当前位置:网站首页>Cost accounting [13]

Cost accounting [13]

2022-07-06 15:35:00 【Star drawing question bank】

1. The cost of raw materials used in the production of several products , It belongs to indirect expense .( )

2. Multi step continuous processing production , You need to take steps as the object of cost calculation , Calculate the cost of semi-finished products and products in each step according to both steps and varieties .()

3. “ Downtime losses ” There should be no balance at the end of the month .( )

4. The cost of fuel directly used in the production of products , Should be recorded “ Basic production cost ” Debit of general ledger and Sub Ledger “ Fuel and power ” Cost items .( )

5. The content of cost analysis mainly includes the analysis of the completion of cost plan 、 Cost budget implementation analysis and cost-benefit analysis .( )

6. Adopt step-by-step carry forward method , According to the reflection method of the semi-finished products carried forward in the product cost Sub Ledger in the next step , There are two methods: comprehensive carry forward and itemized carry forward .()

7. Adopt parallel carry forward step-by-step method , Each step can calculate the product cost at the same time , However, the cost of semi-finished products is not carried forward between steps .()

8. Cost statements only reflect accounting information , It does not reflect the production technology level of the enterprise .( )

9. No matter what kind of organization, manufacturing enterprises , No matter what kind of products are produced , Regardless of cost management requirements , Finally, the product cost must be calculated according to the product variety .()

10. Net loss of scrap , At the end of the month, the cost of the same qualified product in this month shall be borne .()

11. When analyzing an indicator , Compare different indicators related to this indicator , The method of analyzing their relationship is called comparative analysis ( ).

12. “ Downtime losses ” The account should set up a Sub Ledger according to the product variety .( )

13. Quota change variance refers to the difference between actual expenses and quota expenses .

14. The amortization amount of low value consumables used in the production of products shall be recorded in “ Basic production cost ” Account .( )

15. The unit cost statement of main products is generally a statement that reflects the composition of the unit cost of various main products produced by the enterprise in the reporting period . The table should be prepared separately according to the main products , It is a supplement to the production cost table .( )

16. Installment of cost accounting , It is not necessarily related to the month of the accounting year 、 Quarterly 、 Consistent by year .

17. Adopt parallel carry forward step-by-step method , If it is carried forward comprehensively according to the cost of semi-finished products , Cost reduction is also required .()

18. The production workshop consumes low value consumables , When using the one-off amortization method , When scrap materials are priced and warehoused , Should debit “ raw material ” Account , credit “ Manufacturing expenses ” Account .( )

19. The actual cost reduction of comparable products is calculated by using the total cost of the actual output calculated according to the actual unit cost of the previous year and the total cost of the actual output calculated according to the actual unit cost of the current year ( ).

20. Calculate hourly wage expenses , It should be based on the working time record in the attendance record .( )

21. In single step production , Production costs do not have to be allocated between finished products and in-process products .()

22. Allocate manufacturing expenses according to the annual planned distribution rate distribution method , It is most suitable for enterprise workshops with seasonal production .( )

23. It belongs to auxiliary materials commonly used in the production of several products , It can be directly included in the cost of various products .( )

24. Cost reduction rate of comparable products , It can reduce the cost of products , Fill in according to the actual annual cost .( )

25. A product produced in a workshop , Manufacturing costs are included in indirect expenses , Appropriate allocation methods should be used , The allocation is included in the production cost of various products in the workshop .( )

26. Cost is closely related to economic benefit . Improve economic benefits in production , Is to spend the least labor ( cost ) And labor occupation ( Money ) Produce products that meet social needs . so , Cost analysis is the analysis of cost index itself .( )

27. The cost calculation of variety method is carried out on a monthly basis .()

28. The total amount of expenses actually incurred in an accounting period , Not necessarily equal to the sum of product costs in the accounting period .()

29. There is no problem of finished products and cost allocation between products under the variety method .()

30. Under the quota method , The fixed cost of products is the cost determined based on the consumption quota and planned unit price of product production .( )

31. The object of cost accounting of industrial enterprises is the manufacturing cost of products produced by industrial enterprises .( )

32. Cost accounting is the basic function among many functions of cost accounting .( )

33. Quota method is not only a calculation method of product cost , And it is also a method to directly control and manage the product cost .( )

34. When using the step-by-step method to calculate the product cost , The steps of product cost calculation should be completely consistent with the actual production steps .()

35. The cost of various products in the category calculated by classification , With certain assumptions ().

36. Scrap loss does not include the production cost of irreparable scrap found after warehousing .()

37. Under the variety method , Product cost Sub Ledger or cost calculation sheet shall be opened according to product variety , And set up columns according to the cost items .()

38. In practice , To simplify accounting procedures , Waste loss within the scope of three guarantees , It can be directly recorded in “ Management cost ” subject .()

39. “ Waste loss ” A subsidiary account shall be established according to the workshop , Special accounts are set up in the account according to product varieties , And set up columns or special banks according to cost items , Perform detailed accounting .( )

40. Production personnel 、 Wages and welfare expenses of workshop management personnel , According to the salary and expense distribution table , It should be directly included in the production cost of the product .( )

41. The step-by-step carry forward method is actually the multiple continuous application of the variety method .()

42. Classification is a basic method of product cost calculation with product category as the object of cost calculation ().

43. The variety method is generally applicable to enterprises that produce a large number of single steps .

44. The variety method is only applicable to large-scale single-step production .()

45. The allocation of material cost is generally carried out through the preparation of material cost allocation table .

46. Waste loss includes the loss of damage and deterioration due to improper storage .()

47. For consistency , The same enterprise should always prepare the same cost statement in different periods .( )

48. Approved , When dealing with inventory gain of products in process , Should debit “ Loss and overflow of property to be disposed of —— Loss and overflow of current assets to be disposed ” subject , credit “ Manufacturing expenses ” subject .()

49. In theory , The compensation part of the commodity value , Is the theoretical cost of goods .( )

50. Depreciation of fixed assets is a component of product cost , Should be fully included in the cost of the product .( )

51. When using the coefficient method to calculate the product cost , Generally, choose one of the similar products with larger output 、 The products with relatively stable production or compromise specifications are regarded as standard products .()

52. Interest expense in element expense , It is not part of the product cost , It is an expense item of financial expenses .( )

53. The cost calculation period under the variety method is consistent with the accounting reporting period .()

54. Single step production cannot be interrupted due to the technological process , Therefore, the cost can only be calculated according to the variety of products .()

55. Enterprises should mainly organize cost accounting according to the needs of external parties .( )

56. Quota method takes the quota of products as the object of cost calculation ( )

57. Due to the technical reasons of production workers 、 Careless operation 、 The poor management of the enterprise leads to the formation of graded products , Appropriate methods should be used to calculate the cost of grade products , Usually, the grade products are classified into one class , Calculate joint cost , Then set the coefficient according to the unit selling price of grade products , Allocate the joint cost of each grade of products in proportion to the coefficient .()

58. Production costs can be classified according to different standards , The most basic one is the classification of economic content according to production costs .()

59. In workshops that produce a variety of products , Manufacturing costs are included in indirect expenses , Appropriate allocation methods should be used , The allocation is included in the production cost of various products in the workshop .( )

60. Attendance records and output records are the main original records of employee salary accounting .( )

61. “ Basic production cost ” The account should set up the product cost Sub Ledger according to the cost calculation object , There are columns or special banks in the account according to the product cost items .

62. When the inventory loss and damage of products are found in the inventory , Should debit “ Basic production cost ” subject , credit “ Loss and overflow of property to be disposed of —— Loss and overflow of current assets to be disposed ” subject .()

63. Generally, comparative method is used to analyze the profit rate of costs , By comparing the actual number of this year with the planned number of this year , Or compare with the actual amount of the previous year , To find out the reasons for its changes and the impact of the rise and fall of its indicators .( )

64. Waste products in production , Including waste products found in the production process , It also includes waste products found after warehousing .()

65. Abnormal shutdown losses caused by natural disasters , It should be included in non operating expenses .( )

66. All production costs incurred in the auxiliary production workshop are directly recorded in “ Auxiliary production cost ” subject .()

67. The key to the cost calculation of joint products is the allocation of joint costs .()

68. In multi-step production , In order to strengthen the cost management of each production step , The cost of products should be calculated according to the production steps .()

69. For manufacturing expenses , In essence, activity-based costing divides manufacturing expenses into different constituent departments according to activities , Each part is assigned according to the related work .( )

70. When using the classification method to calculate the product cost , The production cost of various products in the category , Whether it's direct production costs or indirect production costs , Are allocated into the product cost .()

71. “ Manufacturing expenses ” Accounts and “ Manufacturing expenses ” Cost items are the same thing .()

72. If the power consumed in the process is not much , There is no “ Fuel and power ” Cost items , The power cost consumed in the process can be included in “ Manufacturing expenses ” Cost items .()

73. The deviation of raw materials from the quota refers to the difference between the actual consumption level of materials and the quota consumption level , That is, the quantity difference of materials , Price differences excluding raw materials .( )

74. The comprehensive carry forward of semi-finished product cost is conducive to analyze and assess the composition of finished product cost from the perspective of the whole enterprise .()

75. Under the parallel carry forward step-by-step method , The cost allocation between finished products and products in process in each step refers to the cost allocation between finished products in a narrow sense and products in a broad sense .()

76. The manufacturing cost is allocated according to the proportion of direct labor cost , It is most suitable for enterprise workshops with seasonal production .( )

77. When using the classification method to calculate the product cost , The classification standard of products includes the structure of products 、 Raw materials and processes used .()

78. The cost statement of commodity products is a statement that reflects the total cost of all commodity products produced by an enterprise during the reporting period ( ).

79. Adopt the machine hour proportion method , The manufacturing cost of finished products can be settled at any time , Simplify distribution procedures , It is most suitable for enterprise workshops with seasonal production .( )

80. In order to encourage enterprises to save costs 、 Reduce production losses , The loss of some products that do not form the value of the product is regarded as the production cost , Included in the cost of the product .( )

81. In a large number of multi-step production enterprises , If the production scale of the enterprise is small , And the cost information of each step is not required in cost management , The variety method can also be used to calculate the product cost .()

82. Under the primary cost accounting system , If the enterprise produces more than two products , Should be in “ Basic production subsidiary ledger ” Lower setup “ Product cost calculation sheet ”.

83. Installment of cost accounting , Not necessarily consistent with the accounting cycle .( )

84. Low value consumables are used as labor materials , The accounting of amortization is exactly the same as that of depreciation of fixed assets .( )

85. The loss of scrap should not be included in the cost of products .

86. The organizational division of labor among cost accounting institutions at all levels within large and medium-sized enterprises , Generally, centralized working mode is adopted .( )

87. The correlation ratio analysis method is a method of analyzing by calculating the ratio of two indicators with different and related properties .( )

88. There are two procedures for auxiliary production cost collection , Accordingly ,“ Auxiliary production cost ” There are also two ways to set the Sub Ledger , The difference between the two is that the procedures for the collection of auxiliary production manufacturing costs are different .()

89. In the enterprise or workshop of small batch and single piece production , If there are many batches of products put into operation in the same month , The simplified batch method can be used to calculate the product cost .()

90. Classification is not an independent cost calculation method , It must be combined with the basic method of cost calculation .()

91. The production organization mode applicable to the variety law is ().(2 branch )

A. Mass production

B. Batch single step production

C. Mass multi-step production

D. Single piece small batch production

92. When the irreparable waste loss is calculated according to the actual cost of waste , Appropriate methods should be used to allocate production costs between qualified products and waste products .()(1 branch )

93. Calculate the variance of quota change of products in process at the beginning of the month , In order to ( ).(2 branch )

A. Adjust the fixed cost of products invested this month

B. Adjust the fixed cost of products in progress at the beginning of the month

C. Correctly calculate the actual cost of the product

D. Correctly calculate the fixed cost of the product, and correctly calculate the fixed cost of the product

94. The characteristic of cost calculation is ().(2 branch )

A. Calculate product cost by product category

B. Calculate the product cost according to the product variety

C. Collect production expenses by product category , Calculate the product cost , The indirect expenses of various products in the same kind of products shall be allocated and determined by a certain method

D. Collect production expenses by product category , Calculate the product cost , The expenses of various products in similar products shall be allocated and determined by certain methods

95. An enterprise will 、 B two products as a class , Use the classification method to calculate the product cost . nail 、 B the two products consume together A Materials , The consumption quota is 16 Kilogram and 20 kg , Per kilogram A The unit cost of each material is 5 element . The enterprise takes product a as the standard product , Then the raw material cost coefficient of product B is ( ).(2 branch )

A. 1.25

B. 6.25

C. 0.8

D. 0.4

96. In the case of small batch, single piece and multi-step production , If management does not require step-by-step calculation of product cost , The costing method to be used is ().(2 branch )

A. Batch method

B. Step by step

C. classification

D. Fixed cost method

97. The loss of scrap should not be included in the cost of products .(1 branch )

98. The following enterprises that use the batch method to calculate the cost of products are ().(3 branch )

A. An enterprise that organizes production according to customer orders

B. Small businesses with constantly changing varieties

C. A workshop for trial production of new products

D. A processing plant that undertakes repair business

99. The fixed assets of an enterprise are depreciated using the service life method , The net residual value rate of a certain type of fixed assets is 5%, It is expected that 15 year , Then the annual depreciation rate is ( ).(2 branch )

A. 6.67%

B. 6.33%

C. 5.37%

D. 6%

100. Direct materials in the product cost project , Including those directly used in product production ().(3 branch )

A. raw material

B. Main materials

C. Auxiliary materials

D. Packaging

边栏推荐

- Introduction to variable parameters

- LeetCode#2062. Count vowel substrings in strings

- Want to change jobs? Do you know the seven skills you need to master in the interview software test

- Lab 8 文件系统

- Scoring system based on 485 bus

- 软件测试面试回答技巧

- Flex --- detailed explanation of flex layout attributes

- STM32学习记录:玩转按键控制蜂鸣器和LED

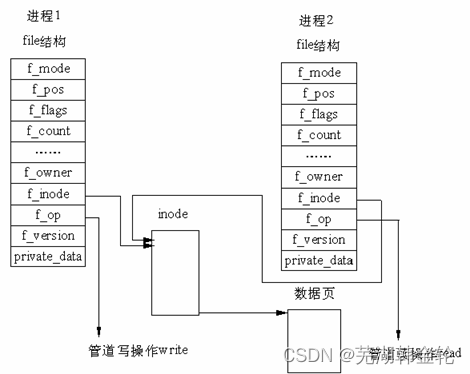

- Lab 8 file system

- Threads and thread pools

猜你喜欢

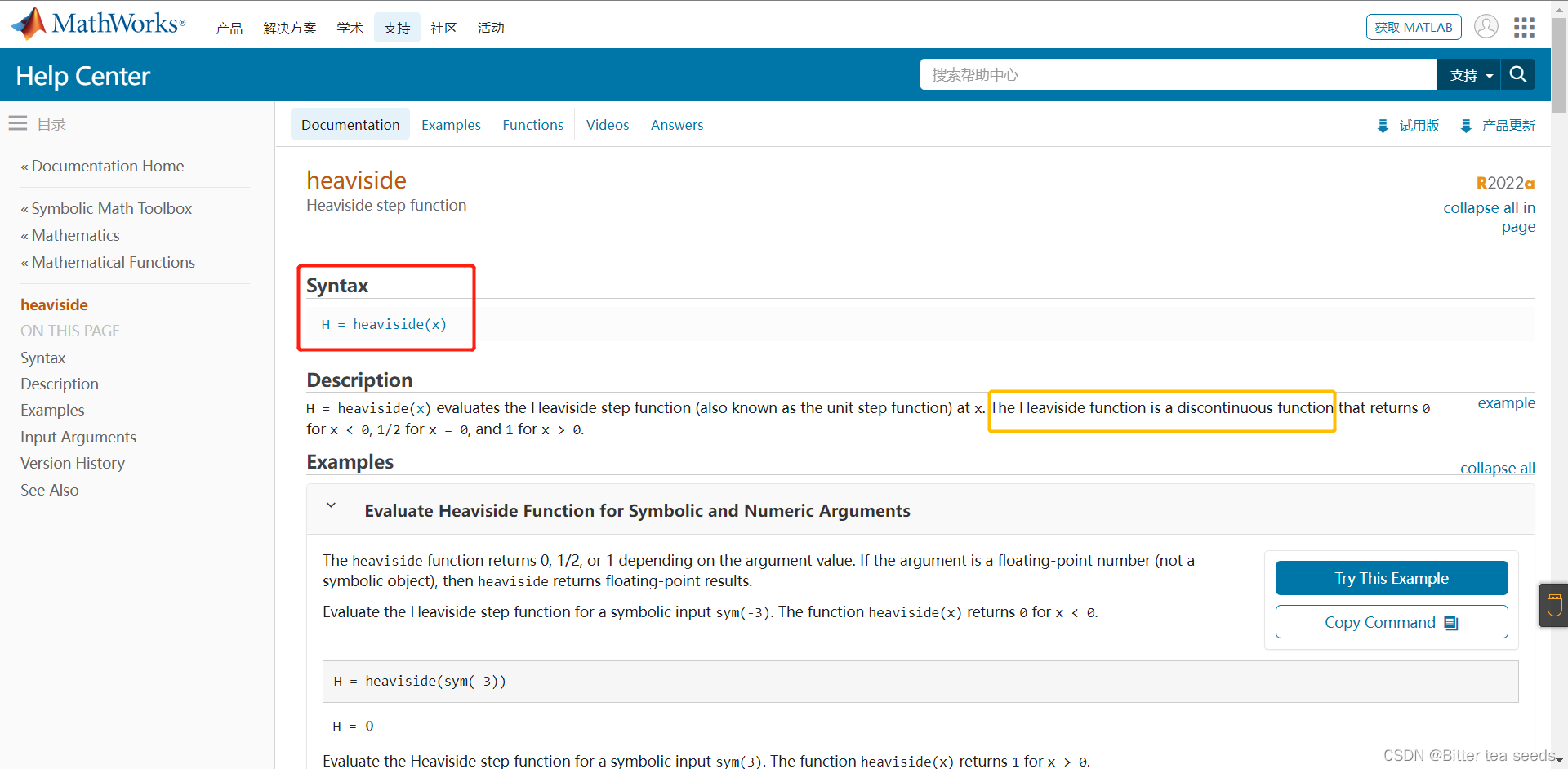

Matlab example: two expressions of step function

The wechat red envelope cover designed by the object is free! 16888

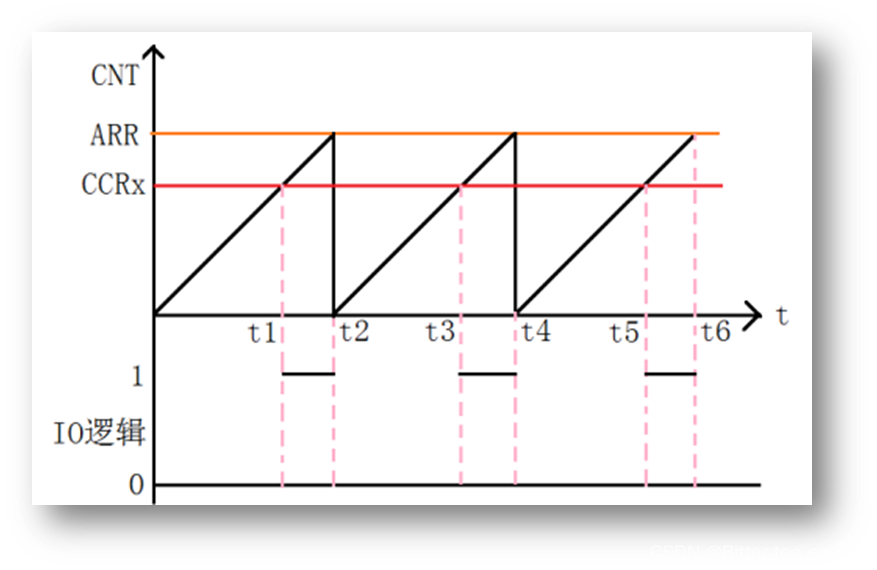

学习记录:如何进行PWM 输出

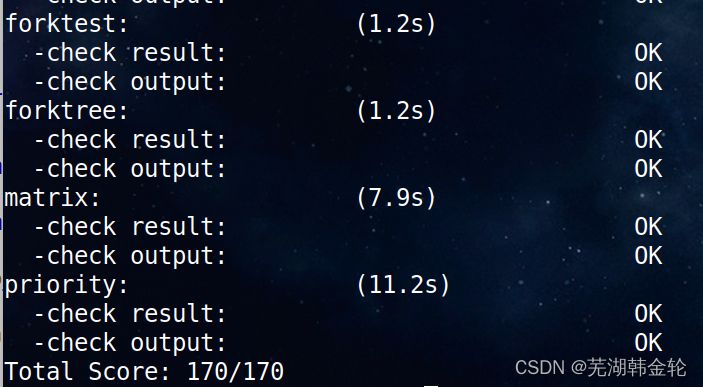

UCORE LaB6 scheduler experiment report

Lab 8 文件系统

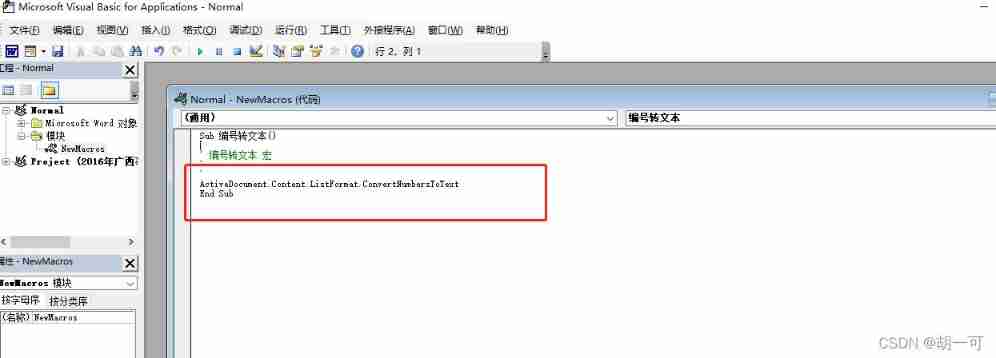

Word macro operation: convert the automatic number in the document into editable text type

Es6---es6 content details

LeetCode#62. Different paths

转行软件测试必需要知道的知识

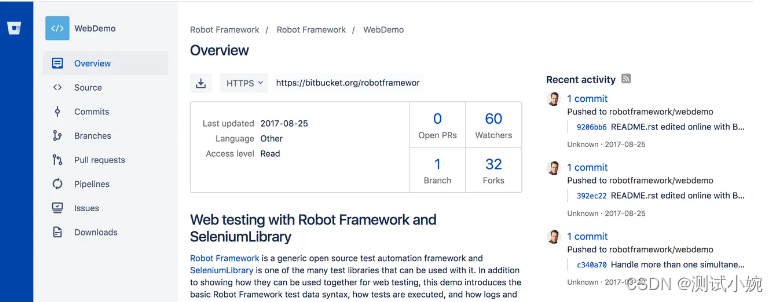

Do you know the advantages and disadvantages of several open source automated testing frameworks?

随机推荐

Collection集合与Map集合

UCORE lab5 user process management experiment report

Mysql database (V) views, stored procedures and triggers

Introduction to safety testing

Unpleasant error typeerror: cannot perform 'ROR_‘ with a dtyped [float64] array and scalar of type [bool]

STM32 learning record: play with keys to control buzzer and led

LeetCode#204. Count prime

ucorelab4

Mysql的事务

Market trend report, technological innovation and market forecast of pneumonia drugs obtained by Chinese hospitals

Crawler series of learning while tapping (3): URL de duplication strategy and Implementation

ucorelab4

Learning record: use STM32 external input interrupt

Mysql database (III) advanced data query statement

学习记录:USART—串口通讯

How to do agile testing in automated testing?

What are the software testing methods? Show you something different

csapp shell lab

Threads et pools de threads

What if software testing is too busy to study?