当前位置:网站首页>Cost accounting [14]

Cost accounting [14]

2022-07-06 15:35:00 【Star drawing question bank】

1. Adopt the planned cost allocation method , Auxiliary production cost variance is recorded in ().(2 branch )

A. Management cost

B. Basic production cost

C. Manufacturing expenses

D. Non operating expenses

2. Power cost directly used for auxiliary production , Should be recorded “ Auxiliary production cost ” General ledger and subsidiary ledger .()(1 branch )

3. Installment of cost accounting , It is not necessarily related to the month of the accounting year 、 Quarterly 、 Consistent by year .(1 branch )

4. Use the same raw materials , The varieties produced by the same processing process are the same , But products of different quality are ().(2 branch )

A. Joint products

B. By-product

C. Grade products

D. Main products

5. The preparation of product production cost table should be ()(2 branch )

A. Comparable products 、 Incomparable products shall be filled in separately

B. Comparable products 、 Incomparable products can be listed in combination

C. Comparable products 、 Incomparable products can be listed separately , It can also be consolidated and filled in

D. There is no need to divide comparable products 、 Incomparable products

6. The bonus included in the total salary includes ().(3 branch )

A. Production Award

B. office 、 Reward salary of public institutions

C. Sports Competition Award

D. Other bonuses

7. The auxiliary production cost adopts the planned cost allocation method , The actual cost of the auxiliary workshop should be ().(2 branch )

A. The expenses to be allocated in the workshop minus the expenses transferred out

B. The expenses to be allocated in the workshop plus the expenses transferred in by allocation

C. The expenses to be allocated in the workshop plus the expenses transferred in by allocation , Less the cost of distribution transfer out

D. The expenses to be allocated in the workshop plus the expenses transferred out , Less the cost of allocation transfer in

8. Cost is closely related to economic benefit . Improve economic benefits in production , Is to spend the least labor ( cost ) And labor occupation ( Money ) Produce products that meet social needs . so , Cost analysis is the analysis of cost index itself .()(1 branch )

9. The deviation of raw materials from the quota refers to the difference between the actual consumption level of materials and the quota consumption level , That is, the quantity difference of materials , Price differences excluding raw materials .()(1 branch )

10. The object of cost calculation is the main symbol to distinguish various methods of product cost calculation .()(1 branch )

11. Cost statements only reflect accounting information , It does not reflect the production technology level of the enterprise .()(1 branch )

12. Of the following items, which should not be included in the cost of products is ().(2 branch )

A. Depreciation of fixed assets used by administrative departments

B. Depreciation of workshop

C. Depreciation of workshop production equipment

D. Wages of workshop auxiliary personnel

13. A product is processed continuously in two production steps , After the first step of processing is completed, turn to the second step of continuous processing , Made into finished products . Total expenses incurred in the first step 55800 element , Cost of finished semi-finished products 27800 element ; The second step is the cost of finished products in this month 52660 element , The cost of semi-finished products 33360 element . requirement : Calculate the cost reduction rate of product a ().(2 branch )

A.1.2

B.1.67

C.1.05

D.0.83

14. Cost statements generally only provide information to business managers .()(1 branch )

15. When using factor analysis method for cost analysis , When determining the substitution order of each factor , The following statement is correct ().(3 branch )

A. Replace the quantity index first , Post substitution quality index

B. Replace the quality index first , Post substitution quantity index

C. Replace the physical quantity index first , Post substitution value index

D. Replace the main indicators first , Replace secondary indicators after

16. The amortization amount of low value consumables used in the production of products shall be recorded in “ Basic production cost ” Account .()(1 branch )

17. Original records are the basis for enterprises to conduct cost accounting .(1 branch )

18. The shutdown loss during the repair of fixed assets is included in the product cost .()(1 branch )

19. There are many auxiliary production workshops 、 There are many unknowns 、 The calculation is complicated , When the enterprise has realized computerization , The method of allocating auxiliary production expenses should be ().(2 branch )

A. Direct distribution method

B. Interactive allocation method

C. Planned cost allocation method

D. Algebraic distribution

20. An enterprise consumes all purchased raw materials for production 30000 element , Auxiliary materials 14000 element , Low value consumables 8000 element , among , Purchased materials are consumed in the production of products 36000 element , Consume self-made materials 10000 element , Basic production workshop consumables 6000 element . The wages of production workers that should be included in the cost of products this month 20000 element , Basic workshop management salary 4000 element , The salary of the staff in the administrative department 6000 element , By salary 14% Withdraw welfare expenses in proportion to . The amount of the following production cost elements is calculated correctly ().(3 branch )

A. Purchased materials :30000+14000+8000=52000

B. Wages :20000+4000+6000=30000

C. Benefits payable :30000×14%=4200

D. raw material :36000+10000=46000

21. The step-by-step carry forward method requires the calculation of the cost of semi-finished products in each step , The reason lies in ().(3 branch )

A. It is the need of cost calculation

B. It is the need of external sales

C. Compare the cost of the same industry

D. It is the requirement of cost control

22. The variety method is only applicable to large-scale single-step production .()(1 branch )

23. An enterprise has two production workshops , Its production types are different , be ().(2 branch )

A. Different costing methods can be used

B. The same costing method should be used

C. Different costing methods cannot be used

D. Several costing methods cannot be combined

24. The relevant economic business of the repair workshop and Transportation Department of an enterprise this month is summarized as follows : The cost of repair workshop 35000 element , Provide repair services 20000 Hours , among , Provide... For the transport sector 3000 Hours , Provide... For basic production workshop 16000 Hours , Provide... To the administration 1000 Hours . Expenses incurred by the transportation department 46000 element , Provide transportation 40000 km , Of which... Is provided for the repair workshop 3500 km , Provide... For basic production workshop 30000 km , Provide... To the administration 6500 km . Planned unit cost : Repair every hour 2 element , Transportation per kilometer 1.20 element . requirement : Calculate the auxiliary production according to the planned cost allocation method ( repair 、 transport ) Actual cost amount .(2 branch )

A. repair :39200( element ), transport :52000( element )

B. repair :52000 element , transport :39200 element

C. repair :40000 element , transport :48000 element

D. repair 48000 element , transport :40000 element

25. An enterprise uses the simplified batch method to calculate the product cost , The production man hours of products in progress recorded in the secondary account of basic production cost of this month are 30760 Hours , Wages and benefits are 50180 element , The working hours occurred in this month are 30270 Hours , Wages and benefits are 53571 element . Then the distribution rate of salary and welfare expenses in this month is .()(2 branch )

A.1.7

B.1.8

C.1.6

D.3

26. An enterprise 7 end of the month , The accumulated raw material cost of all products 68880 element , Working hours 47040 Hours , Wages and benefits 18861 element , Manufacturing expenses 28224 element . Cost of raw materials for finished products 32400 element ,7 Man hours of finished products at the end of the month 23020 Hours . requirement : Calculate the cumulative distribution rate of wages and welfare expenses .(2 branch )

A.0.4

B.0.6

C.1.6

D.1.4

27. In the raw material cost allocation method , The way to strengthen the physical management of raw material consumption is ().(2 branch )

A. Proportional distribution method according to the quota consumption of raw materials of the product

B. The cost of raw materials is allocated according to the proportion of raw materials in the quota method

C. Distribute according to the volume of the product

D. Distribute according to the weight of the product

28. The cost of finished goods in stock , Should be transferred in “ Finished products ” subject ; Finished self-made materials 、 Tools 、 Cost of moulds, etc , Should be transferred in separately “ raw material ” and “ Low value consumables ” Subjects such as .()(1 branch )

29. The cost of work in progress is calculated according to the cost of raw materials consumed, which is applicable to () Products .(3 branch )

A. There are many products in progress at the end of the month

B. The quantity of products in progress varies greatly in each month

C. Direct material costs account for a large proportion of the cost

D. The basis of quota management is good

30. On the basis of quota management , The consumption quota is accurate 、 Stable , There is little change in the number of products in progress at the end of the month , Under the condition that the cost of raw materials accounts for a large proportion of the product cost , The cost of work in progress shall be calculated by ().(2 branch )

A. It is priced according to the cost of fixed raw materials

B. Priced at fixed cost

C. It is priced according to the cost of raw materials consumed

D. It is priced according to the fixed processing cost

31. In order to give full play to the function of cost accounting, small and medium-sized enterprises 、 Improve the efficiency of cost accounting , The general working method is ().(2 branch )

A. Centralized working mode

B. Decentralized way of working

C. Work in a unified way

D. How the workshop works

32. The variety method applies to ().(3 branch )

A. A large number of single-step production enterprises

B. A large number of enterprises with multi-step production but management does not require step-by-step cost calculation

C. A large number of multi-step production and enterprises that require step-by-step cost calculation in Management

D. Small batch and single piece production enterprises

33. The cost table of commodity products can be used to assess ().(2 branch )

A. The implementation results of all commodity product costs and various main commodity product cost plans

B. Manufacturing expenses 、 The implementation results of the enterprise management expense plan

C. It can be analyzed according to cost items , Evaluate the implementation results of unit cost plan of main products

D. Implementation of technical and economic indicators of main products

34. The main sign of distinguishing various basic cost calculation methods is ().(2 branch )

A. Cost calculation object

B. Costing date

C. The allocation of indirect costs

D. The method of allocating expenses between finished products and products

35. Broadly, WIP includes ().(3 branch )

A. Products being processed in the workshop

B. Self made semi-finished products that are finished and warehoused

C. Finished products that have been completed but have not been accepted and warehoused

D. Finished products that have been completed and accepted for warehousing

36. Generally, comparative method is used to analyze the profit rate of costs , By comparing the actual number of this year with the planned number of this year , Or compare with the actual amount of the previous year , To find out the reasons for its changes and the impact of the rise and fall of its indicators .()(1 branch )

37. When using factor analysis method for cost analysis , The sum of the impact of changes in various factors on economic indicators , It should be equal to the difference between the actual number of this economic indicator and the base ()(1 branch )

38. Allocation method of manufacturing expenses , Once confirmed, it cannot be changed at will , In order to maintain the comparability of costs in the previous and subsequent periods .()(1 branch )

39. The completion rate of a process in process = Man hour quota of this process + The sum of the man hour quota of the previous processes ×50%/ Product man hour quota .()(1 branch )

40. The pricing method of raw material cost for in-process products is applicable to the small quantity of in-process products in each month , The number of products in progress varies slightly from month to month , And the cost of raw materials accounts for a large proportion of the product cost .()(1 branch )

41. The indicators that affect the labor cost per unit product are ()(3 branch )

A. Absenteeism rate

B. Work rate

C. Working hours

D. Hourly wage

42. The impact of changes in raw material utilization rate on unit product cost , It can be expressed by the following formula ()(2 branch )

A.(1-)× Raw material cost per unit product before change

B.(1-)× Raw material cost per unit product before change

C.(1-)× Unit product cost before change

D.(1-)× Unit product cost before change

43. Under the quota method , The daily cost of raw materials can be calculated according to the actual cost , Or according to the planned cost .()(1 branch )

44. The differences between the fixed cost and planned cost of products are ().(3 branch )

A. The former is calculated on the basis of consumption quota , The latter is calculated based on the planned quota

B. The former usually changes during the planning period , The latter is usually unchanged during the planning period

C. The former is the cost calculated based on the current consumption quota , The latter is the cost calculated based on the average consumption quota in the planning period

D. The former is based on the actual price , The latter is calculated based on the planned price

45. This month A The fixed cost of raw materials consumed by the product is 55000 element , The difference from the quota is overspending 5000 element , The cost difference rate of the raw materials is to save 5%, be A The difference in the cost of raw materials of the product is ().(2 branch )

A.+2500 element

B.-3000 element

C.-2500 element

D.+3000 element

46. The fixed cost data of irreparable waste of product a listed in the various expense distribution table of an industrial enterprise is : Irreparable waste 5 Pieces of , Cost quota of each raw material 100 element , The fixed working hours per piece are 30 Hours , Hourly wages and benefits 3 element , Manufacturing expenses 4 element . The cost of irreparable waste products is priced according to the fixed cost . The scrap value of irreparable scrap shall be priced according to the planned cost , common 160 element , Warehousing as auxiliary materials , There should be compensation from the culprit 120 element . The net loss of waste products shall be borne by the cost of the same product in the current month . requirement : Calculate the net loss of irreparable waste of product a .(2 branch )

A.1550 element

B.1390 element

C.1270 element

D.1430 element

47. According to the cost of products in progress at the beginning of the month 、 Information about the production cost of this month and the cost of products in progress at the end of the month , Cost of finished products = Cost of products in progress at the beginning of the month + The production cost of this month - Cost of work in progress at the end of the month .()(1 branch )

48. The classification applies to ().(3 branch )

A. Varieties 、 Various specifications , Products that can be classified according to the specified standards

B. Joint products

C. Grade products for non-human reasons

D. Varieties 、 Various specifications , And the number is small , Cost proportion of sporadic products

49. Variety method is the most basic method of product cost calculation , This is because ().(3 branch )

A. The variety method is the simplest to calculate the cost

B. Any cost calculation method must finally calculate the cost of each variety

C. The cost calculation procedure of variety method is the most representative

D. The variety method needs to calculate the product cost on a monthly basis

50. The advantage of classification is ().(3 branch )

A. It can simplify cost accounting

B. Can classify and master the product cost

C. It can make the cost calculation of products in the category more accurate

D. Be able to effectively control the cost of products in the category in time

51. The impact of changes in technical and economic indicators on product costs is mainly reflected in () The impact of indicators .(2 branch )

A. Total product cost

B. Unit cost of product

C. Product output

D. Total product cost and product output

52. Manufacturing expenses shall be allocated to () Account .(2 branch )

A. Basic production cost and auxiliary production cost

B. Basic production costs and administrative expenses

C. Production costs and administrative expenses

D. Financial and operating expenses

53. The unit cost statement of main products is generally a statement that reflects the composition of the unit cost of various main products produced by the enterprise in the reporting period . The table should be prepared separately according to the main products , It is a supplement to the production cost table .()(1 branch )

54. College student Liu Chang 20*4 year 10 I graduated in June and applied to Hengshun food company as a cost accountant . Chief Wang of the cost section of the finance department introduced the company to Xiao Liu :1. Product status : The factory mainly produces all kinds of edible vinegar , Have your own brand .2. Workshop settings : Hengshun company has 3 A basic production workshop ,1 An auxiliary production workshop , production 6 Kinds of vinegar . Section chief Wang asked Xiao Liu : What costing method should the company adopt ?(2 branch )

A. Variety method

B. Batch method

C. classification

D. Step by step

55. When using the batch method to calculate the product cost , What may be accounted for as a batch of products is ().(3 branch )

A. Different products in the same order

B. The same product in different orders

C. A component of a product in the same order

D. The same product in the same order

56. In the batch method, the distribution methods of indirect costs are ().(3 branch )

A. Planned cost allocation method

B. Cumulative distribution method

C. Quota proportional distribution method

D. Current month distribution method

57. Generally speaking, enterprises should be based on () Organize cost accounting .(3 branch )

A. Production and operation characteristics of the unit

B. The need for external reporting

C. The size of the production scale of the unit

D. Requirements for cost management of the unit

58. Other expenses in various element expenses of industrial enterprises include ().(3 branch )

A. Postage

B. Printing costs

C. insurance premium

D. Advertising expenses

59. For the batch method of costing , The following statement is correct ().(2 branch )

A. There is no cost allocation between finished products and products in progress

B. The cost calculation period is consistent with the accounting reporting period

C. Suitable for small batches 、 singleton 、 Management does not require step-by-step costing of multi-step production

D. All the above statements are correct

60. Of the following , What does not belong to the cost element of industrial enterprises is ().(3 branch )

A. Waste loss

B. Purchased fuel

C. Manufacturing expenses

D. Direct material

61. In the following relation , The right ones ().(3 branch )

A. Cost of work in progress at the beginning of the month + Production expenses incurred this month = Cost of finished products this month + The cost of work in progress at the end of the month

B. Cost of finished products this month = Cost of work in progress at the beginning of the month + The cost of work in progress at the end of the month - Expenses incurred this month

C. Cost of finished products this month = Cost of work in progress at the beginning of the month + Production expenses incurred this month - The cost of work in progress at the end of the month

D. The cost of work in progress at the end of the month = Cost of work in progress at the beginning of the month + Production expenses incurred this month – Cost of finished products this month

62. The task of cost accounting mainly depends on ().(2 branch )

A. Requirements for enterprise operation and management

B. The characteristics of enterprise production and operation

C. The organization of enterprise cost accounting

D. Laws and regulations of cost accounting

63. The relevant economic business of the repair workshop and Transportation Department of an enterprise this month is summarized as follows : The cost of repair workshop 35000 element , Provide repair services 20000 Hours , among , Provide... For the transport sector 3000 Hours , Provide... For basic production workshop 16000 Hours , Provide... To the administration 1000 Hours . Expenses incurred by the transportation department 46000 element , Provide transportation 40000 km , Of which... Is provided for the repair workshop 3500 km , Provide... For basic production workshop 30000 km , Provide... To the administration 6500 km . Planned unit cost : Repair every hour 2 element , Transportation per kilometer 1.20 element . requirement : Calculate the auxiliary production according to the planned cost allocation method ( repair 、 transport ) The difference between the actual cost and the planned cost allocation .(2 branch )

A. Repair the difference :4000 element , Transportation differences :-800 element

B. Repair the difference :-800 element , Transportation differences :4000 element

C. Repair the difference :-5000 element , Transportation differences :6000 element

D. Repair the difference :-6800 element , Transportation differences :-200 element

64. When dealing with inventory loss and damage of products , All should be debited “ Non operating expenses ” subject , credit “ Loss and overflow of property to be disposed of —— Loss and overflow of current assets to be disposed ” subject .()(1 branch )

65. Under the variety method, the cost calculation period is carried out according to the production cycle .()(1 branch )

66. On the basis of quota management , The consumption quota is accurate 、 Stable , And at the beginning of the month 、 At the end of the month, under the condition of little change in product quantity , The cost of work in progress shall be calculated by ().(2 branch )

A. Fixed cost method

B. Quota proportional method

C. Equivalent yield method

D. Fixed cost method

67. Adopt step-by-step carry forward method , According to the reflection method of the cost of semi-finished products carried forward in the product cost Sub Ledger in the next step , Can be divided into ().(3 branch )

A. Parallel carry forward step-by-step method

B. Itemized carry forward method

C. Comprehensive carry forward method

D. Planned cost method

68. The basic methods of cost calculation are ().(3 branch )

A. Variety method

B. Batch method

C. Step by step

D. classification

69. The classification method can be used to calculate the product cost of artificially created grade products .()(1 branch )

70. The disadvantage of the quota method is ().(2 branch )

A. The result of the calculation is not accurate

B. The calculation method is not practical

C. The workload of calculation is relatively large

D. The calculation method is complex

71. For consistency , The same enterprise should always prepare the same cost statement in different periods .()(1 branch )

72. The following is not the basic method of cost calculation ().(2 branch )

A. Variety method

B. Batch method

C. Quota method

D. Step by step

73. Among the following indicators, there are ().(3 branch )

A. Output value cost rate

B. Cost reduction rate

C. Cost margin

D. Sales revenue cost rate

74. The correlation ratio analysis method is a method of analyzing by calculating the ratio of two indicators with different and related properties .()(1 branch )

75. In the following accounting accounts , The balance at the end of the year is not transferred to “ This year's profit ” The of the account is ().(2 branch )

A.“ Financial expenses ”

B.“ Manufacturing expenses ”

C.“ selling expenses ”

D.“ Management cost ”

76. The object of cost accounting refers to cost accounting .()(1 branch )

77. Under the quota method , The fixed cost of products is the cost determined based on the consumption quota and planned unit price of product production .()(1 branch )

78. Production costs can be classified according to different standards , The most basic one is the classification of economic content according to production costs .()(1 branch )

79. Under the quota method , The difference of quota change is to break away from quota difference .()(1 branch )

80. The products produced by enterprises can be divided into ()(3 branch )

A. Comparable products

B. Incomparable products

C. Simple products

D. complex product

81. The allocation methods of manufacturing expenses are ().(3 branch )

A. Production man hour proportional distribution method

B. Machine man hour proportional distribution method

C. Direct distribution method

D. Planned cost allocation method

82. Under the batch method , The product cost calculation period is inconsistent with the product production cycle , But it is consistent with the accounting reporting period .()(1 branch )

83. Allocation of purchased power costs , With instrument records , It shall be calculated according to the quantity of power consumed as shown in the instrument and the unit price of power .()(1 branch )

84. We should scientifically organize cost accounting , must ().(3 branch )

A. Reasonably set up cost accounting organization

B. Provide cost accounting personnel

C. Work according to the laws and regulations related to cost accounting

D. Prepare cost plan

85. Cost accounting is actually cost 、 Expense accounting .()(1 branch )

86. The comprehensive carry forward of semi-finished product cost is conducive to analyze and assess the composition of finished product cost from the perspective of the whole enterprise .()(1 branch )

87. Generally speaking , The enterprise shall, according to its own () And other specific circumstances and conditions to organize cost accounting .(3 branch )

A. The size of the production scale

B. Characteristics of production and operation business

C. Establishment of enterprise organization

D. Requirements of cost management

88. The advantage of the quota method is ().(3 branch )

A. Be able to strengthen cost control in time

B. It is beneficial to improve the level of cost quota management and plan management

C. Be able to tap the potential to reduce costs

D. Can be more reasonable 、 It can easily solve the problem of production cost allocation between finished products and products at the end of the month

89. The total amount of expenses actually incurred in an accounting period , Not necessarily equal to the sum of product costs in the accounting period .()(1 branch )

90. There are two procedures for auxiliary production cost collection , Accordingly ,“ Auxiliary production cost ” There are also two ways to set the Sub Ledger , The difference between the two is that the procedures for the collection of auxiliary production manufacturing costs are different .()(1 branch )

91. Suppose a factory has three production workshops , The first workshop produces A Semi product , The second workshop step will A Semi finished products are processed into B Partially Prepared Products , The third workshop will B Semi finished products are processed into C Finished products . The enterprise calculates the cost of each step , And carry forward by item according to the actual cost . The first workshop is completed A The cost of semi-finished products is 40264 element ; The second workshop receives A The cost of semi-finished products is 47710 element ; The second workshop is completed B The cost of semi-finished products is 41677 element ; The third workshop receives B The cost of semi-finished products is 67724 element ; The third workshop is completed C The cost of finished products is 71385 element . requirement : Prepare accounting entries for carrying forward the cost of semi-finished products and finished products .(3 branch )

A. borrow : Self made semi-finished products --A Partially Prepared Products 40264 loan : Production costs -- Basic production cost -- The first workshop 40264

B. borrow : Production costs -- Basic production cost -- Second workshop 47710 loan : Self made semi-finished products --A Partially Prepared Products 47710 borrow : Self made semi-finished products --B Partially Prepared Products 41677 loan : Production costs -- Basic production cost -- Second workshop 41677

C. borrow : Production costs -- Basic production cost -- The third workshop 67724 loan : Self made semi-finished products --B Partially Prepared Products 67724

D. borrow : Stock goods —C Finished products 71385 loan : Production costs -- Basic production cost -- The third workshop 71385

92. When analyzing an indicator , Compare different indicators related to this indicator , The method of analyzing their relationship is called comparative analysis ().(1 branch )

93. In the following subjects , Belong to “ Manufacturing expenses ” Account credit may correspond to ().(3 branch )

A. Basic production cost

B. Auxiliary production cost

C. Management cost

D. Waste loss

94. The classification method has no direct relationship with the type of enterprise production , It can be used in various types of production .()(1 branch )

95. The production cost table does not need to be divided into comparable product cost and non comparable product cost , Because ().(3 branch )

A. It is difficult to divide the products of enterprises into comparable products and non comparable products

B. Comparable products account for a small proportion of all products

C. Neither the enterprise nor the superior organization in charge of the enterprise requires assessment

D. The enterprise itself determines that there is no need to divide

96. An enterprise this month A The product is put into production 500 Pieces of , One time input at the beginning of raw material production , The actual cost is : Direct material costs 62500 element . Direct labor costs 13888 element , Manufacturing expenses 15376 element .A Qualified products 490 Pieces of , Irreparable waste 10 Pieces of , Its processing degree is 60%, The price of scrap materials 300 Yuan warehousing . requirement : Calculate the production cost of irreparable waste .(2 branch )

A.1604 element

B.1304 element

C.1904 element

D.1404 element

97. When allocating and calculating the cost of finished products and products in progress at the end of the month , The conditions for adopting the fixed cost pricing method for products in process are ().(3 branch )

A. Number of products in progress at the end of each month

B. The consumption quota of products is relatively stable

C. At the end of each month, the quantity of products in progress changes slightly

D. The consumption quota of the product is more accurate

98. Incomparable products only refer to products that the enterprise has never produced .()(1 branch )

99. When using the step-by-step method to calculate the product cost , The steps of product cost calculation should be completely consistent with the actual production steps .()(1 branch )

100. The variety method applies to ().(3 branch )

A. Mass single step production

B. Mass multi-step production

C. Management does not require step-by-step costing of multi-step production

D. Small batch 、 singleton , Management does not require step-by-step costing of multi-step production

边栏推荐

- Eigen User Guide (Introduction)

- LeetCode#204. Count prime

- STM32学习记录:玩转按键控制蜂鸣器和LED

- STM32如何使用STLINK下载程序:点亮LED跑马灯(库版本)

- C4D quick start tutorial - Introduction to software interface

- STM32 learning record: play with keys to control buzzer and led

- 51 lines of code, self-made TX to MySQL software!

- 学习记录:理解 SysTick系统定时器,编写延时函数

- JDBC introduction

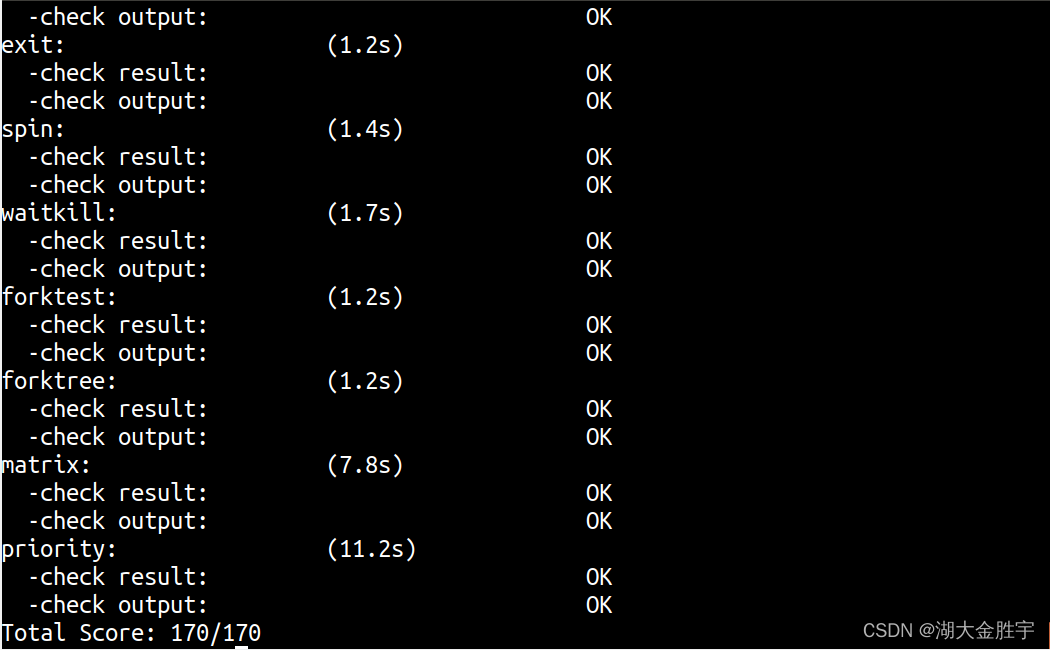

- ucorelab4

猜你喜欢

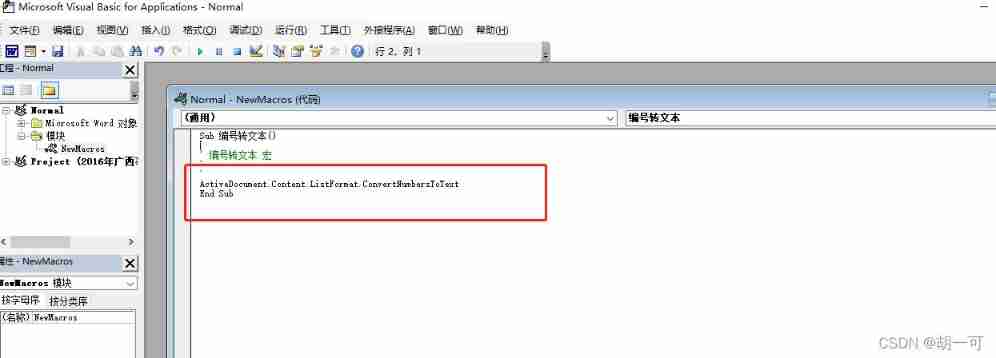

Word macro operation: convert the automatic number in the document into editable text type

Knowledge that you need to know when changing to software testing

STM32学习记录:输入捕获应用

What are the commonly used SQL statements in software testing?

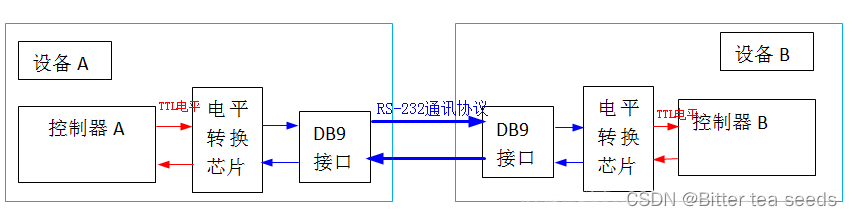

学习记录:USART—串口通讯

MySQL数据库(四)事务和函数

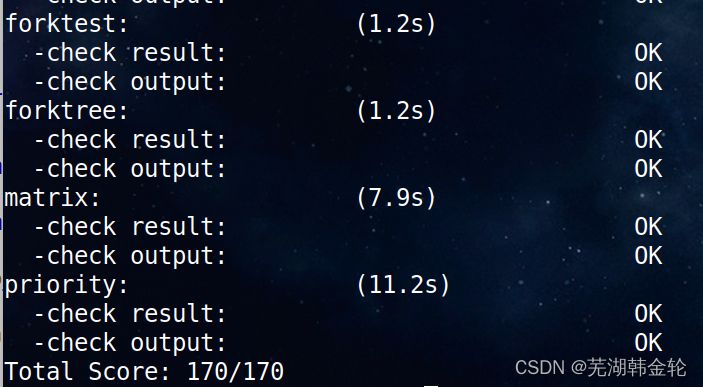

ucore lab 6

遇到程序员不修改bug时怎么办?我教你

UCORE LaB6 scheduler experiment report

Servlet

随机推荐

Hospital privacy screen Industry Research Report - market status analysis and development prospect forecast

Research Report on medical anesthesia machine industry - market status analysis and development prospect prediction

How to become a good software tester? A secret that most people don't know

China medical check valve market trend report, technical dynamic innovation and market forecast

Contest3145 - the 37th game of 2021 freshman individual training match_ A: Prizes

Crawling cat's eye movie review, data visualization analysis source code operation instructions

STM32如何使用STLINK下载程序:点亮LED跑马灯(库版本)

Future trend and planning of software testing industry

Learning record: use STM32 external input interrupt

FSM and I2C experiment report

The wechat red envelope cover designed by the object is free! 16888

CSAPP shell lab experiment report

51 lines of code, self-made TX to MySQL software!

Interface test interview questions and reference answers, easy to grasp the interviewer

Which version of MySQL does php7 work best with?

Learning record: Tim - Basic timer

LeetCode#118. Yanghui triangle

Brief introduction to libevent

[C language] twenty two steps to understand the function stack frame (pressing the stack, passing parameters, returning, bouncing the stack)

ArrayList set