B.protocal The aim is to include MakerDao The liquidation of all the collateral assets in the agreement in extreme cases , The market has 20 Billion dollars , This is the time to do toB The market plate is not too big , But it will rise with the growth of the business it serves . although B.protocal It's still in its infancy , There are many unknowns , But for the following reasons, I think it's worth paying attention to :1. They asked the right questions , There are very few projects that do this ;2. With key partners MakerDao Keep a close relationship ;3. founder Yaron Velner Experience in encryption projects , Once in the Kyber Network For two years CTO, It's also WBTC Co designer of the agreement .

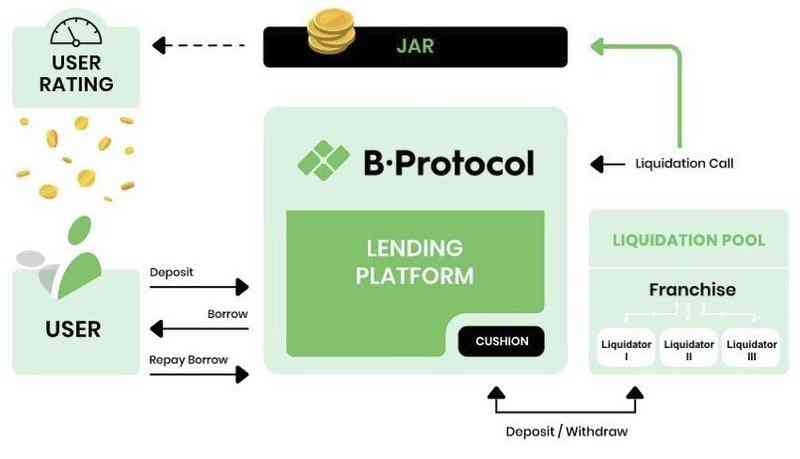

10 month 27 Japan , be based on MakerDAO Of B.Protocal Published online .B.Protocal It's an extreme market situation ( Like this year 3 month ) Settlement agreement , It can protect the mortgage of borrowing users as little as possible : When the debt of users who mortgage and borrow in the platform exceeds their collateral , It will trigger the liquidation mechanism ,B.Protocal Allow the liquidator to pay the debt of the borrowing user in exchange for some collateral , At the same time, liquidity providers are encouraged to share profits with borrowing users , In exchange for priority .

By the end of 11 month 5 The day has come 7000ETH from MakerDAO Import to B.Protocal in .

About B.Protocol

B.Protocol By encouraging liquidity providers to allow the liquidation of uncollateralized loans , And transfer the profits extracted by miners back to the users of the platform , So as to make the lending platform more secure .B.Protocol from Yaron Velner found , He was Kyber Network Of CTO and WBTC Co designer of the agreement .

Since earlier this year “ Black Thursday ” Since the price crash ,DeFi The field faces the risk of large-scale liquidation .B.Protocol Through innovative incentive mechanism to solve this problem .

Although this is MakerDAO Integrated lenders provide potential benefits , but B.Protocol After last week's launch , There's a part of the sound that gets Maker Of oracle I'm worried about the right to vote .

B.Protocol The founder of Yaron Velner I answered about this week B.Protocol、 lately MakerDAO Voting and the potential for future cooperation between projects .

interview

Nate: What is? B.Protocol, How it works ?

Yaron: B.Protocol By providing clarity to participants 、 Quantifiable incentives , send DeFi The lending platform is more stable , At the same time, the extractable value of the miner (MEV) Transfer to users , So that users can get more income from their lending platform , At the same time, it helps to protect its funds .

A week ago , We are MakerDAO For the first time , up to now , There has been a 7000 individual ETH Of the mortgage assets from MakerDAO The vault has been imported into B.Protocol.

User pass B.Protocol Smart contract management interface can import MakerDAO Vault , Gain and MakerDAO The same clause in 、 You can share the clearing proceeds and get voting rights in the next agreement upgrade .

Nate:B.Protocol How is it with MakerDAO Implementation of the interface , To call which parts of the system ?( for example Vaults Vault ,oracle etc. )

Yaron: B.Protocol Integrate with the vault system in a non licensed way , In order to enable the liquidators to share the liquidation profits fairly , We use MakerDAO Of OSM modular , The module determines in the vault system one hour in advance ETH / USD The price of .

MakerDAO Governance decisions allow OSM Integrate , It may be that you want to monetize it at some point , Be similar to Chainlink The profit model of .

Nate: What makes you want to create B.Protocol?

Yaron: exceed 40 Million dollars DeFi Funds rely heavily on reasonable liquidation procedures . In the traditional financial world , Such a platform forms a professional “ brace ”, That means they inspire experienced people algo Traders , Make them willing to take on a certain amount of liquidation in a market crisis .

stay DeFi in , The way is to outsource the process to the public . This unlicensed approach is very much in line with the spirit of blockchain , But it leads to almost zero incentives to build a real clearing system that can handle large amounts of money . Besides , Because there will be competition among the liquidators , Any attempt to encourage the clearing price premium form , Will eventually transfer a lot of value to high gas The miners .

This leads to events like Black Thursday , The liquidation process failed , This makes DeFi The platform has a high daily demand for collateral agents . for example , stay MakerDAI in , Every time you lend 100 The dollar has to have 150 Dollar collateral , And in the Bitmex, borrow 100 The dollar just needs to have 101 Dollar deposits . therefore ,Bitmex Allow you to be in ETH Be long on the price x100 times , and MakerDAO Only x3 The lever of .

In order to make DeFi The platform provides such terms , It needs a real backing .

Nate: Borrowed tokens are used to vote for the most recent MKR Administrators . Can you describe how the process works ? for example , Borrowing and trading order

Yaron: Technically speaking , First ETH It's from dYdX The flash loan ( Because they provide about 2000 Thousands of dollars in ETH Money , And there's no charge for flash loans ). And then this ETH Be deposited Aave, MKR On loan ( In the process, the service charge is almost 0, It's not a flash loan 0.1% Service Charge ). then ,MKR By “ lock ” stay MakerDAO In the voting contract , Have the right to vote , And a vote was taken . then “ lock ” Of MKR Be released , Back to Aave, then ETH Was taken out , Back to dYdX. It all happens in one thing .

Nett :B.Protocol Why vote with borrowed votes ?

Yaron: And MakerDAO After system integration , We had to go deep into the code . It was originally for the liquidation process , And then when our proposal is put to the vote , We are curious about the way the voting process works .

We quickly realized that it was lightning friendly . After months of understanding MakerDAO After the team and the ecosystem , We're pretty sure they know about this feature , And it's a false assumption that they're willing to tolerate . We decided to show it , So it can start some technical discussions , And as a by-product , It can also push for approval of proposals .

Voting is deploying B.Protocol Smart contract executed by the same account , We have no intention of hiding our actions . What we didn't realize was that , It is also possible that the day's attacks were carried out for malicious purposes . result ,MakerDAO The foundation had to take emergency measures .

For let MakerDAO 's team works under pressure , And no more responsible disclosure , We apologize .

Nate: If not in 10 month 26 It was passed on Monday ,MakerDAO The monthly governance cycle may be delayed B.protocal Vote for ( Because it's every month since that day MIP Administrative voting ). Are you worried about this ?oracle How does the delay in whitelist affect your release ?

Yaron: MakerDAO Voting is not yes/no,MKR The holder can only vote for the proposal , You can also vote for it . The bill with the most votes at present is called hat, It can be executed .

As far as we know ,MakerDAO Has never been rejected , But maybe I was wrong . Besides , The introduction of a new proposal may attract more attention , Because there's a pending proposal that needs to be voted on . That is to say , I only learned last week that MakerDAO Voting mechanism , And it can be wrong to assess how things are going .

Delayed approval will delay our release , Because the white list process is long , It's been postponed 2 Zhou . But we are MakerDAO Everyone consulted on the team told us , These tickets will always pass in the end .

Nate: If MakerDAO Experienced malicious governance , That would be right B.Protocol And what impact does it have on its users ?

Yaron: adopt B.Protocol management MakerDAO The users of the vault are essentially MakerDAO user . therefore , If MakerDAO Experience of malicious behavior can lead to loss of funds , It also affects B.Protocol.

B.Protocol Almost completely consistent with its integrated protocol , To make them more stable . Any attack on them could also harm our users . because B.Protocol There's no control over the user's money , Therefore, the security of their deposits depends entirely on MakerDAO The security of .

Nate: B.Protocol How the scoring mechanism works ?

Yaron: B.Protocol Allow liquidators to share revenue with users . This is done according to the user's score , The score depends on the degree of interaction between the user and the protocol .

stay MakerDAO Integrating , The right measure is based on the user generated over time DAI Number . say concretely , Have 1000 individual DAI Debt users will get about 1 New points .

In the first month after launch , The cumulative rate of users is 2 times ( We have been 10 month 27 Daily start , So users still have time to enjoy this policy ).6 After a month , The proceeds will be distributed according to the score , Users can also use scores to vote for protocol upgrades .

The score is not ERC20, And it's not transferable . It's just records kept on the blockchain .

Nett : In addition to compliance , Do you think there is any advantage in making the score non transferable ?

Yaron: B.Protocol The best interest in having organic MakerDAO user . Because there is no initial liquidity required to start , The platform was never intended to be used at all MakerDAO Of the users . These users won't help us improve MakerDAO The security of , And the lack of organic activity will give supporters 0 profits . therefore , Our approach is to MakerDAO Users provide the additional benefits they initially get , But it's impossible to quantify it , So it doesn't encourage human behavior .

Nett : Start up 6 After a month ,B How the governance of the agreement will work ?

Yaron: 6 After a month , Users can vote to upgrade the program sharing mechanism . The mechanism determines the liquidator ( supporters ) How to choose , Their commitment and how they share the benefits .

There will also be new scoring mechanisms , In particular, how to deal with accumulated scores . It doesn't decide what to do with user deposits , These deposits will be kept entirely by them , And subject to the rules of the underlying loan platform .

Nate: How to see B.Protocol The community subsequently participates in the governance of the underlying protocol ? Is there any chance of cooperation ?

Yaron: B.Protocol The long-term goal is to help make the underlying agreement more stable , And through B.Protocol The more underlying protocols of governance are deposited , The safer it is .

The underlying protocol community will have a strong interest in establishing stricter support conditions , This in turn will make it more stable .B.Protocol The community's motivation is to make the underlying protocol more administrator friendly , So as to increase its income . See the interaction between the two communities , And whether the underlying agreement will try to take over at some point B.Protocol government , It's going to be fun .

B.Protocol By motivating liquidity providers ( The holder ) Promise to liquidate the uncollateralized loans and transfer the profits drawn by miners back to the users of the platform , So as to make the lending platform more secure .B.Protocol from Yaron Velner found , He was Kyber Network Of CTO and WBTC Co designer of the agreement .

About

UBI.city - Agreement on future organizational structure , We will release more about UBI.city The conception and design mechanism of , Welcome interested blockchain technology enthusiasts 、 Community initiator 、 Study and analyze people and <span style='color:#BB8719'>Gavin、Iris</span> contact , Discuss together UBI The possibility of the future .

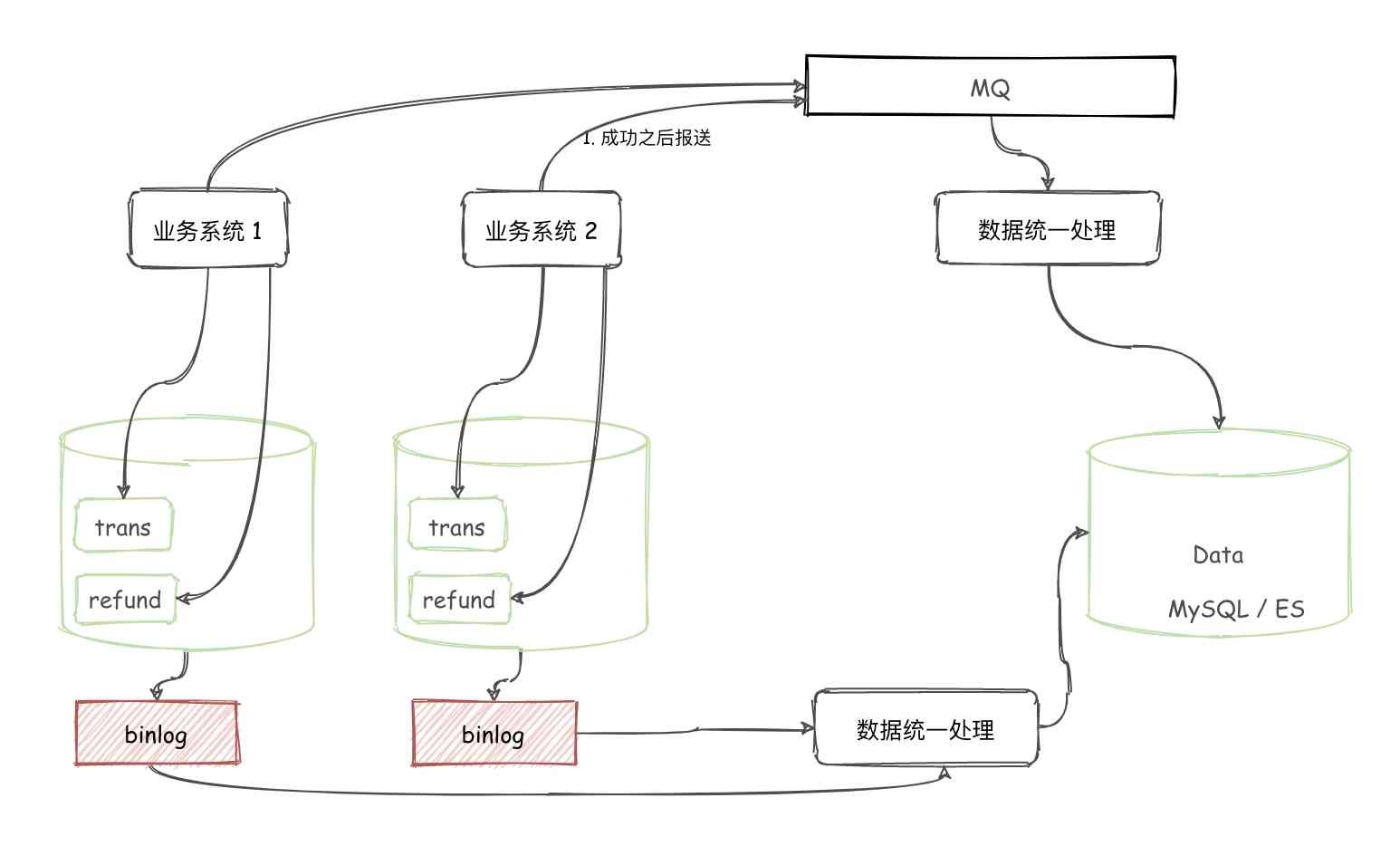

ChinaDeFi - ChinaDeFi.com It's a research driven DeFi Innovation organizations , From all over the world every day <span style='color:#BB8719'>500 A good source of information </span> Close to <span style='color:#BB8719'>900 Content </span> in , seek <span style='color:#BB8719'> Think more deeply 、 It's more systematic </span> The content of , Provide decision-making assistant materials to the Chinese market at the fastest speed