当前位置:网站首页>Aosikang biological sprint scientific innovation board of Hillhouse Investment: annual revenue of 450million yuan, lost cooperation with kangxinuo

Aosikang biological sprint scientific innovation board of Hillhouse Investment: annual revenue of 450million yuan, lost cooperation with kangxinuo

2022-07-07 12:54:00 【leijianping_ ce】

RedI network Lei Jianping 7 month 5 Reported Wednesday

Auscon biology ( nantong ) limited company ( abbreviation :“ Auscon biology ”) The prospectus was submitted a few days ago , Ready to be listed on the science and technology innovation board . Auscon biological project fundraising 30 One hundred million yuan .

among ,5.5 Billion yuan is used for the R & D and production project of Shanghai aosikang coupling drug ,14.5 Billion yuan for Shanghai aosikang biopharmaceutical CDMO Platform project ,10 Billion yuan is used to supplement working capital .

Annual revenue 4.5 Billion Lose the cooperation with conchino

Aosikang biology is based on biological drugs CMC At the forefront of , With their own integrity 、 flexible 、 The modular production process platform cooperates closely with domestic and foreign institutions , Quickly improve their innovation ability , at present CDMO The sector has served dozens of customers , The cell culture medium plate exceeds 200 Multiple customers .

Aosikang biology in the medium formula 、 Process development services 、CDMO Service cooperation , It has established agency or strategic cooperative relations with Asian multinational enterprises , The company is also looking for more strategic partners .

The prospectus shows , Auscon biology 2019 year 、2020 year 、2021 The annual revenue is 8713.6 Ten thousand yuan 、2.1 One hundred million yuan 、4.51 One hundred million yuan ; The net profit is respectively -7975 Ten thousand yuan 、-3817 Ten thousand yuan 、7186.86 Ten thousand yuan ; The net profit after deducting non profits is -8613 Ten thousand yuan 、-4773.5 Ten thousand yuan 、4641 Ten thousand yuan .

At the end of each reporting period , The book value of the company's accounts receivable is 2906.69 Ten thousand yuan 、8193.97 Million and $ 1.6 One hundred million yuan , The proportions in the total assets are 8.61%、11.16% and 5.04%.

2022 year 1 month 13 Japan , Due to the regulatory policy adjustment of vaccine production , Kangxinuo terminated the contract for the commissioned production of adenovirus covid-19 vaccine stock solution from auscon Biology ( Auscon biology others CDMO Business is not affected ),2022 year 1 month 28 Japan , In the production scope of the aosikang biopharmaceutical production license, the entrusted production of recombinant novel coronavirus vaccine has been reduced (5 Adenovirus vector ) Relevant contents of stock solution .

After the termination of the entrusted production business of adenovirus covid-19 vaccine stock solution between auscon biology and kangxinuo , Aosikang biology has adjusted its production schedule in time , Switch the production capacity originally used for the commissioned production of coxinuo covid-19 vaccine stock solution to other customer projects , But the switching process requires cleaning of the production line 、 Equipment commissioning and other work , And the production of new projects should follow the capacity climbing process of gradually increasing the operating load .

Hillhouse and Fosun are shareholders

Auscon biology 2019 In, it was announced to complete the super 3 One hundred million yuan A Round of funding ;2020 year 7 month , Announced a complete 4.5 One hundred million yuan B Round of funding ;2021 year 3 month , Announce the completion of super 4 One hundred million yuan C Round of funding , This round of financing is funded by China's state-owned capital venture capital fund ( abbreviation “ National Venture Capital Fund ”) Jointly lead the investment with Hillhouse venture capital , CDH investment 、 Honghui capital 、 China US Green Fund 、 Sany innovation fund and many other new investment institutions and Jinshi investment 、 CICC capital 、 Fosun's fund and other old shareholders jointly contributed .

2021 year 12 month , Auscon announced the completion 15 A new round of financing of 100 million yuan , Led by shareholders Jinshi investment and CDH Baifu , Many well-known institutions follow the investment .

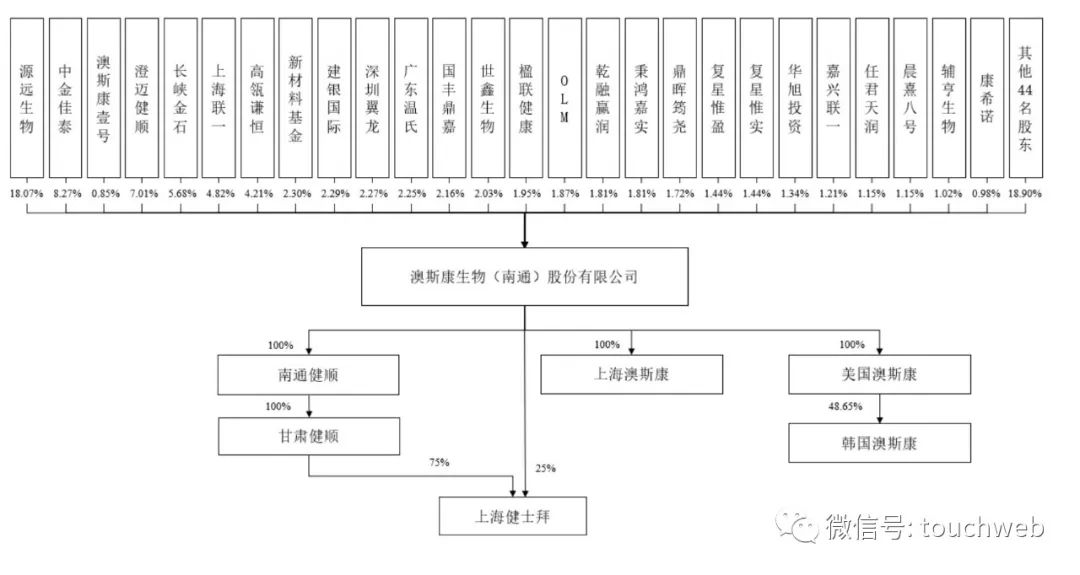

IPO front ,SHUN LUO Yuanyuan biological indirect control through personal shareholding platform 18.07% Shares of , Through the employee stock ownership platform, Chengmai Jianshun 、 Auscon one indirectly controls the company 7.01%、0.85% Shares of , Total controlling company 25.93% Shares of .

SHUN LUO, In Chinese, “ Luoshun ”.1962 year 7 born , American nationality , Permanent residency in China , Graduated from Virginia Tech University , Doctor of molecular immunology .1993 year 8 Month to 1999 year 9 month , He was appointed as the chief researcher of Swiss cerano biopharmaceutical Co., Ltd ;1999 year 9 Month to 2001 year 8 month , ren Beckman Coulter,Inc. Chief scientist ;2001 year 8 Month to 2003 year 2 month , ren Gene XP Biosciences Chairman of the board of directors ;2003 year 2 Month to 2005 year 9 month , ren JRH Biosciences R & D director of R & D department ;

SHUN LUO2005 year 11 Month to 2008 year 2 month , Ren us Genentech Inc. Scientific and technological director of cell culture technology research and Development Department ;2008 year 3 Month to 2011 year 6 month , Serve as the scientific and technological director of the cell culture process research and Development Department of Anjin company ;2011 year 7 Month to 2014 year 7 month , Serve as the CEO of Gansu Wanzhou Jianshun Biotechnology Co., Ltd ;2014 year 7 Month so far , Serve as chairman and general manager of Gansu Jianshun ;2017 year 3 Month so far , Serve as chairman and general manager of aosikang Biology .

Besides , CICC Jiatai holds 8.27%, Chengmai Jianshun holds 7.01%, Changxia Jinshi holds 5.68%, Shanghai Lianyi holds 4.82%, Hillhouse qianheng holds 4.21%, The shareholding of new materials fund is 2.3%, CCB international holds 2.29%, Shenzhen Yilong holds 2.27%, Guangdong Wen's shareholding is 2.25%, Guofeng Dingjia holds 2.16%;

Shixin biology holds 2.03%, Couplet health holdings is 1.95%,OLM The shareholding is 1.87%, Dry melt win run 、 Binghong harvest holds shares of 1.81%, CDH Junyao holds 1.72%, Fosun is only real 、 Fosun Weiying holds shares of 1.44%, Huaxu investment holds 1.34%, Jiaxing Lianyi holds 1.21%, Ren Jun Tianrun 、 Chen Xi No. 8 holds shares of 1.15%.

IPO after , The actual controller of the company is still SHUN LUO, but SHUN LUO The proportion of controlling shares in the company will be reduced to 19.45%.

Yuanyuan biological holdings is 13.55%, CICC Jiatai holds 6.2%, Chengmai Jianshun holds 5.25%, Changxia Jinshi holds 4.26%, Shanghai Lianyi holds 3.62%, Hillhouse qianheng holds 3.16%;

New materials Fund 、 CCB international holds 1.72%, Shenzhen Yilong holds 1.7%, Guangdong Wen's shareholding is 1.69%, Guofeng Dingjia holds 1.62%, Shixin biology holds 1.52%, Couplet health holdings is 1.46%, CDH Junyao holds 1.29%.

Fosun is only real 、 Fosun Weiying holds shares of 1.08%, Huaxu investment holds 1%, Jiaxing Lianyi holds 0.9%, Ren Jun Tianrun 、 Chen Xi No. 8 holds shares of 0.86%.

———————————————

Lei Di was founded by Lei Jianping, a senior media person , If reproduced, please indicate the source .

边栏推荐

- 基于NeRF的三维内容生成

- mysql怎么创建,删除,查看索引?

- [Q&A]AttributeError: module ‘signal‘ has no attribute ‘SIGALRM‘

- 2022 practice questions and mock examination of the third batch of Guangdong Provincial Safety Officer a certificate (main person in charge)

- PHP calls the pure IP database to return the specific address

- Talk about four cluster schemes of redis cache, and their advantages and disadvantages

- [疑难杂症]pip运行突然出现ModuleNotFoundError: No module named ‘pip‘

- @What is the difference between resource and @autowired?

- ICLR 2022 | 基于对抗自注意力机制的预训练语言模型

- Importance of database security

猜你喜欢

![[statistical learning methods] learning notes - Chapter 5: Decision Tree](/img/0e/c60e04ab4a7ae4728cc76eff1c028a.png)

[statistical learning methods] learning notes - Chapter 5: Decision Tree

![[statistical learning method] learning notes - support vector machine (I)](/img/3f/56db88d717d7cd6624b3d0867146e9.png)

[statistical learning method] learning notes - support vector machine (I)

leetcode刷题:二叉树20(二叉搜索树中的搜索)

Leetcode question brushing: binary tree 26 (insertion operation in binary search tree)

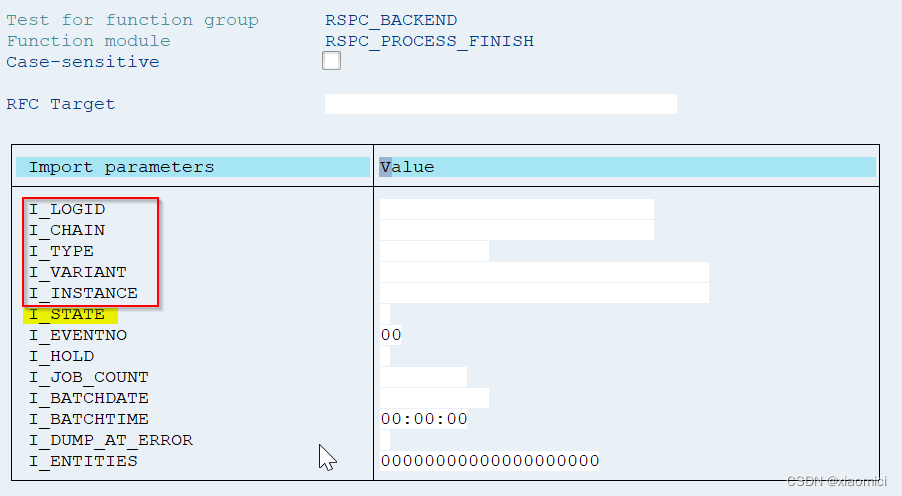

处理链中断后如何继续/子链出错removed from scheduling

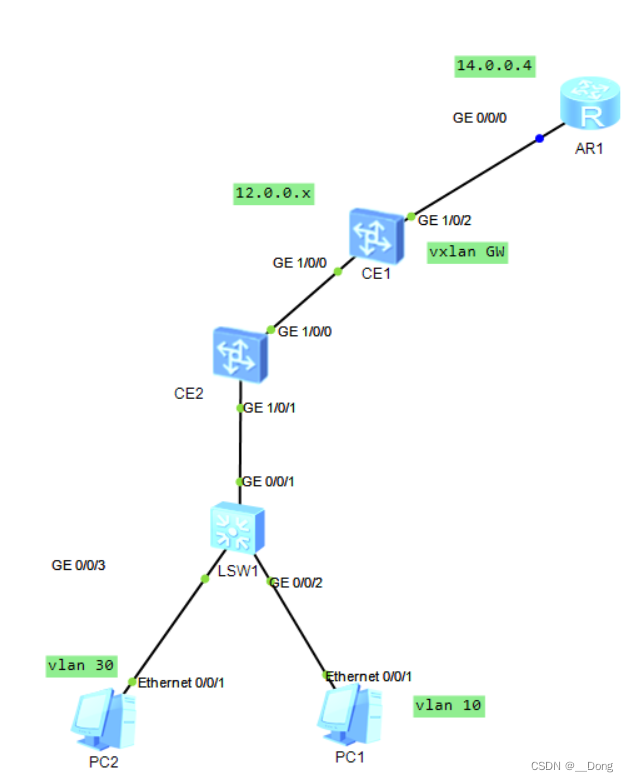

Vxlan static centralized gateway

![《ASP.NET Core 6框架揭秘》样章[200页/5章]](/img/4f/5688c391dd19129d912a3557732047.jpg)

《ASP.NET Core 6框架揭秘》样章[200页/5章]

Pule frog small 5D movie equipment | 5D movie dynamic movie experience hall | VR scenic area cinema equipment

Master公式。(用于计算递归的时间复杂度。)

Several ways to clear floating

随机推荐

用mysql查询某字段是否有索引

Find ID value MySQL in string

Leetcode question brushing: binary tree 26 (insertion operation in binary search tree)

MPLS experiment

opencv的四个函数

What are the benefits of ip2long?

How to apply @transactional transaction annotation to perfection?

Financial data acquisition (III) when a crawler encounters a web page that needs to scroll with the mouse wheel to refresh the data (nanny level tutorial)

[statistical learning methods] learning notes - Chapter 5: Decision Tree

HZOJ #235. Recursive implementation of exponential enumeration

leetcode刷题:二叉树25(二叉搜索树的最近公共祖先)

2022 examination questions and online simulation examination for safety production management personnel of hazardous chemical production units

ClickHouse(03)ClickHouse怎么安装和部署

.Net下極限生產力之efcore分錶分庫全自動化遷移CodeFirst

HZOJ #240. 图形打印四

Day-20 file operation, recursive copy, serialization

Vxlan static centralized gateway

Leetcode brush questions: binary tree 19 (merge binary tree)

Image pixel read / write operation

Master formula. (used to calculate the time complexity of recursion.)