当前位置:网站首页>Cost accounting [22]

Cost accounting [22]

2022-07-06 15:36:00 【Star drawing question bank】

1. The following are not capital expenditures ().

A. Expenses incurred in the purchase of patent rights

B. Expenses incurred in purchasing machinery and equipment

C. Expenses incurred in purchasing a house

D. Expenditure on purchased materials 2. The product cost is calculated by parallel carry forward step-by-step method , Be able to directly provide product cost information reflected by original cost items , So there is no need to restore the cost .()

3. If the manufacturing cost of the auxiliary production workshop is small , In order to reduce the transfer procedures , Or not “ Manufacturing expenses ” Account , And directly recorded “ Auxiliary production cost ” Account .()

4. Enterprises have many varieties and specifications , The number of less 、 Sporadic products with small cost proportion , To simplify the accounting work , The cost can be calculated by classification .()

5. An enterprise 10 end of the month , The accumulated raw material cost of all products 98880 element , Working hours 122060 Hours , Wages and benefits 207502 element , Manufacturing expenses 280738 element . Cost of raw materials for finished products 82400 element ,10 Man hours of finished products at the end of the month 23020 Hours . requirement : Calculate the cumulative distribution rate of manufacturing expenses .

A.1.3

B.2

C.2.3

D.36. Set up in the enterprise “ Fuel and power ” In the case of cost items , Fuel costs incurred in the production workshop directly used for product production , The account to be debited is ().

A.“ Basic production cost ”

B.“ raw material ”

C.“ fuel ”

D.“ Manufacturing expenses ”7. Because cost is a component of product value , Therefore, the cost is bound to be compensated through sales revenue .()

8. The object of cost accounting of industrial enterprises is the manufacturing cost of products produced by industrial enterprises .()

9. The auxiliary production cost adopts the interactive allocation method , The total amount of expenses allocated to the outside world is ().

A. Cost before interactive allocation

B. The cost before interactive allocation plus the cost transferred in by interactive allocation

C. The cost before interactive allocation minus the cost transferred out of interactive allocation

D. The cost before interactive allocation plus the cost transferred in by interactive allocation , Minus the cost of interactive allocation transfer out 10. An enterprise produces product a this month , The total cost of products in progress at the beginning of the month and the cost of production in the current month is 20000 element , The cost of work in progress at the end of the month is 1500 element . Loss of repairable waste of finished products 1000 element , Irreparable waste loss occurs 2000 element . The price of scrap materials 500 Yuan warehousing , Compensation by the negligent person 300 element . Product a is qualified 180 Pieces of . requirement : Calculate the unit cost of qualified products .

A.139 element

B.115 element

C.124 element

D.136 element 11. Cost reduction rate of comparable products , It can reduce the cost of products , Fill in according to the actual annual cost .()

12. If a product has a large number of products at the end of the month , The number of products in progress varies greatly in each month , There is little difference in the proportion of various expenses in the product cost , Production costs are allocated between finished products and products at the end of the month , The method to be used is ().

A. Not included in the product cost method

B. Equivalent yield ratio method

C. Work in progress is calculated as finished products

D. Quota proportional method 13. An enterprise A product 9 The quota cost of raw materials consumed in this month is 67000 element , Deviation from the quota is an overspending 800 element , The cost variance rate of raw materials is overspending 1%. requirement : Calculate the material cost variance that should be allocated to the product .

A.-678 element

B.+678 element

C.+662 element

D.-662 element 14. The product of an enterprise goes through three processes , The man hour quota of each process is 20 Hours and 40 Hours 、60 Hours , Then the completion rate of the third process is ().

A.68%

B.75%

C.70%

D.71%15. The differences between the fixed cost and planned cost of products are ().

A. The former is calculated on the basis of consumption quota , The latter is calculated based on the planned quota

B. The former usually changes during the planning period , The latter is usually unchanged during the planning period

C. The former is the cost calculated based on the current consumption quota , The latter is the cost calculated based on the average consumption quota in the planning period

D. The former is based on the actual price , The latter is calculated based on the planned price

E. The former is the basis for enterprise cost control and assessment , The latter is the basis for national institutions to conduct cost assessment on enterprises 16. Variety method is a kind of () Cost calculation method .

A. The most simple

B. The most basic

C. The most complicated

D. Most special 17. At the end of the month, when the employee salary is distributed , The account to be debited for the staff salary of the medical and Welfare Department is ().

A.“ Salary payable ”

B.“ Manufacturing expenses ”

C.“ Management cost ”

D.“ selling expenses ”18. Various production expenses included in the product cost , According to the method included in the product cost , It can be divided into direct expense and indirect expense .()

19. The variety method of product cost calculation , It takes the product batch as the object of cost calculation , Collect production costs , A method of calculating the cost of a product .()

20. Format of cost report 、 The content and preparation time are generally determined according to the characteristics of production and operation process and the specific requirements of enterprise management .()

21. Attendance records and output records are the main original records of employee salary accounting .()

22. Not set in the enterprise “ Fuel and power ” In the case of cost items , The power cost directly used for product production in the production workshop , The account to be debited is ().

A.“ Basic production cost ”

B.“ Auxiliary production cost ”

C.“ Manufacturing expenses ”

D.“ Management cost ”23. Classification is a basic method of product cost calculation with product category as the object of cost calculation ().

24. The content of cost analysis mainly includes the analysis of the completion of cost plan 、 Cost budget implementation analysis and cost-benefit analysis .()

25. In the following ways , The auxiliary methods of product cost calculation include ().

A. Variety method

B. Step by step

C. Quota method

D. classification 26. For mechanization 、 A highly automated Workshop , The manufacturing cost can be allocated according to the proportion of machine working hours .()

27. All expenses incurred to raise funds for production and operation are called ().

A. Management cost

B. Financial expenses

C. Production costs

D. Production costs 28. An enterprise uses the simplified batch method to calculate the cost of each batch of product a .3 The relevant information in the cost Sub Ledger of each batch of products in the month is as follows :1023 Batch number :1 In production 22 Pieces of . All completed this month , Accumulated raw material cost 79750 element , Accumulated man hours consumed 8750 Hours .2011 Batch number :2 In production 30 Pieces of . Completed this month 20 Pieces of , Accumulated raw material cost 108750 element , Accumulated man hours consumed 12152 Hours ; Raw materials are put into operation at the beginning of production ; The completion degree of products in progress at the end of the month is 80%, The man hours consumed are allocated by the equivalent production proportion method .3015 Batch number : Put into operation this month 5 Pieces of , All unfinished , Accumulated raw material cost 18125 element , Accumulated man hours consumed 2028 Hours . The accumulated indirect expenses included in the secondary account collection of basic production costs are : Wages and benefits 36688 element , Manufacturing expenses 55032 element ; requirement : Calculate the cumulative working hours of all products according to the above data .( List calculation process )

A.22930

B.36688

C.55032

D.20662529. Cost statements only reflect accounting information , It does not reflect the production technology level of the enterprise .()

30. In product variety 、 Enterprises with various specifications , Provide cost management information as soon as possible , Simplify costing , The variety method can be used to calculate the product cost .()

31. Manufacturing expenses shall be allocated to () Account .

A. Basic production cost and auxiliary production cost

B. Basic production costs and administrative expenses

C. Production costs and administrative expenses

D. Financial and operating expenses 32. In the following items , The downtime loss that should be included in the product cost is ().

A. Abnormal shutdown losses caused by natural disasters

B. Shutdown loss due to abnormal reasons

C. Downtime loss during fixed assets repair

D. Non seasonal downtime losses 33. In the case of small batch, single piece and multi-step production , If management does not require step-by-step calculation of product cost , The costing method to be used is ().

A. Batch method

B. Step by step

C. classification

D. Fixed cost method 34. An industrial enterprise produces A product , The loss of repairable waste products this month is : raw material 1500 element , Direct labor costs 350 element , Manufacturing expenses 450 element . This month, A The product is put into production 500 Pieces of , Raw materials are put into production at one time , The actual cost is : Direct material 62500 element ; Direct labor 13888 element , Production cost 15376 element .A The qualified product is 490 Pieces of , Irreparable waste 10 Pieces of , Its processing degree is 60%, The price of scrap materials 300 Yuan warehousing . requirement : Calculate according to the above data A Net loss of product repairable waste and non repairable waste .

A.3904 element

B.3604 element

C.4204 element

D.3304 element 35. The production cost statement mainly includes ()

A. Cost statement of goods and products

B. Unit cost table of main products

C. Breakdown of manufacturing expenses

D. Income statement

E. Breakdown of administrative expenses 36. Adopt the equivalent yield method , The raw material cost is allocated according to the finished products and the product quantity at the end of the month. The conditions that should be met are ().

A. Raw materials are put into use one after another

B. Raw materials are put into use at the beginning of production

C. Raw materials account for a significant proportion of product costs

D. Raw materials are input according to quota 37. The classification method can be used to calculate the product cost of artificially created grade products .()

38. The application of the parallel carry forward step-by-step method is ().

A. Semi finished products are rarely sold abroad

B. Semi finished products are not sold

C. In terms of management, it is not required to provide semi-finished product data of each step

D. In terms of management, it is required to provide the cost data of semi-finished products in each production step 39. An enterprise has two auxiliary production workshops for repair and transportation 、 department . The repair shop incurred expenses this month 18000 element , Provide repair man hours 30000 Hours , among : Repair... For the transportation department 1500 Hours , Repair... For basic production workshop 24000 Hours , Repair... For the administration 4500 The hourly repair cost is allocated according to the proportion of repair man hours . The expenses incurred by the transportation department this month are 22000 element , Transport materials, etc 40000 Ton kilometers , among : Provide transportation services for the repair workshop 2000 Ton kilometers , Provide transportation services for basic production workshops 32000 Ton kilometers , Provide transportation services for administrative departments 6000 Ton kilometers . requirement : The interactive distribution method is used to calculate the external distribution 、 The actual cost of transportation .

A. Repair shop =12500( element ) Transportation Workshop =37500( element )

B. Repair shop 18200( element ) Transportation Workshop =21800( element )

C. Repair shop =12500( element ) Transportation Workshop 42500( element )

D. Repair shop =20500( element ) Transportation Workshop =19500( element )40. When using factor analysis method for cost analysis , The sum of the impact of changes in various factors on economic indicators , It should be equal to the difference between the actual number of this economic indicator and the base ()

41. A large electronic manufacturing company , At present, there is no accounting for the cost of a single product , There is only one total of manufacturing cost and labor cost , Evaluate the appropriateness of this method with cost accounting procedures , What's the impact .()

A. Don't fit

B. appropriate , It doesn't matter

C. Adversely affect cost control

D. Manufacturing expenses and labor expenses shall be accounted separately as the constituent items of product cost 42. Among the following items, those belonging to the production cost of products are ().

A. Outsourcing power cost

B. Manufacturing expenses

C. Labor cost

D. Depreciation expense 43. When using quota method to calculate product cost , When calculating the variation of product quota at the beginning of the month , If the difference of quota reduction , Then... Should be deducted from the product quota cost at the beginning of the month , At the same time, add the product cost of this month .()

44. When using the quota method to calculate the cost , In order to facilitate the analysis and assessment of products , The quota cost of raw materials and the difference from the quota are based on the cost of raw materials () Calculation .

A. actual cost

B. Fixed cost

C. Planning cost

D. Out of quota cost 45. Of the following , The contents of cost accounting and supervision include ().

A. Realization of operating income

B. Withdrawal of surplus reserve

C. The expenditure of various production expenses and the formation of product production costs

D. Expenditure and collection process of various period expenses 46. An enterprise 9 end of the month , The accumulated raw material cost of all products 98880 element , Working hours 122060 Hours , Wages and benefits 207502 element , Manufacturing expenses 280738 element . Cost of raw materials for finished products 82400 element ,9 Man hours of finished products at the end of the month 23020 Hours . requirement : Calculate the cumulative distribution rate of wages and welfare expenses .

A.0.9

B.0.5

C.1.6

D.1.747. Suppose an industrial enterprise has a basic production workshop and an auxiliary production workshop , The former produces a product , The latter provides a kind of labor service . The relevant economic business occurred in a certain month is as follows : Raw materials used in production 12540 element , Which is directly used in the production of product a 7700 element , Used as basic workshop machine material 1210 element ; Directly used for auxiliary production 2700 element , Used as auxiliary workshop machine material 930 element . The manufacturing cost of auxiliary production of the enterprise does not pass “ Manufacturing expenses ” Account accounting . requirement : Prepare relevant accounting entries based on the above information .

A. borrow : Basic production cost --- A product 7700 Manufacturing expenses 1210 Auxiliary production cost 3630

B. loan : raw material 12540

C. borrow : Basic production cost -- A product 7700 Auxiliary production cost 4840

D. loan : Basic production cost -- A product 7700 Management cost 1210 Auxiliary production cost 363048. Sub item progressive carry forward step-by-step method , It is not allowed to follow the of semi-finished products () Carry forward .

A. actual cost

B. Planning cost

C. Fixed cost

D. Responsibility cost 49. Adopt parallel carry forward step-by-step method ,().

A. It can not fully reflect the production consumption level of each production step

B. It can fully reflect the production consumption level of each production step

C. It can fully reflect the production consumption level of products in the first production step

D. It cannot fully reflect the production consumption level of the products in the first production step 50. Adopt parallel carry forward step-by-step method , If it is carried forward comprehensively according to the cost of semi-finished products , Cost reduction is also required .()

51. Product cost refers to the production of a certain kind of 、 The expenditure on a certain number of products ().

A. Sum of production costs

B. Total production, operation and management expenses

C. Total operating and administrative expenses

D. material 、 work 、 The sum of operating expenses and management expenses 52. The object of cost restoration is ().

A. Generalized WIP cost

B. The cost of semi-finished products in each step

C. The cost of semi-finished products in the previous step consumed by finished products

D. Cost of work in progress of each step 53. The irreparable waste loss of the enterprise will make the enterprise ().

A. The total cost of the product may be reduced

B. The total cost of the product may increase

C. The unit cost of products has increased

D. Reduce the unit cost of products

E. The output of products decreases 54. A product is processed continuously in two production steps , After the first step of processing is completed, turn to the second step of continuous processing , Made into finished products . Total expenses incurred in the first step 125000 element , Cost of finished semi-finished products 75000 element ; The second step is the cost of finished products in this month 98000 element , The cost of semi-finished products 75000 element .

A.1.25

B.1

C.0.16

D.0.1255. There is no problem of finished products and cost allocation between products under the variety method .()

56. When the auxiliary production workshops provide little labor services to each other , The appropriate allocation method of auxiliary production cost is ().

A. Direct distribution method

B. Interactive allocation method

C. Planned cost allocation method

D. Algebraic distribution 57. The accounting accounts used in the cost accounting of industrial enterprises include ().

A.“ Basic production cost ”

B.“ Auxiliary production cost ”

C.“ Manufacturing expenses ”

D.“ Waste loss ”58. An enterprise uses the service life method to withdraw depreciation . The original price of a fixed asset is 80000 element , The estimated net residual value ratio is 5%, The estimated service life is 10 year . The fixed assets 2002 year 10 Purchased and put into use in January ,2013 year 8 Scrapped in January , The depreciation accrued at the time of scrapping is ().

A.78200 element

B.76800 element

C.80000

D.7600059. The fixed assets of an enterprise are depreciated using the service life method , The net residual value rate of a certain type of fixed assets is 5%, It is expected that 15 year , Then the annual depreciation rate is ().

A.6.67%

B.6.33%

C.5.37%

D.6%60. The variety method is suitable for mass production , And the management does not require multi-step production enterprises to calculate the product cost step by step .()

61. Allowances included in gross wages include ().

A. Technical allowance

B. Allowance to compensate employees for special labor consumption

C. Health benefits

D. Other allowances 62. The downtime loss that should be included in the product cost is ().

A. Shutdown loss caused by fire

B. The shutdown loss that should be compensated by the fault unit

C. Loss of downtime during seasonal and fixed asset repair

D. Shutdown loss caused by earthquake 63. Under the batch method , The product cost calculation period is inconsistent with the product production cycle , But it is consistent with the accounting reporting period .()

64. In all costing methods , Variety method is the most basic method , Calculating the unit cost of each product is the ultimate goal of cost calculation .()

65. An enterprise uses the simplified batch method to calculate the cost of each batch of product a .3 The relevant information in the cost Sub Ledger of each batch of products in the month is as follows :1023 Batch number :1 In production 22 Pieces of . All completed this month , Accumulated raw material cost 79750 element , Accumulated man hours consumed 8750 Hours .2011 Batch number :2 In production 30 Pieces of . Completed this month 20 Pieces of , Accumulated raw material cost 108750 element , Accumulated man hours consumed 12152 Hours ; Raw materials are put into operation at the beginning of production ; The completion degree of products in progress at the end of the month is 80%, The man hours consumed are allocated by the equivalent production proportion method .3015 Batch number : Put into operation this month 5 Pieces of , All unfinished , Accumulated raw material cost 18125 element , Accumulated man hours consumed 2028 Hours . The accumulated indirect expenses included in the secondary account collection of basic production costs are : Wages and benefits 36688 element , Manufacturing expenses 55032 element ; requirement : Calculate the cumulative salary and welfare distribution rate according to the above data .( List calculation process )

A.1.7

B.1.8

C.1.6

D.366. The following calculation procedures related to variety method are correct ().

A. If only one product is produced , Just open a product cost Sub Ledger for this product

B. If you produce multiple products , The sub ledger of product cost shall be set up according to the variety of products

C. All direct expenses incurred are directly included in the cost Sub Ledger of each product

D. Indirect costs incurred are allocated among various products by appropriate allocation methods 67. The quota method or quota method is applicable to the accurate comparison of various expenses 、 Stable , However, products with little change in product quantity at the end of each month .()

68. The finished products of an enterprise at the end of this month 250 Pieces of , Products in 160 Pieces of . The degree of completion of the product 40%, The cost of raw materials at the beginning of the month and this month 56520 element , Raw materials have been put into production , Then the cost of raw materials for finished products and products in process is ().

A.45000 element 、11250 element

B.40000 element 、16250 element

C.45000 element 、11520 element

D.34298 element 、21952 element 69. The amortization amount of low value consumables used in the production of products shall be recorded in “ Basic production cost ” Account .()

70. The formulation process of fixed cost , It is the process of reflecting and supervising the product cost in advance , It is also the process of implementing ex ante cost control .()

71. Auxiliary production tools and mold manufacturing , Generally, it should be ()

A. Batch method

B. Step by step

C. classification

D. Variety method 72. In the following accounts , There may be a debit balance at the end of the month , There may also be a credit balance ().

A.“ Manufacturing expenses ”

B.“ Basic production cost ”

C.“ Material cost difference ”

D.“ Management cost ”73. The basic production workshop of an enterprise produces a 、 B 、 C three products .7 The total amount of employee compensation for production work in this month is 14700 element , Product a is completed 1000 Pieces of , B. product completion 400 Pieces of , C. product completion 450 Pieces of , Man hour quota of single product : A product 2.5 Hours , B product 2.45 Hours , C product 1.6 Hours . It is required to allocate Party A according to the proportion of fixed working hours 、 B 、 C. employee compensation of product production workers , The correct calculation is ().

A. nail 8750

B. B 3430

C. C 2520

D. nail 、 B 、 C are 490074. In a large number of multi-step production enterprises , If the production scale of the enterprise is small , And the cost information of each step is not required in cost management , The variety method can also be used to calculate the product cost .()

75. An enterprise 7 end of the month , The accumulated raw material cost of all products 68880 element , Working hours 47040 Hours , Wages and benefits 18861 element , Manufacturing expenses 28224 element . Cost of raw materials for finished products 32400 element ,7 Man hours of finished products at the end of the month 23020 Hours . requirement : Calculate the cumulative distribution rate of wages and welfare expenses .

A.0.4

B.0.6

C.1.6

D.1.476. An enterprise will E、F Two products as a class , Use the classification method to calculate the product cost .E、F The two products consume A Materials , The consumption quota is 40 Kilogram and 30 kg , Per kilogram A The unit cost of each material is 5 element . The company will F As a standard product , Then the raw material cost coefficient of product a is ().

A.0.75

B.6.25

C.1.33

D.0.477. Allocation of purchased power costs , With instrument records , It shall be calculated according to the quantity of power consumed as shown in the instrument and the unit price of power .()

78. The change of consumption quota is generally continuous () The trend of , Therefore, the change difference of product quota at the beginning of the month , It usually shows the depreciation of the value of products at the beginning of the month .

A. rising

B. smooth

C. wave

D. Reduce 79. The cost of various raw materials directly used in product production , Should be recorded “ Basic production cost ” Debit of general ledger and its Sub Ledger (“ Direct material ” Cost items ), credit “ raw material ” Account .()

80. There are two procedures for auxiliary production cost collection , Accordingly ,“ Auxiliary production cost ” There are also two ways to set the Sub Ledger , The difference between the two is that the procedures for the collection of auxiliary production manufacturing costs are different .()

81. When the following expenses occur , You can debit directly “ Basic production cost ” The account has ().

A. Electricity for workshop lighting

B. The cost of raw materials constituting the product entity

C. Salary of workshop management personnel

D. Salary of workshop production workers 82. Variety method is the most basic method of product cost calculation , This is because ().

A. The variety method is the simplest to calculate the cost

B. Any cost calculation method must finally calculate the cost of each variety

C. The cost calculation procedure of variety method is the most representative

D. The variety method needs to calculate the product cost on a monthly basis 83. The cost report includes ()

A. Unit cost table of main products

B. Breakdown of manufacturing expenses

C. Breakdown of administrative expenses

D. Production cost table 84. The simplified batch method is applicable to which of the following situations ().

A. There are many batches of products put into production in the same month

B. The number of batches of finished products at the end of the month is small

C. There are many batches of products in process at the end of the month

D. The level of indirect costs varies little from month to month 85. Preparation of manufacturing cost table ()

A. By year

B. By season

C. monthly

D. By ten days 86. The auxiliary workshops of an enterprise incurred a total of production expenses this month 73326 element . among : Cost of raw materials 51200 element , Machine material consumption 3420 element , Payroll payable to production workers 4992 element . Payroll payable to workshop managers 2184 element , Accrued depreciation 3340 element , Total office expenses and other expenses paid with bank deposits 7500 element . requirement : Prepare accounting entries of manufacturing expenses carried forward by auxiliary production workshop .( The manufacturing cost of the auxiliary production workshop is through “ Manufacturing expenses ” Account accounting , The basic production cost Sub Ledger has “ Direct material ”、 Direct labor 、 Manufacturing expenses 、“ Fuel and power ”、 Four cost items , The first three items of auxiliary production cost ).

A. borrow : Auxiliary production cost --- Manufacturing expenses 16444 loan : Manufacturing expenses --- Auxiliary production workshop 16444

B. borrow : Auxiliary production cost --- Manufacturing expenses 72636 loan : Manufacturing expenses --- Auxiliary production workshop 72636

C. borrow : Manufacturing expenses --- Auxiliary production workshop 16444 loan : Auxiliary production cost --- Manufacturing expenses 16444

D. borrow : Manufacturing expenses — Auxiliary production workshop 72636 loan : Auxiliary production cost --- Manufacturing expenses 7263687. The production of industrial enterprises , According to the characteristics of its production organization , Can be divided into ().

A. Mass production

B. mass production

C. Single step production

D. Single piece production 88. An enterprise produces A product , The fixed cost method is used to allocate the material costs of finished products and products in progress at the end of the month . It is known that : Fixed cost of products in progress at the beginning of the month 1000 element , Deviation from quota -10 element ; Fixed cost incurred this month 9000 element , Deviation from quota +110 element ; Finished products of this month 85 Pieces of , Fixed cost per piece 100 element , The material cost variance rate is +2%. requirement : Calculate the distribution rate of deviation from quota . requirement : Calculate the actual cost of finished products .

A.1%/8767.2

B.1%/9767.2

C.2%/8767.2

D.2%/9767.289. It belongs to auxiliary materials commonly used in the production of several products , It can be directly included in the cost of various products .()

90. The main difference between the simplified batch method and the batch method is .()

A. Do not calculate the cost of finished products in batches

B. Do not calculate WIP cost in batches

C. No allocation of overhead costs

D. Do not calculate the cost of raw materials in batches 91. Adopt the planned cost allocation method , Auxiliary production cost variance is recorded in ().

A. Management cost

B. Basic production cost

C. Manufacturing expenses

D. Non operating expenses 92. The organizational division of labor within the cost accounting organization includes ().

A. According to the functional division of cost accounting

B. Division of labor according to the object of cost accounting

C. Centralized working mode

D. Decentralized way of working 93. The auxiliary production cost is allocated by algebraic allocation method ,()

A. Be able to provide correct allocation calculation results

B. It can simplify the allocation and calculation of expenses

C. It is suitable for computerized enterprises

D. The accounting results are not very accurate 94. Implement guaranteed return 、 Bao Xiu 、 Make a change “ Three packs ” The enterprise , All losses caused by waste products found after the product is sold , In accounting, it should be included in ().

A. Waste loss

B. Non operating expenses

C. Management cost

D. Basic production cost 95. The production expenses incurred by the enterprise in the production process , Is the product cost .()

96. The enterprise should be based on () The situation of , Considering the requirements and conditions of Management , Choose an appropriate method to calculate the cost of work in progress at the end of the month .

A. In the number of products

B. The size of the change in the number of products in each month

C. The proportion of various expenses in the cost

D. The basis of quota management is good or bad 97. Of the following , What belongs to the cost element of industrial enterprises is ().

A. Direct labor

B. Fuel and power

C. Labor cost

D. Direct material 98. The variety of products 、 In industrial enterprises with various specifications , To simplify the calculation of work cost , There is also a simple product cost calculation method ().

A. classification

B. Batch method

C. Step by step

D. Variety method 99. Taxes in various element expenses , When incurred or paid , Should be in () Middle disbursement .

A.“ Basic production cost ”

B.“ Management cost ”

C.“ Manufacturing expenses ”

D.“ selling expenses ”100. The number of products in progress at the end of the month is large, and the number of products in progress at the end of each month changes greatly , Products in which the proportion of each cost item is similar , The cost of its work in process shall be calculated by ().

A. Fixed cost method

B. Quota proportional method

C. Equivalent yield method

D. Fixed cost method

边栏推荐

- Learning record: use STM32 external input interrupt

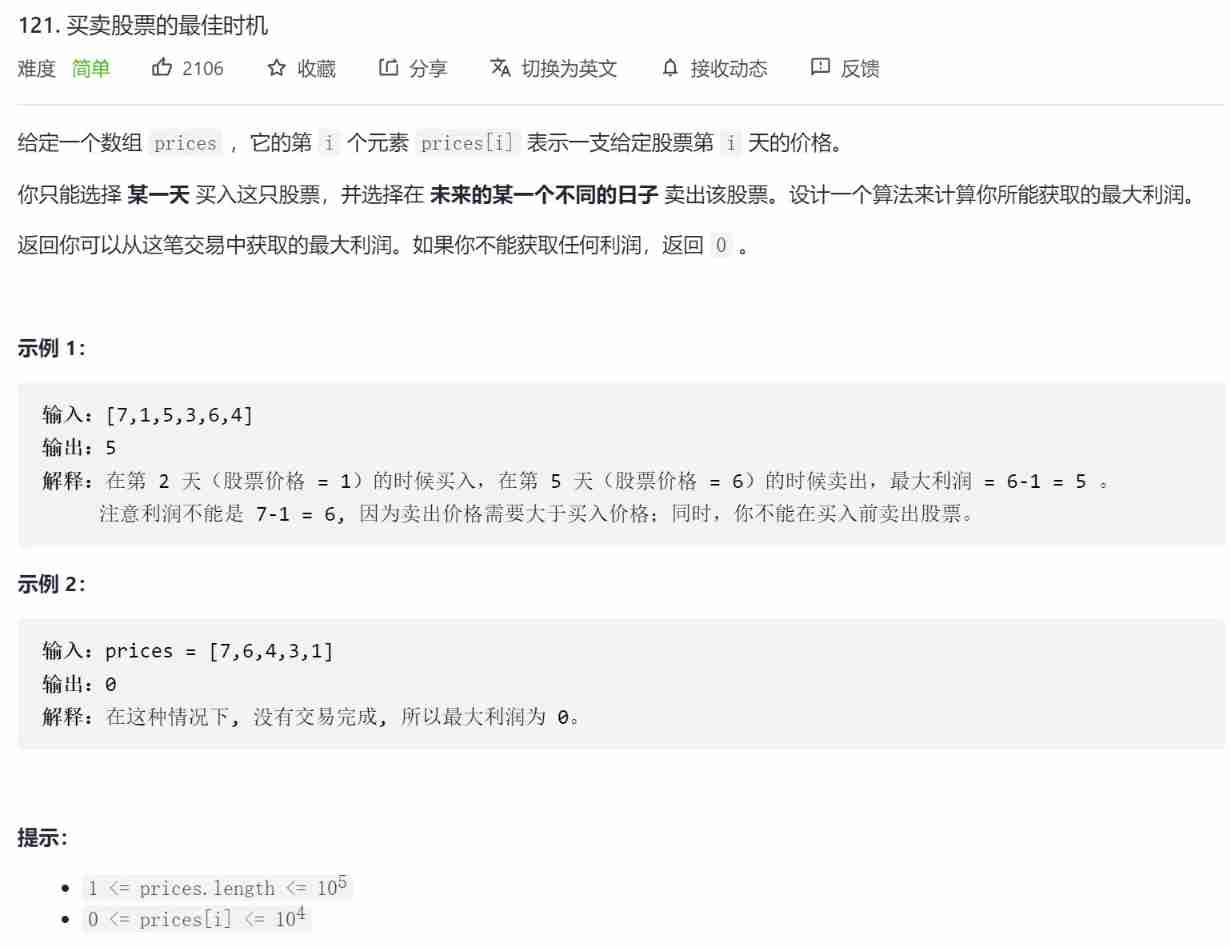

- Leetcode notes - dynamic planning -day7

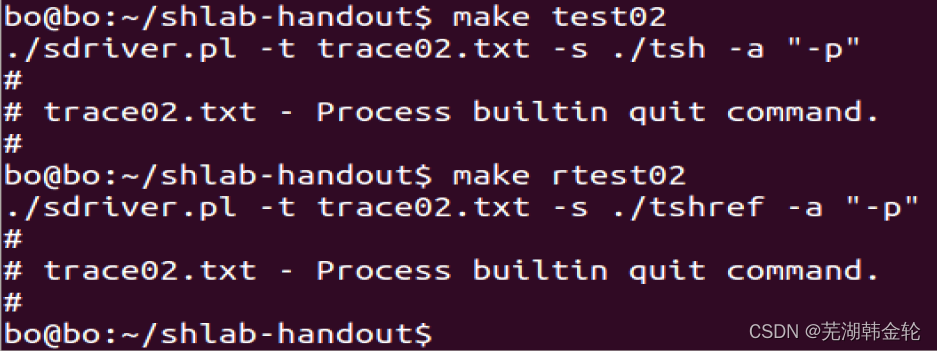

- CSAPP shell lab experiment report

- Interview answering skills for software testing

- MySQL transactions

- Collection集合与Map集合

- Cadence physical library lef file syntax learning [continuous update]

- 软件测试Bug报告怎么写?

- 学习记录:使用STM32F1看门狗

- Leetcode notes - dynamic planning -day6

猜你喜欢

Leetcode notes - dynamic planning -day7

软件测试面试要问的性能测试术语你知道吗?

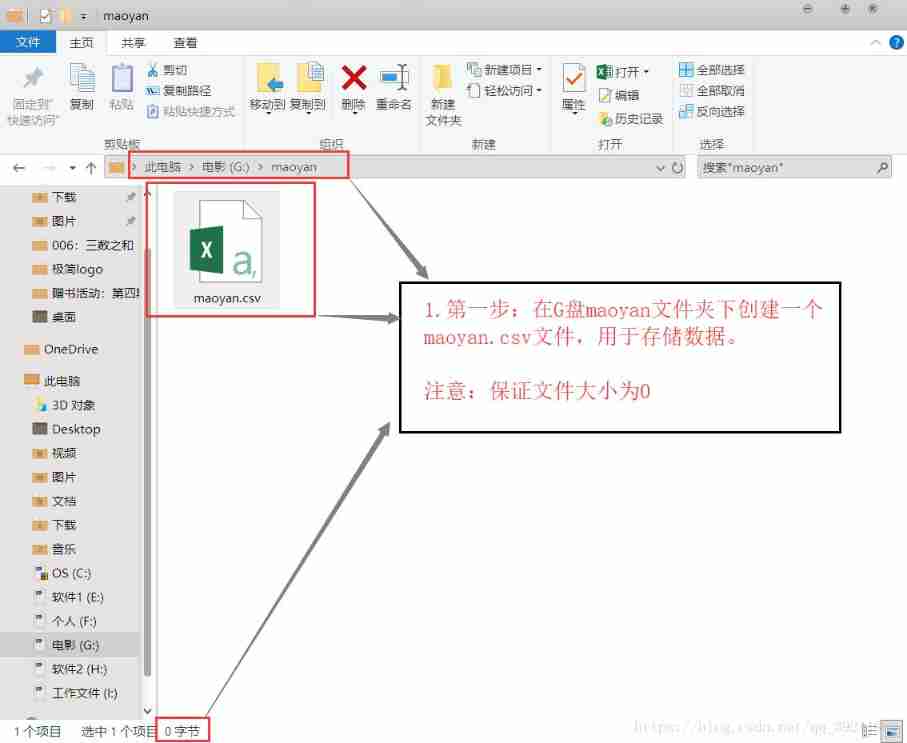

Crawling cat's eye movie review, data visualization analysis source code operation instructions

STM32學習記錄:輸入捕獲應用

Crawler series (9): item+pipeline data storage

What if software testing is too busy to study?

CSAPP shell lab experiment report

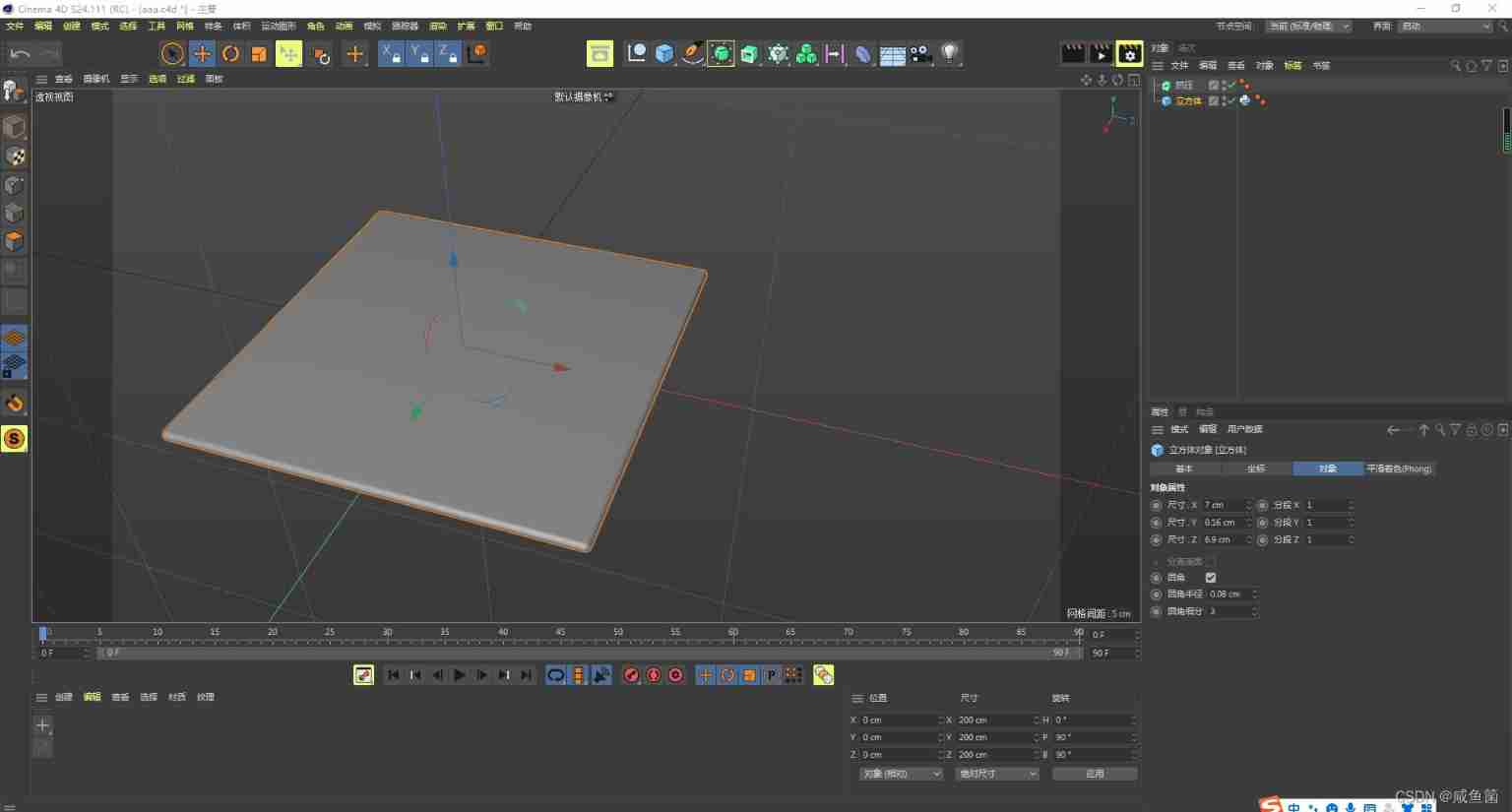

C4D quick start tutorial - Introduction to software interface

What is "test paper test" in software testing requirements analysis

Brief introduction to libevent

随机推荐

STM32學習記錄:輸入捕獲應用

Collection集合与Map集合

ArrayList set

A method and implementation of using VSTO to prohibit excel cell editing

力扣刷题记录

Matlab example: two expressions of step function

转行软件测试必需要知道的知识

[C language] twenty two steps to understand the function stack frame (pressing the stack, passing parameters, returning, bouncing the stack)

UCORE Lab 1 system software startup process

Unpleasant error typeerror: cannot perform 'ROR_‘ with a dtyped [float64] array and scalar of type [bool]

ucorelab3

Indonesian medical sensor Industry Research Report - market status analysis and development prospect forecast

China's PCB connector market trend report, technological innovation and market forecast

Research Report on market supply and demand and strategy of Chinese hospital cleaning chemicals industry

学习记录:USART—串口通讯

Report on the market trend, technological innovation and market forecast of printing and decorative paper in China

Want to change jobs? Do you know the seven skills you need to master in the interview software test

Learning record: STM32F103 clock system overview working principle

Interface test interview questions and reference answers, easy to grasp the interviewer

Mysql database (I)