当前位置:网站首页>Capvision Rongying's prospectus in Hong Kong was "invalid": it was strictly questioned by the CSRC and required supplementary disclosure

Capvision Rongying's prospectus in Hong Kong was "invalid": it was strictly questioned by the CSRC and required supplementary disclosure

2022-07-04 16:54:00 【Bedouin Finance】

In recent days, , Bedouin finance and economics disclosed from the Hong Kong stock exchange that it is easy to understand , Kaisheng Rongying information technology ( Shanghai ) Co., LTD. ( Hereinafter referred to as “ Kaisheng Rongying ”) The application materials for listing on the Hong Kong Stock Exchange have become “ invalid ” state . at present , The company's prospectus can no longer be viewed or downloaded .

It means , Capvision Rongying first rushed to the Hong Kong Stock Exchange and announced its failure . however , Capvision Rongying can still continue to promote by updating financial information and other contents IPO. according to the understanding of , Kaisheng Rongying was founded in 2008 year , Is an industry expert knowledge information service provider —— Provide customers with professional industry knowledge through expert network .

Before that , Kaisheng Rongying once planned to A Shares of the listed .2020 year 4 month , Capvision Rongying once signed a listing guidance agreement with CICC . Then , CICC is in 2020 year 6 month 、2021 year 2 The monthly report sent a report on his coaching progress , But in the end, Capvision Rongying chose to move to the Hong Kong Stock Exchange .

Capvision Rongying quoted frost Sullivan's information in the prospectus, saying , Press 2020 The annual income is calculated as , Capvision Rongying is the largest provider of knowledge and information services for industry experts in China , The market share is about 33.0%. meanwhile , It ranks fifth among the world's five major industry expert knowledge information service providers , Market share is about 3.2%.

2018 year 、2019 year 、2020 The year and 2021 First quarter , The operating revenues of Capvision Rongying are 3.85 One hundred million yuan 、4.61 One hundred million yuan 、6.43 Million dollars 2.13 One hundred million yuan , The corresponding net profits are 8451.1 Ten thousand yuan 、9268.9 Ten thousand yuan 、1.67 Eva 6835.9 Ten thousand yuan .

The prospectus shows , The services provided by the experts of keyvia Rongying to customers during the reporting period were about 9.5 Thousands of hours 、12 Thousands of hours 、15 Ten thousand hours and 4.6 Thousands of hours . At the same time , The company pays industry experts an average of 1283.24 element 、1330.57 element 、1280.01 Yuan and 1219.58 element .

During the reporting period , Kaisheng Rongying's customers are 2018 Year of 758 To increase to 2020 Year of 1236 position . By 2021 First quarter , The number of customers actually served by the company has reached 1005 position . During the reporting period , The average cost per customer is about 50.8 Ten thousand yuan 、47.2 Ten thousand yuan 、52 Wan Yuan and 21.1 Ten thousand yuan .

It is worth mentioning that , Kaisheng Rongying once worked in 2018 - 2021 Several equity changes occurred in . The most obvious is , Tianfeng Tianrui 2020 year 5 In September, he merged his holdings of Kaisheng into the UK 7% All of the shares transferred , The transferee is Zhejiang mintou 、 Huiyu investment 、 Qianhe capital and other institutions .

According to public information , Kaisheng Rongying once worked in 2016 year 11 The moon gains from Tianfeng Tianrui ( Through Tianrong Dingxin and other holdings ) Of 4 Billion yuan of strategic investment . And in the 2018 year 4 month , The cumulative cost of Guangdong private investment is about 2.81 Billion yuan became the shareholder of keyvia Rongying , Among them, Tianrong Dingheng 、 Tianrong Dingchen transferred to Guangdong mintou respectively 7.85% and 4.74% Equity of .

2019 year 12 month , Tianrong Dingxin once transferred to Tuqiang, the director and deputy general manager of Kaisheng Rongying 0.50% shares , The consideration is 1000 Ten thousand yuan ;2020 year 1 month , Li Ying 、 Liu Jun signed agreements with senior executives of keyvia Rongying , Transfer all its equity , No longer a shareholder of the company .

For Capvision Rongying's planned listing in Hong Kong , The International Department of China Securities Regulatory Commission also issued feedback on it , Some questions were asked about its existing problems , Among them, it is required to supplement the prices and pricing basis of previous capital increases and transfers 、 Compliance and whether necessary procedures have been performed .

In the equity structure before this listing , Founder of Kaisheng Rongying 、 Executive director 、 Chairman of the board of directors 、 CEO xurujie directly owns Kaisheng Rongying 29.40% Shares of , Through Shanghai Yueshi holding 3.81%, Total shareholding 33.21%. secondly , Chen Rongsheng holds shares 1.38%, Xurujie holds about through concerted action 34.60% Shares of .

In terms of institutions , Yuemin investment holds Kaisheng Rongying through Yuemin investment Kanghe 7.85% Shares of , Held by Guangdong mintou Kangjia 4.74%, Total shareholding 12.59%. Besides , Qianhe capital 、 Huzhou industrial group 、 Zhejiang mintou and others have also participated in the investment in Kaisheng Rongying .

2021 year 12 month , China Securities Regulatory Commission once again gave feedback on the overseas listing of Capvision Rongying , Quite strict . During the reporting period , The top five clients of Capvision Rongying are all securities companies , Under the above business mode , The company disclosed the securities company as a client , The actual service recipients are fund managers, etc .

Regarding this , The CSRC requires Capvision Rongying to supplement the business model that the payer and the service object are inconsistent , That is, the specific content and income of the three-party business model, and explain the reasons and rationality of adopting the three-party business model , Total revenue and main components of each period under the three-party business model 、 The names of the top five customers and the corresponding revenue amount 、 Main components, etc .

According to the prospectus , The pricing methods of Capvision Rongying mainly include hourly pricing and service package pricing . Regarding this , China Securities Regulatory Commission requires Capvision Rongying to explain the revenue pricing method under the three-party business model , For example, the pricing basis includes non quantitative indicators such as service quality , Please explain the specific pricing method with a representative example .

Besides , China Securities Regulatory Commission requires Capvision Rongying to make a supplementary explanation on whether the three-party business model and other business models comply with the relevant provisions on honest practice of securities operating institutions , The income categories and corresponding business models specifically affected by the trading scale of the securities market ; Whether the service object has entrusted relevant payers ( securities company ) Transactions in the secondary market or other contractual relationships .

meanwhile , China Securities Regulatory Commission requires Capvision Rongying to combine the feedback with relevant income 、 Gross profit margin 、 Cost 、 Large advance payment ( if there be ) Explain whether the company's three-party business model or other business models whose income is affected by the trading scale of the securities market violate relevant laws and regulations on honest practice 、 Department rules 、 Normative documents 、 Self discipline rules, etc .

边栏推荐

- Common knowledge of unity Editor Extension

- D3D11_ Chili_ Tutorial (2): draw a triangle

- Daily notes~

- Application and Optimization Practice of redis in vivo push platform

- [North Asia data recovery] a database data recovery case where the disk on which the database is located is unrecognized due to the RAID disk failure of HP DL380 server

- The content of the source code crawled by the crawler is inconsistent with that in the developer mode

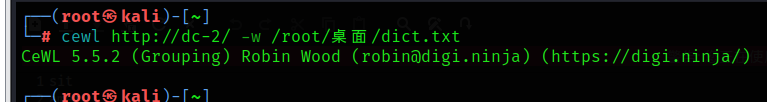

- Detailed process of DC-2 range construction and penetration practice (DC range Series)

- China tall oil fatty acid market trend report, technical dynamic innovation and market forecast

- Redis: SDS source code analysis

- std::shared_ ptr initialization: make_ shared< Foo> () vs shared_ ptr< T> (new Foo) [duplicate]

猜你喜欢

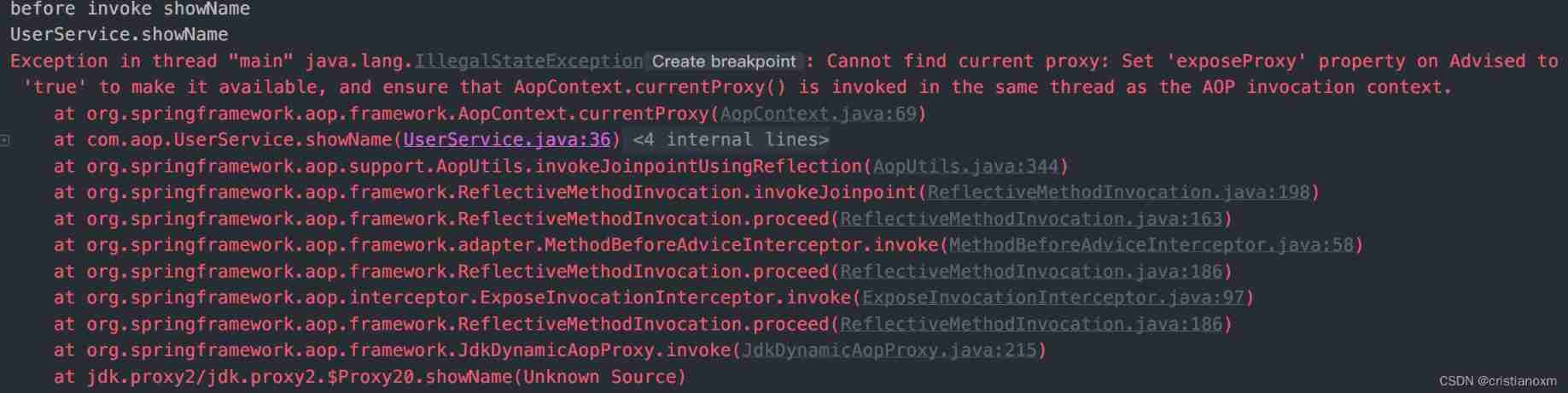

@EnableAspectAutoJAutoProxy_ Exposeproxy property

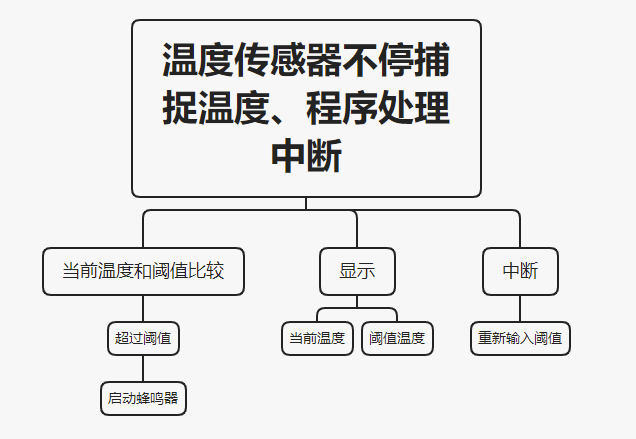

基于wifi控制的51单片机温度报警器

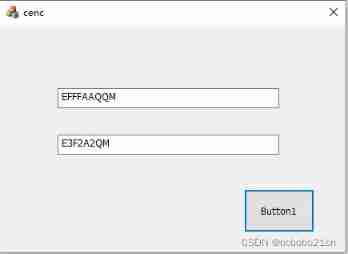

MFC implementation of ACM basic questions encoded by the number of characters

Anta is actually a technology company? These operations fool netizens

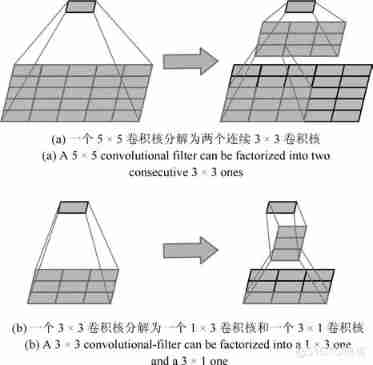

Overview of convolutional neural network structure optimization

What is torch NN?

What is torch NN?

对人胜率84%,DeepMind AI首次在西洋陆军棋中达到人类专家水平

Understand asp Net core - Authentication Based on jwtbearer

DC-2靶场搭建及渗透实战详细过程(DC靶场系列)

随机推荐

Opencv learning -- arithmetic operation of image of basic operation

线程池的使用和原理

Unity interview questions (continuously updated)

Web components series - detailed slides

中位数与次序统计量

Median and order statistics

DIY a low-cost multi-functional dot matrix clock!

Visual studio 2019 (localdb) mssqllocaldb SQL Server 2014 database version is 852 and cannot be opened. This server supports 782

Visual Studio 2019 (LocalDB)MSSQLLocalDB SQL Server 2014 数据库版本为852无法打开,此服务器支持782

高度剩余法

线性时间排序

Redis: SDS source code analysis

Principle and general steps of SQL injection

Position encoding practice in transformer

Practice: fabric user certificate revocation operation process

The content of the source code crawled by the crawler is inconsistent with that in the developer mode

Height residual method

What is torch NN?

《吐血整理》保姆级系列教程-玩转Fiddler抓包教程(2)-初识Fiddler让你理性认识一下

Socks agent tools earthworm, ssoks