当前位置:网站首页>The United States has repeatedly revealed that the yield of interest rate hiked treasury bonds continued to rise

The United States has repeatedly revealed that the yield of interest rate hiked treasury bonds continued to rise

2022-07-06 13:59:00 【yu18261660137】

The US dollar continues to rise due to Treasury bond yields , And hover upward to maintain . On the impact of the Fed's tightening policy , Market investors therefore choose dollars , All because of the direction after the release of the latest employment data of the United States and the decision of the European Central Bank . At present, investors are generally chasing dollars , The optimism of the market seems to be threatened by the recovery of the dollar , The United States 1 After the unexpected rise of monthly non-agricultural employment data , The dollar regained momentum .

Except that the United States has repeatedly disclosed the number of interest rate hikes , The European Central Bank may also announce an interest rate hike before the end of this year. There are several reasons for the rise in inflation in the eurozone 、 German yields rose , As well as being affected by the economic environment , As a factor supporting the euro against the dollar . In this year, the European Central Bank is expected to tighten / Reduce the scale of bond purchase , At the same time, in view of the risk that stopping asset shopping will aggravate the expansion of interest rate spread , In view of previous records , The European Central Bank has been very careful to control this expansion in recent years .

A member of the European Central Bank revealed , Current inflation data shows , Both inflation and core inflation unexpectedly rose . At the same time, it is subject to geopolitical risks , The level of inflation is still unstable . So now we need to adopt a more conservative monetary policy , Gradually decrease from the beginning . The market was affected by the commentary, and the euro weakened against the dollar . Some market analysts believe that the Fed has become more aggressive and unpredictable in raising interest rates , There is a risk of undermining the stability of financial markets , Pointed 2023 The economy may slow down significantly in . Investors need to pay attention to market trends and choose the right time to enter .

边栏推荐

- Implementation principle of automatic capacity expansion mechanism of ArrayList

- [data processing of numpy and pytoch]

- Matlab opens M file garbled solution

- FAQs and answers to the imitation Niuke technology blog project (II)

- [MySQL table structure and integrity constraint modification (Alter)]

- About the parental delegation mechanism and the process of class loading

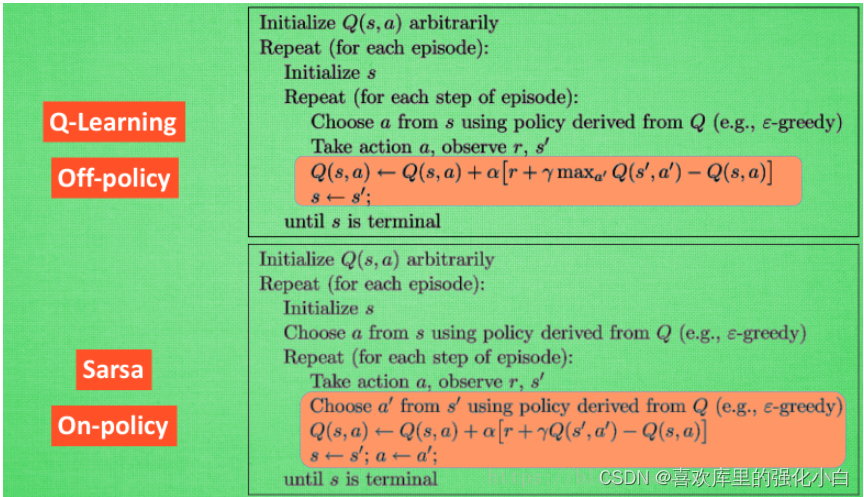

- Reinforcement learning series (I): basic principles and concepts

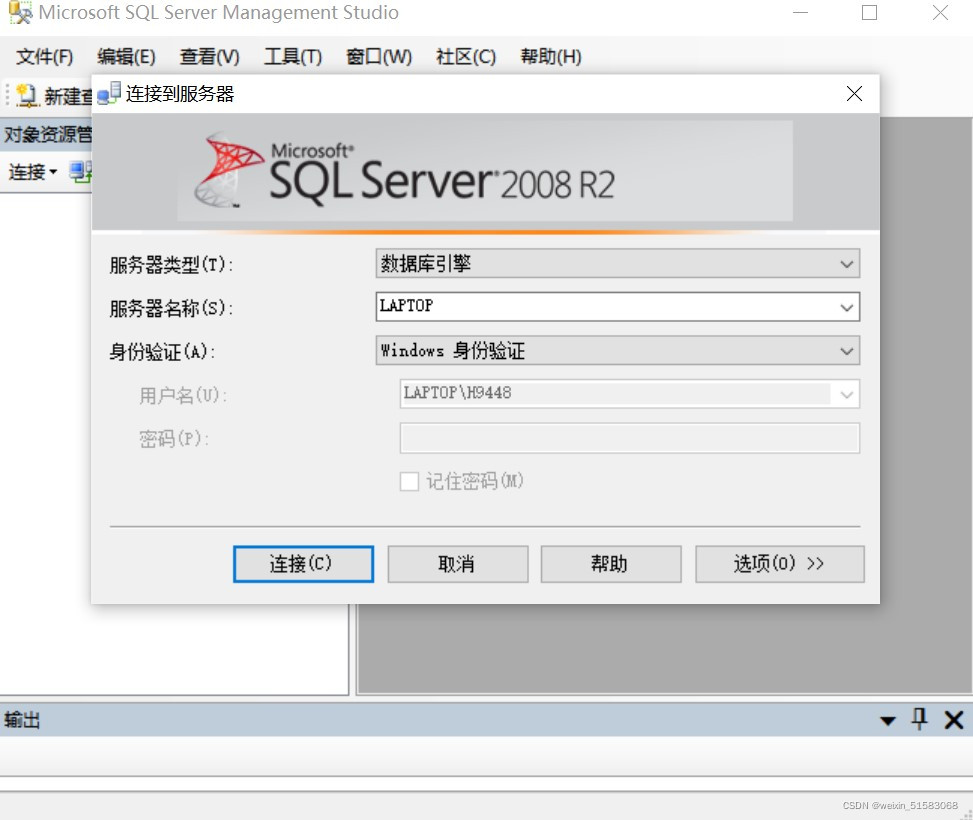

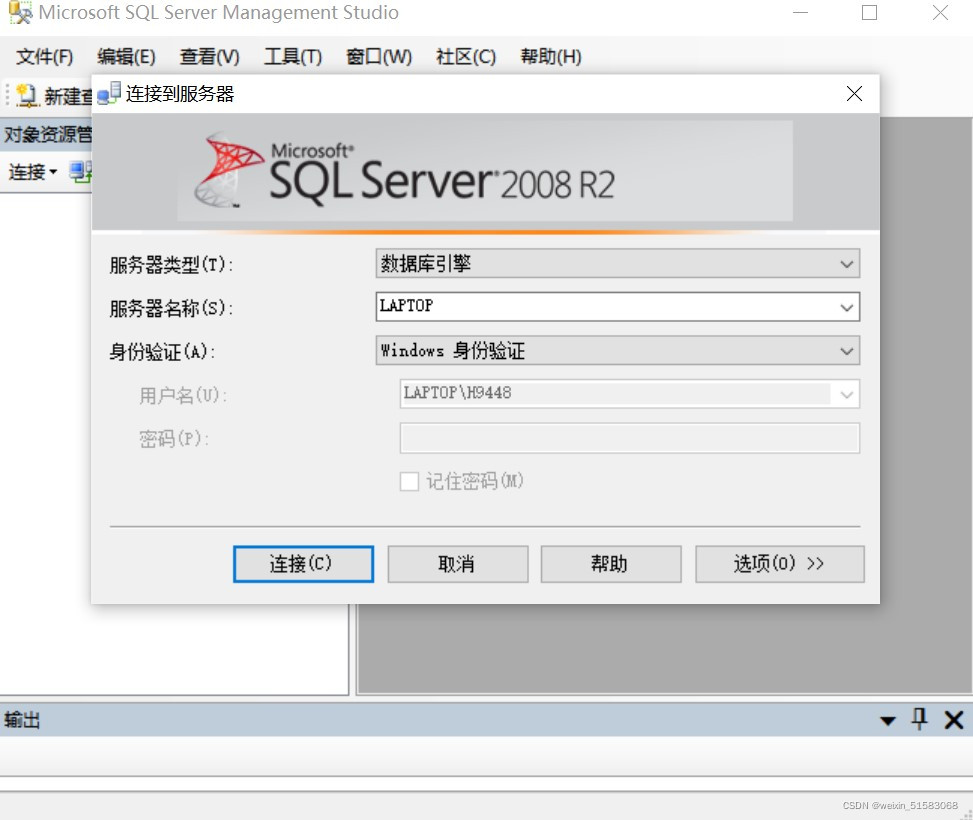

- 附加简化版示例数据库到SqlServer数据库实例中

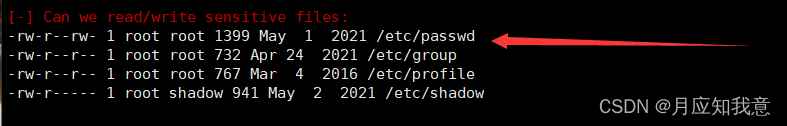

- HackMyvm靶机系列(3)-visions

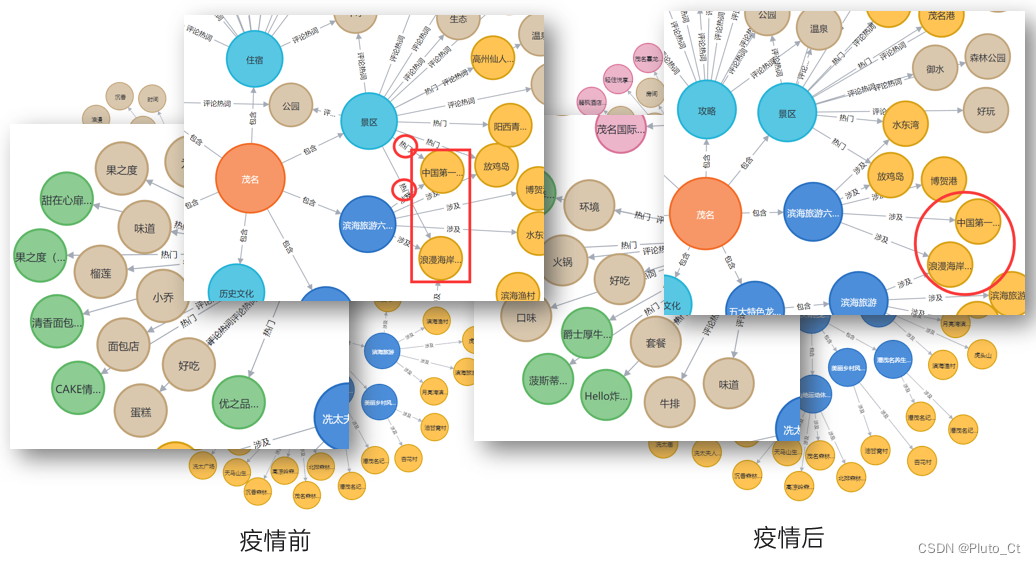

- 2022 Teddy cup data mining challenge question C idea and post game summary

猜你喜欢

HackMyvm靶机系列(7)-Tron

附加简化版示例数据库到SqlServer数据库实例中

2022泰迪杯数据挖掘挑战赛C题思路及赛后总结

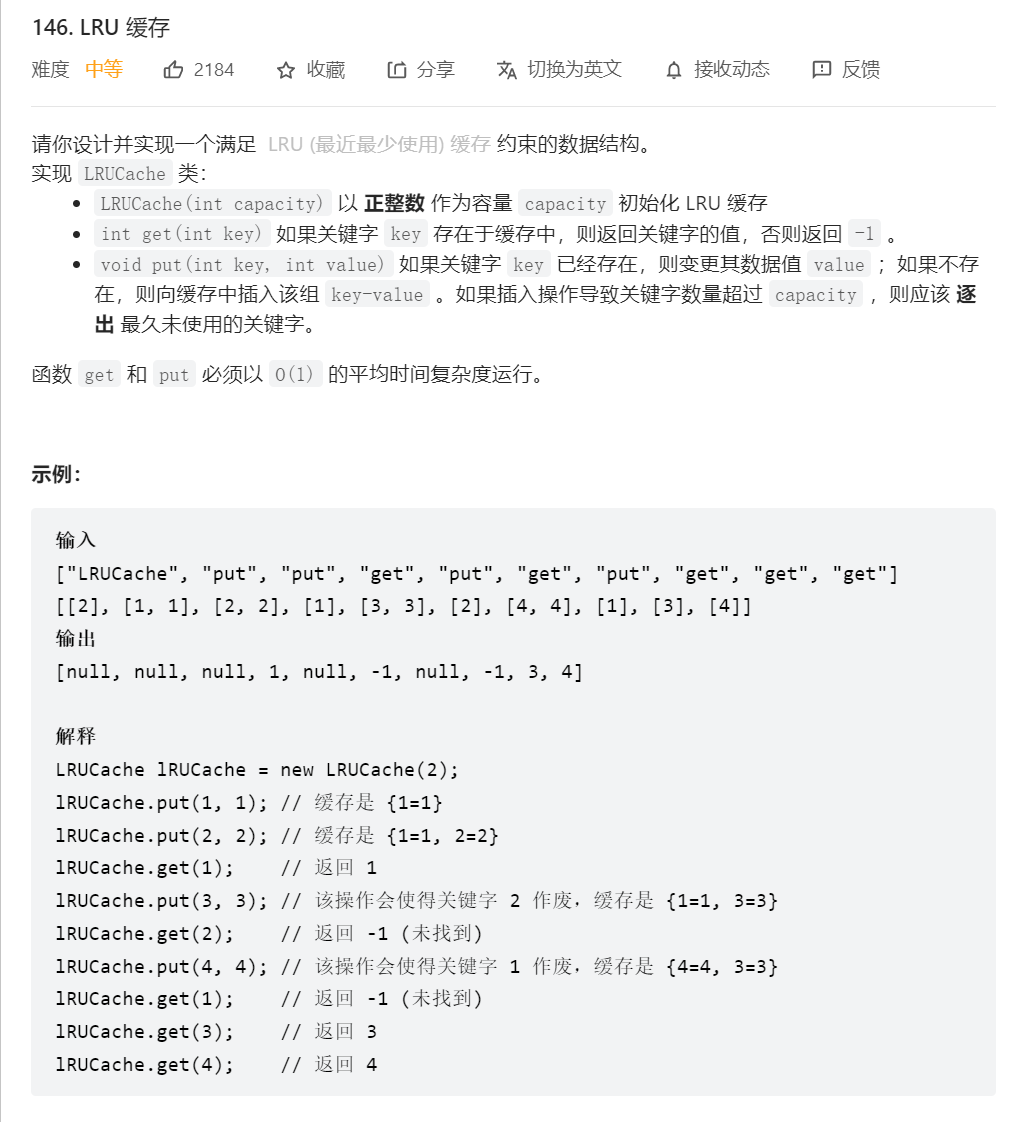

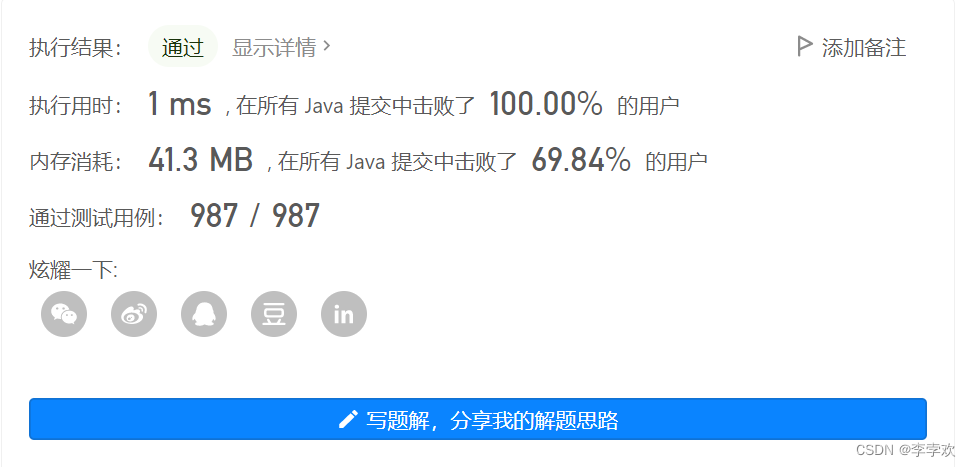

透彻理解LRU算法——详解力扣146题及Redis中LRU缓存淘汰

Attach the simplified sample database to the SQLSERVER database instance

Leetcode.3 无重复字符的最长子串——超过100%的解法

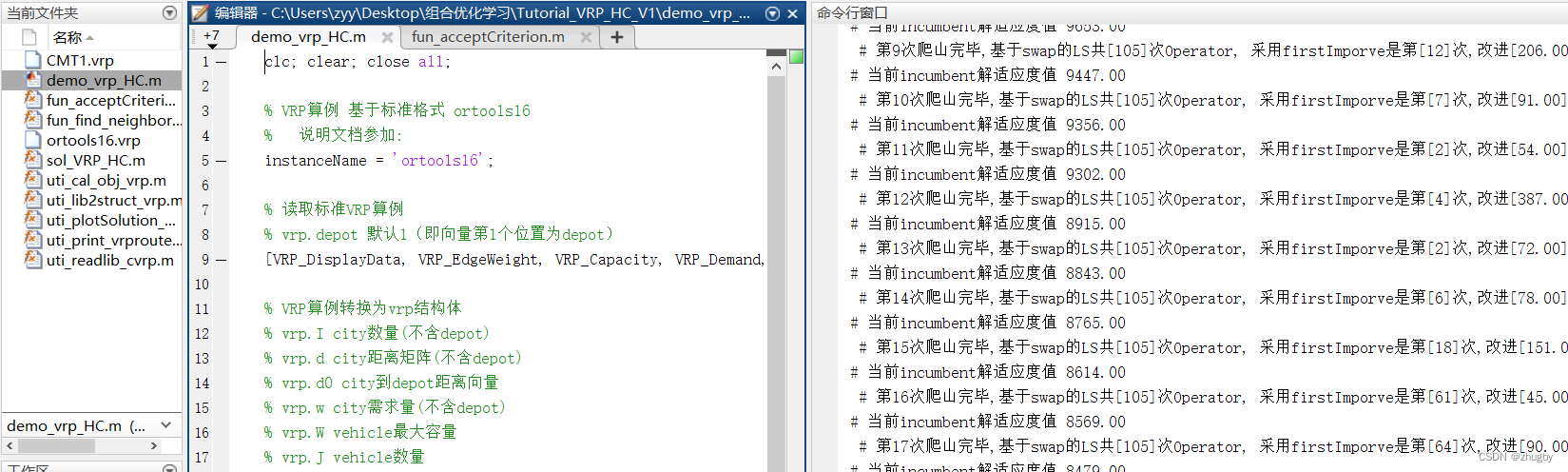

Matlab opens M file garbled solution

强化學習基礎記錄

. Net6: develop modern 3D industrial software based on WPF (2)

Relationship between hashcode() and equals()

随机推荐

HackMyvm靶机系列(5)-warez

. Net6: develop modern 3D industrial software based on WPF (2)

2022泰迪杯数据挖掘挑战赛C题思路及赛后总结

7-1 输出2到n之间的全部素数(PTA程序设计)

Experiment 9 input and output stream (excerpt)

渗透测试学习与实战阶段分析

A comprehensive summary of MySQL transactions and implementation principles, and no longer have to worry about interviews

实验四 数组

强化学习基础记录

[面试时]——我如何讲清楚TCP实现可靠传输的机制

[the Nine Yang Manual] 2021 Fudan University Applied Statistics real problem + analysis

[modern Chinese history] Chapter 9 test

实验五 类和对象

Difference and understanding between detected and non detected anomalies

强化学习系列(一):基本原理和概念

This time, thoroughly understand the MySQL index

优先队列PriorityQueue (大根堆/小根堆/TopK问题)

Inaki Ading

7-11 机工士姆斯塔迪奥(PTA程序设计)

Why use redis