当前位置:网站首页>Accounting regulations and professional ethics [2]

Accounting regulations and professional ethics [2]

2022-07-06 15:36:00 【Star drawing question bank】

1. Among the following taxes in force in China , The central and local shared taxes are ().

A. Sales Tax

B. The VAT

C. corporate income tax

D. Deed tax 2. Management and use of the following funds , Depositors can apply for opening special deposit accounts ().

A. food 、 cotton 、 Oil purchase funds

B. Working capital loan

C. Policy oriented real estate development funds

D. Renovation funds 3. The conditions for opening a personal bank settlement account are ().

A. Handle exchange

B. Using checks

C. Use a credit card

D. Handle fixed-term debit or fixed-term credit 4. Filling in bills and settlement vouchers should be standardized , Achieve ().

A. The handwriting is clear

B. Elements are complete.

C. The number is correct

D. Not bad, not missing 5. according to 《 Measures for the administration of RMB bank settlement accounts 》 The provisions of the , The following () Such funds can be transferred to personal bank settlement account .

A. Personal loan redeposit

B. Tax refund

C. Illegal income

D. farmers 、 vice 、 Sales revenue of mineral products 6. Professional ethics is linked with profession , Its formation and development is due to the emergence of ().

A. Social division of labor

B. Specialization

C. Division of labor

D. Professional division of labor 7. according to 《 Provisional Regulations on value added tax 》 The provisions of the , VAT general taxpayers are engaged in goods with different VAT rates , Sales of goods with different tax rates are not accounted for separately , The method to determine the applicable VAT rate is ().

A. apply 3% Collection rate

B. The average tax rate is applicable

C. Applicable from high tax rate

D. Applicable from low tax rate 8. According to the relevant provisions of the accounting legal system , In handling the handover procedures of accounting work , Find out " White stripe top Library ” The phenomenon , Should

A. The receiver shall check and deal with it after handover

B. The handover personnel shall be responsible for checking and handling within the specified time limit

C. The accounting archives management personnel shall check and deal with

D. The supervisor is responsible for checking and handling 9. When the cashier of an enterprise reviews an invoice for purchasing materials by a purchaser , It is found that the unit price and amount figures on the invoice have been altered , The unit price of materials is also higher than the market price 1 times . This invoice should belong to ( ).

A. Untrue original documents

B. Incomplete original documents

C. Illegal original documents

D. Inaccurate original documents 10. Payment and settlement are implemented () The management system of .

A. Unified management and hierarchical management

B. Membership

C. Unified management

D. Hierarchical management 11. Treasury single account refers to ().

A. It needs to be approved by the superior government or the Ministry of finance 、 Special special accounts that can only be opened with the approval of the government at the same level or authorized by the financial department

B. An account opened by the financial department at the agency bank for the budget unit , Used for financial authorization payment

C. The financial department opens a single treasury account at the central bank

D. The extra budgetary fund income account opened by the financial department in the commercial bank 12. Of the following , What does not belong to the budget allocation of government financial departments should follow the principle of ().

A. Allocate funds according to the budget

B. Allocate funds according to progress , That is to allocate funds according to the actual progress of each user and the state treasury funds

C. Allocate funds according to the needs of each unit

D. Allocate funds according to the specified budget levels and procedures 13. The subjects of government procurement do not include ().

A. Business unit

B. Social groups

C. State-owned enterprise

D. The government authority 14. according to 《 Personal income tax law 》, The collection method of personal income tax in China is ().

A. The tax authority will collect it on site

B. Withheld by the unit

C. It shall be declared by individuals

D. The combination of individual self declaration and withholding 15. Li Mou 2012 year 12 Of the following income obtained in the month , What is exempt from individual income tax is ().

A. Rental income 2500 element

B. Income from remuneration 3000 element

C. Interest income from national debt 500 element

D. Shopping in shopping malls 1000 element 16.《 Basic norms of enterprise internal control 》 since ( ) Implemented within the scope of listed companies , Encourage unlisted large and medium-sized enterprises to implement .

A.2008 year 7 month 1 Japan

B.2009 year 7 month 1 Japan

C.2009 year 1 month 1 Japan

D.2010 year 1 month 1 Japan 17. Used to record 、 The account for accounting and reflecting the income and expenditure activities of non tax income is ().

A. Budget unit zero balance account

B. Treasury single account

C. Special account

D. Special financial account 18. Mr. Pan Xulun, the father of modern accounting in China, advocated :" With faith and determination , Keep your faith , Believe in doing things , Treat others with faith , Never forget ' Lixin ', When there is success .” The content of accounting professional ethics embodied in this sentence is ().

A. Participate in management

B. Be honest

C. Be honest and self disciplined

D. Objective justice 19. The general principle of China's accounting work management system is ( ).

A. Unified leadership , centralized management

B. Unified leadership

C. Unified leadership , Hierarchical management

D. Hierarchical management 20. In the following statements about VAT special invoices , What's not right is ().

A. VAT special invoices are issued by the province 、 Autonomous region 、 Uniformly printed by enterprises designated by the tax authorities of municipalities directly under the central government

B. VAT special invoice refers to the invoice specially used to settle sales of goods and provide processing 、 An invoice used for repair and replacement services

C. Only those who are recognized as general VAT taxpayers by the national tax authorities can receive and purchase VAT special invoices , Small scale taxpayers and general taxpayers under legal circumstances shall not receive, purchase and use

D. Special VAT invoices shall be issued using the anti-counterfeiting tax control system 21. According to our country 《 Budget law 》 The provisions of the , What does not belong to the budgetary authority of the financial department of the State Council is ().

A. Specifically organize the implementation of the central and local budgets

B. Formulate the adjustment plan of the central budget

C. Specific preparation of the central budget 、 Draft final accounts

D. Examine and approve the adjustment plan of the central budget 22. It is an important sign to measure whether the tax burden is heavy or not , Is the core of the tax system .

A. Tax object

B. tax rate

C. Tax basis

D. tax item 23. The budgets of local governments at all levels are made by ( ) Review and approve .

A. The people's government at the corresponding level

B. The people's Congress at the corresponding level

C. The Standing Committee of the people's Congress at the corresponding level

D. The people's government at a higher level 24. according to 《 Provisional Regulations on consumption tax 》 Regulations , When taxpayers use their own taxable consumer goods for continuous production of taxable consumer goods ().

A. Calculate and pay consumption tax according to the product cost

B. No consumption tax

C. Consumption tax is calculated and paid according to the sales price of similar products

D. Consumption tax is calculated and paid according to the constituent taxable price 25. A car store is a general taxpayer ,2013 year 12 The sales of cars in January are tax exclusive 500 Ten thousand yuan , In addition, extra price expenses are obtained 11.7 Ten thousand yuan ( Tax included ), The value-added tax indicated on the special invoice for value-added tax obtained in the current period is 45 Ten thousand yuan . Then the value-added tax payable by the franchise store in the current period is () Ten thousand yuan .

A.38.3

B.40

C.41.989

D.41.726. The specific types of administrative penalties involved in the tax field include ().

A. Confiscation of property

B. Fine

C. Order to make corrections within a time limit

D. criminal detention 27.《 Government procurement law 》 The specified cases where single source procurement can be adopted are ().

A. In case of unforeseen emergency, it is impossible to purchase from other suppliers

B. Only from a single supplier

C. It is necessary to ensure the consistency of the original procurement projects or the requirements of supporting services , We need to continue to purchase from the original supplier , And the total amount of additional purchase funds does not exceed the purchase amount of the original contract 10% Of

D. Buyers are used to using certain products 28. according to 《 Measures for the administration of RMB bank settlement accounts 》 The provisions of the , The following () Such funds can be transferred to personal bank settlement account .

A. Contribution fee 、 Performance fees and other labor income

B. bond 、 futures 、 The principal and income of investments such as trusts

C. Income from personal creditor's rights or property rights transfer

D. Wages 、 Bonus income 29. Applying for opening a temporary deposit account due to temporary business activities in different places , The supporting documents that the depositor should issue to the bank include ().

A. Basic deposit account opening registration certificate

B. The approval document of the administrative department for Industry and Commerce in the place of temporary business

C. Tax registration certificate

D. A copy of the business license 30. The form of accounting professional ethics education is to educate accountants with () Positive education at the core .

A. Professional obligations

B. Professional skills

C. Professional responsibility

D. Professional rights 31. Bookkeeping vouchers that can not be attached with original vouchers include ( ).

A. Payment cost

B. Correct the mistake

C. Settle accounts

D. Selling goods 32. Payment settlement is () act .

A. Fund liquidation

B. Monetary payment

C. Commodity purchase

D. The sale of goods 33. Of the following , accord with 《 Payment and settlement method 》 The regulations are

A. Write Chinese capital figures in traditional Chinese characters

B. Chinese amount in words and figures " horn ” Then don't write " whole ”( or " just ”) word

C. The Arabic number in figures should be preceded by the RMB symbol

D. Fill in the bill issue date with Arabic numbers 34. Accountants violate professional ethics , There may be () Penalty for .

A. Business competent department

B. My unit

C. Industry Association

D. The finance department 35.《 accounting law 》 Regulations , The person in charge of the unit is responsible for the accounting work and accounting materials of the unit ( ) be responsible for .

A. accuracy

B. Authenticity

C. Relevance

D. integrity 36. Payment and settlement as a legal act , Its legal characteristics are ().

A. Payment and settlement is an important behavior

B. Payment and settlement must be carried out according to law

C. Payment and settlement must be carried out through financial institutions approved by the people's Bank of China

D. The occurrence of payment and settlement depends on the will of the client 37. Of the following , Taxable sales that should be included in value-added tax include ().

A. The package rent charged to the buyer

B. The handling charge charged to the buyer for the sale of goods

C. Collection money collected from the buyer for the sale of goods

D. Output tax charged to buyers 38. According to the provisions of the legal system of individual income tax , Taxpayers of individual income tax can be divided into resident taxpayers and non resident taxpayers , The criteria are ().

A. Domestic working hours

B. Income earning workplace

C. Domestic residence time

D. Whether there is a residence in the territory 39. The basic principles that should be observed in the management of bank settlement accounts are ().

A. A basic account principle

B. Law abiding principles

C. The principle of independently choosing a bank to open a bank settlement account

D. Confidentiality principle of bank settlement account information 40. Accounting institutions 、 Accountants should supervise the financial revenue and expenditure , In the following statements , The right is ( ).

A. For financial revenues and expenditures that seriously violate the interests of the state and the public , It should be reported to the competent unit or the finance 、 Audit 、 Tax authority report

B. For violations of national unity _ My finance 、 financial 、 Financial revenue and expenditure stipulated by the accounting system , Do not handle

C. For financial revenues and expenditures with incomplete approval procedures , It should be stopped and corrected

D. Financial revenues and expenditures that are not included in the unified accounting of the unit in violation of the provisions , Should be returned , Request supplement 、 correct 41. Government procurement supervision and administration department , Approved by the superior financial department , Centralized purchasing organizations can be set .

A. Yes

B. wrong 42. Purchasing through competitive negotiation , The following procedure should be followed :(1) Set up a negotiation team ;(2) Prepare negotiation documents ;(3) Determine the list of suppliers invited to participate in the negotiation ;

A. Yes

B. wrong 43. Agricultural producers sell their own primary agricultural products , It does not belong to the VAT exemption project .

A. Yes

B. wrong 44. Taxpayers of individual income tax do not include individuals who have no domicile in China and have resided in China for less than one year .

A. Yes

B. wrong 45. Where there are regulations on taxable income 、 All kinds of taxpayers of taxable property or taxable behavior , Tax registration should be handled in accordance with the law .

A. Yes

B. wrong 46. The tax authorities may take tax preservation measures or compulsory enforcement measures in accordance with the approved Authority , The approval authority here refers to the tax bureau above the municipal level ( branch office ) The director approved .

A. Yes

B. wrong 47. The state is to realize its functions , By virtue of political power , According to the standards stipulated by law , A specific distribution method of paid fiscal revenue .

A. Yes

B. wrong 48. The withholding agent shall report and pay the value-added tax withheld to the competent tax authority in the place where the taxpayer institution is located or where it resides .

A. Yes

B. wrong 49. The highest authority of the Chinese Institute of Certified Public Accountants is the national member congress , The National Member Congress elects the Council . The association has a secretariat , As its permanent executive body .

A. Yes

B. wrong 50. The types of tax registration include business registration 、 Shut down 、 Resume business registration 、 Go out for business inspection and registration 、 Change registration, etc .

A. Yes

B. wrong 51. The accounting department rules are based on 《 legislation law 》 The prescribed procedure , Formulated by the Ministry of finance , The system and measures related to accounting work, which are issued by the head of the Department after signing the order .

A. Yes

B. wrong 52. Selling goods by direct collection , Whether the goods are delivered or not , The time when the tax liability occurs is when the sales volume is received or the evidence of claiming sales volume is obtained , And the day when the bill of lading is handed over to the buyer .

A. Yes

B. wrong 53. It is filled in by the employee when he / she is on business to receive the travel expenses " loan bill ", It shall be returned to the employee when the employee reimburses the travel expenses and settles the loan .

A. Yes

B. wrong 54. The taxpayer will give the purchased goods to others for free , Because the value-added tax has been paid when the goods are purchased , therefore , When giving gifts to others, they can no longer be included in sales tax .

A. Yes

B. wrong 55. Treasury centralized collection and payment system refers to the treasury single account system set up by the financial department on behalf of the state , All operating funds are collected into the treasury single account system 、 Payment and management system .

A. Yes

B. wrong 56. According to the regulation , The bank can check the account information for any unit or individual , However, it shall not be frozen for any unit or individual 、 Deduction and transfer , Do not stop the unit 、 Normal payment of personal deposits .()

A. Yes

B. wrong 57. The bill is issued by the drawer , It is a negotiable security that agrees to pay a certain amount conditionally to the payee or the holder by itself or by entrusting the payer at sight or on a specified date .

A. Yes

B. wrong 58. The endorser fails to record the name of the endorsee and delivers the bill to others , This note is invalid .

A. Yes

B. wrong 59. When the bank handles settlement , It is only responsible for handling the transfer of funds between the settlement parties , Do not assume the responsibility of making any advance .()

A. Yes

B. wrong 60. Provisions of the enterprise income tax law , The enterprise shall start from the end of the year 3 months , Submit the annual enterprise income tax return to the tax authority , And settle and pay taxes .

A. Yes

B. wrong 61. The local budget is made by the provinces 、 Autonomous region 、 The general budget of the municipality directly under the central government consists of , It includes the amount of income handed over by the lower level government to the higher level government and the amount returned or subsidized by the higher level government to the lower level government .

A. Yes

B. wrong 62. fine 、 Confiscation of property, etc., are administrative penalties for tax violations .

A. Yes

B. wrong 63. The financial department should organize and promote the construction of accounting professional ethics , Administer according to law .()

A. Yes

B. wrong 64. Consciously fighting two kinds of accounting moral concepts is the key to the success of Accountants' moral cultivation .

A. Yes

B. wrong 65. The taxpayer will purchase the tax included in the value of material materials and the value of fixed assets used for production and operation , The value-added tax deducted at one time in the current period of purchase is income type value-added tax .

A. Yes

B. wrong 66. The entrusting party entrusts an agency bookkeeping institution to keep accounts on behalf of the entrusting party, and a special person shall be assigned to be responsible for the income, expenditure and custody of daily monetary funds .

A. Yes

B. wrong 67. Local accounting regulations refer to provincial 、 Autonomous region 、 The people's Congress and its Standing Committee of municipalities directly under the central government are dealing with Accounting Law 、 Local accounting regulations formulated on the premise that accounting administrative regulations do not conflict .

A. Yes

B. wrong 68. Bank settlement account refers to the current deposit account and fixed deposit account opened by the bank for the depositor to handle the receipt and payment of funds .()

A. Yes

B. wrong 69. Accounting regulations are formulated on the basis of accounting laws and administrative regulations .

A. Yes

B. wrong 70. The tax period of value-added tax is 1 Japan 、3 Japan 、5 Japan 、10 Japan 、20 Japan 、1 Months or 1 Quarterly .

A. Yes

B. wrong 71. Taxpayers engaged in wholesale or retail of goods , Annual taxable sales in 50 Those below 10000 yuan are small-scale VAT taxpayers .

A. Yes

B. wrong 72. The main forms of accounting professional ethics education include receiving education and self-education .

A. Yes

B. wrong 73. Continuing education of accounting personnel refers to that accounting personnel complete a certain stage of professional learning , Re accept a certain form of . Organized knowledge updating and training activities .

A. Yes

B. wrong 74. Taxation is an important means of regulating economic operation .

A. Yes

B. wrong 75. Selling goods or taxable services , Its tax liability occurs on the day when the sales payment is received or the voucher for claiming the sales payment is obtained , If the invoice is issued first, it is the day of issuing the invoice .

A. Yes

B. wrong 76. The self-discipline mechanism and accounting professional ethics punishment system of the accounting industry are organized and established by the financial department .

A. Yes

B. wrong 77. The withholding agent shall, from the date of the occurrence of the withholding obligation 30 Intraday , Apply to the local competent tax authority for tax withholding registration , Get the tax withholding registration certificate .

A. Yes

B. wrong 78. Accounting professional ethics is mandatory .

A. Yes

B. wrong 79. The date of issue of the bill is in figures , The deposit bank can accept , However, the losses caused thereby shall be borne by the drawer .()

A. Yes

B. wrong 80. The depositor has not paid off the debts of the deposit bank , It is not allowed to apply for cancellation of bank settlement account .

A. Yes

B. wrong 81. According to the provisions of VAT , Fixed business households go to other counties ( City ) Selling goods or taxable services , It shall apply to the competent tax authority in the place where its institution is located for the issuance of tax administration certificate for out of town business activities , And declare and pay taxes to the competent tax authority where the institution is located .

A. Yes

B. wrong 82. township 、 Nationality town 、 The town government shall submit the budget at the corresponding level approved by the people's Congress at the corresponding level to the government at the corresponding level for the record .

A. Yes

B. wrong 83. All units and individuals providing labor services in China are taxpayers of individual income tax .

A. Yes

B. wrong 84. For the convenience of depositors , One company can open multiple basic deposit accounts .()

A. Yes

B. wrong 85. The person in charge of the unit refers to the legal representative of the unit .

A. Yes

B. wrong 86. The superior government can use the funds budgeted by the lower government beyond the budget , Governments at lower levels shall not misappropriate or intercept funds belonging to the budgets of governments at higher levels .

A. Yes

B. wrong 87.《 Enterprise income tax law 》 The provisions of the , The enterprise income tax is levied on a quarterly basis , Monthly prepayment .

A. Yes

B. wrong 88. The head office and branches are not in the same county ( City ) VAT payer of , They should apply to the local competent tax authorities where their respective institutions are located for recognition .

A. Yes

B. wrong 89. The handover personnel cannot handle the handover procedures in person due to illness or other special reasons , Approved by the person in charge of the unit , May by () Agent handover .

A. The transferor entrusts others

B. The transferor authorizes others

C. Head of accounting organization

D. Relatives of the transferor 90." Taxpayers approved by the tax authorities shall use the unified special envelope for express delivery of tax declaration , Handle the delivery formalities through the postal department , And ask the postal department for a receipt as a way to declare evidence ” go by the name of ().

A. Self declaration

B. Mail declaration

C. Data message declaration

D. Simple declaration 91. Li Mou 2012 year 12 Of the following income obtained in the month , What is exempt from individual income tax is ().

A. Interest income from national debt 500 element

B. Shopping in shopping malls 1000 element

C. Income from remuneration 3000 element

D. Rental income 2500 element 92. Treasury single account refers to ().

A. The financial department opens a single treasury account at the central bank

B. An account opened by the financial department at the agency bank for the budget unit , Used for financial authorization payment

C. It needs to be approved by the superior government or the Ministry of finance 、 Special special accounts that can only be opened with the approval of the government at the same level or authorized by the financial department

D. The extra budgetary fund income account opened by the financial department in the commercial bank 93. The budget law stipulates that , The adjustment plan of the central budget must be submitted to ( ) Review and approve .

A. The National People's Congress

B. The Standing Committee of the National People's Congress

C. The State Council

D. The Ministry of Finance 94. Institutions engaged in bookkeeping business in China , There should be at least () Full time practitioners holding accounting qualification certificates .

A.2

B.3

C.4

D.595. Of the following , What is not an element of the tax law ().

A. Tax basis

B. Taxpayer

C. Tax collector

D. Tax agent 96. The bank settlement account is changed , After the bank receives the change notice from the depositor , Change procedures shall be handled in time , And in () Report to the people's Bank of China within working days .

A.2

B.3

C.5

D.497. So-called () It refers to the behavior that must be carried out in a certain form according to the law .

A. Legal acts

B. Contractual behavior

C. Payment settlement

D. Essential behavior 98. In the main content of accounting professional ethics ,() It embodies the basic principle of being a man , It is also the main content of civil ethics .

A. Be honest

B. Strengthen service

C. Stick to the rules

D. Participate in management 99. Among the parties to the instrument , The person who is entrusted by the drawer to pay or bears the responsibility of payment by himself is called ().

A. endorser

B. Drawer

C. payee

D. Drawee 100. Among the following elements of tax law , The important sign to measure the tax burden of taxpayers is ().

A. Tax basis

B. Tax reduction and exemption

C. tax rate

D. Tax object

边栏推荐

猜你喜欢

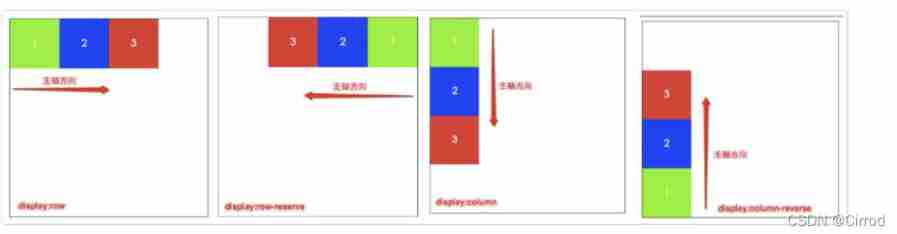

Flex --- detailed explanation of flex layout attributes

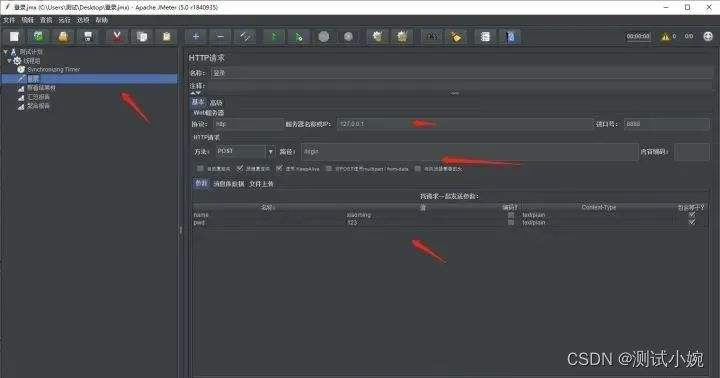

What if software testing is too busy to study?

LeetCode#62. Different paths

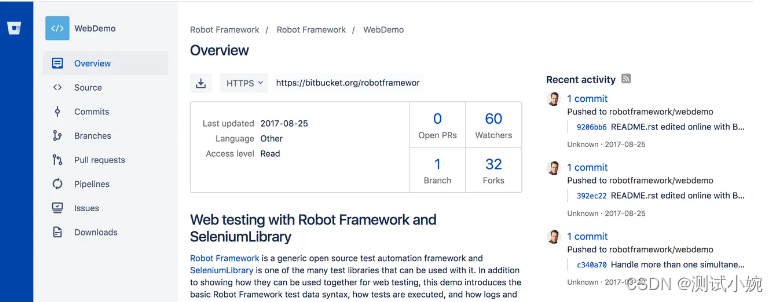

Do you know the advantages and disadvantages of several open source automated testing frameworks?

Want to change jobs? Do you know the seven skills you need to master in the interview software test

ucore Lab 1 系统软件启动过程

FSM和i2c实验报告

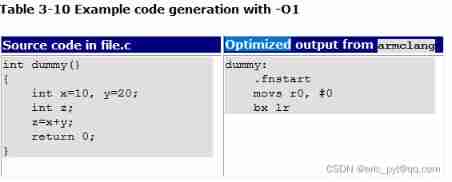

Brief description of compiler optimization level

How to do agile testing in automated testing?

Stm32 dossiers d'apprentissage: saisie des applications

随机推荐

JS --- JS function and scope (II)

Contest3145 - the 37th game of 2021 freshman individual training match_ A: Prizes

How to change XML attribute - how to change XML attribute

学习记录:TIM—电容按键检测

Learning record: use stm32f1 watchdog

学习记录:使用STM32F1看门狗

ucorelab4

Future trend and planning of software testing industry

Mysql database (IV) transactions and functions

毕业才知道IT专业大学生毕业前必做的1010件事

ucore lab 6

ucore lab7

FSM and I2C experiment report

Do you know the advantages and disadvantages of several open source automated testing frameworks?

Intensive learning notes: Sutton book Chapter III exercise explanation (ex17~ex29)

动态规划前路径问题

LeetCode#198. raid homes and plunder houses

JS --- all basic knowledge of JS (I)

Servlet

Cost accounting [16]