当前位置:网站首页>Accounting regulations and professional ethics [7]

Accounting regulations and professional ethics [7]

2022-07-04 16:27:00 【Star drawing question bank】

1. In the following options , The internal control measures of the unit are ( ).

A. Incompatible job separation control

B. Authorization approval control

C. Supply and marketing system control

D. Budget control 2. The requirements for accountants to strengthen service norms in accounting professional ethics include ().

A. Establish a sense of service

B. Improve service quality

C. Be cautious

D. Strive to maintain and improve the good image of the accounting profession 3. Filling in bills and settlement vouchers should be standardized , Achieve ().

A. Elements are complete.

B. The handwriting is clear

C. The number is correct

D. Not bad, not missing 4. According to the provisions of the legal system of enterprise income tax , Of the following , Tax exempt income is ().

A. Interest income from national debt

B. Financial appropriation

C. Dividends between resident enterprises that meet the specified conditions 、 Dividends and other equity investment income

D. Income from donations 5. according to 《 Detailed rules for the implementation of the tax administration law 》 The provisions of the , Taxpayers declare and pay taxes by mail , Should ().

A. Use express mail

B. Take the receipt of the postal department as the declaration voucher

C. The actual declaration date is the postmark date of the post office at the place of mailing

D. Handle the delivery formalities through the postal department 6. Of the following , accord with 《 Payment and settlement method 》 The regulations are ()

A. Write Chinese capital figures in traditional Chinese characters

B. Chinese amount in words and figures " horn ” Then don't write " whole ”( or " just ”) word

C. The Arabic number in figures should be preceded by the RMB symbol

D. Fill in the bill issue date with Arabic numbers 7. When filling in the bill issue date in Chinese capital, it should be preceded by " zero "” Month of ().

A. January

B. February

C. March

D. Ten months 8. The functions of government procurement include ().

A. Save financial expenditure , Improve the use efficiency of procurement funds

B. Strengthen public relations regulation

C. Invigorate the market economy

D. Promote anti-corruption , Protect national industries 9. When a bank opens a bank settlement account for an individual , If necessary, the applicant may also be required to issue ().

A. Residence booklet

B. Driver's license

C. passport

D. certificate provided by a unit 10. In the following statements about the original documents , The right is ( ).

A. Self made original vouchers must be signed or sealed by the leader of the handling unit or its designated personnel

B. Original voucher in several copies , The purpose of each couplet shall be indicated , Each copy can be used as a reimbursement voucher

C. On refund , The receipt should be replaced by the return invoice

D. Proof of employee's public loan , Must be attached to the bookkeeping voucher . When the loan is recovered , You should issue a separate receipt or return a copy of the receipt , The loan receipt shall not be refunded 11. According to the provisions of individual income tax , The form of progressive tax rate is applicable to the following income items: ().

A. Income from wages and salaries

B. Income from production and operation of individual industrial and commercial households

C. Income from transfer of property

D. Income from contracting and leasing operation 12. According to the tax law level , Tax laws can be divided into ().

A. Tax laws

B. Tax administrative regulations

C. Tax regulations

D. Tax normative documents 13. Local accounting regulations refer to provincial 、 Autonomous region 、 The people's Congress and its Standing Committee of municipalities directly under the central government are dealing with Accounting Law 、 Local accounting regulations formulated on the premise that accounting administrative regulations do not conflict .( )

14. The input tax paid is deducted by the output tax collected , The balance is the value-added tax actually payable by the taxpayer .

15. When the bank handles settlement , It is only responsible for handling the transfer of funds between the settlement parties , Do not assume the responsibility of making any advance .()

16. The accounting entity is the legal entity , The legal subject is not necessarily the accounting subject .( )

17. Collection refers to incomplete accounting , But it can control its material 、 Tax payer or individual who produces or sells goods , The tax authorities shall determine the output of the taxable products they produce according to the production capacity under normal conditions 、 The way in which sales are taxed .

18. According to different tax objects , Taxes can be divided into turnover taxes 、 Income tax 、 Resource tax and behavior tax .

19. Taxable consumer goods processed by the self-employed , The trustee shall declare and pay consumption tax to the competent tax authority of the place where its organization is located or where it resides .

20. The endorser fails to record the name of the endorsee and delivers the bill to others , This note is invalid .()

21. An individual bank settlement account is a bank settlement account opened in the name of a natural person by the depositor with his personal identity card and the business license of an individual industrial and commercial door .()

22. The state is to realize its functions , By virtue of political power , According to the standards stipulated by law , A specific distribution method of paid fiscal revenue .

23. The withholding agent shall report and pay the value-added tax withheld to the competent tax authority in the place where the taxpayer institution is located or where it resides .

24. Shower gel. 、 Toilet water 、 Shampoo also belongs to the consumption tax category , It needs to be taxed according to the proportion of cosmetics 30% Impose consumption tax .

25. Taxpayers are also engaged in taxable consumer goods with different tax rates , Selling taxable consumer goods with different tax rates into a complete set of consumer goods , Sales of consumer goods with different tax rates are accounted for separately , Consumption tax shall be calculated and paid at their respective applicable tax rates .

26. Government procurement supervision and administration department , Approved by the superior financial department , Centralized purchasing organizations can be set .()

27. It is filled in by the employee when he / she is on business to receive the travel expenses " loan bill ", It shall be returned to the employee when the employee reimburses the travel expenses and settles the loan .( )

28. Supervision by public opinion is also one of the methods in accounting professional ethics education .()

29. Implement unified leadership in the accounting work management system 、 The principle of hierarchical management .( )

30. The evaluation system shall be implemented for the acquisition of the technical qualification of primary accounting .( )

31. The income from the sale of goods does not belong to the production and operation income of the enterprise , Therefore, it is not the tax object of enterprise income tax .

32. The depositor has not paid off the debts of the deposit bank , It is not allowed to apply for cancellation of bank settlement account .()

33. For the convenience of depositors , One company can open multiple basic deposit accounts .()

34. In the case of ad valorem taxation , The tax basis of consumption tax is the same as that of value-added tax , All refers to the total price and extra price fees charged by the taxpayer to the buyer for the sale of taxable consumer goods .

35. Treasury centralized collection and payment system refers to the treasury single account system set up by the financial department on behalf of the state , All operating funds are collected into the treasury single account system 、 Payment and management system .()

36. A natural person can apply for opening a personal bank settlement account as needed , You can also select from the opened savings accounts and apply to the deposit bank for confirmation as a personal bank settlement account .()

37. residence 、 Change of business location , Involving the change of tax registration authority , It shall apply to the original tax registration authority for changing the tax registration .

38. Governments at all levels shall report on the implementation of the budget to the people's Congress or its Standing Committee at least twice in each budget year .()

39. according to 《 Enterprise income tax law 》 Regulations , Enterprises are divided into resident enterprises and non resident enterprises .

40. according to 《 Measures for the administration of RMB bank settlement accounts 》 Relevant provisions of , The name of the depositor in the bank settlement account has changed , But do not change the Bank of deposit and account number , Should be 5 Submit an application for change of bank settlement account to the deposit bank within working days , And issue the supporting documents of relevant departments .()

41. Original certificate of payment , There must be the collection certificate of the payee and the payee , It cannot be replaced only by the relevant vouchers for payment .( )

42. The person in charge of the unit refers to the legal representative of the unit .()

43. When engaging in temporary business activities in different places, you can open a temporary deposit account in different places .()

44. Payment and settlement is an important behavior , That is, the behavior that must be carried out in a certain form .()

45. Selling goods by direct collection , Whether the goods are delivered or not , The time when the tax liability occurs is when the sales volume is received or the evidence of claiming sales volume is obtained , And the day when the bill of lading is handed over to the buyer .

46. The depositor has not paid off the debts of the deposit bank , Do not apply for cancellation of bank accounts .()

47. Industry invoice is applicable to the business of a certain industry , Such as commercial retail unified invoice 、 Unified commercial wholesale invoice 、 Unified invoice for product sales of industrial enterprises, etc .

48. The principles of the state budget are universally applicable .()

49. The over rate progressive tax rate refers to the division of several levels based on the relative rate of the amount of tax objects , Stipulate the corresponding differential tax rates . China's land value-added tax adopts this tax rate .

50. Government procurement projects included in the centralized procurement catalogue , Due to special circumstances, decentralized procurement can also be implemented .()

51. Taxpayers should pay taxes on all taxable consumer goods in the sales process .

52. Internal audit is an integral part of internal control , It is the internal accounting organization of the unit 、 The supervision of accounting data by accountants .( )

53. Bookkeepers and approvers of economic business and matters 、 Handling personnel 、 The duties and authorities of the property custodian should be clear , And separate from each other 、 Mutual restriction .( )

54. According to the regulation , The bank can check the account information for any unit or individual , However, it shall not be frozen for any unit or individual 、 Deduction and transfer , Do not stop the unit 、 Normal payment of personal deposits .()

55. A unit that uses computers for accounting , The accounting software it uses and the accounting data it generates shall comply with the provisions of the relevant government departments . The government department refers to the competent tax department of the State Council .( )

56. The withholding agent shall, from the date of the occurrence of the withholding obligation 30 Intraday , Apply to the local competent tax authority for tax withholding registration , Get the tax withholding registration certificate .

57. In order to promote the development of local economy , Under certain conditions, the local area can be restricted 、 Legal persons or other organizations outside the society participate in the bidding .()

58. Taxpayers engaged in wholesale or retail of goods , Annual taxable sales in 50 Those below 10000 yuan are small-scale VAT taxpayers .

59. The date of issue of the bill is in figures , The deposit bank can accept , However, the losses caused thereby shall be borne by the drawer .()

60. Government procurement by invitation to bid , The bidder shall, five working days before the end of the prequalification announcement period , Submit qualification certificates as required by the announcement .()

61. Accountant Chen believes , Accounting work is just bookkeeping . Count it out , It has little to do with the business decision of the unit , There is no need to require accountants to participate in management .()

62. threshold 、 The amount of exemption is the specific form of tax deduction .

63. The relationship between financial departments and accounting industry organizations is the relationship between guidance and guidance , It is also the relationship between attachment and being attached , The financial department should vigorously support the orderly development of the Accounting Industry Association , We should also strengthen the standardized management of accounting industry associations .( )

64. There is an error in the accounting book records or an alternate page 、 Missing number 、 Skipping , It should be corrected in accordance with the methods prescribed by the national unified accounting system , The accountant and the person in charge of the accounting agency ( Accountant in charge ) Stamp the correction .( )

65. The head office and branches are not in the same county ( City ) VAT payer of , They should apply to the local competent tax authorities where their respective institutions are located for recognition .

66. The parties involved in government procurement only include purchasers and suppliers .()

67. according to 《 Government procurement law 》 Relevant provisions of , Complex in technology or special in nature , Goods or services for which detailed specifications or specific requirements cannot be determined , The applicable government procurement method is invitation to bid .( )

68. dividend 、 The formula for calculating the taxable amount of dividend income is : Tax payable = Taxable income × Applicable tax rate = The amount of income each time ×20%( or 5%).

69. Consciously fighting two kinds of accounting moral concepts is the key to the success of Accountants' moral cultivation .()

70. The self-discipline mechanism and accounting professional ethics punishment system of the accounting industry are organized and established by the financial department .()

71. Township with budget 、 Nationality town 、 The people's Congress of the town examines and approves the budget at the corresponding level and the report on the implementation of the budget at the corresponding level ; Supervise the implementation of the budget at the corresponding level ; Examine and approve the adjustment plan of the budget at the corresponding level ; Review and approve the final accounts at the same level ; Cancel the budget of the government at the same level 、 Improper decisions and orders of final accounts .()

72.《 Accounting standards for business enterprises ---- The basic principles 》 It is applicable to enterprises established in China ( Including the company ), since 2007 year 1 month 1 The effective date .( )

73. Accounting professional ethics has a wide range of sociality .()

74. Accounting jobs can be one post for one person 、 One person with more posts or one post with more people .( )

75. The special deposit account is for the depositor according to the law 、 Administrative regulations and rules , A bank savings account opened for the special management and use of its special-purpose funds .()

76. In the accounting work handover , Cash should be counted and handed in face according to the balance recorded in the accounting book , If there is a shortage , You can use a white slip to arrive at the warehouse .()

77. township 、 Nationality town 、 The town government shall submit the budget at the corresponding level approved by the people's Congress at the corresponding level to the government at the corresponding level for the record .()

78. Head of accounting organization 、 When the accountant in charge is handed over , All financial and accounting work must be done 、 Major financial revenues and expenditures and the situation of accounting personnel , Introduce the replacement in detail . For the remaining problems that need to be handed over , Written materials should be written .( )

79. The registered capital has changed , Change registration shall be handled .

80. Tax revenue is the purpose of the state to realize its functions , By virtue of political power , According to the standards stipulated by law , A specific distribution method of free financial income .

81. The budget unit opens a zero balance account for the financial department in the commercial bank according to the purpose of fund use .()

82. Bank settlement account refers to the current deposit account and fixed deposit account opened by the bank for the depositor to handle the receipt and payment of funds .()

83. All units and individuals providing labor services in China are taxpayers of individual income tax .

84. Accounting regulations are formulated on the basis of accounting laws and administrative regulations .( )

85. In the event of an unforeseen emergency , For goods or services that cannot be purchased from other suppliers , The procurement method that can be adopted is single source procurement .()

86. Taxation is an important means of regulating economic operation .

87. Taxable consumer goods sold by taxpayers , If returned by the buyer due to quality and other reasons , After being examined and approved by the financial organ of the place where the institution is located or residence , Refundable consumption tax paid .

88. The tax authorities may take tax preservation measures or compulsory enforcement measures in accordance with the approved Authority , The approval authority here refers to the tax bureau above the municipal level ( branch office ) The director approved .

89. Closing balance of securities 、 Impairment is also the content of accounting .( )

90.《 Enterprise income tax law 》 The provisions of the , The enterprise income tax is levied on a quarterly basis , Monthly prepayment .

91. China's accounting legal system consists of Accounting Law 、 Accounting department regulations and accounting normative documents are composed of three levels .( )

92. The main body of the legal relationship of taxation is the tax collector and the payer , As the main party, the government has strong political power , And the tax law itself is an obligation law , It is a law whose core content is to regulate the obligations of taxpayers , It involves all kinds of property of taxpayers .

93. When a taxpayer applies for changing tax registration , It should be collected from the competent tax authority 《 Tax registration change form 》, Fill in the change registration items truthfully 、 Specific contents before and after change registration .

94. China's budget legal system consists of 《 Budget law 》 and 《 Regulations on the implementation of the budget law 》 constitute .()

95. The annual salary is 12 Above ten thousand yuan , Should declare personal income tax by oneself .

96. The types of tax registration include business registration 、 Shut down 、 Resume business registration 、 Go out for business inspection and registration 、 Change registration, etc .

97. dedicated , This is the conscious behavior and basic requirement of accountants to fulfill the moral responsibility of the society and others to fulfill their accounting professional obligations .()

98. The government procurement conducted by the purchaser with loans from international organizations and foreign governments must apply 《 Government procurement law 》.()

99. The general deposit account opened by the depositor can be used for transfer settlement and cash deposit , However, cash withdrawal is not allowed ()

100. The financial department should organize and promote the construction of accounting professional ethics , Administer according to law .()

边栏推荐

- [North Asia data recovery] a database data recovery case where the disk on which the database is located is unrecognized due to the RAID disk failure of HP DL380 server

- Communication mode based on stm32f1 single chip microcomputer

- Hidden communication tunnel technology: intranet penetration tool NPS

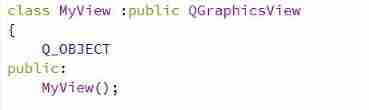

- QT graphical view frame: element movement

- Audio and video technology development weekly | 252

- Using celery in projects

- Ten clothing stores have nine losses. A little change will make you buy every day

- What does IOT engineering learn and work for?

- 压力、焦虑还是抑郁? 正确诊断再治疗

- A trap used by combinelatest and a debouncetime based solution

猜你喜欢

数据湖治理:优势、挑战和入门

Move, say goodbye to the past again

干货 | fMRI标准报告指南新鲜出炉啦,快来涨知识吧

在芯片高度集成的今天,绝大多数都是CMOS器件

![[North Asia data recovery] data recovery case of database data loss caused by HP DL380 server RAID disk failure](/img/f0/12dd17e840a23dc9ded379e1fd7454.jpg)

[North Asia data recovery] data recovery case of database data loss caused by HP DL380 server RAID disk failure

The new generation of domestic ORM framework sagacity sqltoy-5.1.25 release

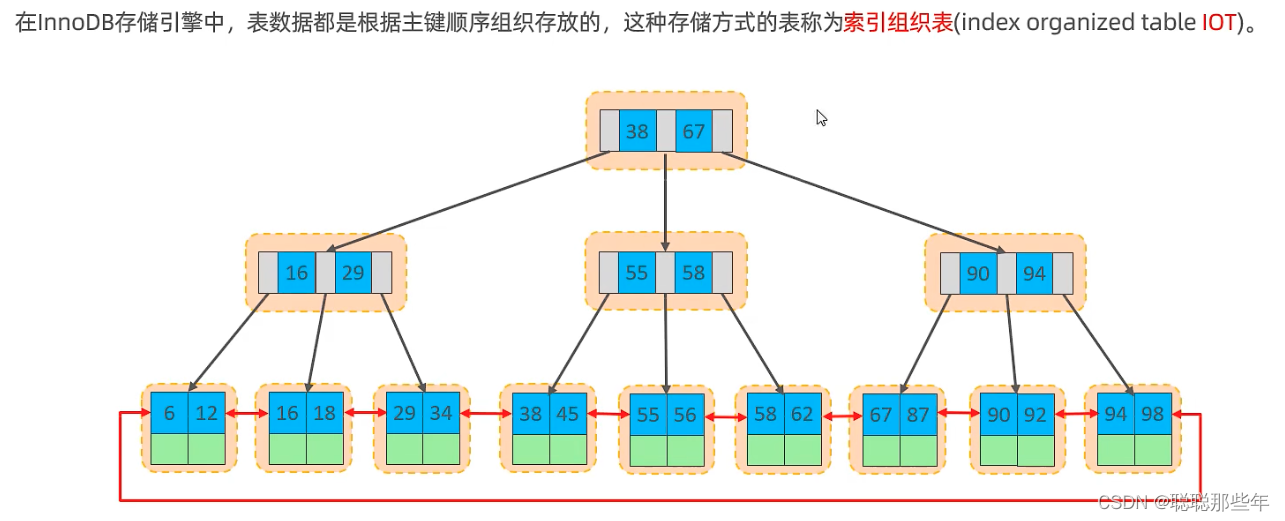

MYSQL索引优化

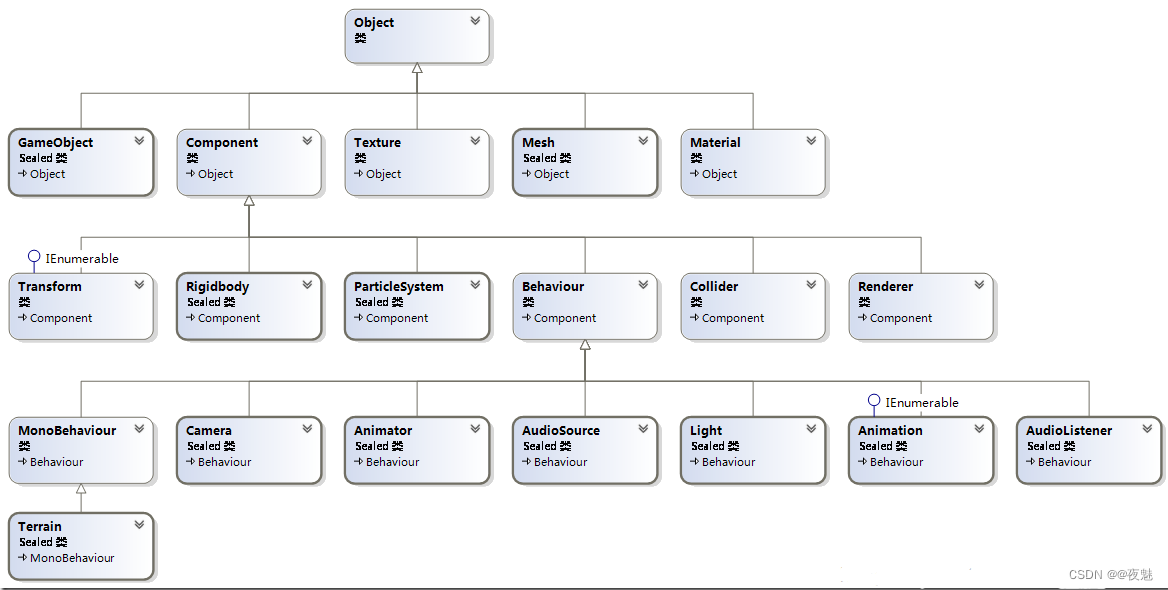

Unity脚本常用API Day03

Qt---error: ‘QObject‘ is an ambiguous base of ‘MyView‘

Interface fonctionnelle, référence de méthode, Widget de tri de liste implémenté par lambda

随机推荐

TypeError: not enough arguments for format string

What is torch NN?

Common knowledge of unity Editor Extension

Unity script API - time class

[book club issue 13] packaging format and coding format of audio files

@EnableAspectAutoJAutoProxy_ Exposeproxy property

Move, say goodbye to the past again

Object distance measurement of stereo vision

Review of Weibo hot search in 2021 and analysis of hot search in the beginning of the year

Vscode setting outline shortcut keys to improve efficiency

[Previous line repeated 995 more times]RecursionError: maximum recursion depth exceeded

Final consistency of MESI cache in CPU -- why does CPU need cache

The new generation of domestic ORM framework sagacity sqltoy-5.1.25 release

Daily notes~

[native JS] optimized text rotation effect

C implementation defines a set of intermediate SQL statements that can be executed across libraries

Model fusion -- stacking principle and Implementation

Salient map drawing based on OpenCV

Common API day03 of unity script

Proxifier global agent software, which provides cross platform port forwarding and agent functions