当前位置:网站首页>When will Wei Lai, who has been watched by public opinion, start to "build high-rise buildings" again?

When will Wei Lai, who has been watched by public opinion, start to "build high-rise buildings" again?

2022-07-05 05:05:00 【Xinmeng Finance】

Seeing him rise high , See him feast guests , I saw his building collapse ……

This sentence seems to be very suitable for the current Wei Lai .

01

High rise 、 The building collapsed

This year, 5 month 20 Japan , Wei Lai Feng was officially listed on the main board of the Singapore Stock Exchange , Become the first intelligent electric vehicle enterprise listed in three places in the world , It's also the first to be in New York at the same time 、 Hong Kong 、 Chinese companies listed in Singapore .

Under the influence of Singapore listing , After hours, the price of Weilai US stocks rose by more than 5%, Hong Kong stock prices are also 5 month 20 It rose after the opening of the day 3.32%, And all the way up . This should be regarded as the most beautiful moment since the establishment of Wei Lai .

However , It has just been a month since the listing of the three places , Wei Lai began to collapse .

6 month 29 Noon , Wei Lai automobile submitted the suspension application to the Singapore Stock Exchange , At the same time, in the morning trading day , Wei Lai Hong Kong stock once fell more than 9%, As of the close of Hong Kong stock market , The share price of Weilai plummeted 11.36%, The embarrassed appearance is in sharp contrast to the scenery a month ago .

And this time the storm has to come from 6 month 23 Speaking of .

6 month 23 Japan , Some netizens broke the news on the network platform , A Weilai automobile rushed out of the high-rise building of Shanghai innovation port Weilai automobile headquarters and fell , And suspected casualties . This topic soon caused many netizens to discuss , Push Wei Lai to Weibo hot search .

With the continuous fermentation of public opinion , until 6 month 23 On Tuesday night 8 spot , Wei Lai guanbo's statement came late :“6 month 22 Japan 17 when 20 about , A Wei Lai test vehicle fell from the third floor of Shanghai innovation port parking building , Two digital cockpit testers were killed , One of them is a colleague of the company , The other is a partner employee .” At last, I don't forget to add “ According to the analysis of the site conditions, it can be preliminarily confirmed , It was an accident , It has nothing to do with the vehicle itself ”.

Originally, I thought that the announcement would quell the hot search of Wei Lai , After the announcement , It caused an uproar on the Internet , Netizens' statement on the delayed future and the last inhuman clarification , One after another angrily scolded Wei Lai's cold-blooded , Once again, Wei Lai is on the cusp . At this time, Wei Lai's image has fallen sharply in the hearts of many netizens .

And nightmares always follow . I don't know if it's right that Wei Lai is in a negative wind , Grizzly, an overseas short selling institution, is eyeing Wei Lai again .6 month 28 Japan , Grizzly released a report on Wei Lai , Think Wei Lai exaggerates his income and net profit margin , And there is something fishy behind the executives .

As soon as the report comes out , Wei Lai's share price fell in response , As of the close, the share price of weilaimei stock closed down 2.57%, Hong Kong shares fell nearly 8%.

that , What's going on behind this ?

02

Grizzly stared at Wei Lai

Grizzly seems to believe that Wei Lai has made a move in revenue ,“ The financial performance report divorced from reality deceived Wall Street and investors ”. In the report , Grizzlies' accusations against Wei Lai automobile mainly focus on the following points :

- Through its battery leasing business (BaaS Business ) Using accounting means to falsely increase income and net profit ;

- Weilai's bet with the investor Hefei makes it face performance pressure ;

- Li Bin, the founder of Weilai, is very close to Liu Erhai, the founder of happy capital, who has been involved in Ruixing's financial fraud , So Li Bin may also have problems .

For these allegations ,6 month 29 The official of RI Weilai issued an announcement in the Hong Kong stock exchange to reply , Said grizzly's accusation was groundless , Its information about the company contains many errors 、 Baseless conjectures and misleading conclusions and interpretations .

Although the official response of Wei Lai is soft , It's not persuasive , But Grizzlies' accusations that everything comes from speculation are not convincing , Even many major international banks have expressed , Grizzly put forward about BaaS Business related queries , It's right BaaS Misreading of patterns , And confusing related concepts and data .

It also shows that , Grizzly bears are suspected of maliciously shorting Wei Lai .

But in fact , Except grizzly , stay 2020 year 11 In August, another well-known short selling agency citron also stared at Wei Lai ,ing Issued a report on the abnormal high stock price and valuation of Weilai , The share price of Weilai fell sharply , The biggest drop was once more than 16%.

Flies don't bite seamless eggs , In a matter of 2 During the year 2 A short company is eyeing , Wei Lai itself is not without any problems .

03

Wei Lai's dilemma

in fact , Recently, Wei Lai's dilemma has been clearly visible , Although the surface is still bright , However, we can see many crises in the financial report of the new quarter .

According to the financial report of the first quarter of this year , Wei Lai achieved revenue in the first quarter 99.11 One hundred million yuan , Year-on-year growth 24.2%, However, the growth rate decreased significantly compared with the same period last year , Year on year decline to 24.39%.

meanwhile , In terms of profitability , Wei Lai's situation is not optimistic . According to relevant data , The net loss of Weilai in the first quarter of this year reached 17.83 One hundred million yuan , Same period as last year 4.5 Compared with a loss of billion yuan , Year on year expansion 295.3%.

In contrast, Wei Lai's head opponent —— Ideal and Xiaopeng , The ideal revenue in the first quarter of this year is 95.62 One hundred million yuan , Year-on-year growth 167.49%, And the net loss is only 1090 Ten thousand yuan , It contracted sharply year on year 96.97%; The revenue of Xiaopeng automobile in the first quarter was 74.5 One hundred million yuan , Up year on year 152.6%. By contrast, it's not hard to find , Wei Lai's performance in the first quarter of this year has fallen behind .

In addition to the growing loss in performance , Wei Lai has also been gradually distanced in sales .

In the first quarter , Weilai's sales volume is 25768 car , The average month is less than 1 Thousands of cars , Limited growth is only 28.5%. And in the same period , Xiaopeng and the ideal sales growth rate are 159.1% and 152.1%. stay 2022 year 1-3 The sales volume of new energy manufacturers in September is on the list , Wei Lai car has fallen behind to no 12 name , The decline is obvious .

that , Why did Wei Lai fall into such an embarrassing situation ? Through the analysis of , There may be several reasons .

First , as everyone knows , At present, Weilai mainly adopts BaaS Switch mode , Try to create the ultimate user service experience through this mode , To attract users .

But the power exchange mode is not mature today , At present, it is still faced with high construction cost of replacement power station 、 Popularization is difficult 、 It's hard to make a profit in the early stage 、 The problem of lack of unified standards , So car companies want to establish or maintain the service of power exchange mode , You need to burn money continuously . Obviously , It has been established in China 900 Wei Lai, a power plant replacement , With the help of capital, many funds have been invested .

At the same time , At present, Wei Lai has no unified standard for batteries , In addition, other new energy vehicle manufacturers have different research and development of batteries , This led to the closure of the Weilai power plant , Only serve your own brand , meanwhile , Because the user scale of Weilai is not large enough , It is impossible to make profits by changing power plants .

So for now , Wei Lai wants to make the power change mode , You can only continue to burn money on your own , This will obviously continue to increase Wei Lai's financial burden .

secondly , No matter how much financing Wei Lai gets, it is limited , Invest a lot of money in changing power stations , It's hard to ignore one thing and lose another , Reduce investment in other businesses .

For example, in research and development , Wei Lai Yu 2019 year -2021 Annual investment respectively 44.29 Billion 、24.88 Eva 45.92 Billion , Respectively accounting for 56.6%、15.3% And 12.7%, The proportion shows a downward trend . It is precisely because of the reduction of R & D investment , As a result, the competitiveness of Weilai products has been constantly weakened in the new forces , Its chip 、 Compared with ideal and Xiaopeng, autopilot and intelligent cockpit are relatively backward .

Just have the advantage of service , And technology is at a disadvantage , It is difficult for such a Weilai car to attract too many users .

Third , Wei Lai, who has been frequently involved in accidents in the past year, has also made its reputation decline sharply .

Except this year 6 Besides this accident in August , In the last year 7 month 30 Japan , A Weilai in Pudong New Area, Shanghai EC6 After hitting the stone pier on the highway, it suddenly caught fire , Start burning violently , The driver was killed . Just last year, not long after this happened 8 End of month , Linwenqin, the founder of meiyihao, also drove Weilai ES8 And enabled its NOP After the automatic driving function , A traffic accident occurred in the Hanjiang section of Shenhai Expressway , Unfortunately, he passed away .

Frequent accidents have caused Weilai automobile to be deeply involved in the storm of public opinion , More and more people began to question the safety and reliability of Weilai products . No matter how brilliant it is in other aspects , Products whose safety cannot be guaranteed , Will be blacklisted by users .

All in all , At present, there are not many problems that Weilai needs to pay attention to and solve , Although this short report will not hurt Wei , However, the negative public opinion that has appeared many times and has been frequently targeted by short selling institutions , Is it also a warning ?

At present, Wei Lai has collapsed , And when can it again “ High rise ”? Let's wait and see .

边栏推荐

- Create a pyGame window with a blue background

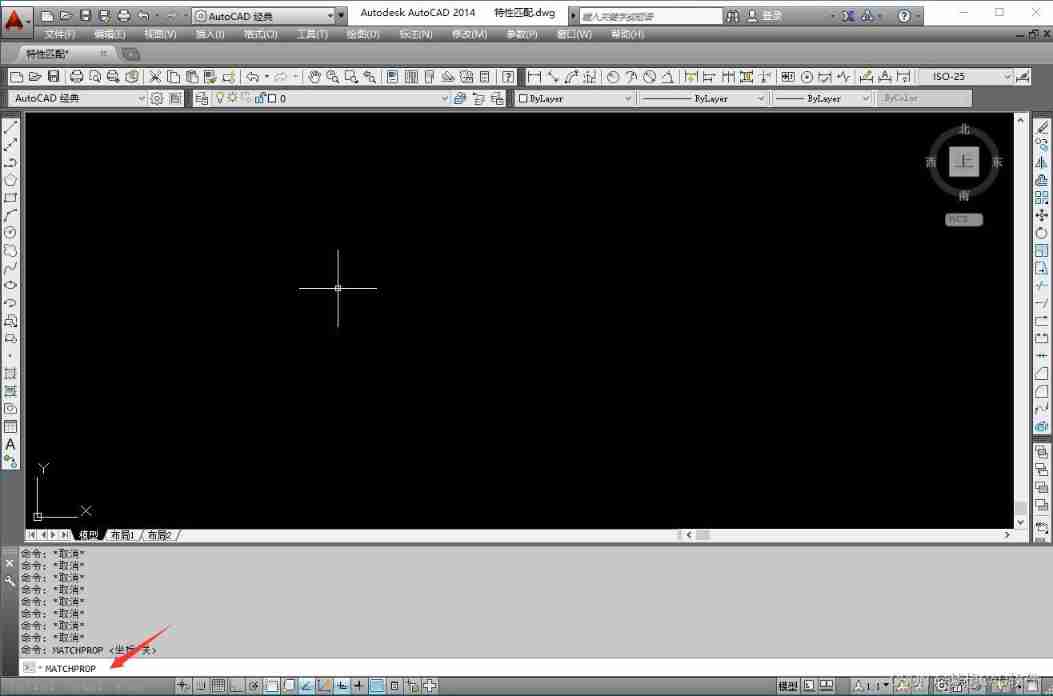

- Autocad-- Real Time zoom

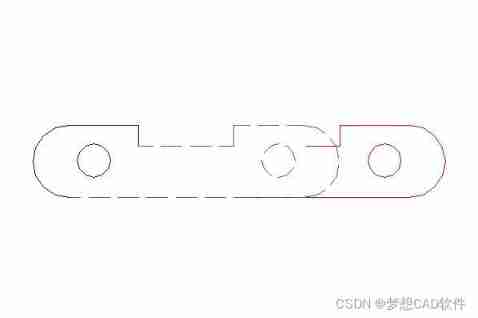

- AutoCAD - continuous annotation

- This article is good

- Redis 排查大 key 的4种方法,优化必备

- 775 Div.1 B. integral array mathematics

- 用 Jmeter 工具做个小型压力测试

- Unity connects to the database

- China needle coke industry development research and investment value report (2022 Edition)

- The first topic of ape Anthropology

猜你喜欢

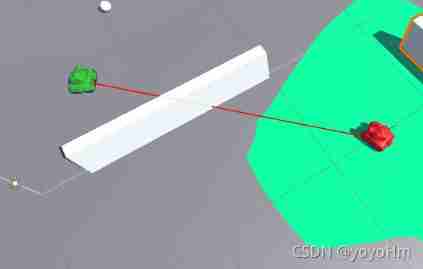

Unity check whether the two objects have obstacles by ray

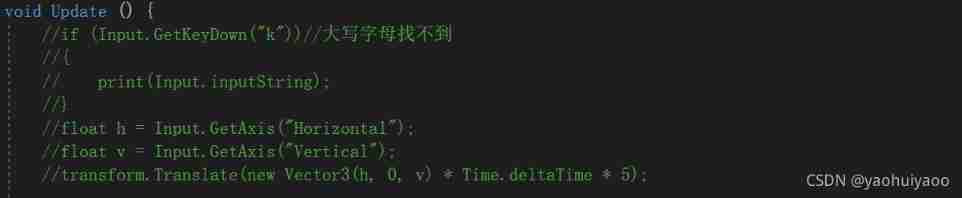

Unity get component

Autocad-- Real Time zoom

3dsmax snaps to frozen objects

AutoCAD - feature matching

AutoCAD - stretching

用 Jmeter 工具做个小型压力测试

Collapse of adjacent vertical outer margins

Download and use of font icons

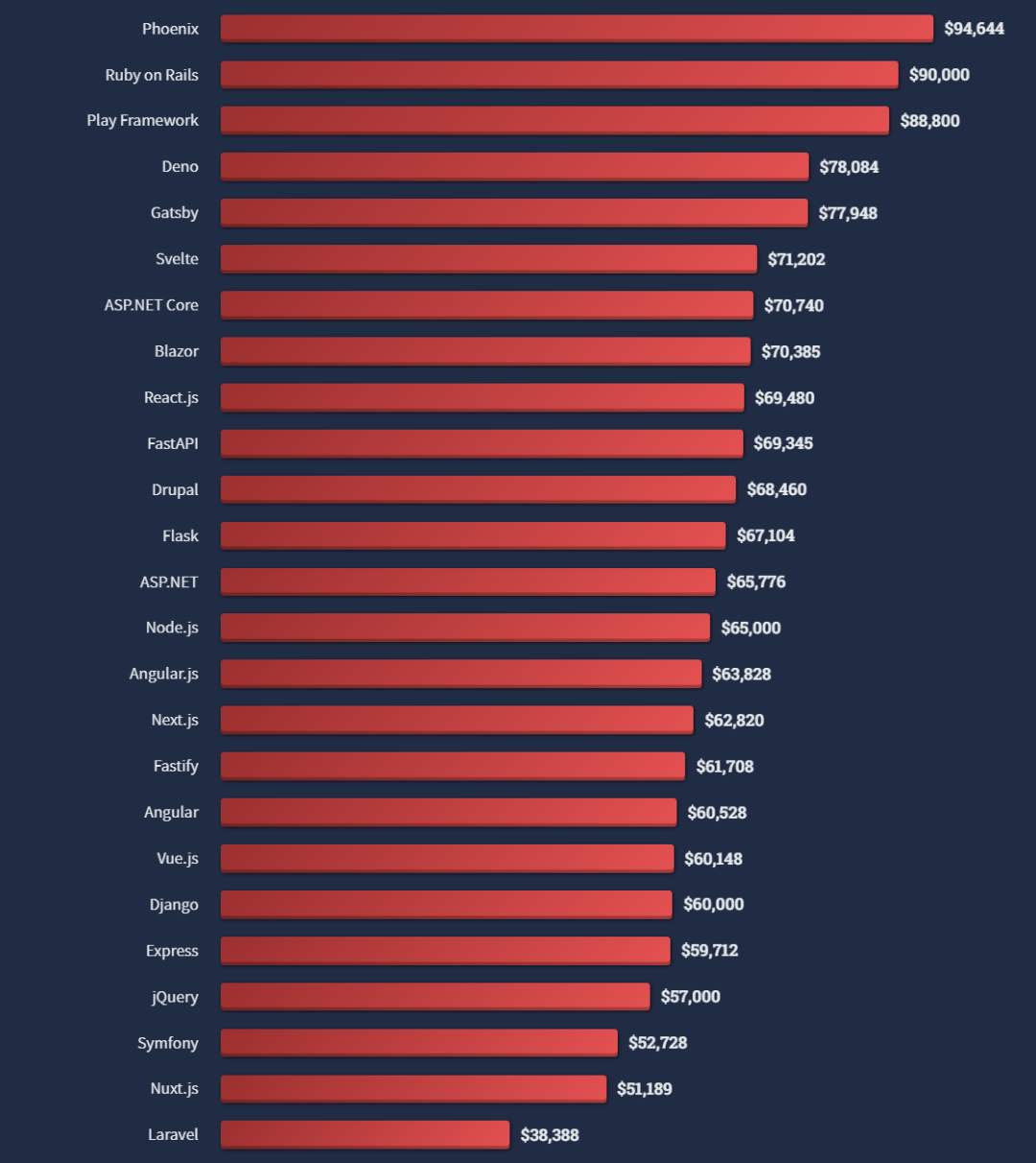

PostgreSQL 超越 MySQL,“世界上最好的编程语言”薪水偏低

随机推荐

2022/7/2做题总结

AutoCAD - graphic input and output

cocos_ Lua loads the file generated by bmfont fnt

The first topic of ape Anthropology

Sqlserver stored procedures pass array parameters

Pause and resume of cocos2dx Lua scenario

Common technologies of unity

Sixth note

2022 / 7 / 1 Résumé de l'étude

MD5绕过

C iterator

Unity3d learning notes

嵌入式数据库开发编程(六)——C API

PR first time

Listview is added and deleted at the index

Ue4/ue5 illusory engine, material part (III), material optimization at different distances

China needle coke industry development research and investment value report (2022 Edition)

嵌入式数据库开发编程(五)——DQL

Research and investment forecast report of adamantane industry in China (2022 Edition)

質量體系建設之路的分分合合