当前位置:网站首页>Accounting regulations and professional ethics [5]

Accounting regulations and professional ethics [5]

2022-07-06 15:36:00 【Star drawing question bank】

1. There are various ways of accounting professional ethics education , But what has a fundamental position is ()

A. Continuing education in accounting

B. Accounting self education

C. Accounting Education

D. Accounting professional honor education 2. The implementation mode of government procurement in China is ().

A. Centralized purchasing

B. Decentralized procurement

C. The combination of centralized procurement and decentralized procurement

D. Agent purchase 3. The following statements are incorrect ( ).

A. The draft of the central final accounts prepared by the financial department of the State Council , After examination and approval by the State Council , The State Council shall submit it to the National People's Congress for approval

B. The draft of the central final accounts prepared by the financial department of the State Council , The State Council shall submit it to the Standing Committee of the National People's Congress for examination and approval

C. The draft final accounts at the corresponding level prepared by the financial departments of local governments at or above the county level , After being examined and approved by the government at the same level , It shall be examined and approved by the Standing Committee of the people's Congress at the same level

D. Draft final accounts prepared by the township government , Approved by the people's Congress at the same level 4. The general principle of China's accounting work management system is ( ).

A. Unified leadership

B. Unified leadership , Hierarchical management

C. Hierarchical management

D. Unified leadership , centralized management 5. Of the following , Have the right to deal with violations 《 accounting law 》 The authorities that impose punishment for acts are ().

A. The financial department of the people's government at or above the provincial level

B. The financial department of the people's government at or above the municipal level

C. The financial department of the people's government at or above the county level

D. Financial departments at all levels 6. According to the provisions of consumption tax , Taxpayers selling taxable consumer goods by installment collection , The occurrence time of its tax obligation is ().

A. The date of receipt agreed in the written contract

B. The day of receiving the first sales payment

C. The day on which the taxable consumer goods are delivered

D. The day on which the voucher for the sales payment is obtained 7. In the following statements about the legal relationship of Taxation , The right is ().

A. Both sides of the levy negotiate on an equal footing 、 The transfer of property ownership shall be carried out in principle of equal value and compensation

B. In the legal relationship of Taxation, rights and obligations are equivalent

C. The establishment of tax legal relationship is not based on the agreement of the two parties

D. Although the right to tax is granted by national laws , But it can be abandoned or transferred 8. Professional ethics is linked with profession , Its formation and development is due to the emergence of ().

A. Division of labor

B. Social division of labor

C. Professional division of labor

D. Specialization 9. In our country , Organize and promote the construction of accounting professional ethics , And administer the relevant work according to law ().

A. The administrative department for Industry and commerce

B. The finance department

C. Accounting industry organizations

D. Other institutions 10. According to our country 《 Budget law 》 The provisions of the , What does not belong to the budgetary authority of the financial department of the State Council is ( ).

A. Specific preparation of the central budget 、 Draft final accounts

B. Specifically organize the implementation of the central and local budgets

C. Examine and approve the adjustment plan of the central budget

D. Formulate the adjustment plan of the central budget 11. The specific types of administrative penalties involving the tax field do not include ().

A. Stop the right of export tax rebate

B. A jail sentence

C. fine

D. Confiscate illegal property 12. About the state budget , The wrong is ().

A. The state budget is the material condition to ensure the operation of the state machinery

B. The national budget is an effective guarantee for the government to implement various social and economic policies

C. The state budget is an estimation reflection of fiscal revenue and expenditure , It does not have the function of supervision

D. The scale of revenue and expenditure of the national budget can adjust the balance of total social supply and demand 13. Accountants " Participate in management ” In the code of conduct , What's not right is ().

A. Directly participate in management activities

B. Indirectly participate in management activities

C. Serve for management activities

D. Be a consultant for managers 14. Current state budget in China ().

A. The central 、 province ( Autonomous region 、 Municipalities directly under the central government )、 City ( autonomous prefecture )、 county ( A city without districts 、 Municipal district ) Level 4 budget

B. The central 、 province ( Autonomous region 、 Municipalities directly under the central government )、 City ( autonomous prefecture )、 county ( A city without districts 、 Municipal district )、 township ( The town of ) Five level budget

C. The central 、 province ( Autonomous region 、 Municipalities directly under the central government )、 City ( autonomous prefecture ) Level 3 budget

D. The central 、 province ( Autonomous region 、 Municipalities directly under the central government )、 City ( autonomous prefecture )、 county ( A city without districts 、 Municipal district )、 township ( The town of )、 Village six level budget 15. Shut down 、 Resumption registration applies to ().

A. All taxpayers

B. Taxpayers who implement the method of regular quota collection

C. Withholding agent

D. Small scale enterprises 16. Payment and settlement are implemented () The management system of .

A. Unified management

B. Hierarchical management

C. Membership

D. Unified management and hierarchical management 17. What is incorrect in the following statement is ().

A. The change reserve cash of business and service industries should also be determined according to the turnover , Included in the cash on hand limit of the account opening unit

B. When the unit receives sporadic cash from the deposit bank , In the column of cash check purpose, it should be indicated " Petty cash " word , Cash not included in the scope of petty cash , You should draw a cash cheque separately

C. So-called " Ramus ischiatus " Cash refers to the enterprise 、 Institutions and organs 、 group 、 The troops directly use their cash income for cash expenditure

D. The cash income of each unit shall be deposited in the bank on the same day ; If there are difficulties on that day , The deposit time shall be determined by the deposit bank 18. The following are the core contents of accounting professional ethics education and run through ().

A. Accounting professional ethics education

B. Warning education of accounting professional ethics

C. Accounting professional ethics education

D. Accounting professional knowledge 、 Skills education 19. The depositor obtains loans from other places and has other settlement needs , You can open accounts in different places ().

A. Temporary deposit accounts

B. Basic deposit account

C. Special deposit account

D. General deposit account 20. In order to expand sales , It is proposed to pay 5 Ten thousand yuan rebate , The salesperson takes the instructions of the general manager of the company to the finance department to request to withdraw the money . Liu, the manager of the finance department, believes that the expenditure does not comply with the relevant regulations , But considering the approval of the general manager of the company , And the payment amount is within its approved limit , The payment was made . Liu's above behavior violates () Accounting professional ethics requirements .

A. Be honest

B. Stick to the rules

C. Participate in management

D. Strengthen service 21. The following goods imported by taxpayers are applicable 13% The low tax rate is ().

A. The car

B. laptop

C. agricultural machinery

D. Bicycle 22. According to our country 《 Budget law 》 The provisions of the , What does not belong to the budgetary authority of the financial department of the State Council is ().

A. Specific preparation of the central budget 、 Draft final accounts

B. Specifically organize the implementation of the central and local budgets

C. Examine and approve the adjustment plan of the central budget

D. Formulate the adjustment plan of the central budget 23. according to 《 Provisional Regulations on consumption tax 》 Regulations , When taxpayers use their own taxable consumer goods for continuous production of taxable consumer goods ().

A. Calculate and pay consumption tax according to the product cost

B. Consumption tax is calculated and paid according to the sales price of similar products

C. Consumption tax is calculated and paid according to the constituent taxable price

D. No consumption tax 24. The following conditions meet the requirements of invoice issuance is ().

A. Invoice the expected possible business

B. Fill in the invoice in English

C. Split the book and use the invoice

D. Fill in the numbers in order 25. The following statement about government procurement is incorrect ().

A. Extra budgetary funds refer to various administrative fees charged by units 、 Government procurement funds 、 Income from intergovernmental donations , It does not include the income from various other undertakings of the unit

B. Supporting procurement projects with both financial funds and other funds of the Department , Or institutions and social organizations with financial allocations or financial subsidies , We should also implement the government procurement system

C. Centralized procurement is the only implementation mode of current government procurement in China

D. The project mentioned in government procurement refers specifically to the construction project arranged by financial funds , Excluding network engineering 、 Information engineering is equivalent to engineering projects unrelated to civil engineering 26. In the following procurement activities , apply 《 Government procurement law 》 The adjustment is ( ).

A. A public institution uses financial funds to purchase office supplies

B. A state-owned enterprise purchases raw materials

C. A wholly state-owned company purchases office supplies

D. A partnership purchases office supplies 27. The following principles that should not be adhered to in payment and settlement are ().

A. Keep your word . Performance payment

B. Whose money goes into whose account . Who controls

C. The bank advances moderately

D. Banks do not advance money 28. Of the following , Those that do not belong to the characteristics of taxation are ().

A. mandatory

B. Distributive

C. gratuitousness

D. Fixity 29. When collecting value-added tax, it is allowed to deduct all the taxes paid on the purchased fixed assets at one time , This practice belongs to ().

A. Productive value-added tax

B. Income type VAT

C. Consumption value-added tax

D. Distributive VAT 30.《 Government procurement law 》 The specified cases where single source procurement can be adopted are ().

A. Only from a single supplier

B. In case of unforeseen emergency, it is impossible to purchase from other suppliers

C. It is necessary to ensure the consistency of the original procurement projects or the requirements of supporting services , We need to continue to purchase from the original supplier , And the total amount of additional purchase funds does not exceed the purchase amount of the original contract 10% Of

D. Buyers are used to using certain products 31. The following statement , The right ones ( ).

A. Accounting qualification certificate , It is a legal certificate to prove that accountants can engage in accounting work

B. Once the accounting qualification certificate is obtained , Effective in the province

C. Management of accounting qualification , Implement the principle of territoriality

D. Acquisition of accounting qualification , Implement the examination system 32. In the following statements about Invoicing requirements , The right ones ().

A. No invoice shall be issued without business operation

B. The invoice sheet and deduction sheet are stamped with the financial seal of the unit or the special seal for invoice

C. Fill in the invoice in foreign language

D. The invoice can be opened and used by yourself 33. The implementation ways of accounting professional ethics mainly include ().

A. Combine self-cultivation with external supervision

B. Combine publicity and education with inspection and punishment

C. Combine industry self-discipline with government supervision

D. Combine ethics with legal supervision 34. When filling in the bill ,¥107000.50 Should be filled in as ( ).

A. RMB one hundred and seven thousand and five jiao

B. RMB one hundred and seven thousand and five jiao

C. RMB one hundred and seven thousand and five jiao only

D. RMB one hundred seven thousand five jiao 35.201X year 5 month , When a provincial financial department inspects an enterprise , The following conditions are found : In order to achieve the predetermined performance goals , Zheng, the person in charge of the unit, asked Li, the person in charge of the accounting institution, to make up transactions , Falsify accounting data , Whitewash financial reports , Li refused , Then he was dismissed . The following statements are correct ().

A. according to 《 Accounting Law of the people's Republic of China 》 The provisions of the , Li has the right to refuse to handle

B. According to the labor contract , Li has no right to refuse to handle

C. Zheng instructed the accounting institution to forge accounting vouchers , A violation of the 《 Accounting Law of the people's Republic of China 》 The provisions of the , But where 5000 Yuan of above 5 A fine of less than ten thousand yuan

D. The reputation and original position of Li, the head of the accounting institution, should be restored 、 Level 36. The following statements are correct ( ).

A. The draft of the central final accounts prepared by the financial department of the State Council , After examination and approval by the State Council , The State Council shall submit it to the National People's Congress for approval

B. The draft of the central final accounts prepared by the financial department of the State Council , The State Council shall submit it to the Standing Committee of the National People's Congress for examination and approval

C. The draft final accounts at the corresponding level prepared by the financial departments of local governments at or above the county level , After being examined and approved by the government at the same level , It shall be examined and approved by the Standing Committee of the people's Congress at the same level

D. Draft final accounts prepared by the township government , Approved by the people's Congress at the same level 37. Payment and settlement as a legal act , Its legal characteristics are ().

A. Payment and settlement must be carried out through financial institutions approved by the people's Bank of China

B. Payment and settlement is an important behavior

C. The occurrence of payment and settlement depends on the will of the client

D. Payment and settlement must be carried out according to law 38. Various departments 、 The basis for each unit to prepare the annual budget draft is ().

A. law 、 statute

B. The instructions and requirements of the government at the same level and the deployment of the financial department of the government at the same level

C. Department 、 Responsibilities of the unit 、 Mission and career development plan

D. Department 、 The quota standard of the unit 39.201X year 5 month , A provincial financial department is checking ABC When the accounting firm inspects , The following conditions are found : Shareholder Zhang 2003 Obtained the certificate of certified public accountant , Then transferred to a certain enterprise ,20X6 To join in ABC Accounting firms engage in auditing . Based on the above , The following statements are correct ().

A. When Zhang was transferred to work in the enterprise , It is necessary to go through the procedures of converting a practicing member of the China Institute of certified public accountants to a non practicing member

B. Zhang meets the specified conditions , Can act as ABC Shareholders of accounting firm

C. Zhang is not satisfied with the recent continuous 5 Conditions for practicing in an accounting firm in , Can't be ABC Shareholders of the accounting firm

D. Zhang is not satisfied with the recent continuous 5 Conditions for engaging in audit business in an accounting firm , Can't be ABC Shareholders of the accounting firm 40. The settlement vouchers that the bank will not accept include ().

A. The amount in words is a settlement voucher in minority languages

B. Settlement voucher with inconsistent amount in Chinese capital and Arabic numerals

C. Settlement voucher with amount in words in foreign language

D. Settlement voucher with changed amount 41. According to the provisions of the payment and settlement method , Of the following , Those who meet the basic requirements of payment and settlement are ().

A. Company 、 Individuals and banks handle payment and settlement , Bills and settlement vouchers printed in accordance with the unified regulations of the people's Bank of China must be used

B. Company 、 Individuals and banks should follow 《 Measures for the administration of RMB bank settlement accounts 》 Issued in accordance with the provisions of 、 Use account

C. The signatures and other records on bills and settlement vouchers should be true , Do not forge 、 To alter

D. Filling in bills and settlement vouchers should be standardized , Complete the elements , The number is correct , The handwriting is clear , Not bad, not missing , No scribble , Prevent erasure 42. According to the relevant regulations , In the following cases , The depositor should apply to the deposit bank to cancel the bank settlement account ().

A. Be merged 、 dissolution 、 Declare bankruptcy or closure

B. Change the company name

C. The Bank of deposit needs to be changed due to relocation

D. Cancellation 、 The business license is revoked 43. Invoices in China are different according to their purposes and contents , Can be divided into ().

A. VAT special invoice

B. Ordinary invoice

C. special invoice

D. Industry invoice 44. Bookkeeping vouchers that can not be attached with original vouchers include ( ).

A. Settle accounts

B. Correct the mistake

C. Payment cost

D. Selling goods 45. according to 《 Personal income tax law 》 The provisions of the , Of the following , Proportional tax rates apply to ().

A. Income from lease of property

B. Income from royalties

C. Wages 、 Salary income

D. Income from contracted operation 46. Of the following , The certificates of the depositor's application for opening a basic deposit account include ()

A. Loan contract

B. Approved and issued by the local administration for Industry and Commerce 《 The business license 》 The original

C. The approval or registration certificate of the government personnel department or the establishment committee and the certificate of approval of the financial department to open an account

D. Personal resident ID card 47. The checks that can be used for transfer are ().

A. cash cheque

B. transfer cheque

C. Ordinary checks

D. Cross a check 48. The following belong to the composition of the national budget ( ).

A. Central budget

B. Local budgets

C. general budget

D. Department unit budget 49. The following statement about the name of the bank settlement account to be opened by the depositor , The right ones ().

A. The name of the bank settlement account opened by the unit shall be consistent with the full name of the supporting documents provided for the application for opening an account

B. The name of the bank settlement account opened by the individual industrial and commercial door with a name , It should be consistent with the font size of its business license

C. The name of a bank settlement account opened by an individual industrial and commercial household without a name , from " self-employed person ” Words and the name of the operator recorded in the business license

D. Name of bank settlement account opened by natural person , It should be consistent with the full name in the valid ID card provided 50. Among the following items, the circumstances that require the cancellation of tax registration are ().

A. The enterprise's bankruptcy terminates the tax liability

B. The business license is revoked

C. The name of the enterprise has changed

D. The change of business location changes the tax authority 51. The basis for governments at all levels to prepare annual budget drafts is ().

A. law 、 statute

B. National economic and social development plan 、 Medium and long-term fiscal plans and relevant fiscal and economic policies

C. The budget management authority of the government at the same level and the budget revenue and expenditure scope determined by the financial management system

D. The budget implementation of the previous year and the change factors of the budget revenue and expenditure of the current year 52. Of the person in charge of a state-owned enterprise ( ) It is not allowed to serve as the head of the accounting institution of the unit 、 Accountant in charge .

A. Wife

B. Children

C. brother

D. uncle 53. If there is no record on the bank draft () And so on , The draft is invalid .

A. indicate " Bank draft ” The words...

B. A promise of unconditional payment

C. Determined amount

D. Name of payer 54. National unified accounting system , The main contents include ( ).

A. Accounting system

B. Accounting supervision system

C. Accounting organization management system

D. Accounting work management system 55. Of the following , The relative records of bank bills include ().

A. Name of payer

B. Place of payment

C. Date of issue

D. Payment date 56. according to 《 Personal income tax law 》 Regulations , When calculating taxable income , The following taxable items () Fixed expenses can be deducted .

A. Income from labor remuneration 3000 element

B. Monthly salary 6000 element

C. By chance 2000 element

D. Income from transfer of property 20000 element 57. The specific types of administrative penalties involved in the tax field include ().

A. Order to make corrections within a time limit

B. Fine

C. Confiscation of property

D. criminal detention 58. The basic composition of China's accounting law includes ( ).

A. Accounting Law

B. Accounting administrative regulations

C. Local accounting regulations

D. National unified accounting system 59. The accounting work management system is a system that divides the responsibility and authority relationship of accounting management , Include ( ).

A. To supervise and inspect

B. Organization form of accounting work management

C. Administrative authority

D. Management organization setting 60. The correct statement about the personal income tax rate is ().

A. Wages 、 Salary income , apply 5% to 45% The excess progressive tax rate

B. Individual businesses 、 Income from production and operation of sole proprietorship enterprises and partnerships , And the contracted management of enterprises and institutions 、 Income from lease operation , apply 5% to 35% The excess progressive tax rate

C. Income from remuneration , Applicable proportional tax rate , The tax rate shall be 20%, And reduce the amount of tax payable 30%, Its effective tax rate is 14%

D. Income from royalties , dividend 、 Dividend income , Income from lease of property , Income from transfer of property , Accidental income and other income , Applicable proportional tax rate , Its tax rate is generally 20%61. The effectiveness of accounting regulations is lower than ( ).

A. The constitution

B. law

C. Accounting administrative regulations

D. Accounting analysis report 62. Government procurement should follow () Principles .

A. Open and transparent

B. Fair competition

C. justice

D. Good faith 63. Of the following , VAT taxpayers are ().

A. Enterprises importing goods

B. Glasses repair shop

C. A supermarket that wholesales goods

D. A car shop that provides repair services 64. The most basic elements of the tax law are ().

A. Taxpayer

B. Tax object

C. tax item

D. tax rate 65. according to 《 Tax collection management law 》 The provisions of the , The tax collection measures that tax authorities can take include ().

A. Verified tax payable

B. Tax enforcement

C. Abolish tax incentives

D. Take tax preservation measures 66. The following statements are correct ().

A. The tax authority is the only administrative subject of Taxation

B. Taxes are levied on those that have not been adjusted by legal authorities and legal procedures , Neither party shall change at will

C. Tax authorities collect taxes from taxpayers on behalf of the state , It can only be levied according to law , No arbitrary collection

D. When the tax authorities verify the amount of tax payable , You can decide what procedure to use 67. Among the following taxes , Belonging to the category of behavior tax ().

A. Stamp duty

B. The VAT

C. auto-purchase tax

D. Urban land use tax 68. Management and use of the following funds , Depositors can apply for opening special deposit accounts ().

A. Renovation funds

B. Working capital loan

C. Policy oriented real estate development funds

D. food 、 cotton 、 Oil purchase funds 69. China's treasury single account system includes ().

A. Treasury single account

B. Zero balance accounts of financial departments and budget units

C. Special financial account

D. Special account 70. The characteristics of accounting professional ethics are mainly reflected in ().

A. The combination of consciousness and compulsion

B. Accounting activities are closely related to the public interest

C. The combination of timeliness and procedure

D. Combination of impartiality and independence 71. According to the provisions of individual income tax , The form of progressive tax rate is applicable to the following income items: ().

A. Income from wages and salaries

B. Income from production and operation of individual industrial and commercial households

C. Income from transfer of property

D. Income from contracting and leasing operation 72. When registering accounting books , The ( ) And other relevant information are recorded in the account one by one .( The difficulty coefficient : easy )

A. Accounting document date 、 Number

B. Number 、 The unit price

C. Economic business summary

D. amount of money 73. The tax basis of the following consumption tax is correctly stated ().

A. Taxable consumer goods subject to ad valorem taxation , Its tax calculation basis is the sales volume including consumption tax but excluding value-added tax

B. Taxable consumer goods subject to ad valorem taxation , Its tax basis is the sales volume excluding consumption tax and including value-added tax

C. Taxable consumer goods subject to specific quota taxation , The basis of tax calculation is the actual sales quantity of taxable consumer goods

D. Taxable consumer goods subject to specific quota taxation , The basis of tax calculation is the actual sales of taxable consumer goods 74. according to 《 Payment and settlement method 》 The provisions of the , The following are intermediary institutions for payment settlement and fund settlement ().

A. Bank

B. City credit cooperatives

C. Rural credit cooperatives

D. The insurance company 75.201X year 5 month , When a provincial financial department inspects an enterprise , The following conditions are found : Due to the strong business ability of financial supervisor Yang , The person in charge of the unit authorizes him to be fully responsible for foreign investment , Including the decision-making and implementation of foreign investment . According to the above , The following statements are correct ().

A. The practice of the enterprise complies with the regulations

B. The practice of the enterprise does not conform to the regulations

C. An effective supervision and control system should be established for major economic businesses

D. Decision makers and executives of major economic businesses should supervise each other 、 Mutual restriction , Prevent permission from being too centralized 76. In terms of expenditure levels , The budget expenditure is divided into ().

A. Economic construction expenditure

B. Central budget expenditure

C. State administrative expenses

D. Local budget expenditure 77. The purchaser of government procurement refers to those who conduct government procurement according to law ( ).

A. State organs

B. Business unit

C. Group organizations

D. Enterprises 78. In the special deposit account () No cash withdrawal .

A. Extra budgetary funds

B. Interbank funds deposited by financial institutions

C. Futures trading margin

D. Capital construction funds 79. The following are related to accounting professional ethics " Be honest and self disciplined ” In the expression of , The right ones ().

A. The core of self-discipline is to consciously resist your bad desires

B. Honesty and self-discipline are the internal requirements of accounting professional ethics

C. Only their own integrity and self-discipline , In order to curb the illegal acts of others

D. Can't be honest and self disciplined , It is difficult to be objective and fair and adhere to the norms 80. In addition to national laws 、 Except as otherwise provided in administrative regulations , The bank shall not be any unit or individual ().

A. Query account status

B. Frozen funds

C. Deduction

D. Open an account 81. The items that can be recorded in the cheque by means of authorized supplementary recording are ().

A. Supplement of authorization on the date of issue

B. Supplement to the authorization of the name of the drawer

C. The authorized supplement of the check amount

D. Supplement to the authorization of the payee's name 82. Self education in the form of accounting professional ethics education is for accountants () Behavior activities .

A. Self learning

B. Own moral cultivation

C. self-improvement

D. Self development 83. The matters that the financial department supervises each unit mainly include ( ).

A. Whether accounting books are set according to law

B. Whether the personnel engaged in accounting work have accounting qualification

C. Accounting voucher 、 Accounting books 、 Whether the financial accounting report and other accounting materials are true and complete

D. Whether to set up an accounting institution according to law 84.《 accounting law 》 Regulations , The person in charge of the unit is responsible for the accounting work and accounting materials of the unit ( ) be responsible for .

A. Authenticity

B. Relevance

C. accuracy

D. integrity 85. The date in words of the bill is not filled in as required ,().

A. Resulting in losses , At the drawer's own expense

B. Resulting in losses , By the bank itself

C. Resulting in losses , The drawer and the Bank jointly undertake

D. The bank may accept 86. according to 《 Measures for the administration of RMB bank settlement accounts 》 The provisions of the , Of the following , Those who can apply for opening a basic deposit account are ()

A. office 、 Business unit

B. Company level ( contain ) A branch of the above army ( branch ) team

C. Permanent establishment in other places

D. Enterprise legal person 87. Bank settlement accounts are divided into ().

A. Basic deposit account

B. General deposit account

C. Special deposit account

D. Personal bank settlement account 88.201X year 5 month , When a provincial financial department inspects an enterprise , The following conditions are found : When the financial supervision and inspection department implements accounting supervision and inspection , In order to cover up its fictitious trading behavior , Deliberately transfer forged accounting materials . According to the above , The following statements are correct ().

A. according to 《 Accounting Law of the people's Republic of China 》 The provisions of the , The financial departments of the people's governments at or above the county level are the subject of accounting supervision and inspection within their respective administrative regions , Exercise the right of supervision over the accounting work of all units within the Administrative Region

B. according to 《 Accounting Law of the people's Republic of China 》 The provisions of the , All units have the obligation to cooperate with the accounting supervision and inspection carried out by the supervision and inspection department according to law , Provide accounting vouchers truthfully 、 Accounting books 、 Financial and accounting reports and other accounting materials as well as relevant information , Don't refuse 、 The hidden 、 Lie about

C. The practice of the enterprise belongs to the act of concealing the accounting data that should be kept according to law and providing accounting data and relevant information unreasonably

D. The enterprise may be fined 5000 Yuan of above 5 A fine of less than ten thousand 89. Accounting professional ethics refers to () Professional code of conduct and norms .

A. Formulated or approved by the state

B. Accounting professional activities should comply with

C. Reflect the characteristics of accounting profession

D. Adjust the accounting professional relationship 90. According to the different tax jurisdiction exercised by sovereign countries , Tax laws can be divided into ().

A. Domestic tax law

B. International Tax Law

C. Foreign tax laws

D. General tax law 91. according to 《 Measures for the administration of RMB bank settlement accounts 》 The provisions of the , The depositor applies to open a temporary deposit account , The following supporting documents should be issued to the bank ().

A. The provisional institutions , The approval document for the establishment of temporary institutions approved by the local competent department shall be issued

B. Construction and installation units in other places , The original business license or the original business license of its subordinate unit shall be issued , And the license or construction and installation contract issued by the competent department of construction and installation at the place of construction and installation, and the basic deposit account opening registration certificate is issued

C. Units engaged in temporary business activities in other places , The original of its business license and the approval of the administrative department for Industry and Commerce of the temporary place of business shall be issued, and the registration certificate of opening a basic deposit account shall be issued

D. Registered capital verification capital , The enterprise name pre-approval notice issued by the administrative department for Industry and commerce or the approval of relevant departments shall be issued 92. The following is about the advantages of decentralized procurement , What's right ( ).

A. flexibility

B. Reduce the cost of purchasing

C. Achieve economies of scale

D. Meet the timeliness of procurement 93. according to 《 Payment and settlement method 》 The provisions of the :"() Handling payment and settlement must comply with the laws of the state 、 Administrative regulations and the provisions of these measures , Do not harm the public interest .”

A. City credit cooperatives

B. Rural credit cooperatives

C. Company

D. Individual businesses 94. The cash on hand journal set by the cashier Hu of a unit adopts loose leaf account book , The bank deposit journal adopts the book entry type . In order to distinguish the daily economic business , When Hu registered the bank deposit journal , After registering the economic business of the day on each account page , The next day's business is re registered on another account page , And press 10 Balance once a day . Of the following , The correct ways to correct Hu's mistakes are ().

A. Cash on hand journal adopts bookkeeping

B. The bank deposit journal is registered on a daily basis

C. The balance of the bank deposit journal is settled once a month

D. The balance of the bank deposit journal is settled once a day 95. Accountants violate professional ethics , There may be () Penalty for .

A. My unit

B. Industry Association

C. The finance department

D. Business competent department 96. In the following statements about the signature and seal of the bill , The right ones ().

A. Signatures on bills and settlement vouchers , Sign for 、 Sign or seal

B. Company 、 The bank's signature on the bill and the unit's signature on the settlement voucher , For this unit 、 The seal of the bank plus the signature or seal of its legal representative or its authorized agent

C. Personal signature on bills and settlement vouchers , Sign or seal your real name

D. The signature and seal of bills is an important condition for the effectiveness of bill acts , It is also an item that must be recorded in the form of bill behavior 97. Among the following organizations or individuals, those who should apply for tax registration are ().

A. Individual businesses

B. Institutions engaged in production and operation

C. Mobile rural small traders without fixed production and business premises

D. The Commodity Distribution Department that enjoys tax exemption 98. The following are the basic principles of accounting professional ethics ().

A. The principle of managing money for the people

B. The principle of honesty and trustworthiness

C. The principle of honesty and justice

D. The principle of collectivism 99. according to 《 Measures for the administration of RMB bank settlement accounts 》 The provisions of the , The depositor applies to open a special deposit account , The certificates to be issued to the bank include ().

A. Extra budgetary funds , A certificate from the financial department should be issued

B. Securities trading settlement funds , The certificate of the securities company or the securities management department shall be issued

C. Futures trading margin , The certificate of futures company or futures management department shall be issued

D. Interbank funds deposited by financial institutions , Its certificate shall be issued 100. The elements that make up the tax law are ().

A. Taxpayer

B. Tax object

C. tax rate

D. Tax payment place

边栏推荐

- LeetCode#36. Effective Sudoku

- Research Report on printed circuit board (PCB) connector industry - market status analysis and development prospect forecast

- Indonesian medical sensor Industry Research Report - market status analysis and development prospect forecast

- Learning records: serial communication and solutions to errors encountered

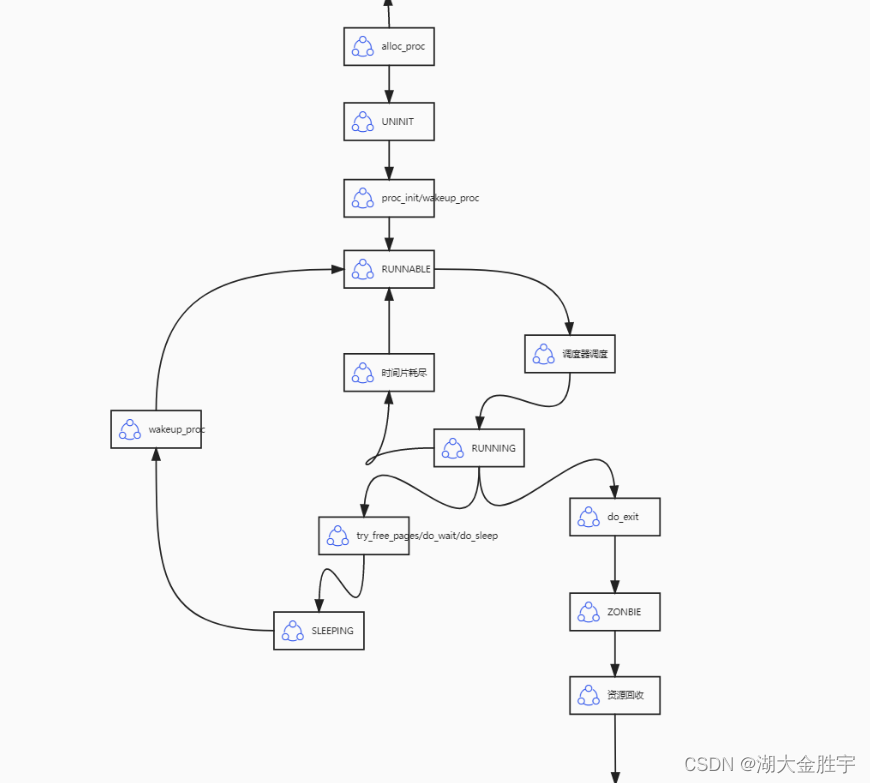

- ucore lab5

- Cost accounting [13]

- 学习记录:USART—串口通讯

- Your wechat nickname may be betraying you

- LeetCode#118. Yanghui triangle

- LeetCode#198. raid homes and plunder houses

猜你喜欢

ucore lab5

C4D quick start tutorial - creating models

How to do agile testing in automated testing?

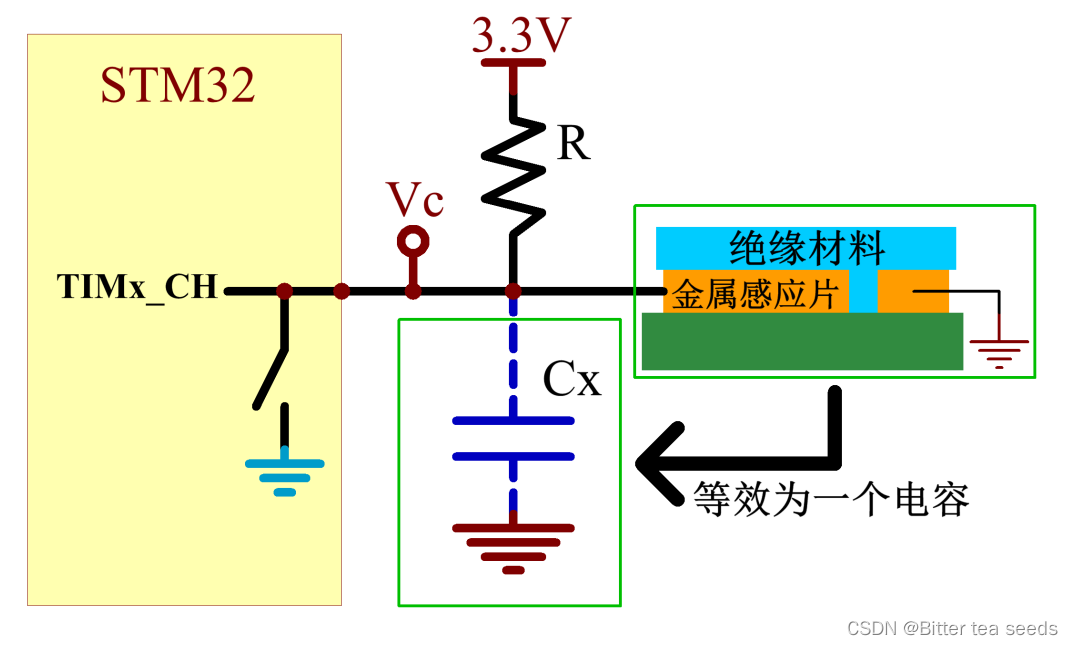

学习记录:TIM—电容按键检测

![[pytorch] simple use of interpolate](/img/16/87aa8a49e60801404822fe644e70c8.jpg)

[pytorch] simple use of interpolate

FSM and I2C experiment report

Intensive learning notes: Sutton book Chapter III exercise explanation (ex17~ex29)

Winter vacation daily question - maximum number of balloons

![Cadence physical library lef file syntax learning [continuous update]](/img/0b/75a4ac2649508857468d9b37703a27.jpg)

Cadence physical library lef file syntax learning [continuous update]

線程及線程池

随机推荐

LeetCode#2062. Count vowel substrings in strings

What are the commonly used SQL statements in software testing?

China medical check valve market trend report, technical dynamic innovation and market forecast

学习记录:使用STM32F1看门狗

Cost accounting [18]

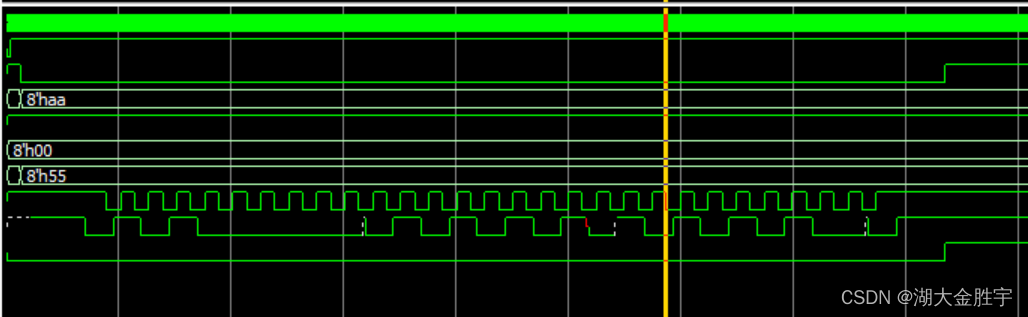

STM32学习记录:输入捕获应用

Flex --- detailed explanation of flex layout attributes

Eigen User Guide (Introduction)

学习记录:TIM—电容按键检测

Cost accounting [14]

学习记录:STM32F103 时钟系统概述工作原理

Unpleasant error typeerror: cannot perform 'ROR_‘ with a dtyped [float64] array and scalar of type [bool]

ucorelab3

JS --- all basic knowledge of JS (I)

Interview answering skills for software testing

LeetCode#204. Count prime

Preface to the foundations of Hilbert geometry

动态规划前路径问题

csapp shell lab

STM32學習記錄:輸入捕獲應用