当前位置:网站首页>There are several levels of personal income tax

There are several levels of personal income tax

2022-07-03 18:34:00 【xieshen2021】

One 、 Personal income tax is divided into several levels

( One ) Monthly taxable income ≤3000 In accordance with 3% Tax rate calculation ;

( Two )3000< Monthly taxable income ≤12000 In accordance with 10% Tax rate calculation ;

( 3、 ... and )12000< Monthly taxable income ≤25000 In accordance with 20% Tax rate calculation ;

( Four )25000< Monthly taxable income ≤35000 In accordance with 25% Tax rate calculation ;

( 5、 ... and )35000< Monthly taxable income ≤55000 In accordance with 30% Tax rate calculation ;

( 6、 ... and )55000< Monthly taxable income ≤80000 In accordance with 35% Tax rate calculation ;

( 7、 ... and )80000< The monthly taxable income shall be in accordance with 45% Tax rate calculation ;

notes : Monthly taxable income = Salary income amount - Various social insurance premiums ( Five insurances and one fund, etc ) - threshold .

Two 、 The object of personal income tax

( One ) Legal object

In our country Individual income tax The taxpayer of is a person who lives in China and has income , And individuals who do not live in China and obtain income from China , Including Chinese citizens , Foreigners and Hong Kong who have obtained income in China 、 Australia 、 Taiwan compatriots .

( Two ) Resident taxpayer

Have a domicile in China , Or live in China without residence 1 Years of personal , Is a resident taxpayer , Should be subject to unlimited tax liability , That is, for its income obtained within and outside China , Pay individual income tax according to law .

( 3、 ... and ) Non resident taxpayers

Individuals who have no domicile and do not live in China, or who have no domicile and have lived in China for less than one year , Is a non resident taxpayer , Limited tax liability , Only for its income obtained from China , Pay individual income tax according to law .

3、 ... and 、 The collection standard of individual income tax

from 2019 From the year onwards Individual income tax From 3500 Yuan to 5000 element , This means that the monthly salary is 5000 People who are less than yuan do not need to pay personal income tax .

《 Individual income tax law of the people's Republic of China 》

( One ) The salary range is 1-5000 Between yuan , Include 5000 element , The applicable individual income tax rate is 0%;

( Two ) The salary range is 5000-8000 Between yuan , Include 8000 element , The applicable individual income tax rate is 3%;

( 3、 ... and ) The salary range is 8000-17000 Between yuan , Include 17000 element , The applicable individual income tax rate is 10%;

( Four ) The salary range is 17000-30000 Between yuan , Include 30000 element , The applicable individual income tax rate is 20%;

( 5、 ... and ) The salary range is 30000-40000 Between yuan , Include 40000 element , The applicable individual income tax rate is 25%;

( 6、 ... and ) The salary range is 40000-60000 Between yuan , Include 60000 element , The applicable individual income tax rate is 30%;

( 7、 ... and ) The salary range is 60000-85000 Between yuan , Include 85000 element , The applicable individual income tax rate is 35%;

( 8、 ... and ) The salary range is 85000 The yuan , The applicable individual income tax rate is 45%.

边栏推荐

- Caddy server agent

- Ping problem between virtual machine and development board

- Summary and Reflection on the third week of winter vacation

- Redis core technology and practice - learning notes (VIII) sentinel cluster: sentinel hung up

- Read the paper glodyne global topology preserving dynamic network embedding

- 042. (2.11) do it when it's time to do it

- 2022-2028 global sepsis treatment drug industry research and trend analysis report

- Line by line explanation of yolox source code of anchor free series network (6) -- mixup data enhancement

- 多媒体NFT聚合平台OKALEIDO即将上线,全新的NFT时代或将来临

- The vscode code is automatically modified to a compliance code when it is formatted and saved

猜你喜欢

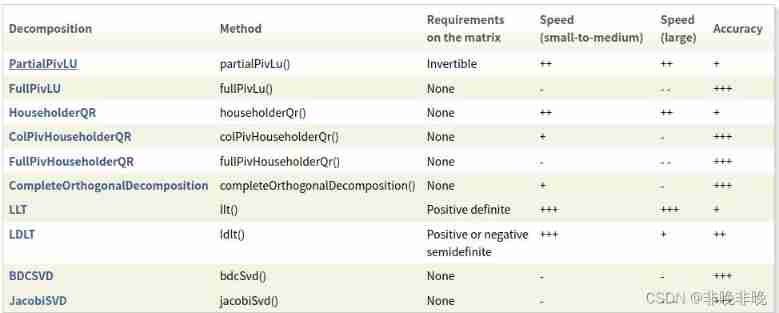

Theoretical description of linear equations and summary of methods for solving linear equations by eigen

How many convolution methods does deep learning have? (including drawings)

2022-2028 global solid phase extraction column industry research and trend analysis report

G1 garbage collector of garbage collector

SQL injection -day16

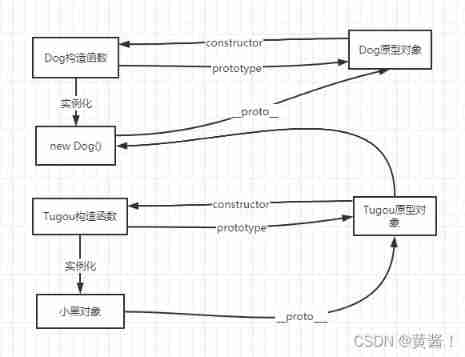

Prototype inheritance..

2022-2028 global plasmid DNA cdmo industry research and trend analysis report

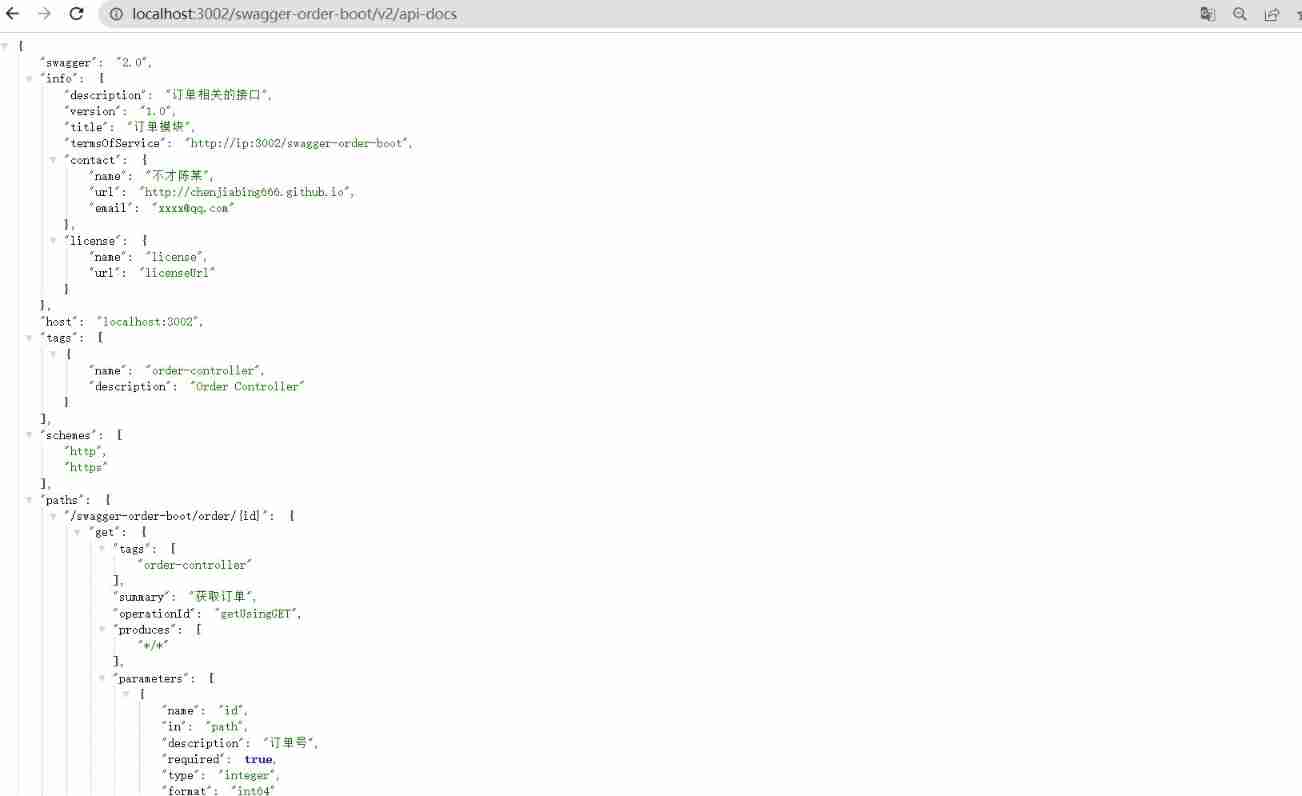

How do microservices aggregate API documents? This wave of operation is too good

Three gradient descent methods and code implementation

Read the paper glodyne global topology preserving dynamic network embedding

随机推荐

[combinatorics] generating function (positive integer splitting | repeated ordered splitting | non repeated ordered splitting | proof of the number of repeated ordered splitting schemes)

What London Silver Trading software supports multiple languages

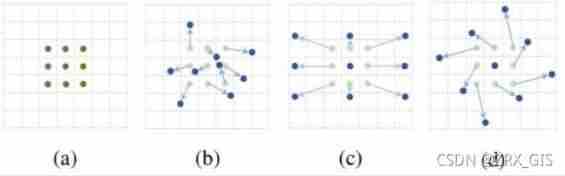

Coordinate layer conversion tool (video)

Redis cache avalanche, penetration, breakdown

[combinatorics] generating function (commutative property | derivative property | integral property)

2022-2028 global marking ink industry research and trend analysis report

[combinatorics] exponential generating function (proving that the exponential generating function solves the arrangement of multiple sets)

Lesson 13 of the Blue Bridge Cup -- tree array and line segment tree [exercise]

Codeforces Round #803 (Div. 2) C. 3SUM Closure

[combinatorics] generating function (property summary | important generating function)*

2022-2028 global plasmid DNA cdmo industry research and trend analysis report

MySQL duplicate check

Ping problem between virtual machine and development board

[combinatorics] generating function (generating function application scenario | using generating function to solve recursive equation)

[combinatorics] exponential generating function (properties of exponential generating function | exponential generating function solving multiple set arrangement)

Setinterval CPU intensive- Is setInterval CPU intensive?

041. (2.10) talk about manpower outsourcing

Module 9 operation

AcWing 271. Teacher Yang's photographic arrangement [multidimensional DP]

2022-2028 global lithium battery copper foil industry research and trend analysis report