当前位置:网站首页>Fund investment advisory business

Fund investment advisory business

2022-07-31 07:40:00 【BabyFish13】

Most investors may be unfamiliar with managed investment advice. What is fund investment advice?What is the meaning of fund investment advice?What overseas experience can you learn from?Today we will talk about the development of fund investment advisory in detail.

I. What is fund investment advice

On October 25, 2019, the China Securities Regulatory Commission issued the "Notice on Doing a Good Job in the Pilot Program of Public Offering Securities Investment Fund Investment Consulting Business", and the pilot program of my country's public offering fund investment consulting business was officially launched.A number of platforms that have obtained pilot qualifications have begun business exploration.

By definition, fund investment advisory refers to accepting the entrustment of clients, providing clients with investment advice on securities investment funds and other investment products approved by the China Securities Regulatory Commission in accordance with the contract, assisting clients in making investment decisions or acting on behalf of clients to apply for transactions as requiredbusiness activities.In a nutshell, investors entrust their money to fund investment advisor managers, who make decisions and buy and sell on behalf of clients.

Ordinary investment advisors provide clients with buying and selling advice and charge a fee for the advice.Fund investment advisory is a full-process service of buying and selling under the discretionary mandate.

Second, the development of fund investment advisory in the United States

The investment advisory service in the United States began to sprout in the 1930s. After more than 90 years of development, by the end of 2019, there were a total of 12,993 investment advisers registered in the United States, with a total of 83.7 trillion US dollars of assets under management.From the perspective of management mode, the scale of management under the discretionary mode accounts for 91.4% of the total scale, which is the mainstream business mode of the US investment advisory market.

The development of the investment advisory model in the United States is very mature, and 77% of households invest in funds through investment advisers.From the perspective of charging mode, the most common mode is to accrue fees according to a certain proportion of the management scale, and the charging standard has been reduced to 0.6-1.2% by 2019.Secondly, there are two common charging modes: fixed fee and performance-based compensation.

From the perspective of the development history of investment advisors in the United States, users' acceptance of fund investment advisors requires a process, but the development potential is huge.Our pilot project has just begun, and there will be a long development process in the future, but with overseas experience, we can also avoid many pitfalls.

Three, the significance of fund investment advice

1. Fully entrusted management and warehouse adjustment - saving time and cost

For most investors, there are a lot of work and family affairs, and there is almost no time to learn investment and financial knowledge and track the market, but there is a need for investment and financial management.A simple understanding is that there is no time to make money when you have money.

2. Integrated service - solve the problem of neither buying nor selling

Won't buy or sell is the main problem for investors.Fund investment advisors solve the problem of what to buy and when to sell through integrated services, and the buying and selling strategies are transparent and regulated.

3. Post-investment service - frequent and continuous companionship

Normal funds only require the disclosure of quarterly and annual reports, which are even templated, with low frequency and few useful things, while fund investment advisors provide interpretation and analysis of real-time information.Increase holding time through companionship.

To sum up, the purpose is one, that is to hope that users can make money and make money within their risk tolerance.

Fourth, what are the investment advisors on the egg roll fund

There are currently 3 investment products on the egg roll, all of which belong to the active value-added-active selection category, and they all belong to the market-wide base selection. The detailed strategies and distinctions are as follows

1. E Fund's equity optimization: adopting a dynamic portfolio optimization model, selecting tracks with excellent long-term performance such as consumption, medicine, technology, and high-end manufacturing, and deploying pro-cyclical sectors such as finance to control portfolio volatility.

2. Selected Growth of Southern Stock Funds: Through quantitative models and qualitative research, the fund company, fund manager, investment style, risk level, historical performance and other dimensions are analyzed, and the growth style is selected to actively manage funds.in order to achieve long-term excess returns.

3. China-Europe Fund: Through the core + satellite strategy, select star fund managers with excellent long-term performance, and dynamically adjust the positions of various styles in combination with the macro.Everyone should be relatively familiar with the CEIBS All-Stars. The Super Stocks All-Stars expands the scope of base selection from CEIBS to the entire market.

To sum up, E Fund pays attention to the balance between small and large caps and value growth. The south is more inclined to the growth style, and the relative balance between China and Europe focuses on fund managers.

Fund investment advisory is not suitable for everyone. For those who love research, they tend to invest by themselves to save investment advisory fees.But for people who don't have time to study and research, fund investment advice is a good choice.

V. Investment advisory of securities companies and funds

According to a Chinese reporter from a brokerage firm, with the official launch of the fund investment advisory business of Sinolink Securities and Everbright Securities, as of now, among the two batches of 29 securities firms that have obtained the pilot qualification for fund investment advisory, the number of securities firms that have officially expanded their business has been expanded.to 19.

Among them, the first batch of 7 securities firms including Guolian Securities, Galaxy Securities, Guotai Junan, CICC Wealth, Huatai Securities, China Securities, Shenwan Hongyuan, etc.External exhibition industry.Among the second batch of approved securities companies, Zhanye securities companies have expanded to 12, including CITIC Securities, China Merchants Securities, Guosen Securities, Orient Securities, Industrial Securities, Caitong Securities, Zhongtai Securities, Nanjing Securities, Hwabao Securities, Shanxi Securities, Sinolink Securities, Everbright Securities.

边栏推荐

- tidyverse笔记——管道函数

- 深度学习通信领域相关经典论文、数据集整理分享

- 03-SDRAM: Write operation (burst)

- Redux state management

- Kubernetes调度

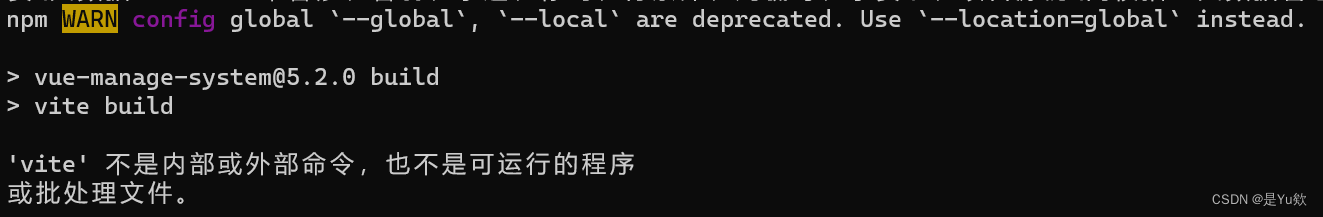

- 'vite' is not an internal or external command, nor is it a runnable program or batch file.

- van-uploader上传图片,使用base64回显无法预览的问题

- Install the gstreamer development dependency library to the project sysroot directory

- 2022.07.12_每日一题

- 什么是半波整流器?半波整流器的使用方法

猜你喜欢

'vite' is not an internal or external command, nor is it a runnable program or batch file.

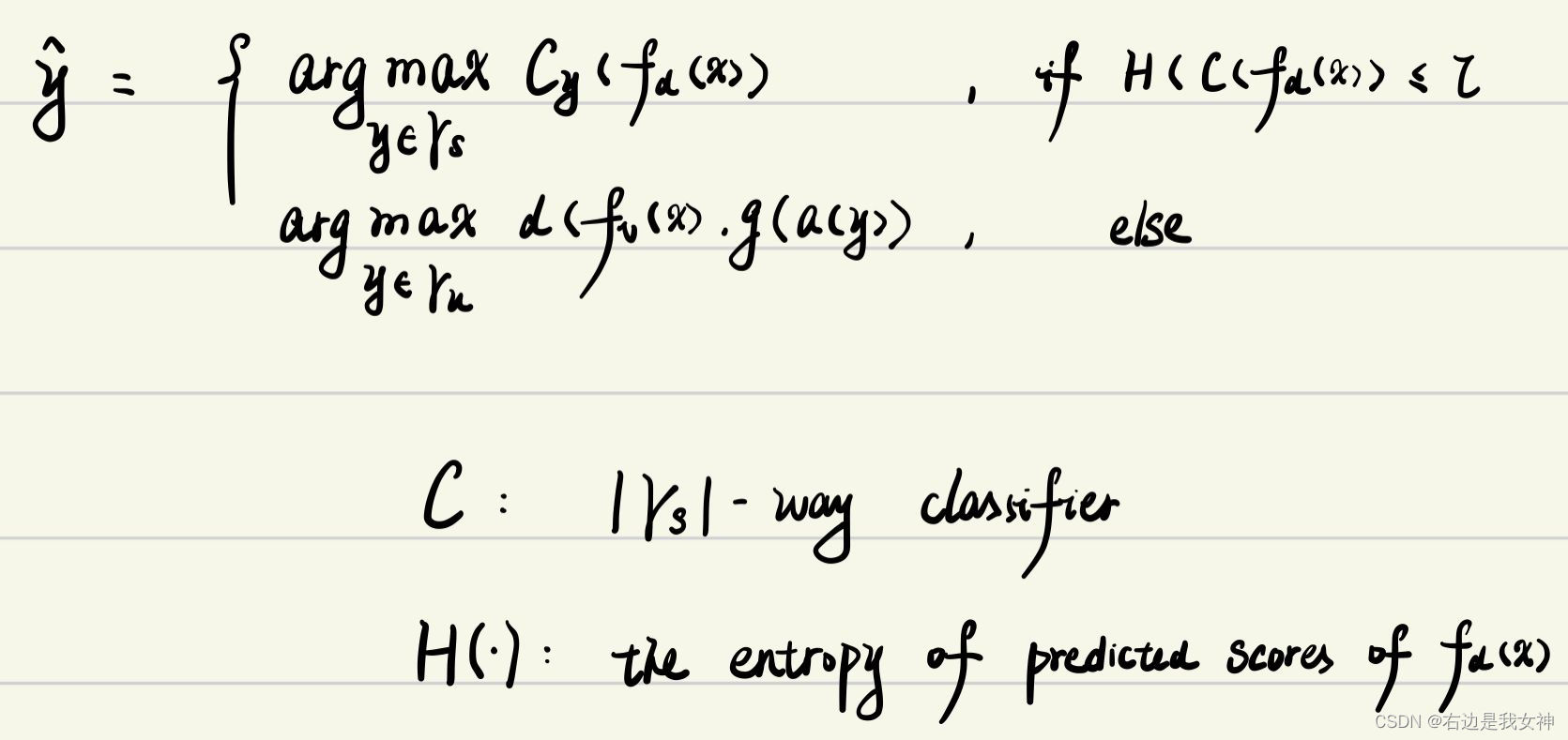

零样本学习&Domain-aware Visual Bias Eliminating for Generalized Zero-Shot Learning

基金投顾业务

Zabbix6.2 Surprise Release!Especially optimize the performance of medium and large environment deployment!

从 Google 离职,前Go 语言负责人跳槽小公司

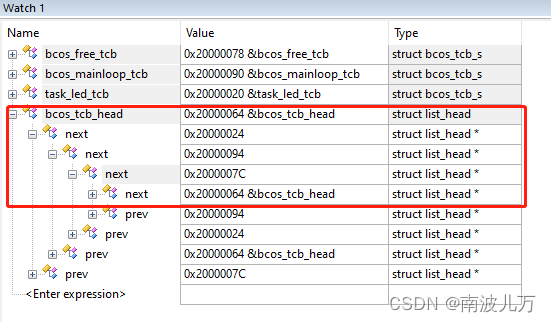

链表实现及任务调度

One of the small practical projects - food alliance ordering system

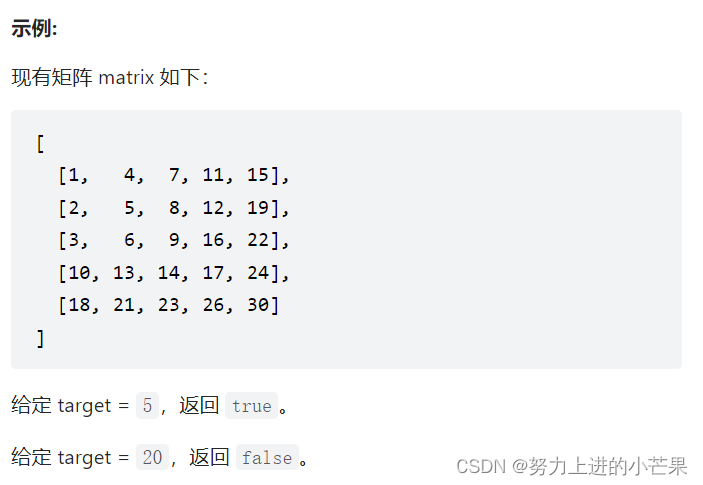

剑指offer(一)

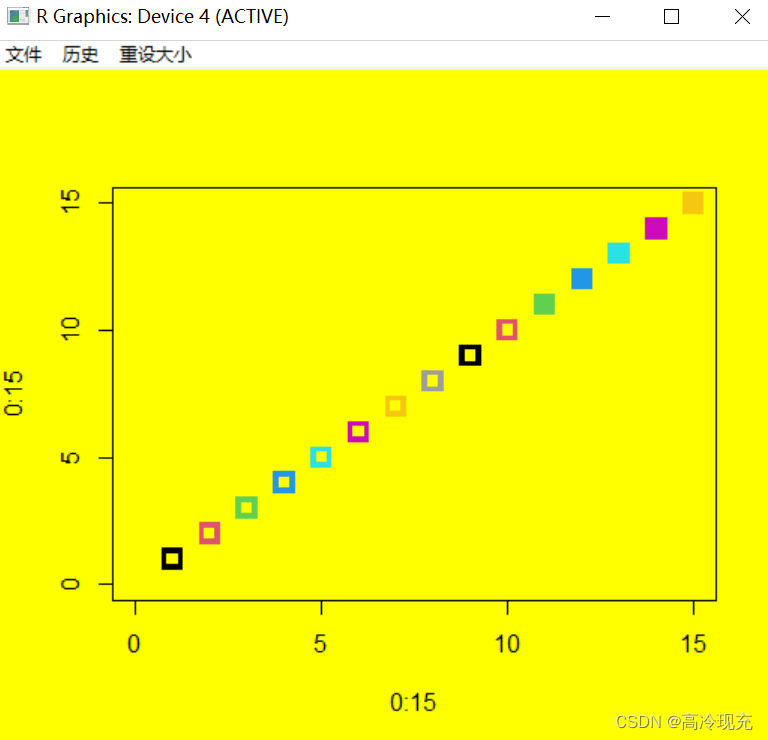

R——避免使用 col=0

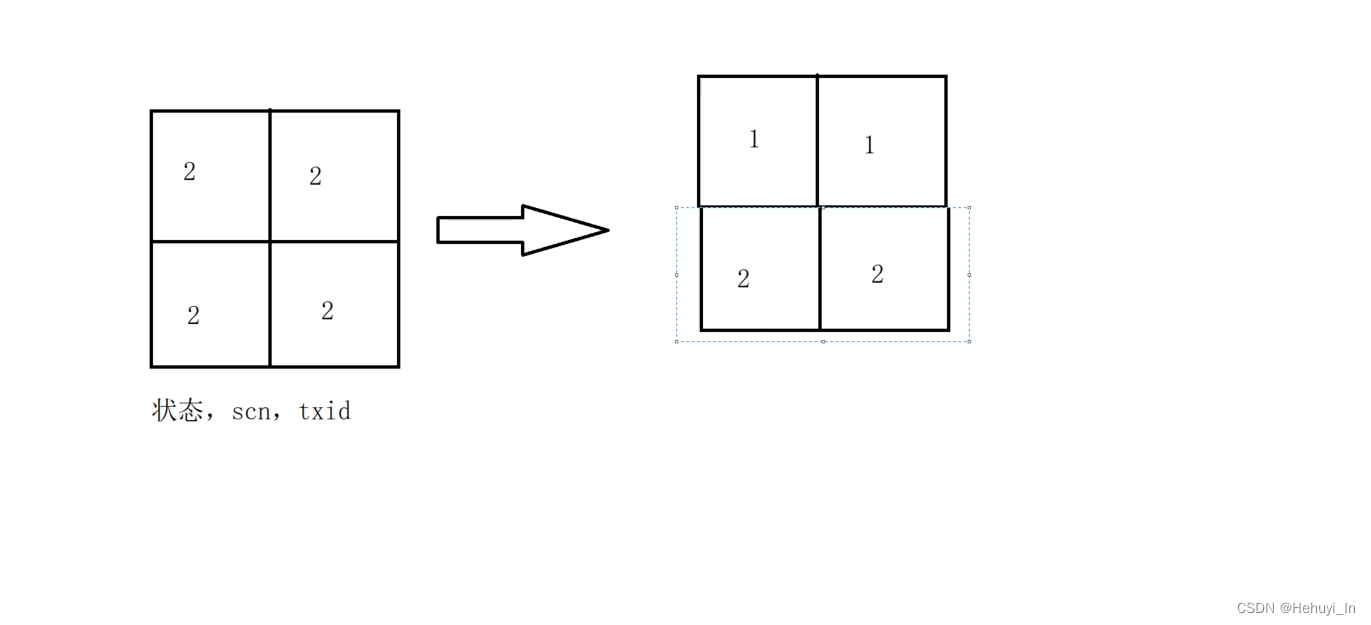

Postgresql source code learning (34) - transaction log ⑩ - full page write mechanism

随机推荐

Zabbix6.2 Surprise Release!Especially optimize the performance of medium and large environment deployment!

tidyverse笔记——管道函数

LeetCode brush # 376 # Medium - swing sequence

2022.07.18_每日一题

庐山谣寄卢侍御虚舟

【微服务】Nacos集群搭建以及加载文件配置

[PSQL] SQL基础教程读书笔记(Chapter1-4)

2022.07.13 _ a day

多进程全局变量失效、变量共享问题

The Perfect Guide|How to use ODBC for Agentless Oracle Database Monitoring?

2022.07.20_每日一题

SQLite数据库连接字符串

线程唤醒机制

【面试:并发篇37:多线程:线程池】自定义线程池

tidyverse笔记——dplyr包

2022.7.29 Array

我开发了一个利用 Bun 执行 .ts / .js 文件的 VS Code 插件

2022.07.13_Daily Question

Difficulty comparison between high concurrency and multithreading (easy to confuse)

DAY18: Xss Range Clearance Manual