当前位置:网站首页>Xingnuochi technology's IPO was terminated: it was planned to raise 350million yuan, with an annual revenue of 367million yuan

Xingnuochi technology's IPO was terminated: it was planned to raise 350million yuan, with an annual revenue of 367million yuan

2022-07-06 18:59:00 【leijianping_ ce】

RedI network Lei Jianping 7 month 5 Reported Wednesday

Suzhou xingnuochi Technology Co., Ltd ( abbreviation :“ Xingnuochi Technology ”) Recently, in the Shenzhen Stock Exchange gem IPO Terminated .

Sinotech had planned to raise funds 3.52 One hundred million yuan , among ,3 Billion yuan will be used for the new production of precision transmission parts and precision molds ,5186 Ten thousand yuan is used for R & D center construction project .

Annual revenue 3.67 Billion

Sinochem technology is a company mainly engaged in the research and development of precision injection molds and precision injection parts 、 Enterprises that produce and sell . The main products are widely used in automobiles 、 Consumer electronics and small household appliances , And the application field continues to expand .

The company relies on its own precision injection product solution ability and Lean quality management system , According to the main product application fields, the automobile 、 Consumer electronics 、 Small household appliances precision injection mold and precision injection parts three product systems . among , Precision injection molded parts constitute the main source of the company's main business income during the reporting period .

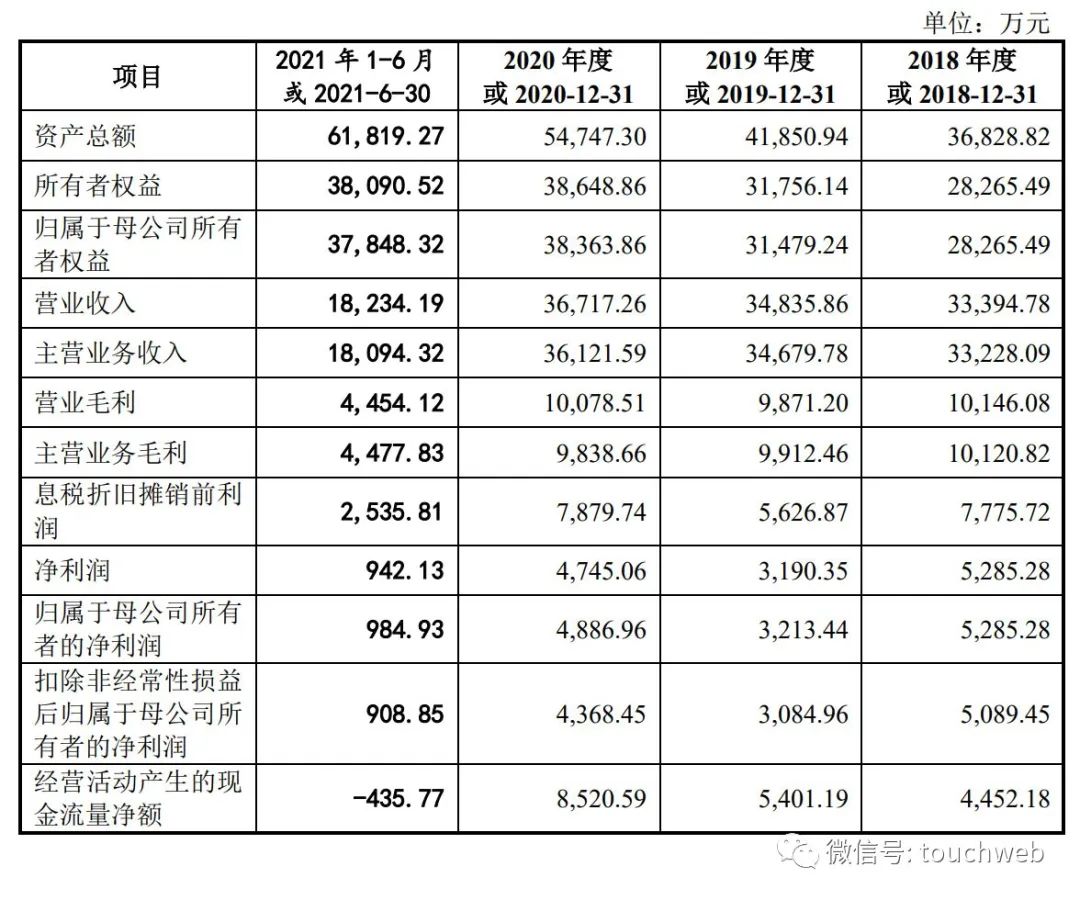

The prospectus shows , Xingnuochi Technology 2018 year 、2019 year 、2020 The annual revenue is 3.34 One hundred million yuan 、3.48 One hundred million yuan 、3.67 One hundred million yuan ; The net profit is respectively 5285 Ten thousand yuan 、3190.35 Ten thousand yuan 、4745 Ten thousand yuan .

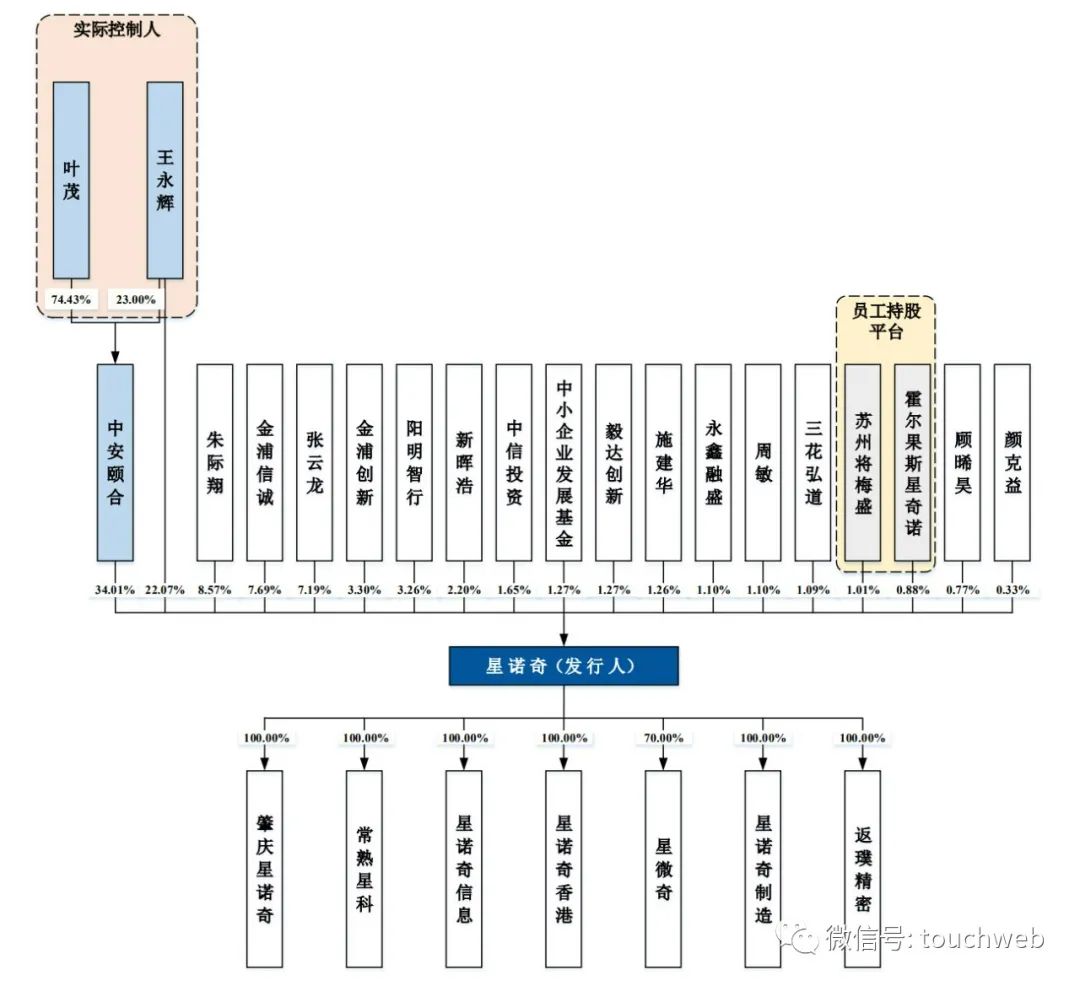

The actual controllers of xingnuochi technology are Ye Mao and Wang Yonghui .

IPO front , Ye Mao does not directly hold shares of the company , Ye Mao indirectly controls the company through Zhongan Yihe 34.01% shares 、 Horgos star Chino, which is controlled by China anyihe, indirectly controls the company 0.88% shares 、 Through Suzhou, Meisheng indirectly controls the company 1.01% shares , Ye Mao indirectly controls the company 35.89% shares ;

Wang Yonghui directly owns the company 22.07% shares . leafy 、 Wangyonghui controls the company in total 57.97% shares .

Zhu Jixiang directly owns the company 8.57% shares , Jinpu Xincheng directly holds 7.69% shares , Zhang Yunlong directly holds 7.19% shares , Jinpu innovation holds 3.2975%, Yangming Zhixing holds 3.2609%, Xinhuihao shares 2.1983%, CITIC Investment Holdings 1.6488, SME Development Fund 、 Yida innovation holds shares respectively 1.2662%, Shi Jianhua holds shares 1.264%, Yongxin Rongsheng 、 Zhou Min holds shares respectively 1.0992%.

———————————————

Lei Di was founded by Lei Jianping, a senior media person , If reproduced, please indicate the source .

边栏推荐

- 驼峰式与下划线命名规则(Camel case With hungarian notation)

- Airiot IOT platform enables the container industry to build [welding station information monitoring system]

- Word如何显示修改痕迹

- Solve DoS attack production cases

- Certains marchés de l'emploi de Shanghai refusent d'embaucher des personnes qui se rétablissent positives à Xinguan

- R语言使用dt函数生成t分布密度函数数据、使用plot函数可视化t分布密度函数数据(t Distribution)

- QLabel 跑马灯文字显示

- ROS自定义消息发布订阅示例

- Understanding disentangling in β- VAE paper reading notes

- Afnetworking framework_ Upload file or image server

猜你喜欢

Openmv4 learning notes 1 --- one click download, background knowledge of image processing, lab brightness contrast

Introduction to the use of SAP Fiori application index tool and SAP Fiori tools

三年Android开发,2022疫情期间八家大厂的Android面试经历和真题整理

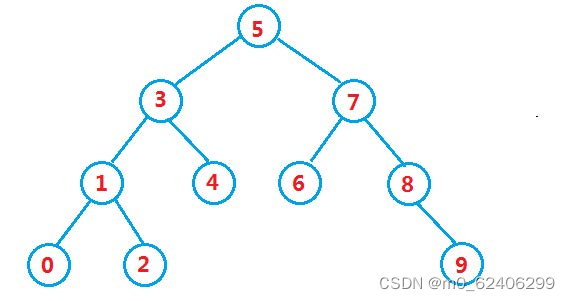

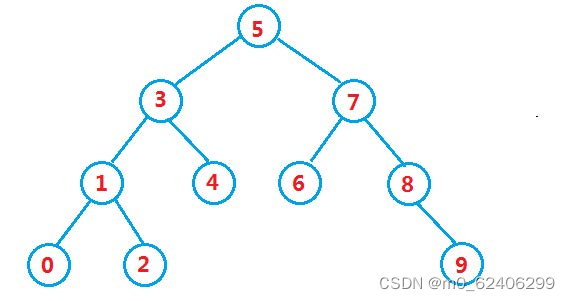

Binary search tree

![Optical blood pressure estimation based on PPG and FFT neural network [translation]](/img/88/2345dac73248a5f0f9fa3142ca0397.png)

Optical blood pressure estimation based on PPG and FFT neural network [translation]

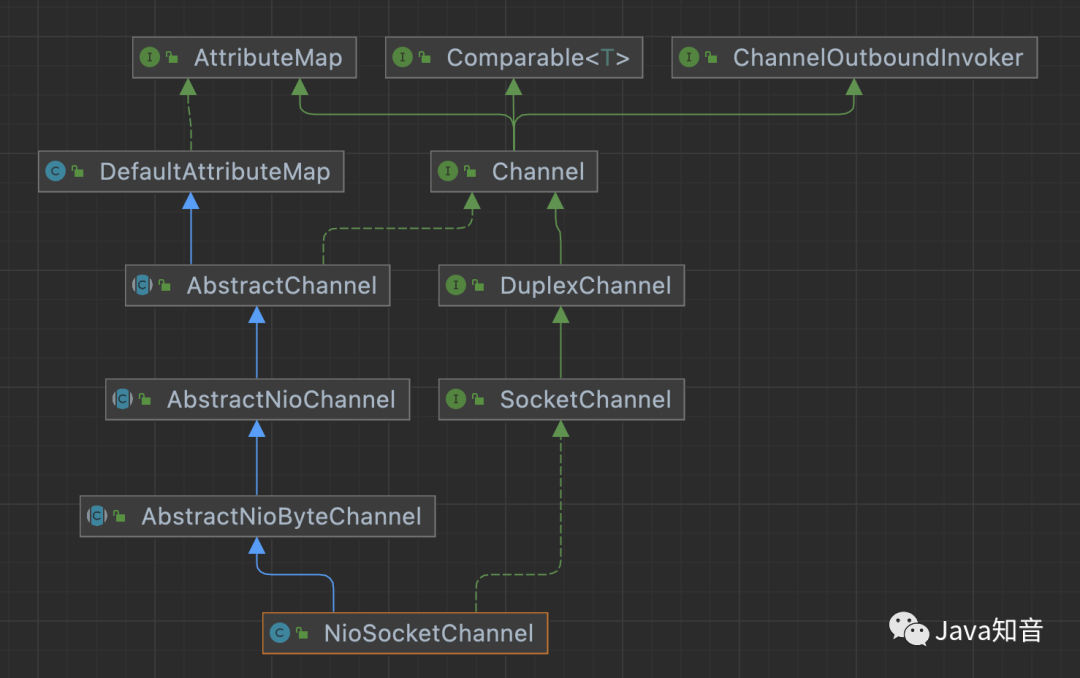

手写一个的在线聊天系统(原理篇1)

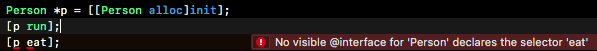

关于静态类型、动态类型、id、instancetype

二叉搜索树

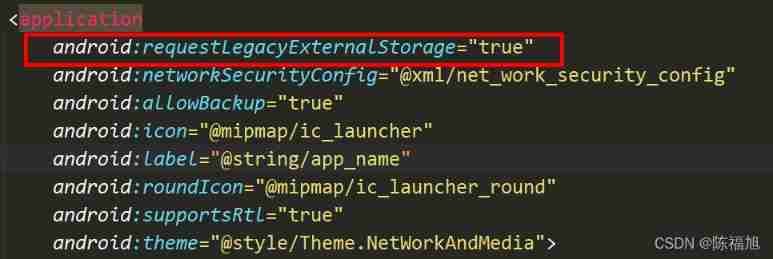

Method of accessing mobile phone storage location permission under non root condition

Handwritten online chat system (principle part 1)

随机推荐

多线程基础:线程基本概念与线程的创建

Lucun smart sprint technology innovation board: annual revenue of 400million, proposed to raise 700million

pychrm社区版调用matplotlib.pyplot.imshow()函数图像不弹出的解决方法

Collection of penetration test information -- use with nmap and other tools

openmv4 学习笔记1----一键下载、图像处理背景知识、LAB亮度-对比度

Xu Xiang's wife Ying Ying responded to the "stock review": she wrote it!

Deep circulation network long-term blood pressure prediction [translation]

Breadth first traversal of graph

R语言ggplot2可视化:使用ggpubr包的ggviolin函数可视化小提琴图

R language ggplot2 visualization: use ggviolin function of ggpubr package to visualize violin diagram

Yutai micro rushes to the scientific innovation board: Huawei and Xiaomi fund are shareholders to raise 1.3 billion

朗坤智慧冲刺科创板:年营收4亿 拟募资7亿

RedisSystemException:WRONGTYPE Operation against a key holding the wrong kind of value

RedisSystemException:WRONGTYPE Operation against a key holding the wrong kind of value

On AAE

Stm32+esp8266+mqtt protocol connects onenet IOT platform

Based on butterfly species recognition

With the implementation of MapReduce job de emphasis, a variety of output folders

Tongyu Xincai rushes to Shenzhen Stock Exchange: the annual revenue is 947million Zhang Chi and Su Shiguo are the actual controllers

SQL injection Foundation