当前位置:网站首页>Accounting regulations and professional ethics [3]

Accounting regulations and professional ethics [3]

2022-07-06 15:36:00 【Star drawing question bank】

1. Used to record 、 The account for accounting and reflecting the income and expenditure activities of non tax income is ().

A. Treasury single account

B. Budget unit zero balance account

C. Special account

D. Special financial account 2. Of the following , What does not belong to the bank is ().

A. urban credit cooperative

B. securities company

C. Policy banks

D. Rural credit cooperatives 3. The following are not the regulations of the government procurement department ().

A.《 Administrative measures for announcement of government procurement information 》

B.《 Interim Measures for the administration of investment projects financed by loans from international financial organizations and foreign governments 》

C.《 Beijing municipal government procurement measures 》

D.《 Interim Measures for government procurement to promote the development of small and medium-sized enterprises 》4. Government procurement items included in the centralized procurement catalogue are purchased by government purchasers , The procurement method that must be used is ().

A. The competent department purchases on behalf of

B. The purchaser purchases by himself

C. Cooperate with other purchasers to buy by themselves

D. Entrust a centralized purchasing agency to purchase 5. Among the constituent elements of China's tax law ,() It is a specific item that should be taxed in the tax law , It is the concretization of the tax object .

A. tax rate

B. tax item

C. taxpayer

D. Tax object 6. The actual payer of tax refers to ().

A. taxpayer

B. Withholding agent

C. Tax payer

D. Collection and payment agent 7. have a genuine and sincere desire , Seeking truth from facts , Not false , No fraud , Keep promise , Pay attention to credit , Pay attention to credibility . This is the accounting professional ethics () The concrete embodiment of .

A. I love my job

B. Be honest

C. Stick to the rules

D. Objective justice 8. The tax basis of business tax is ().

A. sales

B. Turnover

C. amount of income

D. Total revenue 9. The following statement about the basic principles that should be observed in the management of bank settlement accounts , The wrong is ().

A. Depositors of personal bank settlement accounts can only open a basic deposit account in the bank

B. Depositors can choose their own bank to open a bank settlement account

C. The opening and use of bank settlement accounts must comply with the law

D. The bank must keep the information of the depositor's Bank Settlement Account confidential according to law 10. A production and operation enterprise in Shanghai has opened a non independent accounting office in Beijing , The Shanghai tax authority shall issue ().

A. Tax registration certificate

B. Temporary tax registration certificate

C. Registration tax registration certificate

D. Foreign related tax registration certificate 11.() It is the foundation for accountants to abide by accounting professional ethics .

A. Aigang

B. dedicated

C. honest

D. The good faith 12. Terms of payment of commercial bills , No longer than (), Prompt payment term , From the due date of the bill ().

A.1 Months 、10 Japan

B.3 Months 、1 Months

C.6 Months 、10 Japan

D.1 Months 、30 Japan 13. Accountants are in the process of dealing with business , We should act in strict accordance with the accounting legal system , Not subject to the will of others , This reflects the professional ethics of accounting () The requirements of .

A. Objective justice

B. Stick to the rules

C. Be honest and self disciplined

D. Be honest 14. The full-time personnel of the accounting institution who keep accounting files shall not be ( ) As a .

A. Unit cashier

B. Person in charge of the unit

C. Chief accountant

D. The person in charge of the accounting institution or the person in charge of accounting 15. The tax authorities collect taxes , The taxpayer must be issued ().

A. Tax payment voucher

B. Receipt

C. invoice

D. Deduction voucher 16. Government procurement by invitation to bid , The bidder shall, from the end of the prequalification announcement period () front , Submit qualification certificates as required by the announcement .

A. Three working days

B. Five working days

C. Seven working days

D. Ten working days 17. The following are not taxpayers of consumption tax ().

A. Cigarette factories that produce and sell cigarettes

B. Enterprises importing cosmetics

C. Individual industrial and commercial households entrusted with the processing of wooden disposable chopsticks

D. A unit that produces and sells televisions 18." Sticking to a good system is better than doing bad things , The system is greater than days , Human feelings are as thin as smoke ”, The accounting professional ethics embodied in this sentence is ().

A. Objective justice

B. Stick to the rules

C. Strengthen service

D. Be honest and self disciplined 19. According to the treatment of the value of purchased fixed assets , VAT can be divided into different types .2009 year 1 month 1 The date of , China's value-added tax is implemented ().

A. Consumption value-added tax

B. Income type VAT

C. Productive value-added tax

D. Value added tax of actual consumption 20. Cheques are only payable at sight , The date of payment shall not be recorded separately . The legal consequence of recording the date of payment separately is ().

A. Approved by the payee , This record is valid

B. The record is invalid , The bill is still valid

C. Because of this record, the cheque is invalid

D. The record office shall be stamped with the financial seal 21.( ) It refers to the relevant government departments in accordance with relevant laws 、 Regulations and responsibilities and authorities of departments , Accounting behavior of relevant units 、 Supervision and inspection of accounting data .

A. Accounting supervision

B. Government supervision

C. Audit supervision

D. social supervision 22. law-abiding , be conscientious and responsible , Establish correct values and outlook on life , This is the basic requirement for accountants to abide by what kind of professional ethics ().

A. I love my job

B. Be honest and self disciplined

C. Be honest

D. Objective justice 23. Natural person investment 、 consumption 、 The deposit account opened for payment and settlement business is called ().

A. Temporary deposit accounts

B. Personal bank settlement account

C. Special deposit account

D. General deposit account 24. The object of accounting professional ethics evaluation is accountants ().

A. Professional quality

B. Vocational Technology

C. The professional ethics

D. Professional behavior 25. As one of the parties to government procurement , Before participating in government procurement activities () Inside , There is no major illegal record in business activities .

A. Half a year

B. A year

C. Two years

D. Three years 26. The zero balance account opened by the financial department , In business ( ), It should be cleared with the treasury single account in time .

A. The single payment amount is 3000 More than ten thousand yuan ( contain 3000 Ten thousand yuan ) Of

B. The single payment amount is 3000 Less than 10000 yuan ( contain 3000 Ten thousand yuan ) Of

C. The single payment amount is 5000 More than ten thousand yuan ( contain 5000 Ten thousand yuan ) Of

D. The single payment amount is 5000 Less than 10000 yuan ( contain 5000 Ten thousand yuan ) Of 27. The subjects of government procurement do not include ().

A. The government authority

B. Business unit

C. Social groups

D. State-owned enterprise 28.() Refers to the unit . Personal use of bills in social and economic activities . Bank cards and remittances . Collection commitment . The act of monetary payment and fund liquidation by means of entrusted collection and other settlement methods .

A. Commercial payment

B. Commercial settlement

C. Payment settlement

D. Transaction settlement 29. Of the following , Invoices that do not belong to the industry include ().

A. Unified commercial retail invoice

B. Unified commercial wholesale invoice

C. Advertising expense settlement invoice

D. Unified invoice for product sales of industrial enterprises 30. Unless otherwise stipulated by the State Council , Taxpayers export goods , The tax rate shall be ().

A.17%

B.13%

C.3%

D.031. according to 《 The basic work of accounting is standardized 》 and 《 Internal accounting control norms ( On a trial basis )》 The provisions of the , The main body of internal accounting supervision of each unit is ( ).

A. The accounting organization and accounting personnel of the unit

B. Auditors and Accountants of the unit

C. The accounting organization of the unit

D. The audit institution of the unit 32.《 Government procurement law of the people's Republic of China 》 since () Come into effect .

A.2000 year 1 month 1 Japan

B.2003 year 1 month 1 Japan

C.2005 year 1 month 1 Japan

D.2007 year 1 month 1 Japan 33. The direct cause of professional ethics is ().

A. Political needs

B. The economic development

C. Social division of labor

D. The requirements of productivity 34. Accounting handover list , Generally, it should be filled in ().

A. One copy

B. In duplicate

C. triplicate

D. In quadruplicate 35. The accounting statements that can reflect the financial situation of an enterprise on a specific date are ( ).

A. Balance sheet

B. Cash flow statement

C. Income statement

D. Profit distribution statement 36.《 Regulations on the implementation of the budget law 》 On () year 11 month 2 Adopted at the 37th executive meeting of the State Council on August .( The difficulty coefficient : easy )

A.1993

B.1994

C.1995

D.199637. according to 《 Payment and settlement method 》 The provisions of the ,() Be responsible for formulating a unified payment and settlement system .

A. Policy banks

B. commercial bank

C. The head office of the people's Bank of China

D. Branches of the people's Bank of China 38. Of the following ,() The tax payable is calculated by using the excess progressive tax rate .

A. VAT on processed clothing

B. The business tax levied on the sale of houses

C. A consumption tax levied on the production of cigarettes

D. Personal income tax levied on income from wages and salaries 39. The draft final accounts of governments at or above the county level shall be approved by the Standing Committee of the people's Congress at the corresponding level , The financial department of the government at the same level shall, from the date of approval () Reply the final accounts to all departments at the same level .

A.10 Japan

B.15 Japan

C.20 Japan

D.30 Japan 40. Acceptance Bank of bank acceptance bill , The drawer shall be charged according to the face value () The handling charge .

A. One thousandth

B. Five thousandths

C. One in ten thousand

D. Five out of ten thousand 41. In the following statements about VAT special invoices , What's not right is ().

A. VAT special invoice refers to the invoice specially used to settle sales of goods and provide processing 、 An invoice used for repair and replacement services

B. Only those who are recognized as general VAT taxpayers by the national tax authorities can receive and purchase VAT special invoices , Small scale taxpayers and general taxpayers under legal circumstances shall not receive, purchase and use

C. VAT special invoices are issued by the province 、 Autonomous region 、 Uniformly printed by enterprises designated by the tax authorities of municipalities directly under the central government

D. Special VAT invoices shall be issued using the anti-counterfeiting tax control system 42. The main form of accounting professional ethics warning education is ().

A. Theoretical education and classroom teaching

B. Typical case discussion

C. Theoretical education and self-education

D. Discuss and analyze the actual situation 43.() It was issued by the drawer 、 The bank entrusted to handle bill deposit business unconditionally pays a certain amount to the payee or bearer at sight .

A. Check

B. Commercial draft

C. Bank draft

D. Promissory note 44. The cultivation of accounting professional ethics is mainly manifested in personal ().

A. Transformation activities

B. Educational activities

C. Ideological activities

D. Improve activities 45. Accountants set up accounting books privately , serious , The Department of the people's government at or above the county level shall revoke its ( ).

A. Id card

B. Academic certificate

C. certificate of academic degree

D. Accounting qualification certificate 46. In the following statements , What meets the authenticity requirements of accounting data is ().

A. Accounting materials shall truthfully reflect economic and business matters

B. Accounting materials should accurately reflect the process and results of economic and business events

C. The economic and business matters reflected in the accounting data must be legal

D. The constituent elements of accounting materials must be complete 47. Comply with accounting laws , It is for the behavior of accounting practitioners () requirement .

A. At the highest level

B. At a minimum

C. Highest standard

D. Social practice 48. A painter 8 In August, his selected calligraphy and painting works were handed over to a publishing house for publication , Get remuneration from the publishing house 10 Ten thousand yuan . The tax items applicable to the payment of personal income tax for this remuneration are ().

A. Income from labor remuneration

B. Salary income

C. Income from remuneration

D. Income from royalties 49. The core of accounting professional ethics system is ().

A. Accounting professional ethics

B. Accounting professional ethics

C. Accounting professional ethics education and cultivation

D. Accounting professional ethics evaluation and punishment 50. Zhenguang Co., Ltd. is a Sino foreign joint venture ,2010 The following events occurred in the year : The company received an original voucher that the company and company B should jointly bear the expenses , Zhang, an accountant of the company, handled the accounts with the original vouchers and the expenses he should bear , And save the original voucher ; At the same time, at the request of company B, provide a copy of the original voucher to company B for accounting treatment . When the expenses listed in one original voucher need to be borne by more than two units , The correct thing to do is ().

A. The unit that keeps the original voucher issues the original voucher split sheet to other responsible units

B. It is enough to note it in bookkeeping

C. It can be explained by both parties

D. The unit that keeps the original voucher shall issue a copy to other units that should be divided 51. Accountants deal with money all day , Often be tempted by money , No, " Li Wanjin doesn't touch a penny ” Moral character and noble sentiment are not good . It reflects that accountants must have () Professional ethics .

A. Improve your skills

B. Based on honesty

C. Be honest and self disciplined

D. No greed, no occupation 52. Among the following means, those that belong to forging accounting vouchers are ().

A. Fabricate untrue accounting vouchers with false economic and business matters

B. Change the true content of accounting vouchers by altering

C. Change the true content of accounting vouchers by means of compensation

D. Change the true content of accounting vouchers by means of potion corrosion 53. A car store is a general taxpayer ,2013 year 12 The sales of cars in January are tax exclusive 500 Ten thousand yuan , In addition, extra price expenses are obtained 11.7 Ten thousand yuan ( Tax included ), The value-added tax indicated on the special invoice for value-added tax obtained in the current period is 45 Ten thousand yuan . Then the value-added tax payable by the franchise store in the current period is () Ten thousand yuan .

A.41.989

B.41.7

C.40

D.38.354. After graduating from University, Liu engaged in accounting , I think the knowledge I learned in university is enough to cope with my job , So I usually neglect to study business , Nor strengthen learning , Resulting in continuous errors in work . Liu's behavior violates the accounting professional ethics () The requirements of .

A. Improve your skills

B. Objective justice

C. Stick to the rules

D. Strengthen service 55. The following income that does not belong to the production and operation of individual industrial and commercial households is ().

A. Income obtained by individual businesses engaged in catering industry

B. Income obtained by individual industrial and commercial households from handicraft industry

C. Income obtained by individual industrial and commercial households engaged in the repair industry

D. Income from royalties obtained by individual business owners from publishing books 56. Failing to set up accounting books according to law , The financial department of the people's government at or above the county level shall, according to the nature of the illegal act 、 Plot and degree of harm , While ordering correction within a time limit , Impose on the unit () The fine .

A.2000 Yuan of above 10000 Yuan of the following

B.3000 Yuan of above 50000 Yuan of the following

C.10000 Yuan of above 50000 Yuan of the following

D.2000 Yuan of the following 57. The essence of morality is ().

A. People are subjective

B. The will of heaven

C. A reflection of the will of all ruling classes

D. Social ideology determined by the economic foundation of a certain society 58. Accountants have a clear distinction between public and private . No greed, no occupation . law-abiding . Be honest , And become a conscious behavior . This is the professional ethics of accounting () The requirements of .

A. Be honest

B. Objective justice

C. Stick to the rules

D. Be honest and self disciplined 59. The national budget year of our country refers to ().

A. From the Gregorian calendar 12 month 31 The date of , To the next year 12 month 31 Day end

B. From the Gregorian calendar 1 month 1 The date of , To the next year 1 month 1 Day end

C. From the Gregorian calendar 1 month 1 The date of , to 12 month 31 Day end

D. From the Gregorian calendar 12 month 31 The date of , to 12 month 31 Day end 60. according to 《 Accounting file management method 》 The provisions of the , The accounting files formed in the current year are after the end of the year , It can be temporarily kept by the accounting department ( ).

A.1 year

B.3 year

C.5 year

D.10 year 61. Tax categories are divided according to different collection objects , The following taxes that belong to the property tax in China's taxation are ().

A. tariffs

B. Vehicle and vessel tax

C. Resource tax

D. auto-purchase tax 62. When the company reviews the original voucher , It is found that there is an error in the amount of the external original voucher , Should be ().

A. Accept the correction of the voucher unit and affix the official seal

B. The original issuing unit shall correct and affix the official seal

C. The original issuing unit reopens

D. The handling personnel shall correct and report to the leader for approval 63. The following statements about the collection method of fiscal revenue in China are incorrect ().

A. Directly pay into the single account of the State Treasury

B. Directly pay into the financial account of extra budgetary funds

C. Summarized and paid to the single account of the state treasury

D. Summarize and pay to the zero balance account of the financial department and budget unit 64. The following are not elements of the tax law ().

A. Tax payable

B. Tax reduction

C. Tax period

D. tax rate 65. following () This is not the superiority of the centralized treasury collection and payment system .

A. Improve the use efficiency of funds

B. Improve the transparency of fund payment

C. It is conducive to the maintenance and appreciation of state-owned assets

D. It is conducive to the correct decision-making of the country on the macro economy 66. The following are not the characteristics of bank settlement accounts ().

A. Handle RMB business

B. Handle fund collection and payment settlement business

C. It's a current account

D. It's a time deposit account 67. Of the following , What belongs to the regulations of the accounting department is ( ).

A.《 Regulations on financial and accounting reports of enterprises 》

B.《 Accounting file management method 》

C.《 Measures for the administration of accounting professional qualifications 》

D.《 The basic work of accounting is standardized 》68. The organization in charge of national accounting work in China is ().

A. The State Council

B. NPC standing committee

C. The Ministry of Finance

D. auditing department 69. according to 《 accounting law 》 The provisions of the , All laws 、 The financial and accounting reports prescribed by administrative regulations shall be approved by () Audit unit , When providing the report , The audit report shall be provided together with the accounting report .

A. Certified public accountants

B. Certified public accountant

C. Certified tax agent

D. Registered Auditor 70. Of the following , What does not meet the requirements for invoicing is ().

A. Fill out the invoice in the order of numbers

B. Fill in the invoice in Chinese

C. Copy all copies of the invoice at one time

D. Open the book at will and use the invoice 71. Professor Yu of a university was invited by an enterprise , Give management training lectures for the middle-level cadres of the enterprise , Get remuneration from the enterprise 5000 element . The tax items applicable to the payment of personal income tax for this remuneration are ().

A. Income from wages and salaries

B. Income from labor remuneration

C. Income from remuneration

D. By chance 72. The single account of the state treasury and the financial department are opened in commercial banks () Carry out payment and liquidation .

A. Special financial account

B. Zero balance account

C. Budget unit zero balance account

D. Special account 73. It marks the end of the pilot work of China's Government Procurement System Reform , The laws and regulations for the national government procurement work entering a new development period are ().

A.《 Government procurement law of the people's Republic of China 》

B.《 Regulations for the implementation of the government procurement law of the people's Republic of China 》

C.《 Measures for the administration of qualification accreditation of bidding agencies for central investment projects 》

D.《 Interim Measures for government procurement to promote the development of small and medium-sized enterprises 》74. The centralized procurement organization is (), According to the buyer's entrustment to handle procurement matters .

A. Enterprise legal person

B. Social organization legal person

C. Non profit enterprise legal person

D. For profit enterprise legal person 75. The retention period of accounting archives can be divided into two categories: permanent and fixed . The following accounting files that are permanently kept by the enterprise are ().

A. Original certificate

B. Annual accounting report

C. General ledger

D. Accounting handover list 76. Government procurement projects in the central budget , Its centralized procurement catalogue is provided by ( ) Identify and publish .

A. The Ministry of Finance

B. The State Council

C. The National People's Congress

D. The Standing Committee of the National People's Congress 77. According to the provisions of China's financial legal system , Of the following , It can be used to handle the depositor's loan redeposit 、 The funds for loan repayment and other settlement are ().

A. Personal savings account

B. General deposit account

C. Temporary deposit accounts

D. Special deposit account 78. According to the tax collection authority and income control authority , China's taxes can be divided into central taxes 、 Local tax and central local shared tax . Of the following , What belongs to the local tax is ().

A. The VAT

B. Land value added tax

C. corporate income tax

D. Resource tax 79. The fundamental law of national budget management and the basis for formulating other budget laws and regulations are ().

A.《 Budget law of the people's Republic of China 》

B.《 Regulations for the implementation of the budget law of the people's Republic of China 》

C.《 Decision on strengthening the examination and supervision of the central budget 》

D.《 Regulations of Beijing Municipality on budget supervision 》80. The core of socialist morality is ().

A. Serve the people

B. Dedication

C. free 、 equality

D. Thrift and self-improvement 81. Of the following , Those who belong to individual income tax resident taxpayers are ().

A. No domicile in China , Individuals who have lived for less than a year

B. Individuals who have no domicile and do not live in China

C. No domicile in China , And more than 6 Less than three months 1 Years of personal

D. Individuals domiciled in China 82. Tax agent refers to having relevant knowledge of tax agency 、 Experience and ability , Have the qualification of tax agency , the () And province 、 Autonomous region 、 Approved by the State Administration of Taxation of the municipality directly under the central government , Specialized personnel engaged in tax agency and their working institutions .

A. The Ministry of Finance

B. State-owned assets supervision and administration commission

C. State Administration of taxation

D. National People's Congress 83. Accountants " Stick to the rules ” The core of is persistence ().

A. Accounting Law

B. Accounting standards

C. Auditing standards

D. The tax system 84. Qualification of chief accountant 、 Appointment and removal procedures 、 Responsibilities and authorities are determined by ( ) Regulations .

A. The State Council

B. The Ministry of Finance

C. Institute of certified public accountants

D. Chinese Accounting Society 85. The scope of government procurement parties does not include ( ).

A. Purchaser

B. supplier

C. Government procurement supervision and administration agency

D. Purchasing agency 86. In our country 《 Implementation outline of citizen moral construction 》 Put forward the basic content of professional ethics , among , The foundation of professional ethics is ().

A. I love my job

B. Be honest

C. Be fair

D. Serve the masses 87. according to 《 accounting law 》 The provisions of the , All units accept the accounting supervision and inspection implemented by the supervision and inspection department according to law ().

A. Be responsible

B. Due diligence

C. The basic requirements

D. Legal obligations 88. The basic way of accounting professional ethics cultivation is ().

A. The spirit of cautious independence

B. Professional ethics evaluation

C. Social practice

D. Be diligent in learning 89. When overseas enterprises contract construction projects and provide labor services in China , It shall be from the date of signing the project contract () Inside , Apply to the local tax authority where the project is located for tax registration .

A.10 Japan

B.15 Japan

C.30 Japan

D.60 Japan 90.《 Government procurement law of the people's Republic of China 》 since () Come into effect .

A.2000 year 1 month 1 Japan

B.2003 year 1 month 1 Japan

C.2005 year 1 month 1 Japan

D.2007 year 1 month 1 Japan 91. according to 《 Government procurement law 》 The provisions of the , For having particularity , Goods that can only be purchased from a limited range of suppliers , The applicable government procurement method is ( ).

A. Public bidding

B. Invitation to bid

C. Competitive negotiation

D. Single source approach 92. While doing their job well, accountants , Strive to study related businesses , Be fully familiar with the business activities and business processes of the unit , Actively put forward reasonable suggestions on the problems existing in the operation and management of the unit , Assist leaders in decision-making , This reflects the professional ethics of accounting () The requirements of .

A. I love my job

B. Improve your skills

C. Participate in management

D. Stick to the rules 93. Among the following behaviors, those who do not need to pay consumption tax are ().

A. Jewelry stores sell gold and silver jewelry

B. Imported taxable cosmetics

C. Directly sell cut tobacco after entrusted processing and recovery

D. Distribute the self-produced beer as welfare to the employees of the enterprise 94. Financial capital expenditure shall be paid directly and authorized by finance according to different payment entities . The expenditure of direct financial payment does not include ( ).

A. Wage expenditure

B. Purchase expenses

C. Transfer expenses

D. Sporadic expenditure 95. Establish incentive mechanism , The main basis for assessing, rewarding and punishing accountants' compliance with professional ethics is ().

A. Accounting professional ethics standards and norms

B.《 accounting law 》 Etc 、 statute

C. Internal work discipline

D. Relevant provisions of accounting industry organizations 96. Accountants have a correct attitude 、 Act in accordance with the law , When dealing with accounting affairs involving the interests of all parties , Don't be swayed by others , Do not choose because of personal likes and dislikes , Seeking truth from facts , Avoid leaning to either side , Maintain due independence , This is the accounting professional ethics () The requirements of .

A. Be honest

B. Objective justice

C. Improve your skills

D. Stick to the rules 97. In the following statements about personal bank settlement accounts , What's not right is ().

A. The amount paid from the unit bank settlement account to the individual bank settlement account is taxable , The tax withholding unit shall provide the tax payment certificate to its deposit bank when making payment

B. Those who use credit card payment tools can apply for opening a personal bank settlement account

C. Funds paid from the unit bank settlement account to the individual bank settlement account , The bank shall carefully examine the original of the payment basis or collection basis according to relevant regulations , And keep a copy . Keep according to accounting files

D. Savings accounts are the same as personal bank settlement accounts , You can also handle transfer settlement 98. Understand professional ethics 、 emotional 、 Faith turns into (), Is the fundamental purpose of professional ethics training .

A. Economic performance

B. Benefits

C. action

D. habit 99. The guarantee of a bill of exchange must not be conditional , If there are conditions , The consequence is ().

A. This warranty is void

B. Deemed not guaranteed

C. It does not affect the guarantee responsibility for the bill

D. The guarantor is responsible for the attached conditions 100. The accountant qualification certificate will record all kinds of information about the accountant himself , Once obtained , Its effective range is ().

A. The national

B. whole province

C. The whole industry

D. Within the Department

边栏推荐

- 毕业才知道IT专业大学生毕业前必做的1010件事

- ucore lab 2

- C4D quick start tutorial - Introduction to software interface

- What are the software testing methods? Show you something different

- Introduction to safety testing

- MySQL数据库(一)

- Market trend report, technical innovation and market forecast of lip care products in China and Indonesia

- LeetCode#62. Different paths

- Crawler series of learning while tapping (3): URL de duplication strategy and Implementation

- What to do when programmers don't modify bugs? I teach you

猜你喜欢

Intensive learning notes: Sutton book Chapter III exercise explanation (ex17~ex29)

Your wechat nickname may be betraying you

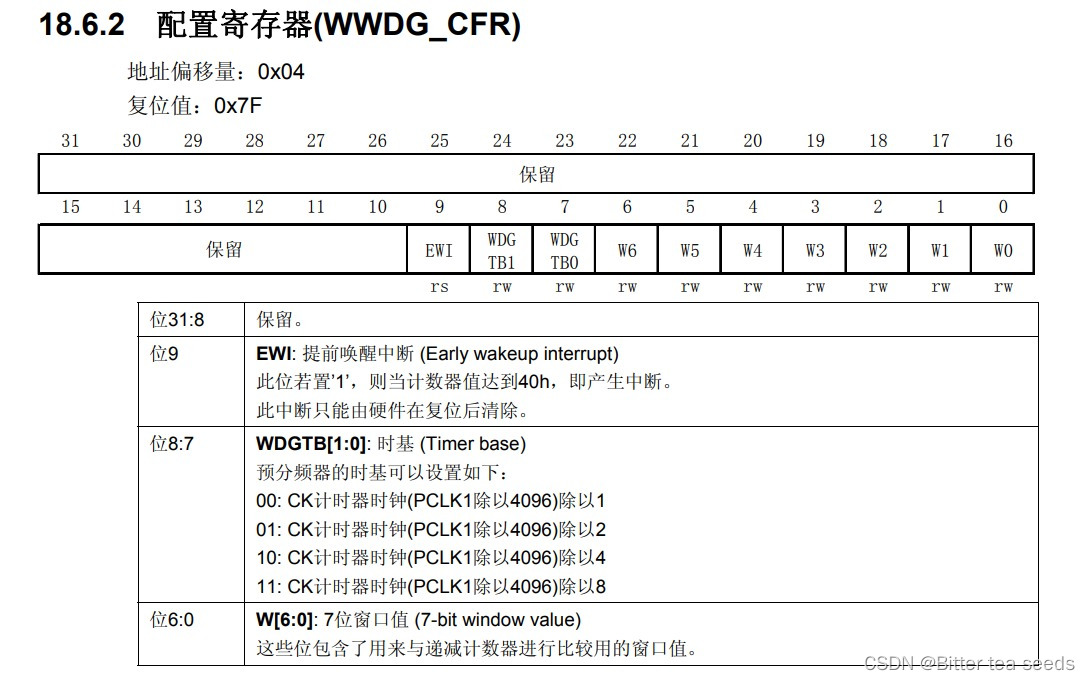

学习记录:使用STM32F1看门狗

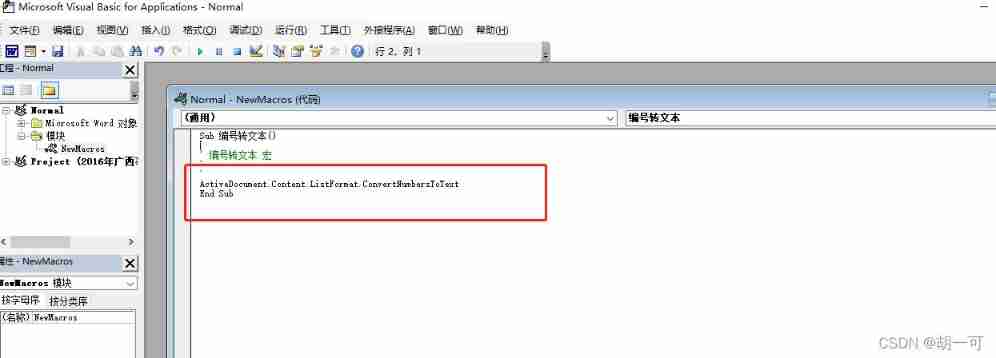

Word macro operation: convert the automatic number in the document into editable text type

![[C language] twenty two steps to understand the function stack frame (pressing the stack, passing parameters, returning, bouncing the stack)](/img/3a/aadde60352c42199ba287a6997acfa.jpg)

[C language] twenty two steps to understand the function stack frame (pressing the stack, passing parameters, returning, bouncing the stack)

Lab 8 文件系统

STM32 learning record: input capture application

ucore Lab 1 系统软件启动过程

FSM and I2C experiment report

MATLAB综合练习:信号与系统中的应用

随机推荐

Learning record: USART serial communication

Lab 8 file system

Introduction to safety testing

Do you know the performance testing terms to be asked in the software testing interview?

Cost accounting [14]

Medical colposcope Industry Research Report - market status analysis and development prospect forecast

ucorelab3

ucorelab4

Jupyter installation and use tutorial

学习记录:串口通信和遇到的错误解决方法

The most detailed postman interface test tutorial in the whole network. An article meets your needs

How to do agile testing in automated testing?

Do you know the advantages and disadvantages of several open source automated testing frameworks?

What are the software testing methods? Show you something different

Visual analysis of data related to crawling cat's eye essays "sadness flows upstream into a river" | the most moving film of Guo Jingming's five years

MySQL数据库(四)事务和函数

Interface test interview questions and reference answers, easy to grasp the interviewer

Word macro operation: convert the automatic number in the document into editable text type

MySQL数据库(二)DML数据操作语句和基本的DQL语句

Lab 8 文件系统