当前位置:网站首页>Excessive dependence on subsidies, difficult collection of key customers, and how strong is the potential to reach the dream of "the first share of domestic databases"?

Excessive dependence on subsidies, difficult collection of key customers, and how strong is the potential to reach the dream of "the first share of domestic databases"?

2022-07-07 15:57:00 【Ink Sky Wheel】

The reporter | Li Biao

In recent days, , Wuhan Dameng database Co., Ltd ( hereinafter referred to as “ Reach a dream ”) Submit the listing application of Shanghai Science and Technology Innovation Board , A formal shock “ The first share of domestic database ”.

The prospectus shows , Dameng plans to raise funds 23.5 Billion yuan for the cluster database management system upgrade project 、 High performance distributed relational database management system upgrade project , And the new generation cloud database product construction project and Damon research institute construction project .

Damon was founded in 2000 year , Start with a locally deployed relational database , Aim at the enterprise service market , Take the paid licensing business software route . Whether in terms of capital composition or business expansion , This company has significant “To G”( To Government) label .

Feng Yucai, founder and chairman of Dameng , Former professor of Huazhong University of science and Technology 、 Doctoral supervisor , In the team 6 Of the core technicians , Yes 5 Mingjun graduated from Huazhong University of science and Technology . Founded in the early , There are many scientific research cooperation between the company and Huazhong University of science and Technology , Huake industrial group ( Huazhong University of science and Technology ) As the largest shareholder . After the withdrawal of Huake industrial group , Chinese software in its place (SH.600536, China Electronics holdings ) It also has the background of state-owned assets .

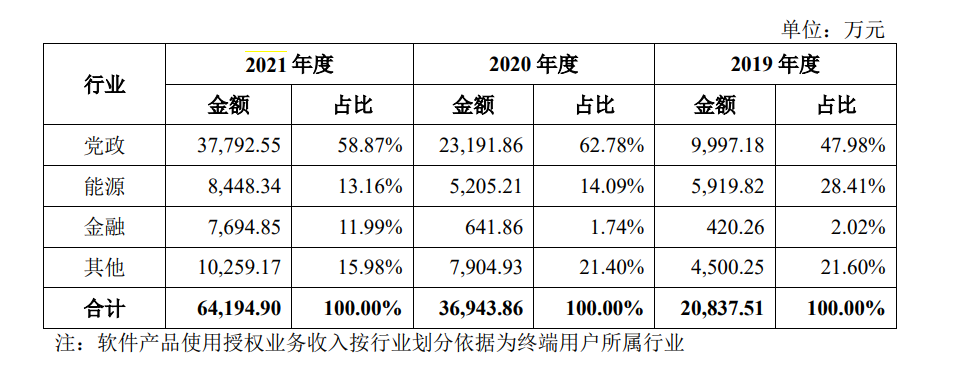

Dameng's business mainly covers finance 、 energy 、 Three major areas of the party and government . Historical data shows , The list of major customers who have contributed nearly half of their sales in consecutive years is mostly government agencies and large central enterprises .

For decades, we have been deeply involved in the database industry , Hold the key customers of government and enterprises , It also coincides with the strong support of policies , Let Dameng hand over a brilliant report card on the eve of listing .

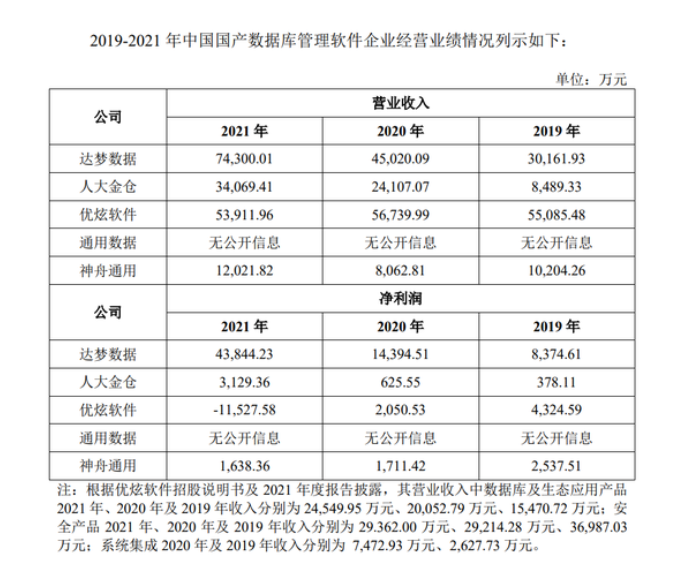

since 2019 - 2021 year , Total annual revenue of Dameng ( Merging subsidiaries ) Respectively 3.02 One hundred million yuan 、4.5 One hundred million yuan 、7.43 One hundred million yuan , The compound annual growth rate of core business income reached 57%; Net profit is 8374 Ten thousand yuan 、1.43 One hundred million yuan 、4.38 One hundred million yuan , The net profit margin corresponds to 29%、32%、59% .

But in high revenue 、 The other side of high profits , The rapid growth of Dameng faces many potential risks .

To G Dividends and hidden worries

Dameng is mainly engaged in the R & D and sales of basic software , Its products include database management systems 、 Graph database 、 Cloud products 、 Support operation and maintenance 、 transfer 、 Supporting software tools for monitoring .

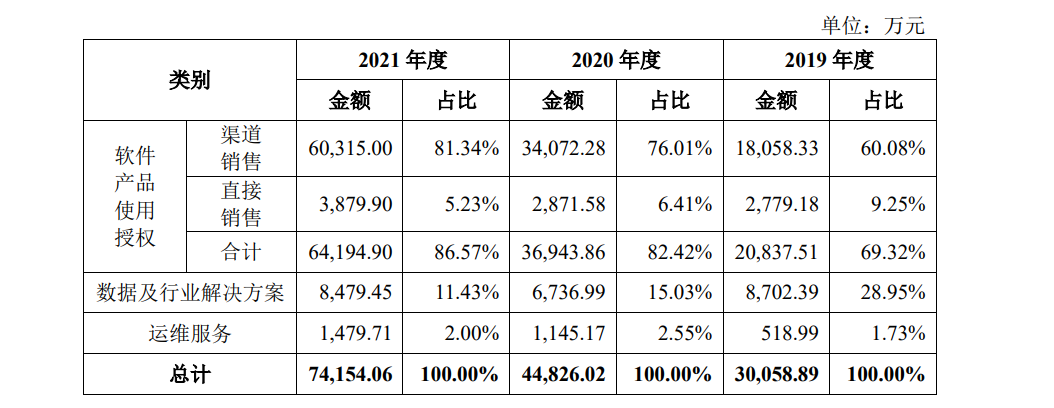

The main source of revenue of the company is the use authorization of software products 、 Data and industry solutions 、 Operational service , The first two businesses contribute most of the revenue .

The proportion of business income of dream database

Software sales is the top priority ,2020 year 、2021 year , More than 80% of the company's revenue comes from software licensing , And continue to grow . From the perspective of cost input , Its sales expenses account for the highest proportion of revenue (23%-33%), Higher than R & D investment (15%-21%).

Mastering key customers is undoubtedly the company's growth password .To G One of the big dividends of the market is , Large and medium-sized government and enterprise users have more budget investment , For safety 、 Stable standardized products require high , Favor the mature mainstream technology route in the market , Prefer to establish long-term cooperative relations with leading manufacturers with many years of industry experience .

With 2021 Year as an example , In the three business areas of Damon , The central 、 The contribution of local government organs at all levels ranks first , More than last year 1.4 One hundred million yuan , Growth of 63%; sinopec 、 petrochina 、 The energy represented by the State Grid is next , More than last year 3243 Ten thousand yuan , Growth of 61%; The most significant change comes from finance , The new users are mainly China Development Bank 、 China Construction Bank 、 Institutional banks including China Life Insurance 、 negotiable securities 、 Insurance agency , a surge 7052 Ten thousand yuan , Increase achieved 1000%.

The proportion of revenue in the three service areas of Dameng database

In addition to major customers 、 In addition to the basic resources of large orders ,To G Another big bonus of the market is hidden in the macro policy environment . Policy orientation can often play “ Ripple effect ”, Stir up the original market pattern .

IDC Newly released 《2021 China's relational database software market tracking report in the second half of 》 Show , In database vendors based on local deployment patterns , Benefit from the drive of favorable policies , Damon has received a large number of government orders in the past year , Market share 5.7%, Rank third , The top two are Oracle HUAWEI .

The prospectus shows , The continuous promotion of informatization construction in various domestic industries is one of the important factors for the rapid growth of the company's revenue during the reporting period .

And the policy change has provided the company with real gold and silver “ affordable ”. from 2019 - 2021 year , Dameng's annual cumulative policy subsidies ( Consolidated tax 、 Government subsidies ) The amounts are 5290 Ten thousand yuan 、9244 Ten thousand yuan 、2.43 One hundred million yuan , The proportion of income is 17.6%、20.5%、32.75%.

However , The policy dividend is for short-term financial data “ A tonic ” At the same time , Often cover up existing problems in the industry , Due to timeliness and uncertainty , Bring risks to enterprises that need to go to the open market independently .

The first is the liquidity risk caused by the company's excessive accounts receivable . Because government and enterprise departments often use installment payment , And the payment approval process is long 、 The contract is complicated , The proportion of accounts receivable is too high 、 The payment collection cycle becomes “To G” Persistent business problems .

During the reporting period , The proportion of accounts receivable of Dameng is located in 30% above , Once more than 46%, Most accounting periods are 1 Within years . As the future revenue scale increases , The balance of accounts receivable will also increase year by year . And the business liquidity of Dameng 、 The solvency is lower than the industry average .

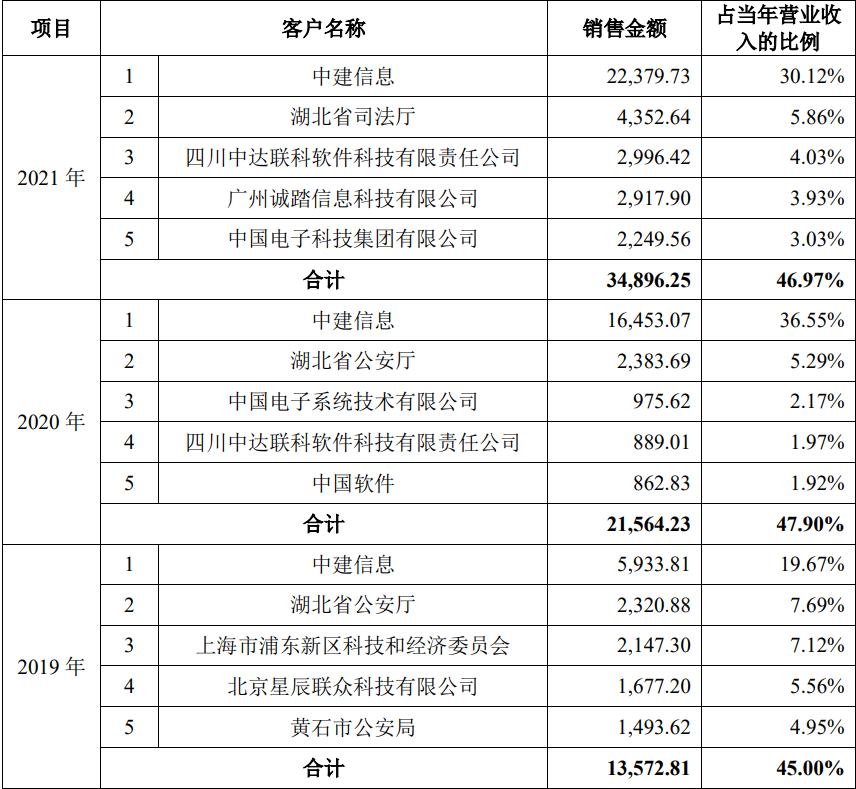

secondly , Highly dependent on fixed head big customers to buy products . It is reported that , The total revenue contribution of the top five customers is close to 50%, This will further affect the business independence of the company . Take CSCEC information, the largest customer, as an example ,2021 The proportion of accounts receivable rose sharply in , Because Dameng didn't join in the contract agreement “ Collect money before a specific date ” of .

Top five customers of Damon database software sales

Third , The proportion of government subsidies is too high , Fail to truly reflect the long-term income of the enterprise . After the preferential policies are included in the income statement , The net interest rate of the company has been greatly increased , At one point it climbed to 60%.

Refer to software sales “ High gross profit 、 Low net profit ” Characteristics of the industry ( It is generally believed , The gross profit margin of the software is 80% near . Oracle's gross profit margin in the latest quarter 、 The net interest rate is about 79.08%、15.83%), about 10%-20% The net profit margin of is more reasonable ( Net profit after deducting government subsidies , The data for three years is 27%、10%、10%).

Follow the risk factor tips , On the one hand, the company takes into account the risk that external industrial policies and government support cannot be sustained , On the other hand, predict the intensification of market competition in the future , Both revenue growth and gross profit may slow down 、 A decline in , Yes, it is growing 、 The severe test of profitability continues unabated .

The technical route diverges , The market has entered a multidimensional competition

The data base of the Institute of communications and Communications Reports Statistics , By 2021 year 5 End of month , The total number of database product providers in China is 80 home , The establishment time is mainly concentrated in 1999 year -2000 Years and 2013 year -2017 Two cycles a year .

The first stage of daydream when it was founded , When the database giant Oracle、IBM Enter the Chinese market .Oralce The leading large-scale commercial relational database has laid the traditional paradigm for nearly a decade .

At the time , emphasize “ Source code 100% Independent research and development ” Damon database aims at the data security of government and enterprise users 、 Stable demand , Relational database with mainstream centralized architecture , Local server based deployment . But now , The mainstream database technology route has forked .

Represented by the cloud native database that has attracted much attention in the industry ,IDC released 《2020 Research Report on China's relational database market in 》 Show , The relational database deployed in the public cloud mode is more than the traditional offline deployment mode for the first time , The market share has reached 51.5%, Among them, Alibaba cloud exceeds 28% Market share of , Beyond a number of vendors specializing in databases . Report predicts , To 2025 year , The market share of cloud native database will reach 73.5%.

At present ,“ Cloud on Database ” It is a general consensus in the field of database . Under this premise , Cloud as base , Distributed architecture 、 Non relational data storage 、 The open source commercialization model also has more possibilities for product technology transformation .

With traditional database manufacturers 、 Cloud manufacturers 、 Startups are flocking , In the future, the market may enter the scuffle of multi-dimensional competition . This pair began to deploy cloud computing last year 、 For Dameng who develops new products of distributed database , Can we strengthen technology research and development 、 Promote product iteration , Establish barriers to market competition , It needs long-term market observation and verification .

Source of the article :https://baijiahao.baidu.com/s?id=1737652292018046099&wfr=spider&for=pc

边栏推荐

- U3D_ Infinite Bessel curve

- Points for attention in porting gd32 F4 series programs to gd32 F3 series

- 讲师征集令 | Apache SeaTunnel(Incubating) Meetup 分享嘉宾火热招募中!

- leetcode 241. Different ways to add parentheses design priority for operational expressions (medium)

- Function: JS Click to copy content function

- OpenGL's distinction and understanding of VAO, VBO and EBO

- HPDC smart base Talent Development Summit essay

- Three. JS introduction learning notes 12: the model moves along any trajectory line

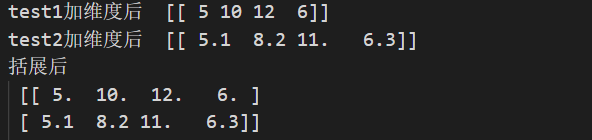

- Numpy --- basic learning notes

- 用手机在通达信上开户靠谱吗?这样炒股有没有什么安全隐患

猜你喜欢

Syntax of generator function (state machine)

Three. JS introductory learning notes 19: how to import FBX static model

The unity vector rotates at a point

强化实时数据管理,英方软件助力医保平台安全建设

Three. JS introductory learning notes 05: external model import -c4d into JSON file for web pages

Dotween -- ease function

Cocos uses custom material to display problems

numpy---基础学习笔记

unnamed prototyped parameters not allowed when body is present

C4D learning notes 1- animation - animation key frames

随机推荐

C4D learning notes 2- animation - timeline and time function

Zhongang Mining: Fluorite continues to lead the growth of new energy market

Getting started with webgl (1)

Detailed explanation of unity hot update knowledge points and introduction to common solution principles

[excelexport], Excel to Lua, JSON, XML development tool

leetcode 241. Different ways to add parentheses design priority for operational expressions (medium)

Using eating in cocos Creator

2022第四届中国(济南)国际智慧养老产业展览会,山东老博会

U3D_ Infinite Bessel curve

L'application à l'échelle de la normalisation mature des produits ai des compagnies maritimes, cimc, leader mondial de l'intelligence artificielle portuaire et maritime / intelligence artificielle des

Regular expression string

Monthly observation of internet medical field in May 2022

Webcodecs parameter settings -avc1.42e01e meaning

Use moviepy Editor clips videos and intercepts video clips in batches

leetcode 241. Different Ways to Add Parentheses 为运算表达式设计优先级(中等)

Points for attention in porting gd32 F4 series programs to gd32 F3 series

XMIND frame drawing tool

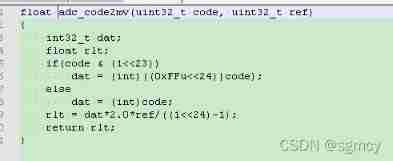

神经网络c语言中的指针是怎么回事

强化实时数据管理,英方软件助力医保平台安全建设

Please supervise the 2022 plan