当前位置:网站首页>First batch selected! Tencent security tianyufeng control has obtained the business security capability certification of the ICT Institute

First batch selected! Tencent security tianyufeng control has obtained the business security capability certification of the ICT Institute

2022-07-06 21:18:00 【Tencent security】

In recent days, , Sponsored by China information and Communication Research Institute “2022 The first business and application security development forum ” Held in Beijing . At the meeting , The Chinese Academy of communications and communications announced 2022 Trusted security assessment results , Tencent security privacy protection decision system “ Credit version ” and “ Transaction anti fraud version ” Both were selected , Become the first batch to pass the China Academy of communications “ Business security capability requirements ” Certified products .

Receive visitors + Integration of risk control

Escort the steady development of credit business

For a long time , The financial industry is based on serving the real economy , It is the key force to promote the development of digital economy . With the deepening of the digital transformation of the financial industry , Big retail + Digitalization has become a significant feature of the deepening development of financial institutions in the future . Financial institutions are using artificial intelligence 、 While big data and other new generation information technologies promote the process of digital transformation , It will also face some security problems in the process of boundary expansion .

Especially in the financial industry, the credit business is expanding , In the face of the rapid changes in the external market and the rigid requirements of the bank's internal stable operation , The decision-making mechanisms of emerging Internet digital services and traditional credit services need to be deeply integrated .

In this context , Tencent security encapsulates customer acquisition and risk control capabilities , Made a set of “ Receive visitors + Risk control ” Integrated retail credit solutions , Focus on the credit business scenario , For pre loan 、 In credit 、 Requirements for risk assessment in the post loan scenario , Combining face recognition 、 Identity Authentication 、 Fraud identification and other technologies and schemes , Risk control of retail credit , It mainly covers feature management 、 Policy configuration 、 List management 、 Release management 、 Test management 、 Real time decision making 、 Decision result output and other functions . meanwhile , Tencent security also has a large number of industry experts , It can help financial institutions plan top-level businesses , Provide financial level business security support .

Take a city commercial bank as an example , Due to the single customer channel , Lack of digital platform , Tencent security helped the bank build a digital platform for retail credit 、 Big data risk control system and advanced channel customer acquisition system , And combined with Tencent's internal experts to jointly operate , The bank has accumulated users since its launch 170 ten thousand , The number of transactions 40 ten thousand , And already 150 Billion balance .

at present , This scheme has been applied in the Bank of China 、 China Everbright Bank 、 China Minsheng Bank 、 Huaxia bank 、 Jilin Rural Credit 、 Jining bank 、 Bank of Qingdao and other banks have successfully landed , It has served hundreds of millions of users , Escort hundreds of billions of credit funds .

Focus on transaction risk control

Help improve the quality and efficiency of enterprise fraud management

In the era of digital economy , Industrial digitalization and digital industrialization are constantly deepening and evolving , The types and scenarios of business security risks are becoming more and more complex , The anti fraud work in the financial market is also more difficult .

meanwhile ,《 Data security law 》 and 《 Personal information protection law 》 The promulgation of also put forward higher requirements for the anti fraud work of financial institutions . Financial science and technology development plan 2.0 It is highlighted in , We should promote the orderly sharing and comprehensive application of data on the premise of ensuring security and privacy , Fully activate the potential of data elements , Effectively improve the quality and efficiency of financial services .

So , Tencent security is based on long-term accumulated experience in service output of financial service infrastructure , Integrated a set of transaction anti fraud solutions , By sorting out the key information in the transaction process , Provide perception from risk 、 distinguish 、 The risk control capability of the full trading link released by the decision , Combine the global device fingerprint 、 Terminal risk control engine 、 User digital identity 、 Technology such as risk intelligence core , Build a complete closed loop of risk prevention and control , It can provide customers with millisecond level real-time risk control decision-making ability , Meet the corresponding requirements of financial institutions for transaction anti fraud , Provide more perfect business management and business analysis services for retail financial business .

In the practice of cooperating with a state-owned bank , This solution will eventually help the bank build a pre event 、 In the matter 、 Post event multi-dimensional risk model , Cumulative monitoring of high-risk transactions 31.9 Billion pen , Block suspicious transaction amount 118.27 One hundred million yuan .

It is worth mentioning that , In addition to federal Learning Technology , Tencent security self-developed SKAnets Small sample learning method , It can help financial institutions quickly grasp the learning tasks and the characteristics of new fraud patterns in the risk iteration period , Build new model samples even if the samples are very limited , Effectively help financial institutions identify fraud , Quantify risk .

Li Chao, an expert on Tencent security financial risk control, said , Risk control is not only the ballast of financial institutions , It is also the engine of financial institutions . This time, we received the recognition of the China Academy of communications technology on the security capability requirements of Tencent's security business , It further strengthened Tencent's determination to safeguard the safety and beauty of digitalization .

future , Tencent security will rely on 20 Years of safety protection experience , Continue to build consultation covering scenes 、 Solution 、 Risk control services 、 Risk control system and other multi-dimensional product matrix , Build a leading privacy computing decision-making system , Escort the digital transformation of all walks of life .

边栏推荐

- Tips for web development: skillfully use ThreadLocal to avoid layer by layer value transmission

- Aiko ai Frontier promotion (7.6)

- Study notes of grain Mall - phase I: Project Introduction

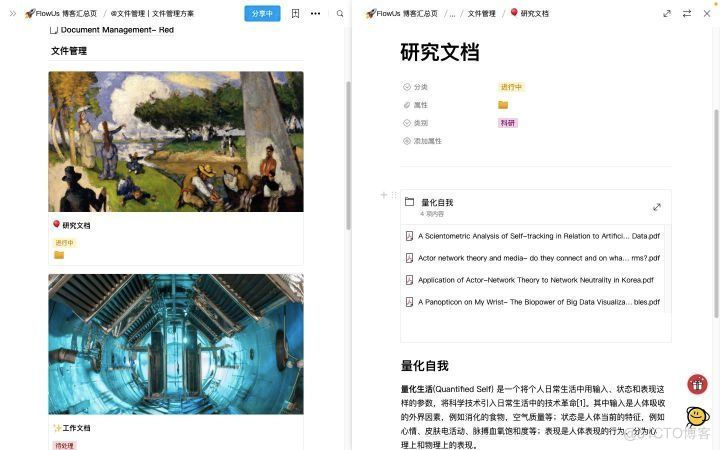

- The most comprehensive new database in the whole network, multidimensional table platform inventory note, flowus, airtable, seatable, Vig table Vika, flying Book Multidimensional table, heipayun, Zhix

- MLP (multilayer perceptron neural network) is a multilayer fully connected neural network model.

- 【mysql】游标的基本使用

- JS操作dom元素(一)——获取DOM节点的六种方式

- 快讯:飞书玩家大会线上举行;微信支付推出“教培服务工具箱”

- el-table表格——获取单击的是第几行和第几列 & 表格排序之el-table与sort-change、el-table-column与sort-method & 清除排序-clearSort

- OSPF多区域配置

猜你喜欢

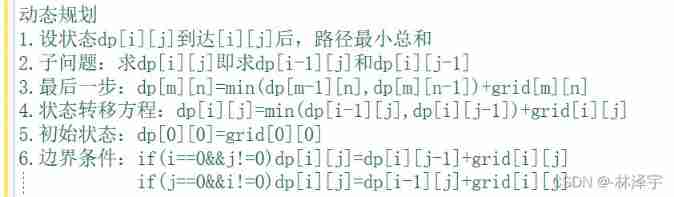

966 minimum path sum

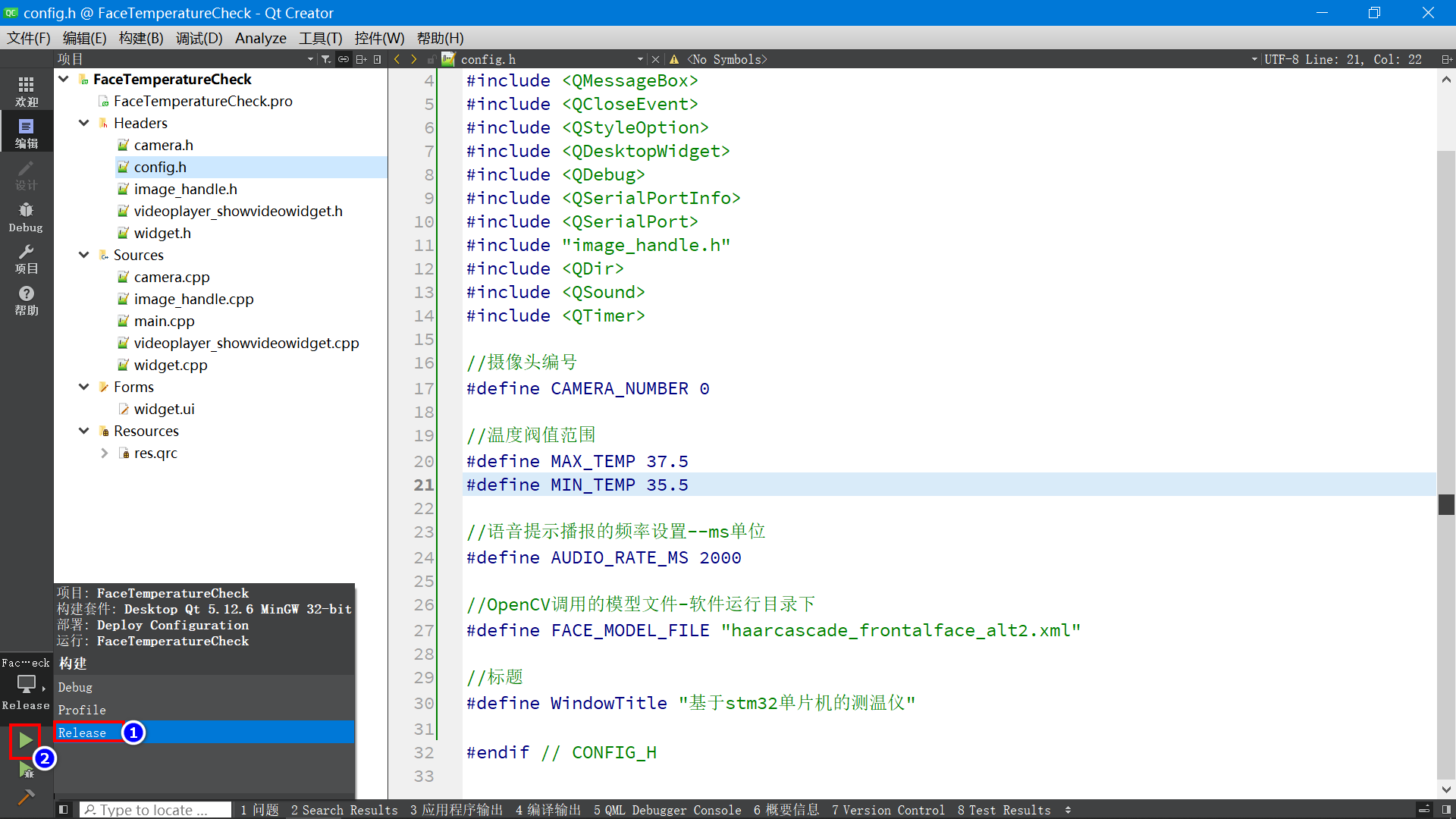

Infrared thermometer based on STM32 single chip microcomputer (with face detection)

This year, Jianzhi Tencent

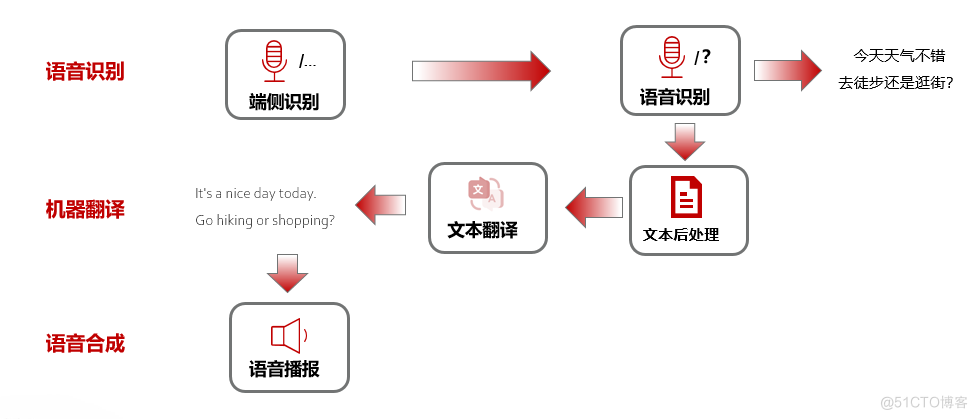

HMS Core 机器学习服务打造同传翻译新“声”态,AI让国际交流更顺畅

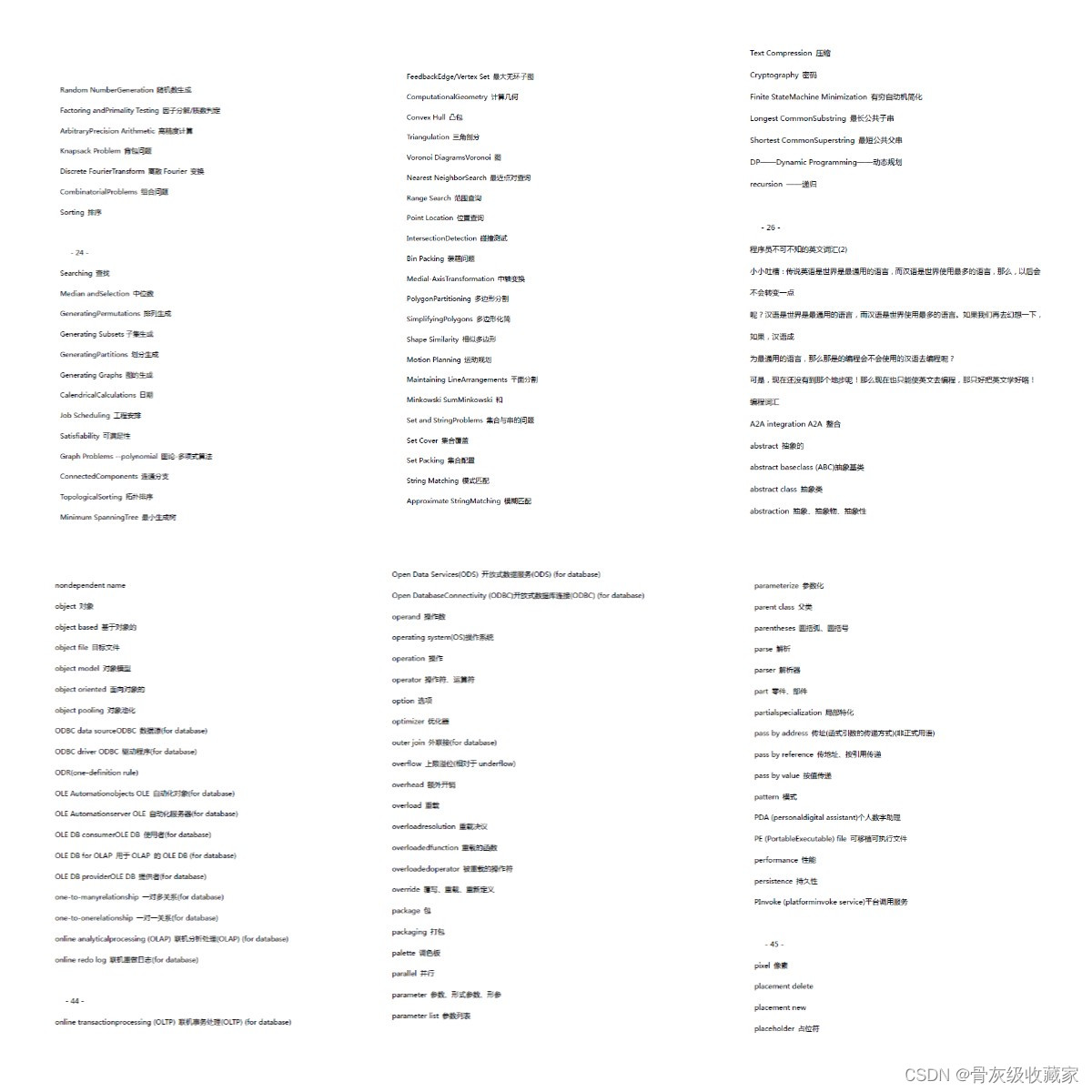

每个程序员必须掌握的常用英语词汇(建议收藏)

Why do job hopping take more than promotion?

Fastjson parses JSON strings (deserialized to list, map)

审稿人dis整个研究方向已经不仅仅是在审我的稿子了怎么办?

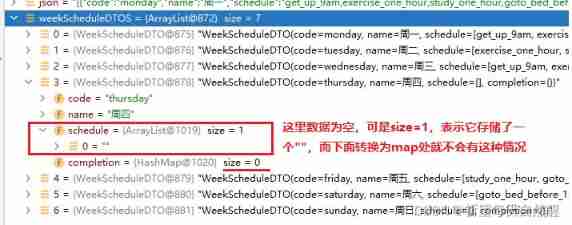

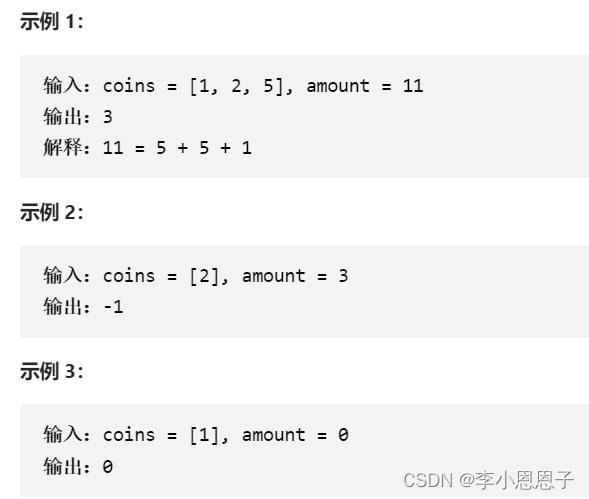

【力扣刷题】一维动态规划记录(53零钱兑换、300最长递增子序列、53最大子数组和)

全网最全的新型数据库、多维表格平台盘点 Notion、FlowUs、Airtable、SeaTable、维格表 Vika、飞书多维表格、黑帕云、织信 Informat、语雀

随机推荐

3D face reconstruction: from basic knowledge to recognition / reconstruction methods!

It's almost the new year, and my heart is lazy

Ravendb starts -- document metadata

How to implement common frameworks

Forward maximum matching method

Aiko ai Frontier promotion (7.6)

20220211 failure - maximum amount of data supported by mongodb

面试官:Redis中有序集合的内部实现方式是什么?

js中,字符串和数组互转(二)——数组转为字符串的方法

The use method of string is startwith () - start with XX, endswith () - end with XX, trim () - delete spaces at both ends

Set up a time server

Pat 1078 hashing (25 points) ⼆ times ⽅ exploration method

Start the embedded room: system startup with limited resources

What are RDB and AOF

@GetMapping、@PostMapping 和 @RequestMapping详细区别附实战代码(全)

Aike AI frontier promotion (7.6)

互联网快讯:吉利正式收购魅族;胰岛素集采在31省全面落地

Three schemes of SVM to realize multi classification

ACdreamoj1110(多重背包)

PG基础篇--逻辑结构管理(事务)