当前位置:网站首页>Cost accounting [15]

Cost accounting [15]

2022-07-06 15:35:00 【Star drawing question bank】

1. The characteristics of the simplified batch method are ().(3 branch )

A. open “ Basic production cost ” Secondary accounts , Register all costs and production hours of all products

B. At the end of the month in which finished products appear , Allocate the accumulated overhead between batches of finished products

C. According to the batch of products “ Basic production cost ” Sub Ledger , Only the direct materials and production hours of each batch of products are registered every day

D. Calculate the cost of finished products and products in process in batches 2. The workload method is applicable to high unit value , But the workload or working hours of each month are not very balanced fixed assets .()(1 branch )

3. The fixed amount at the beginning of the year is used in the product cost method , The production cost of a product in this month is the cost of the finished product in this month .()(1 branch )

4. No matter what kind of organization, manufacturing enterprises 、 What kind of products , Regardless of cost management requirements , Finally, the product cost must be calculated according to the product variety .(1 branch )

5. When determining the coefficient under the coefficient method , Generally, choose one with a large output within the category 、 The products with relatively stable production or compromise specifications are regarded as standard products , Set the coefficient of this product as “1”.()(1 branch )

6. The auxiliary production workshop is not equipped with “ Manufacturing expenses ” Account accounting , Because ().(3 branch )

A. The number of auxiliary production workshops is very small

B. The manufacturing cost is very small

C. The auxiliary production workshop does not provide goods

D. The scale of auxiliary production workshop is very small 7. The quota method or quota method is applicable to the accurate comparison of various expenses 、 Stable , However, products with little change in product quantity at the end of each month .()(1 branch )

8. Various production expenses included in the product cost , According to the method included in the product cost , It can be divided into direct expense and indirect expense .()(1 branch )

9. A college student 2011 year 7 I graduated in January and applied to be a cost accountant in Nanfang Machinery Factory , The section chief of the finance department introduced the company to him :1. Product status , The factory mainly produces large heavy-duty machinery , Used in mining and other enterprises , Mining machinery enterprises are the leading enterprises in China .2. Workshop settings : Equipped with 7 A basic production workshop , In addition, there are 4 An auxiliary production workshop . What accounting posts should the factory Department set up ?()(3 branch )

A. Material cost accounting position

B. Salary cost accounting position

C. Cost accounting 、 Product cost accounting position

D. Cost accountant 10. Enterprises pay () when , Should debit “ Management cost ” Account , credit “ Bank deposits ” or “ Cash on hand ” Account .(2 branch )

A. Property tax

B. Land use tax

C. Stamp duty

D. Vehicle and vessel use tax 11. The production workshop consumes low value consumables , When using the one-off amortization method , When scrap materials are priced and warehoused , Should debit “ raw material ” Account , credit “ Manufacturing expenses ” Account .()(1 branch )

12. The following are the calculation methods of WIP cost: ().(3 branch )

A. Direct distribution method

B. Quota proportional method

C. Equivalent yield method

D. Variety method 13. The production cost statement mainly includes ()(3 branch )

A. Cost statement of goods and products

B. Unit cost table of main products

C. Breakdown of manufacturing expenses

D. Income statement 14. When determining the cost calculation method , We must proceed from the specific situation of the enterprise , Consider at the same time ().(3 branch )

A. Production characteristics of the enterprise

B. Are there any products in progress at the end of the month

C. The size of the enterprise's production scale

D. Requirements for cost management 15. What constitutes the theoretical cost of products are ().(3 branch )

A. The value of the means of production consumed in production (c)

B. The value created by workers for their labor (v)

C. The value created by surplus labor

D. The value created by necessary labor 16. Production losses generally include ().(3 branch )

A. Waste loss

B. Product inventory loss

C. Downtime losses

D. Loss of three guarantees of products 17. An enterprise B product 201* The actual unit costs for the four quarters of the year were 172 element 、186 element 、194 element 、192 element . Determine two 、 3、 ... and 、 Quarter on quarter ratio .(3 branch )

A.108.13%

B.104.3%

C.115.39%

D.98.97%18. When auxiliary production expenses are allocated and transferred out , Sure ().(3 branch )

A. debit “ Manufacturing expenses ” Account

B. debit “ Management cost ” Account

C. debit “ Projects under construction ” Account

D. credit “ Auxiliary production cost ” Account 19. The advantages of adopting the comprehensive carry forward of the cost of semi-finished products according to the planned cost are ().(3 branch )

A. It can speed up the cost accounting work

B. It can simplify the cost calculation

C. Cost reduction is not required

D. It is convenient to analyze the cost of each production step 20. When preparing the cost statement , The accounting treatment method shall be consistent with the previous and subsequent periods .()(1 branch )

21. Adopt the machine hour proportion method , The manufacturing cost of finished products can be settled at any time , Simplify distribution procedures , It is most suitable for enterprise workshops with seasonal production .()(1 branch )

22. An enterprise calculates waste loss and shutdown loss separately , The cost item shall include ().(3 branch )

A. Direct material

B. Direct labor

C. Manufacturing expenses

D. Downtime losses 23. The decision-making function of cost accounting is the premise of forecasting function .()(1 branch )

24. Direct labor cost proportion method is a method of allocating manufacturing costs based on the proportion of direct labor costs directly included in the costs of various products .()(1 branch )

25. Adopt the equivalent yield method , The raw material cost is allocated according to the finished products and the product quantity at the end of the month. The conditions that should be met are ().(2 branch )

A. Raw materials are put into use one after another

B. Raw materials are put into use at the beginning of production

C. Raw materials account for a significant proportion of product costs

D. Raw materials are input according to quota 26. The cost calculation period under the variety method is consistent with the accounting reporting period .()(1 branch )

27. Directly used in product production , However, it is not convenient to directly calculate the product cost , Therefore, there is no special cost item , And various expenses indirectly used in the production of products refer to ().(2 branch )

A. Overhead

B. Direct costs

C. Manufacturing expenses

D. Financial expenses 28. The scope of application of the classification method is related to the production type of the enterprise ().(2 branch )

A. It matters

B. There is a direct connection

C. Not directly related

D. It doesn't matter 29. The organizational division of labor among cost accounting institutions at all levels within the enterprise is as follows: ().(3 branch )

A. According to the functional division of cost accounting

B. Division of labor according to the object of cost accounting

C. Centralized working mode

D. Decentralized way of working 30. Of the following , What belongs to the cost element of industrial enterprises is ().(2 branch )

A. Direct labor

B. Fuel and power

C. Labor cost

D. Direct material 31. A college student 2011 year 7 I graduated in January and applied to be a cost accountant in Nanfang Machinery Factory , The section chief of the finance department introduced the company to him :1. Product status , The factory mainly produces large heavy-duty machinery , Used in mining and other enterprises , Mining machinery enterprises are the leading enterprises in China .2. Workshop settings : Equipped with 7 A basic production workshop , In addition, there are 4 An auxiliary production workshop . What cost general ledger should the factory set up ?()(3 branch )

A.“ Production costs ”“ Manufacturing expenses ”

B.“ Stock goods ”

C.“ Management cost ”

D.“ selling expenses ”“ Financial expenses ”32. Depreciation of basic workshop machinery and equipment shall be included in () Account debit .(2 branch )

A.“ Accumulated depreciation ”

B.“ Management cost ”

C.“ Manufacturing expenses ”

D.“ Basic production cost ”33. All production costs incurred in the auxiliary production workshop are directly recorded in “ Auxiliary production cost ” subject .()(1 branch )

34. The enterprise should be based on () The situation of , Considering the requirements and conditions of Management , Choose an appropriate method to calculate the cost of work in progress at the end of the month .(3 branch )

A. In the number of products

B. The size of the change in the number of products in each month

C. The proportion of various expenses in the cost

D. The basis of quota management is good or bad 35. The following fixed assets without depreciation include ().(3 branch )

A. Unused houses and buildings

B. Unnecessary fixed assets

C. Fixed assets scrapped in advance

D. Fixed assets leased in by means of operating lease 36. About variety law , The following statement is correct ().(2 branch )

A. The cost calculation object is the order of the product

B. Set up product cost Sub Ledger according to production department

C. There must be products in progress at the end of the month

D. The costing period is fixed 37. In product variety 、 Enterprises with various specifications , Provide cost management information as soon as possible , Simplify costing , The variety method can be used to calculate the product cost .()(1 branch )

38. Manufacturing expenses incurred in auxiliary production workshop ().(2 branch )

A. Must pass “ Manufacturing expenses ” General ledger account accounting

B. There is no need to pass “ Manufacturing expenses ” General ledger account accounting

C. As the case may be , Recordable “ Manufacturing expenses ” General ledger accounts , It can also be directly recorded in “ Auxiliary production cost ” Account

D. First write down “ Auxiliary production cost ” Account 39. The difference between the old quota and the new quota due to the revision of the consumption quota or the planned price of production consumption , be called ().(2 branch )

A. Material cost difference

B. Deviation from quota

C. Quota change variance

D. Quota cost variance 40. The variety method is suitable for mass production , And the management does not require multi-step production enterprises to calculate the product cost step by step .()(1 branch )

41. Multi step continuous processing production , You need to take steps as the object of cost calculation , Calculate the cost of semi-finished products and products in each step according to both steps and varieties .()(1 branch )

42. Relevant output of an enterprise 、 The information of unit cost and total cost is as follows : Existing comparable products A product 、B product 、C product , The actual output this month is A Comparable products 100 Pieces of ,B Comparable products 30 Pieces of ,C Comparable products 80 Pieces of . The cumulative total cost of the three products in this year calculated according to the actual average unit cost of the previous year is 1740000 element , among B Products for 250000 element ,C Products for 770000 element ; The cumulative total cost of this year calculated according to the planned unit cost of this year is 1696000 element , The cumulative total cost of this year calculated according to the actual situation of this year is 1667000 element . requirement : According to the above information , Calculate the reduction of comparable products , Reduction rate of comparable products ,A The actual unit cost of the product this month ,A The total cost of the product calculated according to the actual average unit cost of the previous year .(3 branch )

A.73000/4.195%

B.73000/5.195%

C.750/720000

D.450/74800043. The wage item in the element cost refers to the wages of production workers that should be included in the product cost .(1 branch )

44. Enterprises with single-step production , When using the variety method to calculate the product cost , The product cost Sub Ledger is based on () Set up .(2 branch )

A. Product variety

B. Production department

C. Product batch

D. Production steps 45. In order to complete the same batch of products at the same time , In order to reduce production costs, the distribution of work between finished products and products in progress , The smaller the batch of products, the more reasonable .()(1 branch )

46. The method of allocating manufacturing expenses according to the annual planned allocation rate is applicable to ().(2 branch )

A. Enterprises with large manufacturing costs

B. Seasonal production enterprises

C. Enterprises with small basic production workshops

D. Enterprises with small manufacturing costs 47. An enterprise produces a 、 B two products , The total cost of raw materials consumed is 62400 element . Product a put into production this month 220 Pieces of , B product 256 Pieces of . Cost quota of single raw material : A product 120 element , B product 100 element . requirement : The raw material quota cost proportion is adopted to distribute Party A 、 The cost of raw materials actually consumed by product b .()(3 branch )

A. A product 31680

B. A product 31200

C. B product 31200

D. B product 3072048. All cost reports , They are all filled in columns by cost items .()(1 branch )

49. At the end of the month, when the employee salary is distributed , The account to be debited for the staff salary of the medical and Welfare Department is ().(2 branch )

A.“ Salary payable ”

B.“ Manufacturing expenses ”

C.“ Management cost ”

D.“ selling expenses ”50. Of the following , There is no need to pass “ Taxes payable ” The accounting of the account is ().(2 branch )

A. Vehicle and vessel use tax

B. Property tax

C. Land use tax

D. Stamp duty 51. The classification method is applicable to small batch, single piece and multi-step production enterprises .(1 branch )

52. The difference between the monthly production cost of products in process and the quota according to the quota cost valuation method , It is all borne by the products in process .()(1 branch )

53. The total cost of purchased power shall be recorded in “ Bank deposits ” Credit to account .()(1 branch )

54. To simplify accounting , The by-products and main products can be regarded as one kind , Use the classification method to calculate the cost .()(1 branch )

55. In the following enterprises , The enterprises that can use the batch method to calculate the product cost are ().(3 branch )

A. Mechanical ships

B. Textile mills

C. power plant

D. Small special precision instrument 56. For comparable products with actual cost data of the previous year , take () Contrast , Reveal cost reductions or increases , And analyze the reasons , For improving cost management 、 Reducing costs has a positive effect .(2 branch )

A. The actual cost of the current period is the same as the actual average cost of the previous year

B. The actual cost of the current period is the same as the average cost of the previous year

C. The planned cost of the current period is the same as the actual average cost of the previous year

D. The planned cost of the current period is the same as the average planned cost of the previous year 57.“ Waste loss ” The account has no balance at the end of the month .()(1 branch )

58. An enterprise uses the service life method to withdraw depreciation . The original price of a fixed asset is 80000 element , The estimated net residual value ratio is 5%, The estimated service life is 10 year . The fixed assets 2002 year 10 Purchased and put into use in January ,2013 year 8 Scrapped in January , The depreciation accrued at the time of scrapping is ().(2 branch )

A.78200 element

B.76800 element

C.80000

D.7600059. The variety method of product cost calculation , It takes the product category as the object of cost calculation , Collect production costs , A method of calculating the cost of a product .()(1 branch )

60. Adopt the simplified batch method , end of the month ().(3 branch )

A. Allocate expenses between finished products and in-process products

B. Only indirect costs are allocated to finished products

C. Only calculate the cost of finished products

D. Do not calculate WIP cost in batches 61. Cost accounting in a narrow sense usually refers to ().(2 branch )

A. Cost forecast

B. Costing

C. Cost decisions

D. cost analysis 62. Approved , When dealing with inventory gain of products in process , Should debit “ Loss and overflow of property to be disposed of —— Loss and overflow of current assets to be disposed ” subject , credit “ Manufacturing expenses ” subject .()(1 branch )

63. Products with little change in the number of products in progress at the end of each month , You can not calculate the cost of work in progress at the end of the month .()(1 branch )

64. The method of allocating the cost of various products in the same kind of products according to the coefficient proportion ().(2 branch )

A. It is a method of allocating expenses between finished products and products at the end of the month

B. It is a simple product cost calculation method

C. It's a simplified taxonomy

D. It's a way of allocating overhead 65. The cost of raw materials borne by irreparable waste products is 1000 element , The direct labor cost is 500 element ; Recovery of scrap value 200 element , Compensation should be paid by the negligent 300 element , Then the net loss of waste products should be ().(2 branch )

A.1000 element

B.1300 element

C.1200 element

D.1500 element 66. After a product is rejected , Due to waste products , Reduce the number of qualified products , So this product ().(2 branch )

A. Total cost increase , The unit cost remains unchanged

B. The total cost and unit cost remain unchanged

C. Total cost reduction , Unit cost increase

D. Total cost increase , Unit cost increase 67. The basic method of product cost calculation is ().(2 branch )

A. direct method

B. Sequential method

C. Algebra

D. Variety method 68. The organizational division of labor among cost accounting institutions at all levels within large and medium-sized enterprises , Generally, centralized working mode is adopted .()(1 branch )

69. Adopt the simplified batch method , Each batch of products 、 Indirect costs are included between finished products and products , It's all about using ().(2 branch )

A. Cumulative indirect cost allocation rate

B. Indirect cost allocation rate

C. Cumulative production man hours

D. Cumulative raw material cost allocation rate 70. About variety law , The following statement is not true ().(3 branch )

A. The cost calculation object is the order of the product

B. Set up product cost Sub Ledger according to production department

C. There must be products in progress at the end of the month

D. The costing period is fixed 71. The comprehensive carry forward method is used to carry forward the cost of semi-finished products , Can be in accordance with the ().(3 branch )

A. Actual cost carry forward

B. Planned cost carry forward

C. Fixed cost carry forward

D. Cost carry forward of semi-finished products 72. In the cost table of commodity products , The amount and rate of reduction of comparable products , It refers to the reduction amount and reduction rate of the actual cost of comparable products compared with the planned cost ()(1 branch )

73. The cost statements of industrial enterprises are ()(3 branch )

A. Balance sheet

B. Production cost table

C. Unit cost table of main products

D. Breakdown of manufacturing expenses 74. The basic production workshop of an enterprise produces a 、 B 、 C three products .7 The total amount of employee compensation for production work in this month is 14700 element , Product a is completed 1000 Pieces of , B. product completion 400 Pieces of , C. product completion 450 Pieces of , Man hour quota of single product : A product 2.5 Hours , B product 2.45 Hours , C product 1.6 Hours . It is required to allocate Party A according to the proportion of fixed working hours 、 B 、 C. employee compensation of product production workers , The correct calculation is ().(3 branch )

A. nail 8750

B. B 3430

C. C 2520

D. nail 、 B 、 C are 490075. The batch method applies to ().(3 branch )

A. small serial production

B. Management does not require step-by-step costing of multi-step production

C. Produce the same product in batches and turns

D. One piece one-step production 76. Suppose an industrial enterprise has a basic production workshop and an auxiliary production workshop , The former produces product B , The latter provides a kind of labor service . The relevant economic business occurred in a certain month is as follows : Raw materials used in production 13590 element , Which is directly used in the production of B products 8750 element , Used as basic workshop machine material 1210 element ; Directly used for auxiliary production 2700 element , Used as auxiliary workshop machine material 930 element . The manufacturing cost of auxiliary production of the enterprise is through “ Manufacturing expenses ” Account accounting . requirement : Prepare relevant accounting entries based on the above information .(3 branch )

A. borrow : Basic production cost ----- B product 8750

B. borrow : Manufacturing expenses ---- Basic Workshop 1210

C. borrow : Manufacturing expenses 1210

D. loan : raw material 1359077. The classification of product cost calculation is ().(3 branch )

A. Set up cost Sub Ledger by product category

B. Set up cost Sub Ledger by product variety

C. Collect production expenses by product category , Calculate the product cost

D. The indirect costs of various products in the same kind of products are allocated and determined by a certain allocation method 78. The scope of application of the variety law includes ().(3 branch )

A. Mass single step production

B. Mass and multi-step production

C. A large number of multi-step production that does not require step-by-step costing in management

D. Single piece small batch production 79. In the following costing method , The auxiliary cost calculation method is ().(3 branch )

A. classification

B. Quota method

C. Step by step

D. Batch method 80. To keep costs comparable , The scope of product cost expenditure shall be uniformly stipulated by the state .(1 branch )

81. The classification is based on () As the object of cost calculation .(2 branch )

A. Product variety

B. Product category

C. Product production steps

D. Product batch 82. Under the classification , When using the coefficient method to calculate the cost of various products , The conditions for products selected as standard products are ().(3 branch )

A. Large output

B. The output is small

C. Specification compromise

D. Production is relatively stable 83. All costs in the preparation of the enterprise report ,“ Cost statement of goods and products ” Is the main report ().(1 branch )

84. It belongs to auxiliary materials commonly used in the production of several products , It can be directly included in the cost of various products .()(1 branch )

85. When using the step-by-step method , The production steps as the object of cost calculation can ().(3 branch )

A. Set up according to the production workshop

B. Set up according to the actual production steps

C. Set up according to different production steps in a workshop

D. Merge several workshops to set up 86. In order to ensure that the expenses to be borne are correctly collected according to each cost calculation object , The production cost that should be borne by the current product must be correctly in ().(2 branch )

A. Distribution among various products

B. Finished products and distribution among products

C. Distribution between profit products and loss products

D. Distribution between comparable products and non comparable products 87. The method of allocating the cost of various products in the same kind of products according to a fixed coefficient ().(3 branch )

A. It's a kind of taxonomy

B. It's a simplified taxonomy

C. Also called coefficient method

D. Is a separate costing method 88. Adopt the equivalent yield ratio method , There are generally two methods to determine the degree of completion of products in progress : One is to calculate the average completion rate ; The other is to calculate the completion rate of each process separately .()(1 branch )

89. We should control the manufacturing cost of products and other indirect expenses not exceeding the quota , It is not only necessary to control the total amount of these indirect expenses not to exceed the planned amount , At the same time, we also need to control () Not exceeding the quota .(2 branch )

A. Deviation from quota

B. Material cost difference

C. Total production man hours and man hours per unit product

D. Quota change variance 90. The production cost of irreparable waste , It can be calculated according to the actual cost of waste products , It can also be calculated according to the quota cost of waste products .()(1 branch )

91. One of the characteristics of the quota method is , end of the month , On the basis of fixed cost (), Calculate the actual cost of the product , And provide data for regular assessment and analysis of cost .(2 branch )

A. Add 、 Minus the cost of work in progress at the beginning of the month

B. Add 、 Less various cost differences

C. Add 、 Minus the product cost at the beginning of the month

D. Add 、 Minus quota difference 92. A product produced in a workshop , Manufacturing costs are included in indirect expenses , Appropriate allocation methods should be used , The allocation is included in the production cost of various products in the workshop .()(1 branch )

93. The production organization mode applicable to the variety law is ().(2 branch )

A. Mass production

B. mass production

C. Mass production

D. Single piece small batch production 94. When calculating manufacturing expenses , For the auxiliary production workshop, you can decide whether to set..., according to the specific situation “ Manufacturing expenses ” Account .()(1 branch )

95. The quota method applies to ().(2 branch )

A. Single piece and small batch production enterprises

B. The quota management system is relatively sound , The basis of quota management is relatively good , Product production has been finalized , The consumption quota is relatively accurate 、 Stable enterprises

C. Not directly related to the type of production

D. Mass production enterprises 96. Be able to link labor productivity with the cost level of product burden , The distribution method of manufacturing cost that makes the distribution result more reasonable is ().(2 branch )

A. Proportional distribution of working hours of production workers

B. Distribution method according to annual planned distribution rate

C. Direct labor cost proportional distribution method

D. Machine man hour proportional distribution method 97. The actual cost after the interactive allocation of auxiliary production workshops , Should be in () Distribute .(2 branch )

A. Each basic workshop

B. Between the beneficiary units

C. Between the beneficiary units outside the auxiliary production workshop

D. Between auxiliary production 98. The functions of cost accounting include ().(3 branch )

A. Cost forecast 、 Decision making

B. Costing 、 analysis

C. Cost planning

D. cost control 99. A factory uses the variety method to calculate the product cost , Production a 、 B two kinds of products, the factory 20×5 year 5 Materials consumed in the production of product a in January 4410 element , Materials consumed in the production of product b 3704 element , Materials commonly consumed in the production of Party A and Party B products 9000 element ( The material quota consumption of product a is 3000 kg , The material quota consumption of product B is 1500 kg ). requirement : The materials jointly consumed by Party A and Party B shall be distributed according to the proportion of quota consumption , Write entries for material distribution .(2 branch )

A. borrow : Basic production cost - A product 10410 Basic production cost - B product 6704 loan : raw material 17114

B. borrow : Basic production cost - A product 6704 Basic production cost - B product 10410 loan : raw material 17114

C. borrow : Basic production cost - A product 4410 Basic production cost - B product 3704 loan : raw material 8114

D. borrow : Basic production cost - A product 7410 Basic production cost - B product 5204 loan : raw material 12614100. Cost accounting is a branch of accounting , Is a professional accountant , The object is ().(2 branch )

A. Enterprises

B. cost

C. Money

D. Accounting entity

边栏推荐

- C4D quick start tutorial - creating models

- [pytorch] simple use of interpolate

- 12306: mom, don't worry about me getting the ticket any more (1)

- How to become a good software tester? A secret that most people don't know

- 如何成为一个好的软件测试员?绝大多数人都不知道的秘密

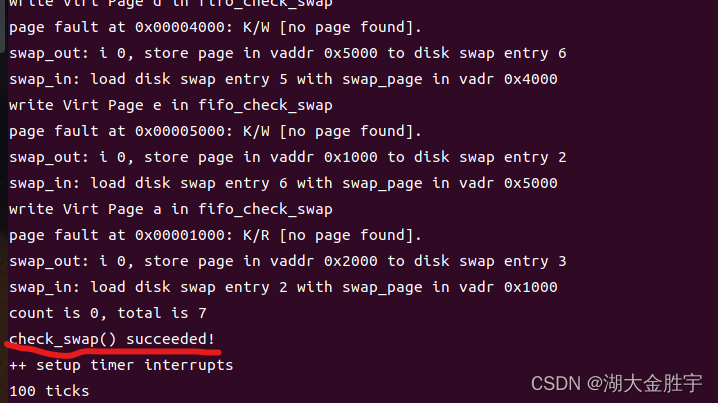

- UCORE lab5 user process management experiment report

- Mysql database (II) DML data operation statements and basic DQL statements

- JDBC introduction

- 软件测试方法有哪些?带你看点不一样的东西

- Interview answering skills for software testing

猜你喜欢

Learning record: use STM32 external input interrupt

ucorelab3

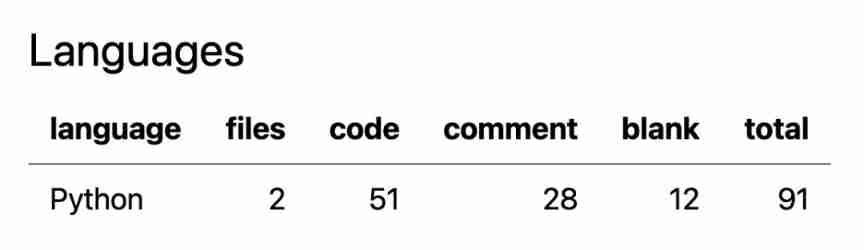

51 lines of code, self-made TX to MySQL software!

自动化测试中敏捷测试怎么做?

What is "test paper test" in software testing requirements analysis

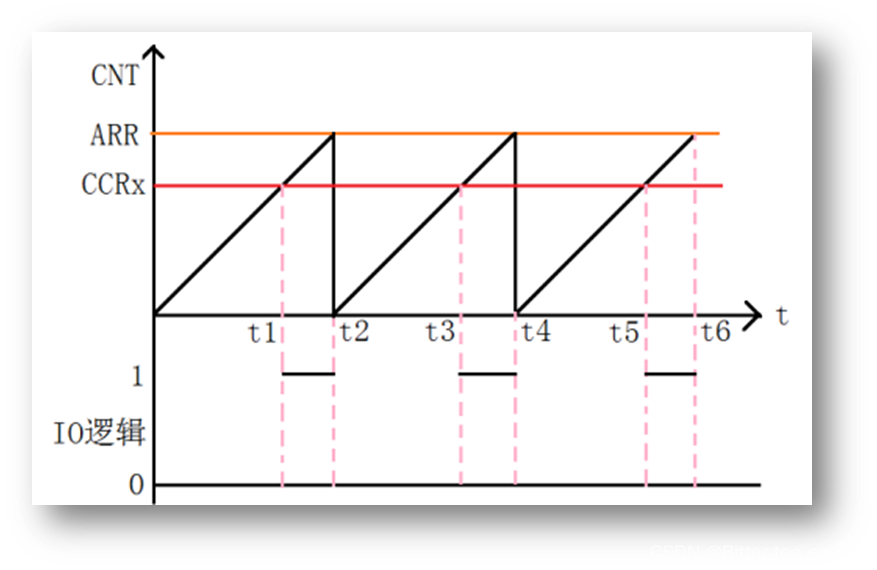

Learning record: how to perform PWM output

软件测试工作太忙没时间学习怎么办?

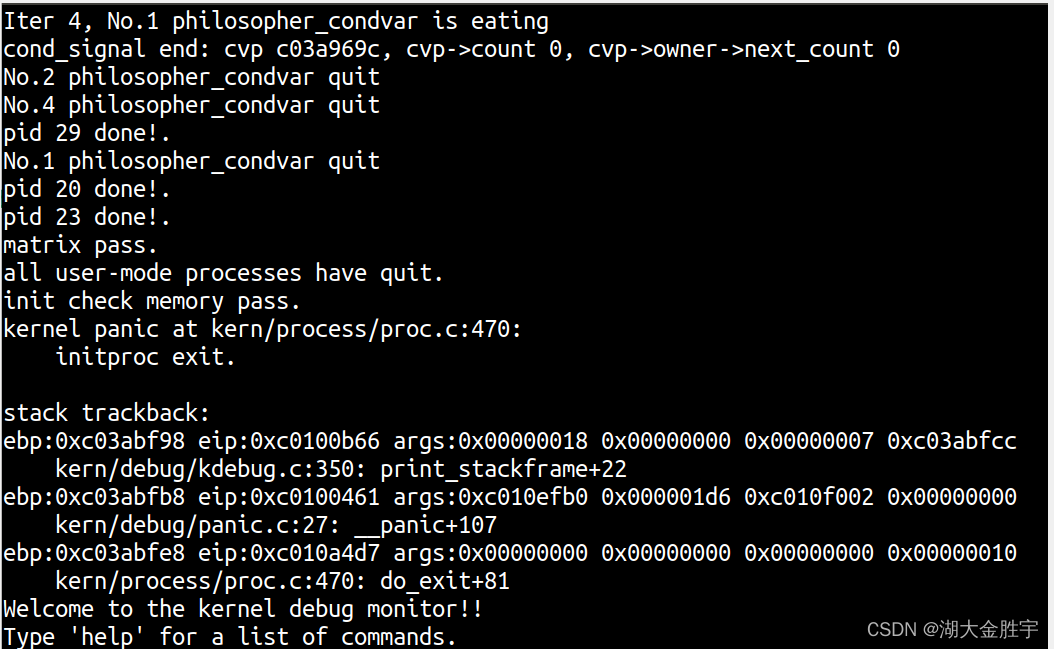

ucore lab7

C4D quick start tutorial - creating models

Winter vacation daily question - maximum number of balloons

随机推荐

STM32学习记录:玩转按键控制蜂鸣器和LED

Cadence physical library lef file syntax learning [continuous update]

Brief introduction to libevent

ucorelab3

STM32如何使用STLINK下载程序:点亮LED跑马灯(库版本)

STM32学习记录:LED灯闪烁(寄存器版)

学习记录:使用STM32外部输入中断

Research Report on market supply and demand and strategy of China's medical chair industry

How to become a good software tester? A secret that most people don't know

C4D quick start tutorial - Introduction to software interface

Lab 8 文件系统

UCORE Lab 1 system software startup process

FSM and I2C experiment report

CSAPP shell lab experiment report

Crawler series (9): item+pipeline data storage

Eigen User Guide (Introduction)

Portapack application development tutorial (XVII) nRF24L01 launch B

转行软件测试必需要知道的知识

Mysql database (II) DML data operation statements and basic DQL statements

Do you know the performance testing terms to be asked in the software testing interview?