当前位置:网站首页>How can big state-owned banks break the anti fraud dilemma?

How can big state-owned banks break the anti fraud dilemma?

2022-07-07 21:05:00 【Tencent cloud database tencentdb】

In recent years , Various fraud cases are frequently reported in the newspapers ,“ Finance makes wealth ” It's impossible to prevent fraud . Online banking fraud 、 Telephone banking fraud 、 Network fraud 、 Telecommunication fraud 、 Swiping bank cards 、POS Machine cash 、 Loan fraud …… Lured by huge interests , The depth of financial fraud is bottomless . Risk control departments of major banks have also been committed to iterating the anti fraud system to guard people's property .

Anti fraud dilemma

When communicating with Tencent cloud, the credit card center of a large state-owned bank once said ,“ The traditional artificial or expert experience based anti fraud system can no longer adapt to complex financial fraud patterns .”

First of all The manual operation steps in the review process are cumbersome , inefficiency . When the bank reviews manually , It is often necessary to call the customer and his unit to verify the authenticity of the information . After the preliminary evaluation of the application by the evaluation system , For individuals, we also need to review various information of applicants and guarantors , Such as credit history 、 Known assets 、 Professional characteristics, etc . Understanding this information often requires cross system 、 Cross departmental access to documents , Such as accessing the image file of the application to the image system 、 Obtain the existing customer information from the card issuing system 、 Get the customer credit report from the credit reporting system .

These seemingly simple operations , Actually, it is tedious and time-consuming .“ If there is a system , These related information can be clearly presented , Let us ‘ Disposable ’ See all the problems , It's a lot more efficient ”, Salesman Xiao Chen ( alias ) Express .

The approval process lacks an associated perspective

Another problem facing banks at present is Gang fraud .

Compared to personal fraud , Gang fraud It affects a wider range 、 Social harm is higher . In credit application fraud , Gang crime will cause losses to the bank .

“ The existing credit card approval rules are mostly for individuals ,” The head of the Credit Card Center said ,“ Those rules against personal fraud are difficult to achieve satisfactory results for gang fraud .”

TGDB How to break the situation ? In the face of the above problems , The credit card center is actively looking for feasible solutions , Finally, I turned my attention to the... Which has been gaining momentum in recent years “ Graph database ”.

It's normal in life “ Relationship ”, In the graph database, it is similar to “ data ” It's just as important .

In the financial world , Money launderers use multiple transfers in a short time “ Relationship ” Hide the source of dirty money ;

Money laundering network multi-layer transfer “ Relationship ”

Pig killing dish uses the Internet to make friends “ Relationship ” Seduce the victim ;

Social networking “ Relationship ”

Fraud gangs use each other's secretive “ Relationship ” Internal and external collusion , Defraud high loans ……

Credit application fraud “ Relationship ” The Internet

Make good use of these often overlooked in the financial world “ Relationship ”, It plays an important role in the healthy development of finance , And finance has done well , Play chess , The whole game .

“ If the data itself cannot be changed , Maybe we can change the way data is stored .” The head of the Credit Card Center said .

After many comparative tests , The large state-owned bank finally chose Tencent cloud number map TGDB.TGDB It is a distributed native map database developed by Tencent cloud , Support dynamic online capacity expansion , Efficiently support trillion point and edge super large map query 、 Calculation 、 analysis , Millisecond deep chain query ; The bottom layer does not rely on third-party storage systems , Compatible with international open source ecosystem and domestic underlying hardware and operating system ; It is easy to use and can reduce a lot of development costs . As for the present The only one that supports Cypher and Gremlin Two query languages The graph database of ,TGDB It also gives customers enough flexible application space with a more open technical architecture .

stay TGDB Under the cooperation of , The credit card center of the bank will record the application information of customers 、 Post loan information 、 The fields in credit information and other third-party data are abstracted as TGDB Figure... In the model “ spot ” and “ edge ”.

“ This kind of dot 、 Compared with the traditional two-dimensional table of relational database, the edge method of building model , More intuitive and effective ”,TGDB The relevant person in charge explained this . The total amount of data finally imported into the graph model is 10 Billion points ,40 Hundred million sides .

be based on TGDB Build an anti fraud map , Empowering business

It is the connection between things as a breakthrough , The Credit Card Center excavates fraud gangs in financial crimes through Association , Reduced the cost of carpet screening , be based on TGDB Anti fraud system Significantly improved the bank's screening efficiency for gang fraud , The calculation of new risk indicators, which could take tens of minutes to complete, can now be completed in real time .

After modeling , Credit Card Center Based on past experience , Preliminarily verified : Application information is abnormally shared 、 Consistency of application information 、 These three kinds of graph rules are associated with high-risk nodes . Under normal circumstances, there should not be multiple people sharing the same application information 、 There is a large amount of inconsistent information in the applicant's historical application record 、 The applicant shares information with the public fraudster . These situations often indicate that the current applicant is likely to be a member of a fraud gang , We need to focus on the investigation .

TGDB Provide clustering 、 Tag spread 、 Minimum connected graph isometric Algorithm , Be able to quickly find social networks centered on current applicants , Mining other related information of the current applicant , Quickly check other suspects who are directly or indirectly related to the current applicant , Let the Mafia escape No escape . The verification results show that , The fraud risk of applicants associated with high-risk nodes is several times higher than that of other ordinary applicants , This also proves the effectiveness of finding fraud gangs based on Association .

Use graph analysis to detect the fraud circle of credit card intermediaries

future

The atlas can also be upgraded

The anti fraud map based on graph database can be continuously evolved and upgraded . future , The bank's Credit Card Center will consider “ Time ” Factor introduction map , Check the people who have suspicious associations with the current applicant from the time dimension . The head of the bank's Credit Card Center said ,“ The idea of this anti fraud system is not only applicable to credit card applications , The future is anti money laundering 、 Anti cash out and other financial risk control fields It will also work , The bank will establish a full platform on this basis 、 Full service chart technology risk control .”

﹀

﹀

﹀

-- More exciting --

Many tests come first ! Tencent cloud database TDGB Won the bid for the Agricultural Bank of China map database project

Birth is king ! Tencent cloud map database performance is thousands of times higher than relational database

↓↓ Click to read the original text , Learn more

边栏推荐

- SQL注入报错注入函数图文详解

- [UVALive 6663 Count the Regions] (dfs + 离散化)[通俗易懂]

- 数值法求解最优控制问题(〇)——定义

- 华泰证券可以做到万一佣金吗,万一开户安全嘛

- How to meet the dual needs of security and confidentiality of medical devices?

- Dachang classic pointer written test questions

- [concept of network principle]

- Nebula importer data import practice

- How to choose financial products? Novice doesn't know anything

- Le capital - investissement est - il légal en Chine? C'est sûr?

猜你喜欢

万字总结数据存储,三大知识点

CodeSonar通过创新型静态分析增强软件可靠性

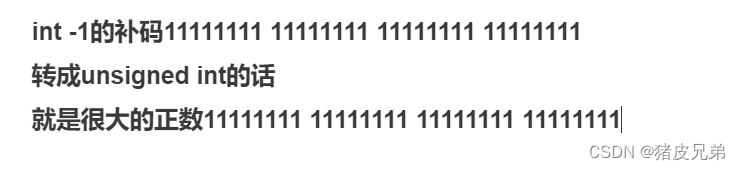

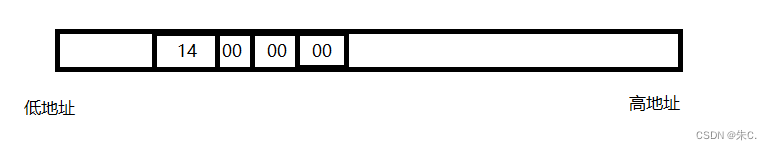

Details of C language integer and floating-point data storage in memory (including details of original code, inverse code, complement, size end storage, etc.)

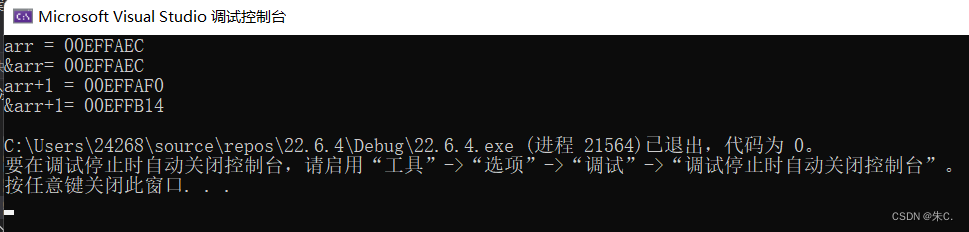

C language helps you understand pointers from multiple perspectives (1. Character pointers 2. Array pointers and pointer arrays, array parameter passing and pointer parameter passing 3. Function point

![Is embedded system really safe? [how does onespin comprehensively solve the IC integrity problem for the development team]](/img/af/61b384b1b6ba46aa1a6011f8a30085.png)

Is embedded system really safe? [how does onespin comprehensively solve the IC integrity problem for the development team]

SQL注入报错注入函数图文详解

智能软件分析平台Embold

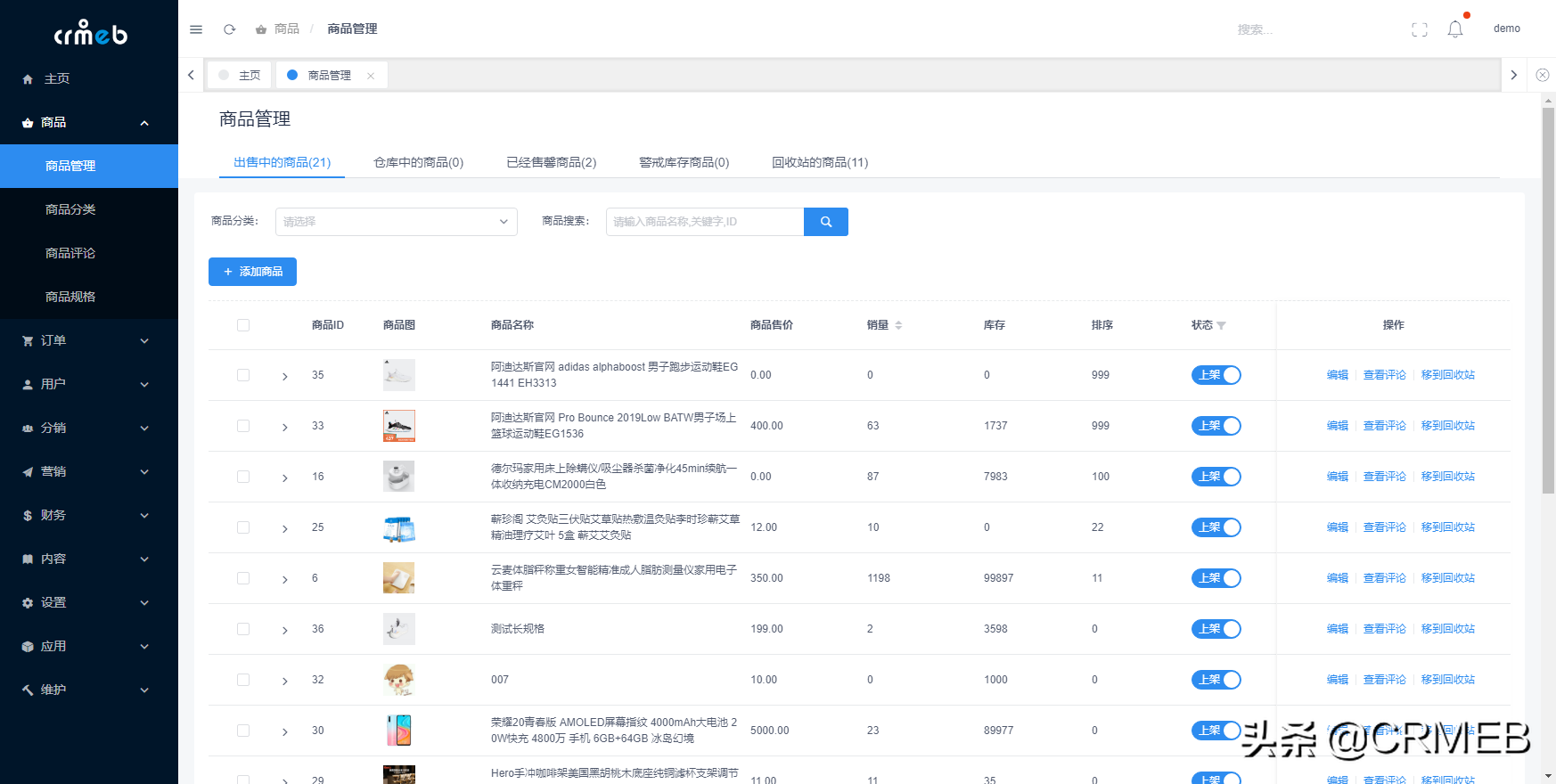

Make this crmeb single merchant wechat mall system popular, so easy to use!

解决使用uni-app MediaError MediaError ErrorCode -5

CodeSonar如何帮助无人机查找软件缺陷?

随机推荐

Word inversion implements "suggestions collection"

Mysql子查询关键字的使用方式(exists)

Numerical method for solving optimal control problem (0) -- Definition

论文解读(ValidUtil)《Rethinking the Setting of Semi-supervised Learning on Graphs》

Flask1.1.4 werkzeug1.0.1 source code analysis: Routing

Écrivez une liste de sauts

恶魔奶爸 A3阶段 近常速语流初接触

Unity3d 4.3.4f1 execution project

Implementation of mahout Pearson correlation

软件缺陷静态分析 CodeSonar 5.2 新版发布

MySQL storage expression error

AADL Inspector 故障树安全分析模块

Details of C language integer and floating-point data storage in memory (including details of original code, inverse code, complement, size end storage, etc.)

Helix QAC 2020.2新版静态测试工具,最大限度扩展了标准合规性的覆盖范围

【奖励公示】第22期 2022年6月奖励名单公示:社区明星评选 | 新人奖 | 博客同步 | 推荐奖

CodeSonar网络研讨会

Phoenix JDBC

Spark judges that DF is empty

目标:不排斥 yaml 语法。争取快速上手

C language helps you understand pointers from multiple perspectives (1. Character pointers 2. Array pointers and pointer arrays, array parameter passing and pointer parameter passing 3. Function point