当前位置:网站首页>When the low alcohol race track enters the reshuffle period, how can the new brand break the three major problems?

When the low alcohol race track enters the reshuffle period, how can the new brand break the three major problems?

2022-07-05 02:22:00 【Yuan Guobao】

Low alcohol wine 2020 It became popular in , In just over two years, a large number of brands have poured in , Only tmall low alcohol new brands exceed 5000 home , Followed by a large number of capital integration ,2021 A total of 56 Start financing , The total investment exceeds 25 Billion . According to the prediction of AI media ,2022 The market scale of low alcohol liquor will break through 5000 One hundred million yuan , Seemingly unlimited potential , But is reality really as beautiful as imagination ?

At the low alcohol circuit , The size of the market 、 Race track competition 、 Price disadvantages are the key factors restricting its development . With the development of the industry , Offline channels 、 Supply chain 、 Product development is also becoming more and more important , The original asset light operation mode is changing to asset heavy , The industry is also accelerating into a new round of reshuffle , The opportunity for new brands to break through is very slim .

1 Annual financing 25 Billion , Seemingly unlimited potential

It's popular in recent years “ Tipsy culture ” The hot low alcohol race track .

The so-called low alcohol wine , Usually refers to alcohol level in 0.5%—20% Between , Liquors dominated by sweet wine , Broadly speaking, it includes wine 、 Yellow Wine 、 beer 、 fruit wine 、 Clear wine 、 The mixer 、 Rice Wine 、 Sparkling wine, etc . And the so-called tipsy , It refers to a state between wakefulness and unconsciousness that young people pursue when drinking . Compared with pushing a glass on a traditional wine table and getting drunk , Today's young people obviously enjoy the pleasure and comfort when they are slightly drunk .

Where there are young people, there must be a market , Where there is a market, there must be capital .2019 year ,“ Low alcohol ” Riding the east wind of capital, it began to explode .2021 year , The financing events of low alcohol racing track are as high as 56 rise , The total amount of financing exceeds 25 Billion , among , Tens of thousands of angel rounds and A Round financing is concentrated in the field of low alcohol alcohol .

The market has also given considerable feedback on low alcohol wines ,2020 In, the sales volume of low alcohol liquor in China was 51.3 One hundred million yuan , Only on tmall platform, the low alcohol brand is up to 5000 home , Among them, there are Lan Zhou 、 Meijian and other emerging brands .2021 New year tmall liquor “ double 11” period , The year-on-year growth rate of the number of low tide drinkers exceeded 50%.

besides , Traditional Baijiu brands have also entered the market for low alcohol liquor —— Maotai launch “ Youmi ” Blueberry wine ; Luzhou Laojiao also launched “ Qing language ”“ Drink between flowers ”“ Peach blossom drunk ” And other fruit wine brands ; Wuliangye launched “ Xianlin green plum wine ”“ Hundred foot pomegranate wine ”“ My tune ” etc. ; Gujing gongjiu also established Anhui baiweilu Wine Co., Ltd .

meanwhile , The farmer mountain spring 、 Consumer giants like coca cola are also grinding their fists and feet .2020 year 5 month , Nongfu mountain spring released its first rice wine + Sparkling wine products TOT Bubble drink . soon , Coca Cola has also introduced the alcoholic beverage Topaz hard soda sparkling wine …

Internet giants also cross the board , Byte skipping “ Byte castle ”“ Inspiration code ” And other low alcohol brands , And rely on Tiktok to sell wine in the form of live broadcast and short video , Netease strictly selected 、 Ali also has its own low alcohol liquor brands .

This shows the popularity of low alcohol liquor market . Analysis and Research on China's low alcohol wine industry shows ,2021 After year , China's low alcohol liquor market will enter a period of rapid growth , The market scale of low alcohol liquor is expected to be 2025 The years will reach 742.6 One hundred million yuan ,2021—2025 The compound annual growth rate can reach 30%.

However, the foam of the low alcohol frenzy was removed , It is not difficult to find its seemingly unlimited potential under the surface , In fact, it is a flash in the pan .

One side , People obviously overestimate the market space of low alcohol wine . Most low alcohol brands are targeting “Z Generations of women ”, China Z Generations of women are about 1.2 Billion , And not all Z Generations of women drink , It shows that the target audience of low alcohol liquor is not as large as expected .

On the other hand , The repurchase rate of low alcohol liquor is not high ,36 Krypton has reported , Almost all low alcohol brands 3 The repurchase rate within months is negligible . And the repurchase rate , Determines the life and death of a brand .

Now , The decline of low alcohol wine gradually revealed ,2022 It's over half a year , However, only 8 Low alcohol liquor brands have won the favor of capital . According to the market intelligence data of magic mirror ,2022 year 4-5 Moon dew 、 The whole category sales of fruit wine is about 1.4 One hundred million yuan , Year-on-year decline in 25.9%. The visible capacity of domestic low alcohol liquor is less than 200 Billion , And “ 100 billion market ” There is still a long distance between our assumptions .

Three shackles , Difficult to solve real problems

Behind the rapid development of low alcohol liquor , In fact, there are many challenges and problems .

First , Low alcohol liquor is highly replaceable .

Low alcohol liquor has the dual characteristics of beverage and wine , Its substitutability also comes from these two directions . In terms of beverages , At this stage, all major soft drink brands that are mature in China are likely to become their substitutes ; As far as wine is concerned , China's brewing industry has a long history , A stable market pattern has long been formed , Among them, the revenue of one category of Baijiu accounts for nearly 70% , beer 、 Wine 、 Rice wine and fermented alcohol together account for more than 25% Share , Other wines remaining ( Including low alcohol alcohol ) Less than 4%.

in addition , Various low alcohol liquor brands can also replace each other . Take plum wine for example , Meijian exists on Taobao alone 、 Suzhou bridge 、 Slow heat body 、 Kunzhu 、 Meinaisu and other brands . Although the selling points of these brands are different , But in the eyes of ordinary consumers, the difference is not big , It is also difficult to distinguish between good and bad , The main factor guiding the purchase is marketing .

secondly , The competition in low alcohol liquor industry is very fierce .

It is not difficult to see from the above , Whether traditional Baijiu brands or consumption giants , Or is it the Internet giant , All actively enter the low alcohol circuit , It can be seen that the entry threshold is not high , Industry insiders say investment 40 Ten thousand or so, you can find a factory to arrange the first batch of wine .2021 According to the Mid Autumn Festival big data released by tianyancha in , At present, there are 11.5 More than 10000 families are in business 、 survival 、 Move in 、 Relocated low alcohol related enterprises . near 7 The registered capital is 100 Ten thousand yuan of the following , near 200 Enterprises have financing experience .

The direct result of the large number of players is the serious homogenization of products , Which leads to fierce competition , Price war is hot . According to the wine industry : The price of a bottle of low alcohol wine ranges from tens of yuan to tens of yuan and then to a few yuan , There is even a phenomenon that a factory manufactures more than a dozen low alcohol liquor brands .

Under such fierce competition , Even if some brands have occupied a certain share in the market , But whether we can keep the market share in the future is a problem , For the latecomers who are already declining , Opportunities and market share will only be less and less .

Last , The industry supply chain is not yet mature .

at present , Including berry sweetheart 、 Lan Zhou 、 A quarter past ten 、 Drunken goose Niang and other online popular low alcohol brands adopt the OEM mode , Only a few low alcohol brands such as Bingqing have established their own factories . For many, the comprehensive strength is not strong 、 For start-up brands with tight funds , There is no excuse for adopting OEM mode , The key is to ensure that the OEM enterprises they rely on have sufficient strength , And quality control is in place .

However, in the long run , It's still a matter of time before the OEM model goes wrong . One side , The brand concentrates most of its resources on marketing , The core R & D and production are handed over to the upstream OEM , Homogenization is aggravated ; On the other hand , Brands cannot control all links of factory production , Quality control is difficult . The brand wants to get long-term development , We should also return to quality and workmanship .

The industry is speeding up the reshuffle , Can the new brand break through

There are many brands of low alcohol liquor in China , However, leading brands have not yet appeared , Predictably enough ,2022 This track will usher in the first round of reshuffle , Offline channels will become an important arena for brands to compete .

Different from other new consumer products , Wine has natural social properties , It is called social currency , This makes it impossible for low alcohol liquor sales channels to leave offline . According to the survey data of relevant reports , Take the supermarket 、 The restaurant 、 Traditional channels such as convenience stores are still the main way to buy wine ; stay 18-30 Among young people aged ,KTV、 Social occasions such as bars are still the main consumption scenes .

In terms of offline channels , Traditional wine enterprises 、 Consumer giants undoubtedly have great advantages , But for the current low alcohol brands , Emerging brands still rely too much on online and lack of offline channel layout .

At present, many well-known brands have launched offline experience stores 、 Co branded physical stores . Such as RIO Launch an offline cocktail experience store in Sinan mansion in Shanghai ; Qiandao Lake brewery spent money to build a fine brewing beer house Cheerday, Become the first offline experience store of beer life in Hangzhou .

Emerging low alcohol brands undoubtedly also recognize the importance of offline channels , It's not clear how to brew O2O Lin Yijia, the person in charge, once said , Plan the next stage with the restaurant 、 Creative linkage of offline channels such as bars , The intention is to deepen the brand impression by continuously brushing the sense of existence . at present , E-commerce channels account for only% of the total sales share 20%, And offline channels occupy 80% As much as .

2021 Lanzhou, which has won two rounds of financing in a row in, also attaches great importance to offline channels , It is reported that , Lanzhou has been laid in Sichuan and Chongqing 1 ten thousand + stores , The monthly dynamic sales rate reaches 40%+, It is estimated that twenty or thirty thousand stores will be laid this year . Xifan fruit wine has been settled 300 Home terminal , Including wanghong restaurant 、 Chain medium and high-end catering stores 、 Chain convenience stores 、 Shang Chao ( Box Ma Xian raw 、7FRESH、 Super species ) Wait for offline channels .

But the layout of offline channels is by no means a day's work , It needs long-term construction and operation . How to match channels for different target scenarios ? How to balance online and offline resource investment and achieve 1+1>2 The effect of ? Only let the product really reach the consumers , To personally perceive the user portrait , It is more conducive to the further iteration of the product . For low alcohol brands , These are particularly critical .

The market is growing rapidly 、 Homogeneous products compete to pour in 、 Industry shuffle , It is a problem that every emerging track must face . After this journey, the low alcohol industry has been a blue ocean , But the current track is still highly fragmented , Lack of head brand , Want to break through the brand scuffle smoothly and stand firm , It's not easy .

边栏推荐

- 172. Zero after factorial

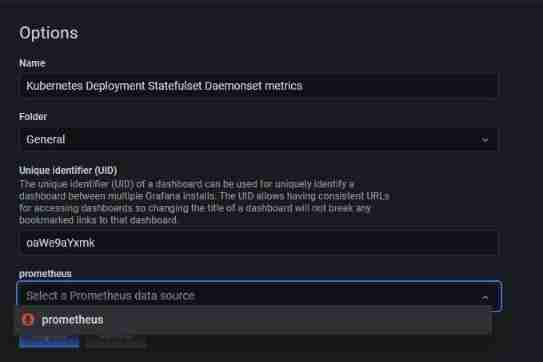

- Prometheus monitors the correct posture of redis cluster

- Luo Gu Pardon prisoners of war

- Some query constructors in laravel (2)

- Pgadmin 4 V6.5 release, PostgreSQL open source graphical management tool

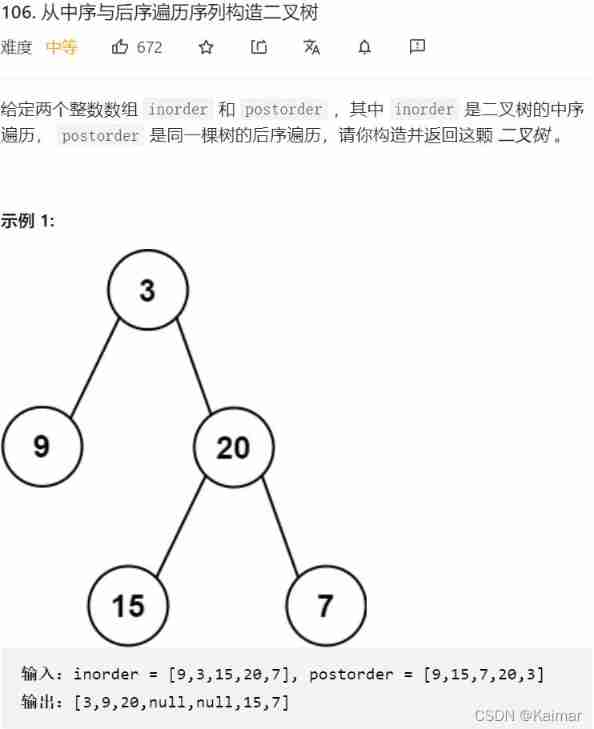

- 【LeetCode】106. Construct binary tree from middle order and post order traversal sequence (wrong question 2)

- [Yu Yue education] National Open University spring 2019 0505-22t basic nursing reference questions

- Interpretation of mask RCNN paper

- Write a thread pool by hand, and take you to learn the implementation principle of ThreadPoolExecutor thread pool

- Design and practice of kubernetes cluster and application monitoring scheme

猜你喜欢

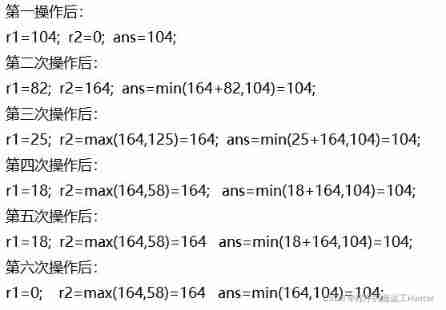

Missile interception -- UPC winter vacation training match

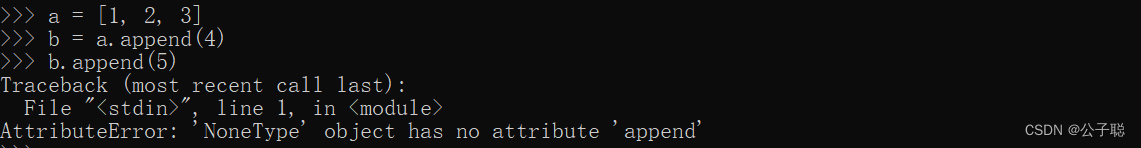

问题解决:AttributeError: ‘NoneType‘ object has no attribute ‘append‘

Design and practice of kubernetes cluster and application monitoring scheme

【LeetCode】106. Construct binary tree from middle order and post order traversal sequence (wrong question 2)

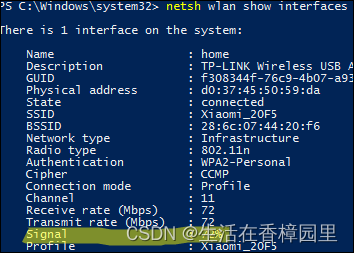

Win: use PowerShell to check the strength of wireless signal

![[technology development-26]: data security of new information and communication networks](/img/13/10c8bd340017c6516edef41cd3bf6f.png)

[technology development-26]: data security of new information and communication networks

【附源码】基于知识图谱的智能推荐系统-Sylvie小兔

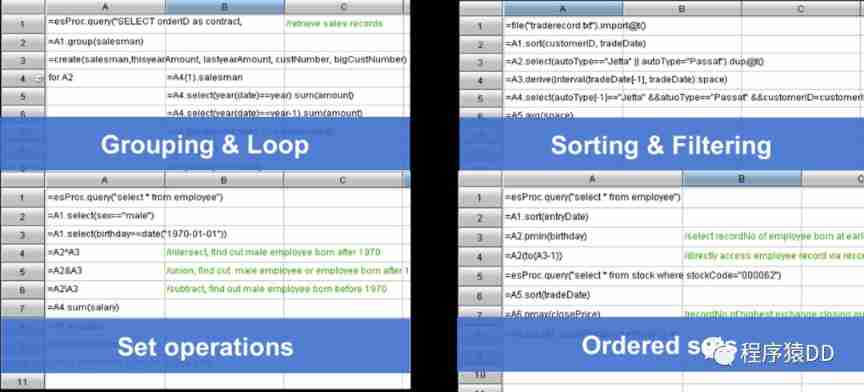

Open source SPL optimized report application coping endlessly

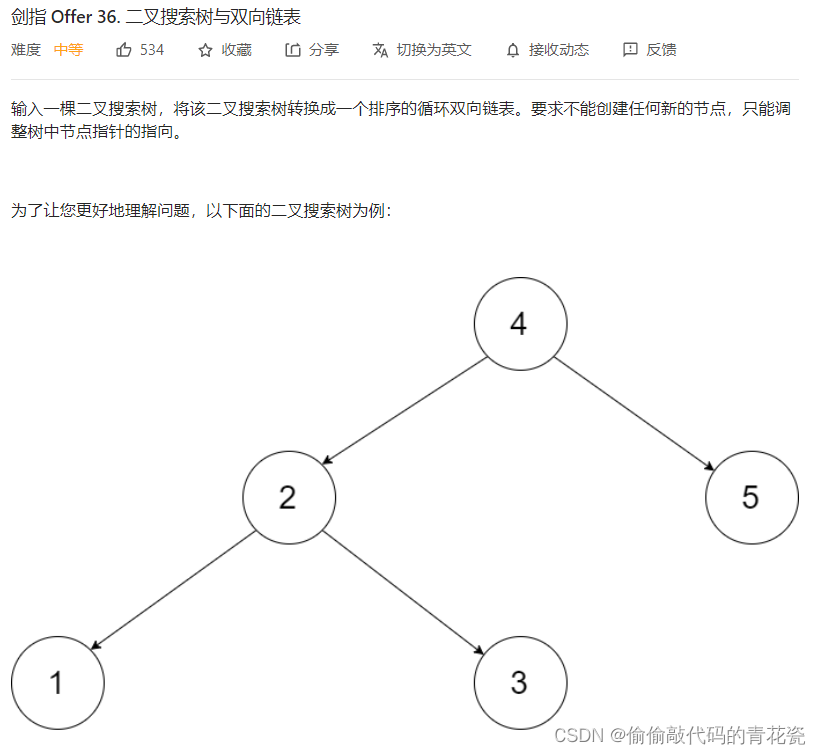

Li Kou Jianzhi offer -- binary tree chapter

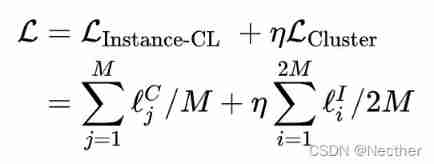

Naacl 2021 | contrastive learning sweeping text clustering task

随机推荐

How to build a technical team that will bring down the company?

Single line function*

openresty ngx_ Lua variable operation

Open source SPL optimized report application coping endlessly

使用druid連接MySQL數據庫報類型錯誤

Three properties that a good homomorphic encryption should satisfy

力扣剑指offer——二叉树篇

Educational Codeforces Round 122 (Rated for Div. 2) ABC

Bert fine tuning skills experiment

【LeetCode】111. Minimum depth of binary tree (2 brushes of wrong questions)

如何搭建一支搞垮公司的技術團隊?

Day_ 17 IO stream file class

Outlook:总是提示输入用户密码

Yolov5 model training and detection

Unpool(nn.MaxUnpool2d)

How to find hot projects in 2022? Dena community project progress follow-up, there is always a dish for you (1)

Visual explanation of Newton iteration method

[Digital IC hand tearing code] Verilog edge detection circuit (rising edge, falling edge, double edge) | topic | principle | design | simulation

The perfect car for successful people: BMW X7! Superior performance, excellent comfort and safety

Interesting practice of robot programming 15- autoavoidobstacles