当前位置:网站首页>Exness foreign exchange: the governor of the Bank of Canada said that the interest rate hike would be more moderate, and the United States and Canada fell slightly to maintain range volatility

Exness foreign exchange: the governor of the Bank of Canada said that the interest rate hike would be more moderate, and the United States and Canada fell slightly to maintain range volatility

2022-07-06 03:15:00 【wx5c1644a6b7d66】

Market Review :

The dollar fell slightly on Wednesday . U.S. Treasury yields fell on Wednesday, putting pressure on the dollar , Meanwhile, the stock market rose , Curbed liquidity demand for dollars . Besides , The moderate remarks made by Atlanta Federal Reserve Bank President Bostick and Cleveland Federal Reserve Bank President mester on Wednesday also weighed on the dollar .

The president of Cleveland Federal Reserve Bank mester said , She thinks 3 Monthly interest rate increase 50 BPS " unconvincing ", Because the Fed doesn't want to do anything to disrupt the market .

Bostick, President of the Federal Reserve Bank of Atlanta, also said , We are in the midst of easing inflation " edge ". He added , His interest rate forecast for this year has been raised three times 25 BPS , He “ A little inclined to raise interest rates 4 Time ”, It depends on the economic response .

The rise in oil prices has stimulated a new round of buying , The Canadian dollar rose against the US dollar , Us and Canada fell , stay 1.268 Around the dollar .

4 Hour chart , The United States and Canada are close to themselves again 1 Low since the end of the month 1.266, After stabilizing in the morning, it rebounded slightly . Short term or maintain narrow range oscillation , Pay attention to the choice of breakthrough direction .

Daily charts , The United States and Canada have touched twice 1.277 It fell back around , At present, the price is in the median area of the shock range , Long and short are in balance .

Price intensity :

The table below shows the price intensity under multiple time periods in the United States and Canada , The black vertical bar represents the position within the price range of each statistical period . The median line between the United States and Canada is close to the median of the interval , The trend is uncertain .

Mcclaim said the path of raising interest rates would be more moderate :

The Bank of Canada (Bank of Canada) The latest economic outlook shows , Consumer price index this quarter (CPI) The average year-on-year increase 5.1%, Much higher than policy makers 1% to 3% Comfort zone .

This rate of inflation leaves the central bank with no choice , Only raise interest rates . The order of the central bank government requires it to keep CPI Every year 2% The speed of growth around , This is the middle value of the comfort zone .

Scotiabank of Canada (Bank of Nova Scotia) Forecasters predict , This requires raising the benchmark interest rate to 2%. at present , The interest rate is 0.25% Emergency setting level , Without causing undue controversy in the financial markets , It is close to zero .

Canada's economy no longer needs emergency stimulus . If the epidemic did not stop the recruitment trend at the end of last year , Employment will return to the original level , GDP has also returned to its pre epidemic level .

As the economy recovers , Policymakers turned their attention to inflation at the latest interest rate meeting , Decide to abandon the commitment to keep borrowing costs close to zero at least until spring . without doubt , President mcclaim and his deputies will be in 3 month 2 Japan , That is, when the next interest rate is announced , Raise the benchmark interest rate .

Mcclaim is 2 month 9 A speech at a conference hosted by the Canadian Chamber of Commerce on Wednesday said ," The economy will need to raise interest rates to slow spending growth , And make demand consistent with supply ."“ We also agree , We must maintain good inflation expectations . If inflation expectations get out of control , The cost of bringing inflation back to target will be much higher . For these two reasons , We made it unusually clear , Canadians should expect higher interest rates .”

Unusual clarity does not mean perfect clarity . Mcclaim refused to talk too much about how fast he would raise interest rates , And at what level he will stop raising interest rates . He was in 1 month 26 At a press conference on April 1, he said , Considering that the benchmark interest rate is basically zero , The epidemic started as 1.75%, It is reasonable to expect that the rate of interest rate increase will be fast at the beginning . But he warned that , Don't think that the central bank is on autopilot . He said , When the support rate approaches 2% when , The central bank can choose to take a rest .

Mcclaim said something in his speech earlier , It may give people an understanding of how policymakers view inflation .

Early last year , Central bankers insist , Inflation will be temporary , They argued. , The serious supply shortage will be solved . But it didn't happen , By the end of this year , Policy makers such as mcclaim admit , They have a problem . Bank of Canada 、 The federal reserve (Federal Reserve) And other central banks have begun to raise interest rates or promote related plans .

But mcclaim did not stop thinking that inflation was mainly a supply phenomenon . This is important , Because raising interest rates can do nothing about inflation . The current inflation is caused by crowded ports 、 The factories closed due to the outbreak of the epidemic and the drought caused by climate change . Mcclem emphatically refuted his view that policy and fiscal stimulus are the main sources of inflation .

“ This is not the result of general excess demand in the Canadian economy ,” Mcclaim said .“ Our economy has just returned to full capacity .”

Canadian banks do have an impact on demand . Mcclaim seems to think that demand is not the problem . If the supply returns to normal , The road to raising interest rates may become smooth .

Important data :

No important data was released yesterday , Bank of Canada governor mcclaim expressed his views on the interest rate hike , Said the interest rate hike would be milder than expected .

today , The United States... Will be announced 1 month CPI, The market expects a year-on-year increase of 7.3%.

边栏推荐

- tcpdump: no suitable device found

- [Li Kou] the second set of the 280 Li Kou weekly match

- How to do function test well

- Résumé des méthodes de reconnaissance des caractères ocr

- Some problem records of AGP gradle

- js凡客banner轮播图js特效

- js 正则过滤和增加富文本中图片前缀

- [ruoyi] ztree custom icon (iconskin attribute)

- Redis SDS principle

- Idea push rejected solution

猜你喜欢

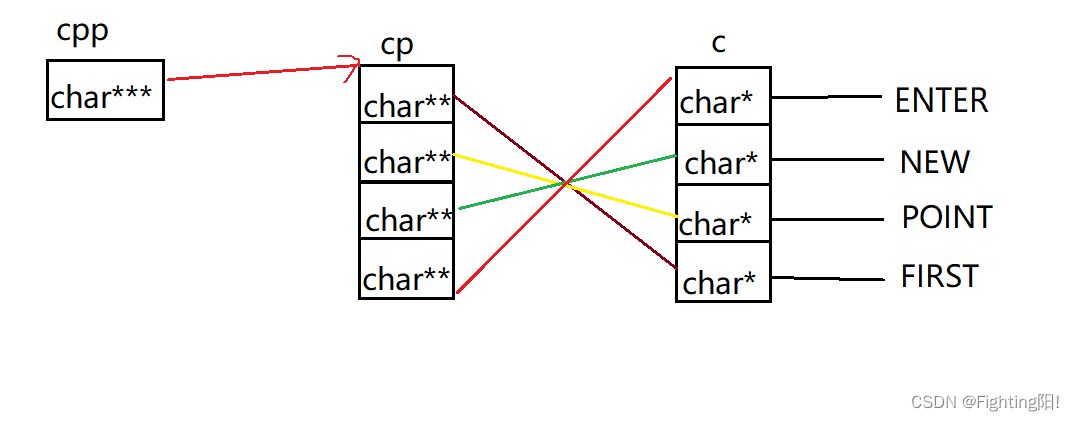

My C language learning record (blue bridge) -- under the pointer

![[kubernetes series] learn the exposed application of kubernetes service security](/img/61/4564230feeb988886fe595e3125ef4.png)

[kubernetes series] learn the exposed application of kubernetes service security

I sorted out a classic interview question for my job hopping friends

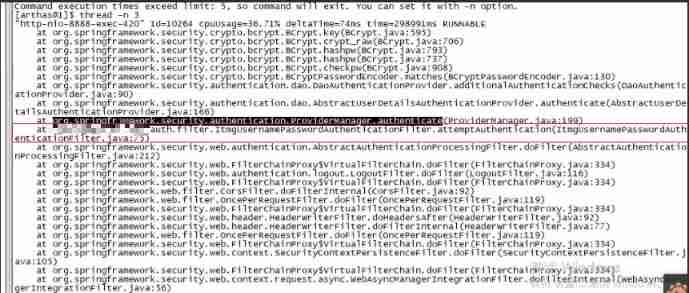

Performance analysis of user login TPS low and CPU full

Recommended foreign websites for programmers to learn

Mysql database operation

【指针训练——八道题】

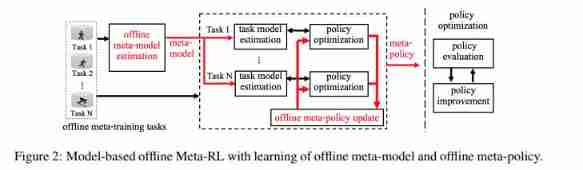

ASU & OSU | model based regularized off-line meta reinforcement learning

Reverse repackaging of wechat applet

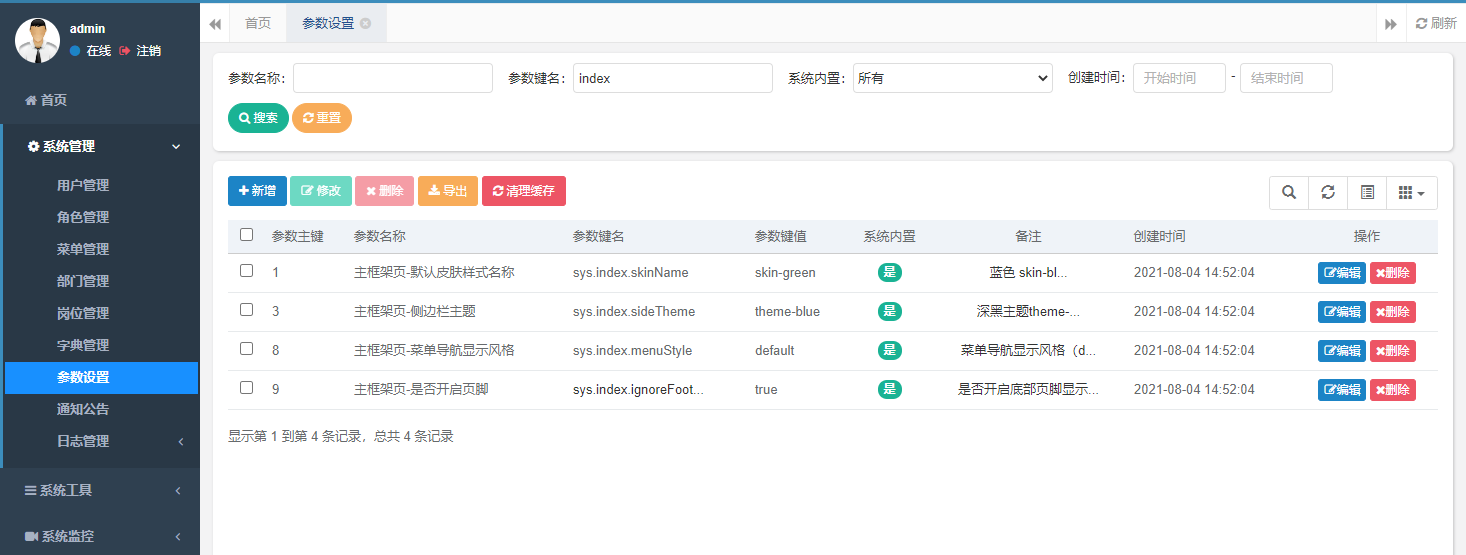

【若依(ruoyi)】设置主题样式

随机推荐

js 正则过滤和增加富文本中图片前缀

指针笔试题~走近大厂

codeforces每日5題(均1700)-第六天

I sorted out a classic interview question for my job hopping friends

How to choose PLC and MCU?

February 14, 2022 Daily: Google long article summarizes the experience of building four generations of TPU

Tidb ecological tools (backup, migration, import / export) collation

Leetcode problem solving -- 173 Binary search tree iterator

Software design principles

SAP ALV单元格级别设置颜色

Jenkins basic knowledge ----- detailed explanation of 03pipeline code

Crazy, thousands of netizens are exploding the company's salary

Redis SDS principle

Explore pointers and pointer types in depth

Buuctf question brushing notes - [geek challenge 2019] easysql 1

Function knowledge points

Audio audiorecord binder communication mechanism

Performance test method of bank core business system

Leetcode problem solving -- 108 Convert an ordered array into a binary search tree

JS音乐在线播放插件vsPlayAudio.js