当前位置:网站首页>Accounting regulations and professional ethics [8]

Accounting regulations and professional ethics [8]

2022-07-04 16:27:00 【Star drawing question bank】

1. The tax period of value-added tax is 1 Japan 、3 Japan 、5 Japan 、10 Japan 、20 Japan 、1 Months or 1 Quarterly .

2. Need to increase or reduce the cash on hand limit , An application shall be submitted to the deposit bank , Approved by the deposit bank .()

3. Provisions of the enterprise income tax law , The enterprise shall start from the end of the year 3 months , Submit the annual enterprise income tax return to the tax authority , And settle and pay taxes .

4. Taxable consumer goods subject to compound tax rates include Baijiu and cigarettes , The proportional tax rate is applicable to all other taxable consumer goods .

5. Taxation as an economic activity , It belongs to the category of economic foundation ; And tax law is a legal system , It belongs to the category of superstructure .

6. Individual industrial and commercial households in the way of quota collection need to close down , It shall apply to the tax authority for registration of suspension of business , Explain the reasons for the suspension 、 Time 、 Tax payment and invoice collection before business suspension 、 Preservation .

7. The bill is issued by the drawer , It is a negotiable security that agrees to pay a certain amount conditionally to the payee or the holder by itself or by entrusting the payer at sight or on a specified date .()

8. Accounting professional ethics is mandatory .()

9. The highest authority of the Chinese Institute of Certified Public Accountants is the national member congress , The National Member Congress elects the Council . The association has a secretariat , As its permanent executive body .( )

10. Accounting professional ethics education should be effective , Can't be separated from self-education .()

11. When the tax authorities have disputes over tax payment , You can apply for administrative reconsideration first , Then pay taxes and late fees according to the tax decisions of the tax authorities .

12. The real estate tax in China's current tax system 、 Urban real estate tax belongs to property tax .

13. Because the person in charge of the unit is satisfied with the authenticity of the accounting work and accounting materials of the unit 、 Take the first responsibility for integrity , Therefore, accountants are not responsible for the distortion of accounting information of their unit .( )

14. Because taxes are fixed , So once the tax is determined , There will be no change .

15. According to the provisions of VAT , Fixed business households go to other counties ( City ) Selling goods or taxable services , It shall apply to the competent tax authority in the place where its institution is located for the issuance of tax administration certificate for out of town business activities , And declare and pay taxes to the competent tax authority where the institution is located .

16. Dedication to society is the starting point of professional ethics , It is also the end result of professional ethics .()

17. Other individuals whose sales exceed the standard of small-scale taxpayers 、 Non enterprise units 、 Enterprises that do not often have taxable behavior can choose to pay taxes according to small-scale taxpayers .

18. When Invoicing , You don't have to fill it out in the order of numbers .

19. Continuing education of accounting personnel refers to that accounting personnel complete a certain stage of professional learning , Re accept a certain form of . Organized knowledge updating and training activities .()

20. The ways of tax declaration are : Direct declaration 、 Mail declaration 、 Data message declaration 、 Simple declaration , The other way .

21. The main forms of accounting professional ethics education include receiving education and self-education .()

22. The financial department can realize the supervision and inspection of accounting professional ethics by combining the registration management of accounting professional qualification certificate with the inspection of accounting professional ethics .()

23. Partial endorsement , It refers to the endorser when endorsing , Endorsements that transfer part of the amount of the bill or transfer the amount of the bill to two or more people respectively , Some endorsements are still valid .()

24. Consumption tax is applicable to production in China 、 A turnover tax levied by units and individuals entrusted with processing and importing taxable consumer goods .

25. Establishing and improving the internal supervision and management system of centralized procurement includes many aspects , The core problem is to form a restraint mechanism of mutual checks and balances within the centralized procurement organization .()

26. For too many original vouchers , It can be bound and kept separately , Indicate the date of the bookkeeping voucher on the cover 、 Number 、 species , At the same time, it should be noted on the bookkeeping voucher " The attachment is separately ordered " And the name and number of the original voucher .( )

27. taxpayer 、 The withholding agent may entrust a tax agent to carry out a comprehensive agency as required 、 Single agent or temporary agent 、 Perennial agent .

28. For units whose business income and expenditure are mainly in currencies other than RMB, one of the foreign currencies can be selected as the bookkeeping base currency , And prepare the financial accounting report of the unit in the selected foreign currency .( )

29. Tax reduction 、 The threshold is a special regulation that the State encourages and cares for some taxpayers and tax objects .

30. The superior government can use the funds budgeted by the lower government beyond the budget , Governments at lower levels shall not misappropriate or intercept funds belonging to the budgets of governments at higher levels .()

31. Taxpayers of individual income tax do not include individuals who have no domicile in China and have resided in China for less than one year .

32. The taxpayer will purchase the tax included in the value of material materials and the value of fixed assets used for production and operation , The value-added tax deducted at one time in the current period of purchase is income type value-added tax .

33. Personal bank settlement accounts are limited to cash deposit and withdrawal , Transfer settlement is not allowed .()

34. Fixity only includes continuity in time , It does not include the fixity of the collection proportion .

35. Taxpayers are subject to tax cuts 、 Tax exempt treatment , In tax cuts 、 Tax declaration may not be handled during the tax exemption period .

36. Selling goods or taxable services , Its tax liability occurs on the day when the sales payment is received or the voucher for claiming the sales payment is obtained , If the invoice is issued first, it is the day of issuing the invoice .

37. Accountants should follow the professional ethics involved in management , Is to actively participate in enterprise management , Make decisions about business activities .()

38. fine 、 Confiscation of property, etc., are administrative penalties for tax violations .

39. In addition to national laws 、 Except as otherwise provided in administrative regulations , The bank shall not check the account information for any unit or individual .()

40. Where there are regulations on taxable income 、 All kinds of taxpayers of taxable property or taxable behavior , Tax registration should be handled in accordance with the law .

41. Get a one-time performance income 2.1 Ten thousand yuan , In this regard, we should implement the plus levy method to calculate individual income tax .

42. Guidance on accounting archives work 、 Supervision and inspection , The financial departments of the people's governments at all levels are mainly responsible for .( )

43. The content of the central budget is the budget revenue and expenditure at the same level ; The balance of the previous year is used for the expenditure arranged in the current year ; Return or subsidize local expenses ; Explain the expenditure of superiors .()

44. Agricultural producers sell their own primary agricultural products , It does not belong to the VAT exemption project .

45. To alter 、 Falsify accounting data , Provide false financial and accounting reports , A violation of the 《 Implementation outline of citizen moral construction 》 The specification of .()

46. Competitive negotiation should be based on meeting procurement needs 、 The principle of equal quality and service and lowest quotation determines the successful supplier .

47. The taxpayer will give the purchased goods to others for free , Because the value-added tax has been paid when the goods are purchased , therefore , When giving gifts to others, they can no longer be included in sales tax .

48. Each unit is responsible for preparing its own budget 、 Draft final accounts ; Turn over the budgetary income in accordance with state regulations , Arrange budget expenditure , And accept the supervision of relevant state departments .()

49. VAT special invoices are only used by small-scale VAT taxpayers .

50. Local accounting regulations refer to provincial 、 Autonomous region 、 The people's Congress and its Standing Committee of municipalities directly under the central government are dealing with Accounting Law 、 Local accounting regulations formulated on the premise that accounting administrative regulations do not conflict .( )

51. Head of accounting organization , The immediate family members of the accountant in charge shall not work as cashiers in the accounting institution of the unit .( )

52. China's consumption tax is within price tax , And value-added tax is extra price tax .

53. The entrusting party entrusts an agency bookkeeping institution to keep accounts on behalf of the entrusting party, and a special person shall be assigned to be responsible for the income, expenditure and custody of daily monetary funds .( )

54. The tax period of consumption tax is 1 Japan 、3 Japan 、5 Japan 、10 Japan 、15 Japan 、 A month or 1 Quarterly .

55. Purchasing through competitive negotiation , The following procedure should be followed :(1) Set up a negotiation team ;(2) Prepare negotiation documents ;(3) Determine the list of suppliers invited to participate in the negotiation ;(4) negotiation ;(5) Confirm the supplier .

56. The accounting department rules are based on 《 legislation law 》 The prescribed procedure , Formulated by the Ministry of finance , The system and measures related to accounting work, which are issued by the head of the Department after signing the order .( )

57. according to 《 Budget law 》 The provisions of the , The financial department of the State Council is responsible for preparing the central and local budget adjustment plans .()

58. The person in charge of the unit shall support and urge the accountants to abide by the accounting professional ethics , Carry out accounting work according to law .()

59. The local budget is made by the provinces 、 Autonomous region 、 The general budget of the municipality directly under the central government consists of , It includes the amount of income handed over by the lower level government to the higher level government and the amount returned or subsidized by the higher level government to the lower level government .()

60. For capital construction projects , The depositor shall apply for opening a special deposit account or a basic deposit account .()

61. Illegally print invoices , according to 《 Tax collection management law 》 Regulations , serious , Criminal , Criminal responsibility should be investigated .

62. For the work of Certified Public Accountants , The financial department has no right to supervise .( )

63. According to need , The whole process of monetary capital business of the unit should be handled by one person .( )

64.() It was issued by the drawer 、 The bank entrusted to handle bill deposit business unconditionally pays a certain amount to the payee or bearer at sight .(2 branch )

A. Check

B. Commercial draft

C. Bank draft

D. Promissory note 65. The role of the state budget is that the state budget can only be embodied in economic life , It mainly includes ().(3 branch )

A. Financial guarantee

B. Regulation and restriction

C. Plan execution function

D. Reflect the role of supervision 66. according to 《 Personal income tax law 》 Regulations , When calculating taxable income , The following taxable items () Fixed expenses can be deducted .(3 branch )

A. Income from labor remuneration 3000 element

B. Monthly salary 6000 element

C. By chance 2000 element

D. Income from transfer of property 20000 element 67. The following ( ) It belongs to the budget management authority of the National People's Congress .(3 branch )

A. Examine the draft central and local budgets and the report on the implementation of the central and local budgets

B. Organize the implementation of the central and local budgets

C. Approve the central budget and the report on the implementation of the central budget

D. To alter or annul the budget decision of the Standing Committee of the National People's Congress 、 Improper resolution of final accounts 68. Purchasing through competitive negotiation , The following procedure should be followed :(1) Set up a negotiation team ;(2) Prepare negotiation documents ;(3) Determine the list of suppliers invited to participate in the negotiation ;(4) negotiation ;(5) Confirm the supplier .(1 branch )

69. according to 《 accounting law 》 The provisions of the , All units accept the accounting supervision and inspection implemented by the supervision and inspection department according to law ().(2 branch )

A. Be responsible

B. Due diligence

C. The basic requirements

D. Legal obligations 70. According to the relevant provisions of the legal system of enterprise income tax , Of the following , When calculating the taxable income of enterprise income tax , What cannot be deducted is ().(3 branch )

A. Donation expenditure exceeding the specified standard

B. fine

C. Tax late fees paid

D. Unapproved reserve expenditure 71. The zero balance account opened by the financial department , In business ( ), It should be cleared with the treasury single account in time .(2 branch )

A. The single payment amount is 3000 More than ten thousand yuan ( contain 3000 Ten thousand yuan ) Of

B. The single payment amount is 3000 Less than 10000 yuan ( contain 3000 Ten thousand yuan ) Of

C. The single payment amount is 5000 More than ten thousand yuan ( contain 5000 Ten thousand yuan ) Of

D. The single payment amount is 5000 Less than 10000 yuan ( contain 5000 Ten thousand yuan ) Of 72. Payment and settlement as a legal act , Its legal characteristics are ().(3 branch )

A. Payment and settlement must be carried out through financial institutions approved by the people's Bank of China

B. Payment and settlement is an important behavior

C. The occurrence of payment and settlement depends on the will of the client

D. Payment and settlement must be carried out according to law 73.() It is an important sign to measure whether the tax burden is heavy or not , Is the core of the tax system .(2 branch )

A. Tax object

B. tax item

C. tax rate

D. Tax basis 74. Consciously fighting two kinds of accounting moral concepts is the key to the success of Accountants' moral cultivation .()(1 branch )

75. In the following accounts , What can be used to pay wages and bonuses is ().(2 branch )

A. General deposit account

B. Basic deposit account

C. Special deposit account

D. Temporary deposit accounts 76. Accountants deal with money all day , Often be tempted by money , No, " Li Wanjin doesn't touch a penny ” Moral character and noble sentiment are not good . It reflects that accountants must have () Professional ethics .(2 branch )

A. Improve your skills

B. Based on honesty

C. Be honest and self disciplined

D. No greed, no occupation 77. Financial capital expenditure shall be paid directly and authorized by finance according to different payment entities . The expenditures to be paid directly by the government include ( ).(3 branch )

A. Wage expenditure

B. Purchase expenses

C. Transfer expenses

D. Sporadic expenditure 78. The following do not belong to the system of establishing accounting treatment procedures ( ).(2 branch )

A. Unit accounting indicator system

B. Setting of accounting books

C. The setting and use of accounting accounts and their detailed accounts

D. Organization form of accounting 79. Of the following taxes ,() It does not belong to behavior tax .(2 branch )

A. Land occupation tax

B. Vehicle and vessel tax

C. Urban maintenance and construction tax

D. auto-purchase tax 80. Compared with the decentralized procurement system in the past , The implementation of unified and centralized government procurement has expanded the scale of procurement , It helps to form a buyer's market for government procurement , This reflects the importance of government procurement () function .(2 branch )

A. Save financial expenditure

B. Strengthen macro-control

C. Invigorate the market economy

D. Protect national industries 81. The core of accounting professional ethics system is ().(2 branch )

A. Accounting professional ethics

B. Accounting professional ethics

C. Accounting professional ethics education and cultivation

D. Accounting professional ethics evaluation and punishment 82. According to the provisions of the financial legal system , The bank settlement account where the depositor handles daily transfer settlement and cash collection and payment is ().(2 branch )

A. Basic deposit account

B. General deposit account

C. Temporary deposit accounts

D. Special deposit account 83. The budget law stipulates that , The adjustment plan of the central budget must be submitted to ( ) Review and approve .(2 branch )

A. The National People's Congress

B. The Standing Committee of the National People's Congress

C. The State Council

D. The Ministry of Finance 84.201X year 5 month , When a provincial financial department inspects an enterprise , The following conditions are found : Because the accounting agency has fewer staff , Accountant Zhang is also responsible for bookkeeping and approval of accounting books . According to the above , The following statements are correct ().(3 branch )

A. Zhang can be responsible for bookkeeping and approval of some matters at the same time

B. Zhang cannot be responsible for bookkeeping and approval of some matters at the same time

C. Zhang is also responsible for bookkeeping and approval of some matters , It does not meet the basic requirements of the internal accounting supervision system of the unit

D. Bookkeeper and approver are incompatible positions , But under special circumstances, the same person can act 85. The following provisions on consumption tax payment are incorrect ().(2 branch )

A. Taxable consumer goods produced by taxpayers , Pay taxes when taxpayers sell

B. Taxable consumer goods produced and used by taxpayers , For the continuous production of taxable consumer goods , No tax

C. Imported taxable consumer goods , Pay taxes when selling imported goods

D. Taxable consumer goods produced and used by taxpayers , For other purposes , Tax paid at the time of transfer for use 86. Qualification of chief accountant 、 Appointment and removal procedures 、 Responsibilities and authorities are determined by ( ) Regulations .(2 branch )

A. The State Council

B. The Ministry of Finance

C. Institute of certified public accountants

D. Chinese Accounting Society 87. Of the following , Invoices that do not belong to the industry include ().(2 branch )

A. Unified commercial retail invoice

B. Unified commercial wholesale invoice

C. Advertising expense settlement invoice

D. Unified invoice for product sales of industrial enterprises 88. township 、 Nationality town 、 The town government shall submit the budget at the corresponding level approved by the people's Congress at the corresponding level to the government at the corresponding level for the record .()(1 branch )

89. Of the following , According to 《 accounting law 》 And formulate specific measures for implementing the national unified accounting system within the system , And reported to the financial department of the State Council for the record ().(2 branch )

A. People's Bank of China

B. Ministry of information industry

C. Ministry of agriculture

D. The General Logistics Department of the Chinese people's Liberation Army 90. The core of socialist morality is ().(2 branch )

A. Serve the people

B. Dedication

C. free 、 equality

D. Thrift and self-improvement 91. The implementation mode of government procurement in China is ().(2 branch )

A. Centralized purchasing

B. Decentralized procurement

C. The combination of centralized procurement and decentralized procurement

D. Agent purchase 92. For capital construction projects , The depositor shall apply for opening a special deposit account or a basic deposit account .()(1 branch )

93.() It is the morality that accountants must have , It is the soul of accounting professional ethics .(2 branch )

A. Don't make fake accounts

B. Objective justice

C. Avoid leaning to either side

D. Good service 94. While doing their job well, accountants , Strive to study related businesses , Be fully familiar with the business activities and business processes of the unit , Actively put forward reasonable suggestions on the problems existing in the operation and management of the unit , Assist leaders in decision-making , This reflects the professional ethics of accounting () The requirements of .(2 branch )

A. I love my job

B. Improve your skills

C. Participate in management

D. Stick to the rules 95. The fundamental law of national budget management and the basis for formulating other budget laws and regulations are ().(2 branch )

A.《 Budget law of the people's Republic of China 》

B.《 Regulations for the implementation of the budget law of the people's Republic of China 》

C.《 Decision on strengthening the examination and supervision of the central budget 》

D.《 Regulations of Beijing Municipality on budget supervision 》96.《 Regulations on the implementation of the budget law 》 By () To formulate the .(2 branch )

A. The National People's Congress

B. The Standing Committee of the National People's Congress

C. The State Council

D. The Ministry of Finance 97. A natural person can apply for opening a personal bank settlement account as needed , You can also select from the opened savings accounts and apply to the deposit bank for confirmation as a personal bank settlement account .()(1 branch )

98. China's treasury single account system includes ().(3 branch )

A. Treasury single account

B. Zero balance accounts of financial departments and budget units

C. Special financial account

D. Special account 99. In the main content of accounting professional ethics ,() It embodies the basic principle of being a man , It is also the main content of civil ethics .(2 branch )

A. Be honest

B. Strengthen service

C. Stick to the rules

D. Participate in management 100. Selling goods by direct collection , Whether the goods are delivered or not , The time when the tax liability occurs is when the sales volume is received or the evidence of claiming sales volume is obtained , And the day when the bill of lading is handed over to the buyer .(1 branch )

边栏推荐

- [book club issue 13] ffmpeg common methods for viewing media information and processing audio and video files

- Book of night sky 53 "stone soup" of Apache open source community

- Understand the context in go language in an article

- Some fields of the crawler that should be output in Chinese are output as none

- Digital recognition system based on OpenCV

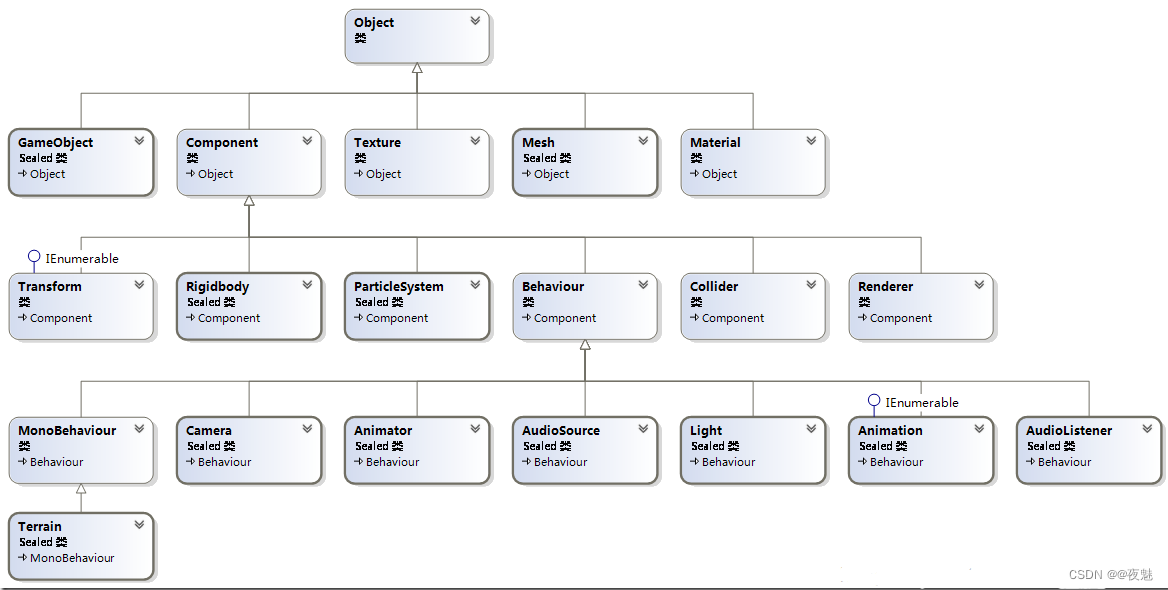

- Common API day03 of unity script

- c# 实现定义一套中间SQL可以跨库执行的SQL语句

- What is the catalog of SAP commerce cloud

- Data Lake Governance: advantages, challenges and entry

- In today's highly integrated chips, most of them are CMOS devices

猜你喜欢

TypeError: list indices must be integers or slices, not str

Dry goods | fMRI standard reporting guidelines are fresh, come and increase your knowledge

Talking about Net core how to use efcore to inject multiple instances of a context annotation type for connecting to the master-slave database

Ten clothing stores have nine losses. A little change will make you buy every day

![[North Asia data recovery] a database data recovery case where the disk on which the database is located is unrecognized due to the RAID disk failure of HP DL380 server](/img/79/3fab19045e1ab2f5163033afaa4309.jpg)

[North Asia data recovery] a database data recovery case where the disk on which the database is located is unrecognized due to the RAID disk failure of HP DL380 server

Unity脚本常用API Day03

![[North Asia data recovery] a database data recovery case where the partition where the database is located is unrecognized due to the RAID disk failure of HP DL380 server](/img/21/513042008483cf21fc66729ae1d41f.jpg)

[North Asia data recovery] a database data recovery case where the partition where the database is located is unrecognized due to the RAID disk failure of HP DL380 server

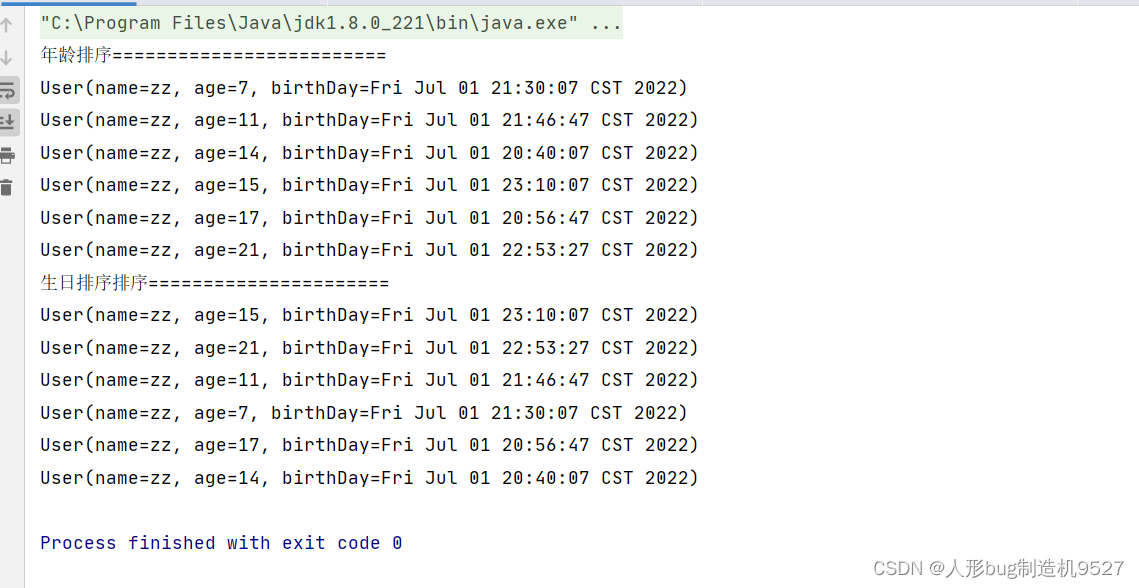

Functional interface, method reference, list collection sorting gadget implemented by lambda

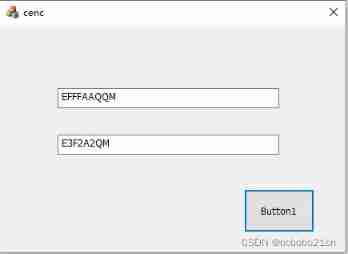

MFC implementation of ACM basic questions encoded by the number of characters

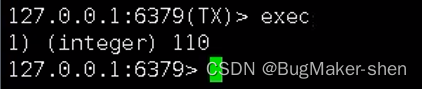

Redis' optimistic lock and pessimistic lock for solving transaction conflicts

随机推荐

时钟轮在 RPC 中的应用

科普达人丨一文看懂阿里云的秘密武器“神龙架构”

[hcie TAC] question 5 - 1

Actual combat | use composite material 3 in application

How was MP3 born?

AI system content recommendation issue 24

Interface fonctionnelle, référence de méthode, Widget de tri de liste implémenté par lambda

Will the memory of ParticleSystem be affected by maxparticles

[Previous line repeated 995 more times]RecursionError: maximum recursion depth exceeded

Explore mongodb - mongodb compass installation, configuration and usage introduction | mongodb GUI

Shell programming basics

Feature extraction and detection 15-akaze local matching

Using celery in projects

Selenium element interaction

Unity script lifecycle day02

科研漫画 | 联系到被试后还需要做什么?

Proxifier global agent software, which provides cross platform port forwarding and agent functions

D3D11_ Chili_ Tutorial (2): draw a triangle

Unity prefab day04

Unity script API - time class