当前位置:网站首页>Cost accounting [19]

Cost accounting [19]

2022-07-06 15:35:00 【Star drawing question bank】

1. The machine man hour proportional distribution method is applicable to ().

A. A workshop for seasonal production

B. Workshops with high manufacturing costs

C. All kinds of products with roughly the same degree of mechanization

D. Highly mechanized workshops 2. The quota cost system not only pays attention to the daily control and post control of costs , More importantly, it can control the cost in advance ()

3. There are many auxiliary production workshops 、 There are many unknowns 、 The calculation is complicated , When the enterprise has realized computerization , The method of allocating auxiliary production expenses should be ().

A. Direct distribution method

B. Interactive allocation method

C. Planned cost allocation method

D. Algebraic distribution 4. The expenditure of purchased materials incurred in the production and operation of the enterprise , It belongs to income expenditure .()

5. Under the variety method , Product cost Sub Ledger or cost calculation sheet shall be opened according to product variety , And set up columns according to the cost items .()

6. The comparative analysis method is to make the two economic contents the same 、 A method of analysis by subtracting economic indicators with the same time or space and place .()

7. Using the chain substitution method , Can reveal ().

A. The factors causing the difference and the influence degree of each factor

B. The factors that make the difference

C. The factors causing the difference and the reasons for the change of each factor

D. The difference between the actual number and the planned number 8. The production cost of special cost items is ().

A. Directly charged to expenses

B. Indirect charges

C. Direct production costs

D. Indirect production costs 9. When the step-by-step carry forward method is adopted , The account of self-made semi-finished goods receipt debit is ().

A. Finished products

B. Self made semi-finished products

C. Basic production cost

D. Manufacturing expenses 10. Whether the classification of products and the determination of distribution standards are appropriate , Is to use () The key to .

A. classification

B. Step by step

C. Batch method

D. Variety method 11.“ Waste loss ” The account has no balance at the end of the month .()

12. The step-by-step carry forward method is actually the multiple continuous application of the variety method .()

13. Quota method takes the quota of products as the object of cost calculation ()

14. The organizational division of labor among cost accounting institutions at all levels within the enterprise is as follows: ().

A. According to the functional division of cost accounting

B. Division of labor according to the object of cost accounting

C. Centralized working mode

D. Decentralized way of working 15. It has a comparable impact on the planned completion rate of the product ().

A. Output and unit cost

B. Yield and variety structure

C. Variety structure and unit cost

D. yield 、 Variety structure and unit cost 16. The amortization methods of low value consumables include ().

A. One off amortization method

B. Direct amortization method

C. Workload method

D. Fifty five amortization method 17. The impact of product unit cost reduction on cost reduction indicators is ()

A. Cost reduction increases , Cost reduction rate increases

B. Cost reduction , The cost reduction rate remains unchanged

C. Cost reduction increases , Cost reduction rate

D. Cost reduction , Cost reduction rate increases 18. For comparable products with actual cost data of the previous year , take () Contrast , Reveal cost reductions or increases , And analyze the reasons , For improving cost management 、 Reducing costs has a positive effect .

A. The actual cost of the current period is the same as the actual average cost of the previous year

B. The actual cost of the current period is the same as the average cost of the previous year

C. The planned cost of the current period is the same as the actual average cost of the previous year

D. The planned cost of the current period is the same as the average planned cost of the previous year 19.() It's not just a cost calculation method , And it is a kind of ex ante evaluation of product cost 、 In the matter 、 Methods of post control and management .

A. classification

B. Quota method

C. Step by step

D. Batch method 20. The cost of fuel directly used in the production of products , Should be recorded “ Basic production cost ” Debit of general ledger and Sub Ledger “ Fuel and power ” Cost items .()

21. Raw materials are put into one-time at the beginning of production , At this time , Both finished products and products in progress at the end of the month are deemed to have a degree of completion of 100% Products .()

22. A college student 2011 year 7 I graduated in January and applied to be a cost accountant in Nanfang Machinery Factory , The section chief of the finance department introduced the company to him :1. Product status , The factory mainly produces large heavy-duty machinery , Used in mining and other enterprises , Mining machinery enterprises are the leading enterprises in China .2. Workshop settings : Equipped with 7 A basic production workshop , In addition, there are 4 An auxiliary production workshop . According to the specific situation of the factory, what accounting system should be adopted ?()

A. Two level cost accounting system

B. First level cost accounting system

C. Unified cost accounting system

D. Quota cost accounting system 23. A worker of an enterprise processes a 、 B two products . The man hour quota of product a is 24 minute ; The man hour quota of product B is 18 minute . The hourly direct labor cost rate of the worker is 5.2 element , Product a processed this month 250 Pieces of , B product 200 Pieces of . The following a 、 B. the unit price of piecework wage for the two products is calculated correctly ().

A. Unit price per piece of product a 2.08( element )

B. Unit price per piece of product B 1.56( element )

C. Unit price per piece of product a 2.05( element )

D. Unit price per piece of product B 1.50( element )24. In an industrial enterprise or workshop that produces only one product , Both direct and indirect costs can be directly included in the cost of this product , All direct costs .()

25. When analyzing the cost of all commodity products , Need to calculate the cost reduction rate 、 This indicator is calculated by dividing the cost reduction by the actual total cost of actual production ().

26. The planned amount of this year in the detailed statement of sales expenses , Should be based on selling expenses () Fill in .

A. Actual amount of this year

B. Actual number of this month

C. Planned number of this year

D. Planned number of this month 27. The basic production workshop of an enterprise this month produces a 、 B two products , Jointly incurred manufacturing expenses 18000 element , The number of machine hours consumed by product a is 5320 Hours , The number of machine hours consumed by product B is 4680 Hours . requirement : Allocate manufacturing expenses according to the proportion of machine hours , Calculate a 、 How much manufacturing expenses should be allocated to each product of B .

A. A is 9576 element ; B is 8424 element .

B. A is 9576 element ; B is 8400 element .

C. A is 9476 element ; B is 8424 element .

D. A is 9076 element ; B is 8324 element .28. Adopt the simplified batch method , Do not register in the product cost Sub Ledger before the product is completed ()

A. Cost of raw materials

B. Manufacturing expenses

C. Production hours

D. Batch number of production products 29. A workshop allocates manufacturing expenses according to the annual planned allocation rate allocation method , The distribution rate is 5 element / Hours .10 Manufacturing expenses actually incurred in the month 40000 element , The actual output is 100 Pieces of , The fixed working hours are 90 Hours ,10 At the beginning of “ Manufacturing expenses ” Account debit balance 3000 element . be 10 Month allocation transfer in “ Basic production cost ’ The amount of the account is ().

A.40000

B.37000

C.45000

D.4800030. The production of the enterprise is divided according to the characteristics of its technological process , It can be divided into single step production and multi-step production .()

31. Under the parallel carry forward step-by-step method , When the finished products of an enterprise are warehoused , Share that should be included in the cost of finished products , It should be transferred out of the product cost Sub Ledger of each step , Then the accounting entry is ().

A. borrow : Basic production cost : Self made semi-finished products

B. borrow : Basic production cost : Stock goods

C. borrow : Self made semi-finished goods loan : Basic production cost

D. borrow : Inventory loan : Basic production cost 32. Production personnel 、 Wages and welfare expenses of workshop management personnel , According to the salary and expense distribution table , It should be directly included in the production cost of the product .()

33. In the following methods , The auxiliary production cost allocation methods include ().

A. Interactive allocation method

B. Algebraic distribution

C. Quota proportional method

D. Direct distribution method 34. Adopt the simplified batch method , Each batch of products 、 Indirect costs are included between finished products and products , It's all about using ().

A. Cumulative indirect cost allocation rate

B. Indirect cost allocation rate

C. Cumulative production man hours

D. Cumulative raw material cost allocation rate 35. The cost of various products calculated by classification ().

A. The calculation results have certain assumptions

B. More accurate

C. It's more real

D. Can really reflect the cost level 36. Breakdown of administrative expenses , Generally, the planned number of expense items is reflected according to the management expense items 、 Actual amount in the same period of last year 、 The actual number of this month is the same as ().

A. Cumulative actual amount of this year

B. Cumulative actual amount of this month

C. Actual amount of this year

D. Cumulative amount of this year 37. Travel expenses of basic workshop management personnel , It should be debited to the following accounts ().

A.“ Manufacturing expenses ”

B.“ Basic production cost ”

C.“ Management cost ”

D.“ Financial expenses ”38. Auxiliary production workshops such as water supply 、 Power supply workshop , The cost is usually calculated by batch method .()

39. When using the simplified batch method to calculate the product cost , The cumulative allocation rate of indirect expenses calculated in the secondary account of basic production cost , It is the basis for allocating the cost between batches of finished products , It is also the basis for allocating the expenses between the finished batch and the product batch at the end of the month, and between the finished products of a batch and the products at the end of the month .()

40. Waste loss includes the loss of damage and deterioration due to improper storage .()

41. Enterprise cost statement ()

A. It is a report submitted to the outside world

B. It is a report prepared internally

C. The relevant departments shall specify which indicators shall be published , Which indicators are not published

D. At the request of creditors and investors , Determine which indicators to publish , Which indicators are not published 42. The characteristics of batch costing are ().

A. Take the production batch as the object of cost calculation

B. The calculation period of product cost is not fixed

C. Calculate the cost of products on a monthly basis

D. Generally, there is no need to allocate the cost of finished products and products in process 43. Adopt the quota method of product cost calculation , Its purpose is to ().

A. Calculate the actual cost of the product

B. Strengthen quota management and cost control

C. Calculate the rated cost of the product

D. Simplify cost accounting 44. The following expenses have occurred in the course of production of an enterprise :(1) The cost of raw materials used in the production of products .(2) The salary of workers in the basic production workshop .(3) Employee compensation of basic workshop managers .(4) The employee compensation of the staff of the special sales organization .(5) Depreciation expense of fixed assets for basic production workshop calculated and withdrawn according to the straight-line method .(6) Insurance premium for basic production workshop buildings .(7) Water and electricity costs incurred in the basic production workshop .(8) The office expenses of the factory management department .(9) The greening fee paid .(10) Machine and material consumption in the basic production workshop . Which of the above should be treated as period expenses ?()

A.(4)

B.(2)

C.(7)、(8)

D.(8)、(9)45. The step-by-step method applies to ().

A. Mass production

B. Mass production

C. mass production

D. Multi step production 46. The disadvantage of the quota method is ().

A. The result of the calculation is not accurate

B. The calculation method is not practical

C. The workload of calculation is relatively large

D. The calculation method is complex 47. The planned price in the factory should be as realistic as possible , Therefore, there should be frequent changes in the year .()

48. The detailed statement of manufacturing expenses reflects the manufacturing expenses incurred in the basic production workshop and auxiliary production workshop .()

49. There are ways to allocate production costs between finished products and products at the end of the month ().

A. Quota proportional method

B. According to the fixed cost method

C. Equivalent yield ratio method

D. Not included in the product cost method 50. The production organization mode applicable to the variety law is ().

A. Mass production

B. mass production

C. Mass production

D. Single piece small batch production 51. The items that should be included in the expenses incurred by the enterprise administrative department for organization and management are ().

A. Manufacturing expenses

B. Production costs

C. Management cost

D. Operating expenses 52. About variety law , The following statement is not true ().

A. The cost calculation object is the order of the product

B. Set up product cost Sub Ledger according to production department

C. There must be products in progress at the end of the month

D. The costing period is fixed 53. In the case of producing multiple varieties , The factors affecting the cost reduction of comparable products are ().

A. Product output

B. Unit cost of product

C. product price

D. Product variety structure 54. The organizational division of labor within the cost accounting organization , There are two ways of centralized work and decentralized work .()

55. The following items shall be included in “ Management cost ” The of the account is ().

A. Interest expense on bank borrowings

B. Interest income from bank deposits

C. The cost of technological development of the enterprise

D. Salary of workshop management personnel 56. All enterprises that produce products in multiple steps , It is required to calculate the product cost step by step according to the production steps .()

57. The cost report belongs to ().

A. External statements

B. Internal report

C. It's an internal report , It's an external report again

D. Whether it is internal or external depends on the enterprise 58. The product cost item is the item that the production expenses included in the product cost are classified and accounted according to the economic content .()

59. Material cost 、 Cost of purchased power 、 depreciation charge 、 Manufacturing expenses belong to element expenses .()

60. A production workshop found irreparable scrap in the production process of product B this month 10 Pieces of , Calculate the production cost of irreparable waste according to the consumed quota cost . The cost quota of single raw material is 60 element ; The total number of quota man hours completed 140 Hours , The hourly rate is : Fuel and power 1.5 element , Direct labor costs 1.9 element , Manufacturing expenses 1.1 element . The price of unrepairable scrap materials 130 Yuan is used as auxiliary material for warehousing ; Compensation should be paid by the negligent 40 element . The net loss of waste products shall be borne by the same qualified cost in the current month . requirement : Calculate the net loss of irreparable waste .

A.1220 element

B.1060 element

C.1350 element

D.1200 element 61. Calculate the production cost of irreparable waste , According to the actual cost of waste products , It can also be consumed according to the waste ().

A. Consumption quota

B. Fixed cost

C. Quota consumption

D. Cost quota 62. In the form of piece rate , Direct labor costs are directly included in expenses , The calculation of deviation from quota is similar to that of raw materials , Remuneration of production workers in line with the quota , Should be reflected in () in .

A. Man hour records

B. Production records

C. Break away from differences

D. Quota variance 63. The characteristic of quota method is to set the product consumption quota in advance 、 Cost quota and () As a cost reduction goal .

A. Fixed cost

B. Planning cost

C. Quota variance

D. Target cost 64. The cost of raw materials accounts for a large proportion of the product cost , Raw materials have been put into production , The distribution of production costs adopts ().

A. Products in process are priced according to the cost of raw materials consumed , The cost of raw materials shall be distributed according to the proportion of equivalent output

B. Equivalent yield ratio method

C. Products in process are priced according to the cost of raw materials consumed

D. The cost of raw materials shall be distributed according to the proportion of equivalent output 65. In the following ways , What belongs to the auxiliary production cost allocation method is ().

A. Fixed cost method

B. Planned cost allocation method

C. Production man hour proportional distribution method

D. Machine man hour proportional distribution method 66. Cost statements generally only provide information to business managers .()

67. The actual consumption of materials is listed in the material cutting accounting 192 kg , The number of blanks actually cut 15 individual , Number of blanks to be cut 16 individual , Single piece consumption quota 12 kg , Planned unit price per kilogram 7.8 element . requirement : Determine material deviation from quota .

A.+93.6

B.-93.6

C.+103.6

D.-103.668. An industrial enterprise adopts the service life method to withdraw depreciation . The monthly depreciation rate of a certain type of fixed assets is 1%, The original value of such fixed assets at the beginning of the month is 3000 Ten thousand yuan , The original value of the added fixed assets in the current month is 300 Ten thousand yuan , The original value of the reduced fixed assets in the current month is 100 Ten thousand yuan , Then the depreciation expense accrued for this kind of fixed assets in the current month is () Ten thousand yuan .

A.29

B.30

C.32

D.3369. Auxiliary production of enterprises ( Such as water supply 、 Power supply 、 Steam supply, etc ) Workshops can also use the variety method to calculate the cost of their labor services .()

70. The auxiliary production cost adopts the planned cost allocation method , The actual cost of the auxiliary workshop should be ().

A. The expenses to be allocated in the workshop minus the expenses transferred out

B. The expenses to be allocated in the workshop plus the expenses transferred in by allocation

C. The expenses to be allocated in the workshop plus the expenses transferred in by allocation , Less the cost of distribution transfer out

D. The expenses to be allocated in the workshop plus the expenses transferred out , Less the cost of allocation transfer in 71. Of the following , There are... Without depreciation ().

A. Fixed assets scrapped and deactivated in the current month

B. Equipment used in the current month

C. Unused houses

D. Fixed assets leased out in the form of operating lease 72. In the batch method, the distribution methods of indirect costs are ().

A. Planned cost allocation method

B. Cumulative distribution method

C. Quota proportional distribution method

D. Current month distribution method 73. In any case , The manufacturing cost of auxiliary production may not pass “ Manufacturing expenses —— Auxiliary production workshop ” Detailed bills are collected separately , Instead, it is directly recorded “ Auxiliary production cost ” Account .()

74. Xiao Zhang Xin went to a manufacturing enterprise to do financial work , The enterprise produces a 、 B 、 C three products , One of them is 、 Product B is a profitable product , Product C is a loss making product . In his work, Zhang found that the manufacturing cost of the factory was evenly distributed among the three products , Do you think this practice has something to do with the loss of C products .()

A. No problem

B. There is a certain relationship

C. Unable to judge

D. The losses of C products are all caused by the adoption of the average distribution method 75. Suppose an industrial enterprise has a basic production workshop and an auxiliary production workshop , The former produces a 、 B two products , The latter provides a kind of labor service . The relevant economic business occurred in a certain month is as follows : Salary expenses incurred 7800 element . Among them, the salary of production workers in the basic production workshop 3400 element , Executive compensation 1300 element ; Salary of production workers in auxiliary production workshop 1100 element , Executive compensation 500 element . The manufacturing cost of auxiliary production of the enterprise is through “ Manufacturing expenses ” Account accounting . requirement : Prepare relevant accounting entries based on the above information .

A. borrow : Basic cost incurred 3400

B. borrow : Manufacturing expenses ------ Basic Workshop 1300

C. borrow : Manufacturing expenses ------ Auxiliary workshop 500

D. borrow : Auxiliary production cost 1100

E. borrow : Auxiliary production cost 1600

F. loan : Salary payable 780076. About variety law , The following statement is correct ().

A. Variety method is a cost calculation method adopted by all production enterprises

B. The variety method is to calculate the product cost on a monthly basis

C. The cost calculation object shall be determined according to the management requirements

D. Generally, there are no products in process at the end of the accounting report period 77. The purpose of cost reduction is to obtain according to () Reflected finished product cost data .

A. Cost of semi-finished products

B. Original cost items

C. Actual cost of finished products

D. Planned cost of finished products 78. Correctly calculate the product cost , The basic work that should be done well is ().

A. Correctly determine the valuation of property and materials

B. Correctly divide the boundaries of various expenses

C. Determine the cost calculation object

D. Establish and improve the original records 79. The classification of product cost calculation is applicable to ().

A. Varieties 、 A wide range of products

B. Products that can be classified according to certain standards

C. Mass produced products

D. Varieties 、 Products with various specifications and can be classified according to certain standards 80. The factors that determine the object of cost calculation are production characteristics and ().

A. Costing entity

B. Costing period

C. Cost management requirements

D. Cost calculation method 81. An enterprise is producing a 、 B 、 C three products , Incurred manufacturing expenses 56000 element . Production man hours provided according to data statistics , Production man hours of product a 20000 Hours , B. production hours of products 14000 Hours ; C. production man hours 30000 Hours . requirement : Allocate manufacturing expenses according to the proportion of production hours .

A. A should allocate =16000 element ; B shall allocate ==11200 element ; C should allocate =24000 element .

B. A should allocate =17500 element ; B shall allocate =26250 element ; C should allocate =12250 element .

C. A should allocate =12250 element ; B shall allocate =17500 element ; C should allocate =26250 element .

D. A should allocate =17500 element ; B shall allocate =12250 element ; C should allocate =26250 element .82. Under the condition that the product variety composition and product unit cost remain unchanged , Simple production changes , It only affects the cost reduction amount of comparable products and does not affect the cost reduction rate of comparable products .()

83. When using the batch method to calculate the product cost , The object of cost calculation is the batch of products .()

84. For the same variety , But products of different quality , The reasons for the difference in quality should be discussed , Decide whether to apply to the taxonomy .()

85. Approved , When dealing with inventory gain of products in process , Should debit “ Loss and overflow of property to be disposed of —— Loss and overflow of current assets to be disposed ” subject , credit “ Manufacturing expenses ” subject .()

86. Carry forward the cost of semi-finished products by items , The cost of semi-finished products in the previous step and the level of processing costs in this step cannot be seen in the cost of finished products in each step .()

87. In order to facilitate cost assessment and Analysis , Fixed cost includes cost items and calculation methods , It should be related to the planned cost 、 The cost items included in the actual cost are consistent with the calculation method .()

88. Because every industrial enterprise must finally calculate the product cost according to the product variety , Therefore, the variety law applies to all industrial enterprises .()

89. Adopt step-by-step carry forward method , The cost carry forward of semi-finished products is consistent with the physical carry forward of semi-finished products , Therefore, it is conducive to the physical management of semi-finished products and the fund management of products in process .()

90. Under the condition that the product variety structure and unit cost remain unchanged , Simple production changes , It will not only affect the cost reduction of comparable products, but also affect the cost reduction rate of comparable products .()

91. Cost report analysis , When using serial substitution analysis , The order of each factor is ().

A. Can be arranged arbitrarily

B. Should be arranged according to certain principles : Quality before quantity

C. Should be arranged according to certain principles : First the main then the secondary

D. Should be arranged according to certain principles : Quantity before quality 92. Among the following methods, the method of allocating expenses between finished products and products at the end of the month is ().

A. Interactive allocation method

B. Planned cost allocation method

C. Proportional distribution of working hours of production workers

D. Quota proportional method 93. Cost accounting in a narrow sense usually refers to ().

A. Cost forecast

B. Costing

C. Cost decisions

D. cost analysis 94. The deviation of raw materials from the quota refers to the difference between the actual consumption level of materials and the quota consumption level , That is, the quantity difference of materials , Price differences excluding raw materials .()

95. Of the following , What belongs to the product cost item is ().

A. Labor cost

B. Direct labor

C. Cost of purchased power

D. Purchased fuel 96. According to the cost of products in progress at the beginning of the month 、 Information about the production cost of this month and the cost of products in progress at the end of the month , Cost of finished products = Cost of products in progress at the beginning of the month + The production cost of this month - Cost of work in progress at the end of the month .()

97. When dealing with inventory loss and damage of products , All should be debited “ Non operating expenses ” subject , credit “ Loss and overflow of property to be disposed of —— Loss and overflow of current assets to be disposed ” subject .()

98. The period expenses of industrial enterprises can be divided into sales expenses according to the economic content 、 Administrative and financial expenses .()

99. A product is processed continuously in two production steps , After the first step of processing is completed, turn to the second step of continuous processing , Made into finished products . Total expenses incurred in the first step 55800 element , Cost of finished semi-finished products 27800 element ; The second step is the cost of finished products in this month 52660 element , The cost of semi-finished products 33360 element . requirement : Calculate the cost reduction rate of product a ().

A.0.83

B.1.05

C.1.2

D.1.67100. This month A The fixed cost of raw materials consumed by the product is 55000 element , The difference from the quota is overspending 5000 element , The cost difference rate of the raw materials is to save 5%, be A The difference in the cost of raw materials of the product is ().

A.+2500 element

B.-3000 element

C.-2500 element

D.+3000 element

边栏推荐

- Interview answering skills for software testing

- Mysql database (V) views, stored procedures and triggers

- How to build a nail robot that can automatically reply

- Automated testing problems you must understand, boutique summary

- Mysql database (III) advanced data query statement

- Es6--- two methods of capturing promise status as failed

- Word macro operation: convert the automatic number in the document into editable text type

- Knowledge that you need to know when changing to software testing

- Learning record: how to perform PWM output

- 线程及线程池

猜你喜欢

软件测试面试要问的性能测试术语你知道吗?

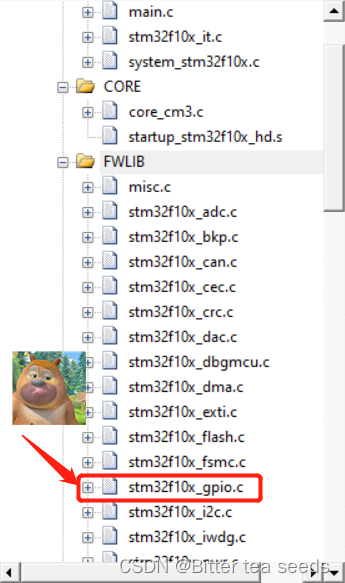

STM32学习记录:玩转按键控制蜂鸣器和LED

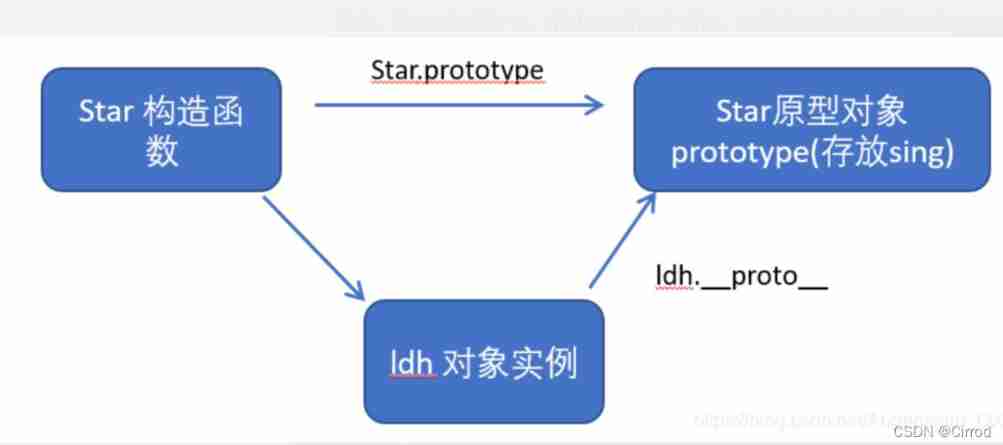

JS --- detailed explanation of JS facing objects (VI)

![Cadence physical library lef file syntax learning [continuous update]](/img/0b/75a4ac2649508857468d9b37703a27.jpg)

Cadence physical library lef file syntax learning [continuous update]

毕业才知道IT专业大学生毕业前必做的1010件事

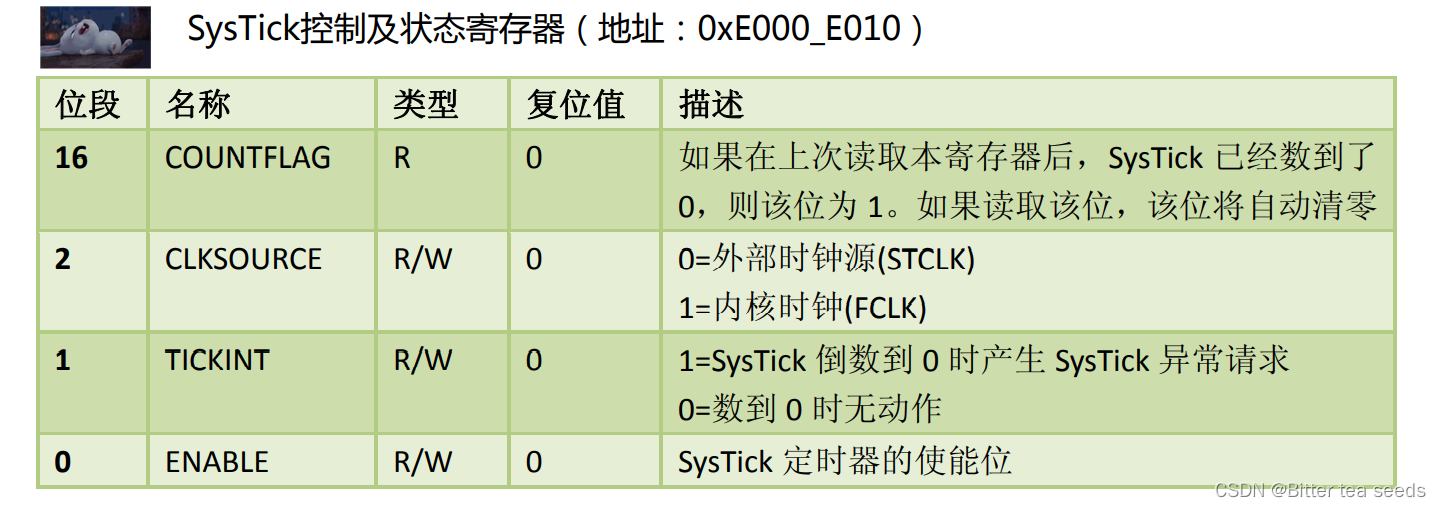

Learning record: understand systick system timer and write delay function

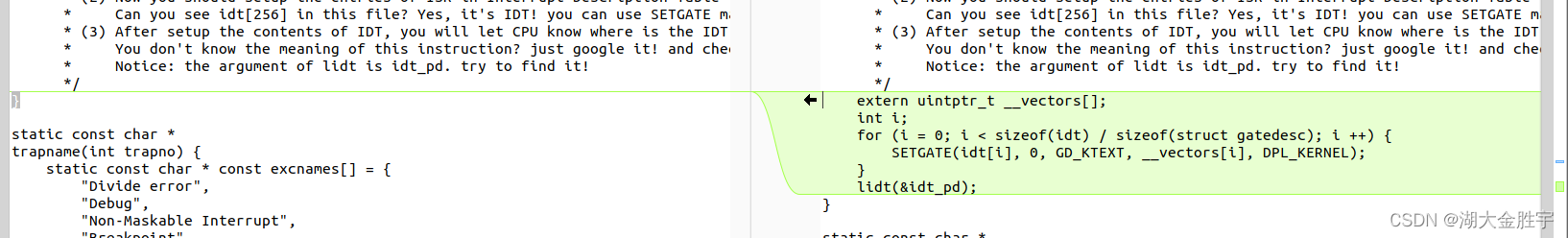

ucorelab4

软件测试需求分析之什么是“试纸测试”

Servlet

Brief introduction to libevent

随机推荐

Learning records: serial communication and solutions to errors encountered

Brief introduction to libevent

Preface to the foundations of Hilbert geometry

Mysql database (I)

Research Report of pharmaceutical solvent industry - market status analysis and development prospect prediction

ucore lab7

STM32学习记录:玩转按键控制蜂鸣器和LED

MySQL数据库(五)视 图 、 存 储 过 程 和 触 发 器

Flex --- detailed explanation of flex layout attributes

Heap, stack, queue

51 lines of code, self-made TX to MySQL software!

STM32 learning record: input capture application

Winter vacation daily question - maximum number of balloons

软件测试行业的未来趋势及规划

JS --- detailed explanation of JS facing objects (VI)

力扣刷题记录--完全背包问题(一)

JS --- all basic knowledge of JS (I)

How to build a nail robot that can automatically reply

软件测试Bug报告怎么写?

Contest3145 - the 37th game of 2021 freshman individual training match_ A: Prizes