Pooled fund trust scheme , Two or more principals

1. The principal is a qualified investor ;

2. The settlor participating in the trust plan is the sole beneficiary ;

3. The number of natural persons in a single trust plan does not exceed 50 people ,

Single entrustment amount >=300w There is no limit on the number of natural person investors and qualified institutional investors .

4. Term of trust >=1 year ;

5. The trust fund is invested by a clear direction & Strategy , And in line with the national industrial policy , Other provisions ;

6. The beneficial rights of the trust are divided into trust units with equal shares ;

7. The trust contract shall stipulate the remuneration of the trustee ;

8. Other requirements of the CBRC .

Qualified investors :

distinguish , Judge , The person who bears the risk of the trust plan .

And meet one of the following .

1, The amount of investment >=100w natural person , legal person , Other organizations ;

2. Personal or household financial assets , At the time of subscription ,>=100w, A natural person who can provide proof of property ;

3. Personal income for the past three years >=20w Or husband and wife for nearly three years >=30w, And can prove that natural persons .

### 3.2.6. The insurance company

Invest by oneself or entrust an insurance asset management institution .

1.. Insurance asset management

The insurance asset management institution is the issuer , administrator , To the insurance group 【 holding 】 company , The insurance company , Share of products sold by investors such as insurance asset management institutions , Fund raising , Select professional institutions such as banks as custodians , Carry out investment management activities .

2. Asset support plan

Insurance asset management companies and other professional management institutions set up support plans as trustees ,

The repayment is supported by the cash flow generated by the underlying assets ,

Business activities of issuing income certificates to qualified investors such as insurance institutions .

3. Private equity funds

Insurance funds set up private equity funds , The promoter shall be a subsidiary of the insurance asset management institution .

The fund manager may be a sponsor ,

The sponsor may also appoint an insurance asset management institution or other subordinate institutions to act as .

4. Investment linked insurance products , Fund management of non life insurance and non scheduled income investment insurance products

Assets should be segregated , To configure , Management, etc , Independent of other insurance products

5. Public securities investment fund business

Some insurance asset management companies , After approval , It can carry out public fund management business .

Qualified insurance companies can also set up fund management companies , Engaged in public fund business .

### 3.7. commercial bank

Personal finance

Private banks

Financial management plans can be sold to specific target customers .

It can be divided into guaranteed income financial management plan , Non guaranteed income financial management plan .

Guaranteed income , The bank promises to pay the minimum return to its customers , Banks take risks , Other income shall be distributed as agreed .

Non guaranteed income , It can be divided into principal guaranteed floating income , Non breakeven floating income .

Commercial banks are private banking customers , When providing financial product sales services to high net worth customers, the customer's risk tolerance shall be evaluated .

Private bank customers refer to , Net financial assets >=600w.

High net worth customers need to meet one of the following :

1. Single subscription of financial products >=100w natural person ;

2. When subscribing for financial products , Personal or household financial net assets >=100w, And can prove ;

3. Personal income for nearly three years >=20w Or family >=30w, And can prove .

Qualified commercial banks , A fund management company may be established , Engaged in public funds, etc .

## 3.3. Asset management issues

### 3.3.1. There are potential liquidity risks in fund pool operation

The low price that the management organization will raise , Short term funds are put into long-term debt or equity projects , Liquidity tension may occur , And transmit it to other asset management institutions through the product chain .

### 3.3.2. Multi level nesting of products leads to risk transmission

Some banks manage their finances in trust , negotiable securities , fund , Insurance asset management products are channels , Invest funds in equity and other products . Internet platform , Non financial institutions that have not been effectively regulated, such as private wealth management, cooperate with financial institutions to nest .

### 3.3.3. Shadow banks face inadequate supervision

Bank off balance sheet financing , Silver letter cooperation , Bank Securities cooperation , Products invested in non standardized debt assets in bank based cooperation , Insurance agency " Real debt of famous stocks " Class investment, etc , It has the characteristics of a silver bank .

### 3.3.4. Rigid payment makes the risk remain in the financial system

Asset management business mainly involves trust relationship or principal-agent relationship , Some business legal relationships are not clear , The essence is the relationship between creditor's rights and debt , There is implicit rigid cashing .

### 3.3.5. Some non-financial institutions do not need to carry out asset management business

Some risks and problems have been exposed when non-financial institutions carry out asset management business .

## 3.4. Promote the standardized and healthy development of asset management business

### 3.4.1. Classification unified standard regulation , Gradually eliminate arbitrage space

Risk to silver banks , We should establish a macro Prudential policy framework for asset management business , Improve policy tools . For standard differences under institutional supervision , We should strengthen functional supervision , Through regulation , Eliminate arbitrage space , Contain the risk transmission caused by product nesting .

### 3.4.2. Guide the asset management business to return to its original source , Orderly break the rigid cashing

The asset management institution shall not promise to guarantee the principal and income . Strengthen the risk isolation between asset management business and proprietary business .

### 3.4.3. Strengthen liquidity risk control , Control lever level

Strengthen independent management , Set up a separate account , Separate accounting and other requirements , Match the product term with the duration of the invested assets . Isolate different asset management products , The risk between self owned funds and entrusted funds of asset management institutions . Reasonably control the stock market , Leverage in the bond market .

### 3.4.4. Eliminate multiple nesting , Suppress channel business

Implement equal access for all kinds of financial institutions to carry out asset management business , fair .

### 3.4.5. To strengthen " Non-standard " The business management , Guard against shadow banking risks

### 3.4.6. Establish a comprehensive statistical system , Provide a fundamental basis for penetrating supervision

边栏推荐

- 实战模拟│JWT 登录认证

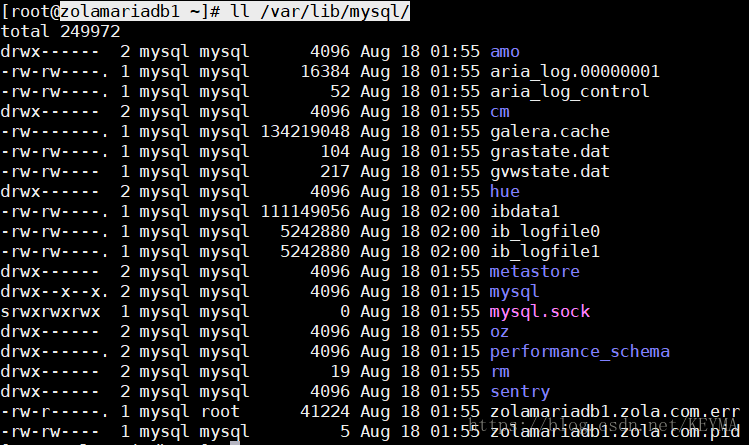

- Galera cluster of MariaDB - dual active and dual active installation settings

- UML图记忆技巧

- ffmpeg快速剪辑

- A complete tutorial for getting started with redis: getting to know redis for the first time

- ICML 2022 || 3DLinker: 用于分子链接设计的E(3)等变变分自编码器

- The solution to the lack of pcntl extension under MAMP, fatal error: call to undefined function pcntl_ signal()

- PS style JS webpage graffiti board plug-in

- Photoshop batch adds different numbers to different pictures

- MariaDB的Galera集群应用场景--数据库多主多活

猜你喜欢

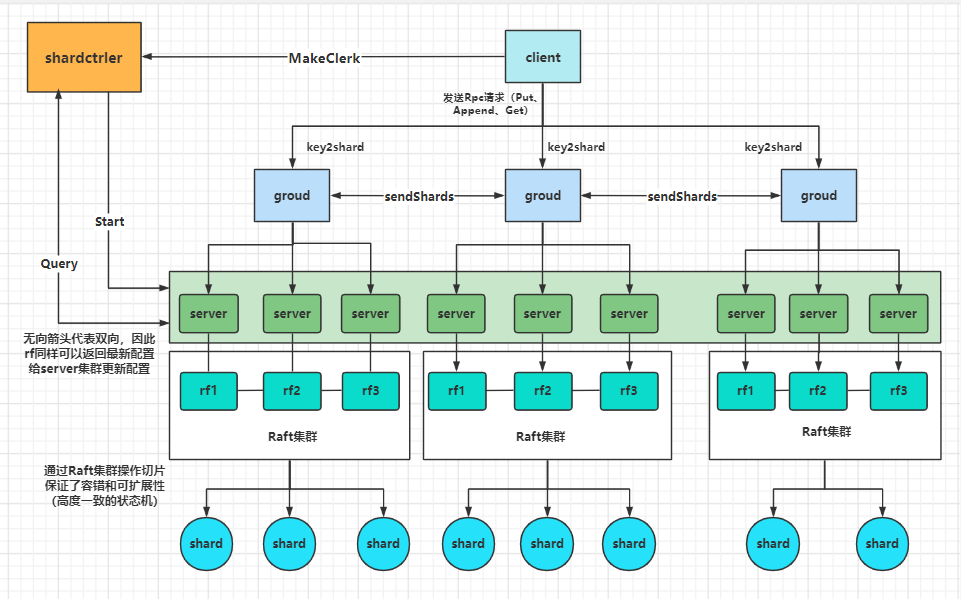

MIT-6.824-lab4B-2022(万字思路讲解-代码构建)

MariaDB的Galera集群应用场景--数据库多主多活

JS card style countdown days

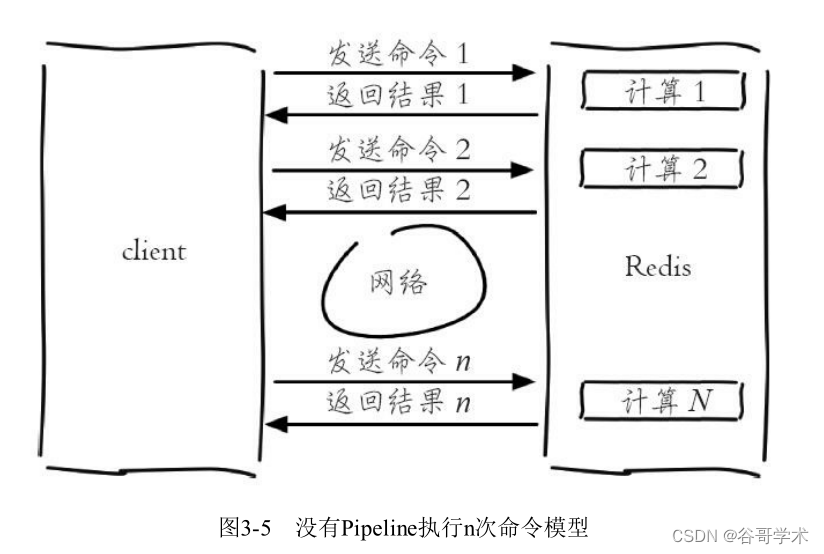

A complete tutorial for getting started with redis: Pipeline

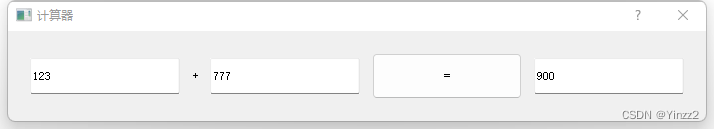

Qt加法计算器(简单案例)

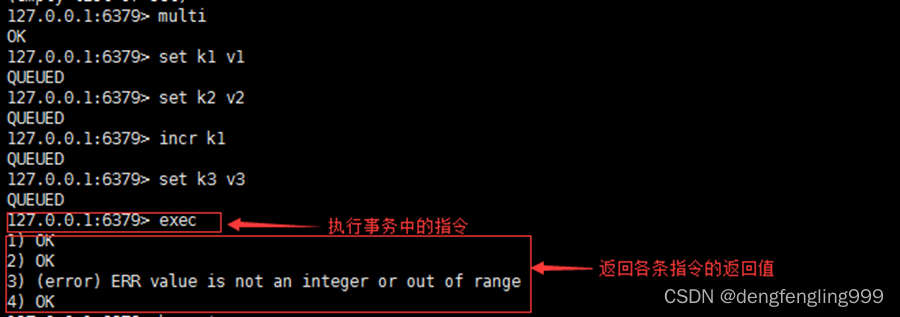

Redis:Redis的事务

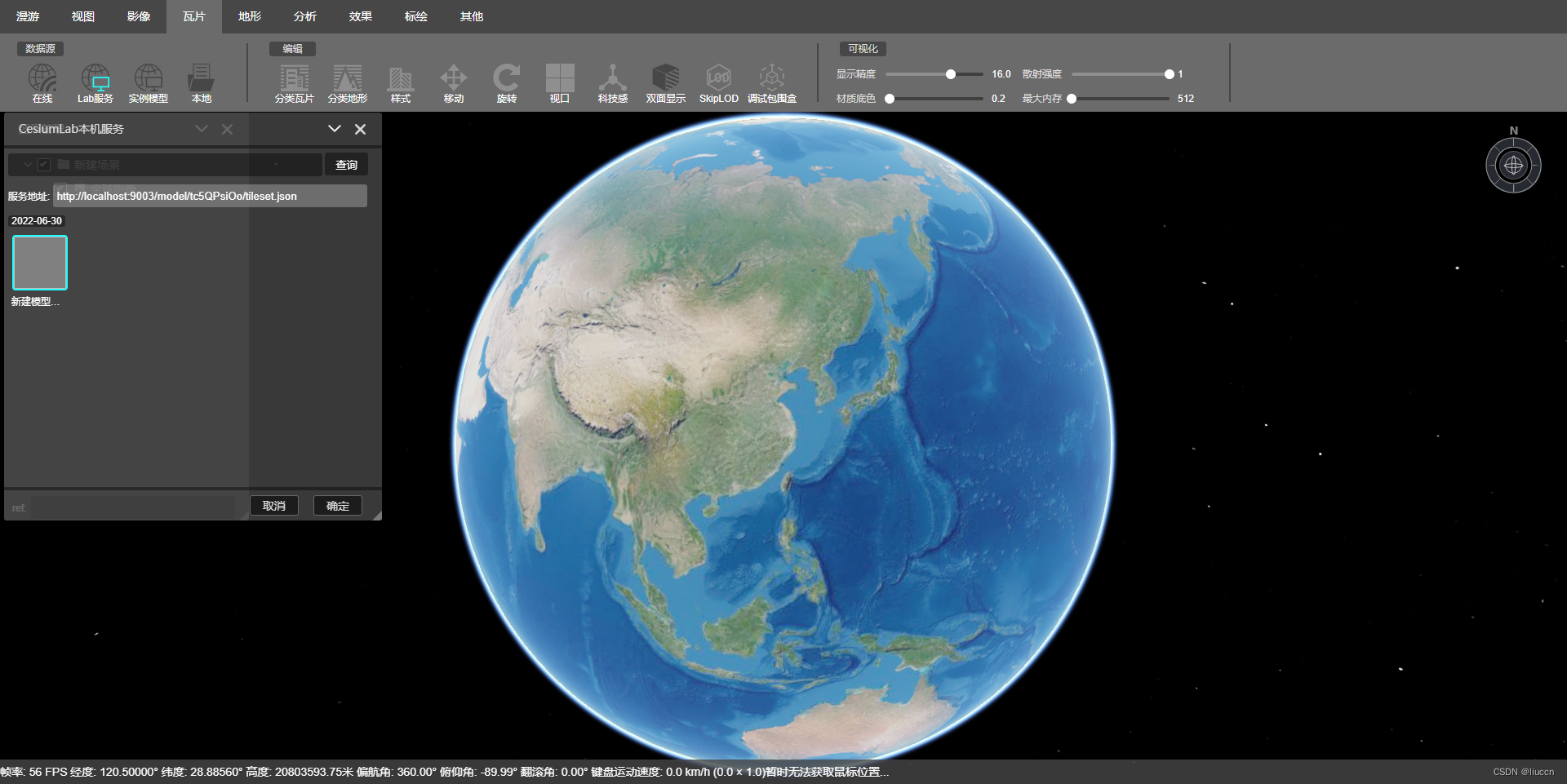

SHP data making 3dfiles white film

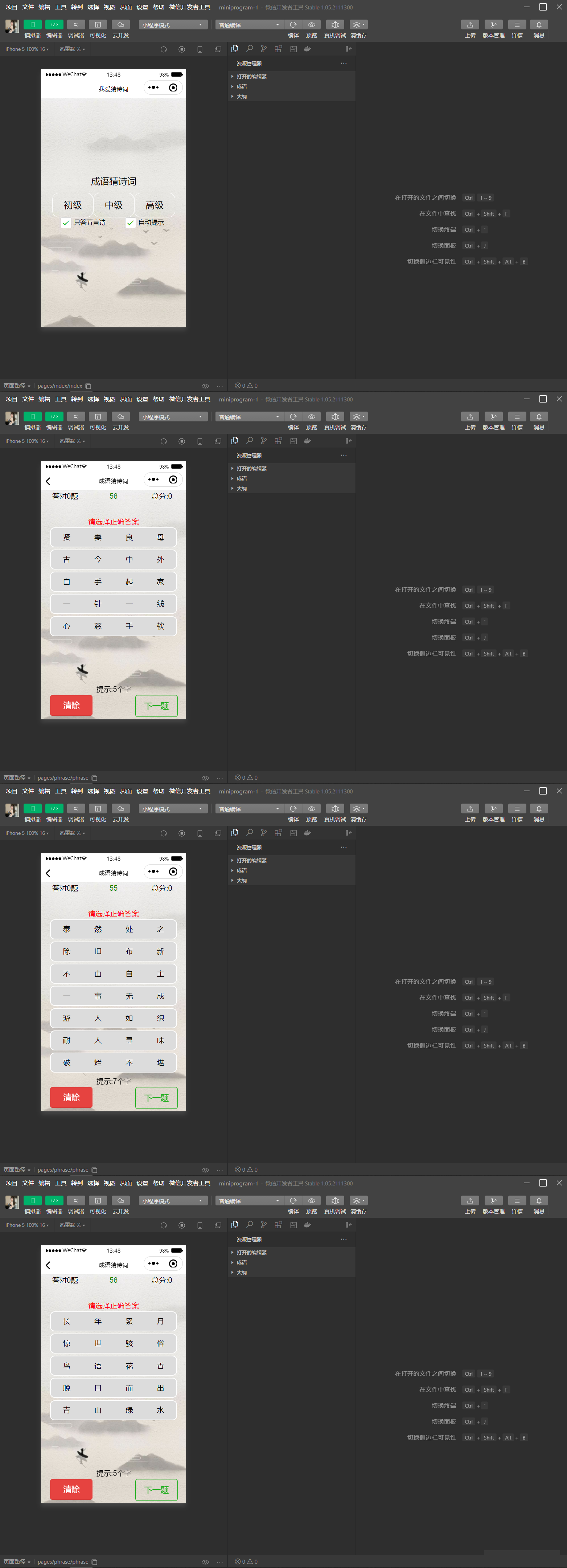

智力考验看成语猜古诗句微信小程序源码

OSEK标准ISO_17356汇总介绍

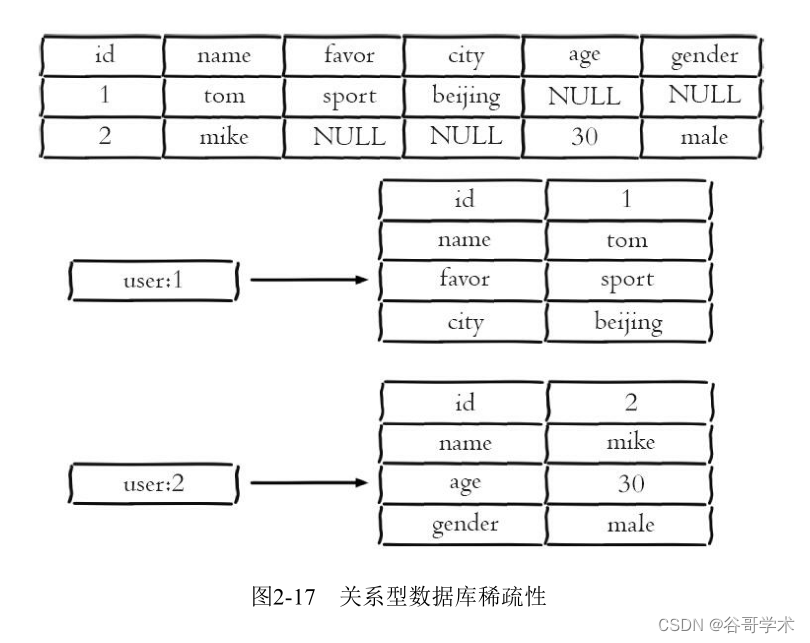

Redis getting started complete tutorial: hash description

随机推荐

The difference between cout/cerr/clog

A complete tutorial for getting started with redis: understanding and using APIs

JS card style countdown days

Jar批量管理小工具

UML diagram memory skills

时间 (计算)总工具类 例子: 今年开始时间和今年结束时间等

cout/cerr/clog的区别

After Microsoft disables the IE browser, open the IE browser to flash back the solution

认识ThreadPoolExecutor

壁仞科技研究院前沿技术文章精选

Redis:Redis的事务

Servlet+jdbc+mysql simple web exercise

[crawler] jsonpath for data extraction

Basic use and upgrade of Android native database

Qt个人学习总结

Notepad++ -- editing skills

[Taichi] change pbf2d (position based fluid simulation) of Taiji to pbf3d with minimal modification

蓝天NH55系列笔记本内存读写速度奇慢解决过程记录

云服务器设置ssh密钥登录

【ODX Studio编辑PDX】-0.3-如何删除/修改Variant变体中继承的(Inherited)元素