当前位置:网站首页>Cost accounting [17]

Cost accounting [17]

2022-07-06 15:35:00 【Star drawing question bank】

1. When calculating the product cost at the end of the month by using the variety method , If (), You can also not calculate the cost of work in progress .(3 branch )

A. No products in progress

B. The number of products in production is very small , And the cost is small

C. The number of products in production is very small , But the cost is huge

D. There are many products in the market , And the cost is large 2. Of the following , It can be used to calculate the production cost of irreparable waste products ().(3 branch )

A. Calculated according to the actual cost consumed

B. The cost is calculated according to the quota

C. It is calculated by deducting the residual value from the actual cost

D. It is calculated by deducting the residual value from the consumed fixed cost

E. After the products are warehoused, it is found that the waste products are lost due to the reasons in the production process 3. The method of allocating various costs in similar products according to the coefficient proportion is ().(3 branch )

A. A classification

B. A variety method

C. A simplified taxonomy

D. A separate method of calculating the cost of a product 4. The formulation process of fixed cost , It is the process of reflecting and supervising the product cost in advance , It is also the process of implementing ex ante cost control .()(1 branch )

5. Adopt step-by-step carry forward method , Calculating the cost of semi-finished products in each step is ().(3 branch )

A. The need for external reporting

B. The need for costing

C. The need for cost control

D. Need to assess and analyze the implementation of cost plan 6. Loss of various wastes found during production or after warehousing , barring ().(2 branch )

A. Materials used for recovery of waste products

B. The production cost of irreparable waste

C. Salary of personnel repairing waste products

D. implement “ Three packs ” Loss 7. Enterprises with multi-step production , When using the variety method to calculate the product cost , The product cost Sub Ledger is based on () Set up .(2 branch )

A. Product variety

B. Production department

C. Product batch

D. Production steps 8. The standard for dividing the basic method and auxiliary method of product cost calculation is ().(2 branch )

A. The complexity of costing

B. Effect on cost management

C. Whether it is widely used

D. Is it necessary to calculate the actual cost of the product 9. Labor costs are cost items .()(1 branch )

10. The variety method is generally applicable to enterprises that produce a large number of single steps .(1 branch )

11. The expenses not included in the cost of products are ().(3 branch )

A. Remuneration of production workers

B. selling expenses

C. Financial expenses

D. Management cost 12. The following statements are correct ().(3 branch )

A. In a workshop that produces only one product , Manufacturing expenses are directly included in the product cost

B. A subsidiary account shall be opened for manufacturing expenses according to product varieties

C. A Sub Ledger shall be set up for manufacturing expenses according to the workshop

D. Manufacturing expenses shall be transferred from the credit of this account to “ Basic production cost ’ Account debit 13. The downtime loss that should be included in the product cost is ().(2 branch )

A. Shutdown loss caused by fire

B. The shutdown loss that should be compensated by the fault unit

C. Loss of downtime during seasonal and fixed asset repair

D. Shutdown loss caused by earthquake 14. Employee compensation included in the product , Debit... Separately according to their purpose () Account .(3 branch )

A.“ Basic production cost ”

B.“ Manufacturing expenses ”

C.“ Management cost ”

D.“ Auxiliary production cost ”15. The production organization to which the variety law applies is ().(2 branch )

A. Mass production

B. Mass production

C. Mass and small batch production

D. Single piece small batch production 16. Raw materials are put into one-time at the beginning of production , At this time , Both finished products and products in progress at the end of the month are deemed to have a degree of completion of 100% Products .()(1 branch )

17. The analysis methods of cost statements mainly include ().(3 branch )

A. Comparative analysis

B. Ratio analysis

C. Difference analysis

D. Trend analysis 18. Of the following , The expenses that should be included in the cost of products are ().(3 branch )

A. Workshop office expenses

B. Seasonal downtime losses

C. Workshop design and drawing fee

D. Inventory loss of products in process 19. The conditions that repairable waste products must meet at the same time include ().(3 branch )

A. After repair, you can use

B. It can't be used after repair

C. The cost of repair is economical

D. It can be fixed , But not economically 20. Adopt the simplified batch method ().(3 branch )

A. It can replace the product cost Sub Ledger

B. It can provide the cumulative production cost and cumulative production man hours of all products of the enterprise or workshop on a monthly basis

C. The cumulative indirect cost allocation rate of all products can be registered through this account , So as to calculate the cost of finished products and products in process

D. More accurate calculation of product cost 21. Format of cost report 、 The content and preparation time are generally determined according to the characteristics of production and operation process and the specific requirements of enterprise management .()(1 branch )

22. The following statements are not part of the product cost report ()(2 branch )

A. Unit cost table of main products

B. Breakdown of manufacturing expenses

C. Detailed statement of sales expenses

D. Detailed statement of revenue and expenditure of main business 23. The cost of work in progress is calculated according to the equivalent output method, which is applicable to () Products .(3 branch )

A. There are a large number of products

B. The quantity of products in progress varies greatly in each month

C. The proportion of each cost item in the cost is not much different

D. A large number of finished products 24.“ Waste loss ” Debit registration of account ().(3 branch )

A. Repairable scrap cost

B. Irreparable waste production costs

C. The repair cost of repairable waste

D. Claims receivable for irreparable waste 25. The product cost item is the item that the production expenses included in the product cost are classified and accounted according to the economic content .()(1 branch )

26. Small batch 、 Single piece products , The appropriate cost calculation method is ().(2 branch )

A. Variety method

B. Batch method

C. Step by step

D. classification 27. Taxes in various element expenses , When incurred or paid , Should be in () Middle disbursement .(2 branch )

A.“ Basic production cost ”

B.“ Management cost ”

C.“ Manufacturing expenses ”

D.“ selling expenses ”28. The items that should be included in the expenses incurred by the enterprise administrative department for organization and management are ().(2 branch )

A. Manufacturing expenses

B. Production costs

C. Management cost

D. Operating expenses 29. Manufacturing expenses are the expenses incurred by an enterprise in the generation process, which can be directly included in the cost of products .(1 branch )

30. In the case of producing multiple varieties , The factors affecting the cost reduction rate of comparable products are ().(3 branch )

A. Product output

B. Unit cost of product

C. product price

D. Product variety structure 31. A product is processed continuously in two production steps , After the first step of processing is completed, turn to the second step of continuous processing , Made into finished products . Total expenses incurred in the first step 125000 element , Cost of finished semi-finished products 75000 element ; The second step is the cost of finished products in this month 98000 element , The cost of semi-finished products 75000 element .(2 branch )

A.1.25

B.1

C.0.16

D.0.1232. When analyzing the cost of all commodity products , When calculating the cost reduction rate , Is the cost reduction divided by ().(2 branch )

A. Total planned cost calculated by planned output

B. Actual total cost based on planned output

C. Total planned cost based on actual production

D. Actual total cost based on actual production 33. The main difference between the simplified batch method and the batch method is .()(2 branch )

A. Do not calculate the cost of finished products in batches

B. Do not calculate WIP cost in batches

C. No allocation of overhead costs

D. Do not calculate the cost of raw materials in batches 34. A worker of an enterprise processes a 、 B two products . The man hour quota of product a is 24 minute ; The man hour quota of product B is 18 minute . The hourly direct labor cost rate of the worker is 5.2 element , Product a processed this month 250 Pieces of , B product 200 Pieces of . The following a 、 B. the unit price of piecework wage for the two products is calculated correctly ().(3 branch )

A. Unit price per piece of product a 2.08( element )

B. Unit price per piece of product B 1.56( element )

C. Unit price per piece of product a 2.05( element )

D. Unit price per piece of product B 1.50( element )35. Classification is a basic method of product cost calculation with product category as the object of cost calculation ().(1 branch )

36. Among the following items, those belonging to the production cost of products are ().(2 branch )

A. Outsourcing power cost

B. Manufacturing expenses

C. Labor cost

D. Depreciation expense 37. Use the sales expense schedule , You can analyze and evaluate the implementation results of the sales expense plan , You can also analyze ().(2 branch )

A. Composition of sales expenses

B. Reasons for the increase or decrease of sales expenses

C. Composition of sales expenses and reasons for increase and decrease

D. Actual completion of sales expenses and reasons for increase or decrease 38. The variety of products 、 In industrial enterprises with various specifications , To simplify the calculation of work cost , There is also a simple product cost calculation method ().(2 branch )

A. classification

B. Batch method

C. Step by step

D. Variety method 39.” Waste loss ” One of the contents of account accounting is ().(2 branch )

A. The repair cost after the product is sold

B. The production cost of irreparable waste found in the production process

C. Price reduction loss of selling nonconforming products

D. Loss of stock products deteriorated due to flood 40. When using the batch method to calculate the product cost , If an order specifies a large and complex product , Its production cycle is long , The batch type as the object of cost calculation is ().(2 branch )

A. The same product in different orders

B. The product component of this order

C. The products in this order

D. The same product in the same order 41. An enterprise 10 end of the month , The accumulated raw material cost of all products 98880 element , Working hours 122060 Hours , Wages and benefits 207502 element , Manufacturing expenses 280738 element . Cost of raw materials for finished products 82400 element ,10 Man hours of finished products at the end of the month 23020 Hours . requirement : Calculate the cumulative distribution rate of manufacturing expenses .(2 branch )

A.1.3

B.2

C.2.3

D.342. The production expenses incurred by the enterprise in the process of production , Is the product cost .()(1 branch )

43. Cost calculation of joint products , Most suitable for classification .()(1 branch )

44. The ratio of the main business cost of selling a certain number of products to the main business income in a certain period is ()(2 branch )

A. Cost profit margin

B. Output value cost rate

C. Cost of sales ratio

D. Sales profit margin 45. Low value consumables consumed by the basic production workshop , It should be debited to the following accounts ().(2 branch )

A.“ Manufacturing expenses ”

B.“ Production costs ”

C.“ Management cost ”

D.“ Financial expenses ”46. The output of standard products is the same as the total coefficient .()(1 branch )

47. In each auxiliary production cost allocation method , It can simplify the calculation work , It can also speed up the distribution ; meanwhile , It can also clarify the economic responsibilities of various workshop departments , What is convenient for cost analysis and assessment is ().(2 branch )

A. Direct distribution method

B. Interactive allocation method

C. Planned cost allocation method

D. Algebraic distribution 48. An enterprise consumes all purchased raw materials for production 30000 element , Auxiliary materials 14000 element , Low value consumables 8000 element , among , Purchased materials are consumed in the production of products 36000 element , Consume self-made materials 10000 element , Basic production workshop consumables 6000 element . The wages of production workers that should be included in the cost of products this month 20000 element , Basic workshop management salary 4000 element , The salary of the staff in the administrative department 6000 element , By salary 14% Withdraw welfare expenses in proportion to . The correct calculation of the following product cost items is ().(3 branch )

A. raw material :36000+10000=46000

B. Wages and benefits :20000+(20000×14%)=22800( element )

C. Manufacturing expenses :6000+4000+(4000×14%)=10560( element )

D. Wages :20000+4000+6000=3000049. Enterprises have many varieties and specifications , The number of less 、 Sporadic products with small cost proportion , To simplify the accounting work , The cost can be calculated by classification .()(1 branch )

50. The following expenses have occurred in the course of production of an enterprise :(1) The cost of raw materials used in the production of products .(2) The salary of workers in the basic production workshop .(3) Employee compensation of basic workshop managers .(4) The employee compensation of the staff of the special sales organization .(5) Depreciation expense of fixed assets for basic production workshop calculated and withdrawn according to the straight-line method .(6) Insurance premium for basic production workshop buildings .(7) Water and electricity costs incurred in the basic production workshop .(8) The office expenses of the factory management department .(9) The greening fee paid .(10) Machine and material consumption in the basic production workshop . Which of the above should be treated as production expenses ?()(3 branch )

A.(1)、(2)

B.(3)

C.(5)、(6)

D.(7)、(10)51. Calculation of property tax payable by enterprises 、 Vehicle and vessel use tax , Should debit () Account .(2 branch )

A.“ Taxes payable ”

B.“ Management cost ”

C.“ Business tax ”

D.“ Manufacturing expenses ”52. Correctly calculate the product cost , The basic work that should be done well is ().(2 branch )

A. Correctly determine the valuation of property and materials

B. Correctly divide the boundaries of various expenses

C. Determine the cost calculation object

D. Establish and improve the original records 53. In taxonomy , The method of allocating the cost of various products in the same kind of products according to the coefficient proportion , be called ().(2 branch )

A. classification

B. Quota method

C. Variety method

D. Coefficient method 54. The production of a product is divided into two steps , The cost is calculated by step-by-step carry forward method . The semi-finished products completed and warehoused in the first step of this month are 10000 element , The cost of semi-finished products collected in the second step of this month is 8000 element , Other production expenses incurred this month are 12000 element , At the beginning of 、 The cost of work in progress at the end of the month is 2000 and 1600 element . The cost of the finished product is calculated accordingly () element .(2 branch )

A.22400

B.21800

C.20400

D.1960055. An enterprise produces a 、 B two products , The actual working hours are : A product 20000 Hours , B product 32000 Hours . The salary expenses summarized according to the employee salary settlement voucher are : The salary of workers in the basic production workshop is 23920 element , The salary of workshop management personnel is 4100 element , Employee compensation of the administrative department of the enterprise 2350 element , Salary of staff in the living and Welfare Department 3000 element , The salary of the staff of the special sales organization is 2000 element . It is required to prepare accounting entries for the distribution of employees' remuneration ; The salary of the workers in the basic production workshop will be reduced to a 、 B. the products are allocated according to the actual working hours , The following is true ().(2 branch )

A. borrow : Basic production cost —— A product 9200—— B product 14720 Manufacturing expenses 4100 Management cost 2350 selling expenses 2000 Salary payable —— Employee welfare 3000 loan : Salary payable 35370

B. borrow : Production costs —— A product 9200—— B product 14720 Manufacturing expenses 4100 Management cost 2350 selling expenses 2000 Salary payable —— Employee welfare 3000 loan : Salary payable 35370

C. borrow : Basic production cost —— A product 9200—— B product 14720 Management cost 6450 selling expenses 2000 Salary payable —— Employee welfare 3000 loan : Salary payable 35370

D. borrow : Production costs —— A product 9200—— B product 14720 Manufacturing expenses 4100 Management cost 2350 selling expenses 2000 Salary payable —— Employee welfare 3000 loan : Wages payable 3537056. The product cost is relative to () In terms of the .(2 branch )

A. Certain production type

B. A certain number and a certain kind of products

C. A certain accounting period

D. A certain accounting entity 57. The comparative analysis method is only applicable to the quantitative comparison of homogeneous indicators .()(1 branch )

58. The cost of fuel directly used in the production of products , Should be recorded “ Basic production cost ” Debit of general ledger and Sub Ledger “ Fuel and power ” Cost items .()(1 branch )

59. The product of an enterprise goes through two processes , The man hour quota of each process is 30 Hours and 40 Hours , Then the completion rate of the second process is ().(2 branch )

A.68%

B.69%

C.70%

D.71%60. Not set in the enterprise “ Fuel and power ” In the case of cost items , The power cost directly used for product production in the production workshop , The account to be debited is ().(2 branch )

A.“ Management cost ”

B.“ Basic production cost ”

C.“ Production costs ”

D.“ Manufacturing expenses ”61. When using the classification method to calculate the product cost , The classification standard of products includes the structure of products 、 Raw materials and processes used .()(1 branch )

62. An enterprise 6 end of the month , The accumulated raw material cost of all products 68880 element , Working hours 47040 Hours , Wages and benefits 18861 element , Manufacturing expenses 28224 element . Cost of raw materials for finished products 32400 element ,6 Man hours of finished products at the end of the month 23020 Hours . Calculate the manufacturing cost of finished products ().(2 branch )

A.9208

B.13812

C.2908

D.3181263. Shutdown loss refers to all expenses incurred during the shutdown of the production workshop or a team in the workshop .()(1 branch )

64. The quota cost system not only pays attention to the daily control and post control of costs , More importantly, it can control the cost in advance ()(1 branch )

65. When the auxiliary production workshops provide little labor services to each other , The appropriate allocation method of auxiliary production cost is ().(2 branch )

A. Direct distribution method

B. Interactive allocation method

C. Planned cost allocation method

D. Algebraic distribution 66.“ Auxiliary production cost ” Generally, the account should be based on the auxiliary production workshop 、 The Sub Ledger will be set up under the workshop according to the type of products or services , Columns are set up in the account according to cost items or expense items for detailed accounting .()(1 branch )

67. Use the planned cost allocation method to allocate auxiliary production expenses , It can simplify and speed up the calculation and allocation .()(1 branch )

68. According to the theoretical cost of the product , What should not be included in the cost of products is ().(2 branch )

A. Salary of production management personnel

B. Waste loss

C. Power for production

D. maintenance of equipment 69. Installment of cost accounting , Not necessarily consistent with the accounting cycle .()(1 branch )

70. The debit account of employee welfare expenses withdrawn according to a certain proportion of the salary of personnel in the medical and Welfare Department is ().(2 branch )

A.“ Salary payable ”

B.“ Production costs ”

C.“ Management cost ”

D.“ selling expenses ”71.“ Downtime losses ” There should be no balance at the end of the month .()(1 branch )

72. The disadvantage of the quota method is ().(3 branch )

A. Fixed cost must be established , Calculate the deviation from quota separately

B. When the quota changes, the quota cost must also be revised , Calculate the variance of quota change

C. The workload is larger than that of other cost accounting methods

D. The allocation result of production cost between finished products and products at the end of the month is inaccurate 73. In the enterprise or workshop of small batch and single piece production , If there are many batches of products put into operation in the same month , The simplified batch method can be used to calculate the product cost .()(1 branch )

74. The product of an enterprise goes through three processes , The man hour quota of each process is 20 Hours and 40 Hours 、60 Hours , Then the completion rate of the third process is ().(2 branch )

A.68%

B.75%

C.70%

D.71%75. The period expenses of industrial enterprises can be divided into sales expenses according to the economic content 、 Administrative and financial expenses .()(1 branch )

76. Set up in the enterprise “ Fuel and power ” In the case of cost items , Fuel costs incurred in the production workshop directly used for product production , The account to be debited is ().(2 branch )

A.“ Basic production cost ”

B.“ raw material ”

C.“ fuel ”

D.“ Manufacturing expenses ”77. If it is waste products caused by waste materials , Piece rate payable .(1 branch )

78. A large electronic manufacturing company , At present, there is no accounting for the cost of a single product , There is only one total of manufacturing cost and labor cost , Evaluate the appropriateness of this method with cost accounting procedures , What's the impact .()(3 branch )

A. Don't fit

B. appropriate , It doesn't matter

C. Adversely affect cost control

D. Manufacturing expenses and labor expenses shall be accounted separately as the constituent items of product cost 79. The number of products in progress at the end of the month is large, and the number of products in progress at the end of each month changes greatly , Products in which the proportion of each cost item is similar , The cost of its work in process shall be calculated by ().(2 branch )

A. Fixed cost method

B. Quota proportional method

C. Equivalent yield method

D. Fixed cost method 80. Adopt the simplified batch method , In the month when there is no finished product , Only indirect expenses and production hours are recorded in the cost Sub Ledger of each batch of products .()(1 branch )

81. An enterprise 5 The relevant cost information of the month is as follows : Raw materials used in production 80000 element , fuel 2000 element , Electricity fees 5000 element , The wages of production workers 30000 element , Salary of workshop management personnel 5000 element , Workshop office expenses 500 element , The salary of enterprise managers 40000 element , Pay interest on the loan for purchasing raw materials 5000 element , Loss on disposal of scrapped fixed assets 1000 element . Press “ Correctly divide the boundary between production cost and period cost ” The requirements of , The following expense classification is correct ().(3 branch )

A. Production and operation management expenses :180000

B. Production costs :15000

C. Production costs :80000+2000+5000+30000+5000+500

D. Period expenses :40000+5000+100082. An industrial enterprise adopts the service life method to withdraw depreciation . The monthly depreciation rate of a certain type of fixed assets is 1%, The original value of such fixed assets at the beginning of the month is 3000 Ten thousand yuan , The original value of the added fixed assets in the current month is 300 Ten thousand yuan , The original value of the reduced fixed assets in the current month is 100 Ten thousand yuan , Then the depreciation expense accrued for this kind of fixed assets in the current month is () Ten thousand yuan .(2 branch )

A.29

B.30

C.32

D.3383. An enterprise is producing a 、 B 、 C three products , Incurred manufacturing expenses 56000 element . Production man hours provided according to data statistics , Production man hours of product a 20000 Hours , B. production hours of products 14000 Hours ; C. production man hours 30000 Hours . requirement : Allocate manufacturing expenses according to the proportion of production hours .(2 branch )

A. A should allocate =16000 element ; B shall allocate ==11200 element ; C should allocate =24000 element .

B. A should allocate =17500 element ; B shall allocate =26250 element ; C should allocate =12250 element .

C. A should allocate =12250 element ; B shall allocate =17500 element ; C should allocate =26250 element .

D. A should allocate =17500 element ; B shall allocate =12250 element ; C should allocate =26250 element .84. Of the following , What does not belong to manufacturing expenses is ().(2 branch )

A. Test and inspection fee

B. Inventory loss of products in process

C. Downtime loss during repair

D. Loss on retirement of fixed assets 85. Activity based costing is based on activity , Through the confirmation of activity-based cost , A method of calculating the production cost of a product by measurement , Among them, the cost driver is regarded as activity . Cost driver is the cause of cost , It is the basis for cost collection and distribution .()(1 branch )

86. The management of quota basis is good , Various products have sound 、 Enterprises with correct quota data , Products with large changes in the number of products at the end of the month , The calculation of in-process product cost shall adopt ().(2 branch )

A. Fixed cost method

B. Quota proportional method

C. Equivalent yield method

D. Fixed cost method 87. The cost statement of commodity products is a statement that reflects the total cost of all commodity products produced by an enterprise during the reporting period ().(1 branch )

88. Incomparable products only refer to products that the enterprise has never produced .()(1 branch )

89. The accounting accounts used in the cost accounting of industrial enterprises include ().(3 branch )

A.“ Basic production cost ”

B.“ Auxiliary production cost ”

C.“ Manufacturing expenses ”

D.“ Waste loss ”90. Allocate manufacturing expenses according to the annual planned distribution rate distribution method , It is most suitable for enterprise workshops with seasonal production .()(1 branch )

91. Suppose an industrial enterprise has a basic production workshop and an auxiliary production workshop , The former produces a 、 B two products , The latter provides a kind of labor service . The relevant economic business occurred in a certain month is as follows : Payroll expenses incurred 6300 element . Among them, the wages of production workers in the basic production workshop 3400 element , Salaries of management personnel 1300 element ; Wages of production workers in auxiliary production workshop 1100 element , Salaries of management personnel 500 element . The manufacturing cost of auxiliary production of the enterprise does not pass “ Manufacturing expenses ” Account accounting . requirement : Prepare relevant accounting entries based on the above information .(3 branch )

A. borrow : Basic cost incurred 3400

B. borrow : Manufacturing expenses 1300

C. borrow : Auxiliary production cost 1600

D. loan : Salary payable 630092. Under the quota method , The cost quota of raw materials is equal to the actual consumption of raw materials multiplied by the planned unit price of raw materials .()(1 branch )

93. Generally speaking, the scope of cost expenditure in actual work and the content of theoretical cost ().(2 branch )

A. There is a certain difference

B. Is consistent with each other

C. It's irrelevant

D. Can replace each other 94. The batch method of product costing is applicable to ().(2 branch )

A. Mass single step production

B. Mass and multi-step production

C. Small batch single piece production

D. mass production 95. The product of an enterprise is completed through two processes , The number of products in process at the end of the first operation is 100 Pieces of , Degree of completion 20%; The number of products in process at the end of the second operation is 200 Pieces of , Degree of completion 70%. The equivalent output of work in progress at the end of the month is ().(2 branch )

A.20 Pieces of

B.135 Pieces of

C.140 Pieces of

D.160 Pieces of 96. Quota method is not only a calculation method of product cost , And it is also a method to directly control and manage the product cost .()(1 branch )

97. The production of industrial enterprises , According to the characteristics of its production organization , Can be divided into ().(3 branch )

A. Mass production

B. mass production

C. Single step production

D. Single piece production 98. An enterprise this month A The product is put into production 500 Pieces of , One time input at the beginning of raw material production , The actual cost is : Direct material costs 62500 element . Direct labor costs 13888 element , Manufacturing expenses 15376 element .A Qualified products 490 Pieces of , Irreparable waste 10 Pieces of , Its processing degree is 60%, The price of scrap materials 300 Yuan warehousing . requirement : Calculate the net loss of irreparable waste .(2 branch )

A.1304 element

B.1604 element

C.1904 element

D.1504 element 99. Auxiliary production cost accounting , Including the collection of auxiliary production costs and the allocation of auxiliary production costs , Assist in the accounting of production cost collection , It is the key to auxiliary production cost accounting .()(1 branch )

100. The object of cost accounting is ().(2 branch )

A. The formation of product production cost

B. Expenditure and collection of expenses in various periods

C. Production cost and period cost

D. The cost of production and operation of enterprises in various industries and relevant period expenses

边栏推荐

- How to do agile testing in automated testing?

- Research Report on pharmaceutical R & D outsourcing service industry - market status analysis and development prospect forecast

- csapp shell lab

- Learning record: USART serial communication

- 51 lines of code, self-made TX to MySQL software!

- 软件测试面试回答技巧

- Learning record: STM32F103 clock system overview working principle

- ucorelab4

- Mysql database (IV) transactions and functions

- 学习记录:TIM—电容按键检测

猜你喜欢

Do you know the performance testing terms to be asked in the software testing interview?

几款开源自动化测试框架优缺点对比你知道吗?

Flex --- detailed explanation of flex layout attributes

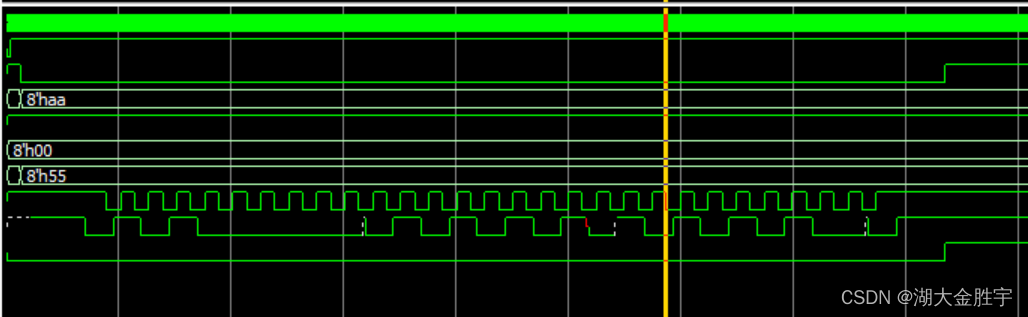

FSM和i2c实验报告

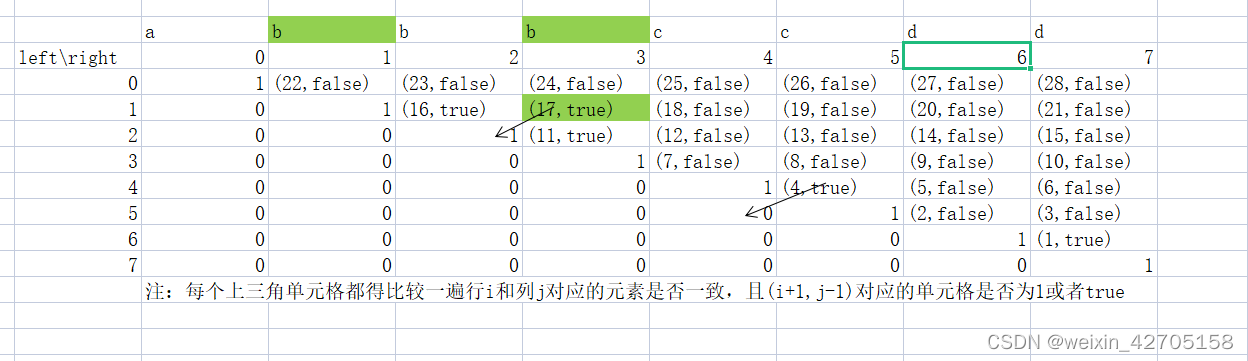

力扣刷题记录

Learning record: use stm32f1 watchdog

Learning record: how to perform PWM output

STM32学习记录:LED灯闪烁(寄存器版)

学习记录:TIM—电容按键检测

Stm32 dossiers d'apprentissage: saisie des applications

随机推荐

Interview answering skills for software testing

LeetCode#204. Count prime

学习记录:TIM—电容按键检测

Crawling cat's eye movie review, data visualization analysis source code operation instructions

ucore lab 2

STM32学习记录:LED灯闪烁(寄存器版)

JS --- detailed explanation of JS facing objects (VI)

Medical colposcope Industry Research Report - market status analysis and development prospect forecast

Iterators and generators

Preface to the foundations of Hilbert geometry

Crawler series of learning while tapping (3): URL de duplication strategy and Implementation

Hospital privacy screen Industry Research Report - market status analysis and development prospect forecast

学习记录:USART—串口通讯

Report on the market trend, technological innovation and market forecast of printing and decorative paper in China

UCORE LaB6 scheduler experiment report

软件测试有哪些常用的SQL语句?

MySQL数据库(四)事务和函数

Servlet

csapp shell lab

[pytorch] simple use of interpolate