当前位置:网站首页>Is the spare money in your hand better to fry stocks or buy financial products?

Is the spare money in your hand better to fry stocks or buy financial products?

2022-07-07 13:58:00 【Koufu Q & A】

Take the answer 1:

Relatively speaking, the return of stocks is higher , Then the risk is relatively high .

Financial products are relatively stable .

Take the answer 2:

Take the answer 3:

Take the answer 4:

Take the answer 5:

If you are a small fund and want to get high returns , You can choose more risky stocks to focus on allocation .

If you have a large amount of idle funds , You can choose financial products and stock funds for balanced allocation , Financial products ensure steady income , Stock funds share risks while pursuing excess returns .

Therefore, whether stock speculation or financial products are better depends on people , There is no standard answer , The best choice is to meet your own needs .

I hope my answer will help you , If you have more questions, please feel free to use your mobile phone / Wechat Consulting !

Take the answer 6:

Please consult manager Yang for stock account opening .

Take the answer 7:

Take the answer 8:

I hope my answer will help you , I wish you a happy investment life !

边栏推荐

- 648. 单词替换 : 字典树的经典运用

- Detr introduction

- 社会责任·价值共创,中关村网络安全与信息化产业联盟对话网信企业家海泰方圆董事长姜海舟先生

- Ogre introduction

- Introduction to database system - Chapter 1 introduction [conceptual model, hierarchical model and three-level mode (external mode, mode, internal mode)]

- 高等數學---第八章多元函數微分學1

- call undefined function openssl_cipher_iv_length

- Realize the IP address home display function and number home query

- xshell连接服务器把密钥登陆改为密码登陆

- toRaw和markRaw

猜你喜欢

随机推荐

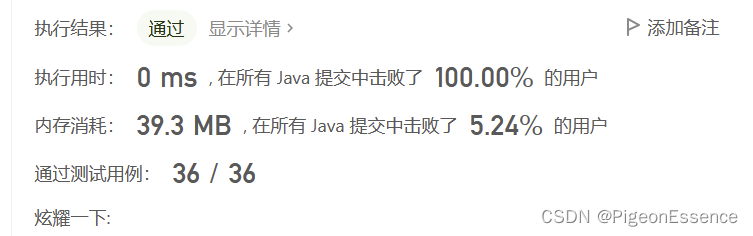

2022-7-7 Leetcode 34. Find the first and last positions of elements in a sorted array

Use day JS let time (displayed as minutes, hours, days, months, and so on)

566. Reshaping the matrix

【堡垒机】云堡垒机和普通堡垒机的区别是什么?

Did login metamask

Supply chain supply and demand estimation - [time series]

flask session伪造之hctf admin

"New red flag Cup" desktop application creativity competition 2022

Move base parameter analysis and experience summary

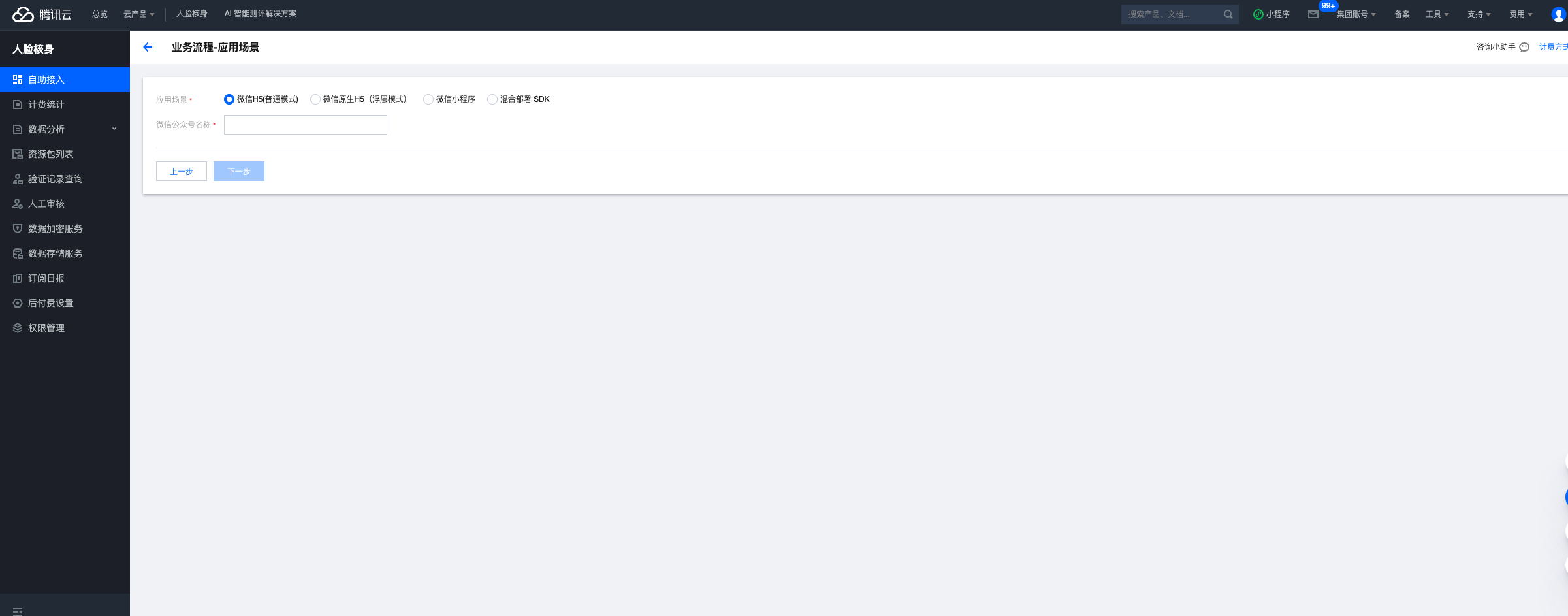

Best practice | using Tencent cloud AI willingness to audit as the escort of telephone compliance

648. 单词替换 : 字典树的经典运用

SSRF漏洞file伪协议之[网鼎杯 2018]Fakebook1

ROS机器人更换新雷达需要重新配置哪些参数

室內ROS機器人導航調試記錄(膨脹半徑的選取經驗)

干货|总结那些漏洞工具的联动使用

Realize the IP address home display function and number home query

参数关键字Final,Flags,Internal,映射关键字Internal

华为镜像地址

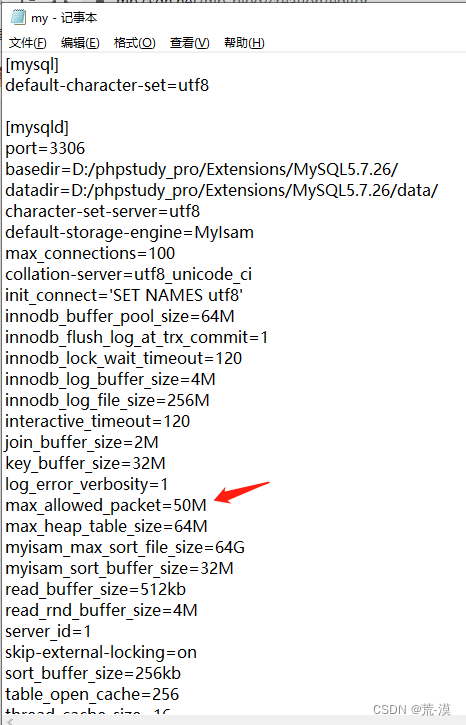

mysql ”Invalid use of null value“ 解决方法

Lavarel之环境配置 .env