当前位置:网站首页>Yutai micro rushes to the scientific innovation board: Huawei and Xiaomi fund are shareholders to raise 1.3 billion

Yutai micro rushes to the scientific innovation board: Huawei and Xiaomi fund are shareholders to raise 1.3 billion

2022-07-06 18:55:00 【leijianping_ ce】

RedI network Lei Jianping 7 month 5 Reported Wednesday

Yutai Microelectronics Co., Ltd ( abbreviation :“ Yu Taiwei ”) The prospectus was submitted a few days ago , Ready to be listed on the science and technology innovation board . Yutaiwei plans to raise funds 13 One hundred million yuan .

among ,2.9 Billion yuan for the development and industrialization of vehicle Ethernet chips ,3.9 Billion yuan for Netcom Ethernet chip development and industrialization project ,2.7 100 million yuan for R & D center construction projects ,3.5 Billion yuan is used to supplement working capital projects .

Annual revenue 2.54 Billion

Yutaiwei focuses on the research and development of high-speed wired communication chips 、 Design and sell . Since its establishment , The company takes Ethernet physical layer chip as the market entry point , Continue to launch a series of chip products , It is one of the few Ethernet physical layer chip suppliers in Chinese Mainland with independent intellectual property rights and large-scale sales .

The application scope of the company's products covers information communication 、 Automotive electronics 、 Consumer electronics 、 Monitoring equipment 、 Industrial control and many other market fields , At present, there are commercial grade 、 Job specification level 、 Different performance levels such as vehicle specification level , And 100 megabytes 、 Gigabit and other product combinations with different transmission rates and different port numbers are available for sale , It can meet the application needs of different end customers on various occasions .

The prospectus shows , Yu Taiwei 2019 year 、2020 year 、2021 The annual revenue is 132.6 Ten thousand yuan 、1295 Ten thousand yuan 、2.54 One hundred million yuan ; Net losses are 2749 Ten thousand yuan 、4037.7 Ten thousand yuan 、46.25 Ten thousand yuan ; The net loss after deducting non-profit is 3035.9 Ten thousand yuan 、4419 Ten thousand yuan 、937 Ten thousand yuan .

Huawei and Xiaomi fund are shareholders

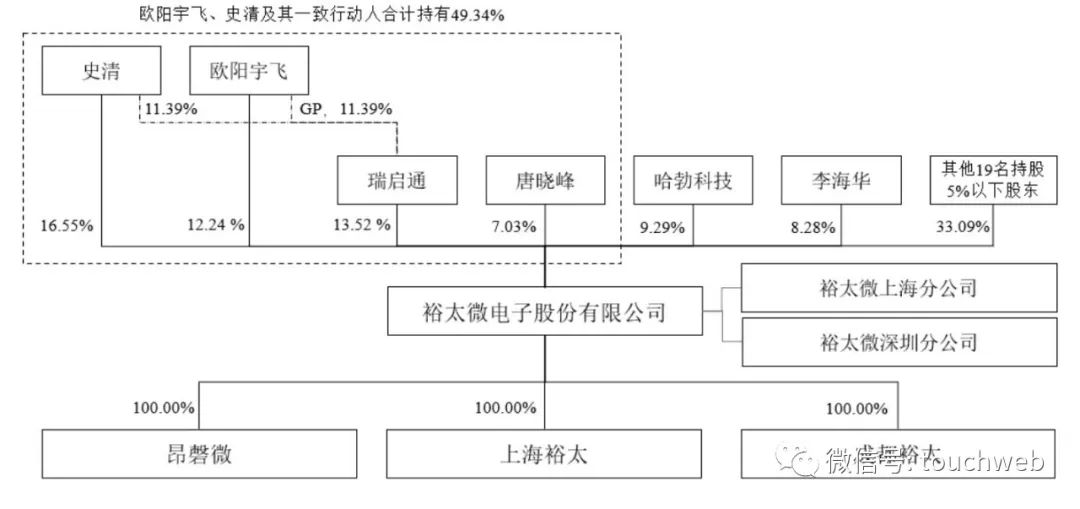

IPO front , Yutaiwei has no controlling shareholder , The actual controllers are Ouyang Yufei and Shi Qing .

Shi Qing directly holds yutaiwei 16.5514% equity ; Ouyang Yufei directly holds yutaiwei 12.2424% equity ; Ouyang Yufei is the general partner of ruiqitong , Ruiqitong holds yutaiwei 13.5152% equity , Therefore, Ouyang Yufei controls 25.7576% shares .

Ouyang Yufei and Shi Qing directly hold shares and jointly control through ruiqitong 42.309% equity .

In order to strengthen the control of the actual controller , Ouyang Yufei 、 Shi Qing 、 Ruiqitong and tangxiaofeng signed a concerted action agreement . Ouyang Yufei, the actual controller of the company 、 Shi Qing and his concerted action, Rui Qitong 、 Tangxiaofeng totally controls 49.3430% equity .

Besides , Huawei's Hubble Technology Holdings 9.2897%, Li Haihua holds 8.2757%, Tangxiaofeng holds 7.0340%, Dingfu investment holds 3.6826%, Yuanhe Puhua 、 Huiqi venture capital holds 3.3868%, Guanggu Fenghuo holds shares of 2.9027%, China mobile fund holds 2.2%, Zhengxuan investment 、 Shanghai Xuanli holds shares of 2.1592%;

Nova Nebula Holdings 1.916%, Juyuan core casting Co., Ltd 1.4516%, Qiao beijingchen holds 1.3555%, Gao Henan holds 1.2012%;

Hope Fund 、 Xiaomi fund holds 1%, Huichuan technology 、 AVIC investment watch ruizhisai 、 Wofu venture capital 、 Tianchuang Hexin 、 Gaochuang venture capital 、 Qilu investment holds 0.958%.

IPO after , Shi Qing holds 12.4136%, Ruiqitong holds 10.1364%, Ouyang Yufei holds 9.1818%, Hubble technology holds 6.9673%, Li Haihua holds 6.2068%;

Tangxiaofeng holds 5.2755%, Dingfu investment holds 2.762%, Yuanhe Puhua 、 Huiqi venture capital holds 2.5401%, Guanggu Fenghuo holds shares of 2.177%, China mobile fund holds 1.65%, Zhengxuan investment 、 Shanghai Xuanli holds shares of 1.6194%, Hope Fund 、 Xiaomi fund holds 0.75%.

———————————————

Lei Di was founded by Lei Jianping, a senior media person , If reproduced, please indicate the source .

边栏推荐

- Echart simple component packaging

- [sword finger offer] 60 Points of N dice

- 2022-2024年CIFAR Azrieli全球学者名单公布,18位青年学者加入6个研究项目

- 抽象类与抽象方法

- 星诺奇科技IPO被终止:曾拟募资3.5亿元 年营收3.67亿

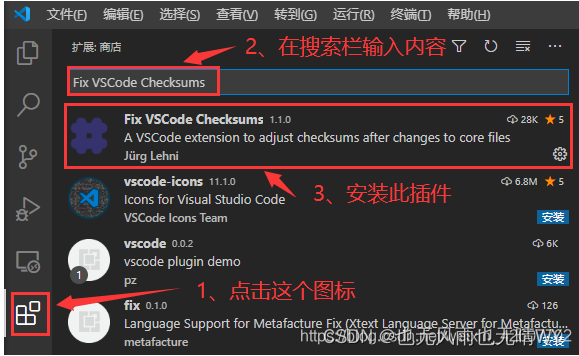

- Visual Studio Code启动时提示“Code安装似乎损坏。请重新安装。”、标题栏显示“不受支持”信息的解决办法

- [the 300th weekly match of leetcode]

- Mathematics in machine learning -- common probability distribution (XIII): Logistic Distribution

- AIRIOT物联网平台赋能集装箱行业构建【焊接工位信息监控系统】

- Certains marchés de l'emploi de Shanghai refusent d'embaucher des personnes qui se rétablissent positives à Xinguan

猜你喜欢

![Airiot IOT platform enables the container industry to build [welding station information monitoring system]](/img/52/88e3c7b7a60867282921d9bb5c96da.jpg)

Airiot IOT platform enables the container industry to build [welding station information monitoring system]

Introduction to the use of SAP Fiori application index tool and SAP Fiori tools

![[Matlab] Simulink 同一模块的输入输出的变量不能同名](/img/99/adfe50075010916439cd053b8f04c7.png)

[Matlab] Simulink 同一模块的输入输出的变量不能同名

抽象类与抽象方法

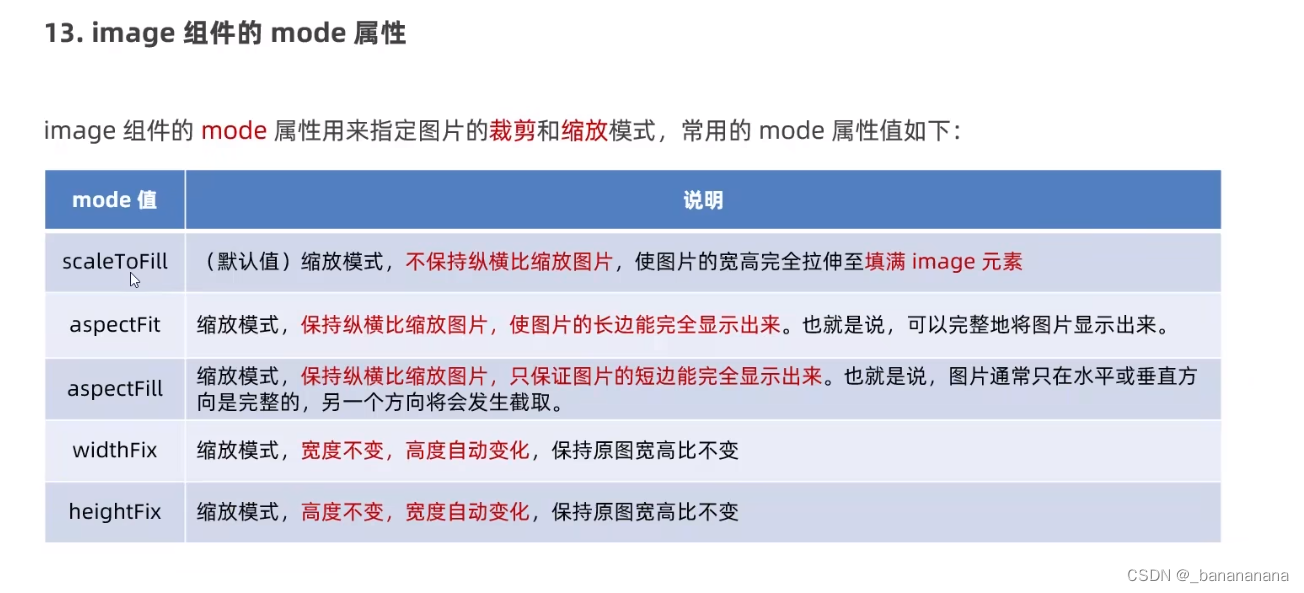

Wx applet learning notes day01

If you have any problems, you can contact me. A rookie ~

Visual Studio Code启动时提示“Code安装似乎损坏。请重新安装。”、标题栏显示“不受支持”信息的解决办法

Jushan database was among the first batch of financial information innovation solutions!

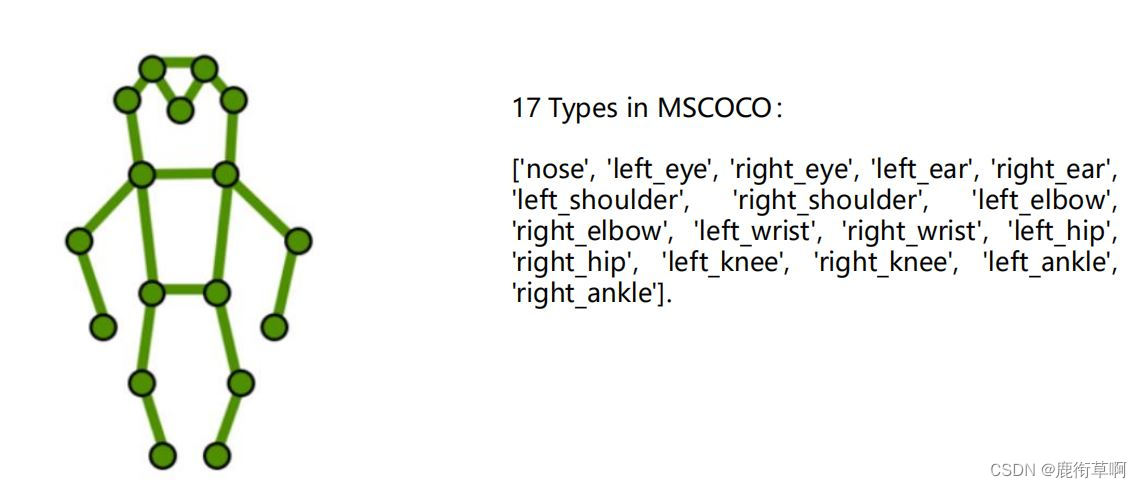

Human bone point detection: top-down (part of the theory)

![[the 300th weekly match of leetcode]](/img/a7/16b491656863e2c423ff657ac6e9c5.png)

[the 300th weekly match of leetcode]

随机推荐

Visual Studio Code启动时提示“Code安装似乎损坏。请重新安装。”、标题栏显示“不受支持”信息的解决办法

Jushan database was among the first batch of financial information innovation solutions!

ORACLE进阶(四)表连接讲解

C#/VB. Net to add text / image watermarks to PDF documents

RedisSystemException:WRONGTYPE Operation against a key holding the wrong kind of value

多线程基础:线程基本概念与线程的创建

Crawling data encounters single point login problem

[sword finger offer] 60 Points of N dice

Breadth first traversal of graph

【论文笔记】TransUNet: Transformers Make StrongEncoders for Medical Image Segmentation

Example of implementing web server with stm32+enc28j60+uip protocol stack

test about BinaryTree

Optical blood pressure estimation based on PPG and FFT neural network [translation]

Test 1234

Penetration test information collection - site architecture and construction

Certains marchés de l'emploi de Shanghai refusent d'embaucher des personnes qui se rétablissent positives à Xinguan

How does crmeb mall system help marketing?

上海部分招工市场对新冠阳性康复者拒绝招录

RedisSystemException:WRONGTYPE Operation against a key holding the wrong kind of value

Xu Xiang's wife Ying Ying responded to the "stock review": she wrote it!