当前位置:网站首页>Although the volume and price fall, why are the structural deposits of commercial banks favored by listed companies?

Although the volume and price fall, why are the structural deposits of commercial banks favored by listed companies?

2022-07-05 13:07:00 【Analysys analysis】

Analysis of Yi Guan :2022 year , Affected by the epidemic and the deterioration of the international environment , The downward pressure on China's economy has increased , The production and business activities of enterprises have slowed down relatively , In addition, the amount of idle funds in the hands of enterprises at the beginning of the year is large , Many listed companies are keen to buy relatively stable bank financial products , In particular, the enthusiasm for structured deposit products has not decreased .

Since the beginning of this year , Many banks generally cut deposit interest rates , The superposition has broken in recent years “ Just against ” Environment , A good profit 、 Principal guaranteed structured deposits , It is regarded as an excellent substitute for principal guaranteed financial management . that , Why do listed companies prefer structured deposits ? What is the future trend ?

The volume and price of structured deposits fell

In the first quarter, it rebounded slightly

According to the data released by the central bank , By 2022 year 4 end of the month , The structural deposit balance of Chinese funded national banks is 59249.76 One hundred million yuan , rose 1.27%, Year-on-year decline in 9.58%.

since 2021 Since then , The overall scale of structured deposits shows a continuous downward trend , Among them, the most influential factor is the regulatory factor . before , The financial supervision department has strengthened the management of deposit costs , Vigorously rectify structural deposits 、 Internet deposits and other products with high interest rates , stay 2021 year 6 This month optimized the formation method of self-regulation upper limit of deposit interest rate . This makes the scale of structured deposits suffer a great impact in the short term , It gradually fell to a low level at the end of the year , Then, with the gradual adaptation of the market and the stabilization of the regulatory environment , stay 2022 year 1-4 There was a partial rebound in August .

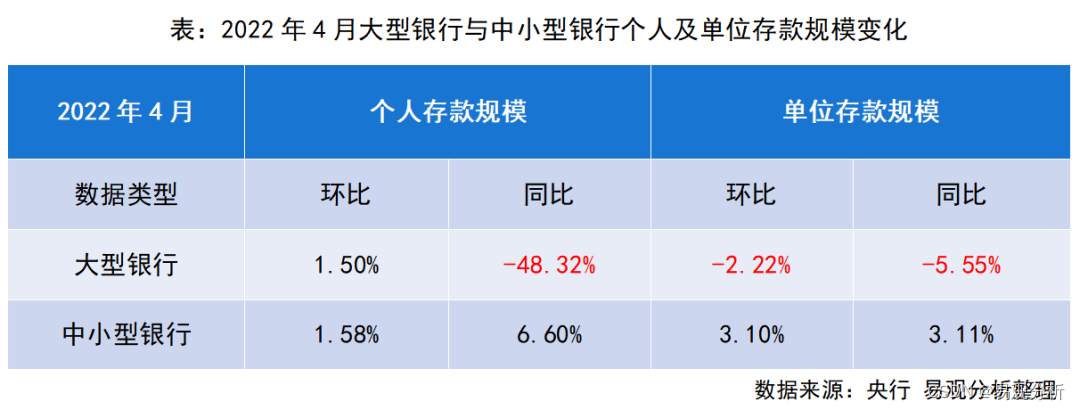

It is divided according to the purchasing entity , Holders of structured deposits include both individuals , It also includes units ( company ). From the previous pressure drop , The pressure drop of individual structural deposits in state-owned banks is relatively large . Besides , The proportion of structural deposits of small and medium-sized banks is still the highest ,4 The proportion of months in the total scale is 64.11%.

The specific term , The scale of personal deposits in large banks increased month on month 1.50%, Year-on-year decline in 48.32%, The scale of structured deposits of large banks fell month on month 2.22%, Year-on-year decline in 5.55%. The scale of individual structured deposits in small and medium-sized banks increased month on month 1.58%, Year-on-year growth 6.60%, The scale of structured deposits of small and medium-sized banks increased month on month 3.10%, Year-on-year growth 3.11%. The decline in the scale of structured deposits of large banks is larger than that of small and medium-sized banks , In particular, the scale of individual structured deposits in large banks has declined rapidly ,4 Month on year decline reached 48.32%.

Listed companies frequently buy

The enthusiasm for structured deposits remains unchanged

Under the downward trend of the scale and income of structured deposits , The enthusiasm of financial management of listed companies for structured deposit products has not decreased . according to an uncompleted statistic 2022 Since the beginning of the year , about 500 More than listed companies actively buy financial products , among 400 Many companies have purchased structured deposits , At the same time, as for structured deposit products, listed companies prefer shorter average maturity 、 Small and medium-sized banks with higher interest rates .

Security 、 Revenue and compliance is

Three advantages of structured deposits

Structured deposits , seeing the name of a thing one thinks of its function , It is on the basis of deposit that “ structure ”. therefore , In essence , It is still a deposit product ; And from the hook “ structure ” Look at , It can embed all kinds of financial derivatives , It can be linked to the interest rate price 、 Exchange rate price 、 commodity price 、 Index fluctuations and entity credit , So that depositors can obtain a certain degree of income while taking risks .

According to Analysys , The reason why listed companies favor structured deposits , There are mainly the following reasons :

First, the breakeven nature . The essence of structured deposit is deposit , Then invest the income . Most structured deposits have a fixed interest rate range , It can guarantee the minimum income . before , Besides bank financing, the investment method favored by listed companies , It also includes public funds 、 Private equity funds 、 trust 、 Securities trader collective plan, etc , Recently, the stock market fluctuated violently , Even some listed companies have seriously affected their statements due to investment losses , The investment style of listed companies is gradually conservative ,“ steady ” The trend of leading words has become increasingly prominent .

Second, the income is acceptable . From the perspective of internal product types of bank financial management , In addition to structured deposits ,“ Deposit family ” It also covers time deposits 、 Call deposit and other types , Compared with other regular deposit products ,“ structure ” The design types of are more abundant , At the same time, it expands more possible space for product profitability , Therefore, it has more advantages in terms of income .

Third, good compliance . Once the structured deposit market was full of chaos 、 There are many problems , For example, the lack of standardization of product operation management 、 Implement induced sales to customers , Some banks even use settings “ False structure ” The means of , In essence, it is engaged in soliciting deposits at high interest rates , Disrupted the order of the financial industry . In recent years , After a series of regulatory rectification , The structured deposit market has improved significantly , In compliance 、 The authenticity has been significantly improved .

Affected by the general environment such as the rebound of the epidemic , Superimpose factors such as finance and real economy , At present, the loan interest rate is continuing to decline . since this year on , Many banks have lowered deposit interest rates , On the one hand, it aims to comply with the general trend under the policy guidance , So that it can maintain a reasonable interest margin , On the one hand, it also helps to stabilize its deposit cost 、 Optimize the term structure of deposits , Through the adjustment of liability side business , So as to further transmit the impact to the asset side .

According to Analysys , In the short term, against the backdrop of downward interest rates , The slight decline in the yield of structured deposits may continue , However, this trend is still difficult to shake the preference of listed companies for structured deposits in a short time . Under this trend , Listed companies prefer shorter average maturity 、 Small and medium-sized banks with higher interest rates , To try to offset the interest rate loss in the general environment . future , As banks continue to invest in the development of new structured deposits, such as “ Double carbon ” Class related products , It is expected that the attraction of structured deposits to listed companies will continue .

The third-party data and other information cited by Analysys in this article are from public sources , Analysys analysis assumes no responsibility for this . In any case , This article is for reference only , Not as any basis . The copyright of this article belongs to the publisher , Without authorization from Analysys , It is strictly prohibited to reprint 、 Reference or in any way use Analysys to analyze any content published . Any media authorized 、 When using the website or individual, the original text should be quoted and the source should be indicated , And the analysis point of view is based on the official content of Yiguan analysis , No form of deletion shall be made 、 Add 、 Splicing 、 deductive 、 Distortion, etc . Disputes over improper use , Yi Guan analysis does not assume any responsibility for this , And reserve the right to investigate the responsibility of the relevant subject .

边栏推荐

- 函数的默认参数&函数参数的多种方法

- PyCharm安装第三方库图解

- LeetCode20.有效的括号

- Introduction to sap ui5 dynamicpage control

- 数据泄露怎么办?'华生·K'7招消灭安全威胁

- Binder通信过程及ServiceManager创建过程

- A deep long article on the simplification and acceleration of join operation

- OpenHarmony应用开发之Navigation组件详解

- 【云原生】Nacos中的事件发布与订阅--观察者模式

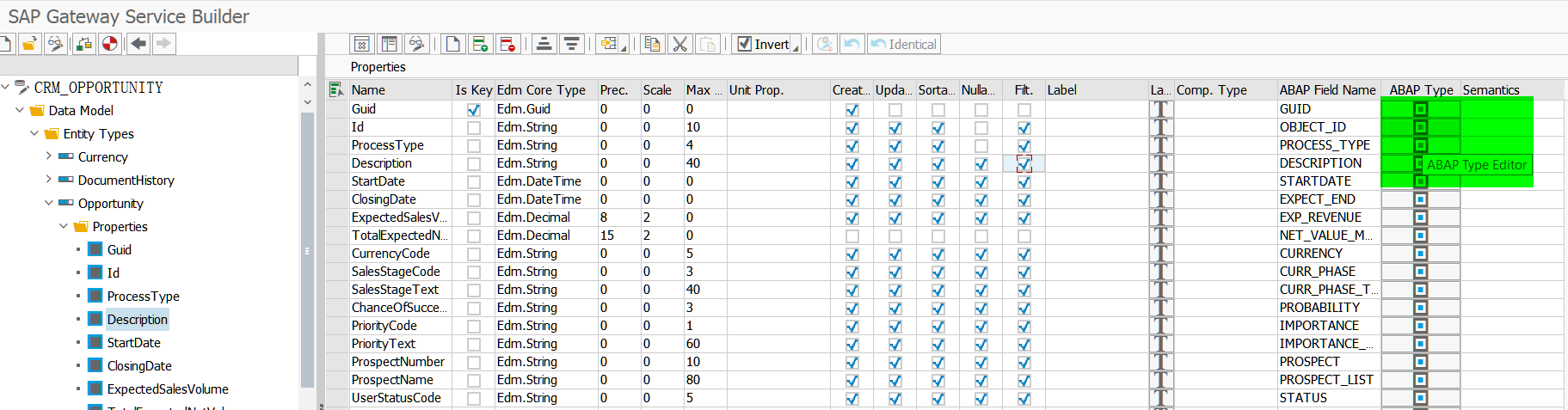

- SAP SEGW 事物码里的导航属性(Navigation Property) 和 EntitySet 使用方法

猜你喜欢

OpenHarmony应用开发之Navigation组件详解

RHCSA8

SAP SEGW 事物码里的 ABAP Editor

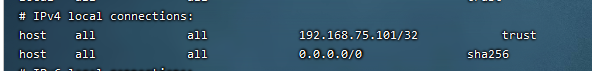

百日完成国产数据库opengausss的开源任务--openGuass极简版3.0.0安装教程

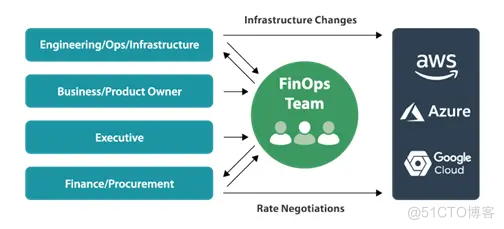

How can non-technical departments participate in Devops?

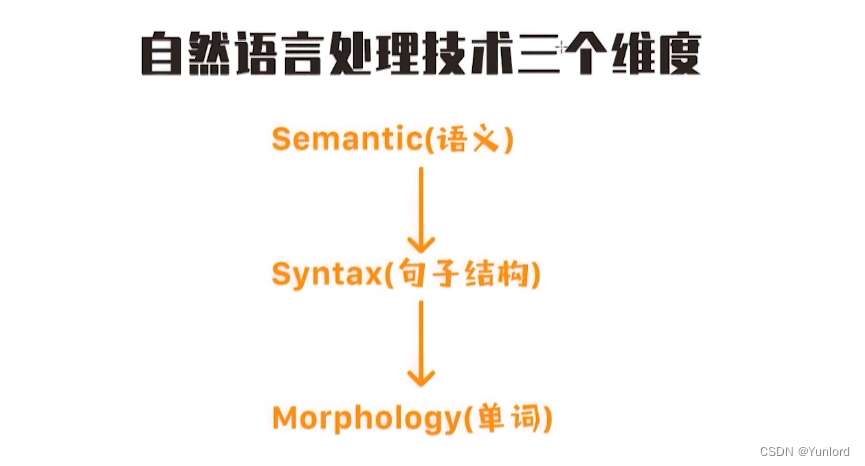

Natural language processing series (I) introduction overview

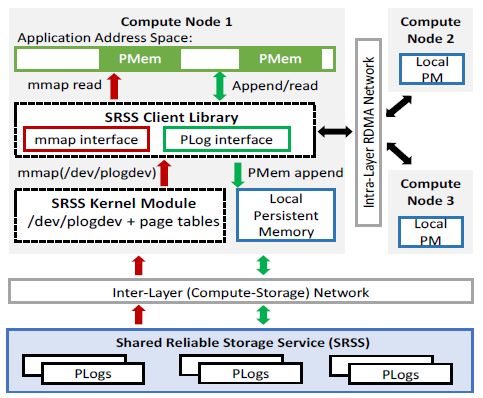

Hiengine: comparable to the local cloud native memory database engine

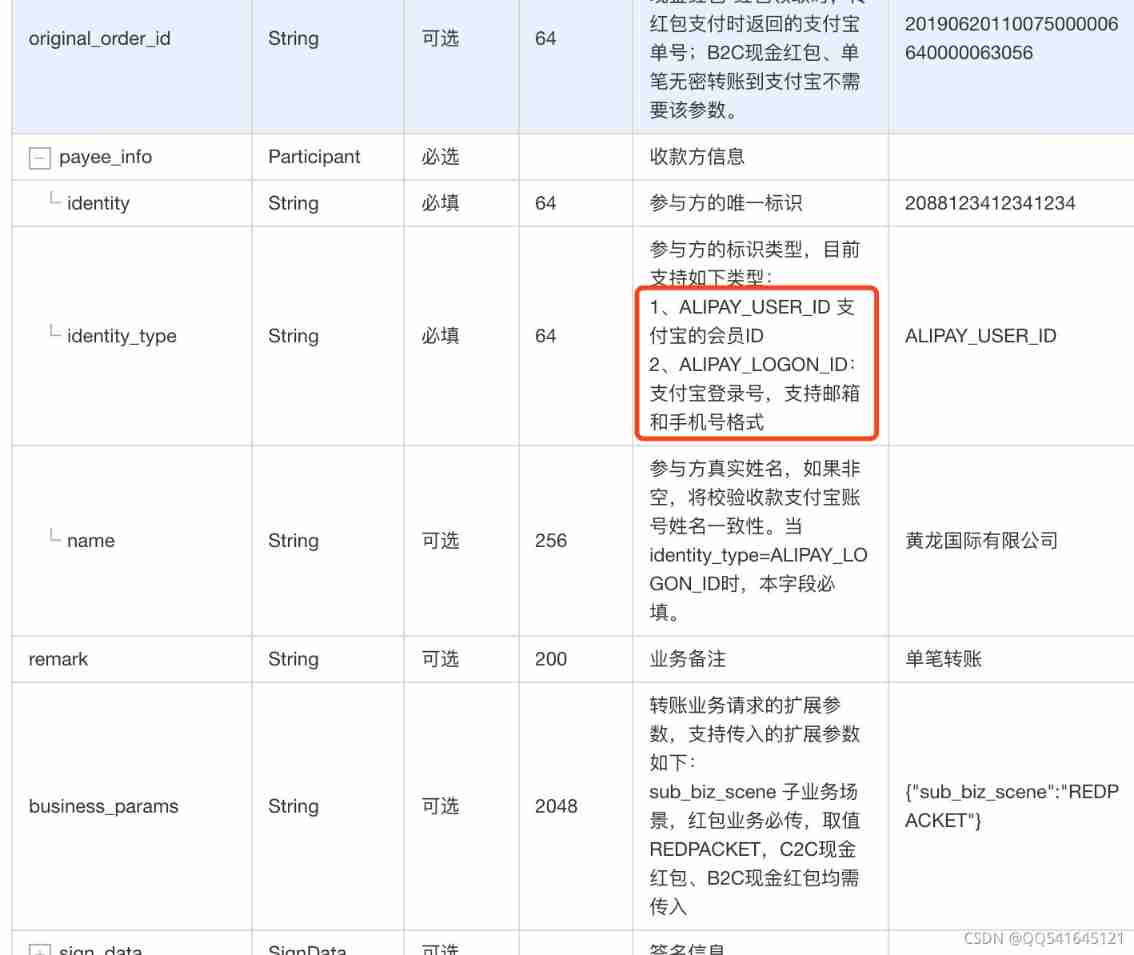

Alipay transfer system background or API interface to avoid pitfalls

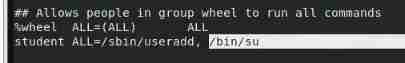

RHCSA5

About the single step debugging of whether SAP ui5 floating footer is displayed or not and the benefits of using SAP ui5

随机推荐

#yyds干货盘点# 解决名企真题:搬圆桌

946. Verify stack sequence

Halcon template matching actual code (I)

解决 UnicodeDecodeError: ‘gbk‘ codec can‘t decode byte 0xa2 in position 107

Pandora IOT development board learning (HAL Library) - Experiment 7 window watchdog experiment (learning notes)

Word document injection (tracking word documents) incomplete

国内市场上的BI软件,到底有啥区别

无密码身份验证如何保障用户隐私安全?

DataPipeline双料入选中国信通院2022数智化图谱、数据库发展报告

Lb10s-asemi rectifier bridge lb10s

Overflow toolbar control in SAP ui5 view

From the perspective of technology and risk control, it is analyzed that wechat Alipay restricts the remote collection of personal collection code

ASEMI整流桥HD06参数,HD06图片,HD06应用

峰会回顾|保旺达-合规和安全双驱动的数据安全整体防护体系

Developers, is cloud native database the future?

Binder通信过程及ServiceManager创建过程

逆波兰表达式

LB10S-ASEMI整流桥LB10S

Write macro with word

SAP SEGW 事物码里的 Association 建模方式