当前位置:网站首页>Lm12 rolling heikin Ashi double K-line filter

Lm12 rolling heikin Ashi double K-line filter

2022-07-07 23:28:00 【Squirrel kuanke】

Quantitative strategy development , High quality community , Trading ideas sharing and other related contents

『 Text 』

ˇ

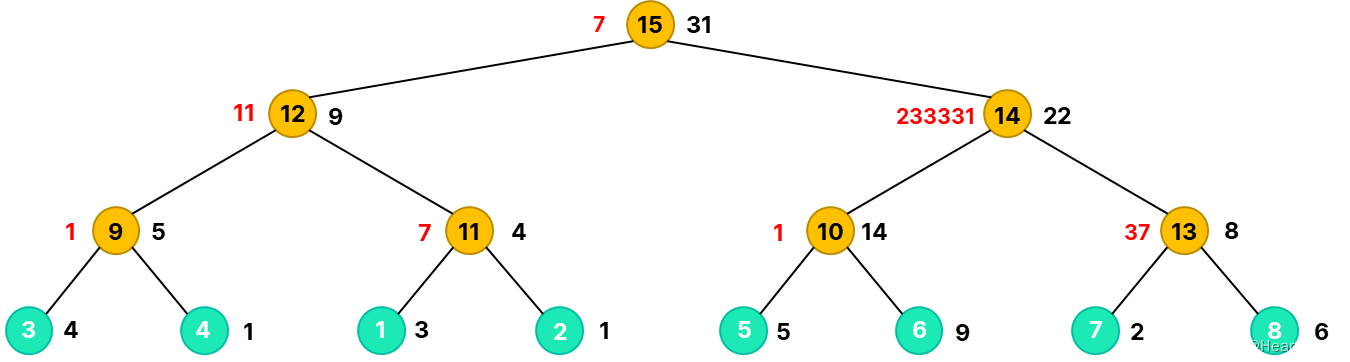

Hello everyone , What we brought today LM The first 11 Periodic strategy iteration . This article inherits the previous one K Line reconstruction perspective , Keep going K Line data reconstruction , The goal is to refactor , Reach the market data K Noise reduction of the line , Then make a timing judgment . As shown in the figure below :

Above, IC personal witness 500 Of stock index futures 15 Minute market chart and Rolling Heikin Ashi.

One 、 Strategy logic and iteration content

double K The basis of line filter comes from Heikin Ashi Candlestick Charts , This last article LM11 The article introduces , No more details here . In nearly half a month after the last article , The author found that Heikin Ashi The candle diagram is still noisy in different oscillations of the stage , But in terms of filtering effect , To a certain extent . Holding “ Scientific research ” And the spirit of self exploration , Try further data filtering .

HA The averaging process in the candle graph is equivalent to the noise elimination process , To a certain extent, the noise of the market is eliminated , It can more clearly reflect the trend of market prices . However, we want to express it in a trend structure K The deductive process of line market structure , This cannot be said to be substandard in the original version , It can only be said that there is still deep excavation value .

In the context described above , take Heikin Ashi Average Rolling The logic of came into being .

The calculation method is shown in the figure below ∶

among ,VWMA It is an average algorithm of trading volume weighting , We first average the trading volume of the original data , Through the data filtered in the first step HA turn .

The purpose is not only to reduce burrs , And there's going to be K Trend of line structure , Through visual comparison , There are significant sensory differences between the former and the latter , The details above are for different varieties and different cycles , It further improves the dual functions of trend structuring and denoising .

In double filtering K After the line is finished , We can see through observation that ,K The structure of the line has changed a lot , The overall trend has not changed . however , Have to admit , Filtering is often associated with lag There is a certain correlation . This may be a more challenging thing for me in the next stage .

Through the above logical description and research , We still use SF21 Count Yin and Yang K And the way up and down ( because K The line is getting rid of the noise ) To build “ new SF21” Strategy .

As shown in the figure below :

In terms of appearance , We play in different ways , Previously included LM11 Last version , We are all based on the original K Signal calculated on the basis of line .

Denoise and trend structure through filtering , We use Rolling Heikin Ashi Collect the exit signal with the data of . As shown in the figure below :

Friends who are familiar with squirrels know , This is a “ Super trendline ” Series I often use krange Adaptive exit strategy , We will double filter K Put the line data in , Optimize and filter noise removal .

meanwhile , We are in this strategy , Added new exit and entry signals here , The new exit signal is unique to the strategy itself , As shown in the figure below :

The signal logic belongs to double filtering K Characteristics of structural inversion of line trend .

Two 、 visualization

J long

IC long

Eb long

J short

LH short

IC short

3、 ... and 、 The performance of

Because of time , This strategy does not test multiple varieties , Only from 5 Large plate extraction 1-2 Basic test of varieties , As shown in the figure below :

2017—2022.6.16

2022.03.01—2022.6.16

Kaiping is adopted for the goods 2 Jump slip point , Stock index futures adopt Kaiping 4 jump , The handling charge is stipulated by the exchange + Back test according to the standard of .

The performance of other varieties should be tested and observed by yourself in the work area , I won't go into details here .

summary :

1、 The heterogeneity of strategy in this period is not related to the algorithm and logic of entry and exit , It's refactoring K Entry point of line .

2、 I only tested black 、 chemical 、 Agricultural products 、 Stock index futures 4 Different plates 1-2 varieties , But heterogeneity comes down a year , I find , The higher the degree of heterogeneity , There is a correlation that the worse the universality is . therefore , This type of strategy can be used as a supplement or combination , And subjective visualization .

3、 This strategy has two more appearances in both long and short , This is a feature of the strategy itself , As mentioned above, it adopts a feature of structural reversal of trend . Only belong to the policy itself .

4、 The strategy is refactored K There is still room for improvement in the process of wiring , The second is refactoring K Line , We can also continue to sort out other entry and exit logic . It's not limited SF21 The idea of .

Due to the differences of various platforms , Back test performance to TBQ The version shall prevail !!!

This strategy is only used for learning and communication , The investor is personally responsible for the profit and loss of the firm offer .

边栏推荐

- Technology at home and abroad people "see" the future of audio and video technology

- 系统设计概述

- 违法行为分析1

- Illegal behavior analysis 1

- UE4_UE5蓝图command节点的使用(开启关闭屏幕响应-log-发布全屏显示)

- Matlab-SEIR传染病模型预测

- ArcGIS: field assignment_ The attribute table field calculator assigns values to fields based on conditions

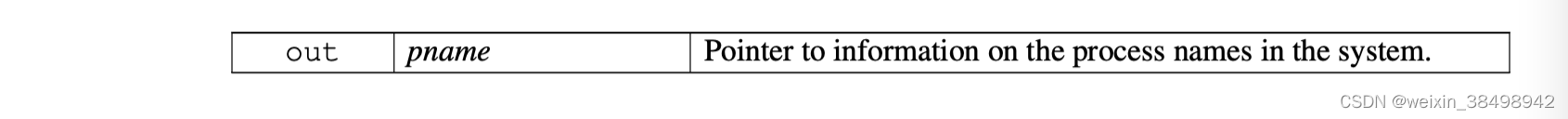

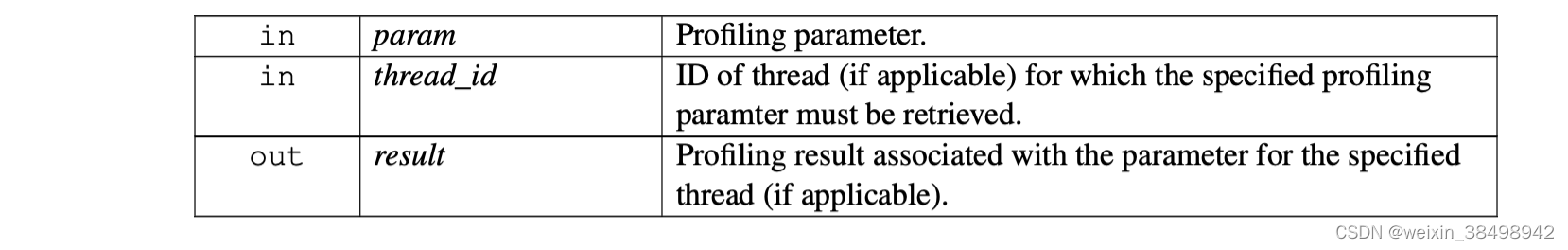

- B_QuRT_User_Guide(38)

- Explain

- Unity3D学习笔记6——GPU实例化(1)

猜你喜欢

2021ICPC上海 H.Life is a Game Kruskal重构树

2022 Season 6 perfect children's model Shaanxi finals came to a successful conclusion

B_QuRT_User_Guide(36)

New potential energy of industrial integration, Xiamen station of city chain technology digital summit successfully held

![[compilation principle] lexical analysis design and Implementation](/img/8c/a3a50e6b029c49caf0d791f7d4513a.png)

[compilation principle] lexical analysis design and Implementation

Oracle-数据库的备份与恢复

B_ QuRT_ User_ Guide(37)

生鲜行业数字化采购管理系统:助力生鲜企业解决采购难题,全程线上化采购执行

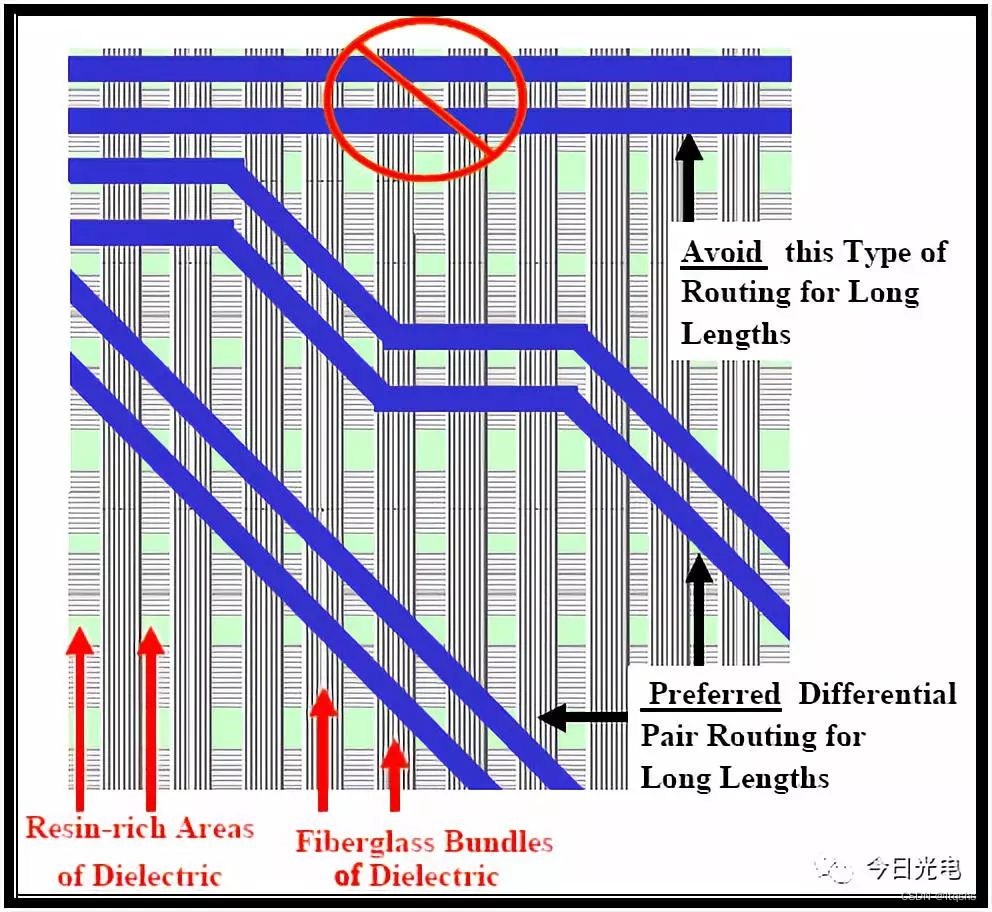

PCB wiring rules of PCI Express interface

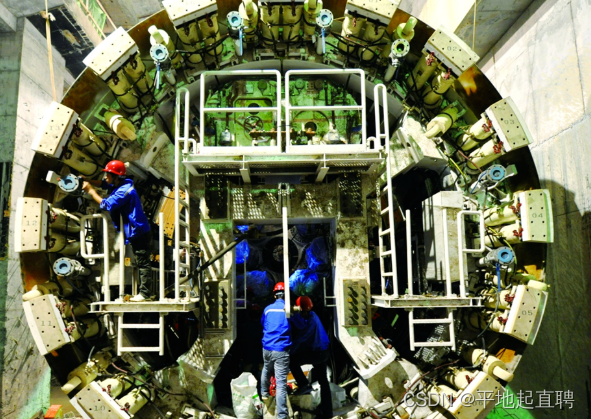

进度播报|广州地铁七号线全线29台盾构机全部完成始发

随机推荐

2022第六季完美童模陕西总决赛圆满落幕

LM12丨Rolling Heikin Ashi二重K线滤波器

Unity3D学习笔记5——创建子Mesh

LDO voltage stabilizing chip - internal block diagram and selection parameters

sql 数据库执行问题

Dynamics 365 find field filtering

ArcGIS: two methods of attribute fusion of the same field of vector elements

LDO稳压芯片-内部框图及选型参数

2021ICPC上海 H.Life is a Game Kruskal重构树

POJ2392 SpaceElevator [DP]

漏洞复现----49、Apache Airflow 身份验证绕过 (CVE-2020-17526)

1. Sum of two numbers

Freelink open source call center design idea

Solution of intelligent supply chain collaboration platform in electronic equipment industry: solve inefficiency and enable digital upgrading of industry

Caip2021 preliminary VP

Three questions TDM

USB(十五)2022-04-14

树后台数据存储(採用webmethod)[通俗易懂]

包装行业智能供应链S2B2B商城解决方案:开辟电商消费新生态

FPGA基础篇目录