当前位置:网站首页>Qingda KeYue rushes to the science and Innovation Board: the annual revenue is 200million, and it is proposed to raise 750million

Qingda KeYue rushes to the science and Innovation Board: the annual revenue is 200million, and it is proposed to raise 750million

2022-07-05 14:13:00 【leijianping_ ce】

RedI network Lei Jianping 7 month 4 Reported Wednesday

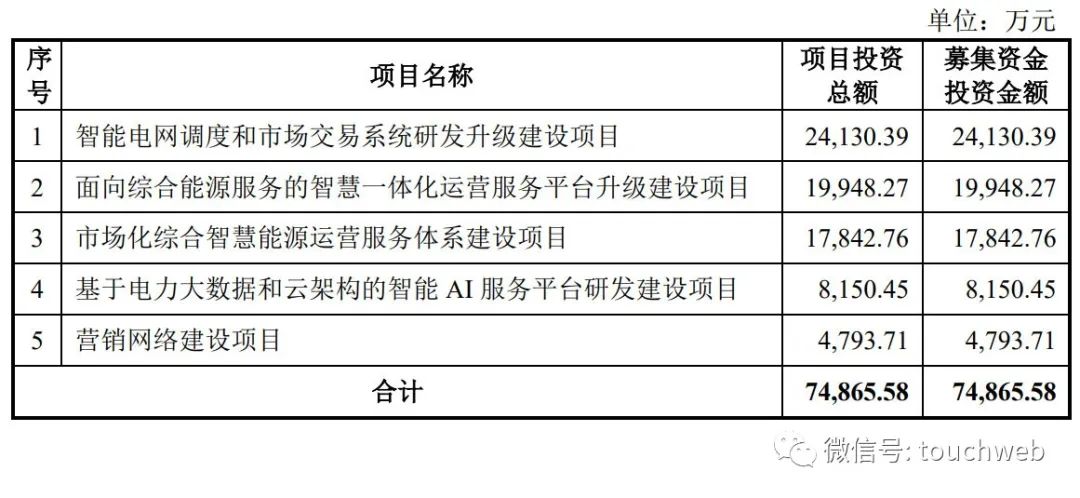

Beijing Qingda KeYue Co., Ltd ( abbreviation :“ Qingda KeYue ”) The prospectus was submitted a few days ago , Ready to be listed on the science and technology innovation board . Qingda KeYue plans to raise funds 7.49 One hundred million yuan .

among ,2.41 Billion yuan is used for the R & D and upgrading construction project of smart grid dispatching and market trading system ,1.99 Billion for the upgrading and construction project of intelligent integrated operation service platform for integrated energy services ,1.78 Billion for the construction project of market-oriented comprehensive smart energy operation service system ,8150 Wan is used for intelligence based on power big data and Cloud Architecture AI Service platform R & D and construction project ,4793.7 Million for marketing network construction projects .

Annual revenue 2 Billion

Qingda KeYue has long focused on power market transactions 、 Power grid intelligent dispatching 、 Strategic consultation in application fields such as smart power distribution and energy Internet 、 Algorithm Research 、 High tech enterprise of software development , The main products and services are self-developed software products 、 Software development services 、 Research consultation 、 System integration and technical services .

Qingda KeYue's customers include power grid companies 、 Power Trading Center 、 Power generation enterprises 、 Power selling enterprises 、 Third party independent subjects, etc , Including the State Grid 、 Southern power grid 、 Mengxi Power Grid and its subsidiaries 20 Many provincial-level power companies 、70 Many power supply bureaus ;10 Many power trading centers ;100 Many thermal power enterprises ,300 Many wind power 、 Photovoltaic 、 Water and electricity 、 Nuclear power and other green power generation enterprises ;10 Many power selling companies ; And several virtual power plant operators 、 Park load aggregator 、 Independent energy storage service company 、 Third party independent entities such as integrated energy service companies .

Qingda KeYue's main products and services include self-developed software products 、 Software development services 、 Research consultation 、 System integration and technical services , among , Self developed software products 、 Software development services account for a large proportion , The total proportion is 75.31%、69.64% and 70.72%, It is the main source of income of the company .

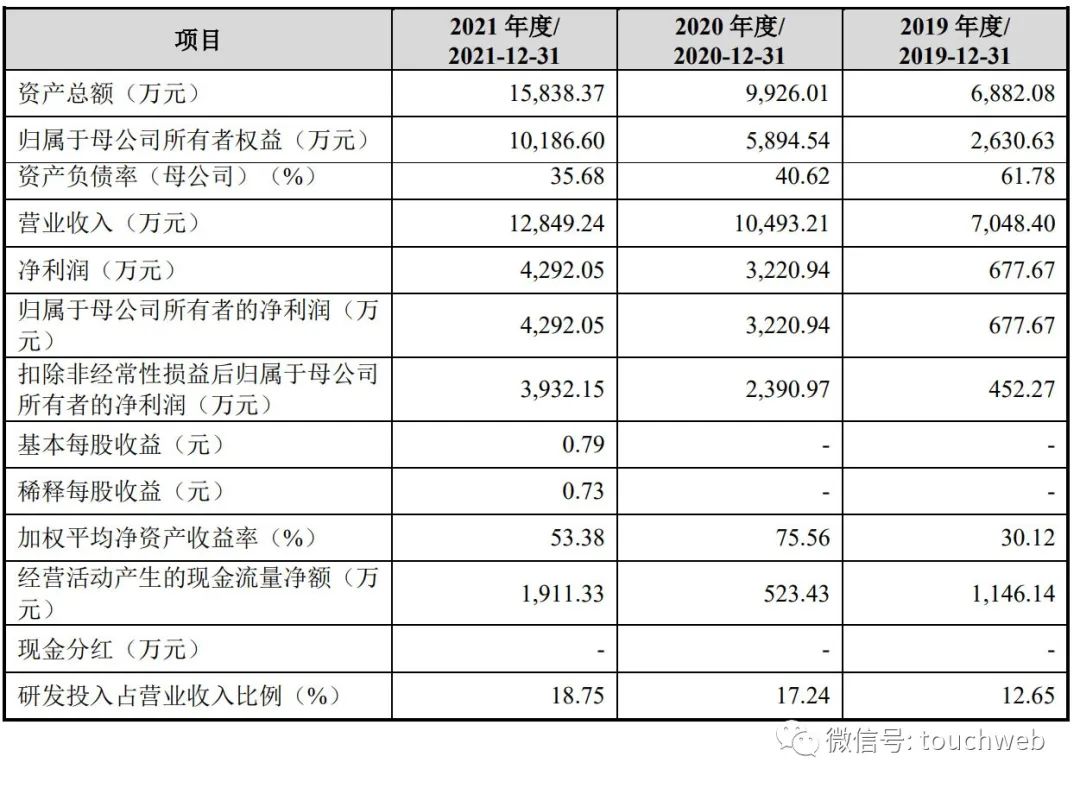

The prospectus shows , Qingda KeYue 2019 year 、2020 year 、2021 The annual revenue is 1.25 One hundred million yuan 、1.73 One hundred million yuan 、1.98 One hundred million yuan ; The net profit is respectively 2787.7 Ten thousand yuan 、5967 Ten thousand yuan 、8035.69 Ten thousand yuan ; The net profit after deducting non profits is 2100 Ten thousand yuan 、5616 Ten thousand yuan 、7201 Ten thousand yuan .

Tongchuang Weiye is a shareholder

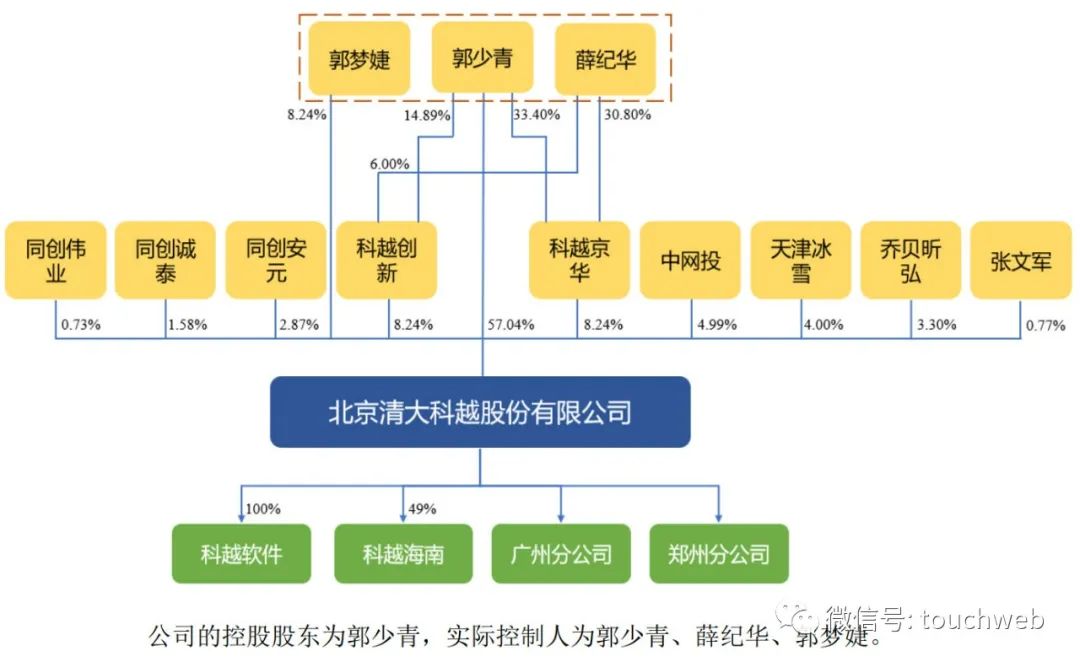

IPO front , The actual controller of KeYue of Qingda is guoshaoqing 、 Xue Jihua 、 Guo Mengjie , Guoshaoqing directly holds shares 57.04%, As the general partner of KeYue innovation, he indirectly controls the voting right proportion of Qingda KeYue 8.24%, As the general partner of KeYue Jinghua, Xue Jihua indirectly controls the proportion of voting rights of KeYue 8.24%, Shareholder Guo Mengjie directly holds shares 8.24%.

Guo Shaoqing and Xue Jihua are husband and wife , Guo Shaoqing and Guo Mengjie are father daughter relationship , In total, the proportion of voting rights that control Tsinghua University KeYue is 81.76%.

Tongchuang Anyuan 、 Tongchuang Chengtai 、 Tongchuang Weiye holds companies respectively 2.87%、1.58%、0.73% Shares of , among , Tongchuang Anyuan 、 Tongchuang Chengtai's fund managers are Anhui Tongchuang Jincheng Asset Management Co., Ltd , Anhui Tongchuang Jincheng Asset Management Co., Ltd. is a holding subsidiary of Shenzhen Tongchuang Weiye Asset Management Co., Ltd ; Tongchuang Weiye is a wholly-owned subsidiary of Shenzhen Tongchuang Weiye Asset Management Co., Ltd .

therefore , Tongchuang Anyuan 、 Tongchuang Chengtai 、 Tongchuang Weiye is controlled by Shenzhen Tongchuang Weiye Asset Management Co., Ltd .

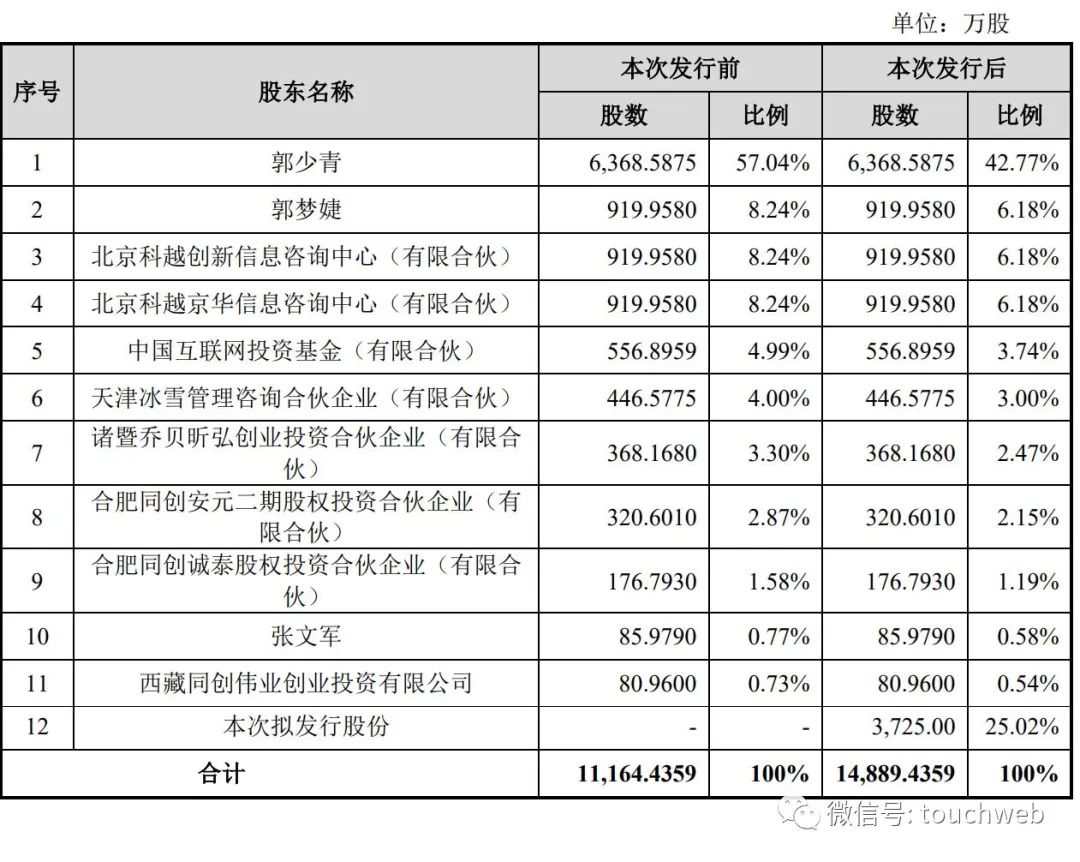

IPO after , Guoshaoqing's direct shareholding is 42.77%, Guo Mengjie 、 Beijing KeYue Innovation Information Consulting Center ( Limited partnership )、 Beijing KeYue Jinghua Information Consulting Center ( Limited partnership ) Their respective shareholdings are 6.18%, China Internet investment fund ( Limited partnership ) The shareholding is 3.74%;

Tianjin ice and snow management consulting partnership ( Limited partnership ) The shareholding is 3%, Zhuji Qiao beixinhong venture capital partnership ( Limited partnership ) The shareholding is 2.47%;

Hefei Tongchuang Anyuan phase II equity investment partnership ( Limited partnership ) The shareholding is 2.15%, Hefei Tongchuang Chengtai equity investment partnership ( Limited partnership ) The shareholding is 1.19%, Zhangwenjun holds 0.58%, Tibet Tongchuang Weiye Venture Capital Co., Ltd. holds 0.54%.

———————————————

Lei Di was founded by Lei Jianping, a senior media person , If reproduced, please indicate the source .

边栏推荐

- R语言使用nnet包的multinom函数构建无序多分类logistic回归模型、使用coef函数获取模型中每个变量(自变量改变一个单位)对应的对数优势比(log odds ratio)

- 判断变量是否为数组

- VC开发非MFC程序内存泄漏跟踪代码

- 怎么叫一手一机的功能方式

- How to call the function mode of one hand and one machine

- 如何深入理解“有限状态机”的设计思想?

- What is the ranking of GF futures? Is it safe and reliable to open an account for GF futures online?

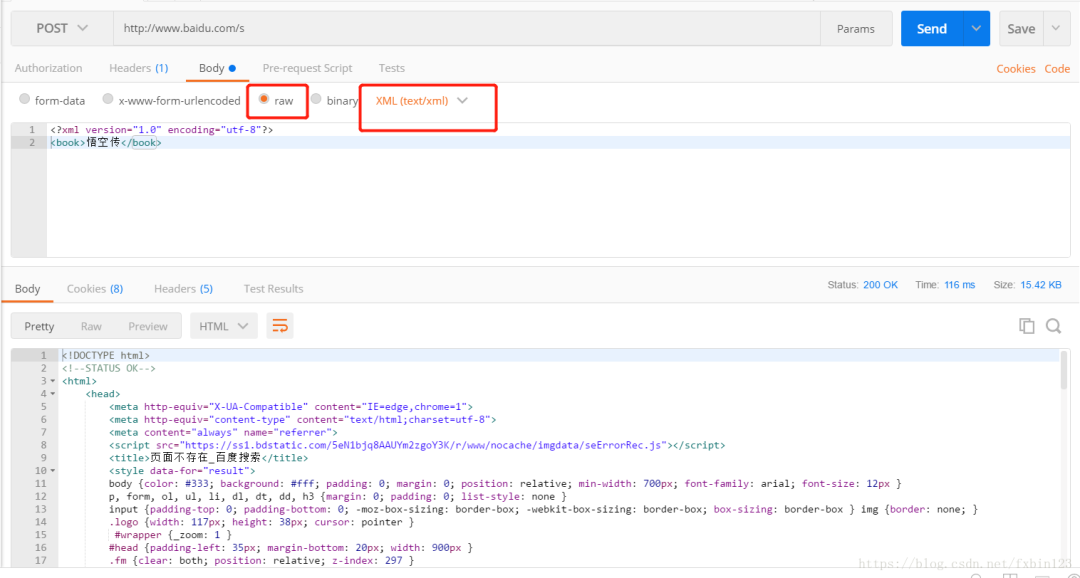

- Postman简介、安装、入门使用方法详细攻略!

- Comparison of several distributed databases

- 关于Apache Mesos的一些想法

猜你喜欢

Kunlun Taike rushes to the scientific innovation board: the annual revenue is 130million, and it plans to raise 500million. CETC Taiji holds 40% of the shares

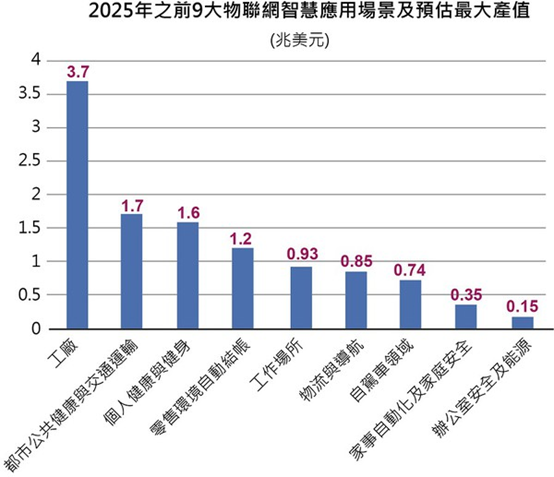

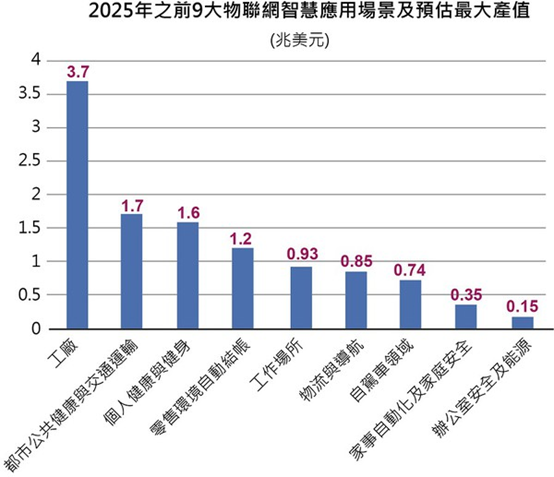

神经网络物联网未来现状和趋势及看法

明峰医疗冲刺科创板:年营收3.5亿元 拟募资6.24亿

Scenario based technology architecture process based on tidb - Theory

Recommendation number | what are interesting people looking at?

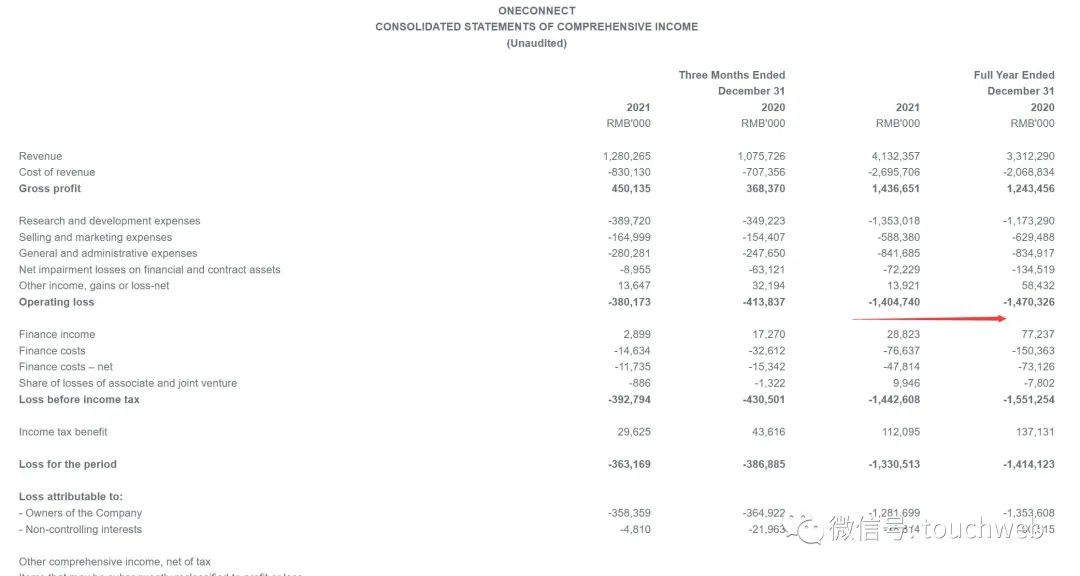

Oneconnect listed in Hong Kong: with a market value of HK $6.3 billion, ye Wangchun said that he was honest and trustworthy, and long-term success

The IPO of Ruineng industry was terminated: the annual revenue was 447million and it was planned to raise 376million

Current situation, trend and view of neural network Internet of things in the future

Deep copy is hard

Introduction, installation, introduction and detailed introduction to postman!

随机推荐

WebRTC的学习(二)

R language ggplot2 visualization: use ggplot2 to visualize the scatter diagram, and use the labs parameter to customize the X axis label text (customize X axis labels)

金融壹账通香港上市:市值63亿港元 叶望春称守正笃实,久久为功

不相交集

2022 driller (drilling) examination question bank and simulation examination

强联通分量

How to call the function mode of one hand and one machine

[buuctf.reverse] 152-154

Assembly language

一网打尽异步神器CompletableFuture

POI set the data format of the column (valid)

LeetCode_69(x 的平方根 )

LeetCode_3(无重复字符的最长子串)

IP packet header analysis and static routing

poi设置列的数据格式(有效)

Interpretation of tiflash source code (IV) | design and implementation analysis of tiflash DDL module

mysql 自定义函数 身份证号转年龄(支持15/18位身份证)

upload (1-6)

Liste des liens (simple)

软件测试人在深圳有哪些值得去的互联网公司【软件测试人员专供版】