当前位置:网站首页>Hong Kong Jewelry tycoon, 2.2 billion "bargain hunting" Giordano

Hong Kong Jewelry tycoon, 2.2 billion "bargain hunting" Giordano

2022-07-04 23:21:00 【I dark horse】

source : Dongsi shitiao capital (ID:DsstCapital) author : Zhang Junwen edit : Cao Weiyu

purchasing price 1.88 The Hong Kong dollar / stocks , It can be said to be prudent .

Hong Kong Jewelry tycoon 25.6 Million Hong Kong dollars “ Copy the bottom ” Giordano .

6 month 23 Friday night ,“ The originator of leisure clothing ” Giordano announced , Chow Tai Fook holdings made a takeover offer through Kaisheng capital , This includes the requirement to cancel the unexercised share options . The maximum amount involved in this all purchase offer is 25.6 Million Hong Kong dollars ( About us 21.82 RMB 100 million ).

According to the offer , Chow Tai Fook will pay per share 1.88 The price of Hong Kong dollars to buy Giordano , Compared with that before Giordano's suspension 1.59 The Hong Kong dollar premium is about 18.2%.

however ,1.88 The Hong Kong dollar / The purchase price of shares , Was strongly opposed . Giordano's second largest shareholder “ Thigh jar long hair ”David Webb Think , The purchase price is far lower than the fair market price , And call on other shareholders to reject the offer .

As the acquirer, Chow Tai Fook is already capital operated “ An old traveller ” 了 , Behind it is the zhengyutong family, one of Hong Kong's four powerful families , Investment tentacles also involve many fields , Although Giordano is its first test in the field of clothing , But the purchase price can be called “ Pinch pennies ”.

01 have 1400 The third richest family in Hong Kong ,25.6 Buy 2000 Many clothing stores

The jeweler bought a clothing brand , There are two reasons .

The Zheng family has been expanding the franchise system of Chow Tai Fook in recent years , At present, the world has 5764 A jewelry store , It is the largest gold jewelry enterprise in the world . future , Chow Tai Fook also plans to sink the channel to the third and fourth tier cities . Giordano has 2056 A clothing store , Most of them are located in prime locations near the street , It is a good supplement to the offline layout of Chow Tai Fook .

20 More than 100 million people bought 2000 Many clothing stores , On average, each store only 100 About ten thousand yuan , I'm afraid it's a very good deal .

Come again , Giordano's dividend payout ratio is very attractive . As early as 2011 year , Zheng Yutong spends 10.5 HK $100 million invested in Giordano , Got it 14.58% Shares of . After that, it continued to increase its holdings , It's not cheap . With 2012 Year as an example , Giordano pays a final dividend 0.23 The Hong Kong dollar , At that time, he held 23% Zheng Yutong of equity , The dividend is about 8048 Million Hong Kong dollars .

however , Giordano's ownership structure is decentralized , To gain control , Chow Tai Fook also has to convince including David Webb Other public shareholders including . According to Giordano's equity structure , Chow Tai Fook is the largest shareholder of Giordano , holding 24.57%, Giordano's management holds shares 1.79%, Other public holdings 73.63%( Including the second largest shareholder David Webb holding 5%).

Chow Tai Fook said , The main reason for this acquisition is the fierce market competition , Giordano urgently needs to make a change . After completion of acquisition , Giordano will be privatized , But also stressed that the original management will not be replaced . Some analysts think , Zheng family starts with Giordano at a low price , To sell again , Before, shareholders were too scattered , Unable to control , Unable to attract the right buyers .

The Zheng family behind Chow Tai Fook is also familiar with capital operation .

The wealth of this family began with Zheng Yutong , He built two business empires, namely, Chow Tai Fook Group and new world development , With Li Ka Shing 、 Li Zhaoji 、 The guodesheng family is also known as Hong Kong “ Four big families ”.《 Forbes 》2021 The Hong Kong rich list shows , The zhengyutong family took 221 Billion dollars ( About us 1400 RMB ) Your wealth ranks third .

In the last century 30 years ,13 Zheng Yutong left Shunde at the age of , Zhou Zhiyuan, a good friend who went to Macau to go to his father . Zhou Zhiyuan runs a Chow Tai Fook financial firm in Macao , It is the predecessor of CTF . Zheng Yutong married Zhou Cuiying, the eldest daughter of Zhou Zhiyuan .1956 year , Zheng Yutong inherited Chow Tai Fook from his father-in-law .

Zheng Yutong is decisive and brave in business , go by the name of “ Shark is brave ”. He pioneered 9999 A thousand gold ( That is, the gold content 99.99%), Fight out of the siege with high quality , Then he set foot in real estate , The new world group was established .

As wealth accumulates , The investment territory of the Zheng family is also expanding . In addition to the layout of the upstream and downstream of the jewelry industry chain , In Finance 、 Medical care 、 Technology and other fields are also blooming everywhere .

Financial field , 2015 year , Chow Tai Fook invested P2P Xinye technology, an online lending service website 、 Fintech company Xiaoying Technology , The two companies are located in 2017 Years and 2018 Listed on the New York Stock Exchange in .2018 year , Chow Tai Fook strategically invested in a consumer finance company jointly funded by Bank of Chengdu and Bank of Malaysia 「 Jincheng consumer finance 」.2021 year , Chow Tai Fook strategic investment in Hong Kong and US stocks intelligent investment trading software 「uSMART Yingli zhitou 」.

The medical field ,2017 year , Zhou Dafu B+ Tens of millions of yuan have been invested in the maternal and infant health management platform 「 Mommy knows 」.2020 year , Chow Tai Fook invested in a surgical robot company in California ZAP Surgical System.2021 year , Zhou Dafu A Round invested in children's health management software 「 Excellent seedling 」.2022 year ,A Round invested in clinical CRO Holy prescription medicine .

Science and technology ,2019 year , Zhou Dafu A+ We have invested in AI industry solution providers Aibee.2022 year , Zhou Dafu B+ Round invested in autonomous driving technology enterprise yingche Technology .

in addition , Australia is also the key area of the Zheng family's investment layout . Small to study abroad service institutions , To tourist resorts 、 Gambling , Even energy is involved . This acquisition of Giordano , Although it is Chow Tai Fook's first test in the field of clothing , But Giordano's biggest market is also in Australia ,2021 In, he contributed more than 10 HK $billion revenue , Accounting for 30% .

therefore , Giordano also helps CTF expand its investment territory in Australia .

02 Market value evaporated 60 Million Hong Kong dollars ,“ Pedestrian street brand ” The scenery is not there

Giordano, who was sold at a low price , I have witnessed the highlight moment of the domestic clothing industry .

1981 year , Giordano was founded in Hong Kong , Once with Benelux 、 Baoshilong is collectively known as Hong Kong capital “ The three fashion giants ”.

At the beginning of the 21st century , Giordano used to be young 、 Synonymous with fashion , The most prosperous business district in the city is always full of Giordano stores .1991 Giordano was listed on the Hong Kong Stock Exchange , The following year, it officially entered the Chinese mainland market . Peak period , Giordano's revenue reached 58.48 Million Hong Kong dollars , The market value is close to 90 Million Hong Kong dollars , The number of stores is nearly 2700 home , Giordano once became the best-selling casual wear group in Asia .

Even UNIQLO founder Masayoshi Yanai once belonged to Giordano “ Admirer ”. He once traveled thousands of miles from Japan to Hong Kong , Visit Giordano management , Hope to learn from Giordano , And seek cooperation . Although the two sides did not reach cooperation in the end , But Yanai is learning a whole set of clothing supply chain secrets , It has laid a foundation for UNIQLO's future development .

Ironically , Now the status of the two brands has long reversed .

UNIQLO has grown into an internationally renowned clothing giant , And once “ teacher ” Giordano has been going downhill , The revenue gap between the two has exceeded 100 billion .

The Chinese clothing market is 2012 In, it officially turned into a turning point , A number of “ Pedestrian street brand ” waning . Giordano also began to decline from this time .2012 year , Giordano's revenue in the mainland decreased 6%, Shut down the inland 163 stores . By 2021 end of the year , The number of global stores in Giordano is 2056 home , Market value only 29 Million Hong Kong dollars , The market value evaporated more than 60 Million Hong Kong dollars .

Giordano is no exception .

A generation “ The king of jeans ” JeansWest , brand Quicksilver stay 2015 Bankrupt in .2017 year , JeansWest Australia business is Howsea Limited Acquisition .2020 year 1 month , JeansWest Australia subsidiary also announced bankruptcy liquidation .

Barney Road, a Hong Kong funded fashion brand endorsed by Andy Lau and Faye Wong , 2010-2015 The store is closed for about six years 3000 home , At present, there are only 1000 Many stores . Parent company deyongjia 2016 Annual pricing 2.5 100 million yuan will be sold to Shanghai Huiye industrial .

“ Urban middle class ” The representative brand of Espirit, Experienced Europe 、 After the store closures in Australia and New Zealand ,2019 year 12 At the beginning of ,Espirit The parent company, Esprit global group, will have the right to operate the brand in the mainland

03 harvard “ The three generations of rich ” Abandon top investment banks , Go home and take charge of hundreds of billions “ Cash cow ”

The Zheng family who intends to buy Giordano , It is also very active in the primary market .

41 Zheng Zhigang, the third generation successor of the Zheng family, aged , Graduated from Harvard University , Successively at UBS 、 Goldman Sachs and other top investment banks have worked for three years , Then return to the family , Personally helped new world department store to successfully land on the Hong Kong Stock Exchange .

Zheng Zhigang's new world at the helm can be described as “ Cash cow ”. It showed a profit , By 2021 year 12 month 31 Japan , The total funds available for the development of the new world 1032 Million Hong Kong dollars , Cash flow is extremely abundant , The debt ratio has also remained low throughout the year .

Zheng Zhigang is still “ The first art shopping center in the world ” Hong Kong K11 founder . Hong Kong K11 Make profits in the first year of operation . Even 2020 When the epidemic was at its worst in , The financial report of new world development is still strong , The interim financial report shows that Hong Kong K11 Art Mall and K11 MUSEA Sales recorded 56% growth , Far exceeds the overall performance of Hong Kong Retail .

in addition , Zheng Zhigang is also very active in the capital market .2017 year , He founded C capital , Consumer brands targeting young people , Invested in Wei Lai 、 Xiao peng 、 The little red book 、 Cargo lala 、 Thomson technology 、Helen’s Taverns and other star enterprises .

SPAC There is also dabbling .2021 year , Zheng Zhigang founded a special purpose company Artisan Acquisition Corp. With consumer grade genetic testing companies Prenetics Merged and listed on NASDAQ . One of the shareholders of the latter is former England international Rio · Ferdinand , During the epidemic Prenetics Won the “ British sports ” Nucleic acid detection business of major events .

In addition to direct investment , Zheng Zhigang also started LP. Sky eye information , New world strategic investment, chaired by Zheng Zhigang , Through private equity institutions Zhengyuan strategy , It has become the capital of Gaorong LP. It is reported that , New world is also a well-known venture capital institution Dachen LP. Zheng Zhigang is also a Shenzhen Qianhai Qianyi Zhihe phase 10 investment partnership ( Limited partnership ) Shareholders , Its main body is Qianhai Wutong buyout Fund .

Despite repeated outbreaks , Industry is frustrated , However, the Zheng family still has abundant capital , It is also inseparable from the income contributed by Chow Tai Fook . Zhou Dafu 2022 The turnover in the fiscal year amounted to 989.38 Million Hong Kong dollars , Year-on-year increase 41%; The profit attributable to shareholders of the company reaches 67.12 Million Hong Kong dollars , Year-on-year growth 11.4%.

All in all , Plenty of cash flow , Let the Zheng family in “ Buy buy buy ” On the road of acquisition, I was very calm .

Chow Tai Fook's counter trend growth is not an example . During the epidemic , Luxury jewelry brands have basically achieved sales growth against the trend , Even higher than the pre epidemic level .

For example, luxury group LVMH 2021 Annual revenue 642.2 Billions of euros ( about 699 Billion dollars ), Record high , a 2020 Annual growth 44%, Compared with before the outbreak 2019 Annual growth 20%.

Hermes (Hermes) 2021 Annual revenue 89.82 Billions of euros ( about 97.8 Billion dollars ),2020 Years for 63.89 Billions of euros , Year-on-year growth exceeds 40%. among , Asia contributed the most , Total revenue 52.27 Billions of euros , Far more than the total revenue of Europe and the United States .

Italian fashion brand Prada (Prada) 2021 Annual net income 33.66 Billions of euros ( about 36.6 Billion dollars ), a 2020 Annual growth 41%, a 2019 Annual growth 8%.

Gucci、 Saint Laurent's parent company, French luxury giant Kaiyun Group 2021 The annual sales volume reached 176.45 Billions of euros ( about 192 Billion dollars ), Year-on-year growth 34.7%, Beyond the pre epidemic level .

边栏推荐

- [odx Studio Edit pdx] - 0.2 - Comment comparer deux fichiers pdx / odx

- CTF競賽題解之stm32逆向入門

- Pict generate orthogonal test cases tutorial

- 实战模拟│JWT 登录认证

- S32 Design Studio for ARM 2.2 快速入门

- [sword finger offer] questions 1-5

- How to choose a securities company? Is it safe to open an account on your mobile phone

- 微软禁用IE浏览器后,打开IE浏览器闪退解决办法

- [Jianzhi offer] 6-10 questions

- 时间 (计算)总工具类 例子: 今年开始时间和今年结束时间等

猜你喜欢

初试为锐捷交换机跨设备型号升级版本(以RG-S2952G-E为例)

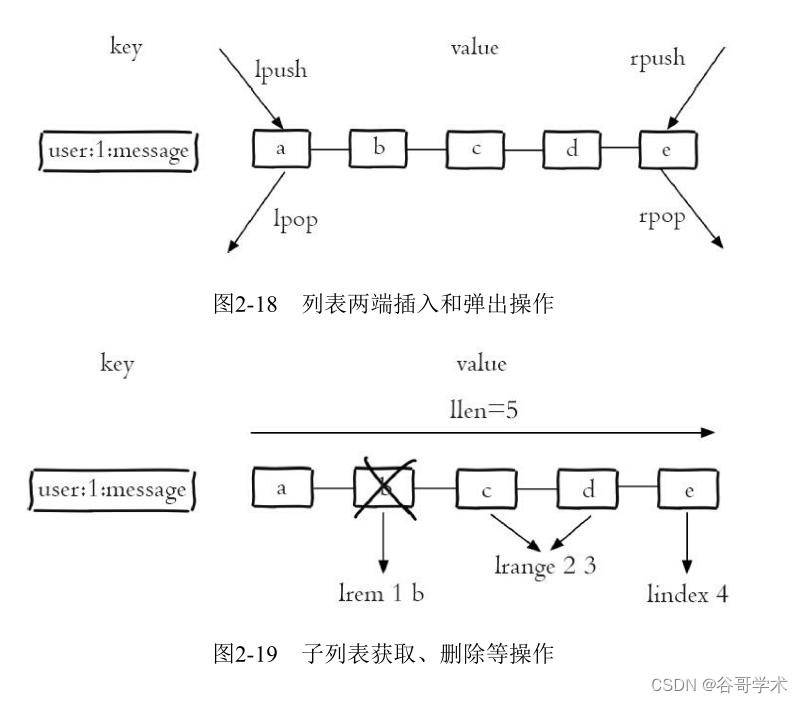

Redis introduction complete tutorial: List explanation

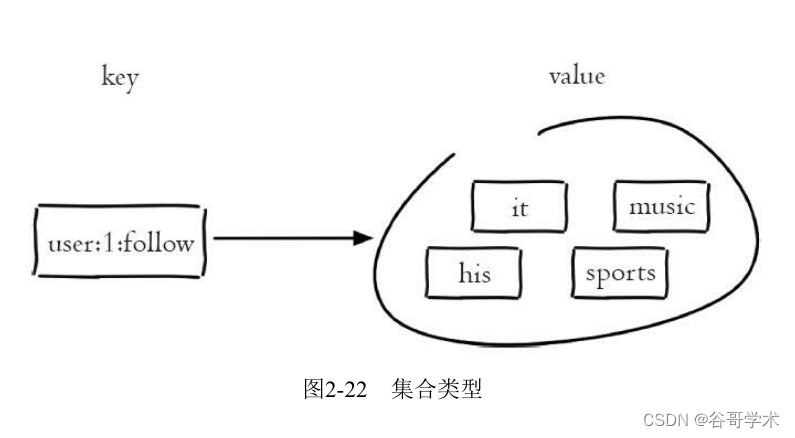

Redis introduction complete tutorial: Collection details

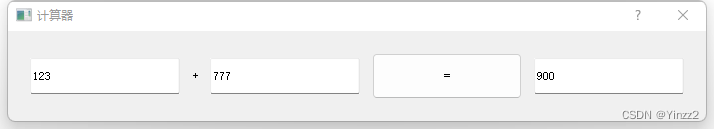

Qt加法计算器(简单案例)

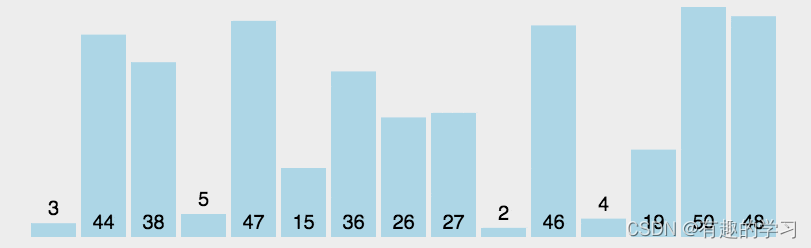

【js】-【排序-相关】-笔记

![[binary tree] the maximum difference between a node and its ancestor](/img/b5/1bc3d102754fc44c6a547807ebab94.png)

[binary tree] the maximum difference between a node and its ancestor

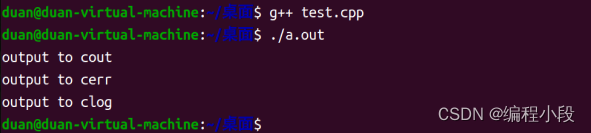

The difference between cout/cerr/clog

![P2181 diagonal and p1030 [noip2001 popularization group] arrange in order](/img/79/36c46421bce08284838f68f11cda29.png)

P2181 diagonal and p1030 [noip2001 popularization group] arrange in order

ECCV 2022 | 腾讯优图提出DisCo:拯救小模型在自监督学习中的效果

OSEK标准ISO_17356汇总介绍

随机推荐

QT personal learning summary

CTF competition problem solution STM32 reverse introduction

Redis getting started complete tutorial: publish and subscribe

位运算符讲解

智力考验看成语猜古诗句微信小程序源码

Question brushing guide public

[binary tree] the maximum difference between a node and its ancestor

【js】-【动态规划】-笔记

[JS] - [dynamic planning] - Notes

Network namespace

头文件重复定义问题解决“C1014错误“

【ODX Studio编辑PDX】-0.3-如何删除/修改Variant变体中继承的(Inherited)元素

Excel 快捷键-随时补充

初试为锐捷交换机跨设备型号升级版本(以RG-S2952G-E为例)

【ODX Studio编辑PDX】-0.2-如何对比Compare两个PDX/ODX文件

[JS] - [sort related] - Notes

企业里Win10 开启BitLocker锁定磁盘,如何备份系统,当系统出现问题又如何恢复,快速恢复又兼顾系统安全(远程设备篇)

微软禁用IE浏览器后,打开IE浏览器闪退解决办法

The difference between cout/cerr/clog

VIM editor knowledge summary

Anonymous users

Anonymous users