当前位置:网站首页>Cost accounting [23]

Cost accounting [23]

2022-07-06 15:36:00 【Star drawing question bank】

1. The scope of application of the step-by-step method is ().

A. Mass production

B. Management requires step-by-step costing of single-step production

C. Single step production or multi-step production that does not require step-by-step cost calculation in management

D. Management requires multi-step production with step-by-step cost calculation 2. Adopt variety method , It is not required to calculate the cost according to the product batch , It is not required to calculate the cost according to the production steps , It only requires that the product cost be calculated according to the variety of the product .()

3. In addition to the basic production department of an iron and steel enterprise , And power 、 Machine repair 、 Transport three auxiliary production departments , The number of employees in the auxiliary production department of the enterprise accounts for... Of the employees of the whole plant 30%, The value of many services provided reaches... In the product composition of the basic production workshop 10%, To simplify accounting , The enterprise is only based on power 、 Machine repair 、 The three transportation departments have set up auxiliary production cost Sub Ledger , The indirect production expenses of the auxiliary production department are also directly included in the auxiliary production cost Sub Ledger of relevant departments , What accounts do you think should be set up for the enterprise's auxiliary production accounting ?()

A. Set by workshop “ Auxiliary production cost ” Sub Ledger

B. Set up by product or labor service “ product ( labour services ) Sub Ledger ”

C. set up “ Manufacturing expenses ——×× Auxiliary production workshop ”

D. set up “ Basic production cost ——×× Auxiliary production workshop ”4. The organizational division of labor among cost accounting institutions at all levels within large and medium-sized enterprises , Generally, centralized working mode is adopted .()

5. Cost reduction of comparable products =()- The cumulative actual total cost of comparable products this year .

A. The cumulative total cost of all products in the current year calculated according to the actual average unit cost of the previous year

B. The cumulative total cost of comparable products in the current year calculated according to the actual average unit cost of the previous year

C. The cumulative total cost of all products in the current year calculated according to the planned average unit cost of the current year

D. The cumulative total cost of comparable products in the current year calculated according to the planned average unit cost of the current year 6. The variety method is the basis of product cost calculation ().

A. The main method

B. Important method

C. The most basic way

D. The most common way 7. Auxiliary production cost allocation method , It is necessary to consider that the auxiliary production workshops provide products and labor services to each other ().

A. Planned cost allocation method

B. Direct distribution method

C. Interactive allocation method

D. Algebraic distribution 8. In the case of mass production , Product cost can only be calculated by product type as cost calculation object .()

9. Low value consumables for product production , Should be recorded () Account .

A.“ Manufacturing expenses ”

B.“ Basic production cost ”

C.“ Management cost ”

D.“ Auxiliary production cost ”10. A college student 2011 year 7 I graduated in January and applied to be a cost accountant in Nanfang Machinery Factory , The section chief of the finance department introduced the company to him :1. Product status , The factory mainly produces large heavy-duty machinery , Used in mining and other enterprises , Mining machinery enterprises are the leading enterprises in China .2. Workshop settings : Equipped with 7 A basic production workshop , In addition, there are 4 An auxiliary production workshop . What cost general ledger should the factory set up ?()

A.“ Production costs ”“ Manufacturing expenses ”

B.“ Stock goods ”

C.“ Management cost ”

D.“ selling expenses ”“ Financial expenses ”11. When using the simplified batch method , Set up sub ledger of each batch of products , On the subsidiary ledger , Register all production costs and production hours consumed .()

12. On the basis of quota management , The consumption quota is accurate 、 Stable , There is little change in the number of products in progress at the end of the month , Under the condition that the cost of raw materials accounts for a large proportion of the product cost , The cost of work in progress shall be calculated by ().

A. Priced at fixed cost

B. It is priced according to the cost of fixed raw materials

C. It is priced according to the cost of raw materials consumed

D. It is priced according to the fixed processing cost 13. Incomparable products only refer to products that the enterprise has never produced .()

14. The relationship between the cost reduction of comparable products and the reduction rate is ()

A. In inverse proportion

B. In direct proportion to

C. Change in the same direction

D. No direct relation 15. The cost table of commodity products can be used to assess ().

A. The implementation results of all commodity product costs and various main commodity product cost plans

B. Manufacturing expenses 、 The implementation results of the enterprise management expense plan

C. It can be analyzed according to cost items , Evaluate the implementation results of unit cost plan of main products

D. Implementation of technical and economic indicators of main products 16. After a product is rejected , Due to waste products , Reduce the number of qualified products , So this product ().

A. Total cost increase , The unit cost remains unchanged

B. The total cost and unit cost remain unchanged

C. Total cost reduction , Unit cost increase

D. Total cost increase , Unit cost increase 17. The classification method is applicable to small batch, single piece and multi-step production enterprises .()

18. The cost statement of commodity products is a statement that reflects the total cost of all commodity products produced by an enterprise during the reporting period ().

19. The step-by-step carry forward method is a step-by-step method used to calculate the cost of semi-finished products .()

20. The advantages of adopting the comprehensive carry forward of the cost of semi-finished products according to the planned cost are ().

A. It can speed up the cost accounting work

B. It can simplify the cost calculation

C. Cost reduction is not required

D. It is convenient to analyze the cost of each production step 21. Manufacturing expenses incurred in auxiliary production workshop , It's OK not to pass () Account accounting .

A. Auxiliary production cost

B. Manufacturing expenses

C. Basic production cost

D. Management cost 22. Use the planned cost allocation method to allocate auxiliary production expenses , It can simplify and speed up the calculation and allocation .()

23. A product is finished in two processes , Raw materials are successively put into production with the processing progress . The consumption quota of raw materials is : The first process 70%, The second process 30%. The number of products in progress at the end of the month is : The first process 300 Pieces of , The second process 300 Pieces of . Finished products in this month 140 Pieces of . The expenses incurred at the beginning of the month and this month are : Cost of raw materials 3500 element , Processing costs 2000 element . requirement : Calculate the cost of finished products .

A.980

B.1540

C.560

D.144024. The classification applies to () Enterprises .

A. Small batch single piece multi-step production

B. Mass and multi-step production

C. Mass single step production

D. Varieties 、 Various specifications , It can be classified according to certain standards 25. Adopt the simplified batch method , end of the month ().

A. Allocate expenses between finished products and in-process products

B. Only indirect costs are allocated to finished products

C. Only calculate the cost of finished products

D. Do not calculate WIP cost in batches 26. When analyzing an indicator , Compare different indicators related to this indicator , The method of analyzing their relationship is called comparative analysis ().

27. The method of allocating the cost of various products in the same kind of products according to the coefficient proportion ().

A. It is a method of allocating expenses between finished products and products at the end of the month

B. It is a simple product cost calculation method

C. It's a simplified taxonomy

D. It's a way of allocating overhead 28. Products in process are priced according to the cost of raw materials , That is, at the end of the month, only the cost of raw materials consumed is calculated for the products in progress , Processing expenses such as wages and welfare expenses are not calculated , The processing costs of the products are all borne by the products in process .()

29. Under the quota method , At the beginning of the month, when the fixed cost of the product changes , As a result, : If the quota is reduced , Reduced quota costs , Increase the difference of quota change ; If the quota is increased , It increases the quota cost , Reduce the difference of quota change .()

30. Under the quota method , The cost quota of raw materials is equal to the actual consumption of raw materials multiplied by the planned unit price of raw materials .()

31. In the case of producing multiple varieties , The factors affecting the cost reduction rate of comparable products are ().

A. Product output

B. Unit cost of product

C. product price

D. Product variety structure 32. Shutdown loss refers to all expenses incurred during the shutdown of the production workshop or a team in the workshop .()

33. The variety method is only applicable to large-scale single-step production .()

34.“ Manufacturing expenses ” Accounts and “ Manufacturing expenses ” Cost items are the same thing .()

35. Coefficient method is a kind of classification , It is a method of calculating distribution with output as weight .()

36. Haidong enterprise 20×4 year 8 Product a produced in January goes through the first 、 Two 、 3、 ... and , Three production processes , The man hour quota of unit product in each process is in turn 32 Hours 、40 Hours 、28 Hours ; The number of products in progress is 250 Pieces of 、360 Pieces of 、160 Pieces of . The completion degree of products in each process is based on the average 50% Calculation . requirement : Calculate the first... In turn 、 Two 、 The equivalent output of the products in the third process .

A.40、151.20、137.60

B.45、187.20、137.60

C.40、187.20、128

D.40、187.20、137.6037. When the repair spare parts completed by the auxiliary production workshop are warehoused , The account to be debited is ().

A.“ Low value consumables ”

B.“ Basic production cost ”

C.“ Auxiliary production cost ”

D.“ raw material ”38. Of the following , Those directly included in the expenses include ().

A. The manufacturing cost borne by several products

B. The cost of raw materials shared by several products

C. The wages of production workers consumed by a product

D. The depreciation cost of machinery and equipment jointly borne by several products 39. Adopt the simplified batch method , Enterprises only open secondary accounts of basic production costs , There is no need to open product cost Sub Ledger .()

40. Cost report analysis , When using serial substitution analysis , The order of each factor is ().

A. Can be arranged arbitrarily

B. Should be arranged according to certain principles : Quality before quantity

C. Should be arranged according to certain principles : First the main then the secondary

D. Should be arranged according to certain principles : Quantity before quality 41. A product is processed in two processes . The working hour quota of each procedure is 24 Hours 、16 Hours . The processing degree of the products in process of each process in this process is based on the man hour quota 50% Calculation . The cumulative man hour quota of the second process is ().

A.16 Hours

B.20 Hours

C.32 Hours

D.40 Hours 42. The production organization to which the variety law applies is ().

A. Mass production

B. Mass production

C. Mass and small batch production

D. Single piece small batch production 43. The basic methods of cost calculation are ().

A. Variety method

B. Batch method

C. Step by step

D. classification 44. The comparative analysis method is only applicable to the quantitative comparison of homogeneous indicators .()

45. When using the batch method to calculate the product cost , If an order specifies a large and complex product , Its production cycle is long , The batch type as the object of cost calculation is ().

A. The same product in different orders

B. The product component of this order

C. The products in this order

D. The same product in the same order 46. Variety method 、 Step by step method and classification method are three basic methods of product cost calculation .()

47. The conditions that repairable waste products must meet at the same time include ().

A. After repair, you can use

B. It can't be used after repair

C. The cost of repair is economical

D. It can be fixed , But not economically 48. When using the step-by-step method , The production steps as the object of cost calculation can ().

A. Set up according to the production workshop

B. Set up according to the actual production steps

C. Set up according to different production steps in a workshop

D. Merge several workshops to set up 49. Of the following items, which should not be included in the cost of products is ().

A. Depreciation of fixed assets used by administrative departments

B. Depreciation of workshop

C. Depreciation of workshop production equipment

D. Wages of workshop auxiliary personnel 50. The proportional distribution method of production hours is a commonly used method of allocating manufacturing expenses .()

51. In the process of calculating waste loss , The accounts that may be credited are ().

A.“ Basic production cost ”

B.“ Waste loss ”

C.“ Salary payable ”

D.“ Manufacturing expenses ”

E.“ raw material ”52. When analyzing the completion of comparable product cost reduction tasks , For the change of product unit cost , The following statements are correct ().

A. Changes in the unit cost of products affect the amount of cost reduction

B. The change of unit cost of products affects the cost reduction rate

C. The change of unit cost of products does not affect the cost reduction

D. The change of product unit cost does not affect the cost reduction rate 53. There are two auxiliary production workshops in an enterprise, the organic repair workshop and the power supply workshop , The expenses incurred in the machine repair workshop this month are 42000 element , Provides 4200 Labor service of working hours , The power supply workshop consumes 200 Working hours ; The power supply workshop incurred expenses this month 108000 element , Provides 52000 Degree electricity , Among them, the machine repair workshop consumes electricity 2000 degree . If the direct distribution method is adopted , Then the distribution rate of repair cost is 10 element / Hours .()

54. The ratio of product sales cost to product sales revenue of selling a certain number of products in a certain period is ().

A. Cost profit margin

B. Sales profit margin

C. Cost of sales ratio

D. Output value cost rate 55. The comprehensive carry forward of semi-finished product cost is conducive to analyze and assess the composition of finished product cost from the perspective of the whole enterprise .()

56. Factors to consider when choosing the basic method of cost calculation ().

A. Whether the product consumption quota is accurate

B. Product category

C. Product costing cycle

D. Production characteristics and management requirements 57. An enterprise will 、 D two products as a class , Use the classification method to calculate the product cost . C 、 D. the two products are consumed together A Materials , The consumption quota is 16 Kilogram and 20 kg , Per kilogram A The unit cost of each material is 5 element . The enterprise takes Ding product as the standard product , Then the raw material cost coefficient of product a is ().

A.1.25

B.6.25

C.0.8

D.0.458. The production of a product consists of three production steps , Adopt the comprehensive carry forward step-by-step method to calculate the product cost , The number of cost restores required is ().

A.2 Time

B.3 Time

C.0 Time

D.4 Time 59.ABC The fixed cost of the three products is 35,47,49. Now suppose a product D The fixed cost of is 100, Let the coefficient be 1, be ABC The coefficients of the three products are :()

A.0.35、0.47、0.49

B.35/47、1、47/49

C.0.35、1、35/39

D.1、35/47、35/4960. When the itemized step-by-step carry forward method is adopted , The expenses incurred in this month that should be borne by the products should be equal to the expenses incurred in this workshop divided by (), Multiply by the equivalent output of the product in process .

A. Equivalent output of products in process

B. Number of finished products

C. This month's output is about

D. Generalized WIP quantity 61. Broadly, WIP includes ().

A. Products being processed in the workshop

B. Self made semi-finished products that are finished and warehoused

C. Finished products that have been completed but have not been accepted and warehoused

D. Finished products that have been completed and accepted for warehousing 62. Under the quota method , Consumption quota of products 、 Cost quota and fixed cost are the basis for enterprises to control production costs on a daily basis , But it is not the basis for calculating the actual cost of products at the end of the month .()

63. On the basis of quota management , The consumption quota is accurate 、 Stable , And at the beginning of the month 、 At the end of the month, under the condition of little change in product quantity , The cost of work in progress shall be calculated by ().

A. Fixed cost method

B. Quota proportional method

C. Equivalent yield method

D. Fixed cost method 64. When using the parallel carry forward step-by-step method to calculate the product cost , The cost of each production step includes the cost of this step , It also includes the cost transferred from the previous step .()

65. Plan in cost accounting 、 control 、 Accounting and Analysis , The personnel in each workshop of the enterprise shall carry out , This way of working is ().

A. Decentralized way of working

B. Centralized working mode

C. Direct accounting method

D. Unified arrangement 66. The analysis methods of cost statements mainly include ().

A. Comparative analysis

B. Ratio analysis

C. Difference analysis

D. Trend analysis

E. Serial substitution analysis 67. The advantage of the quota method is ().

A. Be able to strengthen cost control in time

B. It is beneficial to improve the level of cost quota management and plan management

C. Be able to tap the potential to reduce costs

D. Can be more reasonable 、 It can easily solve the problem of production cost allocation between finished products and products at the end of the month 68. Under the quota method , The daily cost of raw materials can be calculated according to the actual cost , Or according to the planned cost .()

69. The production of industrial enterprises , According to the characteristics of its process , Can be divided into ().

A. Multi step production

B. mass production

C. Single step production

D. Single piece production 70. The cost of raw materials used in the production of several products , It belongs to indirect expense .()

71. Cost accounting is actually cost 、 Expense accounting .()

72. The products that cannot be costed by classification and similar methods are ().

A. Joint products

B. Grade products caused by human factors

C. Lord 、 By-product

D. Sporadic products 73. The trend ratio analysis method is to compare the values of an economic indicator in different periods , Find the ratio , An analytical method for analyzing its increasing and decreasing speed and development trend .()

74. The factors that do not affect the cost reduction rate of comparable products are ().

A. Product variety structure

B. Product output

C. Unit cost of product

D. Total product cost 75. The main sign of distinguishing various basic cost calculation methods is ().

A. Cost calculation object

B. Costing date

C. The allocation of indirect costs

D. The method of allocating expenses between finished products and products 76. In the following relation , The right ones ().

A. Cost of work in progress at the beginning of the month + Production expenses incurred this month = Cost of finished products this month + The cost of work in progress at the end of the month

B. Cost of finished products this month = Cost of work in progress at the beginning of the month + The cost of work in progress at the end of the month - Expenses incurred this month

C. Cost of finished products this month = Cost of work in progress at the beginning of the month + Production expenses incurred this month - The cost of work in progress at the end of the month

D. The cost of work in progress at the end of the month = Cost of work in progress at the beginning of the month + Production expenses incurred this month – Cost of finished products this month

E. Production expenses incurred this month = Cost of finished products this month + Cost of work in progress at the beginning of the month + The cost of work in progress at the end of the month 77.“ Waste loss ” Account month end ().

A. If there is a balance , The balance must be on the credit

B. If there is a balance , The balance must be in the debit

C. There must be no balance

D. There may be debit or credit balances 78. Some parts of product a are from this month 1 A new raw material consumption quota will be implemented as of the th , The cost quota of used raw materials per unit product is 14 element , The new raw material cost quota is 12.4 element . At the beginning of the month, the raw material quota cost of the in-process product calculated according to the old quota is 14000 element . requirement : Calculate the variance of quota change of products in process at the beginning of the month .

A.700 element

B.800 element

C.900 element

D.500 element 79. Quota method is not only a calculation method of product cost , And it is also a method to directly control and manage the product cost .()

80. Various period expenses shall be paid directly at the end of the period ().

A. Included in manufacturing expenses

B. Included in long-term deferred expenses

C. Carry forward profit and loss

D. Included in management expenses 81. A product is finished in three processes , The materials are put into operation at the beginning of each process , The material consumption quota of each process is : The first process 130 kg , The second process 210 kg , The third process 160 kg .9 The number of products in process of each process at the end of the month is : The first process 100 Pieces of , The second process 200 Pieces of , The third process 38 Pieces of . requirement : Calculation 9 At the end of the month, the output of work in progress is about .

A.126

B.136

C.168

D.20082.“ Basic production cost ” Month end balance of general ledger account , Is the cost of basic production in process , That is, the production funds occupied in the basic production process , It should be consistent with the sum of product costs at the end of the month in the subsidiary accounts of various product costs .()

83. Batch method of product cost calculation , The applicable production organization is ().

A. Mass production

B. Mass and small batch production

C. Single piece batch production

D. Small batch single piece production 84. Use the same raw materials , The varieties produced by the same processing process are the same , But products of different quality are ().

A. Joint products

B. By-product

C. Grade products

D. Main products 85. The product of an enterprise is completed through two processes , The number of products in process at the end of the first operation is 100 Pieces of , Degree of completion 20%; The number of products in process at the end of the second operation is 200 Pieces of , Degree of completion 70%. The equivalent output of work in progress at the end of the month is ().

A.20 Pieces of

B.135 Pieces of

C.140 Pieces of

D.160 Pieces of 86. The difference of quota change is the result of the change of quota itself , It has nothing to do with the saving or waste of production expenses in production .()

87. All costs incurred in the production and operation of Hongyuan Manufacturing Co., Ltd. this month are as follows : Raw materials are consumed in the production of products 9800 element 、 Fuel and power 1500 element 、 Direct labor 5200 element 、 Manufacturing expenses incurred in the workshop 3000 element 、 Management expenses incurred by the enterprise management department 1100 element 、 The sales department incurs sales expenses to promote products 1000 element . There are no products in progress at the beginning of this month 、 Put into production 500 All products have been completed and sold . The product cost is ().

A.19500

B.9800

C.8200

D.2050088. When calculating manufacturing expenses , For the auxiliary production workshop, you can decide whether to set..., according to the specific situation “ Manufacturing expenses ” Account .()

89. The pricing method of raw material cost for in-process products is applicable to the small quantity of in-process products in each month , The number of products in progress varies slightly from month to month , And the cost of raw materials accounts for a large proportion of the product cost .()

90. The following happened in the basic production workshop (), Should debit “ Manufacturing expenses ” Account .

A. depreciation charge

B. repair cost

C. Machine material consumption

D. Finance lease fee 91. The factors affecting the cost reduction rate of comparable products are ()

A. Product output

B. Unit cost of product

C. Types and specifications of products

D. Product quantity 92. An enterprise has two auxiliary production workshops for repair and transportation 、 department . The repair shop incurred expenses this month 5000 element , Provide repair man hours 2500 Hours , among : Repair... For the transportation department 500 Hours , Repair... For basic production workshop 1500 Hours , Repair... For the administration 500 Hours , The repair cost is allocated according to the proportion of repair man hours . The expenses incurred by the transportation department this month are 10500 element , Transport materials, etc 7400 Ton kilometers , among : Provide transportation services for the repair workshop 400 Ton kilometers , Provide transportation services for basic production workshops 5400 Ton kilometers , Provide transportation services for administrative departments 1600 Ton kilometers . requirement : Use the direct distribution method to calculate the distribution repair 、 Distribution rate of transportation expenses .

A. The distribution rate of repair cost is 2.5 element / Hours ; The distribution rate of transportation cost is 1.5 element / km .

B. The distribution rate of repair cost is 2 element / Hours ; The distribution rate of transportation cost is 1.41 element / km .

C. The distribution rate of repair cost is 2.5 element / Hours ; The distribution rate of transportation cost is 1.41 element / km .

D. The distribution rate of repair cost is 2 element / Hours ; The distribution rate of transportation cost is 1.5 element / km .93. Using the chain substitution method , Can reveal ()

A. The difference between the actual number and the planned number

B. The factors that make the difference

C. The factors causing the difference and the reasons for the change of each factor

D. The factors causing the difference and the influence degree of each factor 94.“ Auxiliary production cost ” Generally, the account should be based on the auxiliary production workshop 、 The Sub Ledger will be set up under the workshop according to the type of products or services , Columns are set up in the account according to cost items or expense items for detailed accounting .()

95. The product of an enterprise goes through two processes , The man hour quota of each process is 20 Hours and 40 Hours , Then the completion rate of the second process is ().

A.68%

B.69%

C.70%

D.66.67%96. The preparation of product production cost table should be ()

A. Comparable products 、 Incomparable products shall be filled in separately

B. Comparable products 、 Incomparable products can be listed in combination

C. Comparable products 、 Incomparable products can be listed separately , It can also be consolidated and filled in

D. There is no need to divide comparable products 、 Incomparable products 97. The depreciation expense that should not be included in the production cost of the product is ().

A. Depreciation of machinery and equipment

B. Depreciation of workshop

C. Depreciation of warehouse equipment

D. Equipment depreciation expense of administrative department 98. When using the simplified batch method , The subsidiary ledger of each batch of products usually only needs to be registered on a monthly basis and directly included in the expenses and production hours , When there are finished products , To calculate the production cost of finished products carried forward and the cost of products in progress at the end of the month of this batch of products .()

99. The batch method of product cost calculation is applicable to a large number of multi-step production enterprises .()

100. The production organization mode applicable to the variety law is ().

A. Mass production

B. Batch single step production

C. Mass multi-step production

D. Single piece small batch production

边栏推荐

- 动态规划前路径问题

- LeetCode#237. Delete nodes in the linked list

- 学习记录:TIM—基本定时器

- Research Report on medical anesthesia machine industry - market status analysis and development prospect prediction

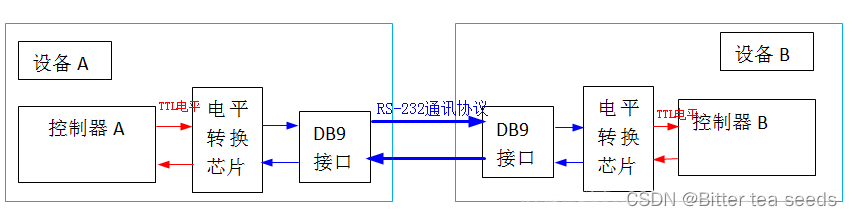

- 学习记录:USART—串口通讯

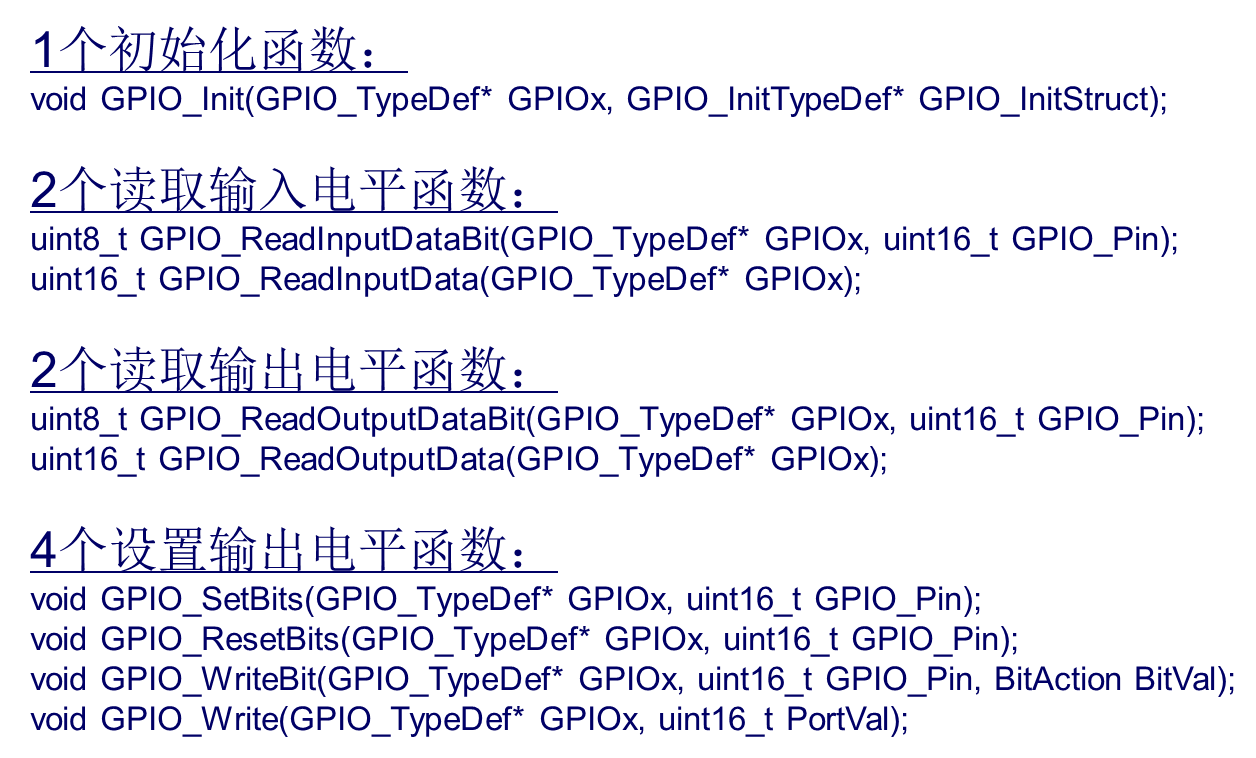

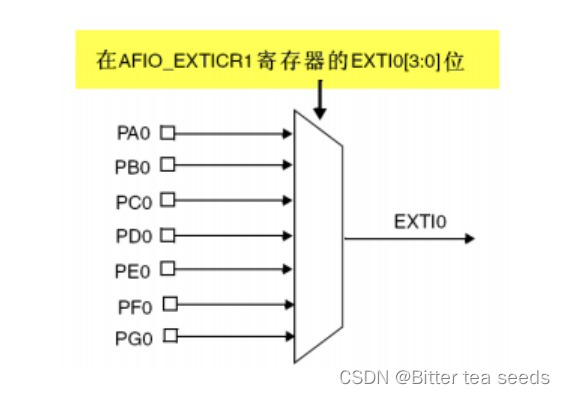

- Learning record: use STM32 external input interrupt

- Crawler series (9): item+pipeline data storage

- Market trend report, technological innovation and market forecast of pneumonia drugs obtained by Chinese hospitals

- The wechat red envelope cover designed by the object is free! 16888

- Market trend report, technical innovation and market forecast of lip care products in China and Indonesia

猜你喜欢

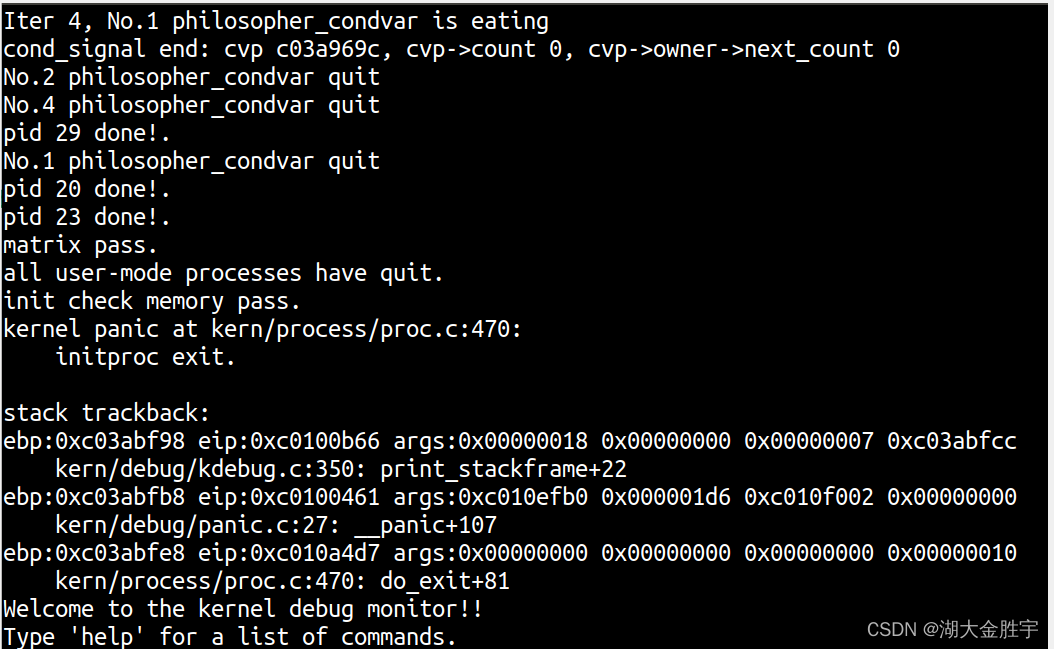

ucore lab7

力扣刷题记录

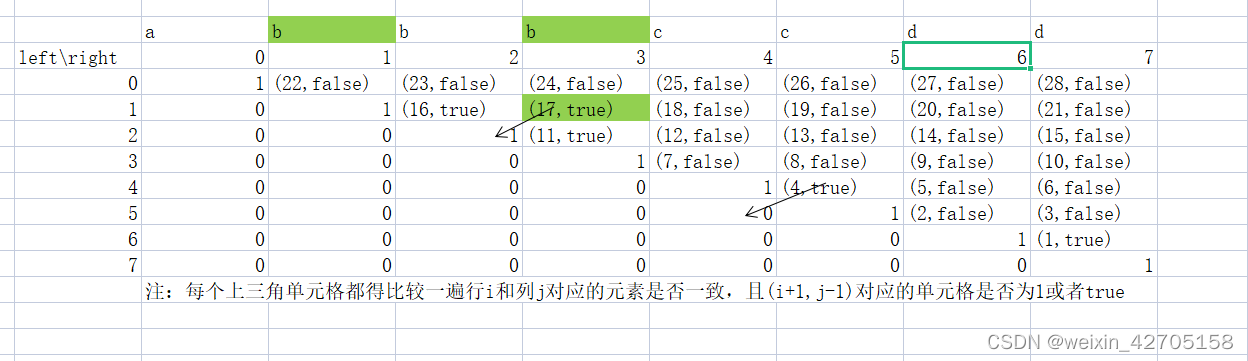

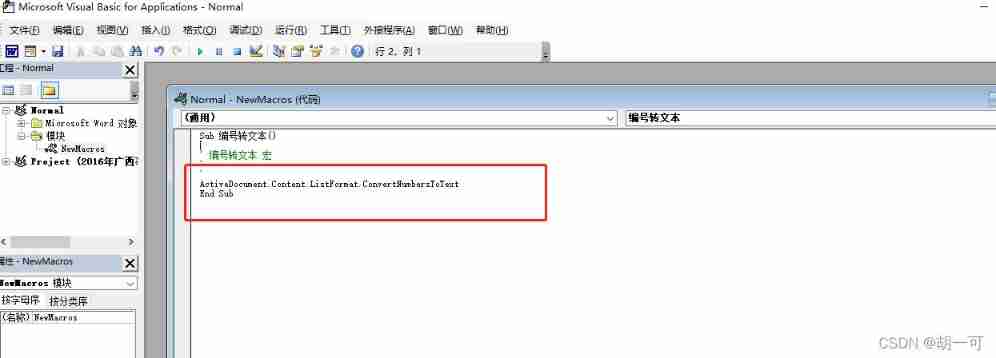

Word macro operation: convert the automatic number in the document into editable text type

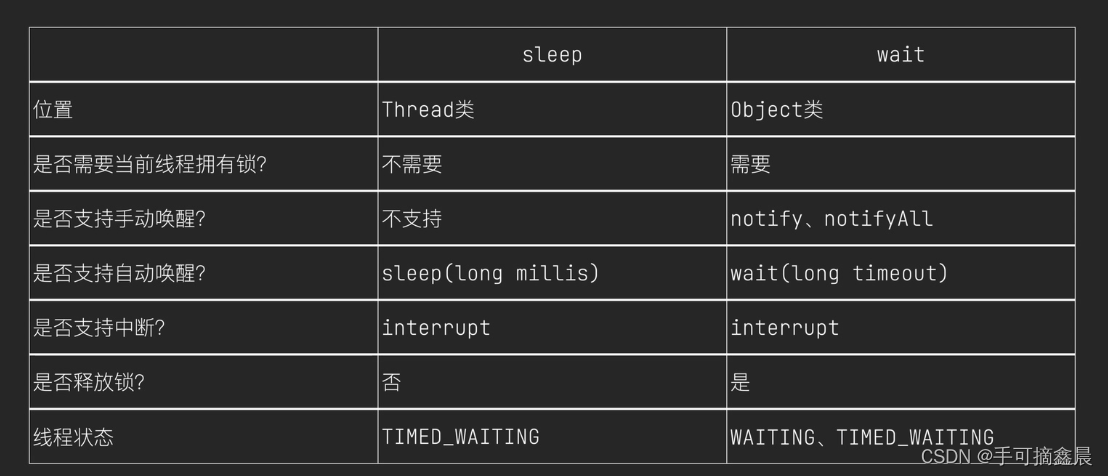

Threads et pools de threads

学习记录:USART—串口通讯

STM32如何使用STLINK下载程序:点亮LED跑马灯(库版本)

Learning record: use STM32 external input interrupt

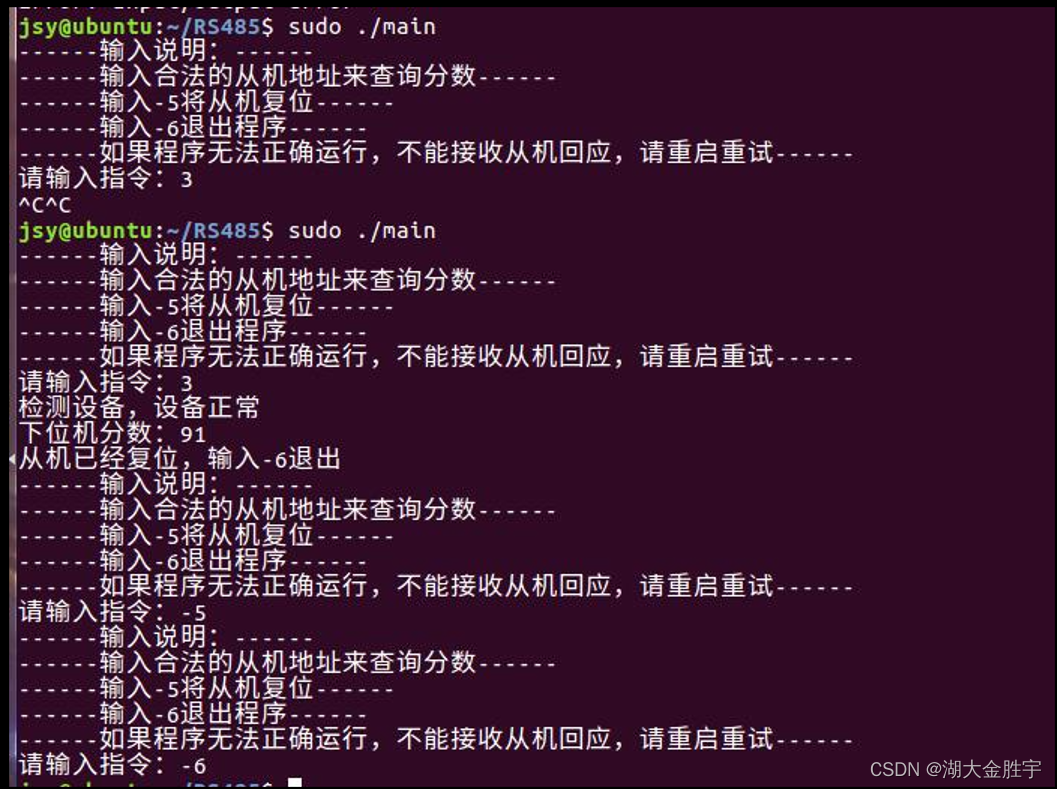

基于485总线的评分系统

学习记录:如何进行PWM 输出

Intensive learning notes: Sutton book Chapter III exercise explanation (ex17~ex29)

随机推荐

ucorelab4

动态规划前路径问题

Printing quality inspection and verification system Industry Research Report - market status analysis and development prospect forecast

Cost accounting [13]

LeetCode#36. Effective Sudoku

Programmers, how to avoid invalid meetings?

FSM和i2c实验报告

LeetCode#19. Delete the penultimate node of the linked list

Research Report on medical anesthesia machine industry - market status analysis and development prospect prediction

ucore lab 6

Research Report on printed circuit board (PCB) connector industry - market status analysis and development prospect forecast

Cost accounting [13]

A method and implementation of using VSTO to prohibit excel cell editing

Interview answering skills for software testing

学习记录:使用STM32F1看门狗

Market trend report, technological innovation and market forecast of pneumonia drugs obtained by Chinese hospitals

csapp shell lab

JS --- detailed explanation of JS facing objects (VI)

线程及线程池

LeetCode#237. Delete nodes in the linked list