当前位置:网站首页>Solana chain application crema was shut down due to hacker attacks

Solana chain application crema was shut down due to hacker attacks

2022-07-04 22:31:00 【Honeycomb Tech】

7 month 3 Japan ,Solana Centralized liquidity on the chain DeFi application Crema Finance Due to hacker attacks, the company announced its shutdown , The official twitter of the agreement refers to the browser on the chain SolanaFM The message says , The value of crypto assets lost is 878.2 Thousands of dollars .

Today in the morning ,Crema Finance When disclosing the attacked thread, it is called , Hackers create fake price change data accounts (Tick account) Bypass contract checks , Then he used false price data and flash loans to steal huge fees in the capital pool .

Data service provider SolanaFM When disclosing the flow of stolen funds, he said , Hackers from Solana The largest lending platform in the chain Solend Launched a number of flash loans , Among the stolen funds 649.7 Million dollars has passed the cross chain bridge Wormhole Transfer to Ethereum . at present , The hacker's address is already Solana And be blacklisted on the Ethereum chain .

since this year on ,Solana Several security incidents have occurred on the chain , Including losses 3.2 $ Wormhole Security incident and stability currency agreement Cashio Due to the collapse of security vulnerabilities . There are users in Crema Finance After the security incident, it means that it is from Solana Withdraw funds from the chain .

Crema Finance Loss exceeding 870 Thousands of dollars

Crema Finance Official website display , It's built on Solana Centralized liquidity agreement on the chain , The application allows users to redeem with a low slip Solana Encrypted assets under the standard , So far, more than 13 Billion dollars of trading volume , Have more than 38000 Users .

7 month 4 Japan , according to Crema Finance Updated information on official twitter shows , The attack took place in 7 month 2 Japan , Hackers create fake price change data accounts 、 Combined with the lightning loan attack, it stole the encrypted assets stored in the application .

According to the Crema Finance Disclosure , The hacker first created a fake 「Tick account」 Account . This account is in Crema Finance Used to store price change data . After creating a fake account , Hackers initialize the capital pool Tick Address is written into the fake account , Bypassing the platform pair Tick Routine inspection of accounts ; after , The hacker deployed a contract , And use the contract from Solend Complete the lightning loan , by Crema Finance The pool of funds increases liquidity ; stay Crema Finance In the platform , The calculation of transaction costs mainly depends on Tick account Data in ,「 result , The real transaction cost data is replaced by forged data , Hackers steal by charging huge fees from the pool .」

In short, that is , Hackers use Crema Finance Of 「Tick account」 Loophole , The fund pool price of the agreement was operated in the way of flash loan , And profit from it .

Solana Browser data provider on the chain SolanaFM Tracked the flow of hackers' funds , The agency disclosed that , Hackers from Solend The platform has carried out at least 6 Pen lightning loan , Yes 74010 SOL Was found to be transferred from the original wallet to another alternative wallet , And then through Wormhole Agreement points 5 The batch was transferred to Ethereum wallet .

Crema Finance The latest information shows , Hackers have converted the stolen funds into 69422.9 SOL and 6497738 USDCet, among USDCet Through the cross chain bridge Wormhole Transfer to Ethereum , And pass Uniswap Exchange for 6064 ETH. Combined with real-time prices ,Crema Finance The value of the encrypted assets stolen this time exceeds 878 Thousands of dollars .

It is reported that ,Crema Finance The team has contacted the unknown attacker through the message on the chain , If the hacker agrees to 72 Return stolen assets within hours , The team will pay 80 Thousands of dollars . The team said , If hackers don't follow the rules , They will contact 「 Police and legal forces 」 Hunt down hackers .

at present , The hacker's address is already Solana And Ethereum chain are tracked and blacklisted . As of press time , The hacker address has not changed ,Crema Finance Nor has it resumed operations .

Solana Applications on the chain have gradually become hackers 「 Cash dispenser 」

This year, , Compete with Ethereum DeFi In the market Solana The ecosystem on the chain is frequently visited by hackers .

3 late ,Solana The agreement on the chain stabilizes the currency agreement Cashio The stable currency generated due to security vulnerabilities CASH Total collapse . In this case , Hackers exploited a vulnerability in the Protocol , So that they can cast unlimited supply without sufficient positions CASH. Because of the incident , Should have been pegged to the dollar CASH Lost value .

according to DefiLlama The data of , In this incident , Hackers from Solana The decentralized exchange on the chain consumes nearly 2800 Working capital of US $million ,DEX Sabre So it stopped CASH Liquidity pool .

Cashio Officials did not disclose the damage caused by the attack , But there are safety experts who estimate based on the data on the chain , The loss of this stable currency agreement is about 5000 Thousands of dollars .

Solana The most notorious security incident on the chain occurred this year 2 month , at that time , Connect Ethereum and Solana Cross chain bridge of chain Wormhole More than... Were lost due to hacker attacks 3.2 $billion in encrypted assets , Become so far right Solana The biggest attack of chain ecology .

at that time , Through Wormhole Loopholes in , stay Solana Cast on the chain 12 10000 pieces of encapsulated ETH, Subsequent use Wormhole take 8 Wan package ETH Replace it with legal on Ethereum blockchain ETH, At the same time, another 4 Wan package ETH To exchange for Solana Other assets in the chain .

This safety incident also made the industry begin to pay attention to the safety of cross chain bridge . Co founder of Ethereum Vitalik Buterin I was in Reddit Warning the risk of cross chain bridge , He thinks that , Hold on Ethereum ETH Our original assets , Always better than in Solana Hold on to ETH Native assets are safer .

Some analysts think ,Solana On the chain DeFi Applications are frequently attacked , It is related to some applications that are not open source , In this way, the opportunity for white hats to find loopholes for them is lost ; Besides , Some applications carelessly Copy The code of similar applications on the Ethereum chain may also lead to vulnerabilities .

about DeFi For the operation team , How to defend against hacker attacks ?

DeFi Security and analysis company HashEx The founder of Dmitry Mishunin Tips in recent articles , To build secure DeFi agreement , First of all, there should be experienced blockchain developers , They should have a professional team leader , Have the skills to build decentralized applications , meanwhile , Using a secure code base for development is also a wise move ,「 Sometimes , Compared with libraries with the latest code base , Not very up-to-date libraries may be the safest choice .」

「 Testing is all serious DeFi Another thing the project must do .」Mishunin say , He always emphasizes the importance of decentralizing the protection of private keys used to invoke the function of restricted access smart contracts ,「 It is best to decentralize the public key through multi signature , Prevent an entity from completely controlling the contract .」

( Statement : Please strictly abide by the local laws and regulations , This article does not represent any investment advice )

Will you transfer funds from Solana Withdraw from the chain ?

边栏推荐

- Introducing QA into the software development lifecycle is the best practice that engineers should follow

- Which securities company has the lowest Commission for opening an account online? I want to open an account. Is it safe to open an account online

- Practice and principle of PostgreSQL join

- php短视频源码,点赞时会有大拇指动画飘起

- md5工具类

- La prospérité est épuisée, les choses sont bonnes et mauvaises: Où puis - je aller pour un chef de station personnel?

- PostgreSQL JOIN实践及原理

- 30余家机构联合发起数字藏品行业倡议,未来会如何前进?

- 凭借了这份 pdf,最终拿到了阿里,字节,百度等八家大厂 offer

- Shell 脚本实现应用服务日志入库 Mysql

猜你喜欢

复数在数论、几何中的用途 - 曹则贤

DevEco Device Tool 3.0 Release带来5大能力升级,让智能设备开发更高效

LOGO特训营 第四节 字体设计的重要性

LOGO special training camp section I identification logo and Logo Design Ideas

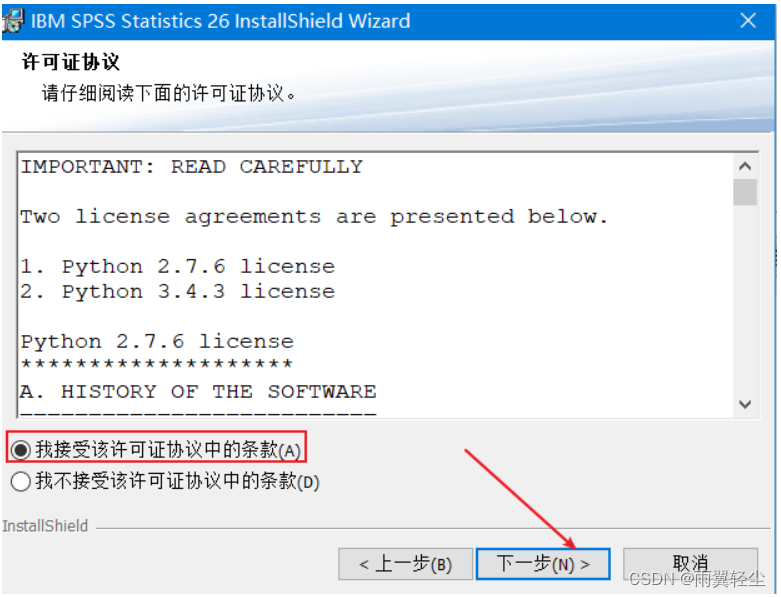

SPSS安装激活教程(包含网盘链接)

LOGO特训营 第二节 文字与图形的搭配关系

嵌入式开发:技巧和窍门——提高嵌入式软件代码质量的7个技巧

AscendEX 上线 Walken (WLKN) - 一款卓越领先的“Walk-to-Earn”游戏

Éducation à la transmission du savoir | Comment passer à un test logiciel pour l'un des postes les mieux rémunérés sur Internet? (joindre la Feuille de route pour l'apprentissage des tests logiciels)

How to transfer to software testing, one of the high paying jobs in the Internet? (software testing learning roadmap attached)

随机推荐

好用app推荐:扫描二维码、扫描条形码并查看历史

TLA+ 入门教程(1):形式化方法简介

Shell 脚本实现应用服务日志入库 Mysql

PHP short video source code, thumb animation will float when you like it

现在mysql cdc2.1版本在解析值为0000-00-00 00:00:00的datetime类

湘江鲲鹏加入昇腾万里伙伴计划,与华为续写合作新篇章

服装企业为什么要谈信息化?

使用 BlocConsumer 同时构建响应式组件和监听状态

La prospérité est épuisée, les choses sont bonnes et mauvaises: Où puis - je aller pour un chef de station personnel?

HBuilder X 常用的快捷键

Logo Camp d'entraînement section 3 techniques créatives initiales

Detailed explanation of flask context

close系统调用分析-性能优化

Tiktok actual combat ~ the number of comments is updated synchronously

Kdd2022 | what features are effective for interaction?

More than 30 institutions jointly launched the digital collection industry initiative. How will it move forward in the future?

【愚公系列】2022年7月 Go教学课程 003-IDE的安装和基本使用

Logo special training camp section 1 Identification logo and logo design ideas

2022-07-04: what is the output of the following go language code? A:true; B:false; C: Compilation error. package main import “fmt“ func main() { fmt.Pri

BigFilter全局交易防重组件的介绍与应用