当前位置:网站首页>Sequoia China, just raised $9billion

Sequoia China, just raised $9billion

2022-07-06 21:33:00 【I dark horse】

source : Hit the net (ID:China-Venture) author : Tao Huidong

Set a new record of investing in China VC A new record of fund-raising amount .

Securities Regulatory Commission (SEC) According to documents , Sequoia China's new US dollar fund has completed its filing and registration , Including a seed fund 、 A venture capital fund 、 An expansion fund and a Growth Fund , The new fund will continue to focus on Technology 、 Investment in areas such as consumption and health care . It is reported that , The total size of the four funds is about 90 Billion dollars , Set a new record of investing in China VC A new record of fund-raising amount .

Recent dollar funds “ Evacuate China ” A lot of voices , Sequoia China's new round of fund-raising shows that international funds still highly recognize the Chinese market . According to foreign media reports , Sequoia received this round of fundraising from the United States 、 The European 、 A number of sovereign funds in the Middle East and other places 、 Charity fund 、 University Endowment Fund and other well-known LP Support for , Among them, there is a long-term partner of Sequoia , There are also new LP Participation .

At present, the domestic primary market “ It's hard to raise money ”, Overseas markets are also shouting “funding winter”, Valuation down 、 Investment contraction is the theme of this half year . according to CB Insights The report of ,2022 In the first quarter of, global venture capital fell month on month 19%, It is the largest quarter on quarter decline in the past decade . In this case , Sequoia's new fund-raising cannot fail to attract attention . The more turbulent times , The more the market pays attention to the performance of head institutions , so to speak , Sequoia China's fund-raising to some extent has “ Set the tone ” The meaning of .

In terms of numbers , Sequoia did not disappoint the market this time .

Single phase fund raising 90 What is the concept of billion dollars ? This will be a family in history VC The largest sum of money raised to invest in the Chinese market . therefore , Even for Sequoia , One time raising 90 Billion dollars is not easy . In conclusion , There are the following points .

The first is over raising . According to foreign media reports , Sequoia won a total of 120 $100 million subscription , Another saying is that the proportion of oversubscription is 50%, Received dollars LP The pursuit of . Sequoia's target fund-raising amount was initially “ Billions of dollars ”,4 The news of September became “80 Billion dollars ”, Finally raised 90 Billion dollars , It can be seen that the actual fund-raising situation is better than expected .

While over raising , The rhythm is also quite fast , From the beginning of the year, it was reported that Sequoia China was raising “ Billions of dollars ” New fund , To 7 At the beginning of the month, the fund was closed , It took only half a year .

In the cold winter of the primary market , The Sequoia people see is a strategy of attack .

according to SEC file , The four funds registered by Sequoia China this time are Sequoia China expansion phase I USD Fund ( Sequoia Capital China Expansion Fund I)、 Sequoia China growth seven dollar fund (Sequoia Capital China Growth Fund VII)、 Sequoia China venture capital nine dollar fund (Sequoia Capital China Venture Fund IX)、 Sequoia China seed phase III USD Fund (Sequoia Capital China Seed Fund III).

It is worth saying more about this . It's not just Sequoia , Most heads are dollars PE/VC Fundraising remains strong .2022 At the beginning of the year, the scale of the second phase fund of Max capital was about 7 Billion dollars , Compared with the first phase fund, the scale doubled , And has been oversubscribed .PE aspect , Chunhua new issue USD PE The fund is said to have raised up to 40 Billion dollars ; Boyu capital new fund 36 Billion dollars and over raised . In addition, LanChi venture capital 、 Happy capital has completed the raising of dual currency funds . Although the current domestic and foreign market uncertainty increases , But the head dollar fund is still expanding its fundraising , Show international LP Interest in the Chinese market has not changed , Dollar funds will still be active in China's primary market , So-called “ The withdrawal of dollar funds ” At least there is no such head mechanism as Sequoia .

Of course , Still have to mention “ Head effect ” This is a cliche . Polarization is the key word of the primary market this year , Almost all head funds are expanding their scale . Not only VC, Blackstone 、KKR、 Carlyle, wait for the head PE Institutions are also raising the largest funds in their history . There are media statistics , The United States is in the top 30 The target fund-raising amount thrown by the head organization , It has even surpassed the mainstream institutions in the market LP Investment capacity . This means that the amount of funds that can be left to non head institutions in the fund-raising market has been very small .

Even in “ Head mechanism ” In this camp , Further differentiation is also taking place . According to the information in the industry , Among the head funds with fund-raising news this year , The second highest fund-raising goal is “ Ten hundreds of millions ”, Less than 20 Billion dollars . In the case of market turbulence ,LP They not only chase their heads GP, And it's chasing “ Topmost ” Of GP.

Another thing to note is , Sequoia raised money this time ,LP The subscription limit of has reached 120 Billion dollars . And two months ago , Foreign media have exposed four Chinese heads VC( Including Sequoia China ) Our fundraising plan , at that time , The total fund-raising goals of the four companies are 120 Billion dollars .

Sequoia is over raised this time , It proves once again the long-term competitiveness that can be built by the large-scale playing method of top institutions , Sequoia is immune to the market environment . According to foreign media reports , In addition to Sequoia China raised this time 90 In addition to the $100 million new fund , Sequoia Capital is still raising 28 Billion dollar India 、 Southeast Asia Fund , And total 22.5 Two US $billion funds , The total amount of funds raised this year easily exceeded 10 billion dollars .

VC They all like to talk about investment through the cycle , But to do that , First of all, we must have the ability to raise funds through the cycle . The latter is probably more difficult . And Sequoia can do , It is based on the accumulation of being at the head of the industry for decades “ reputation ”, This is probably the old brand of segmentation VC And ordinary VC The biggest threshold . Although it is difficult to do the return figures of the first and second funds , But it's not impossible . and “ reputation ” But only through time .

Su Shimin talked about this when talking with Shen NANPENG the year before last ,“ about 40 For people over the age of , Personal reputation represents their ability .” For an investment institution ,“ reputation ≈ Ability ” Is an equation that cannot be ignored .

边栏推荐

- Z function (extended KMP)

- HMS Core 机器学习服务打造同传翻译新“声”态,AI让国际交流更顺畅

- In JS, string and array are converted to each other (I) -- the method of converting string into array

- JPEG2000-Matlab源码实现

- VIM basic configuration and frequently used commands

- 2022菲尔兹奖揭晓!首位韩裔许埈珥上榜,四位80后得奖,乌克兰女数学家成史上唯二获奖女性

- JS traversal array and string

- Hill | insert sort

- [go][转载]vscode配置完go跑个helloworld例子

- guava:Collections.unmodifiableXXX创建的collection并不immutable

猜你喜欢

红杉中国,刚刚募资90亿美元

039. (2.8) thoughts in the ward

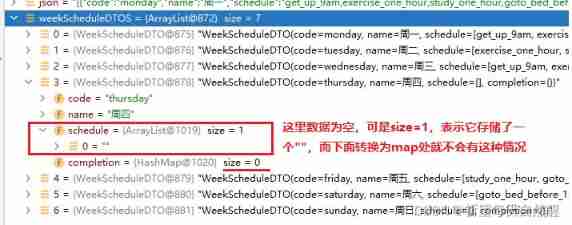

Fastjson parses JSON strings (deserialized to list, map)

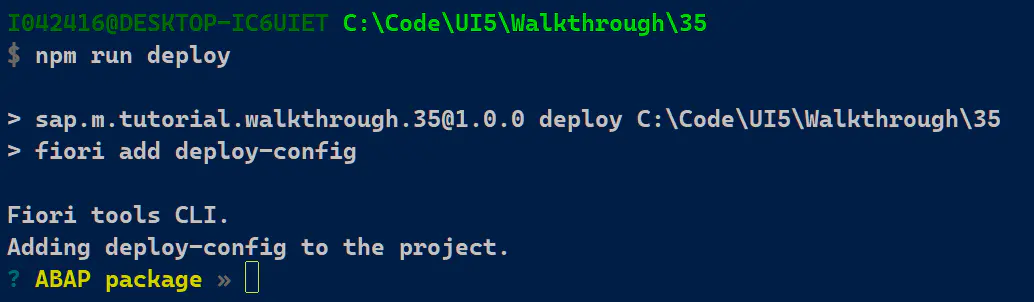

Introduction to the use of SAP Fiori application index tool and SAP Fiori tools

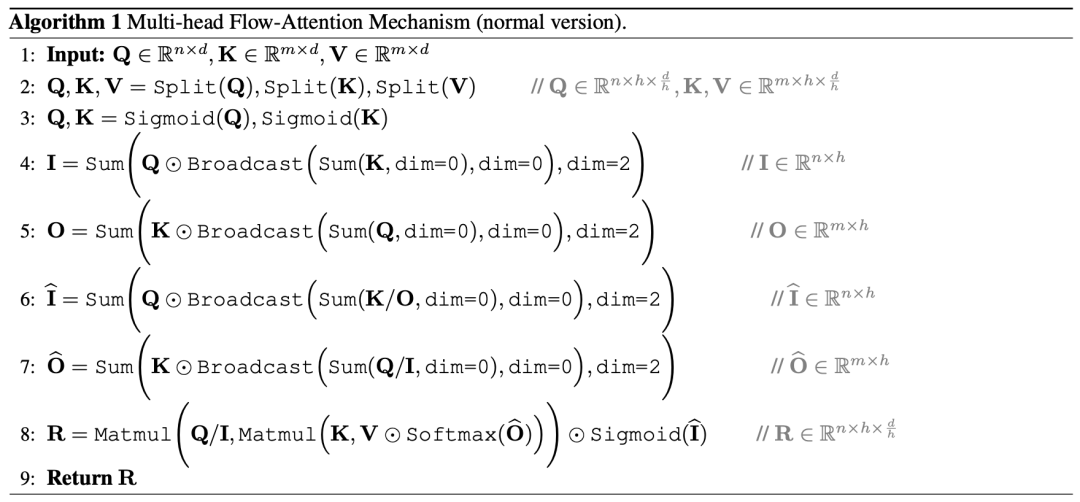

ICML 2022 | flowformer: task generic linear complexity transformer

![[in depth learning] pytorch 1.12 was released, officially supporting Apple M1 chip GPU acceleration and repairing many bugs](/img/66/4d94ae24e99599891636013ed734c5.png)

[in depth learning] pytorch 1.12 was released, officially supporting Apple M1 chip GPU acceleration and repairing many bugs

![[interpretation of the paper] machine learning technology for Cataract Classification / classification](/img/0c/b76e59f092c1b534736132faa76de5.png)

[interpretation of the paper] machine learning technology for Cataract Classification / classification

基于深度学习的参考帧生成

KDD 2022 | 通过知识增强的提示学习实现统一的对话式推荐

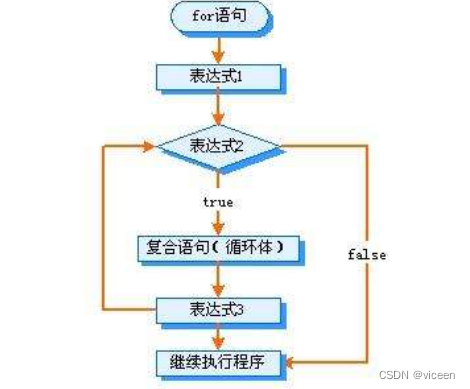

The difference between break and continue in the for loop -- break completely end the loop & continue terminate this loop

随机推荐

SQL:存储过程和触发器~笔记

KDD 2022 | 通过知识增强的提示学习实现统一的对话式推荐

2022菲尔兹奖揭晓!首位韩裔许埈珥上榜,四位80后得奖,乌克兰女数学家成史上唯二获奖女性

14年本科毕业,转行软件测试,薪资13.5K

语谱图怎么看

跨分片方案 总结

抖音将推独立种草App“可颂”,字节忘不掉小红书?

Vim 基本配置和经常使用的命令

SDL2来源分析7:演出(SDL_RenderPresent())

JS operation DOM element (I) -- six ways to obtain DOM nodes

Technology sharing | packet capturing analysis TCP protocol

Redistemplate common collection instructions opsforzset (VI)

Study notes of grain Mall - phase I: Project Introduction

C # use Oracle stored procedure to obtain result set instance

Reviewer dis's whole research direction is not just reviewing my manuscript. What should I do?

[redis design and implementation] part I: summary of redis data structure and objects

Nodejs tutorial expressjs article quick start

It's not my boast. You haven't used this fairy idea plug-in!

c语言char, wchar_t, char16_t, char32_t和字符集的关系

[go][reprint]vscode run a HelloWorld example after configuring go

Anonymous users

Anonymous users