当前位置:网站首页>How does the bull bear cycle and encryption evolve in the future? Look at Sequoia Capital

How does the bull bear cycle and encryption evolve in the future? Look at Sequoia Capital

2022-07-08 02:14:00 【Vernacular blockchain - Dabai】

This is the second stage of the vernacular blockchain 1689 Period sharing

Produce | Vernacular blockchain (ID:hellobtc)

Sequoia Capital was founded in 1972 year , Just this year 50 year , In the field of global venture capital , Sequoia Capital is the undisputed leader .

Since its establishment , Sequoia Capital successfully invested in Apple 、 Cisco 、 Oracle 、 Giant companies such as Google , Witnessed the shining moments of legendary enterprises one after another .

This article is from UnChained Talk about the two partners of Sequoia Capital Shaun Maguire and Michelle Bailhe, The former has opened five companies and succeeded in three , The latter started from McKinsey , Later, he served as the team leader of the Silicon Valley Creative Laboratory .

The vernacular blockchain has collated, translated and excerpted the interview content , See the link at the end of the text for the full version of the video .

Interview highlights :

• What are Sequoia's long-term views and arguments on the encryption industry

• Due to blockchain Technology , Our life will be in 20 How different it becomes after years

• How does Sequoia decide whether to invest in the entity behind the project or token

• Is it against the spirit of decentralization to involve venture capitalists

• Michelle How to view the macroeconomic environment that affects encrypted assets , And whether this cycle is different from the previous cycle

• What encryption projects should focus on and the business model they should pursue

• Even if there is no clear stipulation , How encryption founders should always do the right thing

• The future of the metauniverse and how to define

• Encryption industry mental model and the stage of realizing global landing

01

What are Sequoia's long-term views and arguments on the encryption industry

host : It is said that Sequoia has launched a 5/6 A billion dollar encryption Fund , According to the news, the fund is for the future of encrypted assets 20 We're going to lay it out in 2010 , So what exactly ?

Michelle: The encryption industry is quite mature in technology and Application . Interestingly , The question we have been asked recently is whether our beliefs have changed , The answer, of course, is No . namely , Encrypted assets have created a new asset category and computing platform , And there will be business units that provide services for these assets at the same time . You know that many financial businesses are developed on decentralized platforms in a combination of centralization and decentralization Dapp, So we continue to invest in these projects , Including the core layer Layer2 Infrastructure and Applications , And expect in the future 20 See more good developments during the year .

02

20 What has become of blockchain based life in

host : You think our future 20 What will life be like in ?

Shaun: First of all, I think it's hard to say . You know how to predict the next 20 perhaps 30 What encryption assets will be used in , Similar to in 70 Age prediction 90 How to use the Internet .

I personally think the future 20 All money will be digital in , For example, the dollar may become a digital tool of the government , The adoption rate of decentralized currency will increase significantly , Especially in the developing regions of the world .

Uniswap The current situation of is a good case , That is, you can use some very simple code , Let some businesses with very high transaction volume run forever , No one needs to maintain it , Just release the code , It's right there . I think there are many such examples that can give me a glimpse of the future , But you know , It's sad to make specific predictions .

Michelle: I totally agree Shaun, I imagine something like the Internet , It is basically an information revolution , So it's hard to predict . Just like we couldn't predict that the Internet would become what it is today , No one will predict Google / Mobile Internet is bound to happen today , But they were born .

Now we can book a taxi on our mobile phone , Book a hotel anywhere , Just like what we couldn't understand at that time . But a clear trend is that billions of people will have more information than they used to , And share information / The cost of transaction information will be greatly reduced , I think this is consistent in all businesses , Except it's hard to say exactly what form it will take . And you know today's Internet services are censoring 、 The regulation is different , I think , This does not mean that the old will disappear , But we will have more choices .

03

Sequoia to the project entity /Token Investment decisions

host : At present, many successful large venture capital companies are mostly from the old investment model , Now this kind of start-up company or VC Very much like a centralized company , In order to adapt to this new investment model of decentralized new world , There must be some reorganization 、 Large amount of investment Token etc. , Are they really decentralized ?

Shaun: I agree with you , But the encryption industry has many differences , Although encryption and traditional business have many similarities , For example, you agree that you need to hire engineers and product personnel to help build the best public relations 、 product , You need to pay and manage them , There are many similarities between establishing encryption companies and establishing traditional software business companies .

But it's really not what people think , You know Sequoia already exists 50 year , The biggest victory of early investment is apple, Atari and other hardware companies , And then in 80 End of the decade 90 s , Sequoia Capital's most successful investment is the Internet infrastructure company , You know cisco As an example , I don't know oracle The core infrastructure of . Whether it is really decentralized is not in the surface mode, in fact .

host : Let's talk about your investment in encryption projects , There is a centralized entity behind many agreements , Therefore, you can choose the investment project Token Or the equity of the centralized entity that starts the decentralization project , for example , I know you invested filecoin, So I'm sure , You can choose to invest filecoin Token Or protocol Laboratory , How do you make a decision ?

Michelle: Most of the time, the problem we need to solve is consistency with the founders , We will ask for matching Token, This is very important . Now there are examples of inconsistent incentives everywhere , It will lead to undesirable results , Of course, non encrypted assets are just a broader application of Technology , So we always try to promote the shareholders of equity , We have to discuss again Token Share 、 Proportion, etc .

Now? Token It is widely used in encrypted assets , In fact, there are many different things in my mind , Some things look more like commodity relationships , Used to stabilize or protect the network ( Such as bitcoin or Ethereum or anything else ) The native Token, Then you may have something related to the success of your application Token, Then what you have just looks like bonus points , Like it's basically aviation mileage , Like it has nothing to do with business , But it's just a trade discount or something you like, supermarket points or airline points .

You have other things , You have dog money , Or anything else you want , So what we're talking about is Token It really depends on the business and what they are building , If it is something like bonus points , You know we may not care , Because these are of no value to us, because we are not necessarily users who will trade on them , So we may only care about becoming equity shareholders in other cases , We may really care about applications or both , Then for the first floor , It's just the first level of power , This is where value accumulates , Therefore, its scope depends on the content being built and how you deal with the attitude of some members of the encryption community .

04

Is it against the spirit of decentralization to involve venture capitalists

host : I have to ask a follow-up question , Because obviously , You know Sequoia has investment startups , for example door dash or airbnb, You may have heard some encryption entrepreneurs say such words , Decentralization means that they will have the ability to motivate different workers Token, So when you consider what kind of products or services you can provide on the Internet , How do you make sure it makes more sense ? Whether provided by a centralized entity or in a decentralized manner , Or when you plan to invest in encryption companies ?

Shaun: This idea used to be 20 It has been very popular for years , So now it's a little uncertain , The main difference is whether to give ownership of the early network to users , To help motivate early program guidance . therefore , There will be some differences at the beginning , But the final state is not important , Like you know airbnb, Suppose you have a decentralized airbnb, And you gave up 50 % As Token To motivate early users and early hosts and everything you have after you reach a certain scale , But competition is also emerging in endlessly , People like to use the best products , And good products mean having the largest customer base 、 Have the most liquidity 、 Have better services , So I just want to say , The only difference is whether to give up ownership at an early stage to help stimulate use , But at the end of the day , You must have better products , Because if your product is not better than alternative products , People will leave and do the next thing . So I think this is actually a lot web3 What the company didn't pay attention to .

Michelle: I agree with , This desire for unrestrained decentralization is becoming increasingly popular , I think when you really study it in depth , Running decentralized things is actually inefficient , It needs more computing resources and more coordination to ensure that it can be done well , So over time , Our expectations for its realization are actually very extravagant .

You want to use it to do the most important things , And this is like the pursuit of stateless freedom , You know , Value storage is as important as public information networks , You don't want a government or a company you know to be the only one who controls , So this is a bit like the common problem that mankind has been facing , People have been looking for the best way to organize the government or people , We can centralize democracy or make it more decentralized , But this requires a lot of cost and participation , So for the final desired result , In other things, it optimizes decentralization in order to facilitate access or speed , It adopts a centralized business model .

Take another example , Some people say , If you think about what Google is doing , Or if the problem you are solving is to change the existing advertising business model , Then you will know something web 3 Startups are a big threat to Google . It's a great way for billions of people to get free information and fund it through advertising , But it's hard to do this by charging these people , If what you want is not to get private information 、 Not selling advertisements , And you may need something with more security and control , Then you won't pay for billions of people accessing the same information they can't afford , But it may be a smaller group , You can access it , So in fact, it's just a different choice , So we think it allows centralization , Or this blunt decentralization tool is always at all costs . I'm happy to use centralized things , Because it may be cheaper , More convenient .

05

Michelle How to view the macroeconomic environment that affects encryption

And whether this cycle is different from the previous cycle

host : There are too many news recently , Let's start talking about the bear market in general ! Bitcoin is in 2008 Launched in the last global financial crisis in . Crypto assets mainly exist in about of the United States 0% Interest rate environment , So what do you expect to happen next year ? What stage do you predict we are in the encryption industry ?

Michelle: I think it's just to prepare people for what they see , In the encryption industry , The cryptotree has grown higher . So it will vibrate more severely when it is hit , This does not mean that it will disappear , Or just like the amount of dollars , Maybe the quantity is more, but the value has decreased , Because they are larger . The changes and fluctuations in this period will feel greater than before , That's because we have more users 、 More dollars 、 More liquidity 、 More regulators are concerned , These are encrypted assets that have never been , So it really just tries to prepare people .

And encrypted assets always go through cycles , But this may have some unique elements , Make it feel different , And be prepared for it , I think it really depends on the business you run , As for how you should react , You know, some of them may have been active in a large number of retail transactions in the past few years , You know they may need a very low cost to plan a future environment , The difference is , Retail interest may decrease , But it can't be zero , But less than before , And you've seen , Since last year, the trading volume of many large listed companies engaged in brokerage transactions has decreased significantly , Obviously, last year was a record high , But that doesn't mean it will disappear , But you just need to plan for this difference , So this is what we have been trying to talk about with our founders , Is to realize , This is a different environment , If you continue to do what you are doing in the past two years , You may soon find yourself trapped in quicksand , So realize that the environment has changed , And make corresponding plans for some people you will know , Focus on some product areas or difficult transformation , It also depends on who you are and what you think , But the message we just want to convey is that this is a different plan , Plans that can be prioritized .

06

Even if there is no clear stipulation

How should crypto asset founders always do the right thing

host : Then I want to ask you the last point in your post is that you said to build a sustainable business Token, But it's not a business model , What kind of business model do you think will play a role in decentralization ?

Michelle: You know, Token It's a really cool invention , For example, there are some very cool things in terms of regulatory dynamics , About finding this way to really get motivated , You know, reward users 、 There are many interesting things about rewarding early developers , And many people will use them again for real value , For example, Ethereum or bitcoin and many other similar things , It is indeed useful in stabilizing and protecting the network , There are other places where you know it works , But there are many other projects that have no real value .

In the encryption boom of the past few years, people are very excited , Maybe things are going well , Everything is trading , You may see a lot of growth , Then you think , Oh my god , We are doing something amazing , It's working .

But once the interest rate environment changes and starts to flow out of the market , When liquidity does not exist , You will see the value of the project disappear , This is the situation of many projects now .

Just like you can't see Token The rise can see whether there is such a business model , It's like there's no Token It's the same thing , If you just keep getting valuation growth from investors , But many other health indicators do not exist , This does not mean that the business model is true , Therefore, we should really understand what the actual business model is , What products or services do people actually pay you , How it works , Then what is the relationship between it and assets , This may be business related , It may not be relevant , This is an important question .

07

The future of the metauniverse and how to define

host : Do you have any expectations about what the metauniverse will become ? Do you think VR、AR Must be part of it , Or do you think you don't need , Everyone is talking about the metauniverse , And I don't think there is a good definition , So I'd like to hear your thoughts .

Shaun: Oh , Oh my god , You are posing a problem to me ! I thought of the metauniverse , I agree that there is no good definition of metauniverse at present , Besides reading Neil Stevenson's book , And I like the metauniverse he describes 、 Obviously, it is the meta universe of our ideal life . Anyway, I think the metauniverse may have two different ways , One is just the next big stage transformation of the Internet , It's very hard. , I don't even know what it will be , But just like when the Internet evolves from today to the unknown future , I would call it the meta universe .

And I think a certain type of spatial component may be one of the important properties , It's like we invested in a company called gather The company , It can easily build maps , And you know you can link maps together like an office , So you can have a bunch of remote encryption companies . What you know , It's like they are teams headquartered around the world , But their offices can be like digital Tokyo , There you can walk from one encryption company to another's office , It may be like a shared game room , It feels like connecting people in different parts of the earth , But they can walk digitally from one space to another , And talk to people , So these organizations are not based on geography, but on ideas in cyberspace , This is just like the meta cosmic finance that I hope to be very strong in any field .

08

Encryption industry mental model and the stage of realizing global landing

host : We talked at the beginning , About the encryption industry 20 Years or 30 Vision for , but Michelle, Your blog lists the applications of blockchain Technology S curve , Can you give a brief overview ?

Michelle: In the early stages of this curve, nothing seems to happen , As you know , Encryption is an island , It is very disconnected from other resources , The entry only for assets is still a cumbersome flow of information , You know it's hard to get data from other Internet on the chain into smart contracts , So although this island is necessary , But there are few things that can be done .

Overall speaking , As the island continues to grow in terms of users and funds , There will be more encrypted asset native applications built to serve the universe , Not anywhere else .

It is more likely that the world of existing enterprises begins to connect here , And begin to meet these needs , Then we must enter the second stage , Because the infrastructure has been greatly improved , You know, from the dial-up stage to the broadband stage and now 5G, We are right now , Those core infrastructure layers have been significantly improved , Orders of magnitude faster 、 Cheaper . And we began to establish more connectivity between on chain and off chain applications through the liquidity of assets and information , I think it is difficult for us to see the future development in the initial stage .

Because the core infrastructure must be solved first , It's like the foundation of a building , You really have to start at the bottom , Then we come into contact with Internet users , You can start getting really large applications . So what people often miss is , Through that growth curve , What do you think , wow , This company or product has grown dramatically , But I'm sure it has been eliminated now . When we have 40 Billion or more encrypted users , You may think it's far away , But when you start to see trillion dollar companies or two trillion dollar companies , Not so , Because they do serve the Internet scale population in a very important way , So we think we are still in the early stage of the first stage , Maybe I just hope to enter the second stage , But this is still the real early stage .

Original video link :https://www.youtube.com/watch?v=KXINL12PftA

END

Recommended reading

The pressure of large institutions in the bear market has doubled , Grayscale 、Tether、 Will giant whales such as micro strategy become " Giant thunder "?

DeFi“ Where does the money come from ”? A problem that most people don't understand

The world is embracing Web3.0, Many countries have clearly begun to seize the initiative

Bear market guide | Some essential lessons and specific survival rules

Jay Chou " eldest brother ", encryption " Big cut "?

『 Statement : This article is the author's independent opinion , It does not represent the position of vernacular blockchain , This content is only for the majority of encryption enthusiasts to learn and exchange science , It does not constitute an investment opinion or suggestion , Please look at it rationally , Set up the right idea , Improve risk awareness . The copyright and final interpretation right of the article belong to the vernacular blockchain .』

Yes, please 「 Looking at 」

边栏推荐

- 力争做到国内赛事应办尽办,国家体育总局明确安全有序恢复线下体育赛事

- Redismission source code analysis

- Deeppath: a reinforcement learning method of knowledge graph reasoning

- XMeter Newsletter 2022-06|企业版 v3.2.3 发布,错误日志与测试报告图表优化

- Uniapp one click Copy function effect demo (finishing)

- The circuit is shown in the figure, r1=2k Ω, r2=2k Ω, r3=4k Ω, rf=4k Ω. Find the expression of the relationship between output and input.

- Relationship between bizdevops and Devops

- 分布式定时任务之XXL-JOB

- PHP calculates personal income tax

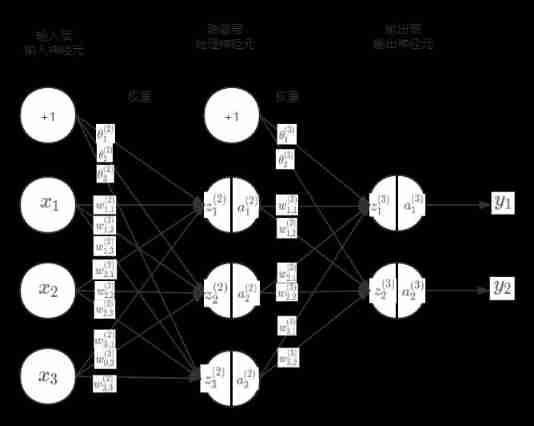

- Neural network and deep learning-5-perceptron-pytorch

猜你喜欢

Ml backward propagation

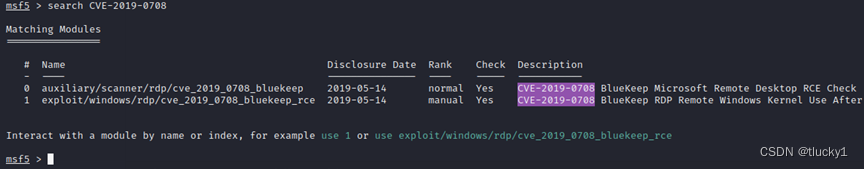

metasploit

《通信软件开发与应用》课程结业报告

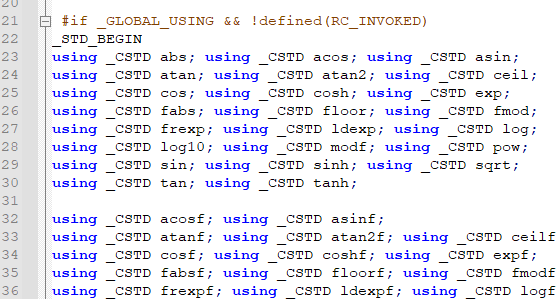

See how names are added to namespace STD from cmath file

Exit of processes and threads

leetcode 865. Smallest Subtree with all the Deepest Nodes | 865. The smallest subtree with all the deepest nodes (BFs of the tree, parent reverse index map)

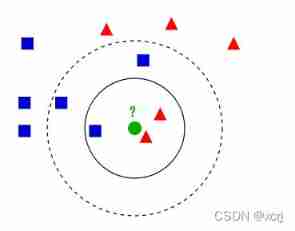

Ml self realization /knn/ classification / weightlessness

Leetcode question brushing record | 27_ Removing Elements

Apache multiple component vulnerability disclosure (cve-2022-32533/cve-2022-33980/cve-2021-37839)

Leetcode featured 200 -- linked list

随机推荐

Semantic segmentation | learning record (5) FCN network structure officially implemented by pytoch

Node JS maintains a long connection

Vim 字符串替换

In the digital transformation of the financial industry, the integration of business and technology needs to go through three stages

The body has a mysterious margin of 8px

Keras' deep learning practice -- gender classification based on inception V3

软件测试笔试题你会吗?

Keras深度学习实战——基于Inception v3实现性别分类

Can you write the software test questions?

Matlab r2021b installing libsvm

阿南的判断

Leetcode featured 200 -- linked list

进程和线程的退出

力扣5_876. 链表的中间结点

Completion report of communication software development and Application

Key points of data link layer and network layer protocol

文盘Rust -- 给程序加个日志

《通信软件开发与应用》课程结业报告

CorelDRAW2022下载安装电脑系统要求技术规格

Installing and using mpi4py