当前位置:网站首页>Cost accounting [18]

Cost accounting [18]

2022-07-06 15:35:00 【Star drawing question bank】

1. Simplified batch method , Product cost Sub Ledger before product completion ().(2 branch )

A. Only register the cost of various materials

B. Register indirect charges , Not registered, directly included in the cost

C. Registration is directly included in the cost , Do not register indirect charges

D. Do not register any fees 2. If a product has a large number of products at the end of the month , The number of products in progress varies greatly in each month , There is little difference in the proportion of various expenses in the product cost , Production costs are allocated between finished products and products at the end of the month , The method to be used is ().(2 branch )

A. Not included in the product cost method

B. Equivalent yield ratio method

C. Work in progress is calculated as finished products

D. Quota proportional method 3. Production personnel 、 Wages and welfare expenses of workshop management personnel , According to the salary and expense distribution table , It should be directly included in the production cost of the product .()(1 branch )

4. Implement guaranteed return 、 Bao Xiu 、 Make a change “ Three packs ” The enterprise , All losses caused by waste products found after the product is sold , In accounting, it should be included in ().(2 branch )

A. Waste loss

B. Non operating expenses

C. Management cost

D. Basic production cost 5. In order to control material requisition , When adopting the fixed cost method , Must carry out () Or quota material issuance system , Raw materials meeting the quota shall be received and issued according to these quota certificates .

A. One time picking

B. No quota picking

C. Multiple picking

D. Quota picking 6. The amortization method adopted is , If the amortization period of low value consumables exceeds 1 year , Should be included in () account .

A.“ Long term unamortized expenses ”

B.“ Deferred expenses ”

C.“ Manufacturing expenses ”

D.“ Low value consumables ”7. Suppose an industrial enterprise has a basic production workshop and an auxiliary production workshop , The former produces product B , The latter provides a kind of labor service . The relevant economic business occurred in a certain month is as follows : Raw materials used in production 13590 element , Which is directly used in the production of B products 8750 element , Used as basic workshop machine material 1210 element ; Directly used for auxiliary production 2700 element , Used as auxiliary workshop machine material 930 element . The manufacturing cost of auxiliary production of the enterprise is through “ Manufacturing expenses ” Account accounting . requirement : Prepare relevant accounting entries based on the above information .

A. borrow : Basic production cost ----- B product 8750

B. borrow : Manufacturing expenses ---- Basic Workshop 1210

C. borrow : Manufacturing expenses 1210

D. loan : raw material 13590

E. borrow : Auxiliary production cost 2700

F. borrow : Manufacturing expenses ------- Auxiliary workshop 9308. The expenses not included in the cost of products are ().

A. Remuneration of production workers

B. selling expenses

C. Financial expenses

D. Management cost 9. Centralized accounting and decentralized accounting refer to ().

A. Cost accounting organizations at all levels within the enterprise

B. Enterprise internal cost accounting function

C. Internal accounting objects of enterprises

D. Enterprise internal cost accounting tasks 10. The detailed statement of manufacturing expenses reflects that the enterprise is in () Statement of manufacturing expenses incurred in the and their composition .

A. Planning period

B. Report period

C. base period

D. In this issue 11. Under the step-by-step carry forward method , When the semi-finished products of the previous step are handed over to the next step for further processing , The cost of semi-finished products ().

A. Do not transfer with the transfer of physical objects

B. Should be retained in this step

C. Transfer with the transfer of physical objects

D. Transfer only the share borne by the finished products 12. The production of a product is divided into two steps , The cost is calculated by step-by-step carry forward method . The semi-finished products completed and warehoused in the first step of this month are 10000 element , The cost of semi-finished products collected in the second step of this month is 8000 element , Other production expenses incurred this month are 12000 element , At the beginning of 、 The cost of work in progress at the end of the month is 2000 and 1600 element . The cost of the finished product is calculated accordingly () element .

A.22400

B.21800

C.20400

D.1960013. When calculating piece rate wage expenses , Should use () As the calculation basis .

A. Attendance records

B. Time

C. Output and quality

D. labour productivity 14. The cost statements reflecting the expenses include ()

A. Production cost table

B. Detailed statement of financial expenses

C. Breakdown of administrative expenses

D. Detailed statement of sales expenses

E. Manufacturing expense table 15. The characteristic of quota method is ().

A. Set up cost Sub Ledger by product category

B. Make consumption quota in advance 、 Cost quota and cost quota

C. When production costs are incurred , The expenses meeting the quota and the differences incurred shall be accounted separately

D. end of the month , On the basis of product quota , Plus or minus various cost differences , Calculate the actual cost of the product 16. Haizhu enterprise 20×4 year 9 Monthly production of B products , Cost of work in progress at the beginning of the month : Direct material 4680 element 、 Fuel power 230 element 、 Direct labor 970 element 、 Manufacturing expenses 600 element ; The production cost of this month : Direct material 43460 element 、 Fuel power 3170 element 、 Direct labor 5880 element 、 Manufacturing expenses 2300 element . Product B is in process at the end of the month 20 Pieces of , The fixed cost of a single piece of work in progress is : Direct material 470 element , Fuel and power 20 element , Direct labor 42 element , Manufacturing expenses 18 element . requirement : According to the above information , Calculate the finished product cost of product B according to the quota cost method of products in process .

A.11000

B.6480

C.38740

D.5029017.“ Waste loss ” A subsidiary account shall be established according to the workshop , Special accounts are set up in the account according to product varieties , And set up columns or special banks according to cost items , Perform detailed accounting .()

18. Xiao Zhang 、 Xiao Li set up a toy factory in partnership , Usually only keep a daily account , Time is long. , It was found that there was no way to distinguish between various categories , What are the costs of different models of toys , It's hard to control the monthly cost , How to calculate the cost ?()

A. Establish a cost accounting organization

B. Provide special cost accounting personnel

C. Various production costs and period costs that will occur , Prepare expense allocation table by setting up accounting accounts , Make attribution and distribution

D. Calculate the cost of finished products and work in progress at the end of the month 19. According to the auxiliary production cost allocation table , When preparing accounting entries , The debit account may be ().

A. Basic production cost

B. Auxiliary production cost

C. Management cost

D. Manufacturing expenses 20. The characteristic of cost calculation is ().

A. Calculate product cost by product category

B. Calculate the product cost according to the product variety

C. Collect production expenses by product category , Calculate the product cost , The indirect expenses of various products in the same kind of products shall be allocated and determined by a certain method

D. Collect production expenses by product category , Calculate the product cost , The expenses of various products in similar products shall be allocated and determined by certain methods 21. In enterprises that do not separately account for waste loss , Not established “ Waste loss ” Accounts and cost items , Value of recycled waste materials , Accounting treatment is not required .()

22. An industrial enterprise mass produces a 、 B 、 C three products . The structure of these three products . The raw materials used are similar to the process , Therefore, they fall into one category (A class ), Use the classification method to calculate the cost . The standard for allocating expenses among various products in the category is : The raw material cost is allocated according to the raw material cost coefficient of various products ; The cost coefficient of raw materials is determined according to the cost quota of raw materials ( Take C product as the standard product ). The production output of this month : A product 1000 Pieces of , B product 1200 Pieces of , C product 800 Pieces of ; Raw material cost quota per unit product : A product 240 element , B product 300 element , C product 360 element . requirement : Calculate the cost coefficient of raw materials

A. A product 0.66

B. B product 0.83

C. C product 1

D. None of the above 23. Cost calculation of joint products , Most suitable for classification .()

24. An enterprise calculates waste loss and shutdown loss separately , The cost item shall include ().

A. Direct material

B. Direct labor

C. Manufacturing expenses

D. Waste loss

E. Downtime losses 25. The disadvantage of the quota method is ().

A. Fixed cost must be established , Calculate the deviation from quota separately

B. When the quota changes, the quota cost must also be revised , Calculate the variance of quota change

C. The workload is larger than that of other cost accounting methods

D. The allocation result of production cost between finished products and products at the end of the month is inaccurate 26. In practice , If the cost of purchased power passes “ Accounts payable ” Account accounting , Then when paying for power, you should ().

A. debit “ Accounts payable ” Account

B. credit “ Accounts payable ” Account

C. Debit the relevant expense account

D. Credit the relevant expense account 27. The auxiliary production workshop of an enterprise produces a batch of low value consumables , To simplify accounting , Auxiliary production and manufacturing expenses are not calculated separately , The expenses incurred this month are as follows : Raw materials for special production tools 6800 element , General material consumption in the workshop 700 element ; Provision for depreciation of fixed assets 2700 element ; requirement : Prepare corresponding accounting entries according to the above information .

A. borrow : Manufacturing expenses — Auxiliary production workshop 10200 loan : raw material 7500 loan : Accumulated depreciation 2700

B. borrow : Auxiliary production cost 10200 loan : raw material 7500 loan : Accumulated depreciation 2700

C. borrow : Basic production cost 7500 loan : raw material 7500 Accumulated depreciation of loan 2700

D. borrow : raw material 7500 Accumulated depreciation 2700 loan : Basic production cost 1020028. The annual planned manufacturing cost of the basic production workshop of an enterprise 163200 element , The planned output of each product in the whole year : A product 24000 Pieces of , B product 18000 Pieces of . Man hour quota per unit product : A product 4 Hours , B product 6 Hours .11 At the beginning of the month “ Manufacturing expenses ” Account credit balance 150 element ; The actual output of this month is : nail 1200 Pieces of , B 1000 Pieces of ; The actual manufacturing cost of the month is 9100 element .12 Actual output in the month : nail 900 Pieces of , B 800 Pieces of , The actual manufacturing cost of the month is 6200 element . requirement : Calculate the annual planned allocation rate of manufacturing expenses and calculate 11 The manufacturing expenses transferred out shall be allocated in the month .

A.0.8 element / Hours ;8640 element .

B.0.6 element / Hours ;8600 element .

C.0.65 element / Hours ;8000 element .

D.0.85 element / Hours ;8400 element .29. Use the sales expense schedule , You can analyze and evaluate the implementation results of the sales expense plan , You can also analyze ().

A. Composition of sales expenses

B. Reasons for the increase or decrease of sales expenses

C. Composition of sales expenses and reasons for increase and decrease

D. Actual completion of sales expenses and reasons for increase or decrease 30. All cost reports , They are all filled in columns by cost items .()

31. The actual cost reduction of comparable products is calculated by using the total cost of the actual output calculated according to the actual unit cost of the previous year and the total cost of the actual output calculated according to the actual unit cost of the current year ().

32. The object of cost restoration is product cost .()

33. Generally speaking, enterprises should be based on () Organize cost accounting .

A. Production and operation characteristics of the unit

B. The need for external reporting

C. The size of the production scale of the unit

D. Requirements for cost management of the unit 34. The unit cost statement of main products is generally a statement that reflects the composition of the unit cost of various main products produced by the enterprise in the reporting period . The table should be prepared separately according to the main products , It is a supplement to the production cost table .()

35. In the following items , Items belonging to manufacturing expenses include ().

A. Vehicle and vessel use tax

B. Test and inspection fee

C. Machine material consumption

D. insurance premium 36. The shutdown loss incurred during the repair of fixed assets in the production workshop shall be included in ().

A. Product cost

B. Non operating expenses

C. Management cost

D. Waste loss 37. The step-by-step carry forward method requires the calculation of the cost of semi-finished products in each step , The reason lies in ().

A. It is the need of cost calculation

B. It is the need of external sales

C. Compare the cost of the same industry

D. It is the requirement of cost control 38. For manufacturing expenses , In essence, activity-based costing divides manufacturing expenses into different constituent departments according to activities , Each part is assigned according to the related work .()

39. In enterprises with single piece and small batch production, the cost calculation period is usually calculated at the end of the month .()

40. Under the condition that the product variety composition and product unit cost remain unchanged , Simple production changes , It only affects the cost reduction amount of comparable products and does not affect the cost reduction rate of comparable products .()

41. The materials collected by the production workshop are directly used for product production 、 Auxiliary materials that contribute to the formation of products , The account to be debited is ().

A.“ Basic production cost ”

B.“ Auxiliary production cost ”

C.“ Manufacturing expenses ”

D.“ raw material ”42. Of the following , It is both a cost calculation method , Another cost management method is ().

A. classification

B. Batch method

C. Variety method

D. Quota method 43. Manufacturing expenses refer to the expenses incurred by various production units within the enterprise for the production of products or the provision of labor services ().

A. Production costs

B. Production expenses that should be included in the cost of products

C. Operating and administrative expenses that should be included in the cost of products

D. Shall be included in the cost of the product 、 However, there are no production costs of specially set cost items .44. The manufacturing cost is allocated according to the proportion of direct labor cost , It is most suitable for enterprise workshops with seasonal production .()

45. Net loss of scrap , At the end of the month, the cost of the same qualified product in this month shall be borne .()

46. In a small batch 、 Single piece production , The product cost can only be in a certain batch 、 Calculate after the completion of a product , Therefore, cost calculation is carried out irregularly , And inconsistent with the production cycle .()

47. Carry forward the cost of finished products , credit () Account .

A. Finished products

B. raw material

C. Stock goods

D. Basic production cost 48. An enterprise consumes all purchased raw materials for production 30000 element , Auxiliary materials 14000 element , Low value consumables 8000 element , among , Purchased materials are consumed in the production of products 36000 element , Consume self-made materials 10000 element , Basic production workshop consumables 6000 element . The wages of production workers that should be included in the cost of products this month 20000 element , Basic workshop management salary 4000 element , The salary of the staff in the administrative department 6000 element , By salary 14% Withdraw welfare expenses in proportion to . The amount of the following production cost elements is calculated correctly ().

A. Purchased materials :30000+14000+8000=52000

B. Wages :20000+4000+6000=30000

C. Benefits payable :30000×14%=4200

D. raw material :36000+10000=4600049. The characteristics of variety method are ().

A. Take the product variety as the object of cost accounting

B. At the end of each month , When there are products , There is no need to adopt a certain method to allocate expenses between finished products and products

C. At the end of each month , There needs to be a way to allocate costs between steps

D. Cost accounting is carried out at the end of each month , That is, the cost calculation period is consistent with the product production cycle 50. When calculating piece rate wage , It should be based on the quantity of products in the production record .()

51. The original value of fixed assets of a workshop at the beginning of the month is 1200 Ten thousand yuan , The original value of machinery and equipment increased this month is 120 Ten thousand yuan , The original value of machinery and equipment decreased this month is 150 Ten thousand yuan , The monthly depreciation rate is 0.2%, Then the depreciation amount of this month is 2.4 Ten thousand yuan .()

52. Among the following enterprises , Suitable for calculating product cost by variety method are ().

A. Textile enterprises

B. Mining enterprises

C. Metallurgical enterprises

D. Machinery manufacturing enterprises 53. Of the following , The fixed assets that should be depreciated in the current month include ().

A. Idle plant

B. Equipment leased in the form of operating lease

C. Overdue equipment

D. Equipment scrapped in the month 54. The production workshop consumes low value consumables , When using the one-off amortization method , Should debit “ Basic production cost ” Account , credit “ raw material ” Account .()

55. The allocation methods of manufacturing expenses are ().

A. Production man hour proportional distribution method

B. Machine man hour proportional distribution method

C. Direct distribution method

D. Planned cost allocation method 56. In order to ensure that the expenses to be borne are correctly collected according to each cost calculation object , The production cost that should be borne by the current product must be correctly in ().

A. Distribution among various products

B. Finished products and distribution among products

C. Distribution between profit products and loss products

D. Distribution between comparable products and non comparable products 57. The change of output affects the unit cost of products, which is shown in ().

A. Direct material items

B. Direct labor projects

C. Variable manufacturing expenses

D. Fixed manufacturing expenses 58. Product cost calculation is actually the of cost and expense account in accounting ().

A. Detailed accounting

B. General ledger accounting

C. Accounting treatment

D. General classification accounting and detailed accounting 59. The object of cost accounting refers to cost accounting .()

60. Formulation and revision of quota , Just to prepare cost plans and conduct cost analysis , It has nothing to do with the calculation of product cost .()

61. When checking , The inventory table of WIP shall be prepared according to the inventory results and Book Data , Fill in the book amount of products in process 、 Actual inventory and inventory gain / loss 、 As well as the reasons for profits and losses and treatment opinions ; For scrapped and damaged products in process , Its residual value should also be registered .()

62. Planned cost allocation method , It refers to the auxiliary production expenses according to the quantity of labor services provided and the planned unit cost () Method of allocation .

A. Between the beneficiary units

B. First, the cost allocation rate is calculated through interactive allocation , And then according to the external beneficiary units

C. Between beneficiary units outside the auxiliary production workshop

D. Between auxiliary production workshops 63. The product cost is relative to () In terms of the .

A. Certain production type

B. A certain number and a certain kind of products

C. A certain accounting period

D. A certain accounting entity 64. Production costs are allocated between finished products and products in progress , Adopt the pricing method of raw material cost of products in process , Applicable to the following products ().

A. The number of products in progress at the end of each month is large

B. The quantity of products in progress changes greatly at the end of each month

C. The cost of raw materials accounts for a large proportion in the cost of products

D. The above three conditions are met at the same time 65. When calculating the planned cost reduction of comparable products , The indicators to be calculated are ().

A. The total cost of actual output calculated according to the actual unit cost of the previous year

B. The total cost of actual output calculated according to the actual unit cost of the current year

C. The total cost of planned output calculated according to the actual unit cost of the previous year

D. The total cost of planned output calculated according to the planned unit cost of the current year 66. Characteristics of cost calculation period of variety method ().

A. Consistent with the production cycle

B. Determine according to the management requirements

C. Consistent with the accounting reporting period

D. Determine when the finished product is produced 67. Under the simplified batch method : The cumulative indirect expenses of all products are included in the distribution rate = The cumulative indirect cost of all products is divided by the cumulative man hours of all products .()

68. The direct materials are excluded from the expenses included in the product cost of the enterprise 、 Fuel and power 、 Expenses other than direct labor , Generally, it is included in the manufacturing cost .()

69. If the power consumed in the process is not much , There is no “ Fuel and power ” Cost items , The power cost consumed in the process can be included in “ Manufacturing expenses ” Cost items .()

70. The following basic methods that do not belong to cost analysis are ().

A. Comparative analysis

B. Yield analysis

C. Factor analysis

D. Ratio analysis 71. An enterprise produces B product , The material cost quota is 576 element ,B The product will be put into production this month 50 Pieces of , According to the quota picking list , Actual collection 2800 kg , The actual cost 28000 element , The actual cost variance rate of materials is 4%. requirement : Calculation B Product material cost variance .

A.-1120 element

B.+1120 element

C.+1152 element

D.-1152 element 72. An enterprise produces A、B Two products , Co consumption of fuel , The actual cost is 29000 element . The fuel cost quota of the two products is :A product 20 element 、B product 15 element ; The actual output of the month is :A product 500 Pieces of 、B product 300 Pieces of . The following accounting entries for fuel consumption are correct ().

A. borrow : Basic production cost ——A product ( Direct material )20000——B product ( Direct material )9000 loan : raw material —— fuel 29000

B. borrow : Basic production cost ——A product ( Direct material )19000——B product ( Direct material )10000 loan : raw material —— fuel 29000

C. borrow : Basic production cost 29000 loan : raw material 29000

D. borrow : Production costs 29000 loan : raw material 2900073. Power cost directly used for auxiliary production , Should be recorded “ Auxiliary production cost ” General ledger and subsidiary ledger .()

74. For consistency , The same enterprise should always prepare the same cost statement in different periods .()

75. The characteristics of parallel carry forward step-by-step method are ().

A. There are few types of semi-finished products produced in each production step

B. Each step only calculates the various expenses of this step and the expenses that should be included in the cost of finished products ' share '

C. Each step only calculates various expenses incurred in this step

D. There are few types of semi-finished products produced in each step , Therefore, there is no need to calculate the cost of semi-finished products 76. The production cost table does not need to be divided into comparable product cost and non comparable product cost , Because ().

A. It is difficult to divide the products of enterprises into comparable products and non comparable products

B. Comparable products account for a small proportion of all products

C. Neither the enterprise nor the superior organization in charge of the enterprise requires assessment

D. The enterprise itself determines that there is no need to divide 77. Adopt the equivalent yield ratio method , The equivalent output of products in process must be calculated correctly , Whether the calculation of the equivalent output of the product is correct or not depends on the measurement of the degree of completion of the product , The methods for determining the degree of completion of products in progress are ().

A. Press 50% Average the completion rate of each process

B. Calculate the completion rate by process

C. Calculated by quota proportion method

D. The above three methods are 78. The indicators that affect the labor cost per unit product are ()

A. Absenteeism rate

B. Work rate

C. Working hours

D. Hourly wage 79. The basic method of product cost calculation is ().

A. direct method

B. Sequential method

C. Algebra

D. Variety method 80. Employee compensation included in the product , Debit... Separately according to their purpose () Account .

A.“ Basic production cost ”

B.“ Manufacturing expenses ”

C.“ Management cost ”

D.“ Auxiliary production cost ”81. A factory uses the variety method to calculate the product cost , Production a 、 B two kinds of products, the factory 20×5 year 5 Materials consumed in the production of product a in January 4410 element , Materials consumed in the production of product b 3704 element , Materials commonly consumed in the production of Party A and Party B products 9000 element ( The material quota consumption of product a is 3000 kg , The material quota consumption of product B is 1500 kg ). requirement : The materials jointly consumed by Party A and Party B shall be distributed according to the proportion of quota consumption , Write entries for material distribution .

A. borrow : Basic production cost - A product 10410 Basic production cost - B product 6704 loan : raw material 17114

B. borrow : Basic production cost - A product 6704 Basic production cost - B product 10410 loan : raw material 17114

C. borrow : Basic production cost - A product 4410 Basic production cost - B product 3704 loan : raw material 8114

D. borrow : Basic production cost - A product 7410 Basic production cost - B product 5204 loan : raw material 1261482. Cost accounting is a branch of accounting , Is a professional accountant , The object is ().

A. Enterprises

B. cost

C. Money

D. Accounting entity 83. When determining the method of allocation of production cost between finished products and in-process products , The factors to be considered are ().

A. Delivery of raw materials

B. In the number of products

C. The basis of quota management is good or bad

D. The proportion of various expenses 84. When a single scrap loss cost item is set , The waste loss incurred by the enterprise shall finally be recorded in () Debit of the account .

A. Basic production cost

B. Waste loss

C. Manufacturing expenses

D. Management cost 85. The difference between the old quota and the new quota due to the revision of the consumption quota or the planned price of production consumption , be called ().

A. Material cost difference

B. Deviation from quota

C. Quota change variance

D. Quota cost variance 86. In the cost table of commodity products , The amount and rate of reduction of comparable products , It refers to the reduction amount and reduction rate of the actual cost of comparable products compared with the planned cost ()

87. Adopt the simplified batch method ().

A. It can replace the product cost Sub Ledger

B. It can provide the cumulative production cost and cumulative production man hours of all products of the enterprise or workshop on a monthly basis

C. The cumulative indirect cost allocation rate of all products can be registered through this account , So as to calculate the cost of finished products and products in process

D. More accurate calculation of product cost 88. Low value consumables are used as labor materials , The accounting of amortization is exactly the same as that of depreciation of fixed assets .()

89. When analyzing the cost of all commodity products , When calculating the cost reduction rate , Is the cost reduction divided by ().

A. Total planned cost calculated by planned output

B. Actual total cost based on planned output

C. Total planned cost based on actual production

D. Actual total cost based on actual production 90. When using the simplified batch method to calculate the product cost , We should set up a secondary account for basic production costs , But there is no need to set up a subsidiary account of product cost .()

91. When using the step-by-step method to calculate the product cost , The steps of product cost calculation should be completely consistent with the actual production steps .()

92. The method of allocating manufacturing expenses in workshops suitable for seasonal production is ().

A. Production man hour proportional distribution method

B. Direct labor cost proportional distribution method

C. Machine man hour proportional distribution method

D. Annual planned distribution rate distribution method 93. end of the month , A batch of completion tools for auxiliary workshop a , Its planned cost 3400 element , actual cost 3250 element . requirement : Prepare accounting entries for delivery of completion tools .

A. borrow : raw material 3400

B. borrow : Low value consumables 3250

C. loan : Auxiliary production cost 3400

D. borrow : Low value consumables 3400

E. loan : Auxiliary production cost 3250

F. loan : Material cost difference 15094. A product is processed continuously in two production steps , After the first step of processing is completed, turn to the second step of continuous processing , Made into finished products . Total expenses incurred in the first step 55800 element , Cost of finished semi-finished products 27800 element ; The second step is the cost of finished products in this month 52660 element , The cost of semi-finished products 33360 element . requirement : Calculate the cost reduction rate of product a ().

A.0.83

B.1.2

C.1.05

D.1.6795. An enterprise produces a 、 B two products , The total cost of raw materials consumed is 62400 element . Product a put into production this month 220 Pieces of , B product 256 Pieces of . Cost quota of single raw material : A product 120 element , B product 100 element . requirement : The raw material quota cost proportion is adopted to distribute Party A 、 The cost of raw materials actually consumed by product b .()

A. A product 31680

B. A product 31200

C. B product 31200

D. B product 3072096. The method of allocating manufacturing expenses according to the annual planned allocation rate is applicable to ().

A. Enterprises with large manufacturing costs

B. Seasonal production enterprises

C. Enterprises with small basic production workshops

D. Enterprises with small manufacturing costs 97. Under the quota method , The difference of quota change is to break away from quota difference .()

98. Cost reduction is from the last step , The comprehensive cost of semi-finished products of the previous step consumed in each step , according to () Stepwise decomposition , Restore and calculate the cost of finished products reflected by the original cost items .

A. The cost structure of semi-finished products consumed this month

B. The structure of the cost of finished products in this month

C. The cost structure of the semi-finished product produced in the previous step

D. The structure of work in progress cost at the end of the previous step 99. All production costs incurred in the auxiliary production workshop are directly recorded in “ Auxiliary production cost ” subject .()

100. We should scientifically organize cost accounting , must ().

A. Reasonably set up cost accounting organization

B. Provide cost accounting personnel

C. Work according to the laws and regulations related to cost accounting

D. Prepare cost plan

边栏推荐

- China medical check valve market trend report, technical dynamic innovation and market forecast

- Mysql database (V) views, stored procedures and triggers

- LeetCode#36. Effective Sudoku

- 学习记录:如何进行PWM 输出

- 力扣刷题记录

- Indonesian medical sensor Industry Research Report - market status analysis and development prospect forecast

- Programmers, how to avoid invalid meetings?

- cs零基础入门学习记录

- What are the software testing methods? Show you something different

- 学习记录:理解 SysTick系统定时器,编写延时函数

猜你喜欢

ucore lab 2

![[C language] twenty two steps to understand the function stack frame (pressing the stack, passing parameters, returning, bouncing the stack)](/img/3a/aadde60352c42199ba287a6997acfa.jpg)

[C language] twenty two steps to understand the function stack frame (pressing the stack, passing parameters, returning, bouncing the stack)

软件测试Bug报告怎么写?

软件测试面试要问的性能测试术语你知道吗?

ucorelab3

Take you to use wxpy to create your own chat robot (plus wechat interface basic data visualization)

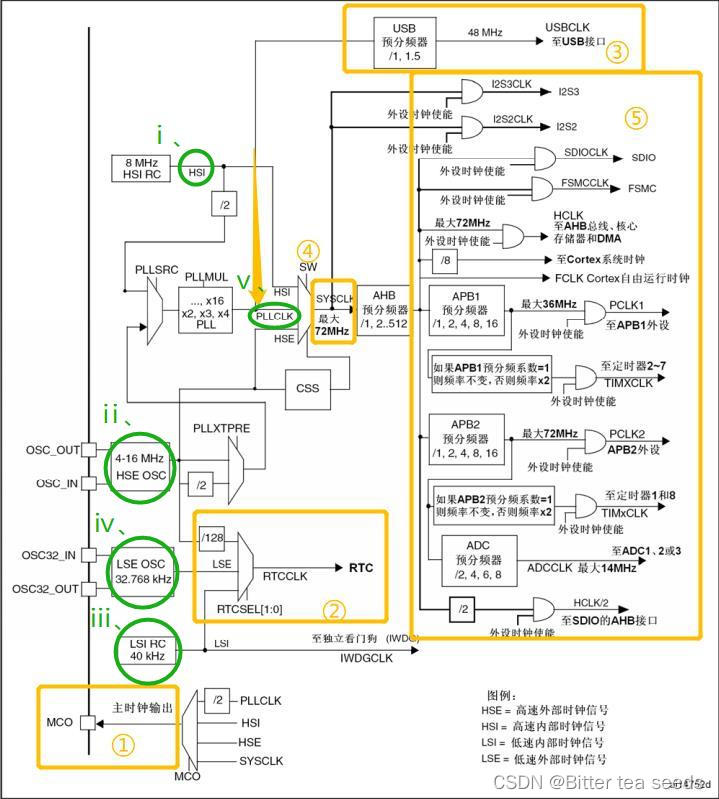

Learning record: STM32F103 clock system overview working principle

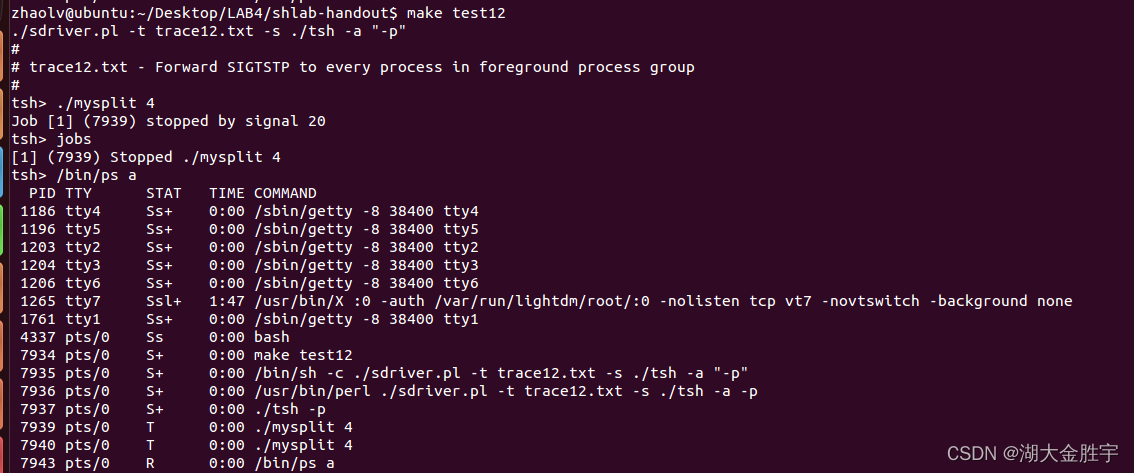

csapp shell lab

C4D quick start tutorial - creating models

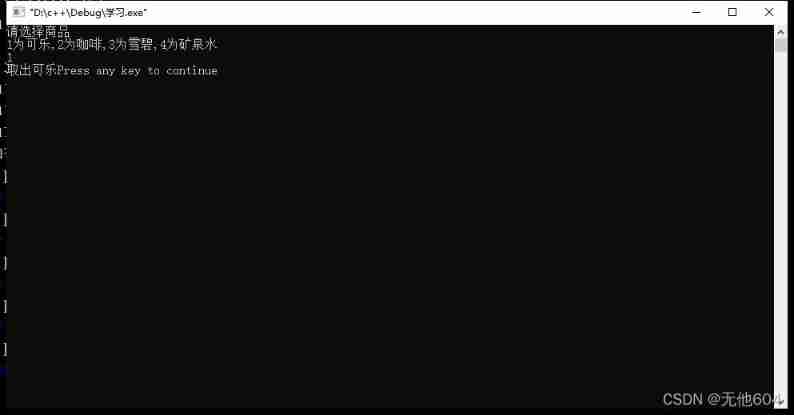

Example 071 simulates a vending machine, designs a program of the vending machine, runs the program, prompts the user, enters the options to be selected, and prompts the selected content after the use

随机推荐

MySQL数据库(四)事务和函数

csapp shell lab

ucore lab 2

JS --- all basic knowledge of JS (I)

How to write the bug report of software test?

转行软件测试必需要知道的知识

A method and implementation of using VSTO to prohibit excel cell editing

STM32學習記錄:輸入捕獲應用

接口测试面试题及参考答案,轻松拿捏面试官

基于485总线的评分系统

Matlab example: two expressions of step function

What is "test paper test" in software testing requirements analysis

力扣刷题记录

MATLAB综合练习:信号与系统中的应用

UCORE Lab 1 system software startup process

学习记录:如何进行PWM 输出

Collection集合与Map集合

How to change XML attribute - how to change XML attribute

MySQL数据库(五)视 图 、 存 储 过 程 和 触 发 器

Brief introduction to libevent