当前位置:网站首页>Cost accounting [21]

Cost accounting [21]

2022-07-06 15:35:00 【Star drawing question bank】

1. There is a large-scale precision equipment in the basic production workshop of an enterprise , Original value 150 Ten thousand yuan , Expected net residual value rate 5%, The estimated working hours available are 18000 Hours .5 In January, the production of this equipment consumed 100 Hours . requirement : The workload method is used to calculate 5 The depreciation amount of the equipment in the month and the accounting entry of depreciation , The following is true ().

A. borrow : Accumulated depreciation 7917 loan : Manufacturing expenses 7917

B. borrow : Manufacturing expenses 7917 loan : Accumulated depreciation 7917

C. borrow : Management cost 7917 loan : Accumulated depreciation 7917

D. borrow : Basic production cost 7917 loan : Accumulated depreciation 79172. The classification method is applicable to small batch, single piece and multi-step production enterprises .

3. Enterprises produce certain kinds of 、 The sum of various production costs incurred by a certain number of products , Is the product cost .()

4. Of the following , The expenses that should be included in the cost of products are ().

A. Workshop office expenses

B. Seasonal downtime losses

C. Workshop design and drawing fee

D. Inventory loss of products in process 5. In single step production , Production costs do not have to be allocated between finished products and in-process products .()

6. The functions of cost accounting include ().

A. Cost forecast 、 Decision making

B. Costing 、 analysis

C. Cost planning

D. cost control 7. In practice , To simplify accounting procedures , Waste loss within the scope of three guarantees , It can be directly recorded in “ Management cost ” subject .()

8. When the auxiliary production cost is allocated by the interactive allocation method , The first interactive assignment was at () Between .

A. Auxiliary production workshops benefiting from each

B. All beneficiary units outside the auxiliary production workshop

C. The basic production workshops benefiting from each

D. Management Department of each beneficiary enterprise 9. The total cost of purchased power shall be recorded in “ Bank deposits ” Credit to account .()

10. The scope of application of the variety law includes ().

A. Mass single step production

B. Mass and multi-step production

C. A large number of multi-step production that does not require step-by-step costing in management

D. Single piece small batch production 11. Adopt variety method , The production cost Sub Ledger shall be in accordance with () Set up... Separately .

A. Production workshop

B. Production steps

C. Product variety

D. Purchase order 12. Step by step method , Whether it is carried forward gradually or in parallel , In the end, they all need to go through “ Self made semi-finished products ” Accounting subjects for cost accounting .()

13. Installment of cost accounting , Not necessarily consistent with the accounting cycle .()

14. An enterprise has two production workshops , Its production types are different , be ().

A. Different costing methods can be used

B. The same costing method should be used

C. Different costing methods cannot be used

D. Several costing methods cannot be combined 15. When using the coefficient method , As a standard product, it should be ().

A. The products with the largest production capacity

B. Most profitable products

C. Varieties 、 A wide range of products

D. Large output 、 Produce stable or moderate products 16. The equivalent output proportion method is applicable to the large number of products in process at the end of the month , At the end of each month, the quantity of products in progress also changes greatly , Products with the same proportion of raw material expenses and processing expenses such as wages and welfare expenses in product costs .()

17. The actual cost after the interactive allocation of auxiliary production workshops , Should be in () Distribute .

A. Each basic workshop

B. Between the beneficiary units

C. Between the beneficiary units outside the auxiliary production workshop

D. Between auxiliary production 18. The bonus included in the total salary includes ().

A. Production Award

B. office 、 Reward salary of public institutions

C. Sports Competition Award

D. Other bonuses 19. The task of cost accounting mainly depends on the requirements of enterprise management , It is also subject to the object and function of cost accounting .()

20. Relevant output of an enterprise 、 The information of unit cost and total cost is as follows : Existing comparable products A product 、B product 、C product , The actual output this month is A Comparable products 100 Pieces of ,B Comparable products 30 Pieces of ,C Comparable products 80 Pieces of . The cumulative total cost of the three products in this year calculated according to the actual average unit cost of the previous year is 1740000 element , among B Products for 250000 element ,C Products for 770000 element ; The cumulative total cost of this year calculated according to the planned unit cost of this year is 1696000 element , The cumulative total cost of this year calculated according to the actual situation of this year is 1667000 element . requirement : According to the above information , Calculate the reduction of comparable products , Reduction rate of comparable products ,A The actual unit cost of the product this month ,A The total cost of the product calculated according to the actual average unit cost of the previous year .

A.73000/4.195%

B.73000/5.195%

C.750/720000

D.450/74800021. Work in progress is calculated according to the fixed amount at the beginning of the year , Apply to () product .

A. The balance of products in progress at the end of each month is small

B. The balance of products in progress at the end of each month is large

C. There is little change in the balance of products at the end of each month

D. The balance of products in progress changes greatly at the end of each month 22. Be able to link labor productivity with the cost level of product burden , The distribution method of manufacturing cost that makes the distribution result more reasonable is ().

A. Proportional distribution of working hours of production workers

B. Distribution method according to annual planned distribution rate

C. Direct labor cost proportional distribution method

D. Machine man hour proportional distribution method 23. The completion rate of work in progress used in allocating processing expenses refers to the product () Ratio to man hour quota of finished products .

A. The man hour quota of the operation

B. The difference between the man hour quota of the previous operation and the man hour quota of the operation 50% The total of

C. Cumulative man hour quota of the operation

D. Time quota of the operation 50%24. Generally, comparative method is used to analyze the profit rate of costs , By comparing the actual number of this year with the planned number of this year , Or compare with the actual amount of the previous year , To find out the reasons for its changes and the impact of the rise and fall of its indicators .()

25. Product cost calculation method , It is divided into basic methods and auxiliary methods .()

26. The method of allocating the cost of various products in the same kind of products according to a fixed coefficient ().

A. It's a kind of taxonomy

B. It's a simplified taxonomy

C. Also called coefficient method

D. Is a separate costing method 27. The cost table of commodity products can reflect the difference between comparable products and non comparable products ().

A. Actual production

B. Unit cost

C. The total cost of this month

D. Total accumulated cost of this year 28. Waste products in production , Including waste products found in the production process , It also includes waste products found after warehousing .()

29. In the raw material cost allocation method , The way to strengthen the physical management of raw material consumption is ().

A. Proportional distribution method according to the quota consumption of raw materials of the product

B. The cost of raw materials is allocated according to the proportion of raw materials in the quota method

C. Distribute according to the volume of the product

D. Distribute according to the weight of the product 30. Among the following indicators, there are ().

A. Output value cost rate

B. Cost reduction rate

C. Cost margin

D. Sales revenue cost rate 31. The total cost of comparable products and non comparable products in this month calculated according to the planned unit cost of this year , It should be multiplied by the actual output of this month () Fill in .

A. The actual unit cost of this year is calculated

B. Planned unit cost calculation of this month

C. The actual unit cost of this month is calculated

D. The planned unit cost of this year is calculated 32. The object of cost calculation is the main symbol to distinguish various methods of product cost calculation .()

33. Loss of various wastes found during production or after warehousing , barring ().

A. Materials used for recovery of waste products

B. The production cost of irreparable waste

C. Salary of personnel repairing waste products

D. implement “ Three packs ” Loss 34. An enterprise B product 201* The actual unit costs for the four quarters of the year were 172 element 、186 element 、194 element 、192 element . Determine two 、 3、 ... and 、 Quarter on quarter ratio .

A.108.13%

B.104.3%

C.115.39%

D.98.97%35. The following fixed assets without depreciation include ().

A. Unused houses and buildings

B. Unnecessary fixed assets

C. Fixed assets scrapped in advance

D. Fixed assets leased in by means of operating lease 36. Waste products can be divided into... According to whether they can and are worth repairing ().

A. Industrial waste

B. Waste

C. Repairable waste

D. Irreparable waste

E. Waste loss 37. The factors affecting the change of cost reduction rate of comparable products are product output 、 Product variety composition and product unit cost ()

38. Scrap loss does not include the production cost of irreparable scrap found after warehousing .()

39. Some parts of product a are from this month 1 The new consumption quota will be implemented from the th : The old material cost quota is 200 element , New for 210 element ; The old man hour quota was 40 Hours , New for 38 Hours . At the beginning of the month, the fixed raw material cost of the products in process calculated according to the quota is 4000 element , The fixed salary expense is 3000 element , The fixed manufacturing cost is 2500 element . requirement : Calculate the conversion coefficient between the old and new quota of product a , Based on this, the variation of product quota at the beginning of the month is calculated .

A.1.05/85

B.1.05/75

C.1.05/95

D.1.05/10540. Classification is not an independent cost calculation method , It must be combined with the basic method of cost calculation .()

41. The cost statements of industrial enterprises are ()

A. Balance sheet

B. Production cost table

C. Unit cost table of main products

D. Breakdown of manufacturing expenses

E. Detailed statement of product circulation fee 42. The simplified batch method is not suitable for ().

A. The level of indirect costs varies greatly from month to month

B. The level of indirect costs varies little from month to month

C. There are many batches of products in progress at the end of the month

D. There are many batches put into operation in the same month 43. The variety method applies to ().

A. Mass single step production

B. Mass multi-step production

C. Management does not require step-by-step costing of multi-step production

D. Small batch 、 singleton , Management does not require step-by-step costing of multi-step production 44. The variety method is only applicable to a large number of single-step production enterprises .()

45. When calculating the cost of irreparable scrap according to the quota cost of scrap , The production cost of waste products is calculated according to the quantity of waste products and the quota of various expenses .()

46. The division basis of the basic method and auxiliary method of product cost calculation is ().

A. Cost calculation object

B. Whether the cost calculation is simple

C. Production organization characteristics

D. Is it necessary to calculate the actual cost 47. Manufacturing expenses shall be allocated to () Account .

A. Basic production cost and auxiliary production cost

B. Basic production costs and period expenses

C. Production costs and financial expenses

D. Financial expenses and sales expenses 48. When the production workshop adopts the simplified batch method to calculate the product cost , You can know the total cost of products in process in the workshop at the end of the month , However, it cannot provide information about the cost of each batch of products in process .()

49. The cost calculation of variety method is carried out on a monthly basis .()

50. When using the classification method to calculate the cost of products , The cost calculated by distribution method among various products in the category ().

A. It's just the cost of raw materials

B. Just manufacturing costs

C. Just production wages and welfare expenses

D. Including all costs 51. Under the simplified batch method , Before the product is finished , Product cost Sub Ledger ().

A. Register only the cost of raw materials

B. Only production hours are registered

C. Only the cost of raw materials and production hours are registered

D. Register all kinds of expenses and production hours 52. The annual planned manufacturing cost of the basic production workshop of an enterprise is 160000 element ; The planned output of each product in the whole year : A product 2000 Pieces of , B product 2500 Pieces of , C product 1000 Pieces of ; Man hour quota per unit product : A product 5 Hours , B product 6 Hours , C product 7 Hours .10 Actual output in the month : A product 200 Pieces of , B product 280 Pieces of , C product 70 Pieces of .10 Manufacturing expenses actually incurred in the month 16000 element . requirement : Adopt the distribution method of annual planned distribution rate , Calculate the annual planned allocation rate of manufacturing expenses and 10 The manufacturing expenses transferred out shall be allocated in the month .

A.5 element / Hours ;15850 element .

B.4 element / Hours ;14400 element .

C.4 element / Hours ;14500 element .

D.5 element / Hours ;16000 element .53. When using the coefficient method , As a standard product, it should be variety 、 A wide range of products .()

54. A product is processed through two processes . The number of products in process at the end of the first operation is 100 Pieces of , The degree of completion is 20%; The number of products in process at the end of the second operation is 200 Pieces of , The degree of completion is 70%. The equivalent output of products in process at the end of the month calculated based on this is ().

A.20 Pieces of

B.135 Pieces of

C.140 Pieces of

D.160 Pieces of 55. In the production man hour ratio method 、 The annual allocation rate is based on the planned method and the direct allocation rate of labor ,“ Manufacturing expenses ” Accounts generally have no ending balance .()

56. The following statements are correct ().

A. In a workshop that produces only one product , Manufacturing expenses are directly included in the product cost

B. A subsidiary account shall be opened for manufacturing expenses according to product varieties

C. A Sub Ledger shall be set up for manufacturing expenses according to the workshop

D. Manufacturing expenses shall be transferred from the credit of this account to “ Basic production cost ’ Account debit 57. When the annual planned allocation rate allocation method is adopted to allocate the manufacturing expenses ,“ Manufacturing expenses ” Accounts usually have balances .()

58. Labor costs are cost items .()

59. The variety method applies to ().

A. A large number of single-step production enterprises

B. A large number of enterprises with multi-step production but management does not require step-by-step cost calculation

C. A large number of multi-step production and enterprises that require step-by-step cost calculation in Management

D. Small batch and single piece production enterprises 60. When using the classification method to calculate the product cost , The classification standard of products includes the structure of products 、 Raw materials and processes used .()

61. The following enterprises that use the batch method to calculate the cost of products are ().

A. An enterprise that organizes production according to customer orders

B. Small businesses with constantly changing varieties

C. A workshop for trial production of new products

D. A processing plant that undertakes repair business 62. Depreciation of basic workshop machinery and equipment shall be included in () Account debit .

A.“ Accumulated depreciation ”

B.“ Management cost ”

C.“ Manufacturing expenses ”

D.“ Basic production cost ”63. The central content of ABC is to take each activity as the accounting object , Confirm and measure the workload through cost drivers , Then a modern cost accounting method that allocates indirect costs based on the workload .()

64. The interactive allocation method of auxiliary production cost allocation method , have () Characteristics .

A. The accounting workload is large

B. The accounting work is relatively simple

C. Two cost allocation rates need to be calculated

D. The accounting result is more accurate 65. In the function of cost , Which are the tasks that should be done in advance ()

A. Cost forecast cost decision cost accounting

B. Cost forecast cost decision cost plan

C. Cost control cost calculation cost assessment

D. Cost calculation cost assessment cost analysis 66. Interest expense in element expense , It is not part of the product cost , It is an expense item of financial expenses .()

67. If the production batch is not large , And the products in the batch have been completed successively across months for a short time , The cost of finished products can be calculated and carried forward according to the planned unit cost .()

68. In order to correctly calculate the product cost , The basic work that should be done well includes ().

A. Formulation and revision of quota

B. Original record work

C. Correctly select various allocation methods

D. Measurement of materials 、 Send and receive 、 Collection, return and inventory 69. The cost calculation period of variety method is characterized by ().

A. Calculate the cost on a monthly basis , Consistent with the production cycle .

B. Calculate the cost on a monthly basis , Inconsistent with the production cycle .

C. Calculate the cost on a monthly basis , Inconsistent with the accounting reporting period .

D. Calculate the cost on a monthly basis , Consistent with the accounting reporting period .70. In the following ways , The auxiliary method of product cost calculation is ().

A. Variety method

B. Batch method

C. Step by step

D. classification 71. When allocating manufacturing expenses according to the annual planned allocation rate allocation method , If the allocated quota at the end of the year is greater than the actual amount , The difference should be in 12 month ().

A. Debit... In blue “ Manufacturing expenses ” subject , credit “ Auxiliary production cost ” subject

B. Debit... In red “ Manufacturing expenses ” subject , credit “ Basic production cost ” subject

C. Debit... In red “ Basic production cost ” subject , credit “ Manufacturing expenses ” subject

D. Debit... In blue “ Basic production cost ” subject , credit “ Manufacturing expenses ” subject 72. An enterprise will M、N Two products as a class , Use the classification method to calculate the product cost .M、N The two products consume A Materials , The consumption quota is 40 Kilogram and 30 kg , Per kilogram A The unit cost of each material is 5 element . The company will M As a standard product , Then the raw material cost coefficient of product B is ().

A.0.75

B.6.25

C.1.33

D.0.473. The classification of product cost calculation is ().

A. Set up cost Sub Ledger by product category

B. Set up cost Sub Ledger by product variety

C. Collect production expenses by product category , Calculate the product cost

D. The indirect costs of various products in the same kind of products are allocated and determined by a certain allocation method 74. The cost reduction is based on the cost composition of the semi-finished products produced this month .()

75. The pricing method of in-process products according to quota cost is applicable to quota management with a good foundation , Each consumption quota or expense quota is relatively accurate 、 Stable , And products with little change in the number of products in each month .()

76. Combination of calculation and management , It is the requirement of cost accounting to count it as effective .()

77. When picking up machine materials in the production workshop , The account to be debited is ().

A.“ Basic production cost ” subject

B.“ Auxiliary production cost ” subject

C.“ Manufacturing expenses ” subject

D.“ Management cost ” subject 78. The following is not the basic method of cost calculation ().

A. Variety method

B. Batch method

C. Quota method

D. Step by step 79. Directly used in product production , However, it is not convenient to directly calculate the product cost , Therefore, there is no special cost item , And various expenses indirectly used in the production of products refer to ().

A. Overhead

B. Direct costs

C. Manufacturing expenses

D. Financial expenses 80. The difference of quota change refers to the change of quota or production cost () The difference between the old and new quotas .

A. Planned price

B. The actual price

C. Variable price

D. Break away from the fixed price 81. The comprehensive carry forward step-by-step method is a semi-finished product cost carry forward method that registers each cost item in the self-made semi-finished product Sub Ledger and the production cost Sub Ledger of the next step .()

82. In taxonomy , The method of allocating the cost of various products in the same kind of products according to the coefficient proportion , be called ().

A. classification

B. Quota method

C. Variety method

D. Coefficient method 83. Under the quota method , Since the production cost of the product is calculated separately according to the quota cost and the difference from the quota , The actual cost of the product can be calculated according to the quota cost of the product, and can be calculated according to the following formula ().

A. The actual cost of the product = Product quota cost +(-) Deviation from quota

B. The actual cost of the product = Product quota cost + Deviation from quota

C. The actual cost of the product = Product quota cost - Deviation from quota

D. The actual cost of the product = Product quota cost × Deviation from quota 84. Other expenses in various element expenses of industrial enterprises include ().

A. Postage

B. Printing costs

C. insurance premium

D. Advertising expenses 85. An enterprise 6 end of the month , The accumulated raw material cost of all products 68880 element , Working hours 47040 Hours , Wages and benefits 18861 element , Manufacturing expenses 28224 element . Cost of raw materials for finished products 32400 element ,6 Man hours of finished products at the end of the month 23020 Hours . requirement : Calculate the cost of finished products (1) Calculate the cumulative distribution rate of wages and welfare expenses .

A.0.4

B.0.6

C.1.6

D.1.486. In the following costing method , The auxiliary cost calculation method is ().

A. classification

B. Quota method

C. Step by step

D. Batch method 87. The object of cost reduction is the cost of finished goods with “ Partially Prepared Products ” The comprehensive cost listed in the project , Cost reduction is based on the cost structure of semi-finished products in the previous step .()

88. The scope of application of the variety law includes ().

A. Mass production

B. Mass and multi-step production

C. A large number of multi-step production that does not require step-by-step costing in management

D. Single piece small batch production 89. Suppose an industrial enterprise has a basic production workshop and an auxiliary production workshop , The former produces a 、 B two products , The latter provides a kind of labor service . The relevant economic business occurred in a certain month is as follows : Payroll expenses incurred 6300 element . Among them, the wages of production workers in the basic production workshop 3400 element , Salaries of management personnel 1300 element ; Wages of production workers in auxiliary production workshop 1100 element , Salaries of management personnel 500 element . The manufacturing cost of auxiliary production of the enterprise does not pass “ Manufacturing expenses ” Account accounting . requirement : Prepare relevant accounting entries based on the above information .

A. borrow : Basic cost incurred 3400

B. borrow : Manufacturing expenses 1300

C. borrow : Auxiliary production cost 1600

D. loan : Salary payable 6300

E. borrow : Manufacturing expenses 1800

F. borrow : Auxiliary production cost 110090. The direct distribution method applies to ().

A. Auxiliary production workshops provide less labor services to each other

B. There is an obvious order in the benefit degree of interactive distribution auxiliary production workshop

C. No interactive allocation has little impact on auxiliary production cost and enterprise product cost

D. The planned cost base is good 91. The product cost of industrial enterprises is finally calculated through the following () Account .

A.“ Manufacturing costs ”

B.“ Basic production cost ”

C.“ Manufacturing expenses ”

D.“ Auxiliary production cost ”92. Adopt step-by-step carry forward method , According to the reflection method of the semi-finished products carried forward in the product cost Sub Ledger in the next step , There are two methods: comprehensive carry forward and itemized carry forward .()

93. The cost of various products in the category calculated by classification , With certain assumptions ().

94. In a large number of multi-step production enterprises , Management does not require step-by-step calculation of product cost , The cost calculation method is ().

A. Variety method

B. classification

C. Batch method

D. Step by step 95. Product a is processed continuously in two production steps , After the first step of processing is completed, turn to the second step of continuous processing , Made into finished products . Total expenses incurred in the first step 50000 element , Cost of finished semi-finished products 30000 element ; The second step is the cost of finished products in this month 48000 element , The cost of semi-finished products 36000 element . requirement : Calculate the cost reduction rate of product a ().

A.1.2

B.1.6

C.0.72

D.0.8396. The cost of raw materials used to produce products and form product entities shall be charged to the following accounts ().

A.“ Basic production cost ”

B.“ selling expenses ”

C.“ Manufacturing expenses ”

D.“ Management cost ”97. Among the following enterprises , Suitable for calculating product cost by variety method are ().

A. Power generation enterprises

B. Automobile manufacturing enterprises

C. Mining enterprises

D. Shipbuilding enterprises 98. The products produced by enterprises can be divided into ()

A. Comparable products

B. Incomparable products

C. Simple products

D. complex product 99. Fuel cost and wage cost are product cost items .()

100. An enterprise uses the simplified batch method to calculate the product cost , The production man hours of products in progress recorded in the secondary account of basic production cost of this month are 30760 Hours , Wages and benefits are 50180 element , The working hours occurred in this month are 30270 Hours , Wages and benefits are 53571 element . Then the distribution rate of salary and welfare expenses in this month is .()

A.1.7

B.1.8

C.1.6

D.3

边栏推荐

- 软件测试行业的未来趋势及规划

- 線程及線程池

- JS --- JS function and scope (II)

- LeetCode#204. Count prime

- Indonesian medical sensor Industry Research Report - market status analysis and development prospect forecast

- LeetCode#53. Maximum subarray sum

- How to build a nail robot that can automatically reply

- ArrayList set

- Research Report on medical toilet industry - market status analysis and development prospect forecast

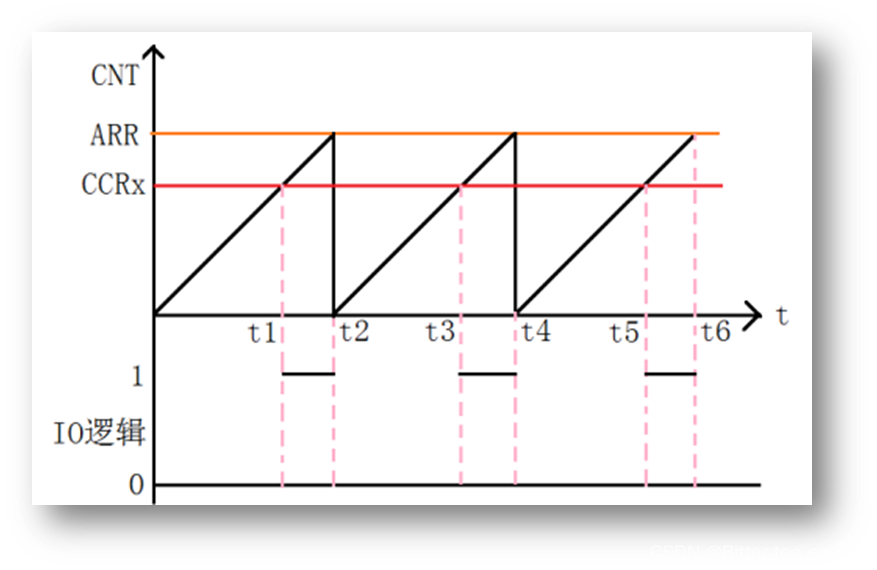

- 学习记录:如何进行PWM 输出

猜你喜欢

STM32 learning record: input capture application

Learning record: how to perform PWM output

What is "test paper test" in software testing requirements analysis

![[pytorch] simple use of interpolate](/img/16/87aa8a49e60801404822fe644e70c8.jpg)

[pytorch] simple use of interpolate

Your wechat nickname may be betraying you

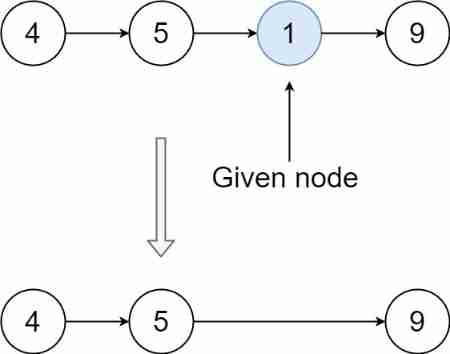

LeetCode#237. Delete nodes in the linked list

What if software testing is too busy to study?

What are the commonly used SQL statements in software testing?

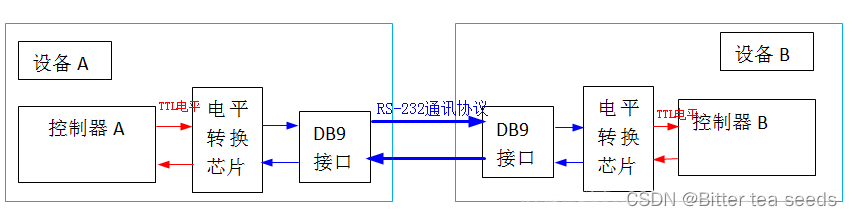

学习记录:USART—串口通讯

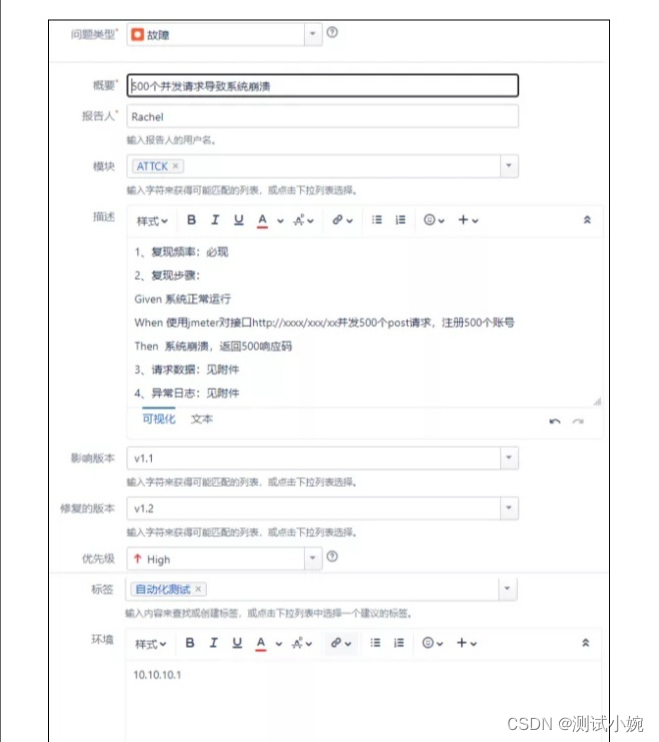

软件测试Bug报告怎么写?

随机推荐

Report on the market trend, technological innovation and market forecast of printing and decorative paper in China

MATLAB实例:阶跃函数的两种表达方式

学习记录:串口通信和遇到的错误解决方法

ArrayList set

Learning record: use STM32 external input interrupt

Learning record: Tim - capacitive key detection

csapp shell lab

Do you know the advantages and disadvantages of several open source automated testing frameworks?

C4D quick start tutorial - creating models

What if software testing is too busy to study?

Servlet

力扣刷题记录--完全背包问题(一)

Research Report on medical anesthesia machine industry - market status analysis and development prospect prediction

LeetCode#198. raid homes and plunder houses

学习记录:TIM—电容按键检测

Eigen User Guide (Introduction)

Matlab example: two expressions of step function

Winter vacation daily question - maximum number of balloons

Automated testing problems you must understand, boutique summary

Take you to use wxpy to create your own chat robot (plus wechat interface basic data visualization)