当前位置:网站首页>Cost accounting [20]

Cost accounting [20]

2022-07-06 15:35:00 【Star drawing question bank】

1. The cost of work in progress is calculated according to the equivalent output method, which is applicable to () Products .

A. There are a large number of products

B. The quantity of products in progress varies greatly in each month

C. The proportion of each cost item in the cost is not much different

D. A large number of finished products 2. The workload method is applicable to high unit value , But the workload or working hours of each month are not very balanced fixed assets .()

3. The quota method is based on the () Based on , Add 、 A method of calculating the actual cost of products by subtracting the difference from quota and quota change .

A. Fixed cost

B. Planning cost

C. Product cost at the beginning of the month

D. Quota variance 4. All costs in the preparation of the enterprise report ,“ Cost statement of goods and products ” Is the main report ().

5. Generally speaking, the scope of cost expenditure in actual work and the content of theoretical cost ().

A. There is a certain difference

B. Is consistent with each other

C. It's irrelevant

D. Can replace each other 6. The standard for dividing the basic method and auxiliary method of product cost calculation is ().

A. The complexity of costing

B. Effect on cost management

C. Whether it is widely used

D. Is it necessary to calculate the actual cost of the product 7. The following are the calculation methods of WIP cost: ().

A. Direct distribution method

B. Quota proportional method

C. Equivalent yield method

D. Variety method 8. A production workshop found irreparable scrap in the production process of product B this month 12 Pieces of , Calculate the production cost of irreparable waste according to the consumed quota cost , The cost quota of single raw material is 60 element , The total number of quota man hours completed 140 Hours , The hourly rate is : Fuel and power 1.5 element . Direct labor costs 1.9 element , Manufacturing expenses 1.1 element , The price of unrepairable scrap materials 130 Yuan is used as auxiliary material for warehousing , Compensation should be paid by the negligent 40 element , The net loss of waste products shall be borne by the cost of the same product in the current month . requirement : Calculate the fixed cost of irreparable waste .

A.1350 element

B.1300 element

C.1220 element

D.1160 element 9.“ Waste loss ” The account debit should reflect ().

A. The production cost of repairable waste

B. The production cost of irreparable waste

C. Labor cost of repairable waste

D. The power cost of repairable waste 10. Machine materials consumed in the production workshop , The account to be debited is ().

A.“ Basic production cost ”

B.“ Auxiliary production cost ”

C.“ Manufacturing expenses ”

D.“ Management cost ”11. Allocate manufacturing expenses according to the annual planned distribution rate distribution method , It is most suitable for enterprise workshops with seasonal production .()

12. The advantage of classification is ().

A. It can simplify cost accounting

B. Can classify and master the product cost

C. It can make the cost calculation of products in the category more accurate

D. Be able to effectively control the cost of products in the category in time 13. The shutdown loss during the repair of fixed assets is included in the product cost .()

14. In a large number of multi-step production enterprises , Management requires step-by-step calculation of product cost , The cost calculation method is ().

A. Variety method

B. classification

C. Batch method

D. Step by step 15. When determining the cost calculation method , We must proceed from the specific situation of the enterprise , Consider at the same time ().

A. Production characteristics of the enterprise

B. Are there any products in progress at the end of the month

C. The size of the enterprise's production scale

D. Requirements for cost management 16. Production losses generally include ().

A. Waste loss

B. Product inventory loss

C. Downtime losses

D. Loss of three guarantees of products

E. Workshop material loss 17. The simplified batch method is applicable to a large number of batches , There are also many unfinished batches at the end of the month , And enterprises that have little difference in the level of indirect charges in each month .()

18. An enterprise produces product B , The cost of raw materials is successively invested with the processing progress . The cost of work in progress at the beginning of a month is : Direct material costs 2000 element , process cost 2400 element . The production cost of this month is : Direct material costs 40000 element , process cost 60000 element , Finished products in this month 300 Pieces of , Products in progress at the end of the month 200 Pieces of , The degree of completion of the product in progress is 50%, The feeding rate of in-process products is 60%. requirement : The cost of finished products of Party B is calculated by the equivalent output proportion method .

A.46800

B.30000

C.76800

D.1680019. The scale of auxiliary production workshop is generally small , To simplify accounting , Waste loss and shutdown loss are not accounted for separately .()

20. Of the following , The advantage of the taxonomy is ().

A. Strengthening cost control can improve the correctness of cost calculation

B. It can improve the correctness of cost calculation

C. It can simplify the calculation of product cost

D. Be able to master the product cost level by variety 21. The purpose of unit cost analysis of main products , Is to seek specific ways to reduce costs , Generally, the actual reduction amount and reduction rate can be obtained first , Then compare with the planned reduction amount and reduction rate .()

22. After finished products are warehoused , Loss of damage and deterioration due to improper storage and other reasons , Not treated as waste loss .()

23. Suppose an enterprise produces a product . Products in progress at the beginning of the month 350 The raw material quota cost of each piece is... According to the old consumption quota of last month 20 element , total 7000 element . Since the beginning of this month, the consumption quota of each material is adjusted to 18 element . Put into operation this month 650 Pieces of , The actual planned cost of raw materials is 17000 element , The material cost variance rate is -2%. Product a this month 1000 All parts are completed . requirement : Calculate the total cost of actual raw materials of finished product a .

A.5300

B.18000

C.23660

D.2866024. When calculating the product cost at the end of the month by using the variety method , If (), You can also not calculate the cost of work in progress .

A. No products in progress

B. The number of products in production is very small , And the cost is small

C. The number of products in production is very small , But the cost is huge

D. There are many products in the market , And the cost is large 25. When preparing the cost statement , The accounting treatment method shall be consistent with the previous and subsequent periods .()

26. Of the following , Belonging to the item of product production cost is ().

A. Direct material

B. Material cost

C. depreciation charge

D. Fuel costs 27. Under the classification , When using the coefficient method to calculate the cost of various products , The conditions for products selected as standard products are ().

A. Large output

B. The output is small

C. Specification compromise

D. Production is relatively stable 28. An enterprise produces product a this month , The total cost of products in progress at the beginning of the month and the cost of production in the current month is 20000 element , The cost of work in progress at the end of the month is 1500 element . Loss of repairable waste of finished products 1000 element , Irreparable waste loss occurs 2000 element . The price of scrap materials 500 Yuan warehousing , Compensation by the negligent person 300 element . Product a is qualified 150 Pieces of . requirement : Calculate the net loss of waste products and the unit cost of qualified products .

A. The net loss is 2200 element .

B. The unit cost of qualified products is 138 element / Pieces of .

C. The net loss is 3000 element .

D. The unit cost of qualified products is 130 element / Pieces of .29. Interest expense is charged to ().

A. selling expenses

B. Management cost

C. Production costs

D. Financial expenses 30. The impact of changes in raw material utilization rate on unit product cost , It can be expressed by the following formula ()

A.(1-)× Raw material cost per unit product before change

B.(1-)× Raw material cost per unit product before change

C.(1-)× Unit product cost before change

D.(1-)× Unit product cost before change 31. If in the same period , The enterprise receives several orders for the same product from different purchasing units , Enterprises should organize production in batches according to orders , Calculate the product cost .()

32. The factors affecting the unit cost of materials are ()

A. Unit price of materials

B. Unit consumption of materials

C. Material unit quota

D. Material plan quota 33. When using the classification method to calculate the product cost , The production cost of various products in the category , Whether it's direct production costs or indirect production costs , Are allocated into the product cost .()

34. An enterprise produces a 、 B two products , The actual working hours are : A product 20000 Hours , B product 32000 Hours . The salary expenses summarized according to the employee salary settlement voucher are : The salary of workers in the basic production workshop is 23920 element , The salary of workshop management personnel is 4100 element , Employee compensation of the administrative department of the enterprise 2350 element , Salary of staff in the living and Welfare Department 3000 element , The salary of the staff of the special sales organization is 2000 element . It is required to prepare accounting entries for the distribution of employees' remuneration ; The salary of the workers in the basic production workshop will be reduced to a 、 B. the products are allocated according to the actual working hours , The following is true ().

A. borrow : Basic production cost —— A product 9200—— B product 14720 Manufacturing expenses 4100 Management cost 2350 selling expenses 2000 Salary payable —— Employee welfare 3000 loan : Salary payable 35370

B. borrow : Production costs —— A product 9200—— B product 14720 Manufacturing expenses 4100 Management cost 2350 selling expenses 2000 Salary payable —— Employee welfare 3000 loan : Salary payable 35370

C. borrow : Basic production cost —— A product 9200—— B product 14720 Management cost 6450 selling expenses 2000 Salary payable —— Employee welfare 3000 loan : Salary payable 35370

D. borrow : Production costs —— A product 9200—— B product 14720 Manufacturing expenses 4100 Management cost 2350 selling expenses 2000 Salary payable —— Employee welfare 3000 loan : Wages payable 3537035. Production of low value consumables , Should be included in () account .

A.“ Auxiliary production cost ”

B.“ Basic production cost ”

C.“ Manufacturing expenses ”

D.“ Management cost ”36. The fixed assets whose depreciation expense should be calculated in this month are ().

A. Equipment reduced this month

B. Houses rented in the form of operating lease of equipment reduced this month

C. Machinery and equipment purchased this month

D. Unused equipment 37. The economic business of a repair workshop and transportation department this month is summarized as follows : The cost of repair workshop 35000 element , Provide repair services 20000 Hours , among : Provide... For the transport sector 3000 Hours , Provide... For basic workshop 16000 Hours , Provide management with 1000 Hours . Expenses incurred by the transportation department 46000 element . Provide transportation services 40000 km , among : Provide... For the repair shop 3500 km , Provide... For basic production workshop 30000 km , Provide management with 6500 km . requirement : According to the above information , Use the interactive allocation method to allocate the auxiliary production cost , Calculate repair 、 Distribution rate of interactive distribution of Transportation Department .

A. The distribution rate of repair is 1.75( element / Hours ); Transportation as 1.15( element / km )

B. The distribution rate of repair is 2.06( element / Hours ); Transportation as 1.26( element / km )

C. The distribution rate of repair is 1.7( element / Hours ); Transportation as 1.2( element / km )

D. The distribution rate of repair is 2.2( element / Hours ); Transportation as 1.5( element / km )38. When performing cost recovery , The reduction distribution rate shall be multiplied by the current month () The cost of each cost item .

A. Semi finished products produced

B. Semi finished products consumed

C. This kind of semi-finished product

D. The semi-finished products consumed 39. Planned amount of the current year in the detailed statement of financial expenses , It should be filled in according to the financial expense plan ; The actual amount in the same period of last year shall be based on () Fill in .

A. The cumulative actual amount in this table in the same period of last year is filled in

B. The cumulative planned amount in this table in the same period of last year is filled in

C. The cumulative actual amount in this table in the same period of this year is filled in

D. The cumulative planned amount in this table in the same period of this year is filled in 40. The cost of finished goods in stock , Should be transferred in “ Finished products ” subject ; Finished self-made materials 、 Tools 、 Cost of moulds, etc , Should be transferred in separately “ raw material ” and “ Low value consumables ” Subjects such as .()

41. In the following accounting accounts , The balance at the end of the year is not transferred to “ This year's profit ” The of the account is ().

A.“ Financial expenses ”

B.“ Manufacturing expenses ”

C.“ selling expenses ”

D.“ Management cost ”42. Products with little change in the number of products in progress at the end of each month , You can not calculate the cost of work in progress at the end of the month .()

43. Cost report is a report that serves the purpose of internal operation and management of an enterprise , Whether it is affected by external factors ()

A. Affected by external factors

B. Not affected by external factors

C. Sometimes by , Sometimes unaffected

D. Related to external factors 44. Some industrial enterprises , Some waste gas will be produced in the production process 、 Waste liquid and waste .“ Three wastes ” Once used, it becomes a by-product . It should also be in accordance with () The cost calculation method of .

A. Qualified products

B. waste

C. Joint products

D. By-product 45. When using the serial substitution method , All comprehensive indicators should be arranged correctly , But multiplication has the property of commutative law , Therefore, the arrangement or replacement order of each comprehensive index can be changed at will .()

46. In the following ways , The step-by-step method without calculating the cost of semi-finished products is ().

A. Itemized carry forward method

B. Comprehensive carry forward method

C. Step by step carry forward method

D. Parallel carry forward method 47. The labor cost provided by Party B's auxiliary workshop for each unit this month : Provide power for the production of products in the basic production workshop ( The basic production workshop of the enterprise is equipped with “ Fuel and power ” Cost items )52830 element , Provide general labor services for the basic Workshop 9200 element , Provide labor services for administrative departments 4110 element , Provide labor services for the Sales Department 3936 element . requirement : Prepare accounting entries for the distribution of auxiliary production expenses .( The manufacturing cost of auxiliary production of the enterprise does not pass “ Manufacturing expenses ” Account accounting ; The basic production workshop of the enterprise is equipped with “ Direct material ”、“ Direct labor ”、“ Manufacturing expenses ”、“ Fuel and power ” Four cost items )

A. loan : Basic production cost 52830 Manufacturing expenses 9200 Management cost 4110 selling expenses 3936

B. borrow : Basic production cost 52830 Manufacturing expenses 9200 Management cost 4110 selling expenses 3936

C. loan : Auxiliary production cost 70076

D. borrow : Basic production cost 62030 Management cost 4110 selling expenses 3936

E. borrow : Basic production cost 62030 Management cost 4110 selling expenses 3936

F. loan : Manufacturing expenses 7007648. After being identified by the quality inspection department, it does not need to be repaired , The loss of nonconforming products that can be sold at a reduced price , As () Handle .

A. selling expenses

B. Waste loss

C. Management cost

D. Sales profit and loss 49. The classification method has no direct relationship with the type of enterprise production , It can be used in various types of production .()

50. The advantages of the parallel carry forward step-by-step method are ().

A. Be able to provide semi-finished product cost data of each step

B. It is conducive to strengthening the physical management of semi-finished products

C. It is conducive to the cost management of each production step

D. Each production step can calculate the product cost at the same time 51. In theory , The compensation part of the commodity value , Is the theoretical cost of goods .()

52. Analysis of administrative expenses , In addition to analyzing the reasons for the change according to the comparison between detailed items and quota indicators , We should also tighten our spending 、 Starting from the requirements of improving work efficiency, check the implementation of all links and measures .()

53. When using classification , Simplify the cost calculation , The key to making the cost calculation relatively correct is ().

A. The classification of products should be appropriate

B. Select the appropriate allocation criteria for expenses

C. The class distance of product classification should be appropriate

D. The smaller the class distance of product classification, the better 54. Suppose a factory has three production workshops , The first workshop produces A Semi product , The second workshop step will A Semi finished products are processed into B Partially Prepared Products , The third workshop will B Semi finished products are processed into C Finished products . The enterprise calculates the cost of each step , And carry forward by item according to the actual cost . The first workshop is completed A The cost of semi-finished products is 40264 element ; The second workshop receives A The cost of semi-finished products is 47710 element ; The second workshop is completed B The cost of semi-finished products is 41677 element ; The third workshop receives B The cost of semi-finished products is 67724 element ; The third workshop is completed C The cost of finished products is 71385 element . requirement : Prepare accounting entries for carrying forward the cost of semi-finished products and finished products .

A. borrow : Self made semi-finished products --A Partially Prepared Products 40264 loan : Production costs -- Basic production cost -- The first workshop 40264

B. borrow : Production costs -- Basic production cost -- Second workshop 47710 loan : Self made semi-finished products --A Partially Prepared Products 47710 borrow : Self made semi-finished products --B Partially Prepared Products 41677 loan : Production costs -- Basic production cost -- Second workshop 41677

C. borrow : Production costs -- Basic production cost -- The third workshop 67724 loan : Self made semi-finished products --B Partially Prepared Products 67724

D. borrow : Stock goods —C Finished products 71385 loan : Production costs -- Basic production cost -- The third workshop 7138555. The decision-making function of cost accounting is the premise of forecasting function .()

56. Overseas Chinese prosper enterprises 20×4 year 9 Monthly production of B products , Cost of work in progress at the beginning of the month : Direct material 4680 element , process cost 1800 element ; The production cost of this month : Direct material 43460 element , process cost 12600 element . Product B will be finished this month 80 Pieces of , Products in progress at the end of the month 20 Pieces of . The unit fixed cost of finished products of product B is : Direct material 470 element , process cost 130 element . The fixed cost of a single piece of work in progress is : Direct material 470 element , process cost 80 element . requirement : According to the above information , Calculate the finished product cost of product B by quota proportion method .

A.50992

B.48512

C.56000

D.5040057. Scrap loss refers to the production cost of irreparable scrap found in the production process and after warehousing , And the repair cost of repairable waste , The losses after deducting the value of the recovered waste products and materials and the compensation that should be paid by the faulted unit or individual .()

58. The theoretical cost of the product includes ().

A.C+V

B.C+V+M

C.V+M

D.C+M59. Comparative analysis is a comparative analysis of relative numbers , Only applicable to similar enterprises 、 Comparative analysis of homogeneous indicators .()

60. The raw materials and process used in the joint product are the same , Therefore, it is most suitable to use () Cost calculation method .

A. classification

B. Batch method

C. Step by step

D. Variety method 61. The quota method applies to ().

A. Single piece and small batch production enterprises

B. The quota management system is relatively sound , The basis of quota management is relatively good , Product production has been finalized , The consumption quota is relatively accurate 、 Stable enterprises

C. Not directly related to the type of production

D. Mass production enterprises 62. In workshops that produce a variety of products , Manufacturing costs are included in indirect expenses , Appropriate allocation methods should be used , The allocation is included in the production cost of various products in the workshop .()

63. Calculation of property tax payable by enterprises 、 Vehicle and vessel use tax , Should debit () Account .

A.“ Taxes payable ”

B.“ Management cost ”

C.“ Business tax ”

D.“ Manufacturing expenses ”64. Under the parallel carry forward step-by-step method , The cost allocation between finished products and products in process in each step refers to the cost allocation between finished products in a narrow sense and products in a broad sense .()

65. The total amount of expenses actually incurred in an accounting period , Not necessarily equal to the sum of product costs in the accounting period .()

66. Allocate manufacturing expenses according to the annual planned allocation rate ,“ Manufacturing expenses ” Account month end ().

A. There may be a month end balance

B. There must be no month end balance

C. There may be a debit balance

D. There may be a credit balance 67. The preparation requirements of cost statements are ()

A. The numbers are accurate

B. Neat writing

C. The content is complete

D. In order

E. Timely preparation and reporting 68. The step-by-step method of cost reduction is ().

A. Parallel carry forward step-by-step method

B. Itemized carry forward step-by-step method

C. Comprehensive carry forward step-by-step method

D. Step by step carry forward method 69. An enterprise will 、 B two products as a class , Use the classification method to calculate the product cost . nail 、 B the two products consume together A Materials , The consumption quota is 16 Kilogram and 20 kg , Per kilogram A The unit cost of each material is 5 element . The enterprise takes product a as the standard product , Then the raw material cost coefficient of product B is ().

A.1.25

B.6.25

C.0.8

D.0.470. The cost of sales ratio is the constituent ratio .()

71.“ Auxiliary production cost ” There may be no balance at the end of the month .()

72. Cumulative overhead allocation rate , Its function is ().

A. It is the basis for allocating indirect costs among departments

B. It is the basis for allocating indirect costs between batches of finished products

C. It is the basis for allocating indirect costs among batches of products

D. It is the basis for allocating indirect expenses between the finished products of a batch of products and the products at the end of the month 73. When determining the coefficient under the coefficient method , Generally, choose one with a large output within the category 、 The products with relatively stable production or compromise specifications are regarded as standard products , Set the coefficient of this product as “1”.()

74. The characteristics of parallel carry forward step-by-step method are ().

A. The cost of semi-finished products in each step shall be transferred with the transfer of semi-finished products

B. The cost of semi-finished products in each step will not be transferred with the transfer of semi-finished products

C. The cost calculation object is the cost share of finished products

D. It is necessary to calculate the cost of finished semi-finished products transferred out 75. An enterprise A product 201* The actual unit costs for the four quarters of the year were 156 element 、162 element 、180 element 、196 element . Based on the first quarter , At the unit cost of the quarter 156 Yuan as the base , Determine the fixed base ratio of the unit cost of products in other quarters compared with the unit cost of products in the first quarter .

A.102.52%

B.103.85%

C.115.39%

D.125.64%76. The characteristics of variety method are ().

A. Take the product variety as the object of cost accounting

B. At the end of each month , When there are products , A certain method needs to be adopted to allocate expenses between finished products and products

C. At the end of each month , There needs to be a way to allocate costs between steps

D. Cost accounting is carried out at the end of each month , That is, the cost calculation period is consistent with the accounting reporting period , Inconsistent with product production cycle 77. In multi-step production , In order to strengthen the cost management of each production step , The cost of products should be calculated according to the production steps .()

78. Under the condition that the product variety composition and product unit cost remain unchanged , Simple production changes , It only affects the cost reduction rate of comparable products, but does not affect the cost reduction amount of comparable products .()

79. Cost is related to some object , Expenses are related to the accounting period .()

80. Fixed assets added in the month will not be depreciated in the month , The fixed assets decreased in the month shall be depreciated in the same month .()

81. In each auxiliary production cost allocation method , It can simplify the calculation work , It can also speed up the distribution ; meanwhile , It can also clarify the economic responsibilities of various workshop departments , What is convenient for cost analysis and assessment is ().

A. Direct distribution method

B. Interactive allocation method

C. Planned cost allocation method

D. Algebraic distribution 82. The production of enterprises is divided according to the characteristics of their production organization , It can be divided into mass production 、 Batch production and single piece production .()

83. When using the batch method to calculate the product cost , What may be accounted for as a batch of products is ().

A. Different products in the same order

B. The same product in different orders

C. A component of a product in the same order

D. The same product in the same order 84. The cost calculation object of multi-step variety method is production steps .()

85. When carrying forward the cost of production tools completed and delivered to the warehouse by the auxiliary production workshop , The account to be debited is ().

A. raw material

B. Low value consumables

C. Partially Prepared Products

D. Stock goods 86. Depreciation of fixed assets is a component of product cost , Should be fully included in the cost of the product .()

87. The fixed cost data of irreparable waste of product a listed in the various expense distribution table of an industrial enterprise is : Irreparable waste 5 Pieces of , Cost quota of each raw material 100 element , The fixed working hours per piece are 30 Hours , Hourly wages and benefits 3 element , Manufacturing expenses 4 element . The cost of irreparable waste products is priced according to the fixed cost . The scrap value of irreparable scrap shall be priced according to the planned cost , common 160 element , Warehousing as auxiliary materials , There should be compensation from the culprit 120 element . The net loss of waste products shall be borne by the cost of the same product in the current month . requirement : Calculate the net loss of irreparable waste of product a .

A.1550 element

B.1390 element

C.1270 element

D.1430 element 88. The following items that do not belong to manufacturing expenses are ().

A. Material consumption of workshop machines

B. Lease fee of fixed assets under finance lease

C. Labor protection fee

D. Seasonal downtime losses 89. Do not form product value , However, what should be included in the product cost are ().

A. Waste loss

B. Seasonal downtime losses

C. Three guarantees loss

D. It's a great loss 90. Loss of various wastes found during production or after warehousing , barring ().

A. Labor wages for repairing waste products

B. Materials used for repairing waste products

C. The production cost of irreparable waste

D. Product deterioration loss caused by poor management 91. Adopt step-by-step carry forward method , According to the reflection method of the cost of semi-finished products carried forward in the product cost Sub Ledger in the next step , Can be divided into ().

A. Parallel carry forward step-by-step method

B. Itemized carry forward method

C. Comprehensive carry forward method

D. Planned cost method 92. The basic production workshop of an enterprise produces products a and other products ,2 The fixed direct labor cost of monthly planned output is 18100 element , The quota production man hour of planned output is 3150 Hours ; The actual direct labor cost of this month is 21375 element , The actual production hours are 3500 Hours ; The fixed working hours of product a this month are 2125 Hours , The actual production hours are 1985 Hours . requirement : Confirm that the direct labor cost of product a deviates from the quota .

A.+110.25 element

B.-110.25 element

C.+150.25 element

D.-150.25 element 93. Adopt the simplified batch method , Of the following , The content of product cost Sub Ledger registration is ()

A. Direct materials occurred this month

B. Labor costs incurred this month

C. Manufacturing expenses incurred this month

D. Total expenses incurred this month 94. The following expenses have occurred in the course of production of an enterprise :(1) The cost of raw materials used in the production of products .(2) The salary of workers in the basic production workshop .(3) Employee compensation of basic workshop managers .(4) The employee compensation of the staff of the special sales organization .(5) Depreciation expense of fixed assets for basic production workshop calculated and withdrawn according to the straight-line method .(6) Insurance premium for basic production workshop buildings .(7) Water and electricity costs incurred in the basic production workshop .(8) The office expenses of the factory management department .(9) The greening fee paid .(10) Machine and material consumption in the basic production workshop . Which of the above should be treated as production expenses ?()

A.(1)、(2)

B.(3)

C.(5)、(6)

D.(7)、(10)95. The characteristic of the direct allocation method of auxiliary production cost is that the auxiliary production cost ().

A. Directly included in the labor cost provided by auxiliary production

B. Directly allocated to all beneficiary workshops 、 department

C. Directly included “ Auxiliary production cost ” Account

D. Directly allocated to all beneficiary units other than auxiliary production 96. The principle of determining the cost accounting laws and regulations is ().

A. In line with international practice

B. Unified leadership 、 Hierarchical management

C. It is conducive to the implementation of the economic responsibility system of cost management

D. Establish cost accounting work on a broad mass basis 97. To simplify accounting , The by-products and main products can be regarded as one kind , Use the classification method to calculate the cost .()

98. The calculation object of batch method is ().

A. Product variety

B. Product production steps

C. Product batch

D. Product category 99. Fixed assets inventory loss 、 Net loss from disposal of fixed assets 、 Loss on sale of intangible assets 、 Debt restructuring losses, etc , Non operating expenses .()

100. In the following items , Manufacturing expenses include ().

A. Insurance premium for production workshop

B. Depreciation of factory office building

C. Inventory loss and damage of products in progress

D. Amortization of low value consumables

边栏推荐

- MySQL数据库(五)视 图 、 存 储 过 程 和 触 发 器

- Your wechat nickname may be betraying you

- 学习记录:使用STM32F1看门狗

- Threads and thread pools

- Future trend and planning of software testing industry

- Flex --- detailed explanation of flex layout attributes

- Heap, stack, queue

- ucorelab4

- Lab 8 file system

- Report on the market trend, technological innovation and market forecast of printing and decorative paper in China

猜你喜欢

Jupyter installation and use tutorial

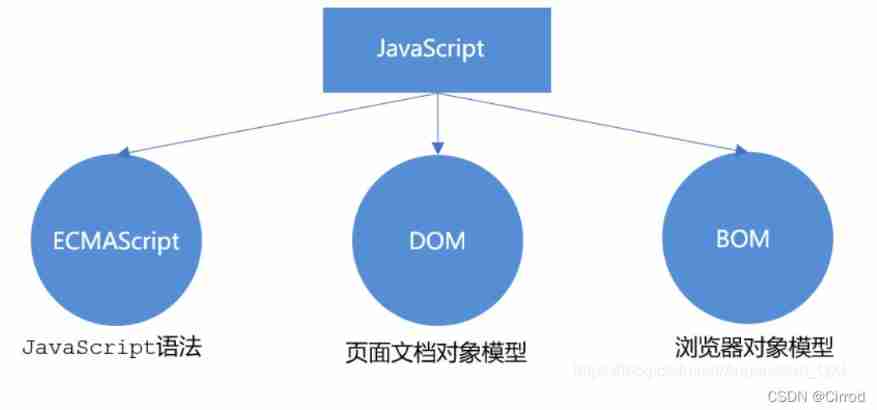

JS --- all basic knowledge of JS (I)

How to do agile testing in automated testing?

Do you know the advantages and disadvantages of several open source automated testing frameworks?

Lab 8 file system

ucore lab 2

Interface test interview questions and reference answers, easy to grasp the interviewer

软件测试有哪些常用的SQL语句?

Stm32 dossiers d'apprentissage: saisie des applications

Portapack application development tutorial (XVII) nRF24L01 launch B

随机推荐

LeetCode#19. Delete the penultimate node of the linked list

Programmers, how to avoid invalid meetings?

JS --- all knowledge of JS objects and built-in objects (III)

csapp shell lab

How to write the bug report of software test?

Portapack application development tutorial (XVII) nRF24L01 launch B

软件测试Bug报告怎么写?

ucorelab4

Knowledge that you need to know when changing to software testing

Mysql database (III) advanced data query statement

学习记录:TIM—基本定时器

Scoring system based on 485 bus

How to do agile testing in automated testing?

线程及线程池

C4D quick start tutorial - Introduction to software interface

JS --- detailed explanation of JS DOM (IV)

LeetCode#36. Effective Sudoku

毕业才知道IT专业大学生毕业前必做的1010件事

Cost accounting [13]

自动化测试中敏捷测试怎么做?